What are the duties of a banker? Banking: the pros and cons of the profession. Where to get an education

Bank employees are qualified professionals involved in the implementation of financial transactions. They accept deposits, issue loans, make payments. What professions are there in the bank and how much do their representatives earn?

Medium wage: 50000 rubles per month

Demand

Payability

Competition

entry barrier

prospects

The position of a bank employee belongs to the category of stable and prestigious. The salaries of employees of financial and credit institutions are decent, and there are no problems with career growth - there would be ambitions. It is indicative that over 40% of economic graduates are looking for a job in the bank. At the same time, bank employees are a collective concept, which means at least a dozen professions - from a teller to a financial analyst.

Historical reference

The origin of banking took place approximately in the second half of the 3rd millennium BC. At that time, moneylenders appeared on the territory of ancient Babylon, who offered loans at interest. The first forms of such "credits" were of a natural nature, since there was no money yet.

A little later, in the 6th century BC, in ancient Greece, trapeziters (money changers) began their banking and credit activities. The main operation they carried out was currency exchange.

Developing, banking was replenished with new types of services. Loans were already given not just at interest, but also secured by collateral. Valuables and real estate were accepted as the latter.

Registration of the first national bank was produced much later - in the 16th century. England was the pioneer. But, as they say, the first pancake turned out to be lumpy: the owners made a lot of mistakes. For example, bank employees had no right to disclose some information about the institution, its founders and investors.

Characteristics of the profession

The duties of a bank employee are reduced to conducting various financial transactions. He can engage in lending, processing approved documentation for storage Money or sell securities.

Being at the cash desk, the bank employee is responsible for material values. He draws up the necessary documentation, performs recalculations and translations financial resources, issues money to customers, acquires and sells currency. He can also give advice to bank visitors on various issues, prepare reports together with colleagues, engage in forecasting and planning.

Financial analyst

The main responsibility of a financial analyst is spelled out in the very title of this position. Its main tasks are to search and analyze financial information relating to the activities of a banking institution, as well as its competitors and the entire market. He has all the data on the state of affairs of the institution and competitors.

In addition, a financial analyst monitors market trends, calculates important indicators in the field of the economy, assesses risks and, based on the results, develops recommendations for management. They relate to the planning of the activities of a banking institution, the effective investment of finances and raising the level.

Personal Financial Advisor

The job of a personal financial advisor has a lot in common with that of an analyst. The only difference is that the consultant does not cooperate with the management, but with the clientele of the bank.

The financial consultant provides information assistance to clients - both individuals and legal entities. His responsibilities include advice on the best ways to manage personal funds. It shows how to make a forecast of expenses and income for a particular period, helps to develop a budget, select a suitable investment program and compile a statistics report.

Accountant

Among bank employees, the profession is one of the most common and is considered one of the most numerous in terms of the number of staff positions. The job responsibilities of such an employee include analysis, planning and evaluation of the bank's income and expenses.

Accountants work in their own department, which is called accounting under the leadership of the chief accountant. He carefully controls the correctness of all accounting transactions. If a mistake is made somewhere, they will be asked first of all from him. In addition, he ensures that the financial, labor and material resources of the bank are used rationally and economically.

Auditor

Any can be internal and external. Since we are talking about bank employees, we are more interested in the specialist on staff. He scrupulously checks and analyzes financial, operational and other information about the work of the institution. The result is a completely unbiased assessment of the state of banking.

The internal auditor, in particular, points out the existing shortcomings in the control system and assesses how well employees perform their duties. What is all this for? The main goal is to identify sources of potential loss.

Loan Expert

When you want to borrow money to buy a product and go to the bank for it, you will be immediately directed to. What is this profession and what does its representative do?

A loan officer is the person on whom it entirely depends whether you end up with a loan or not. In his work, he is guided by the internal policy of the bank and his assessment of the client's solvency. Based on these two criteria, he makes a decision - to grant a loan or refuse.

In addition, this specialist gives detailed advice on all issues related to lending. Preparation of documents necessary for concluding a loan agreement is also his responsibility.

Operationist

The profession of a teller, like an accountant, is also one of the most common and numerous in terms of the number of staff positions. Most often, bank customers turn to him for help.

The operator introduces individuals with the services offered by the bank. He explains their benefits in detail, as he is interested in customers using them. It also helps to draw up a contract correctly, to carry out any available operation on bank accounts and plastic cards. He can be asked to make a payment, make remittance, open a deposit, and so on.

Where to study

What should a bank employee know? Naturally, banking. It is this specialty that you need to pay attention to in the process of searching for a secondary specialized or higher educational institution. "Finance and credit" is also suitable.

Training in the specialty "" is conducted in a good half of colleges and universities in Russia. Here is a short list as an example:

- Moscow City Open College.

- Moscow Financial and Law University.

- Vocational Education College of Perm State University.

- Kaliningrad Business College.

- Russian New University.

To enter universities, one must pass the Unified State Examination in mathematics, Russian language and social science. Some universities may also require the results of an exam in history and (or) English - this must be clarified in the selection committee. In secondary schools (colleges and technical schools) they enroll according to the competition of certificates.

Responsibilities

Each bank employee has a set of responsibilities that are directly related to the profile of his activity.

- The cashier-operator checks the documents presented by the client for authenticity, counts the money that he receives and issues, performs operations with bank securities and plastic cards, fills out various certificates and draws up other documents within his competence.

- Bank agents and managers actively, but unobtrusively, offer the services that the bank provides to customers. In addition, they provide detailed advice on issues that interest a potential client.

- Bank employees who belong to the management are responsible for the distribution of responsibilities between all employees, take part in the development of new products and projects, and predict the further development of the bank.

Skills and personal qualities

An applicant for the position of a bank employee is evaluated not only by his education, qualifications and professional achievements. The employer also pays attention to his personal qualities. A successful employee is always attentive, disciplined, punctual, responsible and, of course, competent in the field of finance and economics. What else is important for such a specialist? He needs to have the ability to quickly and accurately conduct mathematical calculations. In addition, he must politely and clearly explain incomprehensible points to customers.

To achieve career heights, a bank employee must be able to fully concentrate on work and constantly improve their level. Initiative, purposefulness and perseverance will help in this.

In addition to all of the above, a bank employee needs to own:

- knowledge of a personal computer and the principles of operation of office equipment;

- communication skills;

- well-set diction;

- the basics of conflictology.

Wage level

A bank worker can make a career fast enough. Of course, career take-off affects the salary. A beginner earns on average in Russia from 20,000 to 35,000 rubles. For six months of productive work, it is quite realistic to rise to the level of 45 thousand rubles.

Salary for middle management positions loan officer, regional manager) - about 60-80 thousand rubles. Employees with experience and high qualifications can receive about 100-130 thousand rubles.

Career

As a starting step, you can choose the position of a clerk, an assistant accountant or a customer service employee. To climb the career ladder, you will need a higher education. It is also important to have professional skills and abilities. If a bank employee makes every effort, he may well become first the chief specialist, then the head of the department, and even aim at the post of director.

Prospects of the profession

Choosing the profession of a bank employee, you can not worry about the difficulties of finding a job. Financial and credit institutions today are growing like mushrooms after the rain, and they all need good specialists.

Banking professions are still classified as the most reliable and stable. This concerns the near future. If you look a little further, then in the not too distant future - the transition to automated Internet systems for payment and other financial transactions. What does it say? Bank workers will be gradually reduced as they will have to serve an ever-decreasing number of those who will not be able to adapt to innovations.

bankers(top and middle management) are the owners of bank capital and managers involved in the banking business. The profession is suitable for those who are interested in mathematics and economics (see choosing a profession for interest in school subjects).

Features of the profession Banker

Lending is one of the classic banking operations. However, this is not the entire activity of the bank. Most banks do different kinds operations and caters to different customer segments.

- Credit Department accepts applications for loans, analyzes the financial condition of the borrower, the business project under which the loan is taken, the reliability of collateral or other security; maintains a credit file and supervises intended use loan, controls the safety of the collateral. The decision to issue a loan is made by the credit committee, which consists of the heads of various departments of the bank.

- Investment department is engaged in the analysis of projects requiring long-term investments (investments), including the purchase of enterprises, control over the implementation of these projects, the financial condition and development of enterprises.

- Department of valuable securities is engaged in the placement of securities on the stock exchange and on the market, the implementation of investments in profitable securities; as well as issuing own bills of exchange in order to raise funds.

- Dealing Department(treasury) carries out operations on monetary and foreign exchange market, earning profit on exchange rate fluctuations, buying and selling currencies to customers and other banks.

- stock department places shares and bonds of the bank on the market.

- Operations department maintains and services customer accounts, accepts from customers their instructions for making payments and transfers them to the settlement department for execution.

- plastic department cards - an integral structure modern bank. Plastic cards for the bank are additional customers and additional income.

- Legal Department. The work of the legal department begins with the opening of accounts for clients and verification of the legality of the registration of the client (company). Another important job of the legal department of the bank is the conduct of arbitration processes, which inevitably arise in the work of each bank. The result of the lawsuit depends on how the lawyer represents the bank in court.

- Reporting department. Reporting is the face of a bank. A self-respecting client will not work with a bank without studying its statements, which reflect all aspects of the bank's activities: the profitability of its operations, the number of customers, the value loan portfolio and portfolio of securities. In addition, reporting is studied not only by bank customers, but also central bank RF. In the event of reporting that does not comply normative indicators, the Central Bank may prohibit the bank from carrying out certain operations (for example, issue loans or attract deposits), or may revoke the license altogether and close the bank.

- Department economic analysis . Without analysis, there can be no right decision. Right Decisions- this is a high profit, wrong - losses.

- Department information technologies and automation. The activity of a modern bank is impossible without computerization and the use of communication channels. The quality of the bank's work, and hence the number of its customers, largely depends on the quality and security of information technologies.

- Marketing department must provide such advertising that customers choose this particular bank.

How bigger bank, the wider and more voluminous its structure. Banks provide the opportunity to work consistently in all departments. A senior manager needs experience in all departments to lead successfully.

Pros and cons of being a banker

pros

The main advantage of working in a bank is rightly considered stability. Against the background of a turbulent and unpredictable market of commercial enterprises that spontaneously appear and just as spontaneously disappear, commercial banks are a bulwark of stability. In the banking system, it is quite possible to quickly make a career take-off. Working in a bank, a specialist independently chooses the path of development. If a manager wants to climb the career ladder and reach certain heights, he will use every opportunity: strive to intersect in the work of his department with the directions of other banking departments, complete tasks on time, linger after the end of the working day in order to start doing what is scheduled for the next work time. There is a direct relationship between income and the level of professionalism. The higher the position, the greater the responsibility. The degree of risk is directly proportional to the position and salary.

Minuses

The disadvantages of the profession include the highest responsibility, the lack of the right to make a mistake, irregular working hours.

Place of work

A banking specialist can work not only in banks, but also in the planning departments of various enterprises, investment design departments, financial institutions, insurance companies, credit organizations, stock exchanges.

Important qualities

A successful banker must have such personal qualities as attentiveness, responsibility, purposefulness, initiative, readiness for self-education; efficiency, the ability to quickly find the right solutions; composure, clarity in the performance of professional duties, discipline; thrift, the desire to earn money, not spend it; sociability; the ability to conduct a balanced policy.

Banker Training

Russian Institute vocational education"IPO" - recruits students to receive a specialty through a distance program professional retraining and advanced training. Studying at the IPO is a convenient and fast way to receive distance education. 200+ training courses. 8000+ graduates from 200 cities. Short deadlines for paperwork and external training, interest-free installments from the institute and individual discounts. Contact us!

universities

We invite you to familiarize yourself with our list.

You can become a specialist in banking in specialized universities in Russia at the faculties of economics or finance in the specialties "Banking", "Finance and Credit".

Training in this specialty provides a set of knowledge in the field of:

- banking operations

- finance and money circulation

- accounting in banks

- economic analysis

- accounting and economics of an organization (enterprise)

The educational program of the specialty "Banking" provides for the fundamental and special study by students of the legal and organizational foundations of the activities of credit institutions, the essence and technology of banking operations and transactions, the rules of accounting in credit institutions, the threat to banking security and measures to eliminate them, legal framework audit activity. A special place is occupied by training in the skills of reporting on activities credit institution, application of methods and means of protection banking information, registration of primary accounting documents, maintaining synthetic and analytical accounting of banking operations in the relevant accounting registers.

Secondary specialized educational institutions in the specialty "Banking":

- Moscow Commercial Banking College;

- Moscow Credit College.

Salary

Salary as of 24.02.2020

Russia 30000—400000 ₽

Moscow 40000—150000 ₽

The banking community is among the leaders in terms of salaries, the level of which depends on the position held, the size of the bank. The Bankir.ru portal reports that bankers' salaries are growing faster than inflation.

Career steps and prospects

Higher education is a prerequisite for a career and a launching pad for professionalism. You can start a career in a bank from the position of a customer support officer, clerk, assistant accountant. The salary of a novice specialist, as a rule, is low. But there is an opportunity for career growth. Moving up the career ladder of a banker largely depends on the efforts of the employee himself, work experience, level professional development. Within a year, you can become a middle manager (head of department). With certain abilities and aspirations, there is an opportunity to become the head of a bank branch, deputy head of a bank, director of a bank.

famous bankers

Mayer Amschel Bauer (Rothschild) (1744-1812) - the founder of an international dynasty of bankers, the founder of a bank in Frankfurt am Main. The business was continued by his five sons: Amschel Mayer, Solomon Mayer, Nathan Mayer, Kalman Mayer, James Mayer. The brothers created the world's largest international banking consortium in the largest cities of Europe (Paris, London, Vienna, Naples, Frankfurt am Main) in 20 years.

Peabody George (1795-1869) Native American. In the middle of the 19th century, his bank, with the help of capital from the Old World, financed industrial development young republic. Without Peabody, the US economy would not have developed at such a rapid pace. And certainly, without Peabody, the empire of J.P. Morgan would not have appeared.

Herbert Stepic (German: Herbert Stepic, born December 31, 1946, Vienna) is an Austrian banker. Herbert Stepic created a unique network of banks RZB and Raiffeisen International

Gerashchenko Victor Vladimirovich was born on December 21, 1937 in Leningrad. Professor, Doctor economic sciences. Chairman of the Central Bank of Russia during the years of perestroika. In March 2002, he was replaced in this post by Sergei Ignatiev. Viktor Gerashchenko has worked at the International Monetary Fund, the International Bank for Reconstruction and Development, the Multilateral Investment Guarantee Agency, and the European Bank for Reconstruction and Development. In December 2003, he was elected to the State Duma of the fourth convocation.

Portrait of an ideal banker

The well-known banker Yevgeny Bernshtam was asked in an interview a few years ago who a banker is. He replied that "a banker is, first of all, a sane person." A modern banker must have a good profile education, be able to understand not only banking products, but also life, and know the psychology of people very well. He needs to have constructive thinking and be a conservative in the good sense of the word. Very important quality for a banker - the ability to work effectively in a team. It is necessary to have your own position, lead a certain lifestyle, expand your horizons, be able to force yourself to go towards the goal and improve yourself. Some clients can give odds on economic literacy to many bankers. And if an economically educated client is faced with the ignorance of a bank employee, he ceases to respect, not the employee himself as a person, but the bank with which this employee is associated in the mind of the client. The more professional, consistent and purposeful the employees, the more successful the bank in which they work, the more dynamically and confidently the banking structure of the state develops.

Professional holidays:

December 2nd- The Association of Russian Banks has declared Banker's Day (since 2004). The annual International Financial Forum is timed to coincide with this day, at which the most important aspects of the development of the international banking system and global financial markets. And the best employees of banks on this day receive Honorary badges of the Association.

December 2nd- the most suitable date for establishing a bank holiday. On this day in 1990, the laws "On Central Bank Russian Federation"and" About banks and banking activity ". Started from that day recent history banking in Russia.

Very often you can hear that a person is a banker. However, this is a very broad definition that needs to be explained. Let's take a look at a banker who is who, what functions he performs and what is needed to become one.

Who are called bankers

(function(w, d, n, s, t) ( w[n] = w[n] || ; w[n].push(function() ( Ya.Context.AdvManager.render(( blockId: "R-A -329917-22", renderTo: "yandex_rtb_R-A-329917-22", async: true )); )); t = d.getElementsByTagName("script"); s = d.createElement("script"); s .type = "text/javascript"; s.src = "//an.yandex.ru/system/context.js"; s.async = true; t.parentNode.insertBefore(s, t); ))(this , this.document, "yandexContextAsyncCallbacks");

To begin with, it is worth deciding who are bankers? These are specialists, both middle and senior level, working in the bank, being the owners of the bank, being the heads of the department or subdivision.

In addition, specialists with banking qualifications can work not only in banks, but also in the planning departments of enterprises. for various purposes and forms of ownership, can work with investments, various financial institutions and insurance companies. Engage in loans and play on the stock exchanges.

Important qualities of the profession

In order to become a successful specialist, you must have the following qualities:

- Be careful;

- a high degree of responsibility;

- purposeful;

- initiative is welcomed;

- be constantly ready to receive new knowledge and engage in self-education;

- be able to quickly choose the most correct decisions;

- to be collected;

- clearly fulfill the professional tasks and requirements set for the specialist;

- internal self-discipline;

- be frugal;

- desire to earn more and spend less;

- be sociable;

- be able to pursue a balanced and reasonable policy.

Tasks banker

The professional duties of a banking specialist include:

- customer service;

- consulting on various financial issues;

- performance of analytical activities;

- planning and forecasting.

The list may be longer, since the higher the position, the more complex tasks will need to be solved.

Main positives and negatives

Among the positive aspects of the profession of a banker are:

- stable high salary or income;

- the opportunity to make a career, starting with an ordinary one and ending with the head of a department or branch;

- access to a new social status.

The main disadvantages include:

- irregular working hours - when there is a desire to make a career, you have to spend a lot of time doing a certain amount of work;

- huge responsibility for the operations performed;

- there is no right to make a mistake, since the harder it is, the more opportunities to lose your job altogether, receiving a huge fine in addition, if not a criminal case;

- some commercial banks are closing, which leads to the search for a new job;

- you need to constantly engage in self-improvement, especially if you want to make a career.

As you can see, the work of the specialty of a banker is someone who can not only be able to count, but also competently distribute the funds received, largely increasing them. In addition, he must be well versed in areas such as finance and marketing.

(function(w, d, n, s, t) ( w[n] = w[n] || ; w[n].push(function() ( Ya.Context.AdvManager.render(( blockId: "R-A -329917-3", renderTo: "yandex_rtb_R-A-329917-3", async: true )); )); t = d.getElementsByTagName("script"); s = d.createElement("script"); s .type = "text/javascript"; s.src = "//an.yandex.ru/system/context.js"; s.async = true; t.parentNode.insertBefore(s, t); ))(this , this.document, "yandexContextAsyncCallbacks");

Banker - the owner of bank capital or an employee involved in the banking business. The latter include managers, consultants or other employees. The profession of a banker is considered to be in demand. On this moment there is a severe shortage of such highly qualified specialists.

Description of the profession - what does a banker do

The position held determines what the banker does. The work of ordinary employees is to interact with customers. The duties of a banker are conditionally divided into main (work with finances) and auxiliary (assessment of borrowers' prospects, study of the financial industry).The main responsibilities are:

- service

- counseling

- analysis

- planning

There are 8 main banking divisions:

- lending (issuance of loans, acceptance of loan payments, analysis financial condition borrower, etc.)

- investment (analysis of projects that need long-term loans)

- stock department (engaged in the placement of bonds and shares of the bank on the stock market)

- legal department (opening and closing client accounts with verification of the legality of the submitted transactions, control over arbitration processes, is the representative of the bank in court)

- securities (issue of bank bills, placement of securities on the stock exchange)

- treasury (carrying out various operations on financial market for profit)

- Department plastic cards(reception, issuance of plastic cards of the bank)

- marketing (advertising the activities of a particular bank in order to attract new customers)

Important! A banker and a bank employee are different directions. A banker in the pure sense is a businessman, the owner of a bank, bank capital. A bank employee is a hired specialist in a banking structure who holds a certain position.

Who can become a banker: suitable qualities for work

Any specialist who decides to work in financial sector, it is desirable to graduate from a university in the relevant specialty and have a standard set of skills. This includes sociability, punctuality, neatness, accuracy, attentiveness, and so on.

A qualified banker has the following set of qualities:

- Analytical mind

- the ability to process large amounts of information

- responsibility

- ability to delegate (assign tasks to subordinates)

- efficiency

- energy

- industriousness

- active life position

- purposefulness

You need to be prepared for related activities. For example, an employee of the legal department of a bank should understand not only legislative framework but also have knowledge of finance. This allows him to quickly solve problems, draw up contracts correctly and mutually beneficial.

How to apply to study as a banker: necessary subjects

You can learn to be a banker at any university of economic orientation. It is important to choose a specialized educational institution of economic and financial orientation. Mostly it is “Banking” and “Finance and credit”.Graduates with a degree in Banking are suitable for work in investment, insurance institutions and financial departments of the bank. Specialists in the field of "Finance and credit" work in financial centers, credit enterprises and directly in the banking structure in the relevant departments.

A person who wants to become a banker submits the following subjects:

- entrance exam in mathematics (taken in writing upon admission)

- mathematics as a core subject

- USE in a foreign language

- USE in Russian

- Economy

- Jurisprudence

- Social Studies (surrendered at some universities)

Advice. A qualified bank employee understands several areas. For example, an employee of the marketing department, in addition to the main specialty, must also understand finance and the features of banking software products.

What salary can a banker expect

The salary of a banker depends on the department in which he works and the position he holds. The most highly paid is the director. The work of such a specialist is estimated at 4 thousand dollars or more. Such income is justified high risks, the greatest responsibility and a wide range of tasks performed.

For example, the director of consumer lending has the following responsibilities:

- organization of the sales process of various loans

- building verticals of regional offices

- organization of staff development

- motivation of partners and staff

- responsible for fulfilling the bank's business fee on consumer loans

For different heads of departments different types salaries presented below (expressed in thousands of dollars):

- Department for the development of lending processes - 1.8

- management department credit risks – 2.2

- IT project - 2.5

Economists and accountants receive a relatively modest salary, averaging $500. Their duties are to financial statements and support of banking operations. The main requirements for candidates are the ability to work in office software, knowledge of accounting, responsibility and attentiveness.

Competent resume of a banker

There is a set of rules by which a banker's resume is compiled.Such a document has a standard set of information:

- Name of the candidate

- education

- career objective

- age

- Family status

- residential address

- Contact details

- terms of cooperation

- employment (full/part-time)

- schedule

- experience

- skill level

How to become a banker: video

The word "banker" evokes positive associations: a large amount of money (for example, like Scrooge McDuck in the Disney cartoon "DuckTales"), respect, expensive cars, apartments.

Can they become a modern graduate? Not excluded.

Let's see in general what kind of profession is banking, and how "bank employee" and "banker" correlate with it. Let's figure out who does what. If you are puzzled, where can you get a loan for an unemployed student? The service https://loanexpert.net.ua/kredit-dlya-studentov/ will help you with this, for the selection of profitable loans with a minimum interest rate.

Bank employees - who are they and what are their functions

Bank employees are ordinary bank employees who, in most cases, interact directly with customers and perform specific banking operations that do not require in-depth analysis.

Functions are defined by specialization:

- credit advice;

- advice on deposits, servicing depositors;

- work with plastic cards;

- conducting foreign exchange transactions.

Who is a banker and how to become one

A banker is a financial manager, a representative of the highest administrative level, who does not work directly with clients and does not perform specific banking operations, as an ordinary employee, but is engaged in forecasting, planning, conducting a deep comprehensive analysis of the bank's activities, the state of the economy (regional, national, foreign), etc.

Obtaining an economic education is necessary for the profession of a banker. It is also desirable to have a legal, managerial. Internships in leading banks, fluency in several foreign languages are desirable.

The most famous bankers are the Rothschilds, John Rockefeller and others.

List of positions in the bank

Who can work in a bank?

Here's a short list in ascending order:

- cashiers-operators and currency cashiers;

- maintenance specialists;

- credit specialists;

- middle management consultants;

- banker, manager

In addition, there are specialties related to banking, but indirectly related to it: IT service specialists, lawyers, debt collection specialists, etc.

What education do you need to work in a bank

Working in a bank requires the candidate to have an economic education. The profile is decisive.

So, a cashier who is engaged in receiving and issuing funds can graduate from Accounting, Analysis and Audit, Finance and Credit. The second option, like "Banking", is the most common.

What items need to be handed over to the banker

After grade 11, the results of the USE in the following subjects are provided to the selection committee: mathematics, Russian language, social studies.

Some universities replace social studies with a foreign language.

TOP-5 universities with the specialty "Banking"

The future profession is largely determined by the level of the university.

Let's list leading universities that train in this specialty:

- Lomonosov Moscow State University;

- Moscow State University of International Relations;

- Financial University under the Government of the Russian Federation;

- High School of Economics;

- Russian Economic University. G. V. Plekhanov.

Often "Banking" expands or vice versa, narrows. The description of the directions may look like:

- "Banking Manager";

- "Finance of production and banking sectors economy";

- "Banking and risk management";

- "Money, banks, financial markets".

The curriculum of the specialty "Banking" includes such disciplines as:

- banking regulation of foreign exchange transactions;

- investment portfolio management;

- credit policy of the company;

- banking risks;

- settlement and payment systems;

- electronic innovations in the banking business;

- processing and control of banking transactions, etc.

How many years to study

The term of study depends on the number of years spent in a general education institution:

- After 9th grade a graduate can enter a college (for example, at Synergy University) with a study period of 2 years and 10 months;

- After 11th grade- it is possible to enter, firstly, a college - 1 year 10 months; secondly, to the Faculty of Economics at the institute with a term of study of 4 years (full-time bachelor's degree). You can continue your studies in the magistracy lasting 2 years (full-time);

There are also short-term courses - from 3 months to 12.

How much does a banker get

The average salary of a banker in Russia is 300,000 rubles. A bank employee receives an average of 45,000 rubles.

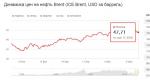

Income depends on the position, work experience, region. For example, the salary of a bank employee is 41,167 rubles, a mortgage consultant is 50,417 rubles.

Career growth in the bank

Career in banking develops quite intensively, which especially attracts young professionals. There are cases when, in 8-12 months, a banking specialist acquires the necessary skills to work in the middle link.

What a good banker should know and be able to do

The requirements are quite serious:

- A banker must know perfectly not only banking, but also financial right, administrative law, the specifics of personnel management.

- A banker must be able to predict the dynamics of development national system and foreign; understand what the consequences may be as a result of the strengthening or collapse of a particular currency, how it will affect the country's economy.

- The specialist must be able to plan the activities of the bank; evaluate what banking products in demand, losing relevance, not in demand; track dynamics interest rate on deposits, loans, mortgages in comparison with the offers of other banks and the situation on the world market.

- An experienced banker, in order to increase the profitability of the bank, can invest in large objects, as well as act as a partner on mutually beneficial terms (for example, a reduced mortgage rate when buying an apartment from a certain developer).

At the same time, the qualities of a banker must be appropriate:

- purposefulness;

- foresight;

- enterprise;

- stress resistance;

- sociability;

- the ability to take risks;

- responsibility.

Pros and cons of working in a bank

The advantages of the profession include its relevance, the presence a large number offers on the labor market in all regions of the Russian Federation, high wages, good conditions labor, the presence of a corporate program in addition to social guarantees in many banks.

Among the shortcomings of the profession, one can note a high degree of financial responsibility, the need for constant regulation of emotions, tone and timbre of speech in order to create the image of a friendly, client-oriented organization. Irregular working hours are possible.