When is the minimum tax calculated for the simplified tax system? Minimum tax simplified tax system. How to reflect the minimum tax in the Income and Expense Book

Organizations and individual entrepreneurs - individual entrepreneurs using the simplified tax system with the taxable object INCOME minus EXPENSES (USN D-R) must calculate the amount of the minimum tax based on the results of the tax period (year). There is no need to calculate the minimum tax based on the results of reporting periods.

Minimum tax is paid if for the tax period the amount of tax calculated in the general manner is less than the amount of the calculated minimum tax, i.e. a loss was incurred. Therefore, it is beneficial for income to be slightly higher than expenses, so that there is no loss under the simplified tax system D-R.

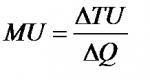

The minimum amount of tax under the simplified tax system for an object of income minus expenses is calculated using the following formula:

Minimum tax = Taxable income received during the tax period × 1 %.

The minimum tax under the simplified tax system 2020 should be paid to the budget if at the end of the tax period it turned out to be more than the “simplified” tax calculated at the regular rate (15% or less).

For example, a company applies the simplified tax system with the object of taxation being income minus expenses:

- For 2020, the company received income in the amount of RUB 28,502,000.

- Reflected in expenses amounted to RUB 28,662,300.

Since the recorded expenses are greater than income, this means that at the end of the year there will be a loss in the amount of 160,300 rubles.

(RUB 28,502,000 – RUB 28,662,300). Therefore, the tax base and single tax at the regular rate are zero. It is in this case that the minimum tax must be calculated. It will be:

RUB 285,020 (RUB 28,502,000 × 1%)

The minimum tax is greater than the single tax, so at the end of 2020 you will have to pay a minimum tax to the budget.

In case of combining the simplified tax system with another tax regime, for example with patent system taxation, the amount of the minimum tax is calculated only from income received from “simplified” activities (letter of the Federal Tax Service of Russia dated March 6, 2013 No. ED-4-3/3776@).

It must be remembered that The minimum tax is paid only at the end of the year, and only if the “simplified tax” loses the right to the simplified tax system within a year, then the minimum tax (if it is payable) must be transferred based on the results of the quarter in which the right to the simplified tax system was lost. There is no need to wait until the end of the year.

It would be a mistake if an organization pays the minimum tax during the year, citing the fact that I will still be subject to it for the year, or that at the end of the quarter the tax turns out to be zero, but something needs to be paid. You need to pay, but advance payments according to the simplified tax system.

Deadlines for payment, BCC minimum tax

The Tax Code of the Russian Federation does not establish special deadlines for paying the minimum tax. This means that it must be listed in the general manner no later than the deadline established for filing tax return:

- legal entities pay minimum tax no later than March 31.

- entrepreneurs - no later than April 30 of the year

KBC minimum tax for 2020, credited to the budgets of the constituent entities of the Russian Federation

182 1 05 01021 01 1000 110.

The “simplified” people will transfer the minimum tax for 2016 to another KBK

The Ministry of Finance published a comparative table of the BCC for 2016-2017. For tax transfers based on the results of 2016, “income-expenditure” simplifications were left with one general BCC, both for the minimum tax and for those calculated at the regular tax rate.

In the payment slip for the transfer of “simplified” tax (including the minimum) you will need to indicate the code budget classification 182 1 05 01021 01 1000 110 .

Minimum tax offset under the simplified tax system

Is it possible to offset already paid advance payments for the simplified tax against the payment of the minimum tax? Theoretically, it is possible, but tax authorities often refuse to offset and demand to pay the entire amount of the minimum tax, citing the fact that “simplified” and minimum taxes have different BCCs and offset is impossible for organizational reasons. But that's not true. The minimum tax is not a special tax, but just minimum size a single tax under “simplification”, and all offset rules can be applied to it. This means that the advance payments you paid during the year under the “simplified” tax can be offset against the minimum tax (). Arbitration practice also confirms the expediency of such actions (Resolution of the FAS VSO dated July 5, 2011 No. A69-2212/2010).

In order to offset advance payments against the minimum tax, you need to submit the appropriate one. And attach to it copies of payment orders confirming the payment of advance payments.

If it still fails to make an offset and the organization pays the minimum tax in full, then the advance payments will not be lost. They will be offset against future advance payments for the “simplified” tax (clauses 1 and 14). The credit can be made within three years.

Accounting for the minimum tax in expenses under the simplified tax system

The difference between the minimum and simplified taxes for last year the taxpayer can take into account in (clause 6). Including increasing losses by the difference (clause 7 of Article 346.18 of the Tax Code of the Russian Federation). It is possible to take into account the difference between the minimum and single taxes under the simplified tax system only at the end of the year (letter of the Ministry of Finance of Russia dated June 15, 2010 No. 03-11-06/2/92). Thus, at the end of 2020, the organization can include in expenses the difference between the minimum and simplified taxes paid at the end of last 2019.

You can include this difference in expenses (or increase the amount of loss by it) in any of the subsequent tax periods (paragraph 4, paragraph 6, article 346.18 of the Tax Code of the Russian Federation). Moreover, the Russian Ministry of Finance clarifies that the difference between the amount of the minimum tax paid and the amount of tax calculated in the general manner for several previous periods can be included in expenses at a time (letter dated January 18, 2013 No. 03-11-06/2/03).

| ADDITIONAL LINKS on the topic |

-

What expenses and in what order are taken into account under the simplified tax system in the form of income minus expenses. Determining expenses for purposes tax accounting when using the simplified tax system.

The minimum tax is paid only under the simplified tax system “income minus expenses”. Since under the simplified tax system there is “income”, the expenditure part is not taken into account when paying tax. And the entrepreneur can only receive a loss actually, and even with this outcome he will have to pay tax in

in the amount of 6% of the revenue received.

Minimum income paid at the end of the year. Its rate is set at 1% of the amount of income. It is paid if the amount of the minimum tax is higher than that calculated in the general case. For example, the company received income in the amount of 30 million rubles for the year, expenses for the same period - 29 million rubles. The tax base in this case will be equal to 1 million rubles. Accordingly, the tax amount at a rate of 15% is 150 thousand rubles. Whereas the minimum tax is 300 thousand rubles. (30,000,000 * 0.01). It is this amount, and not the 150 thousand rubles received under the standard payment scheme, that will need to be transferred to the budget.

A similar situation arises with losses received for the year. On a general basis, the amount of tax payable will be zero, and tax will need to be paid in the amount of 1% of turnover. If the loss was received based on the results of a quarter, half a year or three quarters, the minimum tax is not paid. In this case, advance payments are simply not transferred. There are situations when the single tax turns out to be equal to the minimum. Then you need to pay a single tax.

It is worth noting that the BCC for the minimum tax is different (182 1 05 01050 01 1000 110). The purpose of the payment must also indicate that this is the minimum tax.

Procedure for reducing the minimum tax

The minimum tax can be reduced on advance payments. If at the end of the year it becomes clear that it is necessary to pay the minimum tax, then it is paid in the amount of the difference between the payments made during the year and the calculated tax. Sometimes the tax office requires you to submit an application to offset advance payments against the payment of the minimum tax.

For example, a company received revenue of 5 million rubles per quarter, its expenses amounted to 4.8 million rubles. Accordingly, she made advance payments in the amount of 30 thousand rubles three times. (total - 90 thousand rubles). At the end of the year, its income amounted to 20 million rubles, expenses - 19.2 million rubles. On a general basis, a tax of 120 thousand rubles was calculated. (800,000 *0.15). Consequently, she needs to pay a minimum tax of 200 thousand rubles. Advance payments in the amount of 90 thousand rubles are deducted from this amount, i.e. the balance of 110 thousand rubles is transferred to the budget.

If it turns out that the advance payments exceeded the amount of the calculated minimum tax, then you do not need to pay it. And the excess amount can be offset in the future, or you can apply to the tax office for a refund.

There are no other ways to reduce the minimum tax. Thus, it cannot be reduced by the amount of insurance premiums paid for employees. Since these payments are already included in the amount of expenses incurred.

The simplified tax system is gaining popularity to this day, although among owners of small and medium-sized businesses it is already the most frequently chosen system when registering new enterprises and when changing one type of taxation to another. The simplicity of filling out reports and maintaining accounting and tax records is captivating. In this article we will tell you how the simplified tax system rate is calculated in 2020 and give examples of calculations.

Information about the simplified tax system

On “Simplified”, the taxpayer is expected to pay a single tax (UT) instead of separate taxes on property, profit and value added.

Rates of the simplified tax system vary depending on the selected taxation object: (click to expand)

- 6% (at preferential terms this is 1%), when the object of taxation is the total Income of the enterprise;

- 15% (on preferential terms this is 5%) when the object is the difference between Income and Expenses.

Advantages and disadvantages of using the simplified tax system:

| Advantages: | Flaws: |

| Not much reporting | Revenue limit (from 2017 this is 150 million rubles) |

| No VAT, property and profit tax | Number of employees no more than 100 |

| Not many tax registers, easy control over company losses | Part of the funds in the authorized capital of third-party companies is not higher than 25% |

| In the “Revenue” mode, you don’t have to keep track of all expenses | No right to open branches (only representative offices and separate divisions are allowed) |

| Low rate on insurance payments (20% for certain areas of activity) | Inability to have OS in an amount above the income limit |

| More than 70 regions enjoy benefits (1% under the “Income” regime and 5% under the “D – R” system) | Reluctance of some potential partners who need to account for VAT on transactions to enter into a cooperation agreement |

| Two-year tax holiday for individual entrepreneurs (0% rate), who registered an enterprise after the adoption of the law, and those engaged in production, social, scientific activities or household services | |

| It is possible to combine “STS and ENDV”, “STS and patent”, this can help increase profits |

Who is not entitled to switch to the simplified tax system?

Below is full list enterprises that do not have the right to be taxed under the “simplified tax”:

STS rate 6% and 15% – calculation features

By switching to the simplified tax system, an organization or individual entrepreneur can choose the income of their enterprise or the difference between income and expenses as the object of taxation. Both systems have their advantages, and you need to approach your choice based on data accounting individual company. Read also the article: → “. Conditional equality can help you make your choice:

Income x 6% = (Income - Expenses) x 15%

It can be noted that the tax amounts in both cases will be the same if the costs amount to 60% of the company’s revenue. As expenses increase, the amount of tax payable decreases; accordingly, if incomes “left and right” are equal, it is advantageous to prefer the simplified tax system “D-R”. The formula does not reflect some essential criteria:

- Unproven expenses cannot be deducted from tax. To confirm them, you need to keep documents confirming payment (receipts, checks, etc.) and confirmation of the issue of goods or completion of work (invoice, act).

- The list of expenses is strictly regulated; not all expenses can be taken into account for tax purposes.

- Exists special order recognition of certain expenses. For example, in order to write off the costs of purchasing goods for resale, you will have to document their payment and the fact of the sale (issuance of ownership, payment is not required).

STS “Income”, rate 6%

STS “Income minus expenses”, rate 15%

In this mode, it is possible to take into account the insurance paid by the organization when recalculating the tax. contributions. Their amount cannot be deducted from the tax itself; they are included in the list of expenses for the reporting period.

- If there are no employees in the organization, the entire insurance amount can be included in expenses. contributions;

- If you have employees, then you can take into account no > 50% of payments for yourself and employees.

If you have chosen the simplified tax system “D - R”, the concept of the minimum tax (1% of all revenue) is relevant for you, which you will transfer if the tax amount for the NP is general order the calculation will be lower than the amount of the calculated minimum tax.

Losses under the simplified tax system “Income-Expenses”

- can be deferred for any of the next 10 years;

- transferred in the sequence in which they were received;

- are documented;

- are taken into account when paying the annual tax, they cannot be reflected in advance deductions.

(65 pages)  Content: 1. Separate accounting when combining simplified tax system and UTII: features and rules of accounting 2. Deadlines for submitting a declaration under the simplified tax system 3. The procedure for calculating and paying income tax under the simplified tax system 4. Real estate accounting under the simplified tax system 5. Features of application tax regime USN for legal entities in the form of CJSC 6. Features of accounting simplified taxation system policies 7. Advantages of applying the tax regime of the simplified tax system for LLCs and individual entrepreneurs 8. Features of selling an LLC using the simplified tax system 9. Combining simplified taxation system and PSN 10. How to conduct accounting for an LLC using the simplified tax system? |

STS rate 10% – advantages and disadvantages

This EN rate is classified as differentiated. In order to take advantage of the benefits that it implies, you must register your enterprise in a constituent entity of the Russian Federation, which already has a law establishing the simplified tax system rate at 10%. In addition to the fact that you need to fall under the preferential category of taxpayers, it may also happen that a constituent entity of the Russian Federation has adopted a corresponding law, but there are restrictions for those wishing to pay taxes at this rate:

- by amount of income;

- by the number of employees in the state;

- by salary, etc.

If in the region there are several preferential “simplified” rates for different categories of taxpayers, and an enterprise (or individual entrepreneur) falls under several of them, it chooses the most favorable rate for itself.

Today, a 10% rate is offered to “simplified” residents of Moscow who are engaged in:

- manufacturing industry,

- exploitation of non-residential stock,

- science,

- social services,

- sports activities,

- growing cultivated plants, breeding animals, or both at the same time (revenue from such work is at least 75% of total income).

Rate of the simplified tax system by region (table)

Different regions apply different rates:

| The subject of the Russian Federation | Normative act | Tax rate | Categories of taxpayers |

| Moscow | Moscow Law of October 7, 2009 No. 41 | 10% | 1) manufacturing industries; 2) management of the operation of residential and (or) non-residential stock for a fee or on a contractual basis; 4) care activities with provision of accommodation and provision of social services without provision of accommodation; 5) activities in the field of sports; 6) crop production, livestock production and provision of related services in these areas. |

| Saint Petersburg | Law of St. Petersburg dated May 5, 2009 No. 185-36 | 7% | |

| Leningrad region | Law of the Leningrad Region of October 12, 2009 No. 78-oz | 5% | All organizations and entrepreneurs applying simplification, if the object of taxation is income reduced by the amount of expenses |

| Republic of Crimea | Law of the Republic of Crimea dated December 29, 2014 No. 59-ZRK/2014 | 4% | All taxpayers, if the object of taxation is income |

| 10% | |||

| Sevastopol | Law of Sevastopol dated November 14, 2014 No. 77-ZS | 5% | |

| Law of Sevastopol dated February 3, 2015 No. 110-ZS | 10% | ||

| 3% | Taxpayers who pay a single tax on the difference between income and expenses and carry out activities that are included in the following sections and classes of OKVED OK 029-2014: 1) class 01 “Crop and livestock farming, hunting and the provision of related services in these areas” of section A “Agriculture, forestry, hunting, fishing and fish farming” (with the exception of activities included in subclass 01.7 “Hunting, trapping and shooting of wild animals” , including the provision of services in these areas"); 2) subclass 03.2 “Fish farming” of section A “Agriculture, forestry, hunting, fishing and fish farming”; 3) section P “Education” (except for the types of activities included in subclasses 85.22 “Higher Education”, 85.3 “Professional Training”, 85.42 “Additional Professional Education”); 4) section Q “Activities in the field of health and social services” (with the exception of activities included in subclass 86.23 “Dental practice”); 5) section R “Activities in the field of culture, sports, organization of leisure and entertainment” (except for the types of activities included in subclass 92.1 “Activities for organizing and conducting gambling and betting") |

||

| 4% | |||

| Astrakhan region | Law of the Astrakhan region of November 10, 2009 No. 73/2009-OZ | 10% | 2) production of beverages; 4) clothing production; 5) production of leather and leather products; 7) production of paper and paper products; 8) printing activities and copying of information media; 11) production of other non-metallic mineral products; 12) metallurgical production; 13) production of finished metal products, except machinery and equipment; 14) production of computers, electronic and optical products; 15) production of electrical equipment; 16) production of machinery and equipment not included in other groups; 17) production of other Vehicle and equipment; 18) production vehicles, trailers and semi-trailers; 19) furniture production; 20) production of other finished products; 21) construction |

| Belgorod region | Law of the Belgorod Region of July 14, 2010 No. 367 | 5% | Taxpayers who pay a single tax on the difference between income and expenses, who have the largest specific gravity in income for the corresponding reporting (tax) period was income from the activities specified in Appendix 3 to the law |

| Bryansk region | Law of the Bryansk region of October 3, 2016 No. 75-Z | 12% | Taxpayers who pay a single tax on the difference between income and expenses and carry out activities in the following industries in accordance with OKVED OK 029-2014: 4) construction |

| 3% | Taxpayers who pay a single tax on income and carry out activities in the following industries in accordance with OKVED OK 029-2014: 1) extraction of other minerals (related to common minerals in accordance with the law); 2) manufacturing industries; 3) provision of electrical energy, gas and steam, air conditioning, water supply and sanitation; 4) construction |

||

| Vladimir region | Law of the Vladimir region of November 10, 2015 No. 130-OZ | 4% | Taxpayers who pay a single tax on income and carry out activities in accordance with OKVED OK 029-2014, which are listed in Appendix 1 to the law |

| 5% | Taxpayers who pay a single tax on the difference between income and expenses and carry out activities in accordance with OKVED OK 029-2014, which are specified in Appendix 2 to the law: – 01 Plant and animal husbandry, hunting and the provision of related services in these areas (except for group 01.15); – 02 Forestry and logging (except for subclass 02.2 and subgroup 02.40.2); – 03 Fishing and fish farming; 2) Section 2. Section C. Manufacturing: – 62 Computer software development, consulting services in this area and other related services; – 63 Activities in the field information technologies; 3) Section 5. Section M. Professional, scientific and technical activities: – 72 Research and Development |

||

| 8% | – provision of social services without providing accommodation | ||

| 10% | 1) Section 1. Section A. Agriculture, forestry, hunting, fishing and fish farming: – 02.2 Logging – tax rate; – 02.40.2 Provision of services in the field of logging; – 10 Food production; – 11.07 Production of soft drinks; production of mineral waters and other bottled drinking waters; – 13 Production of textile products; – 14 Clothing production; – 15 Production of leather and leather products; – 16 Wood processing and production of wood and cork products, except furniture, production of straw products and weaving materials; – 17 Production of paper and paper products; – 18 Printing activities and copying of information media; – 20 Production of chemical substances and chemical products (except for subgroup 20.14.1 and group 20.51); – 21 Production of medicines and materials used for medical purposes; – 22 Production of rubber and plastic products; – 23 Production of other non-metallic mineral products; – 24 Metallurgical production; – 25 Production of finished metal products, except machinery and equipment (except for subclass 25.4); – 26 Production of computers, electronic and optical products; – 27 Production of electrical equipment; – 28 Production of machinery and equipment not included in other groups; – 29 Production of motor vehicles, trailers and semi-trailers; – 30 Production of other vehicles and equipment; – 31 Furniture production; – 32 Production of other finished products; – 33 Repair and installation of machinery and equipment; 2) Section 3. Section E. Water supply; drainage, organization of waste collection and disposal, pollution elimination activities: – 37 Collection and treatment of wastewater; – 38 Collection, processing and disposal of waste; processing of secondary raw materials; 3) Section 4. Section J. Activities in the field of information and communication: – 59 Production of films, videos and television programs, publication of sound recordings and notes; – 60 Activities in the field of television and radio broadcasting; 4) Section 5. Section M. Professional, scientific and technical activities: – 71 Activities in the field of architecture and engineering design; technical testing, research and analysis; – Veterinary activities; 5) Section 6. Section P. Education: – 85.4 Additional education; 6) Section 7. Section Q. Activities in the field of health and social services: – 86 Activities in the field of health care; – 87 Residential care activities; – 88 Providing social services without providing accommodation; 7) Section 8. Section R. Activities in the field of culture, sports, leisure and entertainment: – 90 Creative activities, activities in the field of art and entertainment; – 91 Activities of libraries, archives, museums and other cultural objects; – 93 Activities in the field of sports, recreation and entertainment; 8) Section 9. Section S. Provision of other types of services: – 96 Activities for the provision of other personal services (except for groups 96.04 and 96.09) |

||

| Volgograd region | Law of the Volgograd region of February 10, 2009 No. 1845-OD | 5% | Taxpayers paying a single tax on the difference between income and expenses, for whom the largest share of income for the reporting (tax) period was income from the following types economic activity: - construction; – manufacturing industries. The share of income from these types of activities for the reporting (tax) period must be at least 70% of total income. Entrepreneurs have the right to apply a preferential rate if they carry out the types of activities listed in the appendix to the Law. The conditions for applying benefits for entrepreneurs are specified in paragraphs 2, 3 of Article 1 of the Law |

| Voronezh region | Law of the Voronezh region of April 5, 2011 No. 26-OZ | 5% | Taxpayers who pay a single tax on the difference between income and expenses and carry out the following types of activities in accordance with OKVED OK 029-2014: – section C “Processing industries”, except for class 19 “Production of coke and petroleum products”, class 20 “Production of chemicals and chemical products”; – section D “Providing electricity, gas and steam; air conditioning"; – section E “Water supply; drainage, organization of waste collection and disposal, pollution elimination activities” (grades 37, 38, 39); – section M “Professional, scientific and technical activities” (class 72). The conditions for applying the reduced tax rate are given in paragraph 2 of Article 1 of the law |

| 4% | – Section C “Manufacturing” (subclasses 10.1, 10.3; groups 10.51, 10.71, 13.91, 14.12, 14.13; subgroups 10.41.1, 10.41.2, 13.99.1, 32.99.8); – section M “Professional, scientific and technical activities” (class 72); – section Q “Activities in the field of health and social services” (subclasses 87.9, 88.1, 88.9); – Section S “Provision of other types of services” (Class 95; Group 96.01). The conditions for applying the reduced tax rate are given in paragraph 2 of Article 1.2 of the law |

||

| Jewish Autonomous Region | Law of the Jewish Autonomous Region of December 24, 2008 No. 501-OZ | 5% | Taxpayers who pay a single tax on the difference between income and expenses and carry out activities in accordance with OKVED OK 029-2014: 1) 37.20.1 Treatment of waste rubber; 2) 37.20.2 Processing of waste and scrap plastics; 3) 37.20.3 Processing of waste and scrap glass; 4) 37.20.4 Treatment of waste textile materials; 5) 37.20.5 Processing of waste paper and cardboard; 6) 85.3 Provision of social services |

| 8% | 1) 01.42 Provision of services in the field of animal husbandry, except veterinary services; 2) 80.1 Preschool and primary general education; 3) 85.2 Veterinary activities |

||

| 10% | 1) 01.2 Livestock; 2) 01.3 Crop production in combination with livestock production (mixed Agriculture); 3) 05.02 Fish farming; 4) 10.3 Extraction and agglomeration of peat; 5) 15.1 Production of meat and meat products; 6) 15.2 Processing and canning of fish and seafood; 7) 15.3 Processing and canning of potatoes, fruits and vegetables; 8) 15.4 Production of vegetable and animal oils and fats; 9) 15.5 Production of dairy products; 10) 15.6 Production of flour and cereal industry products, starches and starch products; 11) 15.7 Production of prepared animal feed; 12) 15.8 Production of other food products; 13) 15.98 Production of mineral waters and other non-alcoholic drinks; 14) 18.2 Production of clothing from textile materials and clothing accessories; 15) 19.3 Shoe production; 16) 26.4 Production of bricks, tiles and other building products from baked clay; 17) 36.1 Furniture production; 18) 40.3 Production, transmission and distribution of steam and hot water(thermal energy); 19) 41.0 Collection, purification and distribution of water; 20) 45.2 Construction of buildings and structures; 21) 45.3 Installation engineering equipment buildings and structures; 22) 45.4 Finishing work; 23) 51.21 Wholesale trade of grain, seeds and feed for farm animals; 24) 51.32 Wholesale trade of meat, poultry, products and canned goods from meat and poultry; 25) 51.38 Wholesale trade of other food products; 26) 51.39.1 Non-specialized wholesale trade in frozen food products; 27) 60.21.1 Operation of automobile (bus) passenger transport, subject to a schedule; 28) 60.24.1 Activities of specialized road freight transport; 29) 63.1 Cargo handling and storage; 30) 70.32 Management real estate; 31) 74.20 Activities in the field of architecture; engineering design; geological exploration and geophysical work; geodetic and cartographic activities; activities in the field of standardization and metrology; activities in the field of hydrometeorology and related areas; types of activities related to solving technical problems, not included in other groups; 32) 74.5 Employment and personnel selection; 33) 74.7 Cleaning and cleaning of industrial and residential premises, equipment and vehicles; 34) 85.12 Medical practice; 35) 85.14.1 Activities of nursing staff; 36) 90.01 Collection and treatment of wastewater; 37) 90.02 Collection and processing of other waste; 38) 90.03 Cleaning of territory, restoration after pollution and similar activities |

||

| Law of the Jewish Autonomous Region of May 25, 2016 No. 916-OZ | 1% | Taxpayers who pay a single tax on income and are engaged in construction in accordance with OKVED OK 029-2001 | |

| 4% | Taxpayers who pay a single tax on income and carry out activities in accordance with OKVED OK 029-2001, which are specified in the appendix to the law | ||

| Transbaikal region | Law Trans-Baikal Territory dated May 4, 2010 No. 360-ZZK | 5% | A reduced rate applies if the object of taxation is the difference between income and expenses, and taxpayers carry out the following types of activities in accordance with OKVED OK 029-2014: 1. a) subsection DA “Production of food products, including drinks, and tobacco”: 15.1 “Production of meat and meat products”, 15.5 “Production of dairy products”; b) subsection DB “Textile and clothing production”; c) subsection DC “Production of leather, leather goods and footwear production”; d) subsection DK “Production of machinery and equipment”, except for 29.6 “Production of weapons and ammunition”; e) subsection DM “Production of vehicles and equipment” 2. 90.00.2 “Removal and treatment of solid waste”; 3. taxpayers – residents of industrial parks; 4. taxpayers - subjects of state support and stimulation of innovation activities that implement priority innovative projects in the Trans-Baikal Territory |

| Ivanovo region | Law of the Ivanovo region of December 20, 2010 No. 146-OZ | 5% | Taxpayers who pay a single tax on the difference between income and expenses and carry out the following types of activities in accordance with OKVED OK 029-2014: 3) section E “Water supply; drainage, organization of waste collection and disposal, pollution elimination activities”; 4) section F “Construction”; 5) subclass 45.2 “Maintenance and repair of motor vehicles” of section G “Wholesale and retail trade; repair of vehicles and motorcycles"; 6) section H “Transportation and storage”; 7) section I “Activities of hotels and catering establishments”; 8) Section J “Activities in the field of information and communications”; 9) section M “Professional, scientific and technical activities”, with the exception of classes 69, 70; 10) section N “Administrative and related activities Additional services", with the exception of class 77; 11) section P “Education”; 12) section Q “Activities in the field of health and social services”; 13) section R “Activities in the field of culture, sports, leisure and entertainment”, with the exception of class 92; 14) section S “Provision of other types of services”; 15) section T “Activities of households as employers; undifferentiated activities of private households in the production of goods and provision of services for their own consumption.” |

| 4% | Taxpayers who pay a single tax on income and carry out the following types of activities in accordance with OKVED OK 029-2014: 1) section A “Agriculture, forestry, hunting, fishing and fish farming”; 2) section C “Manufacturing”, with the exception of groups 11.01–11.06, classes 12, 19; 3) section F “Construction”; 4) section P “Education”; 5) section Q “Activities in the field of health and social services”; 6) groups 93.11 “Activities of sports facilities”, 93.12 “Activities of sports clubs” of section R “Activities in the field of culture, sports, leisure and entertainment”; 7) group 96.02 “Provision of services by hairdressers and beauty salons”, 96.03 “Organization of funerals and provision of related services” of section S “Provision of other types of services”. The share of income from carrying out as the main one of the above types of economic activity for the reporting (tax) period is at least 70% of total income |

||

| Irkutsk region | Law of the Irkutsk region of November 30, 2015 No. 112-oz | 5% | Taxpayers who pay a single tax on the difference between income and expenses and carry out the following types of activities in accordance with OKVED OK 029-2014: 1) classes 01 “Crop and livestock production, hunting and the provision of related services in these areas”, 03 “Fishing and fish farming” of section A “Agriculture, forestry, hunting, fishing and fish farming”; 2) section R “Education”; 3) section Q “Activities in the field of health and social services”; 4) section T “Activities of households as employers; undifferentiated activities of private households in the production of goods and provision of services for their own consumption" |

| 7,5% | 1) section C “Manufacturing”; 2) section F “Construction”; 3) section I “Activities of hotels and public catering establishments”; 4) subclass 62.0 “Development of computer software, consulting services in this area and other related services” class 62 “Development of computer software, consulting services in this area and other related services”, subclass 63.1 “Data processing activities, provision of services in placement of information, activities of portals on the information and communication network Internet" class 63 "Activities in the field of information technology" section J "Activities in the field of information and communications"; 5) group 95.11 “Repair of computers and peripheral computer equipment”, subclass 95.1 “Repair of computers and communication equipment”, class 95 “Repair of computers, personal and household items”, section S “Provision of other types of services”; 6) class 72 “Scientific research and development” of section M “Professional, scientific and technical activities” |

||

| 5% | Taxpayers who pay a single tax on the difference between income and expenses are residents of industrial parks, subject to the conditions specified in Article 4 of the law. Kabardino-Balkarian Republic |

||

| 5% | Taxpayers who pay a single tax on the difference between income and expenses, subject to the simultaneous fulfillment of the following conditions: – revenue from sales of products (works, services) for the reporting (tax) period is at least 30 million rubles; – the average number of employees exceeds 20 people and the average wage per employee is not lower than the average wage in the Kabardino-Balkarian Republic |

||

| 7% | – for all other taxpayers who pay a single tax on the difference between income and expenses | ||

| Kaluga region | Law of the Kaluga Region of December 18, 2008 No. 501-OZ | 5% | 1) carry out the main types of activities in accordance with OKVED OK 029-2014 from sections: – C “Manufacturing”; – P “Education”; – Q “Activities in the field of health and social services”; – from class 75 section M OKVED; 2) registered after January 1, 2015 (except for cases of reorganization) and entrepreneurs carrying out main activities in accordance with class 72 “Scientific research and development” of OKVED The main type of activity is understood as the type of economic activity defined by the taxpayer in the tax return for the single tax when simplified |

| 7% | carry out the main activities in accordance with section F “Construction” (except for the development of construction projects) | ||

| 10% | carry out main activities in accordance with sections: – B “Mining” (except for the provision of services in the field of mining); – D “Providing electricity, gas and steam, air conditioning” (except for trade in gaseous fuel supplied through distribution networks); – E “Water supply, sanitation, organization of waste collection and disposal, pollution elimination activities”; – R “Activities in the field of culture, sports, income management and entertainment” (except for class 92); – classes 94, 96, section S “Provision of other types of services” |

||

| Kamchatka Krai | Law of the Kamchatka Territory of March 19, 2009 No. 245 | 10% | All taxpayers who pay a single tax on the difference between income and expenses |

| 1% | 2) forestry and other forestry activities; 3) production of other wooden products; 5) waste treatment and disposal |

||

| 2% | Taxpayers who pay a single tax on income and carry out the following types of activities: 1) fish farming; 2) processing and canning of fruits and vegetables. The conditions for applying the rate are given in Part 2 of Article 1.2 of the Law |

||

| 3% | Taxpayers who pay a single tax on income and carry out the following types of activities: 1) production of dairy products; 2) production of bread and flour confectionery products, cakes and pastries for short-term storage; 3) development of computer software, consulting services in this area and other related services; 4) activities in the field of information technology; 5) repair of computers and communication equipment; 6) education; 7) provision of social services without providing accommodation. The conditions for applying the rate are given in Part 3 of Article 1.2 of the Law |

||

| 4% | Taxpayers who pay a single tax on income and carry out the following types of activities: 1) processing and canning of meat and meat food products; 2) production of textile products; 3) clothing production; 4) production of leather and leather products; 5) wood processing and production of wood and cork products, except furniture, production of straw products and weaving materials, with the exception of the production of other wooden products; 6) activities of hospital organizations; 7) collection and treatment of wastewater; 8) waste collection; The conditions for applying the rate are given in Part 4 of Article 1.2 of the Law |

||

| 5% | Taxpayers who pay a single tax on income and carry out the following types of activities: 1) production of cellulose, wood pulp, paper and cardboard; 2) publishing activities; 3) printing activities and provision of services in this area; 4) production of chemicals and chemical products; 6) metallurgical production; 7) production of finished metal products, except for machinery and equipment; 8) production of computers, electronic and optical products; 9) production of electrical equipment; 10) production of machinery and equipment not included in other groups; 11) production of motor vehicles, trailers and semi-trailers; 12) production of other vehicles and equipment; 13) maintenance and repair of vehicles; 14) repair of personal and household items; 15) activities of hotels and other places for temporary residence; 16) activities of water transport; 17) rent and leasing, with the exception of lease of intellectual property and similar products, except copyrights; 18) general medical practice; 19) special medical practice; 20) washing and dry cleaning of textiles and fur products; 21) physical education and health activities; 22) activities in the field of sports. The conditions for applying the rate are given in Part 5 of Article 1.2 of the Law |

||

| Karachay-Cherkess Republic | Law of the Karachay-Cherkess Republic of December 2, 2005 No. 86-RZ | 9% | Taxpayers who pay a single tax on the difference between income and expenses: 1) residents of a tourist and recreational special economic zone on the territory of Zelenchuksky and Urupsky municipal districts; 2) organizations and entrepreneurs carrying out business activities in the field of: – education; – health care and social services; – manufacturing industries. Sales revenue from the above types of economic activities for the last tax (reporting) period must be at least 75% of the total revenue |

| Kemerovo region | 5% | Taxpayers who pay a single tax on the difference between income and expenses, carrying out the following types of economic activities: 3) textile production; 8) production of medicines; |

|

| 15% | |||

| Law Kemerovo region dated November 26, 2008 No. 101-OZ | 5% | Taxpayers who pay a single tax on the difference between income and expenses: 1) subjects of investment activities implementing investment projects included in the List investment projects in accordance with the law of the Kemerovo region “On state support of investment, innovation and production activities in the Kemerovo region.” The conditions are given in paragraph 3 of part 1 of article 1 of the law; 2) subjects of innovative activity implementing innovative projects included in the List innovative projects in accordance with the law of the Kemerovo region “On state support of investment, innovation and production activities in the Kemerovo region.” The conditions are given in paragraph 3 of part 1 of article 2 of the law; 3) managing organizations of technology parks and basic organizations of technology parks included in the register of technology parks of the Kemerovo region (see Article 3 of the law); 4) tax residents technology parks (see Article 4 of the law); 5) management companies of economically favored zones. The conditions are given in paragraph 3 of part 1 of Article 5-1 of the law; 6) participants in economically favored zones. The conditions are given in paragraph 3 of part 1 of article 5-2 of the law |

|

| Law of the Kemerovo region of November 26, 2008 No. 99-OZ | 3% | 1) agriculture, hunting and provision of services in these areas; 2) forestry and provision of services in this area; 3) textile production; 4) clothing production; dressing and dyeing of fur; 5) production of leather, leather goods and footwear production; 6) production of plastics and synthetic resins in primary forms; 7) production of paints and varnishes; 8) production of medicines; 9) soap production; detergents, cleaning and polishing agents; perfumes and cosmetics; 10) production of chemically modified animal or vegetable fats and oils (including drying oils), non-edible mixtures of animal or vegetable fats and oils; 11) production of other non-metallic mineral products; 12) production of finished metal products; 13) production of machinery and equipment; 14) production of electrical machines and electrical equipment; 15) repair of household products and personal items; 16) rental of household products and personal items; 17) production of other basic inorganic chemicals; 18) provision of social services. Income for the reporting (tax) period must be at least 80% of income |

|

| 6% | All other taxpayers are simplified with the object of taxation “income” | ||

| Kirov region | Law of the Kirov Region of April 30, 2009 No. 366-ZO | 6% | Taxpayers paying a single tax on the difference between income and expenses: – residents of park areas who in the current tax period attract employees By employment contracts and pay an average monthly salary per employee in the amount of at least two minimum wages established federal law, and have no tax debts |

| Kostroma region | Law of the Kostroma Region of October 23, 2012 No. 292-5-ZKO | 10% | 2) fishing, fish farming; 3) manufacturing industries (except for the production of jewelry and technical products from precious metals and precious stones, coins and medals). Income from the main activity constitutes at least 70% of income from entrepreneurial activity |

| Kurgan region | Law of the Kurgan region of November 24, 2009 No. 502 | 10% | Taxpayers paying a single tax on the difference between income and expenses who carry out the following types of economic activity: 1) sawing and planing of wood, wood impregnation; 2) production of wooden building structures, including prefabricated ones wooden buildings, and carpentry; 3) production of other products made of wood and cork, straw and weaving materials; 4) production of ceramic tiles and slabs; 5) production of bricks, tiles and other building products from baked clay; production of cement, lime and gypsum; 6) production of products from concrete, gypsum and cement; production of steam and hot water (thermal energy) by boiler houses; 7) activities to ensure the operability of boiler houses; 8) activities to ensure the operability of heating networks; 9) collection, purification and distribution of water; 10) disposal of sewage, waste and similar activities. The conditions for applying the preferential rate are given in paragraph 1 of Article 3 of the law |

| 15% | All other taxpayers are simplified with the object of taxation “income minus expenses” | ||

| Kursk region | Law of the Kursk region of May 4, 2010 No. 35-ZKO | 5% | Taxpayers who pay a single tax on the difference between income and expenses and: 1) were created after January 1, 2010 and carry out their activities according to the types of economic activity of section P “Education”: subclass 85.1 “General education”, group 85.21 “Secondary vocational education”, subclass 85.3 “Vocational training”, group 85.41 “Additional education for children” and adults", subgroup 85.42.9 "Activities for additional vocational education other, not included in other groups" OKVED OK 029-2014, the share of income from which is at least 70% of total income. 2) established as business entities (partnerships) by budgetary and autonomous scientific institutions. Provided that the activities of such societies (partnerships) consist in the practical application or implementation of the results of intellectual activity (computer programs, databases, inventions, utility models, industrial designs, breeding achievements, topologies of integrated circuits, production secrets (know-how) ), exclusive rights which belong to the specified scientific institutions(including together with other persons) |

| 5% | Taxpayers who pay a single tax on income and carry out their activities according to the types of economic activity of section C “Manufacturing”, section M class 72 “Scientific research and development” OKVED OK 029-2014 | ||

| Lipetsk region | Law of the Lipetsk Region of December 24, 2008 No. 233-OZ | 5% | |

| 5% | Taxpayers who pay a single tax on income carrying out the following types of economic activities: 1) food production; 2) production of soft drinks, production of mineral waters and other bottled drinking waters; 3) production of textile products; 4) clothing production; 5) production of leather, leather products; 6) wood processing and production of wood and cork products, except furniture, production of straw products and weaving materials; 7) production of rubber and plastic products; 8) production of other non-metallic mineral products; 9) production of machinery and equipment not included in other groups; 10) production of computers, electronic and optical products; 11) production of electrical equipment; 12) furniture production; 13) production of sporting goods; 14) production of games and toys; 15) production of medical instruments and equipment; 16) production of brooms and brushes; 17) production of folk arts and crafts; 18) scientific research and development; 19) care activities with provision of accommodation; 20) provision of social services without providing accommodation; 21) preschool education; 22) activities in the field of sports |

||

| Magadan Region | Law of the Magadan Region of July 29, 2009 No. 1178-OZ | 7,5% | Taxpayers paying a single tax on the difference between income and expenses who carry out certain types of economic activity in accordance with OKVED OK 029-2014 |

| 3% | Taxpayers who pay a single tax on income for whom, for the corresponding tax period, at least 70 percent of the total income from the sale of goods (work, services) was income from one of the closed types of business activity | ||

| Murmansk region | Law of the Murmansk region of March 3, 2009 No. 1075-01-ZMO | 5% | Taxpayers who pay a single tax on the difference between income and expenses and carry out at least one of the following activities in accordance with OKVED OK 029-2014: 1) section A “Agriculture, forestry, hunting, fishing and fish farming” (types of economic activities established by classes 01, 02 and 03); 2) section C “Manufacturing” (types of economic activity established by classes 10 and 11); 3) section E “Water supply; drainage, organization of waste collection and disposal, pollution elimination activities" (types of economic activities established by class 37, subclasses 38.1 and 38.2 of class 38 and class 39); 4) section J “Activities in the field of information and communications” (types of economic activities established by classes 59, 60 and 63, with the exception of types of economic activities established by subclass 59.2 of class 59 and subclass 63.1 of class 63); 5) section M “Professional, scientific and technical activities” (types of economic activities established by class 75); 6) section N “Administrative activities and related additional services” (types of economic activities established by subgroups 81.29.2 and 81.29.9 of group 81.29 of class 81); 7) section P “Education” (types of economic activities established by class 85); 8) section Q “Activities in the field of health and social services” (types of economic activities established by classes 86–88); 9) section R “Activities in the field of culture, sports, leisure and entertainment” (types of economic activities established by classes 90, 91 and 93); 10) section S “Provision of other types of services” (types of economic activities established by classes 94 and 96) |

| 10% | from sections: 1) C “Manufacturing” (types of economic activity established by classes 12–20, 22–32); 2) E “Water supply; drainage, organization of waste collection and disposal, pollution elimination activities" (types of economic activities established by subclass 38.3 of class 38) |

||

| 15% | – other types of economic activities provided for by OKVED OK 029-2014. When a taxpayer simultaneously carries out several types of activities for which tax rates are set in different amounts, the lowest tax rate is applied |

||

| Nenets Autonomous Okrug | Law of the Nenets Autonomous Okrug of February 27, 2009 No. 20-OZ | 5% | Taxpayers paying a single tax on the difference between income and expenses who: b) fishing and fish farming; d) clothing production; j) furniture production; p) education; |

| 10% | – for the corresponding reporting (tax) period, at least 60% of the income was income from the following types of economic activity according to OKVED 029-2007: a) construction; b) activities of hotels and catering establishments; c) activities of inland water transport and other land transport; d) activity travel agencies and other organizations providing services in the field of tourism; e) cleaning and tidying activities; f) activities in the field of health care and the provision of social services; g) activities in the field of culture, sports, organization of leisure and entertainment, with the exception of activities for organizing and conducting gambling and betting, organizing and conducting lotteries |

||

| 15% | All other taxpayers paying a single tax on the difference between income and expenses | ||

| 1% | – for the corresponding reporting (tax) period, at least 60% of the income was income from the following types of economic activity according to OKVED 029-2007: a) crop and livestock farming, hunting and the provision of related services in these areas; b) fishing, fish farming; c) food production; d) clothing production; e) production of leather and leather products; f) wood processing and production of wood and cork products, except furniture, production of straw products and weaving materials; g) printing activities and copying of information media; h) production of other non-metallic mineral products; i) production of finished metal products, except for machinery and equipment; j) furniture production; k) collection, processing and disposal of waste, processing of secondary raw materials; l) repair of household products and personal items; m) rental of household products and personal items; o) activities related to the use of computer technology and in the field of information technology; n) scientific research and development; p) education; c) provision of personal services, with the exception of the provision of other personal services not included in other groups; r) provision of housekeeping services; s) production of folk arts and crafts; t) professional, scientific and technical activities; x) provision of other types of services, with the exception of the activities of political and religious organizations, provision of other personal services |

||

| 3% | Taxpayers paying a single tax on income who: – for the corresponding reporting (tax) period, at least 60% of the income was income from the following types of economic activity according to OKVED 029-2007: a) fishing, fish farming; b) construction; c) activities of hotels and catering establishments; d) activities of inland water transport and other land transport; e) activities of travel agencies and other organizations providing services in the field of tourism; f) cleaning and tidying activities; g) activities in the field of health care and the provision of social services; h) activities in the field of culture, sports, organization of leisure and entertainment, with the exception of activities related to organizing and conducting gambling and betting, organizing and conducting lotteries |

||

| 6% | All other taxpayers paying a single income tax | ||

| Novgorod region | Law Novgorod region dated March 31, 2009 No. 487-OZ | 10% | Taxpayers who pay a single tax on the difference between income and expenses and carry out activities that, according to OKVED OK 029-2001, relate to: 1) class 01 section A; 2) subsections DA, DB, DC, DG, DH, DI of section D; 3) section F; 4) class 60 section I |

| Orenburg region | Law of the Orenburg Region of September 29, 2009 No. 3104/688-IV-OZ | 10% | All taxpayers are simplified with the object of taxation “income minus expenses” |

| 5% | Taxpayers who pay a single tax on income when carrying out certain types of activities (see appendix to the law) | ||

| Oryol Region | Law of the Oryol region of September 5, 2015 No. 1833-OZ | 5% | Taxpayers who pay a single tax on the difference between income and expenses and carry out the following types of activities in accordance with OKVED OK 029-2014: 1) in section A “Agriculture, forestry, hunting, fishing and fish farming”; 2) in section C “Manufacturing”; 3) in section E “Water supply; drainage, organization of waste collection and disposal, pollution elimination activities”; 4) in section F “Construction”; 5) to class 58 “Publishing activities”; class 59 “Production of films, videos and television programs, publishing of sound recordings and notes”; group 62.01 “Computer software development” of subclass 62.0 “Computer software development, consulting services in this area and other related services” class 62 “Computer software development, consulting services in this area and other related services”; subgroup 63.11.1 “Activities for the creation and use of databases and information resources” of group 63.11 “Data processing activities, provision of information placement services and related activities” of subclass 63.1 “Data processing activities, provision of information placement services, activities portals in the information and communication network Internet” class 63 “Activities in the field of information technology” section J “Activities in the field of information and communications”; 6) in subclass 72.1 “Scientific research and development in the field of natural and technical sciences” of class 72 “Scientific research and development”; class 75 “Veterinary activities”, section M “Professional, scientific and technical activities”; 7) in section P “Education”; 8) in section Q “Activities in the field of health and social services”; 9) to class 90 “Creative activities, activities in the field of art and entertainment”; class 91 “Activities of libraries, archives, museums and other cultural objects”; class 93 “Activities in the field of sports, recreation and entertainment”, section R “Activities in the field of culture, sports, leisure and entertainment”. The conditions for applying the preferential rate are given in paragraphs 2–5 of Article 1 of the Law |

| Penza region | Law of the Penza region of June 30, 2009 No. 1754-ZPO | 5% | When applying the simplified tax system, if the object of taxation is income reduced by the amount of expenses, for the following categories of taxpayers: 1) organizations created: a) graduates of general educational organizations, professional educational organizations or full-time university courses within one calendar year immediately after graduation; b) students during the period of study in general educational organizations, professional educational organizations or full-time studies at universities; 2) entrepreneurs: a) graduates of general education organizations, professional educational organizations or full-time university education within one calendar year immediately after graduation; b) students during the period of study in general educational organizations, professional educational organizations or full-time studies at universities; 3) entrepreneurs and commercial organizations(except for unitary enterprises registered with resident status of the center regional development Penza region |

| Perm region | Law of the Perm Territory of April 1, 2015 No. 466-PK | 5% | 2) section R “Education”; |

| 10% | 3) section F “Construction” |

||

| 1% | Taxpayers who pay a single tax on income and carry out the following types of activities in accordance with OKVED OK 029-2014: 1) class 72 “Scientific research and development”, section M “Professional, scientific and technical activities”; 2) section R “Education”; 3) section Q “Activities in the field of health and social services” |

||

| 4% | 1) section I “Activities of hotels and public catering establishments”; 2) section C “Manufacturing”, with the exception of groups 11.01–11.06, classes 12, 19; 3) section F “Construction” |

||

| Pskov region | Law of the Pskov region of November 29, 2010 No. 1022-oz | 5% | Taxpayers who pay a single tax on the difference between income and expenses and carry out the following types of activities, according to OKVED OK 029-2014: 1) section A Agriculture, forestry, hunting, fishing and fish farming (class 01 (except for group 01.15), subclass 02.3, class 03); 2) section C Manufacturing (class 10, group 11.07, classes 13–31, subclasses 32.2–32.9, class 33); 3) section I Activities of hotels and public catering establishments (class 55); 4) section L Activities for operations with real estate (subgroup 68.32.1); 5) section Q Activities in the field of health and social services (groups 86.10, 86.21, 86.22, classes 87, 88) |

| 10% | 1) section A Agriculture, forestry, hunting, fishing and fish farming (class 02 (except for subclass 02.3); 2) section B Mining; 3) section D Supply of electrical energy, gas and steam; air conditioning; 4) section E Water supply; drainage, organization of waste collection and disposal, pollution elimination activities (class 36); 5) section F Construction; 6) section H Transportation and storage (classes 49–52); 7) section I Activities of hotels and public catering establishments (subclasses 56.1, 56.2) |

||

| 15% | |||

| Altai Republic | Law of the Altai Republic of July 3, 2009 No. 26-RZ | 5% | Taxpayers who pay a single tax on the difference between income and expenses and carry out the following types of activities in accordance with OKVED OK 029-2001: 1) production of food products, including drinks; 2) production of clothing, dressing and dyeing of fur; 3) wood processing and production of wood and cork products, except furniture; 4) publishing and printing activities, replication of recorded media; 5) production of rubber and plastic products; 6) production of other non-metallic mineral products; 7) production of machinery and equipment; 8) production of electrical machines and electrical equipment; 9) production of equipment for radio, television and communications; 10) production of furniture and other products not included in other groups; 11) production, transmission and distribution of electricity, gas, steam and hot water; 12) construction; 13) forestry and provision of services in this area. Income from these types of economic activities amounted to at least 70% of the total income received |

| The Republic of Buryatia | Law of the Republic of Buryatia dated November 26, 2002 No. 145-III | 5% | a) production of other non-metallic mineral products; b) production of finished metal products; c) production of machinery and equipment; d) production of electrical equipment, electronic and optical equipment; e) wood processing and production of wood and cork products, except furniture; f) production of food products, including drinks, with the exception of alcoholic products (drinking alcohol, vodka, liquor, cognac, wine, beer, drinks made from beer, other drinks with an alcohol content of more than 1.5% by volume); g) publishing activities; h) printing activities and provision of services in this area; i) production of folk arts and crafts; j) agriculture (except for organizations and entrepreneurs that have switched to the Unified Agricultural Tax), hunting and the provision of services in these areas; k) construction; l) furniture production; m) processing of secondary raw materials; o) activities related to the use of computer technology and information technology. |

| 10% | a) textile and clothing production; b) production of leather, leather goods and footwear production |

||

| 3% | Taxpayers who pay a single tax on income and carry out the following types of activities: 1) production of other non-metallic mineral products; 2) production of finished metal products; 3) production of machinery and equipment; 4) production of electrical equipment, electronic and optical equipment; 5) wood processing and production of wood and cork products, except furniture; 6) production of food products, including drinks, with the exception of alcoholic products (drinking alcohol, vodka, liquor, cognac, wine, beer, drinks made from beer, other drinks with an alcohol content of more than 1.5 percent by volume); 7) publishing activities; 8) printing activities and provision of services in this area; 9) production of folk arts and crafts; 10) agriculture, with the exception of organizations and individual entrepreneurs that have switched to a taxation system for agricultural producers (unified agricultural tax), hunting and the provision of services in these areas; 11) construction; 12) furniture production; 13) processing of secondary raw materials; 14) activities related to the use of computer technology and information technology; 15) textile and clothing production; 17) preschool education; 18) additional education. The conditions for applying the preferential rate are given in Part 2 of Article 8.3 of the Law |

||

| The Republic of Dagestan | Law of the Republic of Dagestan of May 6, 2009 No. 26 | 10% | All simplified taxpayers who pay a single tax on the difference between income and expenses |

| Republic of Kalmykia | Law of the Republic of Kalmykia dated November 30, 2009 No. 154-IV-Z | 5% | Taxpayers who pay a single tax on the difference between income and expenses and carry out the following types of activities in accordance with OKVED OK 029-2014: 1) section D Manufacturing; 2) section M Education: 80.10.1. Pre-school education (preceding primary general education) |

| 10% | All other taxpayers who pay a single tax on the difference between income and expenses | ||

| Republic of Karelia | Law of the Republic of Karelia dated December 30, 1999 No. 384-ZRK | 5% | Taxpayers who pay a single tax on the difference between income and expenses: – engaged in the production of folk arts and crafts |

| 10% | 1) Organizations and entrepreneurs that are engaged in the production of agricultural products, provided that the proceeds from the sale of agricultural products are 50 percent or more of the total proceeds from sales; 2) organizations and entrepreneurs that are engaged in wood processing and the production of wood products, provided that the proceeds from the sale of products produced by them from this type of activity are at least 70% of the total proceeds from sales; 3) organizations and entrepreneurs who are engaged in fish farming, provided that the revenue from this type of activity is more than 70% of the total revenue from sales; 4) organizations engaged in landscaping and landscaping, including floriculture, provided that the proceeds from the sale of their products from these types of activities are at least 70% of the total proceeds from sales; 5) organizations operating in the field of physical culture and sports, provided that the revenue from this type of activity is more than 70% percent of the total revenue from sales |

||

| 12,5% | All other taxpayers who pay a single tax on the difference between income and expenses | ||

| Komi Republic | Law of the Komi Republic of November 17, 2010 No. 121-RZ | 10% | Taxpayers who pay a single tax on the difference between income and expenses and carry out the types of activities specified in the appendix to the Law. The share of income from these types of activities for the reporting (tax) period must be at least 85% of total income |

| Mari El Republic | Law of the Republic of Mari El dated October 27, 2011 No. 59-Z | 15% | |

| 6% | |||

| The Republic of Mordovia | Law of the Republic of Mordovia dated February 4, 2009 No. 5-Z | 5% | Taxpayers who pay a single tax on the difference between income and expenses and whose main activity is: 1) transport and communications; 2) production of products, provided that this production is carried out by residents of the Technopark in the field of high technologies of the Republic of Mordovia; 3) practical use(implementation) of the results of intellectual activity (computer programs, databases, inventions, utility models, industrial designs, breeding achievements, topologies of integrated circuits, production secrets (know-how), provided that these activities are carried out by business companies whose founders are universities – budgetary institutions located on the territory of the Republic of Mordovia. The conditions for applying the reduced rate are given in paragraph 6 of clause 2 of the law |

| 15% | All other taxpayers who pay a single tax on the difference between income and expenses | ||

| 1% | Taxpayers who pay a single tax on income whose main activity is research and development. The conditions for applying the preferential rate are given in Article 1.1 of the law |

||

| 6% | All other taxpayers who pay a single income tax | ||

| The Republic of Sakha (Yakutia) | Law of the Republic of Sakha (Yakutia) of November 7, 2013 1231-Z No. 17-V | 5% | Taxpayers who pay a single tax on the difference between income and expenses and carry out the following types of activities: 1) agriculture, hunting and forestry; 2) fishing, fish farming; 3) manufacturing industries |

| 10% | All other taxpayers who pay a single tax on the difference between income and expenses | ||

| 6% | Taxpayers who pay a single tax on income and carry out economic activities: – in the territory of Group 1 of municipalities specified in Part 1.1 of Article 7 of this Law, as well as organizations and entrepreneurs engaged in the purchase, storage and supply of alcoholic and alcohol-containing products, retail sale of alcoholic products |

||

| 4% | – in the territories of groups 2–4 of municipalities specified in Part 1.1 of Article 7 of this Law, with the exception of organizations and entrepreneurs engaged in the purchase, storage and supply of alcoholic and alcohol-containing products, retail sale of alcoholic products | ||

| 2% | – on the territory of Group 5 of municipalities specified in Part 1.1 of Article 7 of this Law, as well as organizations and entrepreneurs engaged in the purchase, storage and supply of alcoholic and alcohol-containing products, retail sale of alcoholic products | ||

| Republic of North Ossetia | Law of the Republic of North Ossetia–Alania of November 28, 2013 No. 49-RZ | 10% | Taxpayers who pay a single tax on the difference between income and expenses and carry out the types of activities specified in Appendix 1 to the Law. The share of income from these types of activities for the reporting (tax) period must be at least 75% of total income |

| Republic of Tatarstan | Law of the Republic of Tatarstan dated June 17, 2009 No. 19-ZRT | 5% | For taxpayers who pay a single tax on the difference between income and expenses: – for whom during the reporting (tax) period at least 70% of their income came from income from the following types of economic activities: a) manufacturing; b) production and distribution of electricity, gas and water; c) construction; – for whom during the reporting (tax) period 100% of their income was income from parking services for motor vehicles in multi-level and underground parking lots (parking lots) put into operation from January 1, 2011 to July 1, 2013 with the number of parking spaces according to technical documentation at least 150 units |

| 10% | All other taxpayers who pay a single tax on the difference between income and expenses | ||

| Tyva Republic | Law of the Republic of Tyva dated July 10, 2009 No. 1541 VH-2 | 5% | For taxpayers who pay a single tax on the difference between income and expenses, for whom during the reporting (tax) period at least 70% of their income came from income from the following types of economic activities: – tourism activities |

| 10% | d) textile production; i) furniture production; m) publishing, printing industry and reproduction of printed materials; o) activities in the field of sports |

||

| 4% | For taxpayers who pay a single tax on income for which during the reporting (tax) period at least 70% of their income came from income from the following types of economic activities: a) agriculture, hunting and the provision of services in these areas; b) fishing, fish farming and the provision of services in these areas; c) production of food products, including drinks, with the exception of the production of distilled alcoholic beverages and the production of ethyl alcohol from fermented materials; d) textile production; e) clothing production; dressing and dyeing of fur; f) production of leather, leather products and footwear; g) production of other non-metallic mineral products; h) production of finished metal products; i) furniture production; j) services for wastewater and waste disposal, improvement sanitary condition and similar services; k) wood processing and production of wood and cork products, except furniture; l) activities related to the use of computer technology and information technology; m) publishing, printing industry and reproduction of printed materials |

||

| The Republic of Khakassia | Law of the Republic of Khakassia dated November 16, 2009 No. 123-ЗРХ | 5% | For taxpayers who pay a single tax on the difference between income and expenses who carry out the following types of activities in accordance with OKVED OK 029-2014: |

| 15% | 1) wholesale and retail trade (section G); 2) rent and management of own or leased residential real estate, rent and management of own or leased non-residential real estate (subgroups 68.20.1, 68.20.2 of section L) |

||

| 12% | All other types of activities with the object “income minus expenses” | ||

| 2% | For taxpayers who pay a single tax on income who carry out the following types of activities in accordance with OKVED OK 029-2014: 1) agriculture, forestry, hunting, fishing and fish farming (section A); 2) preschool education, general primary education (groups 85.11, 85.12 section P); 3) waste collection, waste treatment and disposal (subclasses 38.1, 38.2 section E); 4) street sweeping and snow removal (subgroup 81.29.2 of section N) |

||

| 5% | manufacturing industries (section C) | ||

| Rostov region | Law Rostov region dated May 10, 2012 No. 843-ZS | 10% | Taxpayers who pay a single tax on the difference between income and expenses, who are small businesses in accordance with federal legislation |

| 5% | Taxpayers who pay a single tax on income, carrying out investment activity on the territory of the Rostov region | ||

| Ryazan Oblast | Law of the Ryazan region of July 21, 2016 No. 35-OZ | 5% | Taxpayers who pay a single tax on the difference between income and expenses and receive government support in accordance with the Law of the Ryazan Region dated April 6, 2009 No. 33-OZ for the period established by the investment agreement |

| Samara Region | Law of the Samara Region of June 29, 2009 No. 77-GD | 10% | For taxpayers who pay a single tax on the difference between income and expenses, for whom at least 80% of sales proceeds consisted of sales proceeds from the following types of activities according to OKVED: 1) production of food products, including drinks (class 15); 2) textile production (class 17); 3) production of clothing, dressing and dyeing of fur (class 18); 4) production of leather, leather goods and footwear production (class 19); 5) production of cellulose, wood pulp, paper, cardboard and products made from them (class 21); 6) chemical production (class 24); 7) production of rubber and plastic products (class 25); 8) production of finished metal products (class 28); 9) production of machinery and equipment (class 29); 10) production of office equipment and computer equipment (class 30); 11) production of electrical machines and electrical equipment (class 31); 12) production of electronic components, equipment for radio, television and communications (class 32); 13) production of medical devices, including surgical equipment, and orthopedic devices (subclass 33.1); 14) production of cars, trailers and semi-trailers (class 34); 15) production of ships, aircraft and spacecraft and other vehicles (class 35); 16) production of furniture and other products not included in other groups (class 36); 17) research and development (class 73) |

| Saratov region | Saratov Law of November 25, 2015 No. 152-ZSO | 5% | 1) 62.01 Computer software development; 2) 62.02 Advisory activities and work in the field of computer technology; 3) 63.11.1 Activities for the creation and use of databases and information resources; 4) 71.1 Activities in the field of architecture, engineering surveys and providing technical advice in these areas (except subgroups 71.12.2, 71.12.5, 71.12.6); 5) 71.2 Technical tests, research, analysis and certification (except for subgroup 71.20.5, type 71.20.61); 6) 72 Research and Development |

| 6% | 1) 14.19.11 Production of knitted or crocheted clothing and clothing accessories for young children; 2) 14.19.21 Production of clothing and clothing accessories for young children from textile materials, except knitted or knitted; 3) 32.40 Production of games and toys; 4) 85.11 Preschool education; 5) 85.41 Additional education for children and adults |

||

| 7% | 1) code designations included in section C “Manufacturing industries” (with the exception of types 14.19.11, 14.19.21, group 32.40, as well as types of economic activities for the production of excisable goods provided for in Article 181 Tax Code RF); 2) 43.31 Production of plastering works; 3) 43.32 Carpentry and carpentry work; 4) 43.33 Work on installation of floor coverings and wall cladding; 5) 43.34 Production of painting and glass work; 6) 43.39 Production of other finishing and finishing works; 7) 43.9 Other specialized construction works |

||

| 1% | 1) 16.29.12 Production of wooden tableware and kitchen utensils; 2) 16.29.13 Production of wooden figurines and decorations made of wood, mosaics and inlaid wood, boxes, cases for jewelry or knives; 3) 23.41 Production of household and decorative ceramic products; 4) 23.49 Production of other ceramic products; 5) 32.99.8 Production of folk arts and crafts; 6) 72 Research and development; 7) 85.11 Preschool education; 8) 85.41 Additional education for children and adults; 9) 88.10 Providing social services without providing accommodation for the elderly and disabled; 10) 88.91 Provision of day care services for children Condition for applying all reduced rates: income from the relevant type of economic activity for the tax (reporting) period is at least 70 percent of the taxpayer’s total income |

||