Sberbank online bps personal account. Reviews - BPS-Sberbank OJSC Bank custody and collection services

BPS-Sberbank Online is a remote service through which clients of this financial institution will be able to make various payments. However, to use it, you must have access to your “Personal Account”. To do this, you need to go through the registration procedure in any convenient way.

Registration

Only citizens who are clients of the specified financial organization can use Internet banking. To complete the registration procedure, you must follow the established algorithm of actions:

Advantages and Disadvantages

As for the advantages of Internet banking, the following points can be highlighted:

- enrollment cash to another account is carried out in the shortest possible time;

- there is no need to go to a branch of a financial institution in person and sit in long lines;

- You can use the services at any time of the day or night;

- Many payment transactions do not involve payment of a commission fee.

However, there are some drawbacks. The following can be distinguished from them:

- if fraudsters hack the user's account, funds may be stolen;

- The system makes it possible to make a transfer using incorrectly specified details.

However, these disadvantages can be avoided if you follow safety rules.

Safety rules

To protect own funds, you must follow the established rules:

- Avoid primitive passwords. It is necessary to come up with a complex combination that will consist of both numbers and letters. Otherwise, scammers will be able to easily obtain the user’s “Personal Account” login information.

- Update the secret code two or three times a month.

- When making a translation, carefully check all the information provided for errors.

- Install a good antivirus and regularly check your PC for their presence.

- Do not access online banking using an unsecured connection.

Compliance with all the above rules will secure the user’s experience with Internet banking.

Features Overview

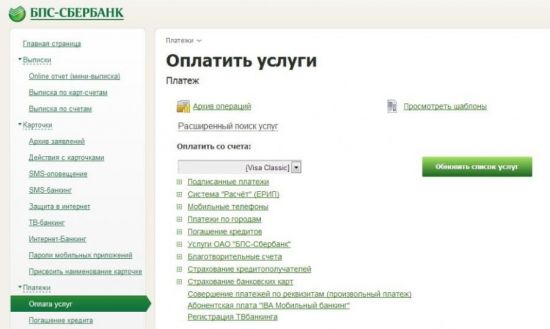

Using the BPS-Sberbank Online service, you can carry out many payment transactions, so it’s worth taking a closer look at the functionality of this Internet banking.

Home page

The main page of Internet banking looks like this: ![]()

![]()

All payment instruments held by the user will be listed here. To the right is the “Personal Menu”, where you can perform the following actions:

- view transaction history;

- manage payments;

- activate the “Autopayment” service;

- read the terms of the “Thank you from Sberbank” promotion;

- review the list of frequently asked questions;

- get acquainted with the current exchange rates.

As for operations performed with specific plastic, you need to click on the “Operations” field, after which a context menu will open. ![]()

![]()

Available actions with cards:

- blocking;

- transfer between your accounts;

- history of completed transactions;

- order a mini-statement;

- connection to the service " Mobile bank»;

- setting up auto payment.

These are just some of the operations that can be performed remotely.

In this section, the user will be able to open or close their own contribution, as well as perform the following actions with it:

- view the balance;

- generate an extract for a specific period of time;

- review the terms of service.

To take advantage of these opportunities, just click on the “Operations” field located opposite the deposit. ![]()

![]()

In this section, you can create a loan application and familiarize yourself with existing loans, as well as limits on them. It is important to know that the application can only be submitted by citizens who have a stable income transferred to Sberbank plastic. ![]()

![]()

Closed accounts

This section contains information about accounts that were closed no more than six months ago. If the user needs to get acquainted with older information, then a personal visit to the financial institution is indispensable. ![]()

![]()

Thanks to access to the “Personal Account” of BPS-Sberbank Online, the user will be able to carry out many payment transactions remotely. This saves a lot of time because you don’t have to wait in long lines. To register, you must follow the established algorithm.

BPS Sberbank Online - Internet banking in the Republic of Belarus. It is an intuitive web interface for client communication with the bank from anywhere in the world where there is access to the World Wide Web. This article explains how to register and login.With development banking sector Internet banking service has become widespread. Sberbank offers its clients convenient system, allowing you to make payments, transfers and many other operations without leaving your home. Those who want to always have a bank at hand should get Internet banking.

bps sberbank internet banking login

Login to the BPS-Sberbank Internet banking system is done by entering your login and password in a special form, which is located on the Sberbank Online page:

https://www.bps-sberbank.by/loginsbol or click on the login form

If you need to change your password or login, you need to click on the link “Change login and password” and then go through the process of replacing data.

BPS-Sberbank clients who have a valid card can register for Internet banking. bank card and Belarusian phone number mobile operator(or identification document).

BPS-Sberbank clients who have a valid card can register for Internet banking. bank card and Belarusian phone number mobile operator(or identification document).

Registration and login to the system is carried out at www.bps-sberbank.by/registration-sbol. To begin the registration procedure, under the login and password entry form, click on the “Registration” link.

At the first stage of registration you need to enter mobile phone and number payment card or identification number client's identification document. After providing the required information, click “Continue.”

At the second stage, come up with a username and password, a payment password and confirm the data with the code from the SMS message, which should arrive on your phone number specified in the previous step.

There are hints next to each data entry field, read them carefully and you won’t go wrong.

![]()

Check the box next to I agree with the agreement for the provision of services “Sberbank Online”, “Mobile Bank” at OJSC “BPS-Sberbank” and click the “Register” button.

After registering, you will be taken to the Main page of your personal account.

Help Desk

Call Contact Center BPS Sberbank can be reached by phone: ![]()

- 148 – from fixed and mobile networks of the Republic of Belarus

- (+37529) 5-148-148 – from abroad

OJSC "BPS-Sberbank", formed in 1923, is one of the oldest and largest banks in the Republic of Belarus.

Management

Matyushevsky Vasily Stanislavovich - Chairman of the Board.

Holding

OJSC "BPS-Sberbank" is the parent organization of the banking holding company.

Story

In 1928, the bank was reorganized into the Bank for Long-Term Lending to Industry and Electrical Facilities.

In 1932, as a result of the reform credit system A financing bank is formed capital construction industry, transport and communications of the USSR. In the 1930s, the Belarusian branch of the bank expanded the scope of its activities, opened Gomel and Mogilev branches and financed more than 700 construction projects in 73 regions of the republic.

In 1941, due to the temporary occupation of the territory of the republic, the bank's activities were suspended. In difficult times post-war years bank in short term resumed its activities and ensured the implementation of the task of effectively using the funds allocated for the restoration of the national economy.

In 1959, the All-Union Bank of Financing was formed capital investments- Stroybank USSR. Construction and reconstruction financing was concentrated in the Belarusian office of Stroybank industrial enterprises, construction industry facilities, transport, communications, housing and socio-cultural purposes (90% of capital investments made in the republic) and short-term lending to contract construction organizations.

In the process of reform banking system carried out in 1987, the Industrial and Construction Bank of the USSR was formed. Structural unit Promstroibank in Belarus began to implement a full range of banking operations and services related not only to investment, but also production and supply and sales activities of enterprises and organizations.

In September 1991, the joint-stock commercial Belpromstroybank was established, and in March 1992, the meeting of founders decided on an open subscription for the bank’s shares and after its completion it became an open joint-stock company. Following the Charter and the strategy approved by shareholders, in the 1990s Belpromstroybank made a significant contribution to solving the problems of reforming the national economy and financial stabilization of enterprises.

In October 1999, the bank was renamed Otkrytoye joint stock company"Belpromstroybank"

In December 2009, the Government of the Republic of Belarus and Sberbank of the Russian Federation announced the signing of an agreement on the purchase by Sberbank of Russia of 93.27% of the shares of OJSC BPS-Bank and the conclusion of an investment agreement on the long-term development of BPS-Bank.

In March 2011, the bank was renamed into Open Joint Stock Company "BPS-Bank".

In October 2011, the bank was renamed into Open Joint Stock Company "BPS-Sberbank".

BPS Bank is a remote customer service system from BPS-Sberbank, operating in Belarus. Internet banking gives Belarusian clients the opportunity to use all bank services and control accounts and cards online. All operations are carried out in your personal account; below we will tell you how to register, log into your account and use it.

Login and account registration

Until 2015, bpsb had a different banking system, after which it switched to the same service that operates in Russia - Sberbank Online.

Only the client who has an account or card with BPS will have access to the personal account. There are two ways to become a user:

- By concluding an agreement with the bank. You only need to take your passport with you.

- Registration without visiting a branch on the lender's website.

If you visit a branch, the bank manager will issue a temporary password and login after submitting the application.

When registering on the site, you need to click on “Register” and enter:

- Card or account identification number.

- Mobile number to which session codes and passwords will be sent in the future to confirm transactions.

By clicking on “Continue” a password will be sent to the specified number. By entering it into the line on the site, the client’s identity will be confirmed and access will be opened. Now you need to log in to your personal account.

The generated password is not secure. The user needs to change it in the future, creating a new, complex combination.

Login personal account BPS is carried out on home page official website www.bps. sberbank. by. No special software or devices are required for authorization.

Let us remind you that if you enter the wrong password several times, access to account will be blocked for several hours.

Using the BPS office

There are two options for connecting to LC:

- For free.

- For 7.5 rubles per year (BYN version).

In the free subscription option, the client receives much fewer options. He can only:

- Receive information about bank accounts and cards.

- Use auto-payment and SMS notifications.

- Confirm transactions with input one-time passwords.

It is impossible to make payments yourself - only through automatic debiting of funds. This is only suitable for those who need to make periodic payments.

Therefore, paying such a small amount is worth it - the user will have access to all the functionality of the account for a year.

The system is not much different from the Sberbank Online service operating in the Russian Federation. The account allows individuals:

- Manage your accounts and cards.

- Transfer funds to private and legal entities to cards and accounts of BPS-Sberbank and other financial institutions.

- Open and replenish deposits, withdraw money to impersonal metal accounts.

- Pay for services and purchases in online stores - housing and communal services, communications, Internet, fines and taxes, etc.

- Apply for loans and make payments on them.

- View information about accounts, credit and debit cards, deposits, as well as information on the balance of funds and completed transactions.

- Receive payment documents and generate documentation from them.

- Browse background information about exchange rates, locations of ATMs and branches of financial institutions, current promotions and programs, etc.

- Activate and deactivate bank services, order and block cards.

- Change account settings: login details, make strictly defined services visible, view the log of user authorizations, etc.

- Take out insurance and make payments on it.

- SMS notifications about transactions.

- Automatic payment for specific transactions without the client’s instructions (for this the user must submit a list with payments and recipients).

- A service similar to the previous one – “One-button payment”. In one click, periodic payments are made, pre-specified in the personal account, i.e. without visiting the bank.

- Approval of payments by entering one-time passwords sent via SMS to the user’s number (different service names are provided for Visa and MasterCard cards).

All operations are carried out in 4 sections:

- "Payments and transfers".

- "Deposits and accounts."

- "Cards".

- "Credits".

Here you can not only carry out transactions, but also view information on registered at the moment banking products and already closed accounts. The main page of the account already contains information about cards, deposits and accounts.

You can familiarize yourself with the terms of service for individuals on the bank’s website by opening the “Individuals” section and going to the “Payment for services using remote channels” subsection. Here are instructions for using the service, maintenance procedures, answers to basic questions and recommendations for ensuring account security.

The work of the office is protected by the SSL protocol. Check the address bar when you visit the site - a lock icon should appear. This means that the data transfer is secure.

By setting up the “One-button payment” function, you can make payments for similar transactions every month.

The function of adjusting the visibility of products is purely aesthetic, allowing you to remove unnecessary information from the dashboard interface.

Please note that you can get a mini-statement in your account, to generate which you need to create a report on personal account. To do this, you need to click on the “Extract” tab in your personal account and enter the following data in the fields that open:

- The beginning and end of the period for which the report is needed.

- The card or account for which the statement is issued.

Receipts and statements can be sent by email, saved as PDF and printed. The subsection “Calculation Sheets” will be useful to those who plan to conclude any transaction in the near future. For example, if the employer signs an agreement with BPS.

You can create template payments by entering parameters in the “Quick payments” subsection.

Important! You can link to an account or card electronic wallet Yandex.Money (this service is part of Sberbank). To do this you will need to go through an identification procedure. Transfers from a wallet to cards are possible:

- Visa.

- MasterCard.

- Belkart.

There are also mobile application BPS bank. You can download it for Android and iOS OS from the PlayMarket and AppStore stores, respectively.

Important! A useful section called financial manager, can be found by opening the “My Finances” section. He will analyze the available profit on all active accounts, cards and loans.

If it is decided to terminate cooperation with the bank, the client only needs to submit an appropriate application to close all products and services. After this, access to the personal account will be closed.

So, access to the account is provided to persons who already have any banking product. The service is convenient and concise, offering all the possibilities for managing your funds and services.

BPS-Sberbank has a long history of development, which began back in 1923. It was then that this oldest financial institution in the country, known as Belpromstroybank. BPS-Sberbank in Belarus received its current name only a few years ago, after the government of the country entered into an agreement with Sberbank of Russia on the acquisition of shares by the latter.

Today BPS-Sberbank is a developed modern financial institution offering clients a wide range of services. The main areas of activity are electronic services to the population, cash settlement operations, lending and opening deposits, trade and investment financing. On the pages of the official web resource there is full list available services with detailed description. There, on the website, you can find out all the addresses of branches and ATMs in the desired city and see their location on an interactive map.