The currency of the future is all about bitcoin. Cryptocurrency Bitcoin is the world currency of the future! The main advantages of bitcoins

Bitcoin is the most famous cryptocurrency in the world. Even grandmothers in remote villages know about it. People are already paying for it on the Internet and even in some shops and cafes, and the capitalization of Bitcoin itself today is more than $100 trillion. This coin has long ceased to be of interest exclusively to enthusiastic people. Virtual money is coming step by step into the lives of ordinary people.

Everyone has heard about Bitcoin, but not everyone really understands what its essence is, its simplicity and complexity at the same time. Let's figure out what this cryptocurrency is and how to start using it.

History of the coin

Knowing what happened to the coin is important. Based on history and exchange rate fluctuations, you can get an idea of the future of the currency. After all, all forecasts, whether it be exchange rates or air temperature, are based on analysis.

When did Bitcoin appear?

The first virtual coin appeared on January 9, 2009. It was Bitcoin version 0.1, which was supported only by the Windows operating system - XP, NT and 2000. In the same month, two more significant events occurred: the author Satoshi Nakamoto released the first block, mined 50 coins and carried out the first transaction in the system.

Six months later, crypto was exchanged for fiat money for the first time: for 5050 bitcoins Marty Malmi received $5.02 to my PayPal wallet.

In December 2009, a new version of bitcoin 0.2 was released, which made it possible to generate blocks not by one, but by several threads at once. This significantly increased the success of miners. Although not for long. It became more difficult to mine coins when Bitcoin 0.3 was released in the summer of 2010 and the number of its users increased.

The history of the BTC coin began two years before its release. Satoshi Nakamoto

started working on the coin concept back in 2007; in 2008, a document was published describing the protocol and operating principle of a unique system for making payments.

Prerequisites for creation

Digging even deeper, you can see that the idea of creating virtual money is not new. Back in 1983, scientists David Chaum And Stefan Brands proposed protocols electronic currency. Another significant contribution to the emergence of cryptography was made by Adam Bakov. In 1997, to counter the sending of spam and combat DoS attacks, he proposed using the Hashcash system, which became the main one for creating blocks in the blockchain chain.

Wei Dai And Nick Szabo - two researchers who had another brilliant idea in 1998. Interestingly, they did not work as a team. They proposed the concepts of “b-money” and “bit-gold” cryptocurrencies, respectively.

Hal Finney

But the biggest contribution to the spread of Bitcoin was made by an American programmer Hal Finney . It’s even difficult to imagine what would have happened to Nakamoto’s brainchild if it weren’t for this man. Hal at that time was the developer of an encryption system for public key email, participants in the cypherpunk movement - people who are interested in maintaining anonymity and cryptography methods. Once upon a time he even attempted to create his own currency. It is not surprising that Satoshi’s letter with the news about Bitcoin interested him.

By running the program, Hal was able to obtain the address and private key to his wallet. But then the system failed. As a true fan of cryptography, Hal Finney figured out what was going on here and offered Nakamoto his help. Thus, Hal became the second user of the system who managed to generate a second node and receive 50 coins for his deposit.

From day one, Finney believed in the currency and even imagined that one day one BTC could be worth 10 million dollars:

Just imagine: Bitcoin can become the main payment system in the world! Then the cost of the issued coins will be equal to all the world's wealth. Hal Finney

How much was Bitcoin worth when it came out?

The very first Bitcoin cost absolutely ridiculous money - about $0.001. And at the very beginning, there weren’t very many who took the coin seriously. Back in 2010, it was very easy to mine coins, so the number of coins among miners was off the charts. They couldn't even figure out where to spend their virtual savings.

Now many people remember the story of a real gourmet Laszlo, who feasted on pizza for 10 thousand bitcoins, as a joke. Also in 2010, he offered 10,000 coins on a forum to anyone who ordered him pizza. Taking into account the exchange rate, the high-calorie dinner cost him $40.

If Laszlo had given up on the idea of eating and kept his coins, today he could see at least $80 million in his account. And if you remember the maximum that was offered for Bitcoin in 2017, then all of 200 million! Here is such an expensive, but quite ordinary pizza with sausages, mushrooms and onions, which was even given the name Bitcoin-Pizza.

Who is Satoshi Nakamoto?

Author of Bitcoin. It's obvious! But it's not that simple. It is still not known who is hiding behind the pseudonym of the creator of the world’s first cryptocurrency. Although no one knows whether this is a pseudonym or his real name. There are a lot of assumptions. Scientists are even conducting entire studies to uncover this mystery. Finding the answer to the question, in their opinion, is very important, as this will give many explanations about the origin of virtual currency and even help to forecast the exchange rate for the future.

Author of Bitcoin. It's obvious! But it's not that simple. It is still not known who is hiding behind the pseudonym of the creator of the world’s first cryptocurrency. Although no one knows whether this is a pseudonym or his real name. There are a lot of assumptions. Scientists are even conducting entire studies to uncover this mystery. Finding the answer to the question, in their opinion, is very important, as this will give many explanations about the origin of virtual currency and even help to forecast the exchange rate for the future.

Some people think that this is a real man- a forty-year-old man who lives in Japan, educated, polite and fluent in English.

Others claim it is a woman. And still others generally believe that a whole group of developers is hiding behind the pseudonym.

The essence of Bitcoin: how the coin works

Simplicity is the main word that can be used to describe Bitcoin. Don't believe me? Have you read a lot of news and reviews and still think that cryptocurrency is too complicated and unclear? Let's figure it out.

Bitcoin allows people to transfer money as easily as sending emails or SMS. All you need to do is install a special wallet application on your computer or smartphone, enter the amount, type or scan the address of the wallet where the currency is transferred, and click send. Just a few minutes - and the recipient will have the money.

How does it work?

At the most basic level, Bitcoin is simply a ledger that contains all account numbers and balances. Transfer amounts between accounts do not include fiat currency or gold. Just people's faith that coins are worth something, and a system that ensures fair exchange.

At the most basic level, Bitcoin is simply a ledger that contains all account numbers and balances. Transfer amounts between accounts do not include fiat currency or gold. Just people's faith that coins are worth something, and a system that ensures fair exchange.

With each transfer, the Bitcoin wallet sends a message to the network describing how to change the journal, the account numbers of the sender and recipient of the coins, and the transaction amount.

Only the owner of the wallet can send such a message, as well as carry out a financial transaction, using a special signature. This is something like a handwritten painting, but which, no matter how hard you try, cannot be faked. Firstly, the public key is based on cryptography - the science of methods for ensuring data confidentiality. And secondly, all signatures are one-time use.

Who verifies the authenticity of the key?

Oddly enough, any user can do this. Bitcoin developers have created an independent, fully decentralized system for conducting anonymous transactions with open source code. The currency does not have “shadow” owners who could manipulate the rate. It cannot be controlled by large corporations, banks, the most famous personalities, or government agencies. This distribution of responsibility and control among all network participants, who are equal to each other, is called decentralization.

Simplicity, decentralization... What other features does BTC have?

The Bitcoin system is built on the blockchain. Yes, yes, another smart word! “Blockchain is a distributed registry file where data is stored...” - you’ve probably heard this exact explanation of such a popular term more than once. So, a blockchain is a regular database, which is a chain of blocks. Moreover, the generated blocks from this chain cannot be deleted or changed.

Blockchain provides several features of Bitcoin, in addition to ease of use - transparency, anonymity and reliability, speed of transfers, absence of intermediaries in transactions, irrevocability.

Anonymously. Or is it still not very good?

Unlike bank transfers and transactions in most other payment systems, Bitcoin addresses are not tied to the user’s identity at the protocol level. At any time, anyone can create a new address and a new public key associated with it, without having to provide personal data. Transactions are also carried out without indicating the first and last name.

Unlike bank transfers and transactions in most other payment systems, Bitcoin addresses are not tied to the user’s identity at the protocol level. At any time, anyone can create a new address and a new public key associated with it, without having to provide personal data. Transactions are also carried out without indicating the first and last name.

Another indication of anonymity is the use of randomly selected P2P network nodes when transferring coins.

But not everything is so secretive. All financial transactions carried out in the system are open and available for viewing to absolutely all its users. Of course, your first and last name is not indicated there, just your wallet address. If you publicly indicated this address somewhere, then any participant will be able to find out when and how many coins you transferred. To ensure maximum anonymity, simply use a new Bitcoin address for each transaction.

Fast. Very fast

How long will it take for the money to reach another continent, for example, by bank transfer? Three days, no less. This does not even take into account the queues at the bank and the time it takes to fill out all the necessary papers. A transfer through an electronic payment system will take a little less time - a maximum of one day. Using the bitcoin network, your relative, friend or just an acquaintance can receive a debt or a gift from you in a maximum of 30 minutes. Anywhere in the world! It usually takes a few minutes to transfer bitcoins. But it all depends on the network load. In the history of the coin’s existence, it never took more than half an hour to complete a transaction.

How long will it take for the money to reach another continent, for example, by bank transfer? Three days, no less. This does not even take into account the queues at the bank and the time it takes to fill out all the necessary papers. A transfer through an electronic payment system will take a little less time - a maximum of one day. Using the bitcoin network, your relative, friend or just an acquaintance can receive a debt or a gift from you in a maximum of 30 minutes. Anywhere in the world! It usually takes a few minutes to transfer bitcoins. But it all depends on the network load. In the history of the coin’s existence, it never took more than half an hour to complete a transaction.

Cheap

All payment systems, without exception, charge a fee for providing the service. At the bank, you will generally have to pay at least $50 for a transfer to another country.

Bitcoin takes a commission only if the transfer is less than 0.01 BTC. Moreover, the user can set the amount of the reward independently: than more amount commission, the faster the transaction will go through.

Reliable?

The network itself is mostly yes. The reliability and security of Bitcoin wallets must be considered separately.

The network itself is mostly yes. The reliability and security of Bitcoin wallets must be considered separately.

Why mostly? In its entire history, there has only been one hack of the system. On August 15, 2010, scammers took advantage of the imperfection of the young network - before adding transactions to the blockchain, they were not analyzed - they generated 184 billion bitcoins and sent them to two addresses. A couple of hours later, this transaction was removed from the blockchain (thus violating one of the main principles of the blockchain - immutability - and splitting adherents into two camps) and the problem was corrected.

Bitcoin currency: exchange rate dynamics

In the history of the first world cryptocurrency there were both ups and downs. And this is natural! In nine years of existence, nothing can happen. There were times when the value did not move from a dead point. And there were also sharp rises to unprecedented heights.

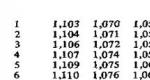

First official rate in relation to traditional coins, Bitcoin received on October 5, 2009. Back then, one dollar could buy 1,309 coins. The first takeoff occurred in June 2011, when the price rose from $10 to $32 in just a week. Then there was a drop to the same $10.

The value of the coin remained virtually unchanged until February 22, 2013, when the price rose again to $30. It was on this day that the currency began to gradually grow; by April 10, one BTC was already worth $266. The potential of virtual money was realized by November 2013, when the coin rose in price to $1,242. After which the rate fell slightly and only crossed the $1,000 mark in December 2016.

2017 turned out to be a really hot year for Bitcoin. On March 2 of this year, a new price record was set - $1,290 per coin. In the same month, BTC became more expensive than one ounce of gold. There were many similar records throughout the year.

The most successful period for the coin was mid-December, when one BTC could be bought and sold for a record to this day 20 thousand dollars.

What is Bitcoin backed by and what affects its value?

The value of fiat money is backed up by something. Either the country's reserves - oil, gold, or GDP, or other assets. Assets become more expensive, the weight of fiat increases and vice versa.

There are no resources behind Bitcoin. To calculate its real value, other methods are used. One of these is the assessment of rare materials. It is this technique that is used in estimating the cost of diamonds, rhodium, tritium or, for example, painite. One gram of this rare crystal costs 9 thousand dollars. Everything would be fine, but he doesn’t even have any practical value. Its limited quantity adds value to it.

There are no resources behind Bitcoin. To calculate its real value, other methods are used. One of these is the assessment of rare materials. It is this technique that is used in estimating the cost of diamonds, rhodium, tritium or, for example, painite. One gram of this rare crystal costs 9 thousand dollars. Everything would be fine, but he doesn’t even have any practical value. Its limited quantity adds value to it.

Same with bitcoins. Their release is limited to 21 million coins. Currency mining will cease around 2140. Every year it becomes more and more difficult to mine coins: the time and required equipment power increases. Plus, every four years, the reward for the found block is halved. All this, of course, affects the value of the coin.

Demand is another factor that influences price. It is demand that increases the cost - this is the law of the market. Often for sharp jump rate up, you can see increased interest in the purchase of bitcoins by users.

Bitcoin positions itself as decentralized payment system. But recently, decisions made in relation to it at the state level have increasingly begun to influence the price of the coin. For example, at the beginning of 2017, the rate dropped significantly after news from the Chinese cryptocurrency market, where the authorities introduced restrictive measures on the operation of exchanges.

Looking for an answer to the question “What is Bitcoin backed by?” in the usual coordinates - still an error. The main factor in price growth is progress.

What's happening with Bitcoin now: rate forecast

The coin started 2018 with a fall. And a record one: from 17 thousand in January to 6 thousand in February. Experts attribute this decline to China. This time, the authorities completely banned Bitcoin mining in the country and blocked all exchanges and ICO sites.

What will happen to the currency next is unknown. Maybe, like last year, the coin will recover and begin to increase in price. Or it may happen that investors fall in love with another currency (there are now more than 300 varieties!), then BTC will continue to fall.

But most experts still lean towards the first option. Fundstrat Global Advisors co-founder Tom Lee suggests that by the end of 2018 the cost will rise to $25,000. The executive director of the Bitcoin Foundation, Lev Klaasen, is even more loyal to the coin, whose forecast is: $40 thousand per coin by the end of 2018.

Crypto investor Petros Anagnostou is taking a long-term view and suggests that by 2020, one Bitcoin will cost between $50,000 and $100,000.

Bitcoin cryptocurrency: methods of obtaining

Like any other cryptocurrency, Bitcoin's main, or rather initial, method of production is mining - the process of creating blocks using the hardware power of a computer. If back in 2009-2011 you could get by with a regular computer to mine coins, today this requires entire farms - special installations combining dozens or even hundreds of video cards. In general, today mining is not the best profitable way receiving bitcoins. Plus, in some countries this process is generally considered illegal.

Don't worry, there are many other ways to become the owner of the popular cryptocurrency and even make a profit.

Cloud mining

Cloud mining

This is an analogue of classic mining, but with its own peculiarity - no need to buy expensive video cards and configure software. The user just needs to buy the capacity of special equipment that is installed in data centers. The mining process is carried out in the cloud. The main risk is scammers. So be careful before purchasing!

Exchangers

These are services where you can use traditional fiat currency. The main thing is to choose good exchanger with an acceptable rate and impeccable security. In RuNet, such services as Changelly, 60cek, LocalBitcoins enjoy authority. - good way, if you are interested in investing in the most popular cryptocurrency.

Cryptocurrency exchanges

If you want to not only invest in a coin, but also make money on it, use cryptocurrency exchanges. In order to be able to buy, sell or exchange bitcoins not only for dollars, euros, rubles or other fiat money, but also for other cryptocurrency coins, you need to select a platform, create your account in it and start trading. Registration is usually simple and does not take much time.

Experienced traders know: capitalization is possible based on the difference in rates. Each trading platform offers its own conditions: Bitcoin futures contracts, input and output methods, transaction fees, analytics and trading tools.

Cryptocurrency faucets

This is a way to get Bitcoin without any material investment. The only thing you need is internet access, time and patience. A lot of patience.

Faucets are online services that distribute cryptocurrency to visitors completely free of charge. All you need to do is fill out a captcha or perform another non-labor-intensive action - and the coins will trickle into your account. True, the amounts there are minimal. To get profitability in the form of at least one bitcoin, you need to try.

Storing Bitcoins: A Brief Overview of Wallets

There are plenty of options for storing cash. They can be put in a regular wallet with a lock or in a piggy bank. In the Soviet Union, money was generally kept in ordinary banks. Or under the mattress. Who is good at what. Today you can immediately put cash on your card.

What to do with Bitcoin, which you can’t even touch? We talk about where cryptocurrency is stored and how to choose the safest wallet.

Where are bitcoins stored?

Today there are five ways to store the first cryptocurrency:

- On a personal computer;

- On removable media;

- On an exchange or web service;

- On paper;

- On the map.

PC wallet

This special program, which is installed on a computer and provides encryption and protection of the wallet with savings with a strong password. There are two types of such wallets: “thick” and “thin”. The first ones download the entire blockchain, which requires a lot of free space on your PC. The most popular representative of this type is the official client of the Bitcoin Core network.

“Thin” or “light” wallets do not require downloading the entire blockchain; they can connect to it through third-party services, which greatly simplifies the life of the Bitcoin owner. The best among such wallets is Electrum, which requires minimal effort from the owner of bitcoins. You just need to install the software and select a server, after which the user receives a passphrase, which must be saved. If anything, it will help restore access to the storage.

Mobile wallet

Often all PC storage programs have a mobile version to make it convenient to manage bitcoins from your phone. But there are also special wallets that are designed specifically to buy and sell Bitcoin on your phone or even pay for goods or services with currency. Most popular applications:

Often all PC storage programs have a mobile version to make it convenient to manage bitcoins from your phone. But there are also special wallets that are designed specifically to buy and sell Bitcoin on your phone or even pay for goods or services with currency. Most popular applications:

These are third-party resources on the Internet that relieve the owner of bitcoins from the need to install additional software on his computer. One of the advantages of such storage is access to the wallet from any device and from anywhere.

In addition to special online resources, you can use cryptocurrency exchanges to store coins. True, experts advise storing on trading platforms only small amounts.

Paper carrier

This option is suitable for those who want to visualize their money in any way. The Bitcoin address and private key are generated in the form of two QR codes, which can be printed and be sure to be stored in a safe place.

In addition to the availability of this type of wallet, many people talk about its unconditional reliability. Although this can be argued. Yes, it is not threatened by the possibility of a cyber attack or hardware failure. But there is no confirmation or guarantee that the address is stored exclusively by the owner. Plus, scanning a QR code itself creates certain vulnerabilities.

Hardware wallet

It's something like a small flash drive. A hardware wallet is a special device that acts as an offline storage of cryptocurrency. This storage method has both its advantages and disadvantages.

It's something like a small flash drive. A hardware wallet is a special device that acts as an offline storage of cryptocurrency. This storage method has both its advantages and disadvantages.

The advantages are obvious:

- Support for all available crypto wallets;

- Software for all operating systems, including mobile ones;

- Support for various cryptocurrencies;

- Ease of use and connection;

- High level of protection.

The only downside is the price. Yes, you have to pay for such a wallet. The amounts vary, on average from 60 to 200 dollars. The most popular on the market are Trezor, Ledger Nano S, Keep Key.

Bitcoin cards

A new word in cryptocurrency storage. They resemble ordinary ones plastic cards. Just as compact and just as easy to use. Only much more reliable. The card contains a QR code on one side and a Bitcoin address on the other.

Hot and cold storage: what's the difference?

Many Bitcoin owners are still arguing which storage is more reliable and convenient - hot or cold. Let's figure out what it is and how these options differ.

The easiest way to differentiate between these storage options is to determine whether they require an Internet connection to function. Hot wallets always require a network connection. Otherwise, you simply will not be able to complete the required transaction. Cold wallets operate completely autonomously. Of the above storage options, cold storage options include hardware and paper wallets. They differ increased reliability, since attackers simply do not have the physical ability to steal your savings from there.

Popular questions about Bitcoin

When and where did the first Bitcoin come from?

The first virtual coin, which is driving millions of people crazy today, appeared in January 2009. Its author and first owner was Satoshi Nakamoto.

No, neither gold nor oil. Behind Bitcoin is... the general trust of people in the system and the willingness of users to conduct transactions. Although many are confident that cryptocurrency is ensured by progress and the ability to make money transfers quickly, free of charge and without intermediaries.

Is Bitcoin allowed in Russia?

There is no complete ban on bitcoins in Russia. Although the legality of using this cryptocurrency is still uncertain. According to Article 75 of the Constitution, the only monetary unit in the territory Russian Federation is Russian ruble. To legalize Bitcoin, the Constitution will have to change a little.

But there were no direct bans on the issuance and circulation of BTC coins. At least until June 2018. It is by this date that the Central Bank, on behalf of the president, must develop and implement mechanisms for regulating cryptocurrencies, mining and ICOs.

Bitcoin: what's next?

Bitcoin has long ceased to be a mysterious and useless currency that can be so thoughtlessly spent on pizza. Every day, bitcoin is becoming an increasingly common currency, which can be used to pay for goods or services on the Internet, pay for a hotel, and even pay in a cafe or restaurant. There are even cases where salaries were paid in bitcoins. And this is just the beginning!

The financial system that exists is considered by many to be unfair and ineffective. And the bitcoin system with equal rights for participants seems to be a good alternative.

However, over its ten-year history, the coin has experienced many difficulties - there have been both ups and sharp declines. And no one, not even the most experienced experts, can give a 100% guarantee that Bitcoin can become the main currency of the future. Although all the prerequisites for this really exist.

It is possible that somewhere in the Internet underground the main economic revolution in history is now taking place, the reason for which is fundamentally new form money. No, not triangular.

When the buzz about Bitcoin began in the press late last year, Norwegian student Christopher Koch suddenly remembered that in 2010 he studied cryptocurrency for thesis and, much to his girlfriend's displeasure, spent $26 buying bitcoins. Having with great difficulty dug up and decrypted his long-forgotten wallet, Christopher, to his amazement, discovered 5,000 bitcoins there, which are now worth more than 4 million dollars! Has the Norwegian girl stopped grumbling? We think so. (Although, if it were in Israel, she would start wailing: “Why couldn’t you buy bitcoins for at least $123, idiot?! Why am I suffering so much?!”)

The beauty of today's Bitcoin situation is that no one, not even the most... smart people in the world, they cannot predict what will happen next. A revolution that will change the whole world (as many people think)? Or will Bitcoin quietly deflate and remain a curiosity?

How it works

Bitcoin is called an experimental digital currency. To be more precise, Bitcoin is a technology, a currency and a payment system. His principles were published in 2008 under the pseudonym Satoshi Nakamoto. Who is behind it is still unknown, which is very symbolic. One of the revolutionary aspects of Bitcoin is the complete anonymity of all users. Over the next two years, these principles were implemented as an open source program by a diverse group of volunteer developers from around the world. The system is open to everyone: anyone can connect to it at any time or study its code without asking anyone for permission.

The essence of Bitcoin is very simple: it is digital cash. With all the pros and cons of cash. You keep digital coins on your computer or smartphone. The program is called a Bitcoin wallet. You can quickly transfer any amount of money to anyone, anywhere in the world, at any time of the day or night, without leaving your computer or smartphone. It's as easy as sending someone an email. Like cash payments, Bitcoin payments are anonymous and not associated with any information about the user - this is their difference from traditional credit card payments or online banking. As with regular cash payments, payments cannot be canceled: once you part with the coin, it is no longer yours. And just like regular cash in your wallet, this currency can be stolen by digital pickpockets if you handle it carelessly and don't take reasonable precautions.

All wallet programs on user computers around the world are interconnected into a huge payment network. Working together and in strict accordance with pre-known rules, these programs ensure the transfer of digital coins from user to user without any control center or administrator. At the same time, it will not be possible to counterfeit bitcoins or try to pay with the same coin twice.

Bitcoins are not tied to the value of any existing currencies or real assets such as precious metals and real estate. Their price is determined solely by supply and demand on online exchanges or in direct transactions between buyer and seller.

Bitcoins are not issued by any central bank or any other issuer. Instead, they enter circulation through a kind of lottery process, where each participant in the system has a small chance of receiving a certain number of bitcoins on average once every ten minutes. Moreover, this chance depends both on the total number of network participants and on the amount of computing resources that a given user provides. Once upon a time, four years ago, Bitcoiners could generate hundreds of coins a day on an ordinary laptop. Nowadays, only powerful specialized servers united in huge computing pools can mine coins.

Bitcoin world news

The student who unfurled the poster “Mom, send some money!” at a US University League game, received $20,000 in donations. The fact is that in addition to this call, the poster featured a Bitcoin sign and a QR code for the student’s Bitcoin wallet. The poster was captured by television cameras, and compassionate bitcoiners, reading the QR code directly from the screen, immediately began sending him digital coins. The first payments began to arrive literally seconds after the poster appeared on the screen, and in just one day the student received Bitcoin donations worth as much as $20,000.

The Bitcoin theft of the century took place on December 7: more than $100 million worth of Bitcoin was stolen from customers of the illegal online market Sheep Marketplace. This hidden site sold a wide range of drugs and its popularity has increased greatly since the closure of the pioneering online drug trading site Silk Road.

Bitcoin has become firmly established in American popular culture. This became obvious to everyone when, in the next episode of the popular animated series The Simpsons, the clown businessman Krusty began to complain that he “lost all his money playing in the Bitcoin market.”

A hard drive with 7,500 bitcoins lies in a landfill in the English city of Newport. These coins were mined back in 2009 by IT specialist James Howell, and their current value is about $6 million. The hard drive with digital coins was thrown away by James in the process of routinely clearing out “digital junk”, and only a month later it dawned on him how much he had screwed up. The inconsolable James did not bother to make a backup copy of his wallet, so now he is assembling a team of “treasure hunters” armed with an excavator to dig through a huge landfill and extract lost digital treasures from under a two-meter layer of garbage.

Will Bitcoin change the world?

At first glance, Bitcoin is just another electronic payment system like PayPal or WebMoney, and even operates with an obscure virtual currency, the value of which is constantly fluctuating. But its fans believe that Bitcoin will lead to a complete rethinking of everything international finance, will destroy economic barriers between countries and free money from state control. They claim that Bitcoin is a revolution that will change the lives of each of us, just as the Internet did earlier.

Saying that Bitcoin is just digital money is like saying “The Internet is such a fancy phone.” This is true on some level, because the Internet is also designed to transmit information.

So, Bitcoin has three aspects: technology, currency and payment network. Let's look at each of these aspects in more detail.

Bitcoin as a currency

The world's central banks can print currencies in unlimited quantities, guided by some of their own considerations or political circumstances. And all the currencies of the world are gradually depreciating - some quickly, some slowly.

The number of bitcoins put into circulation is strictly fixed by the rules and is halved every four years. A total of 21 million will be produced by 2140. There are few coins, the number of users is growing, so the cost of one Bitcoin is also growing, which leads to a paradoxical situation for the modern world: Bitcoin as a currency is, in principle, subject not to inflation, but to deflation. Despite short-term fluctuations in the exchange rate, in the long term this currency, in theory, should not only maintain, but also increase its purchasing power. Even after the number of users of the system stops growing, the value of the coin will slowly increase due to the growth of the Bitcoin economy. Deflation could be a problem, but fortunately Bitcoin can be divided almost indefinitely, and paying for a thousandth or millionth of a part is no more difficult than a whole coin.

Bitcoin as a payment network

No less revolutionary potential lies in the organization of the Bitcoin payment network. It does not depend on banks and intermediaries. It ignores state borders and lies beyond the control of governments. No one can stop you from sending bitcoins to anyone - even to a needy black man in Africa, even to a prostitute, even to a politician.

At the same time, for the Bitcoin network it is absolutely indifferent whether we are talking about transferring millions of dollars to the other side of the world or about a small payment for a cup of coffee. Payment anywhere and for any amount will cost only a few cents if you are in a hurry, or completely free if you are willing to wait a little. Bank commissions of 0.5–2% of the payment amount or $25–50 per international translation Look against this background as a real robbery.

The Bitcoin payment network is open to absolutely everyone. Including for those who for some reason do not have a bank account. And in fact there are quite a few of them: out of the 7.5 billion world population banking services only 1 billion are covered. However, two billion of those currently unbanked nevertheless have an Internet connection - mostly through mobile networks.

And now connecting to the international payment network for these billions is just a matter of downloading and installing a Bitcoin client. In much of the developing world, people have never even seen a landline phone, but everyone has a cell phone. These billions of people will begin to participate in international trade and financial flows without ever knowing what a bank is.

Bitcoin as a technology

Finally, technology. A decentralized computing network approves transactions without any need for an administrator, control center or supreme arbiter. This is already a revolution. But a decentralized digital currency is just the first application of this technology. With the same success, it is possible to build a decentralized system of accounting and transfer of ownership rights to any movable and real estate or, for example, registration and notarization of documents without any state registration bureaus and notaries. And even a system of 100% honest secret voting. If the Internet is primarily a protocol for exchanging information, Bitcoin is a protocol for exchanging anything.

Perhaps the technological aspect of Bitcoin is the most interesting of the three. After all, even if something happens to the Bitcoin currency or the Bitcoin network, this does not mean the end of Bitcoin. Bitcoin technology is known to everyone - anyone can take the open source code, fix the flaws and release a new version of it. Digital currencies will not disappear: the genie is out of the bottle and it will not be possible to put it back. What we see now can be compared to the complex, black and white, ugly and slow Internet interface of the late 80s. The potential of all possible applications of these technologies is still far from being discovered; the Amazons, Googles and Facebooks of the Bitcoin world have not yet appeared.

Bitcoin in numbers

120 exaflops is the total power of the Bitcoin distributed network, making it the most powerful computing network in human history. And the combined computing power of the world’s 500 leading supercomputers is about a thousand times inferior to the Bitcoin network.

42% know that Bitcoin is a digital currency, according to a Bloomberg survey conducted in November 2013. At the same time, 6% of respondents consider Bitcoin a game for Xbox, and 7% - a new application for iPhone. The rest honestly admitted that they had no idea what they were being asked about.

$6,000,000,000 - turnover of the illegal online market Silk Road, closed by the FBI in October 2013. Drugs, fake documents and weapons on this site were sold exclusively for bitcoins. The site operator, anarchist Ross Ulbricht, pocketed over $80 million in commissions over two years of work.

21,000,000 is the maximum number of digital coins that can ever be issued. Calculations show that this limit can only be reached by 2140.

4847% is the annual return of the Bitcoin Fund of Exante, which took first place in the Bloomberg rating. Traditional investment funds, which took second and third place, showed annual returns of 34% and 25%.

73% - this is how much the price of Bitcoin lost from its peak of $266 in just a week of trading in April 2013. Experts called it a crash from which Bitcoin would never recover. However, the price of the coin set a new price record within six months.

280,000 - this is how many new Bitcoin users register monthly on just one of the blockchain.info online wallets. The growth rate has increased significantly since the beginning of this year, when the service grew by only 30–40 thousand new users per month.

$312,000 - this will be the minimum price of one bitcoin if the cryptocurrency can completely replace gold as a store of value. The value of all gold reserves in the world is estimated at $6.5 trillion.

5 cents - this is how much they gave for one digital coin in July 2010 on the Mt.Gox exchange.

927 people on Earth own half of all existing Bitcoins, according to estimates by businessinsider.com.

Why Bitcoin Could Fail

However, Bitcoin skeptics also have many arguments. The main one is the absence of any intrinsic, or fundamental, value of the coin. Bitcoin is just a handful of bytes. How can he even be worth anything? Unlike gold, which it is sometimes compared to, it is absolutely useless for anything other than being money.

A little about GirlsGoneBitcoin

Anonymous digital cash? What you need for online striptease! The pioneer of this type of business was the GirlsGoneBitcoin group on the Reddit website, where you can find more than 4.5 thousand visitors. The “get naked for bitcoins” business model has become so successful and profitable that there are now dozens of copycat sites all over the Internet, catering to every taste.

Some people think that Bitcoin is financial Pyramide new type. After all, those who learned about bitcoins earlier than others were able to buy them cheaper. Now they make a profit at the expense of newcomers who have to overpay. Like any pyramid, Bitcoin faces a sad end, skeptics predict. As soon as the number of people willing to invest in it dries up, the Bitcoin rate will drop to zero.

The instability of the digital currency does not allow it to be taken seriously, skeptics complain. In fact, today Bitcoin costs 700 dollars, tomorrow - 800, the day after tomorrow - 500. You get tired of changing price tags every hour.

And security problems can alienate the general public. Indeed, it is not easy now to save and protect your digital treasures, especially for ordinary people. Digital coins are stolen by hackers, computers with Bitcoin wallets are broken and lost. It is impossible to recover lost coins - this is digital cash.

The deflationary nature of Bitcoin could also be a source of problems. Since its value is constantly increasing, everyone will only save and not spend. As a result, Bitcoin prices for everything will continually decline, and the Bitcoin economy will fall into a murderous deflationary spiral.

Finally, one of the most serious arguments against the coming triumph of digital currency is the resistance of government agencies. In the face of powerful competition from a non-inflationary currency, states will not be able to freely print their currencies, carry out devaluations and manipulate money markets. The lack of profit from the printing press, coupled with the complication of collecting taxes and duties from transactions in anonymous cryptocurrency, will force states to shrink greatly, fire millions of civil servants and curtail many economic and social programs. Bitcoin skeptics conclude from this prospect that states will never allow serious competition for their monetary monopoly and Bitcoin will soon be subject to massive persecution and bans.

Bitcoins accepted here

The first purchase of a real product for bitcoins recorded in the annals of history took place in May 2010, when American Laszlo Hanecz paid another bitcoiner 10,000 coins for two pizzas delivered to his home. “The pizzas were just amazing!” - recalls Laszlo. He says he doesn't regret his purchase at all, even though the 10,000 Bitcoin he paid for a couple of pizzas is now worth several million dollars. Perhaps these were the most expensive pizzas in the history of mankind.

Just a couple of years ago, many people ridiculed Bitcoin’s claims to be called a currency on the grounds that, in fact, little could be bought for it. Well, perhaps some early enthusiasts accepted it as payment for all sorts of exotic items like handmade soap or socks made from llama wool.

Today, many online stores gladly accept digital currency. For example, on the website bitcoinstore.com you can buy more than 20,000 items of various electronics, and much cheaper than on Amazon. American distributors began selling Lamborghini and Tesla cars for bitcoins, and Richard Branson recently announced that bitcoins can now be used to buy a ticket to fly into space on the ships of his company Virgin Galactic.

Bars and pizzerias (hello, Laszlo!) are also not far behind. In December, it became possible to drink beer using bitcoins in Russia: the Killfish bar chain officially announced that in all 66 bars of the network it is now possible to pay with digital currency.

The dark side of bitcoin

And, of course, the anonymity of Bitcoin and the impossibility of rolling back payments makes it the only reliably working option for online purchases of illegal goods and services. Using bitcoins, online casinos bypass the US ban on online gambling, and you can use them to buy drugs banned in the US.

But the real hit of illegal online sales are illegal substances. The pioneer of this business is the hidden site Silk Road, created in early 2011 by the American anarchist practitioner Ross Ulbricht, who operated under the pseudonym Dread Pirate Roberts. This site, which was called the “Amazon of the drug trade,” featured a wide range of drugs and psychotropic substances that could be purchased with bitcoins and then received by mail. Customers rated suppliers and wrote reviews of the products they received. Shopping on this site was not much different from regular online retail and was so superior to the experience of buying drugs in the back alley that connoisseurs switched en masse to using Silk Road.

Interestingly, Silk Road's activities reduced the risks of both buyers and producers. This business model has taken the economic base out from under criminal gangs that rely on the transport and distribution of drugs for their livelihood. It would seem that professional anti-drug fighters should have only rejoiced at this, but that was not the case. For the FBI and the Drug Enforcement Agency, the Dread Pirate Roberts became enemy number one, and the best forces were sent to find him. Last October, these efforts were successful, the site's operator was arrested at the San Francisco City Library, and the site was shut down. However, the achievements of law enforcement turned out to be a pyrrhic victory: Silk Road was replaced by dozens of others. So the bright future of illegal online trading is not in danger.

Altcoin problem

One of the arguments against Bitcoin is the problem of clones. Skeptics argue that since the system's code is open, thousands of clones (also called altcoins) will appear, and the original Bitcoin will lose value. They compare Bitcoin to services like Napster or MySpace, which were pioneers in their category, but then lost the palm to more advanced ones. technically competitors. Attempts to create a “better Bitcoin” do not stop. More than 150 altcoins have already been created. Most of them are nothing more than hobby projects with scanty capitalization. Here are some of the most interesting examples.

Primecoin is the first altcoin that does useful calculations instead of dumb transaction hashing. Well, how useful... It searches for new large prime numbers, which is theoretically very useful for cryptography and some other branches of mathematics. Unfortunately, you can't expect a cure for cancer.

Litecoin is the oldest and most “honored” altcoin. It offers a number of technological improvements, such as faster transaction confirmations and a different crypto hashing algorithm.

Peercoin is perhaps one of the most innovative clones. It makes really interesting changes to the transaction confirmation scheme, which can greatly reduce the energy costs of running the network. If energy consumption ever becomes a serious issue, then perhaps the Bitcoin network should adopt these improvements.

Dogecoin is a funny altcoin inspired by pictures of dogs. Users were so moved that, just for fun, they bought themselves a little bit each, increasing the price of dogwood by a thousand times for a couple of hours.

What's next?

Will Bitcoin be able to overcome the resistance of governments, central banks and the powerful financial lobby, as well as the innate conservatism of people in everything related to money? Will this technology realize its revolutionary potential and change our world?

Experts are debating Bitcoin, with opinions ranging from “absolutely useless nonsense” to “the salvation of all mankind.” Legislators and regulators are trying to figure out what kind of misfortune has fallen on their heads and whether it is possible to somehow limit the unusual financial freedom that this very Bitcoin gives to ordinary people. Central banks are issuing dire statements and warnings about the risks of investing in digital currency. The cost of digital coins on exchanges time after time flies into the stratosphere, then again collapses onto the sinful earth. Investors, following stock market fluctuations, either bless the digital currency or curse it.

But no matter what happens around, Bitcoin itself is absolutely indifferent. He is not concerned with passions, opinions, statements, laws, regulations, price fluctuations and any other vanity. At any time of the day or night, in any country and on any computer, Bitcoin simply does what it was designed to do - securely transfer ownership of digital coins in accordance with all known and immutable rules. The experiment continues.

In the past year, the hottest topic has certainly been cryptocurrencies and Bitcoin in particular. Some call it the “new era of cryptocurrencies,” others call it liberation from the slavery of central banks and inflation.

Over the current year, the growth of cryptocurrencies has amounted to hundreds or thousands of percent. At the same time, the Bitcoin exchange rate is so volatile that in one day its fluctuations can amount to ten percent. As I write this article, the price of Bitcoin is $15,000. When this article is published, its value could be anywhere from $1 to $100,000.

Since its creation, the Bitcoin exchange rate has increased 1.5 million times. Of course, this could not remain without the close attention of the general public. As a result, today there are practically no people left who have not heard anything about Bitcoin.

In this regard, many people have a question: is it worth buying Bitcoin? To figure it out, let's try to answer a few questions.

Is Bitcoin a currency?

Currency is legal tender. Each state sets its own legal currency, in Russia it is the ruble, in the USA it is the dollar. The currency is backed by the economy of the country that issues it. The larger and more reliable an economy is, the stronger the currency and people's trust in it.

You can use currency to buy things and services. But can you buy bread and milk at your local supermarket with bitcoins? No, first you will have to exchange them for dollars, and then for rubles.

Basics practical use Bitcoin today is shadow economy, payments for illegal goods and services, since transactions are anonymous and hidden from regulatory authorities.

Just because Bitcoin can be used to pay in some places does not make it a currency. Just like a bottle of vodka does not become a currency just because it can be used to pay for plowing a garden in the village.

The value of a currency is, in a sense, a reflection of the economy, so its value can be more or less successfully predicted (or at least attempted). If the economy is expected to weaken and decline, then we can expect that country's currency to depreciate against the currencies of other more reliable countries.

Bitcoin is not backed by anything, so it is almost impossible to predict its price. The price of Bitcoin is now determined solely by the supply and demand of the crowd of investors, and the crowd, as we know, is a creature that can easily fall into both euphoria and depression.

Is Bitcoin a bubble?

Albert Einstein said: “ There are two infinite things in the world - the universe and human stupidity. Although I’m not sure about the first one.”

The history of mankind knows many bubbles - when the cost of something reached cosmic heights only due to rush demand, and not fundamental factors.

The most famous are the tulip mania, the shares of the South Sea Company (on which Isaac Newton himself lost money), and the most recent is the dot-com bubble.

The picture below shows the rise and fall of the most famous market bubbles. Now Bitcoin in terms of its scale is in second place after tulip mania, if we count from 2014. And if we take an earlier period, then Bitcoin is already much higher.

The Rise and Fall of Famous Market Bubbles

All market bubbles have a few things in common. The first is that they all grew due to the rush, irrational demand and rosy expectations of people who believe in the endless growth of the value of the asset.

Why buy Bitcoin? Because he is growing. Why is it growing? Because they buy it. This is a game of the last fool - everyone who bought Bitcoin hopes to find a fool who will be willing to buy it at a higher price. And this will continue until all the fools run out or the overvaluation of the product becomes obvious to everyone.

Experts identify several stages of inflating a classic bubble: rise - takeoff - first sell-off - bear trap - media attention - enthusiasm - greed - obsession - new reality - denial - bull trap - return to normality - collapse - capitulation - despair - reversion to the mean.

Judging by the Bitcoin price chart, it is now at the stage of a new reality. And indeed, now one can come across the opinion that Bitcoin will soon replace all money.

Is Bitcoin heading towards a classic bubble?

The second thing is that the market price is divorced from fundamental factors. During tulip mania, you could buy a house for a bulb. During the dot-com crisis, technology stocks were trading at hundreds of times their earnings. And many companies had losses instead of profits, which did not prevent them from trading at cosmic P/E. Just high expectations and nothing more.

And the third thing is that all bubbles burst sooner or later. You can't fool everyone all the time, and trees don't grow to the sky. Sooner or later, everyone realizes that the price is far from reality and begins to actively get rid of the inflated asset. Irrational growth gives way to irrational flight.

Is Bitcoin safe?

The currency of the state is regulated by laws and regulators. The state controls and is responsible for the protection and solvency of its currency.

Currently, Bitcoin is not regulated by any legislation or regulator. The regulator is the system and technology itself. But no one is responsible if something happens.

Practice shows that the technology is not so safe. For example, the South Korean exchange Youbit announced bankruptcy and closure after it was hacked and hackers stole 17% of its assets. As a result, the assets of exchange users will be reduced to 75% of the available volume.

In 2014, 744,408 bitcoins ($460 million) were stolen from the Mt.Gox exchange. On August 2, 2016, attackers hacked the Hong Kong exchange Bitfinex, stealing 119,756 bitcoins. At the time of the hack, this amount was $72 million.

If you search, you will find that similar things have happened with other cryptocurrencies.

What do experts say about Bitcoin?

“Avoid Bitcoin like the plague. Have I made myself clear?", said the founder of Vanguard Group Inc. John Bogle responds to a question from the audience at a Council on Foreign Relations event in New York.

“Bitcoin has no underlying rate of return. You know that bonds have an interest coupon, stocks have earnings and dividends, gold has nothing. There's nothing that keeps Bitcoin alive except the hope that you'll sell it to someone for more than you paid for it."

Co-founder of Bitcoin.com Emil Oldenburg said that Bitcoin has no prospects as a trading currency.

“I can say that investing in Bitcoin is the most extreme investment you can make.<…>People will start exiting Bitcoin as soon as they understand how this cryptocurrency works.", Business Insider quotes the entrepreneur as saying.

Is it worth buying Bitcoin?

Charles Kindleberger, historian and researcher of financial bubbles, wrote: "It's hard to stay level-headed and sane when your friend gets rich."

It is for this reason that Bitcoin is growing - no one wants to remain on the sidelines when everyone around is talking about it and making money. But today Bitcoin is something that has no true value, backing, regulation or practical application.

No contact with real economy Bitcoin has no value. If it cannot be exchanged for dollars or other real currency, no one needs it.

Today no one buys Bitcoin to pay with it. Today, everyone buys Bitcoin in order to sell it at a higher price to someone else. Therefore, there is no question of investing in Bitcoin. This can only be a matter of speculation.

In a sense, it resembles a commodity - gold or oil. The price of a product is determined by the cost of its production, supply and demand on the stock exchange. But unlike a commodity, Bitcoin cannot be made into gasoline or jewelry.

Perhaps sometime in the future, cryptocurrencies will become something more real, but most likely it will be something else. Is it worth investing in this now? Let everyone decide for themselves.

I learned about Bitcoin relatively recently, but it immediately captivated me with its p2p idea. The deeper I dug into their Wiki, the more I became inspired by this idea. Its implementation is beautiful and elegant from a technical point of view.

A search for Bitcoin Habr returns two topics. But this is more news. It is noticeable from the comments that many people, especially those not directly familiar with Bitcoin, have many questions about the principles of its operation. There are also a lot of guesses, often incorrect. In order to somehow clarify the situation, it was decided to write this article.

Real money?

First on the list of main misconceptions about Bitcoin is the idea that Bitcoin is just another “piece of paper”, albeit electronic, which only represents “real” money, and is a kind of promissory note. This is where most of the other misconceptions originate: since these are pieces of paper, they are worth nothing; they can be printed or destroyed as many as you like; they can be faked; they can be copied.I repeat - all this is nothing more than misconceptions. The idea of Bitcoin was based on the desire to create not just another “piece of paper” that represents real money, such as gold, but an analogue of gold itself. Take those properties of gold that make it ideal money, and make an electronic currency based on them.

Mining difficulty

Gold cannot be copied - it can only be mined. But this is a very costly process both in time and resources. This is partly why gold is so highly valued. To make it clearer, let's look at an example.Let’s say a person worked diligently to mine gold all day and eventually extracted 1 kg. For him, the value of mined gold is equal to one day of hard work. After a hard day at work, he decided to relax and go to the cinema. By a happy coincidence, the cashier gave the tickets in exchange for gold. Why? Because the cashier likes gold, but doesn't like working with a pickaxe all day. Therefore, he is ready to provide a service - give away the ticket - in exchange for 1 kg of gold. In fact, he exchanges his service for one day of hard work.

Now let's imagine a different situation. They invented a copier that works with gold. And any person can make 10 kg from one 1 kg of gold in a minute. In this situation, the cashier will no longer exchange tickets for gold, since now he himself can easily print as much as he wants. Gold will cease to have any value and can no longer be used as money.

In Bitcoin, the process of mining coins also requires resources and time. But in this case it's not human resources, and computer ones.

Conditionally limited resource

The longer it takes to mine gold, the more difficult (and resource-intensive) it becomes to extract. This will ensure that inflation is under control.Materiality

This is a property not so much of gold as of any non-electronic currency. One gold bar cannot be exchanged twice for a service or product. That is, at one point in time it can be either the seller or the buyer.This behavior is natural for material currency, but not for electronic currency. To achieve this behavior of virtual money, you need to apply a lot of ingenuity. In Bitcoin, this behavior is provided by the transaction mechanism. All transactions are combined into chains. Each transaction takes coins from one or more existing transactions and specifies who they are intended for. Therefore, you can always check the entire chain for validity.

Difficulty of mining, limited resource, materiality - these properties, plus the use of cryptography to ensure security, allow Bitcoin to be used as money. The core of Bitcoin is based on them. These are not just agreements. All of them are embedded in the by design system, and it will not work any other way. It's time to look at this very design.

Block chain

Any electronic payment system must store transactions somewhere and somehow. In Bitcoin, all information is stored in a block chain. Blocks are transmitted in JSON format. Each block contains a header and a list of transactions. The header consists of several properties, among which is the hash of the previous block. Thus, the entire blockchain stores all transactions for the entire duration of Bitcoin.In current versions of the Bitcoin program, the entire blockchain is downloaded by each client, which makes the system completely decentralized. The data is not encrypted in any way and anyone can manually trace all transactions. There is even a special website - Bitcoin Block Explorer, where you can easily view all the information about blocks and transactions.

At the time of writing, the number of blocks in the chain was 110,968, and, as I said earlier, this number increases by 1 approximately every 10 minutes. This means that one of the participants was able to create a new block.

By the way, all participants are divided into two groups: those who are working on the new block and those who are not working. According to statistics, these groups have a ratio of 1 to 3. Why create blocks at all, and even every 10 minutes? Transactions are recorded in blocks. Each block contains all transactions that took place during its creation, i.e. within 10 minutes.

It works as follows. One of the clients creates a new transaction and sends it to other clients who are busy generating a block. They add this transaction to their block and continue generating. Sooner or later someone will be able to generate a block. Such a block is sealed (no more transactions are added to it) and sent out across the network. Next, clients check the block and transactions within it for validity. If there are no problems, then the transactions are considered approved. At this point, the fresh block has already reached each client and is added to the chain. After this, the process repeats - clients begin to generate the next block and collect new transactions into it.

New pyramid or currency of the future?

In the second half of 2017, Bitcoin (BTC) soared to unprecedented heights and became the most profitable financial instrument for many large investors. In just a few months, the cost of this cryptocurrency increased from $2,750 to $19,000. This year, BTC is still growing, and according to experts, the price increase will continue to be observed for a long time.

Will cryptocurrency become an alternative to securities?

The emergence of digital currency promises their future financial markets. According to most experts, Bitcoin will continue to rise in price for a long time, and therefore owners of crypto coins will continue to receive tangible benefits. It is still difficult to say what Bitcoin will become as a result - a reliable instrument and an excellent alternative to classical money or a soap bubble like MMM on a global scale.

According to Alpari Group analyst Roman Tkachuk:“Bitcoin is a very interesting financial instrument, but at the same time it is highly risky. At the beginning of 2018, the crypto coin increased in price several times. In general, over 5 years the cost increased 60 times, which made it possible for those who invested in it at the initial stages to get rich.”

“In essence, Bitcoin is now positioned as an investment instrument,” FOREX CLUB analyst Andrey Shevchin comments. Cryptocurrency dynamics alone pose a real challenge to almost all of today's trading instruments, regardless of national currencies. After all, back in 2011, 1 Bitcoin coin cost 11–13 dollars, and today its cost varies in the range of 13,000 dollars.

“Bitcoin is a modern alternative to gold and to a certain extent it is the main competitor to the dollar and financial system in the classical sense. Like precious metals a digital coin has no fair value, and therefore everything is determined by the relationship between supply and demand,” says Alpari Group expert Tkachuk.

“Gaining popularity as a payment instrument, Bitcoin is actively growing against the dollar. Therefore, the more transactions using a given digital currency, the higher its value. Additionally, rising prices attract not only investors, but also speculators,” the analyst emphasizes.

Bitcoin also has such advantages as:

- Limited number of Bitcoin coins.

- Special blockchain technology.

- Anonymity.

- Minimum emissions.

Thanks to the above qualities, the attractiveness of crypto coins is higher than ever.

Will Bitcoin continue to grow?

"On this moment cryptocurrency is experiencing its peak of popularity. Consequently, demand now exceeds supply. Taking this factor into account, digital currency will gradually increase in value,” notes financial expert Tkachuk.

On the other hand, the higher the value of a currency rises, the higher the risks of deflating the so-called bubble increase. However, the main risk for Bitcoin is the tightening of regulation by the Central banks of various countries.

According to FOREX CLUB chief analyst Andrey Shevchin, Bitcoin currently looks overvalued. Based on this, a correction in its value can begin at any time.

On the other hand, there is now a rather difficult geopolitical situation in the world. Against this backdrop, blockchain is rapidly gaining momentum, investors are buying coins, and more and more people around the world are showing interest in Bitcoin. Therefore, the growth of cryptocurrency will continue for some time. .

Bitcoin: the currency of the future or a big soap bubble?

Many financial experts and analysts have differing opinions regarding crypto coins. Thus, some believe that Bitcoin is a promising currency that will replace standard money in the near future.

Blockchain technology is constantly evolving, attracting more and more people around the world every day. Of course, there are fundamental and technological risks, especially when taking BTC to a new level of exploitation. Additionally, the cost of Bitcoin is speculatively inflated, however, as long as it is in high demand, its price will rise steadily .

Other experts and analysts consider Bitcoin a big “soap bubble”, just like the American one. stock market. That is, it can swell for quite a long time, however, in the end everything will burst exactly, it’s only a matter of time.

Financial analysts believe that BTC is not yet capable of fully performing the functions that are inherent in national currencies. This is due to the fact that Bitcoin has an unstable exchange rate. Accordingly, no one wants to use cryptocurrency for payments, the value of which can increase or decrease by 15–20% in just one day.

Additionally from Central Banks different countries there is no clear position regarding virtual currencies. However, today one can observe a tendency to intensify the fight against the exchange of cryptocoins for regular money and vice versa. It is likely that in the future, many states will impose sanctions on online retailers that accept cryptocurrencies, which may actually lead to a drop in demand for digital coins.

Also, do not forget about hacker attacks. After all, despite the fact that they are constantly being improved, it is nevertheless quite possible to hack them.

Of course, if a number of different circumstances develop favorably, then it is quite likely that Bitcoin will be able to replace everyone’s familiar coins and paper banknotes. However, the prospect of cryptocurrencies still remains dubious, since, on the one hand, it opens up wide financial opportunities, and, on the other, it creates high risks for people.