What do you need to invest. Investing from scratch in detail: step by step instructions. There are several ways to acquire precious metals

One of the most affordable options "where to invest on the Internet", and sometimes very profitable, is. Then you can look towards the creation or ready-made Internet sites (online stores) for the purpose of further earnings or resale. The purchase of shares (shares) in already existing Internet projects also refers to investments, although they are quite risky, because. You don't know until the end what real goals the organizer is pursuing.

Despite the obvious availability, I do not recommend investing in HYIPs, lending (credit exchanges), binary options, sports betting, because the risks are extremely high. As a rule, in the options proposed above, it is possible to work using electronic payment systems, such as Webmoney, Yandex.Money, perfect money, QIWI and others.

Where to invest 100,000 rubles (dollars, hryvnias)

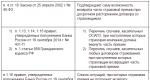

The first thing to do is to identify the risks. If the main goal is to try to keep your savings, more conservative options are suitable, for example, bank deposits, buying precious metals on long term, investment in antiques. With an amount of 100 thousand dollars, you can add the option of buying real estate.

The first thing to do is to identify the risks. If the main goal is to try to keep your savings, more conservative options are suitable, for example, bank deposits, buying precious metals on long term, investment in antiques. With an amount of 100 thousand dollars, you can add the option of buying real estate.

Considering more profitable, but also more risky options “where to invest 100,000 rubles”, you can pay attention to the purchase of companies (Gazprom, Google, Yandex, etc.), , ( trust management). You can read more about the pros and cons of these options in the article above.

The richest people (video)

Where to invest money in order to count on a stable profit and not worry that the invested funds may be lost? Today I will talk about the main ways of investing and describe their main advantages. In addition, I will also point out which method is suitable for ruble, and which for dollar or cryptocurrency capital.

How to form an investment strategy, taking into account different methods and amounts, and how to protect yourself from possible losses?. If a couple of years ago one of the most effective tools a binary option was considered, before that mutual funds and deposits, then over time, Internet projects and cryptocurrency entered the arena.

The Best Ways to Invest Money for Newbies

Beginners daily ask themselves the question: where to invest so that money at interest brings profit and does not quickly depreciate over time. If 10 years ago the most popular options were stocks and bank deposits, today there are a lot of ways. They differ:

- rate of return;

- term of work;

- level of risk;

- investment form.

A typical threat for beginners is not being able to correctly calculate all the amounts for investments, and losing all capital.

If the initial investment is additional income, then over time they can turn into the main income, but not in the office, but at home. To make this a reality, you need a competent investment strategy. I also recommend using only profit for investments and reinvestment, and save the capital itself.

Remains important question: where to look for investment tools, how often to invest, and how to minimize risks. Many methods are collected on the tutdenegki portal. When choosing online investments or cryptocurrency, look for recommendations on my GQ Blog Monitor, and besides that, I can advise you personally.

Invest money in real business

When the amount on hand is not too significant, and the interest on the deposit does not satisfy, you can find a commercial offer and financially support someone's business. In one of his articles, how to properly manage cash flow, I said that different sources of income are correct and rational. When choosing a business for investment, you can immediately bet on several options: from a bakery to producing show business stars. To avoid risks, I recommend:

- always conclude a partnership agreement indicating the amount (percentage of investments);

- specify the terms of payment of dividends;

- clarify the points of risk allocation.

You can find offers among friends, online, or on special crowdfunding sites. In my article, I have already explained what is direct investment, and, as a rule, the money raised works to develop and modernize the business. You can also choose to invest in a startup by finding a project at the very start and evaluating its idea, a possible development market, and an audience.

Investing in bank deposits

This is a way that allows you to invest and not follow the situation on the market. because of official work, the availability of licenses, a solid reputation, banks rarely appropriate customer funds. Deposits are accepted in rubles and dollars, less often in euros for a period of 1 month to 2 years at different interest rates with the principle of accumulation at the end of the term or with monthly withdrawals. Some packages have the option early termination with commissions.

The principle of the deposit is simple: than longer term work, the higher the percentage offered to the client.

If you have 100,000 rubles, then this is a good opportunity not to keep funds at home and receive income from them while you are working on increasing your entire capital.

Investments in mutual funds

Activities are strictly regulated official documents and has been in the service market for over 20 years. The main advantage of the work is that the funds have a stable and reliable reputation. The basic disadvantages of the job are the low percentage. A significant advantage in the activities of mutual funds is a small amount of money for a starting investment (from 1 to 3, and up to a maximum of 5 thousand rubles), and for those who are looking for where to invest with little risk, this is a good option. The average annual yield is 8-10%. There are backgrounds that work not only with currencies, but also with precious metals and foreign assets.

To minimize risks and in-depth expert assessment before investing, I recommend studying the ratings of independent agencies for a certain period or the entire period of the fund's activity. One of the authoritative sources is the banki.ru resource.

Currency deposits

When there is capital in foreign currency, there is not only a desire to receive monthly income, but also legitimate question: where to invest money so that they do not depreciate, remain and make a profit. State and commercial banks offer currency deposits, but the main argument against this method is too low a percentage.

The main advantages of the deposit:

- security of funds;

- no temptation to spend money;

- partial protection against inflation.

It is difficult to call such income the main one, but it can be considered as an additional one, especially taking into account the different starting amounts for investments.

Gold, silver, precious metals and coins

The liquidity of banking metals does not fall over the years. Many banking organizations they offer to buy an ingot of metal of different samples and weights in branches or through Internet banking, and put it in a deposit box. Working with gold requires a fairly solid capital, but the price of Au does not fall for a long time. One side, good way to store money, on the other hand, this is a temporary “freeze”, because there are no jumps in the course. By investing the same amount in cashbury, you could get more profit, and I hope that payments will still be restored from November 1st.

Securities: stocks, bonds

Studying the advice of experts who recommend effective ways where to invest money, determine methods to receive passive income in the current year and in 2020, it is worth choosing stocks and bonds. You can start with a small price, then move on to the blue chips. It is convenient that many brokers, through which transactions take place, offer a history of changes in quotes, make recommendations: buy or sell securities. Liquidity indicators for bonds of the state or companies will help to calculate future profits in advance.

I remind you that you won’t be able to buy shares on your own, for this you need to use the services of brokers, and you choose the degree of trust management at your own discretion.

Profitable investment on the Internet with minimal investment

The investment market offers different projects in terms of profitability and risk level. Some sites are open for investments from $10. When choosing projects with minimal investment, it is worth monitoring their work and your invested money. In one of my materials, I clarified what a scam is and no one is immune from it. For beginners, I recommend not to risk large sums, gradually increasing them and becoming more familiar with the principle of the platforms.

It is convenient that you can invest in rubles, dollars, cryptocurrency, and withdraw money through those payment systems that were used to replenish the deposit. Carefully study the conditions for accruing profits, the minimum thresholds for withdrawing profits and the method. By adding projects to my site, I try to give the most important information for every investor to make an informed decision. Having understood the basic principles of investment, you can choose Internet work as your main job, saving yourself from a boring and monotonous office. I propose to compare the average yield from different methods and working currencies.

Average return on popular investment instruments:

| # | Instrument name | Average return | Working currencies |

|---|---|---|---|

| 1 | Internet projects | 27-32% per month | Fiat (dollar, ruble, cryptocurrency) |

| 2 | Cryptocurrency | Depends on the type of work (exchange, projects, ISO) - up to 15% per month | Buying with fiat (mostly USD) |

| 3 | Up to 10-12% per month, payback 2-3 years | Rubles, dollars, euros | |

| 4 | Bank deposits | 7.6-8% (per year) 3-3.2%(per year) 2.7-2.9% (per year) No more than 0.1% per year |

Rubles dollars Euro Metal |

| 5 | Investments in mutual funds | Up to 8% per month, although there are more risky options up to 20-25% | Rubles |

Internet projects

Choosing this method, as a rule, no contracts are concluded if they invested in a business. Clients are attracted not so much by anonymity as by a high percentage that cannot be obtained from a bank deposit or from the work of a mutual fund. Projects have different legends and offer different investment conditions:

- by currencies;

- according to tariff plans;

- by profitability.

I strongly recommend that you objectively assess all risks and not always give preference to a project with a higher profitability. I often say in my materials that online investment makes money if you remember about diversification.

Investments in cryptocurrency

The advantages of the method - you can invest small amounts in cryptocurrency, and choose not only bitcoin or top altcoins, but also other coins. There are several ways to invest in order to make a profit:

- purchase of coins and further sale on exchanges;

- use of exchange sites;

- buying coins, and then investing them in Internet projects.

There is a way to get money without investment - work with cranes and perform small tasks. This income does not require huge efforts, but it ties you to sites in time, and what works without investments is a significant advantage. You won’t get a lot of capital, but you can still try to collect at least half of some coin from different sites. Many sites do not require registration and verification, but before you start working, you need to create a crypto wallet to transfer payments. If you are used to investing in new projects and count on long-term profit, ico is suitable, because you can get different coins from different projects, and then withdraw them for trading and earn on the difference in the exchange rate.

From April to June inclusive, 827 ICOs were held, during which $8,359,976,282 were raised. For comparison, for the entire 2017, the total amount was $6.2 billion.

Such investment activities can bring significant profit, especially to those who have chosen the project and invested in it at the very start. At the same time, I want to clarify that 55% of all ISOs ended in failure, which is also worth remembering and taking into account.

I'll start with the risks, because although there are many of them, the desire to make a profit takes over. For those who want to invest money, and not just make a profit, but use capital at a high percentage, I recommend:

- carefully approach the choice of the amount;

- use several tools at once to increase the level of diversification;

- don't invest borrowed funds;

- do not invest the latest savings.

Initially investing in such instruments, imagine that you have lost this money. With proper calculation and a positive set of circumstances, you can get good earnings and even stimulate your nerves. These rules are like if you choose a financial pyramid, which I already wrote about, but you can make a profit with it. Among the main recommendations, I would single out monitoring the state of the market, as well as the ability to listen to your inner voice, prompting you to invest in stocks or choose HYIP projects. Money loves an account, so calculate in advance when the breakeven comes and how much you can earn in a certain period. For investments, you can choose domestic companies with registration in other states or invest in MFIs - with experience in different countries.

I note that many do not want to invest, because they think that small amounts do not bring income. This is not true. Of course, interest is charged on the starting capital, but even 1000 rubles can bring profit, and sometimes even after a couple of days. If you have the time, opportunities, and most importantly the desire to learn how to invest, then you can act as your personal consultant and investor in one person, but if this is not the case, you should choose trust management of finances, with the features of which I closely acquainted readers in my material.

Summing up, I will clarify that due to the fact that the market for investment offers is constantly evolving, there is no difficulty in choosing an instrument to invest different amounts in different currencies and that they not only work, but consistently generate income. It is very important to choose investment portfolio management strategies according to the share of risk at the initial stage, as I have already written about, and besides that, over time, hone it for market changes.

Traditionally, I wish all the tools to be valid and interesting, and for maximum security, use independent reviews and monitors, such as investment world and other sites. More opinions, less risk.

“Someone can sit in the shade today just because someone planted a tree at one time.”

Warren Buffett

No matter how they say it, but investments are part of any reasonable person. In contrast to the primitive work on the system “ worked - ate“, investing money can also generate income during the holidays, even if it lasts for decades.

Trite, but true.

The question of where to invest money to make it work is relevant today more than ever, because everyone does not want to count pennies in line at the pharmacy in retirement, but to travel the world and enjoy life. But doing this on an existing pension is simply impossible.

If you think that you have now great job, a lot of money and you can spend everything, because tomorrow there will be more - this is not so. By not investing today, you are depriving yourself of the future.

After all, at some point you will not want or be able to work, which in this case will bring you income?

To begin with, we will show you the investment portfolio and its return, as an example of real investment returns for last month, and then we will consider the types of investments separately.

| PAMM account (number) | Profit Loss | % Manager |

|---|---|---|

| Konkord stable profi (415171) | 4,1% | 10-20% |

| Kalsarikannit (416226) | 9,7% | 10-25% |

| CartMan_in_da house (427015) | -1,2% | 10-50% |

| FX_KNOWHOW (450950) | 20,2% | 30-45% |

| CELINDRJOEV V.J. (451520) | 9,7% | 30% |

| Victory_ForLuck_02 (446503) | 20,1% | 40-45% |

| Profit72 (435041) | 49,3% | 15-50% |

| Hipster (452975) | 128,6% | 20-35% |

| Suc 1.0 (433298) | 15,5% | 30-50% |

| Krat.co (449044) | 33,2% | 50% |

| AlpenGold999 (452288) | 78,3% | 50% |

| Lamprechtsofen2.0 (432236) | 6,3% | 20-45% |

| Respek_t (429024) | 30,4% | 15-40% |

| Moriarti (329842) | 5,8% | 20-40% |

| SL TP V (425470) | 5,8% | 0-45% |

If you have not yet decided where to invest your money, then you can focus on this portfolio. I invest only in the most reliable PAMM accounts, and before investing money, I carefully analyze and weigh the pros and cons. Managers who satisfy the ratio of reliability / profitability become part of my investment portfolio. I systematically withdraw profits, reinvest, replenish investments and add new assets.

But here on the blog I update the portfolio once a month and it is NOT a copy of my portfolio and a reason for 100% copying, as some PAMMs do not have time to get here, being short-term or high-risk, while others are excluded before the end of the month. This portfolio contains successful PAMM accounts that, in my opinion, deserve attention.

This portfolio of PAMM accounts is a rough guide and indicator of opportunities. Here are collected PAMM accounts according to the criteria of stable profitability over the course of the year, in which they invest a large number of investors.

You can also add more aggressive PAMM accounts, exclude unprofitable ones in time and add new profitable managers.

Investing money in the stock market

In this article, we will talk about where to invest money with the greatest benefit.

Investing in stocks is the classic way to invest. The average yield here can be from 10 to 20% per year, but it can be much higher.

What are stocks on the stock exchange? This, in fact, is the foundation on which the world rests, because each of us in the bathroom has funds from Nivea, Johnson & Johnson, Gillette…, everyone has phones Apple, Samsung, Lenovo… there are computers in the rooms Acer, Asus, HP, on operating systems Windows; shop furniture IKEA and clothes in the wardrobe from Versace, Lacoste, Polo Ralph Lauren Corporation.

All we want to say is that we are all consumers of the products of private companies.

If you are looking for where to invest money, then stocks are a great way to earn not only on the products of companies themselves, but also to secure a constant substantial income. This is an interesting process that will teach you how to think like an investor, understand different markets, compare prices and choose the best.

If you are looking for where to invest money, then stocks are a great way to earn not only on the products of companies themselves, but also to secure a constant substantial income. This is an interesting process that will teach you how to think like an investor, understand different markets, compare prices and choose the best.

How to invest in shares?

Everything is very simple, shares are traded on stock exchanges, and they are sold through special intermediaries - brokers. You do not need to travel somewhere, stand in lines, run around with documents... You can buy shares without getting out of bed. Register, replenish the deposit and buy shares.

- It is worth noting that well-known and already successful companies will not always be the best idea.

After all, it's not just about the name, but also about the profit. For example, capitalization Google about 500 billion dollars. Imagine What do companies need to do to double their growth?

And now let's take a small chain of clothing stores or restaurants, in order for their shares to grow by 2-3 times, it is enough to expand the sales market, open several new points of sale, and this is quite realistic to do within a year.

That is why some new startups and companies can bring not 20% per annum, but more than 1000%.

For the sake of completeness, we decided to show our example of earning on stocks.

We went to the website of a broker with whom we have been working for many years -. In assets, we selected Ferrari shares and clicked on the button BUY:

A few days later, the share price went up, as did our profit:

To make a profit on your personal account, you need to sell shares, that is, close our deal:

The results of the transaction can be viewed on the same page trading platform tab Deals:

Watch a video about investing in stocks from Robert Kiyosaki:

Investment benefits. Investing in stocks has been around for over 150 years. Every third American and every second Japanese owns shares in a company. And as you know, the pensioners of these countries are quite satisfied with their lives. Dividends and profits from owning shares can be received throughout life. Buying and selling does not take more than 10 minutes. You can start already from 200 dollars.

Minuses. Investing in shares carries the risk that the company may depreciate. But for this, it is carried out, an investment portfolio is compiled. In this case, even if one company loses positions, the remaining companies in the portfolio will provide the investor with a positive return.

Real estate

Real estate - the traditional way where can you invest money. It is difficult to say something new on this topic. We have included real estate in the list where you can invest for obvious reasons. Real estate is a valuable asset for any person. Real estate can be rented out, whether it is an apartment, an office, a garage or a shopping center. Real estate, albeit not immediately, but rises in price, especially if it is purchased in a new area, where in 10 years there will be a fully populated and active center.

Real estate - the traditional way where can you invest money. It is difficult to say something new on this topic. We have included real estate in the list where you can invest for obvious reasons. Real estate is a valuable asset for any person. Real estate can be rented out, whether it is an apartment, an office, a garage or a shopping center. Real estate, albeit not immediately, but rises in price, especially if it is purchased in a new area, where in 10 years there will be a fully populated and active center.

Although, of course, in today's realities, even for the next decade, the purchase of real estate in 99% of cases can hardly be called an investment. After all, the maximum that the majority receives - it is the safety of funds.

Advantages of investment. Safe investment with minimal risk. With a skillful approach, you can extract a monthly profit before the final sale.

Minuses. These are slow investments that in most cases turn out to be just saving money and do not increase the capital of the investor, but, on the contrary, freeze it.

Startups

Startups are young innovative companies. Many people call themselves a startup not by offering something radically new, but by presenting a new version of “ old“. In reality, a startup is a company with a product that did not exist before.  The same Google or once were startups, offering the world something that did not exist before. In two decades, those who invested in well-known start-ups at the beginning became millionaires.

The same Google or once were startups, offering the world something that did not exist before. In two decades, those who invested in well-known start-ups at the beginning became millionaires.

Today, new companies are born in the world that have a chance for rapid growth.

How to invest in a startup?

Most profitable way is to wait for a confirming moment that the company is successful, really has a demand and will develop. We're talking about.

In the early days of an IPO, company stocks can rise by more than 100%.

And you don't need to hold the stock any further, on the contrary, after the first days IPO shares need to be sold fixing profits, since more than 70% of companies do not withstand further expectations of investors and the market, and fall in price to a reasonable level, and in the following years they do not grow at all, of course, we are not talking about all of them without exception.

- Startups are an interesting way to make money on investments, because the growth of a company can be huge in a short time.

You can inquire about new startups, upcoming IPOs, analyze companies and invest in the best of them. One successful investment can pay back the losses of 10 unsuccessful ones many times over. It is these rapid rises that make this niche very profitable for investors.

Startup benefits. If there is income, then it will be high. You can invest both at the source and later on the company's IPO.

Minuses. You need to soberly assess whether the market is ready for the company's product and look at the numbers, not the presentation.

Binary Options

Binary options cannot be called an investment in the classical sense of the word, but still this is the most profitable investment money today. so simple that they have only 2 conditions - UP and WAY DOWN hence the name - binary. The bottom line is that you choose an asset ( the same stocks, oil, gold, stock indices…) and specify the condition - will the price of the asset rise or fall.

- The term of the transaction determines the scope, for example, you have invested in a stock option with the condition that the quote rises for 15 minutes. If after 15 minutes the shares rise in price relative to the rate at the time of buying the option, you will receive a predetermined fixed profit in 70-80%! Moreover, it doesn’t matter how much the asset grows, only the condition is important - Higher, that is, growth can be at least 1 point.

Thus, you can earn not only on the growth but also on the fall of the price, using the DOWN option condition.

Among the assets of binary options, the most liquid stocks and stock indices, commodities and currencies. And this is very convenient, because according to these assets, news is released daily, which allow you to earn.

For example, tomorrow the new iPhone goes on sale - this is a clear sign that tomorrow Apple stock will rise. Buy an UP option on Apple stock and earn a guaranteed profit.

The interesting thing is that you can invest in binary options for a period of time. from a minute to a month, while the amount of profit remains unchanged - within 70-80%, depending on the asset. Instead of a lot of words, we will show you how it works on the example of a broker:

1. Choose an asset. In our case, the choice fell on stocks Google:

Specify the term of the transaction, that is, the time of its completion:

At the moment, Google stock quotes are rising, while the price has touched the lower support line. We predict growth - enter the amount of investment and click UP:

We opened a deal for 10 minutes. At the appointed time, the option was automatically closed and the broker showed the results of the transaction:

At the time of purchase of the option, the stock price was 779.205 . In the conditions, we indicated that at the time of closing the option, the price will be higher. According to the results, she was listed at the mark 780.260 . Having invested $60, we returned $102, of which $42 was net profit:

Our growth condition was fulfilled and we got 70% profit!

Advantages of investment. 70% profit in 10-20 minutes is an indisputable plus. The ease and simplicity of the process makes this type of investment the most accessible.

Minuses. For successful investments, it is necessary to analyze the asset, use strategies, and other tools, not every person is able to correctly understand the market.

PAMM accounts

We continue the review the best options, where everyone can profitably invest money, and one of these options are. The creator of this opportunity was the largest foreign exchange market a broker in Russia - which is regulated by the Central Bank of the Russian Federation and has a license from it to carry out operations in the financial market.

A PAMM account is a trader's account that investors can invest in.

Thus, a trader trades on the stock exchange not only with his own funds, but also with the funds of investors. PAMM account manager gives from 50 to 90% profit to its investors. An unlimited number of people can invest in a PAMM account, and the profit is divided in proportion to the deposits. For example, a PAMM account managed by more than 4 million dollars:

The broker provides full monitoring of the PAMM account, which reflects profit by day, week, month, transaction volumes, investment volumes and other data. Among many successful PAMM accounts, there are managers with more than three years of experience, that is, PAMM accounts have been generating profits for many years, and in general, this is not a novelty today.

In any case, PAMM accounts continue to bring good profits, the average profitability of an investor who has a portfolio of 10-15 managers from 50 to 100% per annum.

If you reinvest the profits, you can earn more 810% in just 3 years:

Benefits of investing. This type of investment has already proven itself with time and profitability. Amounts for investment are affordable for the majority of the population. You can withdraw money instantly at any time.

Minuses. There are practically no downsides to portfolio investment. It can be called a minus that some investors invest in non-professional managers with unstable trading.

Bank deposits

A bank deposit should be considered not so much an investment as a way of storing money, allowing you to more or less protect them from inflation. Profit up to 10% per annum can hardly be called serious. Nevertheless, this option is still very popular among the population, even though banking system The country is going through hard times today.

A bank deposit should be considered not so much an investment as a way of storing money, allowing you to more or less protect them from inflation. Profit up to 10% per annum can hardly be called serious. Nevertheless, this option is still very popular among the population, even though banking system The country is going through hard times today.

Traditionally, investors have the greatest confidence in Sberbank, VTB, Gazprombank. They offer to place deposits under not the most high interest (from 7 to 8%), but stand out favorably in terms of reliability. We do not recommend participating in long-term programs, even if they offer more profitable terms. The current situation in the sector is such that it is better to limit ourselves to "titmouse in hand". In any case, placing money in a bank is just a way to store it. If you are interested in investing, you should look for other offers.

“How many millionaires do you know who got rich by investing in bank deposits? That's the same."

Robert J. Allen

It's different if you invest through investment banks like Goldman Sachs. It is worth saying that investments there also do not bring a huge percentage, it can be the same 8-10% per annum and some risks.

Why is this being done?

It's all about the amounts. If you have $20 million, you won't put all your money in one Sberbank account, right? We all know about instability and the rules of diversification. Besides, Goldman Sachs, Barclays and similar ones can offer favorable conditions for the investor, professional portfolio management, etc.

Benefits of deposits Reliable and virtually risk-free.

Minuses. Low Interest, you can withdraw money under the terms of some deposits only after 1-3 years.

ETFs

If you are looking for the best place to invest in stock market, you should probably be interested in such an option as exchange-traded investment funds (). They represent a portfolio of assets, basically, as closely as possible repeating some stock index, for example, or. Thus, by purchasing one ETF share, you immediately receive a diversified portfolio formed by real professionals.

If you are looking for the best place to invest in stock market, you should probably be interested in such an option as exchange-traded investment funds (). They represent a portfolio of assets, basically, as closely as possible repeating some stock index, for example, or. Thus, by purchasing one ETF share, you immediately receive a diversified portfolio formed by real professionals.

In fact, ETFs are the same mutual funds - you get a share in the portfolio (in an ETF it is a share, in a mutual fund it is shares), but there are a number of differences.

- As in a conventional mutual fund, it is professionally managed by a management company.

- If in mutual fund the amount of the minimum investment is set by the management company or the sales agent, then in ETFs it is equal to the price of one share.

- Also, you cannot sell shares from a mutual fund at any second, unlike shares on the stock exchange.

- Mutual investment funds themselves can have ETF shares in their assets, only in this case they take their percentage for this.

In short, ETFs have created a sensation in the stock market, being full-fledged portfolios.

An important advantage of exchange-traded funds is the ability to trade throughout the day. During this time, the price of ETF shares may change, while the size of a mutual fund share is calculated only once per session. Units cannot be purchased with borrowed or borrowed funds. For ETF shares, this is acceptable. Additional commissions may be charged when trading units of mutual funds. Working with stocks investment funds exempted from such "requisitions".

Where to find ETF shares? In the same place where all the shares are - on the stock exchange. Actually, the process of buying Google shares from ETF shares is no different. This process we have described not much above, where there is also a list of the best brokers.

Advantages of investment. Ready-made investment portfolios of shares. There are thousands of ETFs with different portfolios. Reliable long-term investment.

Minuses. It is necessary to monitor the industry in order to sell in time if a decline begins, and as a rule, if there is a decline somewhere, then there is growth somewhere, that is, you can sell some ETFs and immediately buy others.

Art

If there is a desire not only to earn money, but also to get aesthetic pleasure from the process, we recommend that you think about purchasing art objects. Suffice it to say that the main buyers of such things are not passionate collectors and wealthy connoisseurs, namely players financial market

. You don't have to be an expert at all. You can always use the services of competent consultants.

If there is a desire not only to earn money, but also to get aesthetic pleasure from the process, we recommend that you think about purchasing art objects. Suffice it to say that the main buyers of such things are not passionate collectors and wealthy connoisseurs, namely players financial market

. You don't have to be an expert at all. You can always use the services of competent consultants.

Paintings are by far the most common commodity. On average, the creation of a popular contemporary artist today will cost from $ 5,000. Over the years, the cost of a masterpiece can increase hundreds of times.

For example, Andy Warhol's Lemon Marilyn was purchased in 1962 for $250. After 45 years, it was sold for $28 million. 250,000% per annum.

It makes sense to acquire the works of masters of the second half of the last century - now it is them" time. Naturally, it is not worth counting on a quick return on such investments. In any case, you will become the owner of a valuable work of art, that is, a fairly reliable asset.

According to the statistics of gallery catalogs, even three-year-old paintings are already becoming more expensive by an average of 40-60%, as you understand, there are paintings among them with a growth of 1000%. As the auction houses explain, the increase in the cost of paintings is directly related to the activity of the artist. If he regularly exhibits at exhibitions, receives new awards, then with each such step his paintings can rise in price. by 100%.

Investment benefits. Very rich and developed personalities are engaged in investments in art. In addition, they can bring large percentages, especially if the artist is gaining popularity or even died.

Minuses. A long-term investment that requires the advice of an art expert. It is advantageous to collect collections of paintings by one or more artists, which can be costly.

Investment in trading

Trading is an investment in yourself.

Now many people will think that trading is money from speculation in the stock market, profit from the amounts invested in exchange assets ... But first of all, trading is profitable investment into yourself.

Many people say that investing in yourself is profitable. How? Specifically in numbers? Invest in education and get a job? It's a life, not an investment.

Unlike other jobs associated with preliminary training, trading provides unlimited opportunities where it is not necessary to have an economic education. The thing is, trading starts with personal preparation. You must be prepared psychologically, and everything else - matter of technology.

Unlike other jobs associated with preliminary training, trading provides unlimited opportunities where it is not necessary to have an economic education. The thing is, trading starts with personal preparation. You must be prepared psychologically, and everything else - matter of technology.

- Today there is no difference between a financial analyst and an Internet user, since all information is stored and presented only on the Internet. It equalizes almost everyone!

In order to start trading, you need to read at least about it, draw up a plan of action, financial plan and start collecting information about the market and assets. Of course, not everything is so simple, but this is already the beginning. There are many examples when people earned millions in a couple of years and went on an indefinite vacation without worrying about anything.

Can a lawyer with three years of experience, or a doctor, or a manager boast of such success?

For example, the broker allows you to trade stocks, indices, commodity futures like oil, gas, metals, agricultural products, energy and others:

Why have we come to view trading as an opportunity to invest money? Because it is profitable, it is available to everyone, it is interesting and right here money is born. All banks are trading on stock exchanges, trade currencies, bonds and so on. So why invest in banks when you can earn money through the banking system yourself?

The benefits of trading. Unlimited opportunities to work for yourself, without a schedule and in comfortable conditions. Due to the vast amount of information about the markets, it is not necessary to have a financial education or special connections.

Minuses. Successful trading requires mental preparation, a sufficient deposit to survive losses and overcome risks.

Individual investment account

Since 2015, a new concept has appeared in the legislation of the Russian Federation - individual investment account. By placing funds on such an account, you receive a guaranteed tax deduction 13% from the invested amount ( annually) or are exempt from tax on income received as a result of financial transactions.

Consider the benefits of placing money in an individual investment account:

Consider the benefits of placing money in an individual investment account:

- To open here, it is enough to deposit everything 5 000 rubles.

- The maximum amount to be deducted is 400 000 rubles.

You can only top up your account in cash. The broker offers four investment options.

- If you just want to receive passive income, choose a savings strategy and you will be charged 5.5% per annum. Don't forget about the guaranteed 13% tax deduction.

- Under the conservative option, the investor's funds will be invested in reliable, low-risk fixed-income instruments. This may additionally bring up to 15% per year. Such activity is recommended if the account has more than 100,000 rubles.

- The optimal strategy can generate income up to 30% per annum, however, the risks increase significantly. It is worth using it if you have more than 250,000 rubles.

- The most risky is an aggressive strategy that can bring up to 50%