Extension of the mortgage program. Assistance program for mortgage borrowers from the state. What a Borrower Should Not Expect

In 2015, the state assistance program was launched mortgage borrowers in order to help people fulfill their loan obligations, for whom they have really become unbearable.

The program began to operate in 2016, was suspended, then renewed again. During this time, 18,887 families received assistance. Decree of the Government of the Russian Federation of August 11, 2017 N 961 decided to resume the program, the deadline is not specified in the document.

State support is provided through the Ministry of Construction of the Russian Federation through AHML. To this end, the Agency for Housing Mortgage Lending JSC allocated funds in the amount of 2 billion rubles to compensate for losses to creditors on mortgage loans. housing loans.

AHML is a state organization with 100% state capital. It was created to support banks that provide long-term loans for the purchase of housing by citizens.

How are AHML, the bank that issued the "problem" mortgage, and the borrower related to each other. Omitting the terms, we get the following algorithm:

- The bank issues a loan to the borrower from its own funds;

- To restore its stock receives money from AHML;

- The agency buys the right to the issued loan from the bank, leaving it with the functions of an operator in settlements with the debtor. The bank raises the interest on the loan a little and earns on the difference in the rate.

The 2018 sample program has been heavily modified to take into account economic situation, lowering mortgage rates and the appearance of banks' own programs of assistance (refinancing and restructuring) of bad debts. Support has become more personalized.

One thing remains unchanged: the program does not provide for payment for the borrower of his debt, but only helps to reduce the monthly financial burden to a feasible level.

Only four categories of citizens receive the right to receive state support:

- Parents, adoptive parents / guardians / guardians of a minor child (one or more).

- Persons who are dependents of citizens under the age of 24 who are studying full-time in a secondary or higher educational institution.

- Disabled people or citizens with disabled children.

- Combat veterans.

- In rare cases, a revision of the terms of the contract is provided for other citizens at the request of executive authorities, deputies of the State Duma, the commissioner for human rights.

New: Reducing the interest on the mortgage taken to 6% for families where 2nd and 3rd children are born, from January 1, 2018 to December 31, 2022. Program "Family Mortgage with State Support". AHML has already allocated money for this.

requirements for your financial condition (both conditions are required):

- Three months before the date of application for assistance, the average family income per month must be less than or equal to two times the regional cost of living.

- The minimum mortgage payment has increased by 30% or more compared to the amount of the monthly payment determined at the time of the conclusion loan agreement.

In fact, this is a condition that only those who have taken currency mortgage, since the ruble amounts of the contract are fixed and cannot grow by 30%. And with the galloping dollar and euro, this is possible.

Mortgage Housing Area Limits for Assistance Purposes:

- 1-room apartment - 45 m2;

- 2-room apartment - 65 m2;

- 3-room apartment and other multi-room housing - 85 m2.

If the mortgaged housing is larger, the bank will simply advise you to sell it and buy a smaller apartment.

Price 1 sq.m. mortgage housing should not exceed 60% of the market price of 1 sq.m. typical housing on the market (for calculation, current data on the regional market are taken).

Last condition still narrows the circle of applicants for help. Market prices per square meter are subject to change. And if the apartment has fallen in price, then support will be denied. But space restrictions do not apply to families with three or more children.

Additional terms:

- 1. The borrower is a citizen of the Russian Federation;

- Mortgage issued at least a year ago;

- Mortgage housing is located on the territory of the Russian Federation and should be the only one for the borrower (it is possible to have one more housing, but on condition that the joint share of the mortgagor and members of his family does not exceed 50% of this property).

To get help, you need to contact the bank where the mortgage is issued. The bank must be included in the AHML list.

latest news: AHML renamed to Dom.RF JSC.

- Replacing a foreign currency loan with a ruble one. The new rate on the loan should not be higher than on the current mortgage loans offered to banks at the time of the renewal of the agreement, and not higher than 11.5%.

- Reduction of liabilities to the credit institution. The bank can reduce the loan debt by 30% of the loan balance, but not more than 1.5 million rubles. The amount of compensation is the decision of the financial institution.

Amount of payments under the program mortgage assistance it is possible (but difficult!) to double it by submitting an application to a special interdepartmental commission. The same commission will also consider your complaint if the bank refuses to provide assistance or when it is issued under 2 points of the conditions from the list of mandatory ones.

During the restructuring period, the lender cannot demand a commission or other additional payments from the borrower.

All actions related to restructuring are carried out at the expense of the state.

Scroll required documents, which must be collected before going to the bank:

- Passport of a citizen of the Russian Federation;

- completed application form; (you can fill in the form found on the bank's website);

- loan agreement;

- birth certificate of children (minors);

- combat veteran's certificate;

- documents on solvency for the last three months;

- work book (original for the unemployed and a copy for the employed);

- certificate stating that the child is a full-time student;

- the decision of the guardianship authorities and the court order (for guardians and adoptive parents of minors);

- certificate of state registration real estate object;

- certificate of medical and social expertise (for disabled people and in the presence of a disabled child);

- a valid insurance policy and a receipt for payment of the insurance premium.

You can clarify the entire list of documents at the bank or on the bank's website in the appropriate section.

What if you are not eligible for the program but need help?

We repeat that in practice only borrowers who have issued a mortgage in foreign currency can count on receiving assistance from the state. For the rest, a high percentage of failures.

And what about other borrowers who also found themselves in a difficult situation?

Banks offer their own options for restructuring / refinancing, mortgage loans without the participation of AHML.

According to Dom.RF forecasts, average mortgage rates will be about 8% by the end of 2018, and the rate of 7% is “a one-two-year perspective”.

In Russia, there is a social mortgage for poor people. This is a whole range of activities designed for people who are unable to get a loan under normal conditions. Mortgage with state support, for all its merits, involves a number of severe restrictions.

Let's consider what programs are operating in 2019-2020, what are their main nuances.

Forms of state subsidies

Mortgage programs with state support (social) allow people with low incomes to borrow from the bank a large amount needed to purchase a home.

Part of the costs is covered by the state.

There are several forms of social subsidies:

- Lending with a decrease interest rate through the budget.

- Issuance of state support for part of the cost of the apartment.

- Providing subsidies for the purchase of housing from social fund in installments.

Each of these types of assistance has its own subtleties and nuances. In addition, the country has several programs aimed at different groups of the population. For example, young families, the military, state employees and some others are separately credited.

You can only receive state support for one program. This does not apply to the use of maternity capital.

Goals of state support for mortgages

The essence of the program is as follows:

- Creation of conditions for the growth of well-being of the poor and other vulnerable categories of citizens.

- Activation of the real estate market, banking sector.

- Stimulating the construction of a well-maintained social housing(investment).

Five profitable programs

Mortgages with state support have been provided for several years. In 2016, the conditions changed slightly. They remain the same for the current period. When choosing a program, you should focus on the group for which it is written.

Let's take a look at the main features of the five most popular projects.

Do you need on the subject? and our lawyers will contact you shortly.

Young family

A mortgage repayment certificate is provided to spouses who have not crossed the 35th anniversary. In addition, the family should be in line for improvement of living conditions in the local administration. Also, such a family must have sufficient income to take out a loan or cash sufficient to pay the remaining cost of housing.

A mortgage repayment certificate is provided to spouses who have not crossed the 35th anniversary. In addition, the family should be in line for improvement of living conditions in the local administration. Also, such a family must have sufficient income to take out a loan or cash sufficient to pay the remaining cost of housing.

The amount of the subsidy depends on the composition of the applicant's family. By general rule it is:

- Childless couples will be provided with an amount equal to at least 30% of the estimated cost of housing.

- For families with children - 35%.

This type of support is used for down payment on a mortgage or as an addition to the already available amount for the purchase of an apartment. Also, the subsidy can be directed to the construction of housing.

You must prove your ability to pay your share:

- income statements (of a certain level);

- a document stating that the principal amount is available (bank statement).

Military lending

Servicemen who signed the contract later than 01/01/2005 receive a certain amount on a personal account every month. Transfers come from federal budget. The amount of contributions depends on the size of the annual funded contribution and the period of participation of the serviceman in the system. You can use it, for example, to make a down payment, after three years.

Only needy defenders of the Fatherland are provided with this subsidy. Police officers are equal to the military. They are entitled to a subsidy only after 10 years of service.

Banks issue mortgages to military personnel with the condition of its repayment until the age of 45.

Assistance to young scientists and pedagogical workers

Citizens who have devoted themselves to work in the field of science and education are also entitled to a mortgage with state support.

It is designed mainly for young people. The applicant should not be more than 35 years old, for doctors of science, the age is extended to 40 years. These citizens are required to confirm that they need to improve their living conditions, in accordance with the law. They must also have at least 5 years of work experience in the relevant organization.

The certificate for state support can be used as a down payment. The calculation of the amount of social benefits is based on the size of the total living space per young scientist, equal to 33 square meters. meters, and average market value 1 sq. meters of total housing area by subject Russian Federation, on the territory of which a scientific organization is located - the place of work of a young scientist.

Social program

It can be used by any citizen of the Russian Federation who has proven the need to improve living conditions. The program is implemented in three ways:

- Acquisition of apartments from the social fund, the cost of which is 1.5 - 2.5 below the market value.

- Reducing the interest rate at the expense of the budget.

- Subsidized down payment.

The beneficiary himself is obliged to have 10% of the total amount in the bank account.

Only an officially employed citizen can take part in the social mortgage.

Maternal capital

Quite often, families with children use the funds allocated by the state after the birth of the second and subsequent children to pay off the mortgage.

Quite often, families with children use the funds allocated by the state after the birth of the second and subsequent children to pay off the mortgage.

The certificate is allowed to be made as a down payment or to repay the balance of a previously issued mortgage.

Compatible with other types of social lending at the expense of the budget.

In addition, at the birth of the third and subsequent children after 01/01/2019, the state again allocates 450,000 rubles to pay off the family's mortgage.

Also, do not forget about state mortgage subsidies up to 6% for families in which the second and subsequent children were born after 01/01/2018. The program is designed for primary housing and cooperation with largest banks countries.

General conditions of all state programs in 2019-2020

There are a number of conditions that the beneficiary and their proposed new home must meet.

- Budgetary funds can be spent both on the market of primary and secondary housing. Some programs are also designed for the construction of a new individual housing construction facility.

- Entry fee - from 20% (except for young professionals).

- Mortgage is issued only in the state currency.

- The loan term is limited to 30 years.

- Mandatory property insurance.

- Calculation of the area of future housing according to the established formula:

- 33 sq. m. per citizen;

- 42 - for two;

- for each next family member, 18 square meters are added. m.

Five profitable offers and their conditions in 2019-2020

Many financial institutions are involved in government activities. Their proposals differ in certain nuances.

Many financial institutions are involved in government activities. Their proposals differ in certain nuances.

Common to all is the following: the state mortgage program imposes restrictions on financial institutions. Cooperation with the budget does not allow including additional conditions in contracts aimed at increasing the bank's income.

Bank programs fully comply with the rules and restrictions established by government regulations regarding the choice of housing, loan terms.

Sberbank conditions

This financial institution has been providing government-supported mortgage loans for several years. The conditions for 2019-2020 are practically the same as before:

- rate from 5%;

- registration in the amount of 300 thousand rubles;

- maximum amount established by the Central Bank: up to 6 million rubles. in the Russian Federation, up to 12 million rubles. - in Moscow and St. Petersburg;

- down payment - from 20%;

- issued to citizens over 21 years of age;

- the monthly contribution should not exceed 45% of the total family income.

"VTB"

We give only conditions that differ from those already mentioned for Sberbank. VTB allows early repayment of debt. There are no additional fees for this.

This financial institution designated the initial contribution in the amount of 20%. But there are two attractive conditions:

- Minimum documents for registration: passport and official data on income.

- The co-borrower program allows you to bring in relatives.

Rosselkhozbank

The rate has been reduced here. It is only 4.7%. From the first month you can pay the entire amount, penalties and fines are not provided.

The rate has been reduced here. It is only 4.7%. From the first month you can pay the entire amount, penalties and fines are not provided.

The age of the mortgage borrower does not depend on gender. The main condition is that the person must return the entire amount to the bank before the 65th anniversary. However, the bank takes up to 90 days to decide on the approval of the application.

If the client refuses insurance, the rate automatically increases (becomes normal).

"New building"

A project financed from two sources: the budget and citizens' incomes. It is aimed at people with low wages. Granted the right to cover debts:

- maternal money;

- tax deduction.

What is a tax deduction

Each taxpayer can apply to tax authority so that he would be returned part of the amount spent on the purchase of housing and a mortgage. The budget receives some of the money from wages citizens - tax. The Federal Tax Service will return 13% of the amount of purchased housing and interest paid under the mortgage loan to you.

According to the legislation, the amount of purchased housing is limited to 2 million rubles. That is, 260 thousand rubles can be returned from the main fee. (13% of 2 million). But interest payments are limited to 3 million rubles. Thus, the maximum refund amount can be 390 thousand rubles.

Interest payments are calculated as follows:

The amount of interest payments on the loan x 13% = tax refund.

If you spent, for example, 450 thousand rubles, then they will return to you:

450,000 × 13% = 58.5 thousand rubles

The operation is not automatically carried out by the state agency. You should apply to the tax office with a statement.

Additional mortgage costs

These include:

- A visit to a notary in order to draw up documents (the amount depends on the region).

- Appraisal of housing (under the contract).

- Purchase of insurance policies.

Universal algorithm for obtaining a mortgage - 5 simple steps

Lending with state support is practically no different from the usual procedure for obtaining a mortgage.

Lending with state support is practically no different from the usual procedure for obtaining a mortgage.

All actions are strictly scheduled. They look like this:

Step 1: Collection of documents

This is the most important step. Rushing is not recommended. Read the legal requirements carefully. Make photocopies of the IDs of all family members. Collect certificates of income, property, current housing. Don't forget to check the State Aid Certificate. Some banks require proof of employment. You need to ask the administration of the enterprise for a work book or a certified copy of it.

The number of securities depends on the conditions of the credit institution.

Step 2. We select a bank

Here the conditions and preferences of the borrower are important. The main data that require close consideration are given above. You should evaluate your strength when considering the rates and the percentage of the amount that you want to deposit immediately.

Step 3. What will we buy

Citizens enjoying a budget guarantee are often limited in their choice of apartments. Some programs allow you to invest only in new buildings. As a rule, their circle is limited. Banks cooperate with their developers, who, in turn, receive budget resources. In this way, the state protects its money.

The easiest way would be to talk to the bank, ask for their recommendations. Based on them, choose an apartment to your liking and means. Banks often cooperate with real estate agencies and can help in the selection of housing.

Step 4. Drawing up an agreement with the bank

When all approvals have been passed, housing has been found that satisfies the conditions put forward, you should read the loan agreement.

When all approvals have been passed, housing has been found that satisfies the conditions put forward, you should read the loan agreement.

Look carefully at the sections printed in small print.

There may be hidden future troubles in the form of consent to a fine in case of delay in payment for an hour and the like.

Ask if the agreement includes a condition for the early repayment of the mortgage. This may come in handy later.

Step 5. Registration of ownership

After the transfer of money and the signing of contracts (purchase and sale and credit), the buyer should fix his right to the property. To do this, the contract of sale must be taken to the Rosreestr branch. There it will be registered, thereby securing your right to real estate.

Until the entire debt is paid off, you will actually own the property that is pledged to credit institution. Therefore, it must be insured.

The bank's right to an apartment is legally registered as a mortgage. The mortgage is made by the credit organization, it is kept in the bank. This document guarantees the return of the invested amount to the financial institution.

A mortgaged apartment cannot be sold, donated, etc. without the consent of the bank. In the most critical cases, experts should be consulted.

Results of mortgage programs and development prospects

The effectiveness of cooperation between the budget and citizens in obtaining mortgages has been proven by the activities carried out.

The effectiveness of cooperation between the budget and citizens in obtaining mortgages has been proven by the activities carried out.

So, in 2015, an increase in the provision of residents of the country with their own meters was recorded. The indicator rose from 22 square meters. m. per person up to 24 sq. m. m. Share of families that can afford to purchase new apartment, is also growing.

In that year, it rose by 30%.

- The main positive outcome was the ability of people with low incomes to solve the housing problem.

- The loan is issued for long terms, overpayments on it differ in small sizes.

- The payment schedule is loyal.

- The interaction of people with banks is under strict state control.

Negative points

Cons, unfortunately, not all are overcome.

- Some lenders delay the application process.

- The list of required documents is still significant.

- There are cases when a credit institution is in no hurry to issue mortgage money.

At the same time, there is a growing interest in this type of cooperation among citizens. People are beginning to trust state guarantees for the purchase of housing.

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

For a prompt resolution of your problem, we recommend contacting qualified lawyers of our site.

Last changes

From April to the end of November 2018, Russians could issue soft loan for the purchase of finished wooden house from the manufacturer. The state provided the necessary subsidies to banks, covering 5% of the initial interest on the loan.

In April 2019, a law on “mortgage holidays” was signed, suggesting that borrowers who find themselves in a difficult life situation will be able to count on providing them grace period: 6 months during which these persons will be able to suspend payments on the loan or reduce their size.

The new rules apply to citizens who have lost their jobs, received disability groups 1-2 or lost their breadwinner. Such rules of law will also apply to existing credit relations.

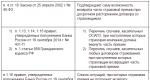

The Government of the Russian Federation decides:

1. Approve the attached changes that are being made to the basic conditions for the implementation of the assistance program for certain categories of borrowers on mortgage loans (loans) who find themselves in a difficult financial situation, approved by Decree of the Government of the Russian Federation of April 20, 2015 No. 373 "On the main conditions for the implementation of the assistance program for certain categories of borrowers on mortgage loans (loans) who find themselves in a difficult financial situation, and increase authorized capital Joint-Stock Company "Agency for Housing Mortgage Lending" (Collected Legislation of the Russian Federation, 2015, No. 17, item 2567; No. 50, item 7179; 2016, No. 50, item 7089; 2017, No. 8, item 1245).

2. To the Ministry of Construction and Housing and Communal Services of the Russian Federation:

by September 1, 2017, create an interdepartmental commission to make decisions on reimbursement to creditors (lenders) for housing mortgage loans (loans), mortgage agents operating in accordance with the Federal Law "On Mortgage securities", on mortgage housing credits (loans), the rights of claim on which are acquired by mortgage agents, and to the joint-stock company "Agency for Housing Mortgage Lending" on mortgage housing credits (loans), the rights of claim on which are acquired by this company, losses (part thereof) incurred as a result of the restructuring of mortgage housing credits (loans) in accordance with the terms of the program of assistance to certain categories of borrowers on mortgage housing credits (loans) who find themselves in a difficult financial situation, approve the regulation on the said commission, the composition and procedure for its work;

to send funds in the amount of 2 billion rubles to the joint-stock company Agency for Housing Mortgage Lending in accordance with the established procedure in accordance with the order of the Government of the Russian Federation dated July 25, 2017 No. 1579-r as a contribution to the authorized capital of the joint-stock company Agency for Housing Mortgage Lending "for the purpose of compensating for losses (their part) to creditors (lenders) on mortgage housing credits (loans), mortgage agents operating in accordance with the Federal Law "On Mortgage Securities", on mortgage housing credits (loans), the rights of claim on which purchased by mortgage agents, and to the Joint Stock Company "Agency for Housing Mortgage Lending" on mortgage housing loans (loans), the rights of claim on which were acquired by this company, in the event that these mortgage housing loans (loans) are restructured in accordance with the terms of the assistance program for certain categories of borrowers on mortgage personal loans (loans) in a difficult financial situation.

3. The Federal Agency for State Property Management shall ensure, in accordance with the established procedure, an increase in the authorized capital of the Joint-Stock Company "Agency for Housing Mortgage Lending" by 2 billion rubles by placing additional shares and carry out actions related to the acquisition of these shares and registration of the ownership of the Russian Federation on them, in accordance with a tripartite agreement between the Ministry of Construction and Housing and Communal Services of the Russian Federation, federal agency for the management of state property and the joint-stock company "Agency for Housing Mortgage Lending".

4. Recommend to the joint-stock company Agency for Housing Mortgage Lending, before increasing the authorized capital in accordance with paragraph three of clause 2 and clause 3 of this resolution, to direct its own funds in the amount of not more than 500 million rubles to reimburse creditors (lenders) on mortgage housing loans ( loans), mortgage agents operating in accordance with the Federal Law "On Mortgage Securities", on mortgage housing loans (loans), the rights of claim on which are acquired by mortgage agents, losses (part thereof) resulting from the restructuring on the terms of the program assistance to certain categories of borrowers on mortgage loans (loans) who find themselves in a difficult financial situation, and allow the funds received in accordance with paragraph three of clause 2 of this resolution to be used to reimburse the costs of the joint-stock company Agency for Housing Mortgage Lending, fuss those who during the implementation of the assistance program for certain categories of borrowers on mortgage housing loans (loans) who find themselves in a difficult financial situation, in accordance with this paragraph.

5. If the applications of borrowers for restructuring mortgage housing credits (loans) were received before the entry into force of this resolution, but were not satisfied, compensation for losses (their part) to creditors (lenders) on mortgage housing credits (loans), mortgage agents carrying out activities in accordance with the Federal Law "On Mortgage Securities", on mortgage housing loans (loans), the rights of claim on which are acquired by mortgage agents, and to the joint-stock company "Agency for Housing Mortgage Lending" on mortgage housing loans (loans), the rights of claim on which acquired by this company, can be carried out in the event of a repeated application by the borrower, subject to the basic conditions for the implementation of the program of assistance to certain categories of borrowers on mortgage housing loans (loans) in a difficult financial situation, as amended by this resolution.

APPROVED

Government Decree

Russian Federation

dated August 11, 2017 No. 961

changes,

which are included in the main conditions for the implementation of the assistance program for certain categories of borrowers on mortgage housing loans (loans) who find themselves in a difficult financial situation

The main conditions for the implementation of the assistance program for certain categories of borrowers on mortgage loans (loans) who find themselves in a difficult financial situation shall be stated as follows:

"APPROVED

Government Decree

Russian Federation

April 20, 2015 No. 373

(as amended by the decision

Government of the Russian Federation

dated August 11, 2017 No. 961)

Basic conditions

implementation of an assistance program for certain categories of borrowers on mortgage loans (loans) who find themselves in a difficult financial situation

1. The main conditions for the implementation of the program of assistance to certain categories of borrowers on mortgage loans (loans) who find themselves in a difficult financial situation (hereinafter referred to as the program) determine the conditions for restructuring mortgage loans (loans) for certain categories borrowers who find themselves in a difficult financial situation, as well as the terms of compensation to creditors (lenders) on mortgage housing credits (loans), mortgage agents operating in accordance with the Federal Law "On Mortgage Securities", on mortgage housing credits (loans), rights claims for which were acquired by mortgage agents, and to the joint-stock company "Agency for Housing Mortgage Lending" for mortgage housing credits (loans), the rights of claim for which were acquired by this company, losses (part thereof) resulting from such restructuring (hereinafter, respectively - the creditor, borrower, reimbursement, restructuring).

2. Reimbursement under the program is carried out on a one-time basis for housing mortgage loans (loans) restructured in accordance with this document, in the manner established by the Joint-Stock Company "Agency for Housing Mortgage Lending", published on its official website in the information and telecommunications network "Internet".

3. Losses (their part) of the creditor on each mortgage housing loan (loan) restructured in accordance with this document are subject to compensation in the amount by which, as a result of restructuring in the cases provided for in subparagraph "c" of paragraph 10 of this document, the amount monetary obligations the borrower under the loan agreement (loan agreement), but not more than the maximum amount of compensation established by paragraph 6, taking into account paragraph 7 of this document.

4. Reimbursement under the program is carried out within Money provided for the implementation of the program.

5. Restructuring is carried out on the basis of the decision of the creditor on the application for restructuring provided by the borrower to the creditor (hereinafter referred to as the application for restructuring).

Restructuring can be carried out by concluding an agreement by the creditor and the borrower (solid and several debtors) on changing the terms of a previously concluded loan agreement (loan agreement), entering into a new loan agreement (loan agreement) for the purpose of full repayment of debt on a restructured mortgage housing loan (loan), concluding a settlement agreement (hereinafter referred to as the restructuring agreement). The terms of the restructuring agreement must comply with the requirements established by paragraph 10 of this document.

6. The maximum amount of compensation for each restructured mortgage housing credit (loan) is 30 percent of the balance of the credit (loan) amount calculated as of the date of conclusion of the restructuring agreement, but not more than 1,500 thousand rubles, except for the cases provided for in clause 7 of this document.

7. In accordance with the decision of the interdepartmental commission for making decisions on compensation to creditors (lenders) on mortgage housing loans (loans), mortgage agents operating in accordance with the Federal Law "On Mortgage Securities", on mortgage housing loans (loans), rights of claim on which were acquired by mortgage agents, and to the joint-stock company "Agency for Housing Mortgage Lending" on mortgage housing loans (loans), the rights of claim on which were acquired by this company, losses (part thereof) resulting from the restructuring of mortgage housing loans (loans) in in accordance with the terms of the program (hereinafter - the interdepartmental commission), the maximum amount of compensation for each restructured mortgage housing loan (loan) on the basis of the relevant application of the lender to the interdepartmental commission may be increased, but not more than 2 times, in the manner prescribed by the regulation on interdepartmental commissions.

8. Unless otherwise provided herein, as of the date of submission of the application for restructuring, the following conditions must be simultaneously met:

a) the borrower (solidary debtors) is a citizen of the Russian Federation belonging to one of the following categories:

citizens who have one or more minor children or who are guardians (custodians) of one or more minor children;

citizens who are disabled or have disabled children;

citizens who are combat veterans;

citizens who are dependent on persons under the age of 24 who are students, students (cadets), graduate students, adjuncts, residents, assistant trainees, interns and full-time students;

b) change in the financial position of the borrower (solidary debtors) - the average monthly total income of the borrower's family (solidary debtors), calculated for 3 months preceding the date of filing an application for restructuring, after deducting the amount of the planned monthly payment on the loan (loan), calculated as of the date preceding date of submission of the application for restructuring, does not exceed for each family member of the borrower (solidary debtor) twice the subsistence level established in the constituent entities of the Russian Federation, in whose territory the persons whose incomes were taken into account in the calculation live. At the same time, the average monthly total income of the borrower's family (solid debtors) in billing period is equal to the sum of the average monthly incomes of the borrower (solidary debtors) and members of his family, which for the purposes of this subparagraph include the spouse (wife) of the borrower (solidary debtor) and his minor children, including those under his guardianship or guardianship, as well as the persons specified in the fifth paragraph of subparagraph "a" of this paragraph, and the amount of the planned monthly payment on the credit (loan), calculated on the date preceding the date of filing the application for restructuring, increased by at least 30 percent compared to the amount of the planned monthly payment, calculated on the date conclusion of a loan agreement (loan agreement);

c) the fulfillment of the obligations of the borrower under the loan agreement (loan agreement) is secured by a mortgage of a dwelling located on the territory of the Russian Federation, or a pledge of claims to such dwelling, arising from an agreement on participation in shared construction that meets the requirements federal law"On participation in shared construction apartment buildings and other real estate objects and on amendments to some legislative acts of the Russian Federation" (hereinafter referred to as the agreement on participation in shared construction);

d) the total area of residential premises, including residential premises, the right of claim to which arises from an agreement on participation in shared construction, the mortgage of which is a security for the fulfillment of the obligations of the borrower under a loan agreement (loan agreement), does not exceed 45 sq. meters - for a room with 1 living room, 65 sq. meters - for a room with 2 living rooms, 85 sq. meters - for a room with 3 or more living rooms;

e) residential premises, including residential premises, the right of claim to which arises from an agreement on participation in shared construction, the mortgage of which is a security for the fulfillment of the obligations of the borrower under a loan agreement (loan agreement), is (will be) the only housing of the mortgagor. At the same time, in the period starting from the date of entry into force of Decree of the Government of the Russian Federation dated April 20, 2015 No. 373 "On the main conditions for the implementation of the program of assistance to certain categories of borrowers on mortgage loans (loans) who find themselves in a difficult financial situation, and an increase in the charter capital of the joint-stock company "Agency for Mortgage housing loans"by the date the borrower submits an application for restructuring, it is allowed to have an aggregate share of the pledgor and members of his family in the right of ownership of no more than 1 other residential premises in the amount of not more than 50 percent. For the purposes of this subparagraph, the family members of the pledgor include the spouse of the pledgor and his minor children, including those under his guardianship or guardianship Compliance with these conditions is confirmed by the application of the borrower in a simple written form. state register real estate is not required. Joint Stock Company "Agency for Housing Mortgage Lending" checks the information provided in accordance with this subparagraph by the borrower;

f) the loan agreement (loan agreement) was concluded at least 12 months prior to the date of filing by the borrower of the application for restructuring, except for cases where the mortgage loan (loan) was granted for the purpose of full repayment of debt on a mortgage housing loan (loan) provided at least than 12 months prior to the date of the borrower's application for restructuring.

9. In case of non-compliance with no more than two conditions provided for in paragraph 8 of this document, the payment of compensation under the program is allowed in accordance with the decision of the interdepartmental commission in the manner prescribed by the regulation on the interdepartmental commission.

10. The restructuring agreement must simultaneously provide for the following conditions:

a) change in the currency of the credit (loan) from foreign exchange into Russian rubles at an exchange rate not exceeding the exchange rate of the corresponding currency established central bank Russian Federation as of the date of conclusion of the restructuring agreement (for credits (loans) denominated in foreign currency);

b) setting the lending rate not higher than 11.5 percent per annum (for credits (loans) denominated in foreign currency) or not higher than the rate in force on the date of conclusion of the restructuring agreement (for credits (loans) denominated in Russian rubles);

c) reduction of monetary obligations of the borrower (solidary debtors) in the amount not less than the maximum amount of compensation established by paragraph 6, subject to paragraph 7 of this document, due to a one-time forgiveness of a part of the loan (loan) amount and (or) change of the credit (loan) currency from a foreign currencies into Russian rubles at a rate lower than the rate of the corresponding currency established by the Central Bank of the Russian Federation as of the date of conclusion of the restructuring agreement (for credits (loans) denominated in foreign currency);

d) exemption of the borrower (solidary debtors) from payment of the penalty accrued under the terms of the loan agreement (loan agreement), with the exception of the penalty actually paid by the borrower (solidary debtors) and (or) collected on the basis of a court decision that has entered into legal force.

11. When concluding a restructuring agreement, it is not allowed to shorten the terms of mortgage housing credits (loans) and (or) charge a commission from the borrower (solidary debtors) by the creditor for actions related to restructuring.

12. All settlements under the program are made in Russian rubles at the rate of the relevant currency established by the Central Bank of the Russian Federation as of the date of conclusion of the restructuring agreement (for credits (loans) denominated in foreign currency).".

Document overview

The main conditions for the implementation of the program of assistance to certain categories of borrowers on mortgage housing loans (loans) who find themselves in a difficult financial situation have been clarified. The changes will make it possible to continue the program and restructure at least 1.3 thousand credits (loans).

The Ministry of Construction of Russia provides for the creation of an interdepartmental commission that will be able to make decisions, including on increasing the amount of compensation to borrowers.

In addition, the Ministry was instructed to send 2 billion rubles to the Agency for Housing Mortgage Lending. for the purpose of the program.

The exchange rate of the ruble is constantly changing. In this regard, some categories of people may suffer. Often this applies to borrowers who have foreign currency loans. Some of them are at risk of becoming bankrupt.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and IS FREE!

To prevent negative consequences some measures have been taken at the legislative level. They are associated with the support of mortgage borrowers who find themselves in a difficult situation. For them, a Government Decree was issued in 2015.

In March 2017, the program ceased to exist ahead of schedule. This was due to the fact that the funds allocated for assistance were spent.

In August of the same year, the Government of the Russian Federation issued a new decree. As part of it, an additional two billion rubles were allocated.

From that moment on, the House of the Russian Federation borrower assistance program has been successfully functioning. However, the conditions for its implementation in 2019 have undergone changes.

What it is

The state program is intended to provide assistance to citizens who are faced with mortgage problems. It is implemented for certain categories of persons with loans.

It is important that applicants justify a sudden financial hardship.

Assistance is provided for several categories of borrowers.

These include:

- citizens whose families have one or more children under the age of 18;

- persons participating in hostilities and having received the status;

- or mothers/fathers of children with disabilities;

- citizens who have, when studying full-time in an educational institution of the latter.

This support is working. Therefore, assistance within the framework of it was allocated to more than 18 thousand families in the Russian Federation. Their mortgages have been restructured.

To get help you need:

- visit the bank where the mortgage loan was issued;

- find out if there is a possibility of restructuring the loan;

- study the conditions of participation in the program;

- transfer the full package of documents to the creditor;

- wait until a decision is made on the possibility of participation in the program.

How the program works

The rate on mortgages taken in foreign currency after restructuring is up to 11.5%. If we are talking about a ruble loan, then it will not exceed the key value at the time of the procedure.

It is up to the borrower to choose the appropriate option for assistance from the state. If we are talking about a foreign currency mortgage, then he can convert it into rubles. In this case, the lower exchange rate is taken into account.

You need to focus on the level set by the Central Bank of the Russian Federation on the date of application for restructuring.

The second option is debt relief. It will not be possible to completely eliminate it. However, it is possible to refuse any part if the payment to the credit institution is made.

No fees are charged during the procedure. The final decision is made by the lending institution itself. She has the right to refuse or agree to restructuring. If the bank agrees to satisfy the application, the final decision is made by AHML.

Application form for a mortgage loan:

How much can you expect

You can repay the loan up to 30% of the loan amount. You need to focus on the indicators available at the time of the conclusion of the restructuring agreement. In this case, the final payment cannot exceed 1.5 million rubles.

The creditor may apply to the interdepartmental commission with a relevant application. On its basis, a larger compensation is possible.

It is issued:

- mortgage lenders;

- mortgage agents;

- joint-stock company AHML.

Part covered incurred by the organization expenses. The amount can be increased no more than twice. The procedure for reimbursement is prescribed in the Regulations on the Interdepartmental Commission.

Photo: child's birth certificate

Validity

The new version of the law does not prescribe the final date until which it is possible to submit applications for restructuring. However, it is not worth delaying the appeal.

Legislators note that the termination of the program is provided after the allocated funds are spent.

The amount is two billion rubles. It is important to have time to apply to a credit institution as soon as possible so that the money is allocated for this mortgage loan.

How to get help

To get help, you need to contact the credit institution that issued the mortgage loan. In it you can find out the list of documents that are required to provide for the restructuring.

Also, experts will tell you what is the procedure for concluding an agreement to reduce the amount of the payment or terminate the payment of part of the loan.

To find out full list documents are required in advance. This is due to the fact that a separate list may be provided for each person.

It is also reflected on the bank's website. If the citizen does not have any documents, then the credit institution will ask you to take them additionally.

What criteria should be met

There are several conditions that must be met in order to receive state financial support:

- Only eligible to apply individuals who are dependent minor child or disabled. In addition, the list of categories includes combat veterans, disabled people of any group. It is important to confirm that during this period of time they are in a difficult situation. financial position.

- Documents on the material condition are provided for the last three months.

- Persons whose aggregate income is more than the minimum wage cannot participate in the program. In this case, the value should not exceed a double value. If the amount is higher, the applicants will be denied restructuring.

- Specialists of a credit institution are guided by the date of execution of the contract. It must have been signed more than a year ago at the time of application.

- The fact in which the mortgage loan is issued is not taken into account.

- The borrower needs to collect a list of documents requested by the bank.

If a person does not meet the requirements, he will be denied consideration of the application.

Requirements for the subject of mortgage

Requirements are imposed not only on the client applying to the bank.

Separate conditions are observed in relation to real estate attracted as collateral:

- Housing should be the only place for the borrower and his family members to live. It is also assumed that real estate is expressed in proportion. At the same time, a person should have no more than 50% of property rights.

- The object must be located on the territory of Russia. It is used as collateral for a mortgage.

- Any property can be used as an object. Housing is also allowed, which is divided into parts under an equity agreement.

- The law sets limits on the area that real estate has. For one-room apartments, it is 45 square meters. m, for two-room apartments - 65 sq. m. If there are three rooms, the limit value is determined at the level of 85 sq.m.

- price of one square meter housing cannot be lower than the cost of a similar area in any property in the primary market. Also, the amount should not exceed more than 60% of the cost per square meter of the secondary market.

- These restrictions do not apply to families with three or more children.

If the object meets the established requirements, then the person can take part in state program. You need to be careful when contacting AHML and a credit institution, as the latter may refuse to restructure.

Documentation

To prove that the borrower is eligible to participate in the program, he needs to collect a certain package of documents.

They confirm his financial condition:

- A person draws up an application, the form of which is provided by a credit institution. The form can be issued by the manager directly at the branch.

- It is required to have documents confirming the possibility of receiving support due to family circumstances. These are birth certificates of children, certificates certifying the presence of a disability.

- Financial status can be confirmed by a certificate from the employer, a copy work book. If a person does not work, you need to have an act of registration as an unemployed person. Papers on earnings issued by the Federal Tax Service, the Pension Fund of the Russian Federation, the department social protection. You may also need other papers that show the level of profit at the time of the loan, as well as at the date of the proposed restructuring. You need to testify that profits have decreased by 30 percent or more.

- Loan papers attached collateral real estate. These are a copy of the loan agreement, a certificate from the bank, a payment schedule and an appraisal report drawn up at the time of receiving the loan.

- Extracts from the state register for real estate and other documents for the apartment must be available. It is shown that the person has no other real estate in the property. Statements remain valid for three months.

- A copy of the agreement on participation in shared construction is required.

- After drawing up the application, a new payment schedule is determined. The basis for its registration is an updated loan agreement.

Where to go

Taking into account the current difficult economic situation, the Government of the Russian Federation approved assistance to mortgage holders from the state: 600 thousand rubles could be received by borrowers who found themselves in a difficult financial situation. Read more about the conditions for receiving compensation.

In 2017, for certain categories of borrowers, material assistance is provided in an even larger amount. It is necessary to focus on the fact that not everyone can get it.

State support for mortgage borrowers

The Government of the Russian Federation approved special program assistance to borrowers who have taken out a loan for housing. It lies in the fact that people who paid a mortgage to the bank will be able to receive an amount of up to 600 thousand rubles, as well as restructuring of foreign currency mortgages at the rate Central Bank. The duration of the program was set from 2015 to May 31, 2017 inclusive. But life made its own adjustments, and already on March 7, the program was closed ahead of schedule due to a budget deficit (all the funds that were originally pledged were spent). By the way, borrowers who managed to apply required package documents before March 7, 2017, may well count on receiving assistance under this program.

Return of 600 thousand on a mortgage in 2017 - who is entitled to the assistance in question?

Naturally, many now want to get a very decent amount to pay off the mortgage, but not everyone is entitled to it. So, the following categories of borrowers can count on the right to receive funds from the state in the prescribed amount for mortgage repayment:

- Persons raising one or more children under the age of eighteen (or who are their guardians);

- This service can be used by those citizens who are raising a disabled child, regardless of the disability group (by the way, this amendment was made in the previous project to help mortgage borrowers);

- Borrowers who support adult children under the age of 24 who are studying at a university on a full-time basis;

- Combat veterans.

That is, in order to write off the principal debt on a mortgage up to 600 thousand rubles in Sberbank or any other financial organization participating in the program, the borrower must prove their right to use this privilege.

Certain nuances that the program has to write off the principal debt on a mortgage up to 600 thousand rubles

If earlier all citizens belonging to one of the above categories were entitled to financial assistance from the Agency for Housing Mortgage Lending (AHML) for partial repayment of a mortgage loan in the amount of up to 600 thousand rubles, but not more than 20% (previously, in 2016, it was 10%) of the balance of the principal debt, then starting from February 23, 2017, some adjustments were made to this paragraph. These points will be considered in more detail below.

Restrictions on the amount of allocated funds

The amount of material assistance to mortgage borrowers has been increased to 1.5 million rubles, but at the same time it should not exceed 30% of the balance of the principal debt. This innovation is valid only for the following categories of borrowers:

- Combat veterans.

- Persons raising two or more minor children (or who are their guardians).

- Disabled persons or parents of a disabled child (regardless of the established disability group).

- persons who have one child under the age of eighteen or who are his guardians,

- persons supporting full-time students who have not reached the age of 24,

- can receive financial assistance in the amount of 600 thousand rubles, while the specified amount should not exceed 20% of the balance of the principal debt.

How is financial assistance provided?

Contrary to popular misconception, no borrower will receive the specified amount in cash. Material aid from the state for the payment of a mortgage loan is to write off part of the principal debt.

How to reduce the mortgage by 600 thousand?

The fundamental points are listed below:

- First of all, you will need to contact the bank and apply for restructuring. Important point- it is not necessary that the borrower had an overdue debt on the loan at the time of the application.

- The time elapsed from the moment of signing the loan agreement to the submission of the application for restructuring from 2017 does not matter.

- Any mortgage is subject to restructuring, even the one that was issued as a social one.

What are the income requirements for a mortgage borrower who wants to use this service?

The average family income for the 3 months preceding the application, after deducting the average monthly payment under the contract during the same period, does not exceed two living wages for each family member (both borrowers and co-borrowers are taken into account).

Considering the currency mortgage, it should be noted that all the requirements for maximum income that were set before have lost their relevance.

Which apartments are covered by the federal mortgage program (600 thousand assistance)

1. Mortgage housing should be the only one.

3. In addition, there are strict restrictions on the area:

- apartment - no more than 45 sq.m;

- apartment - 65 sq.m;

- apartment and more - 85 sq.m.

An important point is that if there are three or more minor children in the family, the requirements regarding the price and area of \u200b\u200bhousing are not relevant. However, according to innovations since 2017, in order to receive 600 thousand to pay off a mortgage from the state, a family cannot additionally own any other property, including more than half of the shares.

In which banks is a subsidy for the repayment of a mortgage of 600 thousand?

It must be understood that writing off a part of the debt to the client for mortgage loan, in this case, the bank does not incur losses. And receiving from the state 600 thousand rubles of mortgage compensation, the borrower does not spoil relations with the bank. It also doesn't affect it in any way. credit history. Therefore, the vast majority of banks that issue mortgage loans take part in the program under consideration.

But in any case, before you start preparing the documents necessary to receive assistance, you should check with bank employees about the possibility of obtaining compensation when working with this financial institution.

The list of documents that must be provided to participate in this program for the return of 600 thousand on a mortgage at Sberbank or another credit institution may vary in each individual case (depending on the terms of the loan, the size of the mortgage and other factors), so this question should be check directly with the employees of the bank whose client is the borrower.