Insurance presentations. Casco motor insurance. Legislative basis for compulsory insurance

Insurance. Moldova. Supervision. Types of insurance. Personal insurance. Mandatory pension insurance. Forms of insurance. Cargo insurance. The concept of insurance. Voluntary health insurance. Ecological insurance. Russian insurance market. Insurance fraud. Insurance companies market. State insurance supervision.

Business property insurance. Liability insurance for owners of hazardous facilities. COMPANY " Insurance Group UralSib. History of insurance. Topic: Accident insurance. Insurance accounts receivable. On the insurance of civil liability of the carrier for causing harm to passengers. Methodology for investigating fraud.

Personnel insurance. Risk management in an insurance company. Insurance and pension business. Difficulties of insurance. Economic problems insurance. International conference on insurance. Development trends insurance market Russia. State supervision and regulation of insurance activities. Prospects for the development of the insurance market in Russia.

Trends in the development of insurance in the Russian Federation. Ethics of business communications. Overview of the Russian insurance market. Responsibility of payers of insurance premiums for violation of legislation on insurance premiums. Organization of mandatory health insurance in the Moscow region. Professional liability insurance for appraisers.

Production of boiler supervision objects. JSC Russian Agency for Insurance of Export Credits and Investments. Insurance Company"indigo". Economic fundamentals insurance business. Fraud in RBS. Historical development of insurance. Mortgage risk insurance in Russia.

slide 2

Plan

slide 3

The purpose of the lecture: familiarization with the basics of insurance, its classification, the organization of insurance business in the republic and development prospects

slide 4

Economic entity and functions of insurance Classification of insurance Organization of insurance business in the Republic of Kazakhstan

slide 5

Economic essence and functions of insurance

Insurance as an economic category is an integral part of finance. However, if finance as a whole is associated with the distribution and redistribution of income, then insurance covers the sphere of exclusively redistributive relations. In the system of socio-economic relations, characteristic parts of insurance are distinguished, which are caused by the following circumstances: Natural features and the condition of people (illness, old age, death, birth of children) Participation of people in labor activity, the risky nature of this activity (injuries, disability, occupational diseases) Unfavorable production conditions (drought, cold spells) Natural disasters (catastrophes, fires) National economy

slide 6

We can distinguish the following essential features that characterize the specificity of insurance as an economic category:

1. When insuring, monetary redistribution relations arise due to the presence of the probability of the occurrence of sudden, unforeseen and insurmountable events, i.e. insured events. 2. When insuring, the distribution of the inflicted damage between the insurance participants is carried out, which is always closed. 3. Insurance provides for the redistribution of damage, both between territorial units and in time, while for the effective redistribution of funds insurance fund within one year, a sufficiently large territory and a significant number of objects to be insured are required. 4. A closed distribution of damages determines the return of funds mobilized to the insurance fund. The insurance payments of any insurance made to the insurance fund have only one purpose - compensation for the probable amount of damage on a certain territorial scale and within a certain period.

Slide 7

The above features of redistributive relations that arise in insurance allow us to give it the following definition: Insurance is a set of special closed redistributive relations between their participants regarding the formation of a target insurance fund at the expense of monetary contributions, intended to compensate for probable damage caused to business entities, or to equalize losses in income in connection with the consequences of insured events.

Slide 8

The continuity of social production requires protection, compensation for losses. In this regard, society, producers must have the necessary funds (in-kind reserves or reserves, cash). Such funds are formed in the form of reserve and insurance funds. Economic relations associated with the action of adverse natural, production factors and compensation for damages at the expense of cash contributions are allocated to separate category– category of insurance.

Slide 9

The purpose of insurance is the public or collective protection of citizens, property, production to ensure the continuity of social reproduction. The main features of insurance are as follows: The probabilistic nature of the relationship The extraordinary nature of the relationship

Slide 10

The essence of insurance is manifested in its functions, they allow you to identify the features of insurance as a link in the financial system:

1. Risk function, since the insurance risk as the probability of damage is directly related to the main purpose of insurance for providing financial aid injured. 2. Insurance also has a preventive function associated with the use of part of the insurance fund to reduce the degree and consequences of the insured risk. 3. Savings sums of money with the help of insurance is not associated with the need for insurance protection of the achieved family income, that is, insurance can also have a savings function. 4. The control function of insurance expresses the properties of this category for the strictly targeted formation and use of the insurance fund. This function follows from the indicated 3 specific functions and manifests itself simultaneously with them in specific insurance relations.

slide 11

In insurance, two main methods of forming insurance reserves and funds are used:

Budget Insurance

slide 12

The budgetary method of forming funds involves the use of budget funds, that is, the funds of the whole society. The insurance method provides for the formation of funds at the expense of contributions from enterprises, organizations and the population. The amount and procedure for paying premiums is determined depending on the type of insurance by law or by a special agreement between participants in insurance relations. Used in public defense budget method, for social insurance - budgetary and insurance methods, for property and personal insurance - the insurance method. Insurance funds are reserves of monetary or material resources formed at the expense of contributions from participants in insurance relations, funds state budget, voluntary deductions of funds, donations from the participants of insurance relations.

slide 13

2. Classification of insurance

The classification criteria are the differences in the objects of insurance, taking into account the category of insured, the amount of insurance liability and the established procedure for organizing insurance. In accordance with these criteria, insurance is divided into branches, classes, types.

Slide 14

In addition, the forms of insurance are distinguished according to the following criteria: By the degree of obligation - mandatory and voluntary By the object of insurance - personal and property Based on the grounds for making insurance payments - cumulative and non-cumulative

slide 15

Due to differences in the objects of insurance, the entire set of insurance relations can be divided into five sectors: 1. Property insurance 2. Social insurance 3. Personal insurance 4. Liability insurance 5. Business risks insurance

slide 16

Compulsory insurance is insurance provided by law. The policyholder is obliged to conclude a contract with the insurer on the conditions prescribed legal act regulating these insurance relations. Such an agreement can be concluded with any insurer offering its services. For a state insurance organization, the conclusion of such an agreement is its responsibility. Voluntary insurance is insurance carried out by virtue of the will of the parties. Personal insurance is an insurance of the interest of an individual, swinging his life and health. The purpose of personal insurance is to pay citizens a stipulated sum of money upon the occurrence of a certain event in their life.

Slide 17

The purpose of property insurance is to compensate for damage caused by natural disasters and other random events to various property. Therefore, the object of insurance are various material values and related interests. Cumulative insurance is insurance that provides for the implementation of an insurance payment on any of the following grounds: after the expiration of the period established by the insurance contract, upon the occurrence of an insured event.

Slide 18

Non-cumulative insurance is insurance that provides for the implementation of an insurance payment only upon the occurrence of an insured event. In the Republic of Kazakhstan, the following classification of insurance has been adopted By industry By type By class

Slide 19

Life insurance includes two classes Life insurance Annuity insurance The essence of insurance is manifested in its functions, they allow you to identify the features of insurance as a link in the financial system.

Slide 20

The main determinant is:

1. Risk function, because insurance risk how the probability of damage is directly related to the main purpose of insurance to provide financial assistance to victims. 2. Insurance also has a preventive function associated with the use of part of the insurance fund to reduce the degree and consequences of the insurance fund to reduce the degree and consequences of the insurance risk. 3. Saving money with the help of insurance is not connected with the need for insurance protection of the achieved family wealth, that is, insurance can also have a savings function. 4. The control function of insurance expresses the properties of this category to the strictly targeted formation of the use of the insurance fund. This function follows from the indicated 3 specific functions and manifests itself simultaneously with them in specific insurance relations.

slide 21

General insurance includes 16 classes

Accident and illness insurance Health insurance Insurance of automobile, railway, air and water transport Cargo insurance Property insurance Business risk insurance Civil liability insurance of vehicle owners, carrier, under the contract, for causing damage

slide 22

Life insurance - a set of types of personal insurance that provide for the implementation of an insurance payment in the event of the death of the insured or his survival until the end of the insurance period, or the age specified in the insurance contract. Annuity insurance is a set of types of personal insurance that provides for the implementation of periodic insurance payments in the form of a pension or rent in cases where the insured reaches a certain age, disability (due to age, disability, illness), death of the breadwinner, unemployment or other cases leading to a decrease or loss of personal income by the insured. income.

slide 23

Accident and sickness insurance is a set of types of personal insurance that provide for insurance payments in a fixed amount or in the amount of partial (full) compensation for additional expenses of the insured in cases of death, disability or damage to health as a result of an accident or illness. Health insurance is a set of types of personal insurance that provide for the implementation of insurance payments in the amount of partial or full compensation for the expenses of the insured person, caused by his application to medical institutions for medical services included in the health insurance program.

slide 24

Vehicle insurance is a set of insurance types that provide for insurance payments in the amount of partial (full) compensation for damage caused to the interests of a person associated with the use of a means of transport due to damage or destruction. Cargo insurance - a set of types of insurance for the provision of insurance payments in the amount of partial (full) compensation for damage in connection with the damage or destruction of cargo, regardless of the method of its transportation. Property insurance - a set of types of insurance that provide for the provision of insurance payments in the amount of full or partial compensation for damage as a result of damage or destruction of property.

Slide 25

Insurance authorities are given the right to independently develop new risk types insurance. The range of insurance coverage in Kazakhstan includes long-term endowment insurance:

Regional insurance Life insurance Earthquake insurance Recruit insurance Women's childbirth insurance Animal theft insuranceInsurance of apartments purchased as personal property Insurance of bank deposits of individuals

slide 26

Organization of insurance business in the Republic of Kazakhstan

AT market economy the state monopoly on the insurance business was destroyed. In Soviet times, there was a single body that carried out all types of property and personal insurance - Gosstrakh. Currently, several insurance companies and companies of various forms of ownership have formed on the insurance market. The scope of their activities also covers risky types of insurance: insurance of exchange transactions, cargo, loans, commercial, legal and other specific risks. In Kazakhstan, the State Insurance Corporation for Insurance of Export Credits and Investments has been organized.

Slide 27

Insurance organizations different forms of ownership in carrying out their activities enjoy equal rights.

Participants of the insurance market of the Republic of Kazakhstan are: Insurance organization Insurance broker Insurance agent Insured, insured, beneficiary Actuary Authorized audit organization Mutual insurance society individuals and legal entities engaged in entrepreneurial activity related to insurance

Slide 28

The state can be the founder and shareholder of an insurance company only represented by the Government of the Republic of Kazakhstan. Organizations, more than 50% of the authorized capital of which belong to the state, cannot act as founders and shareholders of an insurance company. An insurance company must form the following collegiate bodies: board of directors - management body management board - executive body audit commission - control body

Slide 29

The solvency of an insurance organization is determined by its ability to timely and fully fulfill its obligations. financial obligations. Solvency indicators of an insurance organization are its compliance with the normative ratios between the assumed liabilities and assets, taking into account their liquidity. The financial stability of an insurance organization is determined by its ability to maintain its solvency during the entire period of validity. commitments made under insurance contracts, taking into account the possible adverse impact of external financial and other factors.

slide 30

Indicators of the financial stability of an insurance company include: The minimum amount of authorized and equity capital The value of assets and the degree of their diversification The amount of insurance reserves and other circumstances The solvency indicators The ratio of insurance and reinsurance liabilities The profitability of the insurance services provided The effectiveness of the investment policy being implemented

Slide 31

test questions

What circumstances cause the need for insurance What is the nature of insurance relations What characteristic features are inherent in the category of insurance In the totality of insurance relations, what parts do you know What methods are used to form insurance funds List the types of insurance. Give a brief description of each type of insurance What is the concept of "insurance business" Give examples of types of insurance carried out in mandatory and voluntary forms List the terms of the insurance business that you know and disclose their content How the insurance business is organized in the Republic of Kazakhstan in accordance with the Law "On Insurance Activities" Which bodies exercise control over the activities of insurance organizations How is it ensured financial stability insurers In what directions can the insurance business develop in the Republic of Kazakhstan

slide 32

Bibliography

Melnikov V.D. Fundamentals of Finance: textbook - Almaty: LEM publishing house, 2005. Sakhariev S.S. Finance: textbook Almaty: Legal Literature, 2004 Finance: tutorial- ed. A.M. Kovaleva - M .: Finance and statistics, 1998

View all slides

Compulsory insuranceauto civil liability

(OSAGO)

St. Petersburg

2014

ERGO slide master – 2010

1

Legislative basis for compulsory insurance

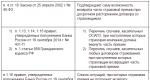

Civil Code of the Russian Federation, Chapter 59"Obligations as a result of causing harm", art. 1079

Federal Law No. 40-FZ of April 25, 2002

“On Compulsory Civil Liability Insurance

owners Vehicle» (current version of 09/01/2013)

Federal Law No. 170-FZ of July 1, 2011

"On the technical inspection of vehicles and on amendments to certain

legislative acts Russian Federation»

Rules compulsory insurance civil

responsibility of vehicle owners

Insurance rates

ERGO slide master – 2014

2

License

ERGO slide master – 20143

Important Concepts

OSAGO - compulsory motor third party liability insurancevehicle owners.

An object

OSAGO

–

risk

civil

responsibility,

emerging

due to harm to life, health or property of the victims

when using the vehicle on the territory of the Russian Federation.

Insurer

– insurance

organization,

which

entitled

realize

Compulsory third party liability insurance for vehicle owners

conditions and procedure established by Federal Law No. 40 in accordance with the permit

(license) issued by the federal executive authority for

supervision of insurance activities.

Policyholder – a person who has entered into a contract of compulsory

insurance. The insured may be any legal entity or

capable individual who has reached the age of 18.

Use of the vehicle - operation of the vehicle related to

his participation in traffic within the roads, as well as on the adjacent and

territories intended for the movement of vehicles (yards, residential areas,

parking lots, gas stations and other areas).

ERGO slide master – 2014

4

Important Concepts

Road traffic accident (RTA) - an event that occurred inthe process of driving on the road of the vehicle and with its participation, in which the death or

people are injured, vehicles, structures, cargo are damaged, or other

material damage

Victim - a person whose life, health or property has been caused

damage when using the vehicle by another person, including

a pedestrian, a driver of an injured vehicle, and

passenger

transport

funds

-

participant

road transport

incidents.

ERGO slide master – 2014

5

Insurance case

Insured event - the onset of civilDamage caused as a result of:

responsibility

Force majeure or intent

owner

transport

damages:

the victim;

life

The effects of a nuclear explosion, radiation or

health

radioactive contamination;

property of the victim,

military operations, as well as maneuvers or other

entailing in accordance with the contract

military activities;

OSAGO the obligation of the insurer to carry out

civil war, civil unrest or

insurance payment.

strikes;

ERGO slide master – 2014

6

Sum insured

Sum insured - the amount within which the insurer, upon the occurrence of eachinsured event (regardless of their number during the term of the contract

compulsory insurance) undertakes to compensate the victims for the harm caused,

is:

no more than 160 thousand rubles.

Compensation for damage

life and health

Compensation for damage

property

per victim

from 01.04.2015 - 500 thousand rubles.

for each, regardless of the number

victims

400 thousand rubles

per victim

(regardless of the number of victims)

ERGO slide master – 2014

7

Vehicles subject to insurance

Subject to insurance:Vehicles allowed to participate in road traffic in accordance with the law

of the Russian Federation (Termination of OSAGO insurance for equipment on a non-wheeled propulsion

(caterpillar, sledge, etc.) (effective from 09/01/2014).

Vehicles not subject to insurance:

1.With a maximum design speed of not more than 20 km/h

2. Not allowed to participate in road traffic due to technical characteristics

3.Located

in

disposal

Armed

strength,

per

exception

buses,

cars

cars and others used in business activities

4. Trailers for cars owned by citizens (individuals)

ERGO slide master – 2014

8

Validity period of the insurance contract

TS,registered in the territory of the Russian Federation - 1 year

(regardless of the period of use of the vehicle);

TS,

registered

in

foreign

states

and

temporarily

used on the territory of the Russian Federation - for the entire period of temporary use, but

for at least 5 calendar days

Transit transport - the duration of the journey to the place of registration or place

maintenance, but not more than 20 days

ERGO slide master – 2010

9

Documents provided by the Insured to the agent for issuing an OSAGO policy

IndividualEntity

Statement;

Statement;

Passport (of the Insured);

Title or vehicle registration certificate;

Driver's licenses of persons admitted to

vehicle management;

Certificate

about

registration

legal

faces

(Insured);

The passport

transport

funds

(PTS)

or

registration certificate;

Diagnostic card or Technical inspection coupon for the vehicle;

Presentation of a Diagnostic Card or a TO Ticket is not required in the following cases:

1. For new vehicles and vehicles not older than 3 years (for cars, trucks weighing up to 3.5 tons, trailers and semi-trailers,

motor vehicles)

2. For new (in the year of their release) trucks with a maximum permitted weight of more than 3.5 tons

3. For vehicles intended for the carriage of passengers (cars, buses, trucks equipped for

transportation of passengers)

4. For specialized vehicles and trailers for them, designed and equipped for the transport of dangerous goods

5. For low-power vehicles (with a maximum design speed of not more than 50 km / h) and trailers for them

6.For urban ground electric transport

7. For vehicles registered by VAI or automotive services federal bodies executive branch, in

which military service, TS of bodies carrying out operational-search activities

8. For tractors, self-propelled road-building and other machines and trailers for them, which are registered

Gostekhnadzor.

9. When issuing OSAGO policies for vehicles heading to the place of registration or maintenance (“transit” policies)

*For the vehicles specified in paragraphs 3-8, MOT must be carried out every 6 months

IMPORTANT: When concluding an OSAGO agreement, it is required mandatory check maintenance through a single PCA base (if

The insured does not present the original diagnostic card or maintenance ticket)

ERGO slide master – 2010

10

Documents issued to the Insured

When concluding a compulsory insurance contractThe following documents are issued to the insured (individual)

(package of documents):

Insurance policy

OSAGO rules

with a list

representatives

insurer in

subjects of the Russian Federation

ERGO slide master – 2010

Forms

accident notices

Receipt

11

Making changes to the insurance contract. Addendum design

During the validity period of the OSAGO contract, the Insured is obliged IMMEDIATELYnotify the Insurer in WRITTEN form about changes in information,

specified in the application for insurance

Information requiring renewal of the Policy:

Owner: change of full name citizen, renaming of a legal entity

Vehicle: replacement (issuance) of the vehicle passport / vehicle registration certificate (series,

number), replacement of the state registration plate.

Persons admitted to management: change of full name or driver's license, change

list of persons admitted to management

Period of vehicle use: changing the period of use of the vehicle during the insurance period

!!!It is unacceptable to change the vehicle and the Insured!!!

ERGO slide master – 2010

12

Early termination of the insurance contract

The contract may be prematurely terminated in the following cases:Death of a citizen - Insured or Owner

Change of vehicle owner (vehicle sale)

ERGO slide master – 2010

Destruction (loss) of a vehicle - recycling

13

insurance premium

Important!!!The insurance premium for OSAGO is determined in accordance with the insurance

tariffs set by the Government of the Russian Federation.

These rates are the same for everyone.

insurance companies.

Insurance premium payment option: Lump sum (in full)

Form of payment of the insurance premium:

Spot

calculation

Bank transfer (bank

by card through the cash desk of the branch)

Cashless payments

(at a bank branch on an invoice issued by

insurance company to pay for the policy)

Payment day:

Day of payment of the insurance premium in cash to the Insurer

The date of transfer of the insurance premium to the settlement account of the insurer

ERGO slide master – 2010

14

The procedure for calculating the insurance premium

The insurance premium is calculated according toWith " methodological recommendations No. 4, approved by the RSA

The formula for calculating the insurance premium:

P \u003d Tb x Kt

x Kp x Kn

X

cbm

X

Co.

X

kvs

X

km

X

Ks

P - insurance premium

Tb - basic tariff

Kt - coefficient of the territory of primary use

Kbm - the coefficient of the presence or absence of insurance payments

Co - coefficient limiting the number of persons admitted to management

Kvs - the coefficient of age and experience of the driver

Km - vehicle power factor

Кс - coefficient of seasonal use of the vehicle

Kp - coefficient taking into account the term of insurance

Kn - coefficient insurance rate(gross violations)

ERGO slide master – 2010

15

Calculation of the insurance premium - Base rate (TB)

Basic insurance rates.Base rate (TB).

The base rate is determined on the basis of the information specified in the TCP or in the certificate of

vehicle registration. In the event that in the TCP or in the certificate of registration

there are contradictions between the type and category of the vehicle, then the base rate

determined by vehicle category (A, B, C, D, E).

For example, Volkswagen Amarok. Type of vehicle according to the document - cargo-on-board, category B.

The base rate is determined by category B.

The ownership of the vehicle by an individual or legal entity is determined by the OWNER

of the vehicle indicated in the title or in the certificate of registration.

Methodology, page 1

ERGO slide master – 2010

16

Insurance Premium Calculation - Territory Coefficient (CT)

Coefficient depending on the territory of primary use of the vehicle(Kt) determined

for legal entities

for individuals

at the place of registration of the OWNER of the vehicle

(see Owner's passport)

at the place of registration of the vehicle

(see certificate of registration or title)

Important!!!

If an OSAGO agreement in respect of a vehicle owned by a legal entity is concluded before

registration of the vehicle, the coefficient CT is determined based on the place of registration of the legal entity of the owner of the vehicle.

Kt DOES NOT APPLY when concluding OSAGO for transit vehicles, i.e. for vehicles heading to the place

registration.

When concluding OSAGO for vehicles registered in foreign countries and temporarily

used on the territory of the Russian Federation, CT = 1.7.

Methodology, page 2

ERGO slide master – 2010

17

Insurance Premium Calculation - Bonus-Malus Coefficient (BMF) Methodology, page 3

Availability - absence ratio of insurance payments (Coefficient Bonus - Malus) KBMWhen concluding the first insurance contract given coefficient set to 1 (class 3)

Cbm does not apply when insuring trailers, vehicles registered in foreign countries, vehicles,

next to the place of registration or maintenance.

Start class

Meaning

annual term

insurance coefficient

Cienta KBM)

Class at the end of the annual term of insurance, taking into account the availability of insurance

cases that occurred during the period of validity of previous OSAGO agreements

0 payouts

1 payout

2 payouts

3 payouts

4 or more

M

2,45

0

M

M

M

M

0

2,3

1

M

M

M

M

1

1,55

2

M

M

M

M

2

1,4

3

1

M

M

M

3

1

4

1

M

M

M

4

0,95

5

2

1

M

M

5

0,9

6

3

1

M

M

6

0,85

7

4

2

M

M

7

0,8

8

4

2

M

M

8

0,75

9

5

2

M

M

9

0,7

10

5

2

1

M

10

0,65

11

6

3

1

M

11

0,6

12

6

3

1

M

12

0,55

13

6

3

1

M

13

0,5

13

7

3

1

M

ERGO slide master – 2010

18

Calculation of the insurance premium - (Ko)

Coefficient depending on the number of persons admitted to the management of the vehicle (Ko)If OSAGO is in relation to

unlimited number of people

admitted to the management of the vehicle, then

Ko = 1.8

If the contract specifies

specific persons admitted to

vehicle control, then

Ko = 1

In all cases when

either the owner of the vehicle or

insured or owner

and the insured are

legal entities

coefficient Ko = 1.8.

IMPORTANT!!! TO NOT APPLICABLE:

trailer insurance.

When insuring a vehicle,

registered in foreign

states and temporarily

used on the territory

Russian Federation:

KO = 1 (for vehicles,

owned by individuals);

KO = 1.8 (for vehicles,

owned by legal entities).

Methodology, p.12

ERGO slide master – 2010

19

Calculation of the insurance premium - (Kvs)

Coefficient depending on the age and experience of the driver (Kvs)The FAC is used only when insuring a vehicle, the owner and insurer of which

is an individual.

If in insurance policy more than one driver is listed, the maximum

coefficient of all defined for each driver.

If the OSAGO agreement is concluded in relation to an unlimited number of persons admitted to

control (coefficient KO - 1.8), for the calculation the coefficient KVS = 1 is used.

IMPORTANT!!! When determining the PIC, the driver's age and experience are not rounded off.

Age up to 22 years inclusive, experience up to 3 years inclusive - Kvs = 1.8

Age over 22 years old, experience up to 3 years inclusive = Kvs - 1.7

Age up to 22 years inclusive, experience over 3 years - Kvs = 1.6

Age over 22 years, experience over 3 years - Kvs = 1

Example: A driver aged 22 years and 4 months, experience - 2 years and 8 months, belongs to the category of drivers

over the age of 22 years and experience up to 3 years inclusive (FAC = 1.7).

IMPORTANT!!! FAC is not applicable for insurance of trailers and vehicles owned by legal entities. persons.

When insuring vehicles registered in foreign countries:

For physical persons FAC = 1.7

For legal persons FAC = 1

Methodology, page 13

ERGO slide master – 2010

20

Calculation of the insurance premium - (Km)

Coefficient depending on the engine power of a passenger vehicle (KM)KM is used ONLY for insurance of vehicles of category "B", including those used in

as a taxi.

When determining engine power, PTS data or certificates of

registration.

The power value must be expressed in horsepower.

If in the PTS the engine power is indicated only in kilowatts, then when recalculated in horsepower

force, the ratio 1 kW = 1.36 hp is used.

up to 50 l / s inclusive - KM = 0.6

over 50 to 70 l / s inclusive - KM = 1

over 70 to 100 l / s inclusive - KM \u003d 1.1

over 100 to 120 l / s inclusive - KM \u003d 1.2

over 120 to 150 l / s inclusive - KM \u003d 1.4

over 150 l / s - KM \u003d 1.6

Methodology, page 13

ERGO slide master – 2010

21

Calculation of the insurance premium - (Кс)

Coefficient depending on the period of use of the vehicle (CS)The minimum period of use is:

for individuals

for legal entities

3 months (KS = 0.5):

1 year (KS= 1)

EXCLUSION for legal entities

For vehicles owned by legal entities persons can apply COP = 0.7, but only to "seasonal" vehicles:

snow removal, agricultural, watering vehicles, etc. Minimum period = 6 months.

IMPORTANT!!!

The period of use cannot be set and the QC DOES NOT APPLY when insuring a vehicle:

for the duration of the journey to the place of registration;

Russian Federation.

The value of the COP, see the training manual

Methodology, page 14

ERGO slide master – 2010

22

Calculation of the insurance premium - (Kp)

Coefficient depending on the term of insurance (KP)The CP applies only to:

when insuring the civil liability of vehicle owners,

registered in foreign countries and temporarily used in the territory

Russian Federation (KP value, see manual)

when insuring the civil liability of owners of vehicles following to

place of registration, or place of maintenance (KP = 0.2).

Methodology, page 15

ERGO slide master – 2010

23

Calculation of the insurance premium - Violation coefficient (KN)

Violation rate (KN)KH = 1.5 applies if:

1. The insured informed the insurer of knowingly false information that affected the reduction

insurance premium;

2. The insured or a person admitted to driving the vehicle deliberately contributed to the onset

insured event or an increase in related losses.

Methodology, page 15

ERGO slide master – 2010

24

Insurance Premium Calculation - Maximum JV

Maximum insurance premiumIn the event that the amount of the insurance premium under the OSAGO agreement exceeds three times

the size base rate(TB) multiplied by the territory coefficient (CT), and the coefficient

gross violations KH = 1, then the insurance premium is calculated by the formula:

T = 3 * TB * CT

In the event that the amount of the insurance premium under the OSAGO agreement exceeds five times

the base rate (TB) multiplied by the territory coefficient (CT), and the coefficient of gross

violations KN = 1.5, then the insurance premium is calculated by the formula:

T = 5 * TB * CT

Methodology, page 17

ERGO slide master – 2010

25

Agent's commission

Commission fee for OSAGO, in accordance withfederal law"On compulsory insurance of civil

Responsibility of Vehicle Owners” dated April 25, 2002.

N 40-FZ, is 10% of the contract amount.

From January 01, 2015 commission to intermediaries

will be 5%.

ERGO slide master – 2010

26

ERGO slide master – 2010

27

Voluntary civil liability insurance (DGO)

Civil liability is the responsibility of the owners of the vehicle in the event of damage to life as a result of an accident,health and property of third parties due to the use of the insured vehicle by persons authorized to drive it and

specified in the Insurance Contract.

Basic insurance premiums for DGO risk

Vehicle type

Passenger vehicles, minibuses

(up to 8 seats inclusive),

SUVs

Trucks, buses,

minibuses (more than 8 seats)

Trailers, semi-trailers

trucks, other vehicles

300 000

Sums insured, rub.

600 000 1 000 000 1 500 000

Insurance premiums, rub.

600,00

900,00

1 500,00

1 800,00

900,00

1 500,00

2 000,00

3 000,00

550,00

800,00

1 000,00

1 600,00

2 000 000

By

agreement with

employee

divisions

auto insurance

Coefficient (Kp)

Age up to 22 years inclusive, experience up to 3 years inclusive

1,8

Age up to 22 years inclusive, experience over 3 years

1,6

Age over 22 years, experience up to 3 years inclusive

1,7

Age over 22, experience over 3 years

The OSAGO agreement does not provide for limiting the number of persons

admitted to the management of the vehicle

If there are payments for drivers or the Owner specified in

OSAGO policy

IMPORTANT!

DGO insurance can

carried out only in conjunction with

OSAGO ERGO Rus

IMPORTANT!

Adjustment coefficients to the base premium for the risk of DGO (Kp)

Additional factors affecting the degree of risk

IMPORTANT!

Only accepted for insurance

Vehicles of foreign production

not older than 10 years

1

1,8

1,5

DGO policy is issued

at the same time with the OSAGO policy,

terms of insurance and drivers,

approved vehicles must

coincide

IMPORTANT!

Sum insured for DGO non-aggregate

(i.e. it is not reduced by the size

insurance payments made

regardless of how many)

Correction coefficients to the base rate are multiplied sequentially: SPind = Base premium × Kp

ERGO slide master – 2010

3

4 Indicator 2010 Change 2010 to 2009 Number of concluded contracts (million)37.1+5.3% Insurance premiums (billion rubles)92.6+7.7% Claimed insured events (million)2.35+14% Insured events settled (million)2.29+17% Insurance payments (billion rubles)53.8+10.7% OSAGO statistics for 2010

6 Direct indemnification statistics Within the framework of the PES system, victims were paid: mln. – for the 1st calendar year (from to) mln. – TOTAL: for the 2nd calendar year (from to) mln. - for the period from million rubles. by The number of complaints about the PES is more than 2 times less than for the traditional OSAGO The PES meets its objectives (improving the level of customer service)

7 Conditions for the application of the European Protocol: two vehicles were involved in the accident; the liability of participants in an accident is insured; damage is caused only to property; there are no disagreements between the participants in the accident. 25 thousand rubles - the maximum insurance payment in case of a simplified registration of an accident. 23.7 rubles - the average payment under OSAGO in 2010. The share of losses settled without the participation of traffic police officers is about 4%. A radical improvement in the application of the European Protocol is needed. Simplified registration of an accident (without the participation of police officers - European Protocol)

9 Settlement of CASCO-OSAGO requirements Problem: non-fulfillment of obligations under subrogation requirements. Solution: Creation of rules for professional activities of CASCO-OSAGO; In order to control the proper implementation of the rules of the CASCO-OSAGO Rules - the creation of the Commission for the settlement of the requirements of the CASCO-OSAGO (the date of the establishment of the Commission) up to 4.21 billion rubles as of the year. as of Mr.

10 Requirements of the insurance legislation to the minimum size of the authorized capital of insurance organizations - members of the RAMI In accordance with the Federal Law from the Federal Law with minimum size authorized capital: -120 million rubles. – for an insurer providing civil liability insurance, except for medical insurance; -480 million rubles - for the implementation of all types of insurance + reinsurance; Among the full members of the RAMI are: - 22 insurance companies with a charter capital of less than 120 million rubles; insurance companies with a charter capital of less than 480 million rubles. As of (according to the data received by the RSA): - Decision to increase - 9 UK (intention). -Increased authorized capital- 3 SC. - Cancellation of reinsurance - 2 SK. - No changes - 40 insurance organizations.

11 Rules for the provision of blanks for members of the RAMI Problem: withdrawal from the market of insurance companies with a large number of OSAGO policy forms. Conclusion of invalid insurance contracts. Solution: to limit the number of issued forms of OSAGO* policies. * The rules of professional activities for the provision of OSAGO policy forms have been agreed with the Ministry of Finance and the Federal Antimonopoly Service of Russia.

12 Provision of OSAGO policy forms Provision of BSO depending on the risk group Formed on the basis of coefficients calculated by the RAMI based on the data of the RAMI and the supervisory authority The amount of the RAMI security for RAMI members and the distribution by groups is calculated quarterly* 1st group (+) 2nd group (+30%) 3rd group (+20%) 4th group (+0) 5th group (forms are not issued) *The insurer can receive any number of forms for financial security.

13 1. Date of entry into force of the law on maintenance: d. 2. Maintenance functions are transferred from the Ministry of Internal Affairs of the Russian Federation to legal entities or individual entrepreneurs with the appropriate accreditation. 3. The following changes are made to the procedure for concluding an OSAGO agreement: a) The presence of a valid maintenance coupon is a necessary condition for concluding an OSAGO agreement. The OSAGO agreement is not concluded if less than 6 months are left before the expiration of the TO coupon; b) When concluding an OSAGO contract, the policyholder transfers the MOT coupon to the insurer, and the insurer enters information about the expiration date of the MOT coupon into the OSAGO policy. Traffic police officers will not check the availability of MOT with drivers: the relevant information will be reflected in the OSAGO policy. In the future, it is assumed that information about the passage of maintenance will be transmitted to the insurer exclusively in in electronic format by accessing the AIS TO database (planned date - y.). Technical inspection of vehicles

14 3. The main functions of the RSA: a) accreditation of maintenance operators; b) implementation of inspections of the activities of maintenance operators based on complaints received; c) withdrawal of accreditation - if there are appropriate grounds; d) maintaining a register of maintenance operators; e) the formation of an open information resource, containing information from the register of maintenance operators; f) organizing the provision of TO operators with TO forms. 4. Accreditation of maintenance operators: a) unlimited; b) paid; The accreditation fee will be paid once. 5. Functions of the traffic police: maintenance of the MOT database. RSA has proven its effectiveness will play a key role in the organization of technical inspection. Technical inspection of vehicles

Insurance - relations to protect the interests of individuals and legal entities, the Russian Federation, constituent entities of the Russian Federation and municipalities in the event of the occurrence of certain insured events at the expense of monetary funds formed by insurers from paid insurance premiums (insurance premiums), as well as at the expense of other funds of insurers. Insurance activity (insurance business) - the field of activity of insurers for insurance, reinsurance, mutual insurance, as well as insurance brokers, insurance actuaries for the provision of services related to insurance, with reinsurance.

Compulsory insurance is a form of insurance in which insurance relations between the insurer and the insured arise by virtue of law.

Voluntary insurance is a form of insurance that arises only on the basis of a voluntarily concluded agreement between the insurer and the insured.

Risk Investment Precautionary Savings Control

The economic essence of insurance is the creation of monetary funds at the expense of contributions from parties interested in insurance and intended to compensate for damage from persons participating in the formation of these funds.

The principle of taking into account the psychological factor The principle of combining economic risk The principle of solidarity, the distribution of damage The principle of financial equivalence

Liability Insurance

Personal insurance

Property insurance

The type of insurance expresses the specific interests of policyholders related to the insurance protection of homogeneous objects from their characteristic hazards.

InsurerInsurantInsured eventInsured eventInsurance premium

Insurance fundInsurance payoutInsurance riskCoinsuranceReinsurance

Compulsory social insurance in Russia - employer's contributions to compulsory social insurance funds social insurance

Insurance premium - payment for insurance paid by the insured to the insurer

Insurance payment - payment by the insurer insurance compensation

On the topic: methodological developments, presentations and notes

Economics presentation grade 10. Subject: Insurance. The work was created by Barbashova Natalya Alekseevna, teacher of Moscow State Educational Institution Secondary School No. 251, Fokino, Primorsky Territory

The presentation is designed for use in an economics lesson when considering the question "How to protect yourself from unforeseen losses?". It contains forms and principles of insurance, types and objects of insurance, as well as...