Home credit bank JSC. Home Credit Bank. Awards, branch network, points of sale HomeCredit

Bank Home Credit occupies a leading position in the Russian financial retail market. Included in the TOP-10 in terms of loans individuals ranked first in the market consumer loans at points of sale. On this page we present the main banking products of this financial institution.

All banking products

Home loan

For clearance online applications and getting a loan just a passport is enough.

Basic conditions

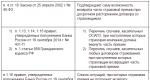

- Amount from 10,000 to 500,000 rubles for new clients

- Amount from 10,000 to 990,000 rubles for those who are already a client of the bank

- Term from 12 to 60 months

- Rate: from 7.9 - to 24%

- No certificates, only passport

Requirements for the borrower

- Age: 22 to 70 years old

- Citizenship: RF

- Permanent source of income

- Registration or place of residence in the region where the loan is granted

- Good credit history

Installment card "Freedom"

The installment card from Home Credit Bank compares favorably with competitors in that the installment plan is valid in any store, and not just in a partner store.

Installment terms from Home Credit

- Installment period - up to 10 months (for purchases in partner stores) or up to 51 days (in other stores);

- Card maintenance is free;

- SMS package - 2 months free of charge, then 99 rubles per month.

The card also has two nice bonuses.

- Skipping the next minimum payment (free of charge);

- Extension of the installment plan for 10 months (1,490 rubles).

Debit Card - Benefits

A debit card from Home Credit Bank with the possibility of free service, free cash withdrawal at any ATM in the world 5 times a month and accrual of 7% per annum on the card balance, do this card very attractive for daily use.

Main advantages

- Free card delivery by courier

- Instant replenishment of the card no commission in internet bank

- Cashback is credited with points of the Benefit program. 1 point is always 1 ruble

- Free maintenance with a balance of 10,000 rubles. or transactions in the amount of 5,000 rubles. per month, in other cases 99 rubles. per month

Basic conditions

- Annual interest rate on daily balance

- 7% - with a balance of less than 300,000 rubles and making purchases in the amount of at least 5,000 rubles per month

- 3% - for the amount exceeding 300,000 rubles and making purchases in the amount of at least 5,000 rubles per month

- 0% - in other cases

- Cashback "Benefit"

- up to 10% cashback on purchases from bank partners

- 3% - for purchases in cafes, gas stations and travel

- 1% - on any purchases

- Monthly account maintenance fee

- 0 ₽ if the amount of purchases on the card exceeds 5,000 rubles or the balance on the card exceeds 10,000 rubles, or if the card is issued as part of a payroll project

- 99 ₽ in other cases

- Additional Benefits

- 0 ₽ - replenishment of the account in the Internet bank and in the mobile application

- no commission cash withdrawals at any ATMs in the world - 5 times a month

Why Choose Home Credit?

The bank attracts clients of different social status due to the presence of a wide range of products. Here you can get a small loan to purchase goods in stores or a larger amount for personal needs. For wealthy clients, the bank has prepared offers for obtaining status cards endowed with beneficial options, such as a purchase insurance program, urgent medical or legal assistance, receiving a cashback or participating in a bonus program.

When applying for loan products, a client of Home Credit Bank can always count on participation in financial protection programs. In case of occurrence difficult situations, the bank will help to increase the loan term in order to reduce the amount of the payment, provide credit holidays or the option to skip the monthly payment.

A large proportion of the bank's customers are depositors. Opening a deposit in Home Credit Bank is beneficial due to flexible conditions, competitive interest rate. Clients can be sure of the safety and security of their funds, since all client deposits are insured according to the all-Russian system of insurance of deposits of individuals.

Assistance and participation of the bank in the social life of society

In addition to products and services in the financial field, the bank is actively involved in social life society. Continuous work is being done to improve financial literacy population - special materials for borrowers are issued. The Bank cooperates with journalists who are ready to share the best materials contributing to improving the financial literacy of Russians.

Since 2009, Home Credit has been participating in a charity program aimed at helping graduates get higher education. Assistance is provided to those children who find themselves in difficult social and economic conditions.

For almost two decades, Home Credit Bank has been constantly improving and improving its services and services, trying to meet the needs of its customers, to be reliable and profitable.

Home Credit bank resume

Home Credit Bank was founded in 1992 and over the subsequent years of work has taken one of the leading positions in Russian market in consumer lending. The network includes more than 1,000 ATMs and about 300 offices and representative offices in Russia, whose employees are always ready to provide competent advice and help in obtaining loans, credit cards and other banking products. Which is not surprising, because one of the main strategic directions for the bank is the development of customer service.

Official website of Home Credit Bank

Comments and feedback can be posted only by registered users.

.

21.10.2019 17:26

Roman, are you really stupid? Home loan offered you a deal, and you cheated on him. Through the debit card "Polza" you can pay utility bills. For a payment for any amount, the payment is only 10 rubles and no interest on the payment amount to another bank. Cashback up to 10% in addition, for purchases in stores when paying by card. So, you're wrong, Roman. Home Credit Bank is one of the best banks in the world. I have been using the services of Home Credit Bank for about 10 years and have no complaints. In addition to positive emotions, this bank does not cause anything else for me. So, I recommend Home Credit Bank to everyone.

28.07.2019 12:18

We decided to put money on the 24 Months Plus deposit. Bank office in Rostov-on-Don, Selmash ave. When opening a deposit, a bank employee informed that an additional condition for this contribution - mandatory opening“Benefit” cards, otherwise% will be at a rate of 6.5 and not 8.3%. Moreover, I have to put 10,000 rubles on it, which must be on the card for at least 1 month, then I can withdraw them and close the card. This condition seemed strange. I ask where it is written, the answer is on the site. She said several times that I don’t need another card - I just want to open a deposit. The answer is - it is necessary, otherwise a different percentage. TC deposit processing started 20 minutes before the end of the working day, there was no time to carefully read the documents and the card was opened. The bank calls almost every day and asks when I will put money on the card. I read the contract - in clause 4 “At the request of the Depositor, he MAY BE issued bank card....". I wrote to the bank’s chat - they said - we don’t understand what, it’s the issue of the “benefit” card and the deposit are not connected in any way. Those, in order to fulfill some indicators, the employee simply deceived us. We spent time issuing cards for deposits, clarifying the validity, correspondence, and we will spend more time closing unnecessary cards. Summary - next time we are unlikely to turn to this bank. Kind of disgusting.

05.10.2018 12:16

Good afternoon! I want to leave a review about the good work of the employees of Home Credit and Finance Bank LLC, located at the address: Perm, Komsomolsky prospekt 71. I have been a client of this bank quite recently, but I want to note the friendly, attentive attitude of the employees. The team is very young, but very competent specialists! Always ready to answer any question in an accessible and intelligible way, to help in resolving the financial problem that has arisen! The team is led by Yulia Bychina. I express special gratitude to her and specialist Ekaterina Kolesnikova. I wish them further success in their work! Sincerely, Kurnev AM.

Home Credit is Russian commercial Bank, which is one of the leaders in the domestic consumer lending market. Home Credit Bank also firmly takes its place in the top 5 Russian banks in terms of loans, term deposits population and the size of the branch network.

Bank history

The history of Home Credit Bank begins with the foundation in 1990 of the Technopolis Innovation Bank, which was acquired by the Home Credit Group in 2002. In the same year, the first representative office of the bank was opened in Nizhny Novgorod, first outlet and issued the first loan under the Home Credit brand in our country.

In 2003, Home Credit Bank issued the first commodity loan, and also created the first federal trading network in partnership with Technosila and began to cooperate with Eldorado. In the same year, Home Credit in Russia began its geographical expansion. 2004 was a very important year in the history of the bank's development - Home Credit issued the first credit card, joined MasterCard, entered into a contract with the Russian Post, placed points of sale in all federal districts(Besides Far East), made its first profit, became one of the leaders in the Russian POS lending market and received the first ratings from Moody’s and S&P.

In subsequent years, Home Credit Bank continued its active development. Thus, in 2005, the first cash loan was issued and the country's first transaction on the securitization of ruble loans was concluded. The year 2006 for Home Credit is marked by the entry into the mortgage market and the introduction of an anti-fraud system. The following year, the bank issued its first car loan and became a leader in the credit card market.

In 2008, Home Credit Bank stopped dealing with mortgages and car loans, and used the onset of the crisis as an opportunity for further development; also this year, the bank began to attract deposits. The following year, Home Credit actively switched to retail lending, began to engage in payroll projects, develop a network of ATMs, and launched an Internet bank and SMS bank. In 2010, the activity in the direction of car loans was resumed, and in 2012, a new simple product line was developed.

Home Credit Bank Services

To date Home credit bank offers the following types of services: loans (cash loans, Internet bank loans, car loans); cards (credit and debit); deposits (in rubles and foreign currency); salary project; individual bank safes; insurance; remote banking services; settlement and cash services; depositary operations; open market operations; lending legal entities.

Awards, branch network, points of sale HomeCredit

The high quality of work, reliability and stability of Home Credit Bank is confirmed by various awards, including the Silver Award of the "BRAND OF THE YEAR / EFFIE-2012" award. The bank's customers are already more than 27 million people, who are served in the distribution network of Home Credit Bank out of 960 bank offices, 6920 micro-offices, 1276 ATMs and more than 73 thousand points of sale.

License of the Central Bank of the Russian Federation: No. 316

About bank

Home Credit Bank was registered in 1990 under the name "Technopolis". Among the founders then were many Zelenograd enterprises, as well as the Russian Brokerage House and the Russian Oil Company. In 2002, the bank was acquired by Home Credit Finance A.S. from the Czech Republic, after which the organization was refocused on consumer lending and renamed Home Credit and Finance Bank. Home Credit has been licensed by the Central Bank since May 12, 1992, and has the right to carry out all types of banking services: carries out transactions in rubles and foreign currency, lend to the population and open deposits, sell valuable papers. The organization is included in the register of banks participating in the system compulsory insurance deposits.

The regional network of the bank includes 23 branch offices in different regions, the head office is located 125040, Moscow, st. Pravdy, d. 8, building 1. In the region, the main office is located at 125040, Moscow, st. Pravdy, d. 8, bldg. 1, opened 23 branch branches and 29 ATM cash machines.

Home Credit offers its customers a wide range of financial services. A wide range of products has been developed for individuals, including term deposits, plastic cards, both debit and credit, as well as consumer, mortgage and car loans. The Bank provides currency exchange and life insurance, purchased goods, property and investments.

Lending, settlement and cash services are available for legal entities, salary projects and financial protection. Most in demand on financial market Russian service - consumer lending. Home Credit has a wide range of programs with 34 offers. The most popular programs among clients of the organization are refinancing, mobile ur + euroset, buying on credit + window house. The minimum rate is only 7.45%. Continues the line loan products mortgage from Home Credit. The financial institution has car loan programs, minimum bid for which is 9.90.

Most often, Home Credit Bank customers choose to buy a car.

The preservation and increase of capital is of interest to many financially active citizens, and Home Credit Bank offers its customers profitable deposit programs. Among 12 deposits, the maximum bet is 8.00. Those interested in opening a deposit can pay attention to the programs 18 months Plus, Cabinet Plus, 12 months Plus.

Home Credit also issues a large number of plastic cards. Among 12 debit cards the most demanded Key in USD , WORLD , Key in EUR . The maximum bet on the balance on them is 6.00. Credit card users most often pay attention to the program Home Credit - Eldorado, Card "FAIR", Card with the benefit of Platinum. Many clients of Home Credit Bank are interested in currency exchange.

On Vyberu.Ru you will find a daily updated dollar exchange rate according to the organization's data.

Today's buying rate of the American currency is 60.18.

dollar selling rate this moment- 64.98. For those who prefer to use the EU currency, euro exchange is available. Today's euro selling rate at Home Credit Bank is 72.34, buying - 67.53.

Almost all of the liquidity raised in assets went to lending to retail clients. Benefits from the repayment of corporate loans were also used to issue retail loans. Home Credit is in 27th place in terms of assets. Extensive loan portfolio allowed the bank to take 11th place in the credit rating.