Is the balance sheet a trade secret? Can the organizational structure of an organization constitute a commercial or official secret? staffing confidential information

The tax secret is certain information available to the tax authorities on payers of taxes and fees. In its letters, the Ministry of Finance has repeatedly pointed out the need to exercise due diligence when choosing business partners.

But those who apply to the tax authorities with requests to provide data on a particular legal entity, the tax authorities say that it is impossible to disclose information, hiding behind tax secrecy.

So what kind of information relates to tax secrets, how this information should be protected, we will tell in this article.

Information protected under tax secrecy is confidential

Responsibility for disclosure of information constituting a tax secret

What information about the company is not included in the tax secret (TIN, average headcount, etc.)

What taxpayer information is tax secret?

Are tax returns a trade secret?

Subscribe to our accounting channel Yandex.Zen

Information protected under tax secrecy is confidential

Tax secrecy is assigned to a separate article of the Tax Code of the Russian Federation with the same name under number 102. Tax secrecy is a special procedure established by law for accessing and using information about taxpayers obtained by tax authorities in the course of interaction with taxpayers.

In the course of the work of companies with the tax authorities, the latter receive a lot of information that relates to the entrepreneurial activities of companies. Which, of course, leads to concerns about the safety of such information. According to Art.

102 of the Tax Code of the Russian Federation, information protected under the tax secrecy regime is secret and should not be disclosed by tax authorities and other government agencies, their employees and other persons who, due to official duties, have become aware of this information.

Responsibility for disclosure of information constituting a tax secret

Information constituting a tax secret has a special procedure for access and storage. The loss of documents containing information constituting a tax secret, as well as the disclosure of information classified as secret, entails liability of officials under the legislation of the Russian Federation, up to and including criminal liability.

Employees are not entitled to disclose information that they received in the course of their work, without the consent of the owner of this information, except in cases provided for by the Federal Law (at the request of the courts, bodies of preliminary investigation or inquiry).

It is not allowed to provide databases, archives by tax authorities, except for cases established by the legislation of the Russian Federation.

What information about the company is not included in the tax secret (TIN, average headcount, etc.)

Tax secrecy does not include information received by tax authorities and other government agencies that are classified as exceptions specified in subpara. 1–13 p. 1 art. 102 of the Tax Code of the Russian Federation. They are the following:

- Information about the taxpayer that has become publicly available, including those that have become such with his consent. In the most complete form, publicly available information is contained in an extract from the Unified State Register of Legal Entities. At present, any interested user can receive it on the website of the Federal Tax Service, indicating in the request the name and TIN or PSRN of the legal entity of interest.

- Information about violations of the payer related to tax legislation, including arrears, penalties and fines that he has.

How to find out if an individual has debts for transport tax, how to find out the amount of tax by TIN, see the article: “How to find out transport tax by TIN (without registration)?

- Information provided by the tax or law enforcement authorities of other countries, transferred within the framework of international agreements on cooperation between the indicated departments of these countries with the Russian Federation.

- Information on the application by the taxpayer of special regimes or his participation in the consolidated group of taxpayers.

- Since June 2016, the average number of employees for the previous year does not apply to data constituting a tax secret.

- From the same period, information on taxes paid, contributions and fees of the organization for the previous year is not secret. Exceptions - information on the amounts of customs fees collected within the framework of the EAEU, as well as amounts transferred as part of the obligations of a tax agent.

- Information on the amount of income and expenses for the previous year, provided to the tax authorities as part of the accounting (financial) statements.

- Since 2016, information on registration of organizations and individuals from other countries is also considered open.

What taxpayer information is tax secret?

The list of information provided to the tax authorities that is permitted for disclosure is strictly limited. This means that information not included in the above list of exceptions is included in the tax secret. This can include any information about the production processes taking place in the company, about the partners of the organization and the terms of transactions.

Under the data constituting a tax secret, are understood to include information received as part of tax audits, data received from license issuing authorities, social security institutions, medical and educational institutions, notary offices and banks.

In particular, secret information includes information contained in special declarations filed by citizens under the law “On voluntary declaration by individuals of assets and accounts (deposits) in banks ...” dated 08.06.2015 No. 140-FZ.

Are tax returns a trade secret?

Source: https://nalog-nalog.ru/spravochnaya_informaciya/kakie_svedeniya_sostavlyayut_nalogovuyu_tajnu/

Trade secret of the enterprise - what applies, information and signs

What is a trade secret? What information pertains to it? What is the punishment for an employee for violating trade secrets? What documents establish the trade secret regime at the enterprise?

A trade secret (hereinafter referred to as CT) is a regime of confidentiality of information that allows its owner to increase income, avoid unjustified expenses, maintain a position in the market for goods, works, services, or obtain other commercial benefits (clause 1, article 3 federal law dated July 29, 2004 No. 98-FZ “On Trade Secrets”, hereinafter referred to as Law No. 98-FZ).

TAX SECRET: WHAT IS IT AND WHO CAN ENCOUNTER ON IT?

What information applies to CT

The information constituting the CT may include production, technical, economic, organizational and other information of any nature that has a real (potential) commercial value, as well as information about the methods of conducting the company's professional activities (clause 2, article 3 of Law No. 98- FZ).

At the same time, in relation to such information, free access should be limited and the CT regime should be introduced (for example, by issuing an order and approving the local regulatory act of the company "Regulations on CT").

For example, information that may constitute a CT includes:

- information about the conditions of the concluded contracts;

- certain technological production processes;

- developed standards for existing business processes in the company;

- long-term plans for the development of the company;

- information about the preparation and results of negotiations with business partners of the company;

- information about business ideas and the results of their research;

- information on external and internal financing;

- information about events tax planning and tax risks.

Each company has its own list of information that makes up the CT, which is approved by the head, based on the specifics of the financial and economic activities of the company.

However, Article 5 of Law No. 98-FZ contains a list of information in respect of which the CT regime cannot be established. Such information includes:

- data in the constituent documents of the company, as well as the Unified State Register of Legal Entities and the EGRIP;

- documents giving the right to do business;

- pollution information environment, the state of fire safety, etc.;

- working conditions in the company (number, composition of employees, wage system, availability of vacancies, etc.);

- payment arrears information wages and other social payments;

- data on violations of the legislation of the Russian Federation and facts of prosecution;

- data on the list of persons entitled to act without a power of attorney on behalf of the company.

LOGO, REGISTRATION

Other regulatory documents may also contain information on the composition of information that cannot be compiled by the CT. Such information is, for example, accounting (financial) statements (clause 11, article 13 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”).

The CT mode is established in the company by taking the following actions:

- approval of the list of information constituting the CT;

- restricting access to classified information by establishing a procedure for handling this information;

- establishing a list of employees who have access to such information;

- ensuring the security of information constituting CT;

- marking “Confidential” on material media containing information or including in the details of documents;

- establishing liability for disclosure of CT.

In order to implement the requirements of the policy information security of the company, as well as the safety of the information constituting the CT, the company approves the "Regulations on the CT".

CONTRACTOR VERIFICATION

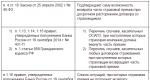

Documents relating to the regime for establishing a CT must be kept permanently in the company (Article 62 of the List, approved by order of the Ministry of Culture of the Russian Federation dated August 25, 2010 No. 558).

Punishment for disclosure of trade secrets

Disclosure of information constituting a CT is an action (inaction), as a result of which information constituting a CT, in any possible form (oral, written, other form, including using technical means) becomes known to third parties without the consent of the owner of such information, or contrary to an employment or civil law contract.

LEGAL SUPPORT FOR BUSINESS

An employment contract with an employee can be terminated in the event of a single gross violation by the employee of labor duties: disclosure of a commercial secret protected by law, which became known to the employee in connection with the performance of his labor duties, including the disclosure of personal data of another employee (clause "c" clause 6 part 1 of article 81 of the Labor Code of the Russian Federation).

As the courts note, with reference to paragraph 43 of the Decree of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2, if the employee disputes the dismissal on this basis, the employer is obliged:

- provide evidence that the information disclosed by the employee is a trade secret,

- this information became known to the employee in connection with the performance of his labor duties;

Source: https://rosco.su/press/kommercheskaya_tayna_predpriyatiya_chto_otnositsya_svedeniya_i_priznaki/

Is the VAT declaration, articles of association and report a trade secret

The question of whether the tax return data belongs to a trade secret arises, mainly, when the business entity's counterparty requires them to be available for review. Is a refusal legal in such a situation and when it is impossible to refuse, what is considered a trade secret according to the law and how should it be protected? These subtleties must be understood in order to avoid unpleasant consequences.

1. Definition of a trade secret 2. What information constitutes a tax secret 3. Is a VAT declaration a trade secret 4. Is a charter a trade secret 5. Is a tax report financial condition trade secret 6. Are salary and staffing a trade secret? 7. Data that is not a tax secret 8. Responsibility for disclosure of commercial and tax secrets

This concept and all the nuances associated with it are regulated by the Law "On Trade Secrets" dated July 29, 2004 No. 98-FZ (hereinafter - Federal Law No. 98).

According to it, any data relating to production, technical, economic, organizational and other processes occurring in a business entity that have real or theoretical commercial significance due to their unknown to other persons is considered a trade secret. Without fail, they must meet the following criteria:

- lack of free and unhindered access to them;

- their owner (taxpayer) has introduced a trade secret regime.

That is, the administration of the organization, in an order, determined a list of data constituting a trade secret, established an algorithm for their use, adherence to which is strictly controlled (Article 10, clause 1 of the Federal Law No. 98). This information is protected and without the use of certain efforts to eliminate the means of protection, it cannot be obtained.

In conjunction with industrial, commercial secrets constitute a tax secret, regulated by the provisions of Article 102 of the Tax Code.

note

At the legislative level, the special regime of industrial secrets is not established. It can be understood as any data relating to the process of making goods (Article 1465 of the Civil Code, Article 3 of the Federal Law No. 98).

What information constitutes a tax secret

Such information includes information about:

- production processes taking place in a business entity,

- his partners;

- terms of transactions;

- results of tax audits;

- details of special declarations.

Is the VAT return a trade secret?

Intelligence tax declaration are not included in the list of data not constituting a trade secret, determined by the fifth article of the Federal Law No. 98.

Based on this, VAT declarations may constitute a commercial secret, which is fixed by an economic entity in the local normative document- Regulations on trade secrets.

They may not be provided at the direct request of the counterparty, however, he may request the data of interest from the Federal Tax Service, since they are not considered tax secrets. Therefore, it is important to put on the filed tax documentation the stamp "Commercial secret".

Is the charter a trade secret?

The emphasis on the fact that the content of the constituent documentation cannot be a trade secret is made in the second paragraph of the fifth article of the Federal Law No. 98.

Moreover, some legal entities (state and municipal) are required by law to post the charter on their Internet portals (clause 6 of the order of the Ministry of Finance No. 86n).

Is the financial statement a trade secret?

Information in accounting (financial) reports cannot be a commercial secret (clause 11, article 13 of the Federal Law No. 402). This is also postulated by the order of the Ministry of Finance No. 43n, which confirms its publicity and obliges organizations to ensure the possibility of unhindered familiarization with it (paragraph 42).

Are salary and staffing a trade secret?

The fifth article of the Federal Law No. 98 indicates that the number and composition of the staff, as well as the SOT, are not a commercial secret. This is confirmed by legal practice.

Data that is not a tax secret

The Federal Tax Service may satisfy the request of the counterparty of the organization to provide the following information about it, which is not considered a commercial or tax secret in accordance with Art. 102 NK:

- publicly available information (data from the extract of the Unified State Register of Legal Entities);

- on fees, taxes and contributions paid for the previous reporting period;

note

Amounts repaid tax agents within the scope of their duties constitute an exception.

- about tax violations (including accrued penalties and imputed fines);

- on the use of special regimes;

- on the payroll number of employees for the last reporting period;

- on financial results within the framework of the balance sheet;

- on registration of organizations and individual entrepreneurs - non-residents.

Relations with contractors and government agencies on the use of information constituting a trade secret

If the information is a trade secret, counterparties may be denied access to it. However, the denial of access to it by the tax authority, performing its direct duties, will be considered unlawful (Articles 6, 15 of the Federal Law No. 98).

At the same time, the application of the com-secret regime to important data is an additional guarantee in such business relationships (Article 102 of the Tax Code). To do this, according to the sixth article of the Federal Law No. 98, it is necessary to mark documents, information from which tax inspectors should be kept secret, with a special stamp indicating the name and location (legal entities) or full name. and addresses (IP).

This information cannot be disclosed by tax authorities and other government agencies, their employees and other persons who, by virtue of official duties, have them.

Responsibility for disclosure of commercial and tax secrets

Negligent attitude to such information, their loss or disclosure causes the following responsibility of the officials responsible for this in accordance with domestic law, regardless of whether they are employees of a business entity or civil servants:

- disciplinary - a remark or reprimand, the employer has the right to dismiss the employee if the disclosure was due to his fault (Article 81 of the Labor Code);

- civil liability - not clearly defined, however, based on the general norms of civil law, the requirement of the injured party to fully compensate for the losses incurred, compensation for lost profits may be implied;

- administrative - a fine (Article 13.14 of the Code of Administrative Offenses);

- criminal - established by the Criminal Code, one hundred and eighty-third article, implies a fine, corrective or forced labor, as well as imprisonment.

note

A person who operates with secret data, but does not have sufficient grounds to consider it illegal, including those who received them erroneously or accidentally, cannot be held liable.

Civil servants cannot disclose information received from databases, archives and other documentation, without the appropriate permission of their owner, except for such cases as specified in the Federal Law, such as:

- court request;

- request of investigating or inquiring authorities.

Thus, a trade secret is regulated by a special federal law, and a tax secret that includes it is regulated by the Tax Code. These regulations regulate what information should be kept secret by both business entities and the Federal Tax Service, and what information can be publicly available.

(289 voice.,

staffing is an important and necessary local act. And first of all, it is necessary for the head of the company. In this article, I will talk in great detail about the staffing table and answer all the questions that arose in practice.

Why do you need staffing?

Staffing (SR) is used to formalize the structure of the company, its staffing. The SR performs several functions at once:

- allows you to clearly trace the organizational structure of the company;

- fixes the number of structural units and the number of staff units for each position (profession);

- allows you to trace the system of remuneration of employees of structural divisions;

- establishes and fixes the size of allowances;

- facilitates the tracking of vacancies and the selection of personnel for these vacancies;

- helps to analyze the cost of staff remuneration and the efficiency of departments in general and employees in particular.

Is it necessary to have a staffing table?

There are two points of view on the binding nature of this document. Some experts believe that the employer has the right to independently decide on the need to maintain a staffing table. But most practitioners are of the opinion that SR is mandatory.

The staffing is mentioned in articles 15 and 57 of the Labor Code of the Russian Federation and in paragraph 3.1. Filling Instructions work books. In all references, the labor function of an employee is defined either as work according to the position in accordance with the staff list, or as an indication of the profession, specialty. Therefore, if the position is defined by the employment contract (as is usually the case), then the employer must have a staffing table.

So, despite the fact that none normative act it is not said that the SHR is mandatory, we recommend that this document be drawn up. This also applies to individual entrepreneurs!

The staff list is also requested by the inspection bodies. So, the FSS encourages employers to draw up a SHR, since it serves to confirm the correctness of the calculation of insurance premiums. Pension Fund The Russian Federation has also repeatedly drawn attention to the need for HR in organizations. Often, the tax authorities, when carrying out on-site inspections ask staff.

For example, in the decision Arbitration Court of Moscow dated April 28, 2007 in case No. A40-4332 / 07-117-33 it is noted that “The Tax Code of the Russian Federation imposes on the taxpayer the obligation to submit, upon request tax authority documents and information required for tax control. The fact that employment contracts, staff lists, personal and individual cards are not documents tax accounting, does not in itself refute the obligation of the organization to have such documents and present them for the field tax audit because the information they contain may be of significant tax implications.”

What are the consequences if the company does not have a staffing table?

The lack of a staffing table is regarded by the inspection bodies as a violation under Art. 5.27 of the Code of Administrative Offenses of the Russian Federation. Under this article, the penalty:

- for an official - up to 5,000 rubles,

- for an organization - from 30,000 to 50,000 rubles.

Due to the fact that there is no clear obligation for the employer to maintain this document in the legislation, these sanctions can be challenged in court. But in practice, there are no court decisions when a fine is contested only for the absence of a SR. Usually during inspections they find a bunch of violations of labor laws. Therefore, it is difficult to say whether such an attempt will succeed or not.

Lack of staffing can lead to other problems. For example, an employer that does not have a staffing table is deprived of the opportunity to carry out a reduction in the number or staff of employees. More precisely, he can carry out a reduction, but he will not be able to document the legitimacy of his actions in the event of a dispute. Number of places to be held special assessment labor are also determined according to the staffing table.

If the employment contracts with employees indicate that they have been hired for certain positions, and there is no staff, then the employment contract will still be considered concluded, and the employee will perform the labor function stipulated by the contract.

If you accepted an employee as a position not specified in the SR, this contradiction is also always resolved in favor of the employee - he is considered accepted for the position or profession specified in the contract.

Who should develop and approve the staffing table?

The legislation does not define the circle of persons who should develop the SR. In the CEN, this duty was assigned to the labor economist. You will hardly find such a position in organizations today.

Therefore, staffing is the concern of the head of the company or entrepreneur. They can take up the compilation of the SHR on their own or assign this duty to another employee (issue an order or make an obligation to job description or employment contract).

As a rule, in small organizations, the compilation of SR is entrusted to the personnel service or accounting department. In large companies - the planning and economic department or the department of labor organization and wages.

But the head of the company or the individual entrepreneur himself approves the SHR. Labor legislation does not provide for taking into account the opinion of the representative body of employees when approving the staffing table.

AT unified form T-3, developed for the design of the ShR, was provided with a stamp of approval through an order. That is, it was proposed to approve the staffing table by order of the head.

There is no stating part in this order, and the order may begin immediately with the words “I ORDER”, since no additional explanations are required for the implementation of the SR. Although you can specify the reasons (if any) for which the approval of the new staffing is taking place.

Details of the order (number and date of registration) are transferred to the staffing table:

Please note that the dates of compilation, approval and entry into force of the staffing table may not coincide, as in our example:

- 05/18/2018 - date of compilation

- 05/21/2018 - date of approval,

- 06/01/2018 - the date of entry into force.

Taking into account the fact that wages are accrued to employees on a monthly basis, it is logical to put the staffing table into effect from the first day of the month. But if necessary, you can enter the SHR from any date you need.

How often should the staffing table be drawn up?

The law does not provide an answer to this question. Previously, it was believed that the SR is a planning document, therefore, the expediency of compiling for one year was justified. In the unified form T-3, there is even a corresponding prop “for a period”. But now economic situation changes unpredictably: one SR can be relevant for several years, or it can change three times a year.

Officials on the onlineinspektsiya.rf website in a January 2017 review explained:

“The norms of the current legislation do not establish any frequency with which the employer has the right to make changes to the staffing table. The employer has the right to change the staffing table at any time at its sole discretion.

What is a staffing arrangement?

The staffing table shows the total number of staff units (positions) and does not make it possible to determine whether a position is vacant or occupied, and which of the employees occupies it. Since this is an official document approved by order, no notes or corrections can be made on it.

In order to have an idea of the positions occupied, some companies also maintain a staffing arrangement. This is such a working version of the ShR, where in front of each position they write the name and initials of the employee who replaces it. You can also specify other information: the employee's personnel number, position status, special category (disabled person, pensioner, etc.), length of service and other information about the employee.

The staffing changes depending on the ongoing changes in the composition of the staff, it is not approved, it is not official binding document. It is rather an informational form that facilitates analysis and planning.

By the way, the shelf life of regular constellations is set. In accordance with the "List of typical managerial archival documents generated in the course of the activities of state bodies, local governments and organizations, indicating the periods of storage", approved by Order of the Ministry of Culture of Russia dated August 25, 2010 N 558 (as amended on February 16, 2016), it is 75 years after the compilation of the new ones.

How much and where are staffing tables that are no longer valid?

Staffing tables at the place of development and approval are stored permanently, that is, all the time the company exists (clause 71 of the List). After the liquidation, all documents are handed over to the municipal archive, and the expert commission of the archive will decide whether to leave your orders and staffs for long-term storage. As a rule, SR commercial organizations are of no value to history, therefore, when accepting documents of a liquidated company, they are destroyed.

In the meantime, the company (organization or individual entrepreneur) is operating, staffing tables must be stored. According to the storage rules, all applications are stored together with the document that approved them. Since SRs are approved by orders, they are filed together with these orders and stored in one file.

Algorithm for compiling and approving SR

1. Issue an order for the development of SHR(this stage may be absent if the staff is developed by the leader himself).

The order reflects following points:

it is indicated who is entrusted with leading and carrying out the work on compiling the SR,

the circle of persons who should assist in the preparation of the SR is determined,

employees are named, with whom the SHR is agreed,

the terms for drawing up, agreeing, approving the SR are established.

2.Draw up a staffing table.

3. Agree (if necessary) staffing

Sometimes, according to the Charter of the organization, mandatory coordination of the staffing table with the founders is required. But usually the draft staffing table is agreed with the heads of structural divisions and individual executives, and is checked by a lawyer.

The approval process and the list of persons with whom the staffing should be coordinated are not defined by law, as a rule, it is prescribed in the company's local regulatory act. After reviewing, they either put the visa “I agree” or “comments are attached” and attach a memo with their suggestions and comments. If significant changes are made to the project during the approval and approval process, then re-approval can be carried out.

Is the staff list a confidential document?

Paragraph 5 of Article 5 of Law No. 98-FZ explicitly states that a trade secret regime cannot be established with regard to information about the number, composition of employees, the wage system, working conditions, and the availability of vacancies.

Therefore, the SR (a document containing information on the number, composition of employees and the system of remuneration) cannot be a trade secret. The courts adhere to the same point of view (see, for example, the decision of the Federal Antimonopoly Service of the North-Western District of July 25, 2005 in case No. A13-2375 / 2004-24, the decision of the Supreme Court of the Komi Republic of April 26, 2012 No. 33-1453 / 2012).

All this allows us to say that the information provided for by the staff list is not secret by virtue of the law. Therefore, the staff list cannot be included in the List of documents containing commercial secrets.

Is the VAT declaration a trade secret? such a question arises for an organization, for example, in the case when the counterparty asks to provide the above-mentioned statements before concluding an agreement. Next, we will tell you what to do in such a situation.

VAT declaration: is tax reporting classified as a trade secret?

Law No. 98-FZ of July 29, 2004 “On Trade Secrets” (hereinafter referred to as Law No. 98-FZ) does not classify information on tax payments as data that cannot be a commercial secret of an organization (Article 5 of Law No. 98-FZ) .

Thus, the organization, if it deems it necessary, can fix in a local document - a provision on trade secrets, that such information is confidential (see clause 1, article 10 of Law No. 98-FZ).

If the counterparty asks the organization to submit this document in order to verify the reliability of the future partner, then the title page and section 1 of the VAT return with the marks of the Federal Tax Service can be submitted for analysis, which will already serve as confirmation of the organization's fulfillment of its obligations in terms of paying tax.

If the declaration is submitted to in electronic format, the counterparty can be presented unloaded from personal account in the reporting system used (for example, through the website of the Federal Tax Service), notifications from the tax authority about data entry into the general database of the Federal Tax Service or about the receipt of a declaration by the named state agency.

The counterparty, in turn, may request information on the payment of VAT by this legal entity or individual entrepreneur and in the tax office, since this data does not apply to tax secrets (subclause 3, clause 1, article 102 tax code RF). The same conclusion is confirmed by the official explanations of the Ministry of Finance of Russia (see the letter of the department dated 04.06.2012 No. 03-02-07/1-134).

Is the charter a trade secret?

In addition, documents such as TIN and OGRN, licenses, in the same way, it is unacceptable to hide and designate as confidential information. The law obliges the listed documents to be placed in the public domain for review, for example, by consumers - in the corner of the buyer (clause 1, article 9 of the RF Law "On Protection of Consumer Rights" dated February 7, 1999 No. 2300-1).

Also, some legal entities are required by law to post the charter on their website on the Internet. For example, state and municipal institutions have such an obligation (see paragraph 6 of the order of the Ministry of Finance of the Russian Federation of July 21, 2011 No. 86n).

Balance sheet - a trade secret or not?

With regard to accounting (financial) statements, the establishment of a trade secret regime is unacceptable (clause 11, article 13 of the law “On Accounting” dated 06.12.2011 No. 402-FZ).

The balance sheet is one of the components of accounting (clause 5 of the order of the Ministry of Finance of the Russian Federation of July 6, 1999 No. 43n), respectively, it cannot be a commercial secret. The same order also confirms the publicity of accounting and establishes the obligation of the organization to ensure that users can familiarize themselves with it (clause 42).

Are salary and staffing a trade secret?

According to par. 6 art. 5 of Law No. 98-FZ, information on the number and composition of employees and on the remuneration system cannot be classified as a commercial secret. At the same time, the system of remuneration means not only its type (piecework, hourly, etc.), but also the size of salaries, tariff rates, additional payments, allowances, bonuses (Article 135 of the Labor Code of the Russian Federation).

Thus, neither the size of the salary, nor the contents of the staff list are classified as commercial secrets, which is confirmed by judicial practice(for example, the decision of the Suojärvi District Court of the Republic of Karelia dated July 12, 2010 in case No. 2-340/2010).

So, neither the balance sheet, nor the content of the constituent documents, nor information about the salaries of employees (as well as the staffing table) can be a trade secret of the organization. A legal entity or individual entrepreneur is not required to submit a VAT return upon request to a counterparty, although the latter may request relevant information from the Federal Tax Service, since this information does not belong to tax secrets.

New accounting law forces trade secrets

In 2013, Federal Law No. 402-FZ dated 06.12.2011 “On Accounting” came into force. The law has radically revised the possibility of attributing financial statements to information constituting a trade secret.

Instead of the imperative construction, Part 4, Art. 10 of the Federal Law of the same name of November 21, 1996 No. 129-FZ “Content of registers accounting and internal financial statements is a trade secret”, we received an indication in Part 11 of Art. 13 of the new law "With respect to accounting (financial) statements, a trade secret regime cannot be established."

Instead of the imperative construction, Part 4, Art. 10 of the Federal Law of the same name of November 21, 1996 No. 129-FZ “Content of registers accounting and internal financial statements is a trade secret”, we received an indication in Part 11 of Art. 13 of the new law "With respect to accounting (financial) statements, a trade secret regime cannot be established."

Moreover, for financial statements, the concept of legal deposit has been introduced, which economic entities obliged to compile it (except for public sector organizations and the Bank of Russia) must submit to the authority state statistics at the place of state registration. Mandatory copies of accounting (financial) statements constitute a state information resource, to which access is provided to interested parties. Moreover, without the clause “in cases provided for by law”, but simply “to interested parties”. Access restrictions are allowed only in the interests of maintaining state secrets.

The new version of the law does not explain how to deal with the resulting conflict with Part 1 of Art. 91 of the Federal Law "On Joint Stock Companies", which allows access to accounting documents only to shareholders holding in the aggregate at least 25% of the company's voting shares.

In the event that the legislation of the Russian Federation or the agreement provides for the submission of the accounting register to another person or to a state body for hard copy, part 7 of Art. 10 obliges an economic entity, at the request of another person or a state body, to make, at its own expense, on paper copies of an accounting register drawn up in the form of an electronic document. The question of the possibility of classifying the entire register or part of it as information constituting a trade secret also hung in the air.

The new law does not contain a provision that information is accumulated in accounting registers for reflection in accounting accounts and financial statements, previously contained in Part 1 of Art. 10. Thus, there are no grounds to consider that the initial data for financial statements contained in registers cannot constitute a commercial secret. On the other hand, if information from the register is included in the reporting, one of the requirements that determine the possibility of classifying information as a commercial secret is violated - that it is legally unknown to third parties.

On the whole, the conclusion is disappointing - the financial statements and the register, which were previously “intimate9raquo; the affairs of the organization, which she had the right to close from prying eyes, become in fact publicly available (reporting) or unprotectable (register). If we were only talking about their accessibility for government agencies, this could still be taken calmly, although Federal Law No. access to it by any persons, including on unmotivated requests. But new law goes even further, establishing a blanket rule with regard to the possibility of access and referring us to other laws. And what will be the consequences of this, only time and practice of law enforcement will show.

So there is no time to be bored. Everyone who has a trade secret regime has to revise the lists of information constituting a trade secret, if this has not been done before, deal with the presence of financial statements and accounting registers in them - and urgently make adjustments. The presence in the lists of unprotectable information, the classification of which as a commercial secret is expressly prohibited by law or which does not meet the requirements of paragraph 2 of Art. 3 of the Federal Law "On Trade Secrets" (98-FZ) and Art. 1465 IV of the Civil Code of the Russian Federation, may lead to the recognition of the list as not complying with the law (i.e., without legal force) and to challenging the legitimacy of establishing a trade secret regime in general. Remember, “the trade secret regime is considered established after the owner of the information constituting a trade secret takes the measures specified in part 1 of this article” (Article 10 of the 98-FZ)? And the first among these measures is the development of a list of information constituting a commercial secret. The list has no legal force - there is no regime. And our courts, based on inner conviction, can decide a lot of things.

The network edition "X-media" is registered Federal Service on supervision in the field of communications, information technologies and mass communications.

Founder: ICS-MEDIA LLC. Chief editor: Kiy N.B.

"Personnel officer. ru", 2012, N 7

LIST OF CONFIDENTIAL INFORMATION

In any company there is confidential information, which is especially carefully protected from employees who do not have access to it, as well as competitors and suppliers. At the same time, it is quite difficult to determine the degree of data secrecy. As a result, all information related to the activities of the organization is considered confidential. As a result, litigation arises both with employees and with other companies.

A list of relevant data is given in several legislative acts, however, the company can independently restrict access to some information. At the same time, the main document that makes it possible to determine whether information is classified as confidential is Federal Law No. 98-FZ of July 29, 2004 "On Commercial Secrets" (hereinafter - Law No. 98-FZ). However, the list contained in this Law is incomplete, and other information about confidential information is contained in other regulatory legal acts.

List of confidential data,

defined by law

|

View |

List of information |

Legislative |

|

Information, |

Information of any kind |

Article 3 |

|

banking |

Information about transactions, accounts and |

Article 26 |

|

Advocate |

Information related to the provision |

Basics |

|

Intelligence, |

Any information and documents received |

Article 9 |

In practice, the confidentiality regime is determined by:

A list of information constituting a trade secret; a list of confidential information in the organization;

Contractual regulation of relations with employees;

Contractual regulation of relations with counterparties by establishing the relevant provisions in the contract;

By applying restrictive marks and a confidentiality stamp to material carriers of confidential information indicating its owner.

In addition to these measures, the company may, if necessary, apply means and methods of technical protection of confidential information, as well as other measures that do not contradict the legislation of the Russian Federation.

The trade secret regime cannot be established in relation to the following information:

On environmental pollution, the state of fire safety, the sanitary-epidemiological and radiation situation, food safety and other factors that have negative impact to ensure the safe operation of production facilities, the safety of every citizen and the safety of the population as a whole;

On the number and composition of employees, the system of remuneration, on working conditions, including labor protection, on indicators occupational injury and occupational morbidity, the availability of vacancies;

On the debt of employers for the payment of wages and other social benefits;

About violations of the legislation of the Russian Federation and the facts of bringing to responsibility for their commission;

On the size and structure of income of non-profit organizations, on the size and composition of their property, on their expenses, on the number and remuneration of their employees, on the use of unpaid labor of citizens in the activities of a non-profit organization;

On the list of persons entitled to act without a power of attorney on behalf of a legal entity;

Information, the mandatory disclosure of which or the inadmissibility of restricting access to which is established by federal laws before the entry into force of Law N 98-FZ.

Consider the procedure for establishing a list in a particular company.

How to deal with an employee

divulging confidential information?

In many companies, the following measures are applied to an employee who discloses classified information: they impose a disciplinary sanction, recover damages in court. Some employers simply fire the offenders, believing that the dissemination of confidential information is a serious offense. Indeed, there is such a possibility. According to paragraphs. "c" p. 6 h. 1 art. 81 of the Labor Code of the Russian Federation, an employment contract can be terminated by the employer even in the event of a single disclosure of a trade secret that has become known to the employee in connection with the performance of his labor duties.

In the event of a dispute regarding the reinstatement of a person dismissed on the basis under consideration, it is the employer who bears the burden of proving all the circumstances of the disclosure of trade secrets. It is necessary to carefully consider all the circumstances of a particular case, analyze whether there are legal grounds for dismissing an employee suspected of disclosing confidential information, and also assess the possible risks if the employee disputes the dismissal.

Let's take the following example: an employee used a flash drive to print a document on a printer. However, the employer considered these actions to be the disclosure of trade secrets, since the ban on the use of a flash drive to transfer confidential information was contained in a local act. However, the organization did not have an exact list of such classified data. As a result, the employee turned to the labor inspectorate, and after the check, he managed to achieve the removal of the disciplinary sanction.

Thus, when imposing a disciplinary sanction, the employer must:

Prove that the employee caused material harm to the organization;

Establish that the employee disclosed confidential data included in the list;

Confirm the fact of disclosure and familiarization of the employee with the list of confidential information.

If the company wants to recover damages in court (for example, the manager quit and sold the confidential database to competitors), then it will be necessary to assess the material damage. Key condition, allowing to form an evidence base, is the presence of a list of confidential information.

List of confidential information

in a separate organization

Each organization has its own list of confidential information. As a rule, it includes:

Information about production and management;

Data on the level of wages of employees;

Personal data of employees;

Management decisions, production development plans, investment programs;

Meeting minutes;

Confidential agreements;

Information about the negotiations;

Information about personnel composition, staffing;

Cost and prices;

Accounting reporting, primary documentation;

Information about taxes and fees paid;

Auditors' reports.

Please note: personal data and confidential information are not equivalent concepts. The latter is broader and may include various financial statements, data on the personnel of the organization and other information that is protected by the company in accordance with the established trade secret regime.

Information constituting a trade secret (production secret) is information of any nature (production, technical, economic, organizational, and others), including the results of intellectual activity in the scientific and technical field, as well as information about the methods of carrying out professional activities that have actual or potential commercial value due to their being unknown to third parties, to which third parties do not have free access on a legal basis and in respect of which the owner of such information has introduced a trade secret regime. Disclosure of information constituting a trade secret is an action or inaction, as a result of which such information in any possible form (oral, written, otherwise, including using technical means) becomes known to third parties without the consent of the owner or contrary to labor or civil legal contract (Determination of the Moscow City Court dated November 14, 2011 in case N 33-36486).

The concept of personal data is established in the Federal Law of July 27, 2006 N 152-FZ "On Personal Data". This is any information relating directly or indirectly to a specific or identifiable natural person (subject of personal data).

That is, if confidential information can apply to both individuals and legal entities, personal data - only to individuals. The list of confidential data classified as such at the legislative level is given in the appendix.

It is necessary to pay attention to the fact that information recognized by the company as confidential may not be classified as such. Confidential documents may be classified as financial statements provided to the company's members for information only (Resolution of the Federal Antimonopoly Service of the Volga District dated 05.04.2005 N A12-12462 / 04-C56). A similar conclusion was made in the Decree of the Federal Antimonopoly Service of the Far Eastern District dated 05/16/2007, 05/08/2007 N F03-A73 / 07-1 / 1090 in case N A73-9822 / 2006-9, in which the court recognized that neither the norms of the Federal Law of 11.21. .1996 N 129-FZ "On accounting", no art. 89 of the Federal Law of December 26, 1995 N 208-FZ "On Joint Stock Companies" does not provide for the mandatory provision to the shareholder of copies of primary accounting documents, turnover sheets of analytical accounting and an electronic database accounting program society. At the same time, for example, information about the fulfillment by taxpayers of their obligations to pay taxes is not a tax secret and can be disclosed (Resolution of the Federal Antimonopoly Service of the West Siberian District of July 27, 2010 in case N A27-25441 / 2009).

Thus, the employer must independently draw up a list of confidential information and establish it in an administrative document, depending on the importance of this information. However, the recognition of data as confidential can be challenged in court. Wherein important point are also not only the establishment of the list of confidential information, but also the procedure for its protection.

Procedure for protecting confidential information

In accordance with Art. 10 of Law N 98-FZ, measures to protect the confidentiality of information taken by its owner should include:

Determining the list of data constituting a trade secret;

Restriction of access to such information by establishing a procedure for handling them and monitoring compliance with this procedure;

Accounting for persons who have gained access to confidential information, and (or) persons to whom it was provided or transferred;

Regulation of relations on the use of data constituting a commercial secret by employees on the basis of employment contracts and contractors on the basis of civil law contracts;

Putting on material media containing confidential information, or including in the details of documents containing such information, the stamp "Commercial secret" indicating the owner of such information.

In order to protect the confidentiality of information, the employer must:

Familiarize, against receipt, the employee who needs access to such information to perform work duties with a list of information constituting a trade secret, owned by the employer and his counterparties;

To familiarize the employee against receipt with the trade secret regime established by the employer and with the measures of responsibility for its violation;

Create the necessary conditions for the employee to comply with the established regime (Article 11 of Law N 98-FZ).

The employment contract with the head of the organization should provide for the obligation of this employee to ensure the confidentiality of information owned by the organization and its counterparties, and responsibility for appropriate measures.

Recognition of data as confidential

can be challenged in court

In doing so, the company can take the following actions:

Implementation of a permit system for the access of performers (users, maintenance personnel) to information and related works and documents;

Restriction of access of personnel and unauthorized persons to protected premises and premises where informatization and communication facilities are located, as well as information carriers are stored;

Meeting transcripts;

Differentiation of access of users and maintenance personnel to information resources, software tools for processing (transfer) and data protection;

Accounting and secure storage paper and machine carriers of information, keys (key documentation) and their circulation, excluding their theft, substitution and destruction;

Redundancy of technical means and duplication of arrays and storage media;

Protection against copying of information, the use of certified means of its protection;

Use of secure communication channels;

Cryptographic transformation of data processed and transmitted by means of computer technology and communications.

It is very important to establish in the local act of the organization not only a list of confidential information, but also the procedure for their use.

In relations with employees, companies usually use two tactics: protection of interests in court, protection of interests in pre-trial order by terminating the contract with the employee. Let's consider the first way. As an example, we can cite the Decision of the Moscow City Court dated 12/22/2011 in case N 4g / 8-10945 / 11. Resolving the stated claims, guided by Article. 81 of the Labor Code of the Russian Federation, the Federal Law "On Commercial Secrets", the court concluded that the plaintiff's dismissal was legal and justified, since he divulged a commercial secret. The plaintiff sent to the address of a third-party organization e-mail documents to which third parties did not have free access and in respect of which the employer has introduced a trade secret regime.

In court, the company proved the following facts: familiarization of the employee with the regulation "On Commercial Secrets", compliance with the procedure for bringing to disciplinary responsibility, the fact of sending documents to the address of the deputy CEO third-party organization - data on counterparties, information on the terms and methods of providing services, the amount of remuneration.

But, if confidential information is not transferred to third parties, the fact of copying information without transferring it to third parties cannot be regarded as disclosure. So, in the Ruling dated 12.12.2011 in case N 4g / 8-10961 / 2011, the Moscow City Court concluded that the information copied by the plaintiff onto a flash card was a trade secret of the company, however, evidence that this information was transmitted by her third parties, the defendant's side did not present, and the plaintiff denied the commission of such actions. The court also did not receive evidence that the plaintiff forwarded the specified information to the e-mail boxes of third parties, as well as the facts of placement on the Internet. When inspecting the plaintiff's home computer and removing the copied information from it, the defendant did not record such facts. There was no mention of this in the act of deleting information. The actions of an employee, as a result of which the specified information becomes available to other employees who monitor compliance with the trade secret regime in the organization, cannot be qualified under paragraphs. "c" p. 6 h. 1 art. 81 of the Labor Code of the Russian Federation. In such circumstances, when confidential information has not been disclosed to third parties, individual can be reinstated at work with the payment of compensation for the time of forced absenteeism.

Dissemination of unclassified information is not a disclosure of confidential information. This conclusion follows from the ruling of the Moscow City Court dated November 14, 2011 in case No. 33-36486. The court came to the conclusion that information about the availability of equipment, its cost, data on distributors does not represent a trade secret, since it is placed in price lists, catalogs and booklets. Thus, confidentiality was not violated. A similar conclusion was made by the Moscow City Court in the Ruling dated 10/18/2011 in case No. 33-33741. In resolving the dispute and partially satisfying the claims, the court reasonably proceeded from the fact that the obligation to prove the existence of a legal basis for dismissal and compliance with the established procedure for dismissal rests with the employer. The employer did not provide either evidence that the B2B system contained confidential information or evidence that the plaintiff disseminated data constituting a trade secret.

Of course, many companies cannot prove their case in court, since the regulatory framework does not contain a specific list of documents that can be used to confirm losses associated with the illegal disclosure of confidential information. In addition, it is very difficult to assess exactly the material component, for example, leaks of information about counterparties or financial indicators, as well as the very fact of disclosure. After all, disclosure can be carried out both in writing and orally. In this regard, many companies are forced to use such methods of punishing negligent employees as disciplinary sanctions.

However, sometimes companies prefer not to wash dirty linen in public and part with such employees in an amicable way. In such situations, it is preferable to issue a dismissal by agreement of the parties, provided for in Art. 78 of the Labor Code of the Russian Federation. One of the significant advantages is that it is almost impossible to challenge such a dismissal, since there is a mutual agreement between the parties.

In conclusion, it should be noted that the integrity of the trade secret, the protection of the interests of the organization and the possibility of restoring justice in court depend on how clearly the company defines the list of confidential information, as well as the procedure for their protection.

Application

Example of a list of confidential data

List of information classified as confidential

(official) information in the central office

federal agency railway transport

and subordinate enterprises and institutions,

approved Order of the Federal Agency

railway transport dated 24.01.2011 N 18

|

Information classified as confidential (official) information |

|

|

I. Information about sectoral management activities |

|

|

Separate materials of the meetings of the Federal Agency for Railway |

|

|

Information (information) prepared by Roszheldor for incoming from |

|

|

Information about the organization of work, about specific measures or ongoing |

|

|

II. Information about administrative and economic activities |

|

|

Information about the personal data of an employee of Roszheldor contained in |

|

|

Information obtained during the admission of a citizen to the state |

|

|

Information about the employee's awareness of information constituting |

|

|

Minutes of meetings of tender commissions for holding tenders for |

|

|

Acts of inspections of the activities of territorial departments and |

|

|

Information about the staffing of Roszheldor |

|

|

Information about the location of structural units in the building |

|

|

Minutes of the meetings of the housing commission |

|

|

Minutes of the meetings of the competition commission for holding |

|

|

III. Information about the regime of secrecy, mobilization preparation, |

|

|

Acts of inspections to ensure access control in the administrative |

|

|

Information on the results of the vulnerability assessment of transport facilities |

|

|

Information that is information resources unified state |

|

|

IV. Data protection information |

|

|

Information about the organization of the processing of service information on the means |

|

|

Information that reveals the organization, state of information protection, or |

|

|

Information about methods, means or effectiveness (status of protection) |

|

|

Generalized information contained in the scheme of local computing |

|

|

Information about specific ongoing and (or) planned activities to |

|

|

V. Other information |

|

|

Information about the organization, state or location of engineering systems |

|

|

Information disclosing the content of plans and specific measures for |

|

|

Data of security video surveillance, fixation of the security system of the premises, |

E. Shestakova

CEO

"Actual Management" LLC

Signed for print

A trade secret is a regime of confidentiality of information that allows its owner, under existing or possible circumstances, to increase income, avoid unjustified expenses, maintain a position in the market for goods, works, services, or obtain other commercial benefits. The regime of a trade secret is established by its owners, i.e. persons who carry out entrepreneurial activity (legal entities and individual entrepreneurs)

Relations related to the establishment, change and termination of the trade secret regime are regulated by the provisions of Federal Law No. 98-FZ of July 29, 2004 “On Trade Secrets” (hereinafter referred to as Law No. 98-FZ).

trade secret- this is a regime of confidentiality of information that allows its owner, under existing or possible circumstances, to increase income, avoid unjustified expenses, maintain a position in the market for goods, works, services, or obtain other commercial benefits. The trade secret regime is established by its owners, that is, persons engaged in entrepreneurial activities (legal entities and individual entrepreneurs).

One of the mandatory measures to protect data confidentiality is the development and approval of the List of Information, which determines exactly what information the employer will protect by all legal means available to him.

At the same time, information constituting a trade secret, in accordance with paragraph 2 of Art. 3 of Law No. 98-FZ, an entrepreneur has the right to include information of any nature (production, technical, economic, organizational and others), including the results of intellectual activity in the scientific and technical field, as well as information about the methods of carrying out professional activities that have a valid or potential commercial value due to their being unknown to third parties, to which third parties do not have free access on a legal basis and in respect of which the owner of such information has introduced a trade secret regime.

Attention:

A trade secret is protected by law, regardless of the type of medium on which it is recorded.

Well, since we are talking about “information of any nature”, it turns out that the staff list can be safely attributed to documents containing commercial secrets ...

But it was not there! As always, from general rule exceptions are provided. In particular, Article 5 of Law No. 98-FZ lists information that cannot be a trade secret. And this means that the employer does not have the right to establish a confidentiality regime in relation to them, including cannot include them in the List of information constituting a trade secret.

So, data is not a trade secret:

- contained in the constituent documents of a legal entity, documents confirming the fact of making entries about legal entities and individual entrepreneurs in the relevant state registers;

- contained in the documents giving the right to carry out entrepreneurial activities;

- on the composition of the property of a state or municipal unitary enterprise, public institution and on their use of funds from the respective budgets;

- on environmental pollution, the state of fire safety, the sanitary-epidemiological and radiation situation, food safety and other factors that have a negative impact on ensuring the safe operation of production facilities, the safety of each citizen and the safety of the population as a whole;

- on the number, on the composition of employees, on the system of remuneration, on working conditions, including labor protection, on indicators of industrial injuries and occupational morbidity, on the availability of vacancies;

- on employers' debts for wages and other social benefits;

- about violations of the legislation of the Russian Federation and the facts of bringing to responsibility for these violations;

- on the terms of tenders or auctions for the privatization of objects of state or municipal property;

- on the size and structure of income of non-profit organizations, on the size and composition of their property, on their expenses, on the number and wages of their employees, on the use of unpaid labor of citizens in the activities of a non-profit organization;

- on the list of persons entitled to act without a power of attorney on behalf of a legal entity;

- the mandatory disclosure of which or the inadmissibility of restricting access to which is established by other federal laws.

As you can see, in paragraph 5 of Art. 5 of Law No. 98-FZ explicitly states that the trade secret regime cannot be established by persons engaged in entrepreneurial activities in relation to information about the number and composition of employees, the wage system, working conditions, including labor protection, indicators occupational injuries and occupational morbidity, the availability of vacancies.

Therefore, it is not necessary to talk about a trade secret in relation to the staffing table - a document containing information on the number, composition of employees and the wage system.

The courts take the same view.

EXAMPLE

The regional court upheld the decision of the district court, which in favor of S., dismissed under paragraph 2 of Art. 278 of the Labor Code of the Russian Federation, the compensation provided for in Art. 279 of the Labor Code of the Russian Federation. Since the amount of compensation was not agreed upon by the parties when concluding the employment contract, the court determined it in the amount established by law. At the same time, the court indicated, in particular, that S.'s actions to disseminate information contained in the Company's staff list cannot be qualified as guilty disclosure of trade secrets, since, by virtue of the provisions of Art. 57 of the Labor Code of the Russian Federation, art. 4, paragraph 5 of Art. 5, part 1, art. 10 of Law No. 98-FZ, the content of the staffing table cannot be classified as information constituting a trade secret.

Conclusion that the staffing by virtue of a direct indication of paragraph 5 of Art. 5 of Law No. 98-FZ does not apply to documents containing commercial secrets, is reflected in other judgments(See, for example, the decision of the Federal Antimonopoly Service of the North-Western District of July 25, 2005 in case No. A13-2375 / 2004-24, the decision of the Supreme Court of the Komi Republic of April 26, 2012 No. 33-1453 / 2012).