Fiscal policy. Fiscal policy of the state. Types of state fiscal policy Fiscal policy in market conditions

Fiscal policy, its goals and instruments

Fiscal policy is the measures taken by the government to stabilize the economy by changing the amount of government budget revenues and/or expenditures. (This is why fiscal policy is also called fiscal policy.)

The goals of fiscal policy, like any stabilization (countercyclical) policy aimed at smoothing out cyclical fluctuations in the economy, are to ensure: 1) stable economic growth; 2) full employment of resources (primarily solving the problem of cyclical unemployment); 3) stable price level (solving the problem of inflation).

Fiscal policy is the government's policy of regulating, first of all, aggregate demand. Regulation of the economy in this case occurs by influencing the amount of total expenditures. However, some fiscal policy instruments can be used to influence aggregate supply through influencing the level of business activity. Fiscal policy is carried out by the government.

The instruments of fiscal policy are expenditures and revenues of the state budget, namely: 1) government procurement; 2) taxes; 3) transfers.

Impact of fiscal policy instruments on aggregate demand

The impact of fiscal policy instruments on aggregate demand varies. From the aggregate demand formula: AD = C + I + G + Xn it follows that government purchases are a component of aggregate demand, therefore their change has a direct impact on aggregate demand, and taxes and transfers have an indirect effect on aggregate demand, changing the amount of consumer spending ( C) and investment costs (I).

At the same time, the growth of government purchases increases aggregate demand, and their reduction leads to a decrease in aggregate demand, since government purchases are part of aggregate expenditures.

An increase in transfers also increases aggregate demand. On the one hand, since with an increase in social transfer payments (social benefits), the personal income of households increases, and, therefore, other things being equal, disposable income increases, which increases consumer spending. On the other hand, an increase in transfer payments to firms (subsidies) increases the possibilities of internal financing of firms and the possibility of expanding production, which leads to an increase in investment costs. A reduction in transfers reduces aggregate demand.

Tax increases work in the opposite direction. An increase in taxes leads to a decrease in both consumer spending (as disposable income is reduced) and investment spending (as retained earnings, which is the source of net investment, are reduced) and, therefore, to a reduction in aggregate demand. Accordingly, tax cuts increase aggregate demand. Tax cuts lead to a shift of the AD curve to the right, which causes an increase in real GNP.

Therefore, fiscal policy instruments can be used to stabilize the economy at different phases of the economic cycle.

Moreover, from the simple Keynesian model (the “Keynesian cross” model) it follows that all instruments of fiscal policy (government purchases, taxes and transfers) have a multiplier effect on the economy, therefore, according to Keynes and his followers, regulation of the economy should be carried out by the government with using the tools of fiscal policy, and above all by changing the amount of government purchases, since they have the greatest multiplier effect.

Depending on the phase of the cycle in which the economy is located, fiscal policy instruments are used differently. There are two types of fiscal policy: 1) stimulating and 2) contractionary.

Expansionary fiscal policy is applied during a recession (Figure 10.1(a)), aims to reduce the recessionary output gap and reduce the unemployment rate and is aimed at increasing aggregate demand (aggregate expenditure). Its tools are: a) increasing government procurement; b) tax reduction; c) an increase in transfers. Contractionary fiscal policy is used during a boom (when the economy overheats) (Fig. 10.1.(b)), aims to reduce the inflationary output gap and reduce inflation and is aimed at reducing aggregate demand (aggregate expenditures). Its tools are: a) reduction of government procurement; b) increase in taxes; c) reduction in transfers.

In addition, fiscal policy is distinguished: 1) discretionary and 2) automatic (non-discretionary). Discretionary fiscal policy is a legislative (official) change by the government in the amount of government purchases, taxes and transfers in order to stabilize the economy.

Automatic fiscal policy is associated with the action of built-in (automatic) stabilizers. Built-in (or automatic) stabilizers are instruments whose value does not change, but the very presence of which (their integration into the economic system) automatically stabilizes the economy, stimulating business activity during a recession and restraining it during overheating. Automatic stabilizers include: 1) income tax (including both household income tax and corporate income tax); 2) indirect taxes (primarily value added tax); 3) unemployment benefits; 4) poverty benefits.

Let's consider the mechanism of the impact of built-in stabilizers on the economy.

The income tax works as follows: during a recession, the level of business activity (Y) decreases, and since the tax function has the form: T = tY (where T is the amount of tax revenue, t is the tax rate, and Y is the amount of total income (output)), then the amount of tax revenue decreases, and when the economy “overheats”, when the actual output is at its maximum, tax revenue increases. Note that the tax rate remains unchanged. However, taxes are withdrawals from the economy that reduce the flow of expenses and, therefore, income (remember the circular model). It turns out that during recession the withdrawals are minimal, and during overheating they are maximum. Thus, due to the presence of taxes (even lump sum, i.e. autonomous), the economy automatically “cools down” when it overheats and “heats up” during a recession. As was shown in Chapter 9, the appearance of income taxes in the economy reduces the value of the multiplier (the multiplier in the absence of an income tax rate is greater than in its presence: >), which enhances the stabilizing effect of the income tax on the economy. It is obvious that a progressive income tax has the strongest stabilizing effect on the economy.

Value Added Tax (VAT) provides built-in stability in the following ways. During a recession, sales volume decreases, and since VAT is an indirect tax, part of the price of a product, when sales volume falls, tax revenues from indirect taxes (withdrawals from the economy) decrease. In overheating, on the contrary, as total incomes rise, sales volume increases, which increases indirect tax revenues. The economy will automatically stabilize.

As for unemployment and poverty benefits, the total amount of their payments increases during a recession (as people begin to lose their jobs and become poor) and decreases during a boom, when there is “overemployment” and rising incomes. (Obviously, to receive unemployment benefits, you need to be unemployed, and to receive poverty benefits, you need to be very poor). These benefits are transfers, i.e. injections into the economy. Their payment contributes to the growth of income, and, consequently, expenses, which stimulates economic recovery during a recession. A decrease in the total amount of these payments during a boom has a restraining effect on the economy.

In developed countries, the economy is regulated by 2/3 through discretionary fiscal policy and 1/3 by the action of built-in stabilizers.

The Impact of Fiscal Policy Instruments on Aggregate Supply

It should be borne in mind that fiscal policy instruments such as taxes and transfers act not only on aggregate demand, but also on aggregate supply. As noted, tax cuts and increased transfers can be used to stabilize the economy and combat cyclical unemployment during recessions, stimulating growth in aggregate spending and hence business activity and employment. However, it should be borne in mind that in the Keynesian model, simultaneously with the growth of aggregate output, the reduction of taxes and the growth of transfers causes an increase in the price level (from P1 to P2 in Fig. 10-1(a)), i.e. is a pro-inflationary measure (provokes inflation). Therefore, during a boom period (inflationary gap), when the economy is “overheated” (Fig. 10-1(b)), an increase in taxes can be used as an anti-inflationary measure (the price level decreases from P1 to P2) and tools for reducing business activity and stabilizing the economy and reduction in transfers.

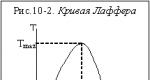

However, since firms view taxes as costs, an increase in taxes leads to a reduction in aggregate supply, and a decrease in taxes leads to an increase in business activity and output. A detailed study of the impact of taxes on aggregate supply belongs to the economic adviser to US President R. Reagan, an American economist, one of the founders of the concept of “supply-side economics” Arthur Laffer. Laffer constructed a hypothetical curve (Fig. 10-2.), with the help of which he showed the impact of changes in the tax rate on the total amount of tax revenues to the state budget. (This curve is called hypothetical because Laffer made his conclusions not on the basis of an analysis of statistical data, but on the basis of a hypothesis, i.e. logical reasoning and theoretical inference).

Using the tax function: T = t Y, Laffer showed that there is an optimal tax rate (t opt.), at which tax revenues are maximum (T max.). If the tax rate is increased, the level of business activity (aggregate output) will decrease and tax revenues will decrease because the tax base (Y) will decrease. Therefore, in order to combat stagflation (a simultaneous decline in production and inflation), Laffer in the early 80s proposed a measure such as reducing the tax rate (both income and corporate profits).

The fact is that, in contrast to the impact of tax cuts on aggregate demand, which increases production volume but provokes inflation, the impact of this measure on aggregate supply is anti-inflationary in nature (Fig. 10.3), i.e. production growth (from Y1 to Y*) is combined in this case with a decrease in the price level (from P1 to P2).

Advantages and disadvantages of fiscal policy

The advantages of fiscal policy include:

- Multiplier effect. All fiscal policy instruments, as we have seen, have a multiplier effect on the value of equilibrium aggregate output.

- No external lag (delay). External lag is the period of time between the decision to change a policy and the appearance of the first results of its change. When the government decides to change fiscal policy instruments, and these measures come into effect, the result of their impact on the economy manifests itself quite quickly. (As we will see in Chapter 13, an external lag is characteristic of monetary policy that has a complex transmission mechanism (monetary transmission mechanism)).

- Availability of automatic stabilizers. Since these stabilizers are built-in, the government does not need to take special measures to stabilize the economy. Stabilization (smoothing out cyclical fluctuations in the economy) occurs automatically.

Disadvantages of fiscal policy:

1. Displacement effect. The economic meaning of this effect is as follows: an increase in budget expenditures during a recession (increase in government purchases and/or transfers) and/or a reduction in budget revenues (taxes) leads to a multiplicative increase in total income, which increases the demand for money and increases the interest rate on money market (loan price). And since loans are primarily taken out by firms, an increase in the cost of loans leads to a reduction in private investment, i.e. to “crowding out” part of the investment expenditures of firms, which leads to a reduction in output. Thus, part of total output is “crowded out” (underproduced) due to a reduction in private investment spending as a result of rising interest rates due to the government's expansionary fiscal policy.

2. Presence of internal lag. The internal lag is the period of time between the need to change a policy and the decision to change it. Decisions on changing fiscal policy instruments are made by the government, but their implementation is impossible without discussion and approval of these decisions by the legislative body (Parliament, Congress, State Duma, etc.), i.e. giving them the force of law. These discussions and agreements may require a long period of time. In addition, they come into effect only from the next financial year, which further increases the lag. During this period of time, the economic situation may change. So, if initially there was a recession in the economy, and stimulating fiscal policy measures were developed, then at the moment they begin to take effect, the economy may already begin to recover. As a result, additional stimulation may lead the economy to overheat and provoke inflation, i.e. have a destabilizing effect on the economy. Conversely, contractionary fiscal policies designed during a boom may, due to the presence of a long internal lag, worsen a recession.

3. Uncertainty. This shortcoming is characteristic not only of fiscal, but also of monetary policy. The uncertainty concerns:

- problems of identifying the economic situation It is often difficult to accurately determine, for example, the moment when a period of recession ends and recovery begins, or the moment when a recovery turns into overheating, etc. Meanwhile, since at different phases of the cycle it is necessary to apply different types of policies (stimulating or restrictive), an error in determining the economic situation and choosing the type of economic policy based on such an assessment can lead to destabilization of the economy;

- the problem of exactly how much the instruments of public policy should be changed in each given economic situation. Even if the economic situation is determined correctly, it is difficult to determine exactly how much, for example, it is necessary to increase government purchases or reduce taxes in order to ensure an economic recovery and reach the potential output, but not exceed it, i.e. How to prevent overheating and acceleration of inflation. And vice versa, when implementing a contractionary fiscal policy, how not to lead the economy into a state of depression.

4. Budget deficit. Opponents of Keynesian methods of regulating the economy are monetarists, supporters of supply-side economics and rational expectations theory - i.e. Representatives of the neoclassical trend in economic theory consider the state budget deficit to be one of the most important shortcomings of fiscal policy. Indeed, the instruments of stimulating fiscal policy, carried out during a recession and aimed at increasing aggregate demand, are an increase in government purchases and transfers, i.e. budget expenditures, and tax reduction, i.e. budget revenues, which leads to an increase in the state budget deficit. It is no coincidence that the recipes for government regulation of the economy that Keynes proposed were called “deficit financing.”

The problem of the budget deficit became especially acute in most developed countries that used Keynesian methods of regulating the economy after World War II, in the mid-70s, and in the United States the so-called “twin debts” arose, in which the government deficit The budget was combined with a balance of payments deficit. In this regard, the problem of financing the state budget deficit has become one of the most important macroeconomic problems.

Macroeconomic regulation of the economy includes two components:

1. Monetary policy (see earlier);

2. Budgetary and tax policy of the state (fiscal policy) is a set of government measures to regulate public spending and taxation.

Fiscal policy- is state regulation of the economy, carried out by the government through taxes and government spending. The goal of fiscal policy is to accelerate economic growth; control over employment and inflation; counteracting economic crises and smoothing them out.

Levers of fiscal policy:

1. Changes in tax rates;

2. Changes in the volume of government procurement;

3. Change in the volume of transfers.

Depending on the phase in which the economy is located, there are two types of fiscal policy:

1. Stimulating;

2. Containing.

Expansionary fiscal policy used during a decline in production, during times of high unemployment, and low business activity. Aimed at increasing production and employment through: 1. increasing government purchases and transfers, 2. reducing taxes.

Schematically, the effect of the incentive policy is as follows:

Action 1: government procurement increases. As a result, aggregate demand grows and production volume increases.

Act 2 Taxes are reduced. As a result, aggregate supply increases, while the price level decreases.

Restrictive policy used during periods of economic recovery. Aimed at curbing business activity, reducing production volumes, eliminating excess employment, and reducing inflation through:

1. Reductions in government purchases and transfers;

2. Tax increases.

Schematically, the effect of the containment policy is as follows:

1. Action: government purchases are reduced. As a result, aggregate demand decreases and production volume decreases.

2. Action. Taxes are increasing. As a result, aggregate supply from entrepreneurs and aggregate demand from households decrease, while the price level increases.

Depending on the way fiscal policy instruments influence the economy, there are:

1. Discretionary fiscal policy;

2. Automatic (non-discretionary) fiscal policy.

Discretionary fiscal policy represents conscious legislative change government of the magnitude of government purchases (G) and taxes (T) in order to stabilize the economy. These changes are reflected in the state budget.

When working with the “public procurement” tool, a multiplier effect may occur. The essence of the multiplier effect is that an increase in government. spending in the economy leads to an increase in national income by b O a larger value (multiple multiplier expansion of national income).

State multiplier formula procurement":

Y=1=1

G 1 - MPC MPS

where, ?Y is the increase in income; ?G - growth of government procurement; MPC - marginal propensity to consume; MPS is the marginal propensity to save.

Hence?Y G = 1 ? ?G

The influence of taxes on the volume of national income is carried out through the mechanism of the tax multiplier. The tax multiplier has a much smaller effect on reducing aggregate demand than the government spending multiplier on increasing it. An increase in taxes leads to a reduction in GDP (national income), and a decrease in taxes leads to its growth.

The essence of the multiplier effect is that when taxes are reduced, there is a multiple (multiplier) expansion of total income and planned expenses on the part of consumers and an increase in investment in production on the part of entrepreneurs.

Tax multiplier formula:

Y = - MRS = - MRS

T MPS 1 - MRS

where, ?T - tax increase

Hence?Y T = - MRS ? ?T

Both instruments can be used simultaneously (combined fiscal policy). Then the multiplier formula takes the form:

Y = ?Y G + ?Y T = ?G ? (1 - MRS) / (1 - MRS) = ?G ? 1

A combination policy can result in either a budget deficit (if the country is in economic recession) or a budget surplus (if the country is in economic expansion).

The disadvantage of discretionary fiscal policy is that:

1. There is a time lag between decisions and their impact on the economy;

2. There are administrative delays.

In practice, the level of government spending and tax revenues may change even if the government does not make appropriate decisions. This is explained by the existence of built-in stability, which determines automatic (passive, non-discretionary) fiscal policy. Built-in stability is based on mechanisms that operate in a self-regulating mode and automatically respond to changes in the state of the economy. They are called built-in (automatic) stabilizers.

Non-discretionary fiscal policy (automatic) is a policy based on the action of built-in stabilizers (mechanisms) that automatically soften fluctuations in the economic cycle.

Built-in stabilizers include:

1. Change in tax revenues. The amount of taxes depends on the amount of income of the population and enterprises. During a period of production decline, income will begin to decrease, which will automatically reduce tax revenues to the budget. Consequently, the income remaining for the population and enterprises will increase. This will make it possible to slow down the decline in aggregate demand to a certain extent, which will have a positive impact on economic development.

The progressivity of the tax system has the same effect. When the volume of national production decreases, incomes decrease, but at the same time tax rates decrease, which is accompanied by a decrease in both the absolute amount of tax revenues to the treasury and their share in society’s income. As a result, the fall in aggregate demand will be milder;

2. The system of unemployment benefits. Thus, an increase in the level of employment leads to an increase in taxes, which finance unemployment benefits. When production declines, the number of unemployed increases, which reduces aggregate demand. However, at the same time, the amount of unemployment benefits is growing. This supports consumption, slows the decline in demand and, therefore, counteracts the worsening of the crisis. The systems for indexing income and social payments operate in the same automatic mode;

3. Fixed dividend system, farmer assistance programs, corporate savings, personal savings, etc.

Built-in stabilizers mitigate changes in aggregate demand and thereby help stabilize the output of the national product. It was thanks to their action that the development of the economic cycle changed: production declines became less deep and shorter. Previously, this was not possible because tax rates were lower and unemployment benefits and social security payments were negligible.

The main advantage of non-discretionary fiscal policy is that its instruments (built-in stabilizers) are activated immediately at the slightest change in economic conditions, i.e. There is practically no time lag here.

The disadvantage of automatic fiscal policy is that it only helps smooth out cyclical fluctuations, but cannot eliminate them.

To find out whether the government's fiscal policy is correct, it is necessary to evaluate its results. Most often, the state of the state budget is used for these purposes, since the implementation of fiscal policy is accompanied by an increase or decrease in budget deficits or surpluses.

3.5.1. The concept and content of fiscal policy. Types and instruments of fiscal policy

Fiscal policy is a policy that involves using the government’s capabilities: levying taxes and spending funds from the state budget to regulate the level of business activity and solve various social problems.

This is the government's policy in the field of government spending and taxes.

This policy carried out by legislative bodies, because they control taxation and the state budget.

Main goals of fiscal policy:

1. Smoothing out economic cycle fluctuations.

2. Stabilization of economic growth rates.

3. Achieving a high level of employment.

4. Decrease in inflation rates.

Basic tools:

1. Government spending.

2. Taxes.

Fiscal policy affects the national economy through commodity markets. Changes in government spending and taxes are reflected in aggregate demand and through it influence macroeconomic objectives.

The main task of fiscal policy is to balance the macroeconomic system. In general, fiscal policy is aimed at maintaining full employment and producing a non-inflationary gross national product. Typically, fiscal policy is carried out in the determination of discretionary and non-discretionary instruments (in the form of a “fiscal mixture”) and gives maximum effect in the short term.

Fiscal policy there are two types:

|

Discretionary This is an active policy. This is the deliberate manipulation of taxes and government spending. It is carried out in the long term. Basic tools: 1. State employment program(financial labor exchanges, placement of government orders in private enterprises). 2. Development of various social programs. 3. Public Works Program(production of public goods - public transport, communications, improvement of parks, public gardens). Changes in tax rates– the main tool. |

Policy built-in stabilizers passive policy. It is based on the fact that tax revenues and a significant part of government expenditures automatically cause a change in the relative level of taxes and budget expenditures. Basic tools: Income tax; Unemployment benefits; Social payments; Income indexation. |

Valid during recession expansionary fiscal policy(fiscal expansion) – consists of:

Increased government spending;

Tax reduction;

A combination of increased government spending and lower taxes.

This leads to deficit financing, but reduces the decline in production.

In conditions of inflation containment policy.

It's called fiscal restriction:

Reducing government spending;

Increase in taxes;

A combination of government spending cuts and rising taxation.

This policy focuses on a positive budget balance, which causes a reduction in production.

Built-in stabilizers policy(passive) - an economic mechanism that automatically responds to changes in the economic situation without the need for any steps on the part of the government.

The main stabilizers are changes in tax revenues.

During periods of economic growth, tax revenues automatically increase, which reduces purchasing power and curbs economic growth.

During an economic downturn, tax revenues decline and there is a gradual increase in purchasing power, which curbs the economic downturn.

| Previous |

Fisk translated from Latin means basket. In ancient Rome, a fiscus was a military treasury in which money was kept. At the end of the Roman era, the fisc began to be called the state treasury.

Fiscal policy is a set of financial measures of the state to regulate public expenditures and revenues to achieve certain socio-economic goals. Currently, such goals in developed countries are mainly anti-crisis regulation, reducing unemployment and inflation.

In any economic system, cyclical fluctuations can be distinguished: ups and downs in the economy caused by shocks to aggregate demand and aggregate supply and called business cycles, economic or business cycles. The phases of business cycles are rise, peak, recession (or decline) and bottom, that is, crisis. The deepest recession is called depression. Often such fluctuations in business activity are unpredictable and irregular. There are also business cycles of different periods, frequencies and sizes. The reasons for such cycles can be very different: from wars, revolutions, technological processes and investor behavior to, for example, the number of magnetic storms per year and the rationality of macroeconomic agents. In general, this unstable behavior of the economy is explained by a constant imbalance between aggregate supply and demand, overall spending and production volumes.

As a rule, government policy depends on the state of the economy of a given country, that is, on what phase of the cycle the country is in: growth or recession. If the country is in recession, then the authorities carry out stimulating economic policy to bring the country out of the bottom. If the country is experiencing growth, then the government carries out contractionary economic policy in order to prevent high inflation rates in the country

The material basis for the implementation of fiscal policy is the concentration in the hands of the state of natural material and financial resources, which are redistributed between legal entities and individuals in the interests of the state. Essentially, fiscal policy comes down to the formation and expenditure of public funds through the tax and budget systems. Therefore, fiscal policy can be interpreted as fiscal policy.

Methods of financial regulation are divided into direct and indirect. Direct methods of budget regulation include: subsidies (which means assistance, support), subsidies (gift, donation), transfers (transfer, transfer). Methods of using elements of the tax system are indirect.

Indirect methods are the most subtle and complex instruments of economic regulation. The most common methods of encouraging business activity and certain types of activities are tax incentives. These also include an accelerated depreciation mechanism, discounts for subsoil depletion and an investment tax credit.

The essence of the tax mechanism accelerated depreciation consists in legislative permission for enterprises to write off for depreciation a part of the profit that significantly exceeds the actual depreciation of fixed capital. As a result, the amount of taxable profit and, consequently, tax deductions are reduced. The accelerated depreciation method is an important incentive to increase capital in the business sector of the economy. Its use contributes to the intensification of scientific and technological progress, technical improvement of production and the development of knowledge-intensive industries.

Benefit in the form discounts for subsoil depletion is being introduced to increase the competitiveness of mining industry enterprises by creating favorable conditions for capital accumulation and attracting investment. On this basis, enterprises have the opportunity to significantly reduce the amount of tax payments or not make them at all under the pretext of deteriorating conditions for mining. This method has a significant impact on the location of productive forces and the creation of infrastructure.

Investment tax credit in essence, it is government financing of private capital investments and is designed to stimulate the replacement of obsolete equipment with new equipment. This credit is calculated as a percentage of the cost of the equipment and is deducted directly from the tax amount, rather than from taxable income, thereby reducing the cost of the purchased production equipment by the amount of the discount.

Types of fiscal policy

Fiscal policy, depending on the mechanism of its impact on changes in the economic situation, is divided into discretionary And non-discretionary, or automatic.

Discretionary fiscal policy (Discretionary fiscal policy) is a system of manipulation of taxes and government spending, the main tools of which are changes in tax rates, public works, changes in spending on social needs (transfer payments).

A good way to keep revenues from shrinking and prevent the recession from turning into an avalanche crisis would be to temporarily reduce income tax rates. But this could happen after parliament decides that the economy needs to be stimulated through tax cuts. During a recession, public works (government investments aimed at overcoming unemployment) can significantly reduce the depth of the economic decline.

Programs such as unemployment benefits and old-age pensions act as automatic built-in stabilizers. But in addition to this, the government can, at its discretion, conduct various financial assistance programs, which are additional means of stabilization.

However, the implementation of these measures is subject to political facts - material assistance programs for short-term purposes are not easily reduced when the situation improves again. Political difficulties are involved; with debates in parliament regarding the adoption of relevant laws. In addition, there is a functional lag, that is, a lag between the moment when a decision is made on any fiscal measures and the period when these measures begin to affect employment, production or the price level.

The most actively used are discretionary methods such as changes in tax rates and government spending. Since discretionary fiscal policy has its disadvantages listed above, it cannot be given preference. Therefore, built-in stabilizers should be combined with discretionary fiscal policy measures aimed at ensuring the fullest employment of resources

At the core automatic fiscal policy lies in the use built-in stabilizers, by which we understand the properties of the fiscal system to reduce the negative consequences of economic fluctuations without the need for any decisions to be made by the government.

One of the main built-in stabilizers is the mechanism for changing tax revenues when using a progressive tax scale. During periods of economic growth, tax revenues automatically increase, thereby reducing aggregate demand and restraining the pace of economic development. Accordingly, during periods of economic recession, tax revenues automatically decrease.

Built-in stabilizers also include a system of material unemployment benefits and various social payments for the needs of the poor, aimed at preventing a reduction in aggregate demand during an economic downturn. During the recovery stage, accompanied by a decrease in the number of unemployed, payments under social assistance programs are reduced, which leads to a containment of aggregate demand.

Although built-in stabilizers can reduce the effects of cyclical fluctuations, softening shocks in the economy, they are completely unable to completely eliminate them. Therefore, in addition to them, discretionary fiscal policy of the state always remains extremely necessary.

Lecture outline:

20.2 Government expenditures. Expansionary and contractionary fiscal policy.

20.3 Discretionary and automatic fiscal policy.

20.4 Fiscal policy and state budget. State budget deficit.

20.5 Public debt and methods of managing it.

Fiscal policy(fiscal policy) - a set of government measures to regulate government spending and taxes to achieve the level of full employment and further economic growth (therefore, fiscal policy is also called fiscal policy).

Fiscal policy, also called financial and fiscal policy, extends its effect to the main elements of the state treasury (fiscal). Fiscal policy combines such large types and forms of financial policy as budgetary, tax, income and expenditure policies. Fiscal policy extends to the mobilization, attraction of funds necessary for the state, their distribution, and ensuring the use of these funds for their intended purpose, Figure 20.1.

Figure 20.1 – Characteristics of fiscal policy

One of the most important tasks of fiscal policy consists in searching for sources and methods of forming centralized state monetary funds, funds that allow realizing the goals of economic policy.

Fiscal policy goals like any stabilization (countercyclical) policy aimed at smoothing out cyclical fluctuations in the economy, are to ensure:

1 Stable economic growth;

2 Full employment of resources (primarily solving the problem of cyclical unemployment);

3 Stable price levels (solving the problem of inflation).

Fiscal policy- This is the government’s policy of regulating, first of all, aggregate demand. Regulation of the economy in this case occurs by influencing the amount of total expenditures. However, some fiscal policy instruments can be used to influence aggregate supply through influencing the level of business activity. Fiscal policy is carried out by the government.

The instruments of fiscal policy are expenditures and revenues of the state budget, namely:

1 Government procurement;

3 Transfers.

Impact of fiscal policy instruments on aggregate demand

The impact of fiscal policy instruments on aggregate demand varies. From the aggregate demand formula: AD = C + I + G + Xn it follows that government purchases are a component of aggregate demand, therefore their change has a direct impact on aggregate demand, and taxes and transfers have an indirect effect on aggregate demand, changing the amount of consumer spending ( C) and investment costs (I).

At the same time, the growth of government purchases increases aggregate demand, and their reduction leads to a decrease in aggregate demand, since government purchases are part of aggregate expenditures.

An increase in transfers also increases aggregate demand. On the one hand, since with an increase in social transfer payments (social benefits), the personal income of households increases, and, therefore, other things being equal, disposable income increases, which increases consumer spending. On the other hand, an increase in transfer payments to firms (subsidies) increases the possibilities of internal financing of firms and the possibility of expanding production, which leads to an increase in investment costs. A reduction in transfers reduces aggregate demand.

Tax increases work in the opposite direction. An increase in taxes leads to a decrease in both consumer spending (as disposable income is reduced) and investment spending (as retained earnings, which is the source of net investment, are reduced) and, therefore, to a reduction in aggregate demand. Accordingly, tax cuts increase aggregate demand. Tax cuts lead to a shift of the AD curve to the right, which causes an increase in real GNP.

Therefore, fiscal policy instruments can be used to stabilize the economy at different phases of the economic cycle.

Fiscal policy The state, as part of fiscal policy, is focused mainly on achieving a balanced budget, balanced in government revenues and expenditures throughout the entire budget period.

Public expenditure policy is designed primarily to satisfy the demand of the public sector, that is, to satisfy the need for spending on urgent government needs, reflected in the budget expenditure items.

Government Revenue Policy proceeds from existing and potential sources of cash flow to the state budget, taking into account the limited possibilities of using these sources, the excess of which can undermine the economy and ultimately lead to the depletion of revenue generation channels.

Tax policy– part of fiscal economic policy, manifested in the establishment of types of taxes, objects of taxation, tax rates, conditions for collecting taxes, tax benefits. The state regulates all these parameters in such a way that the receipt of funds through the payment of taxes ensures the financing of the state budget.

Taxes– obligatory payments of individuals and legal entities levied by the state. Tax classification is presented in Figures 20.2, 20.3.

Figure 20.2 – Types of taxes, Laffer curve

The dependence of tax revenues on the tax rate was described by A. Laffer. The graphical representation of this dependence is called the A. Laffer curve. According to the A. Laffer curve, an increase in tax rates leads to an increase in tax revenues only up to certain limits. A further increase in the tax rate will lead to an excessive tax burden. It leads to the withdrawal of many manufacturers from the market due to bankruptcy and to tax evasion.

The result of these actions is an undesirable decrease in tax revenues to the treasury. The Laffer curve shows that, under certain conditions, a reduction in tax rates can create incentives for business, promote the formation of additional savings and thereby promote the investment process. Reducing bankruptcies should help expand the tax base, since the number of taxpayers should increase.