BCC under the simplified tax system: “income”, “income minus expenses” for individual entrepreneurs. Kbk for transferring penalties for the usn kbk tax usn income minus expenses

Which BCCs should be used under the simplified tax system in 2017? What are the BCCs with the object “income” and “income minus expenses”? How will the simplified BCC change in 2017? We'll talk about this in our article.

Deadline for transferring the single tax to KBK in 2017

Payers of the simplified tax system must quarterly calculate and pay advance payments for the “simplified” tax no later than the 25th day of the month following the quarter, as well as the tax for the year no later than March 31 (for organizations) and April 30 (for individual entrepreneurs). When paying the simplified tax system, you must indicate in the payment slip the budget classification code (BCC) to which the tax is transferred according to the simplified tax system.

KBK simplified tax system “income” in 2017

The BCC for the simplified tax system for 2017 is provided for by the Instructions approved by Order of the Ministry of Finance dated July 1, 2013 No. 65n. For the simplified tax system with the object “income”, the single BCC for 2017 is 182 1 05 01011 01 1000 110. Please keep in mind that in 2017, when transferring the “simplified” tax, the payment order must indicate the BCC depending on whether it is transferred the amount of tax, penalties and or fines. KBK simplified tax system “6 percent” in 2017 are as follows:

KBK simplified tax system “income minus expenses” in 2017

If “income minus expenses” is chosen as the object of taxation, then the KBK simplified tax system in 2017 for organizations and individual entrepreneurs is as follows:

KBK simplified tax system with “minimum tax” in 2017

From 2017, the minimum tax under the simplified tax system will no longer have a separate BCC. That is, the minimum tax in 2017 will need to be transferred according to the code for ordinary advance payments (Order of the Ministry of Finance of Russia dated June 20, 2016 No. 90n). Let us explain how such a change in the BCC to the simplified tax system will affect real life.

Let’s assume that an organization with the object “income minus expenses” lost the right to the simplified tax system in September 2016. Following the results of 9 months of 2016, it reached the minimum tax according to the simplified tax system. It must be transferred no later than October 25th. You need to deposit money to KBK 182 1 05 01050 01 1000 110. It is this KBK that is valid for the minimum tax under the simplified tax system in 2016.

Now let’s imagine that the organization has finalized the simplified version by the end of the year. She has reached the minimum tax and must pay it no later than March 31, 2017. You need to transfer the money to another KBK - 182 1 05 01021 01 1000 110. Since 2017, the new KBK has been valid both for the regular tax on the object “income minus expenses” and for the minimum “simplified tax”.

In other words, in 2016, organizations with the object “income minus expenses” used two different BCCs. One for regular tax under the simplified tax system, the other for the minimum tax. Since 2017, the situation has changed - the BCC for such payments will be uniform. Below is a table of the BCC according to the simplified tax system for 2017.

Individual entrepreneurs and LLCs need a budget classification code (BCC) to prepare reports, fill out payment orders, and transfer penalties, taxes, contributions and fines to the budget. It is important to indicate the purpose correctly, otherwise payments will be returned, which will lead to unnecessary expenses and late payment. In case of late payment, inspectors impose fines.

Structure of the KBK 2016

The BCC consists of 20 bits (digits). The BCC contains the code of the manager of budget funds, the code of the type of income, and the code of transactions.

The budget classification code is a grouping of profits and costs of budgets at any level of the financial system, as well as the source of financing the deficit. BCC is recognized as an integral element of the classification of profits of the Russian budget.

To understand how to use the KBK, consider its structure:

1. The first three digits indicate which organization the collection is intended for. This could be the Federal Customs Service, Social Insurance Fund, Pension Fund, Federal Tax Service, Federal Compulsory Medical Insurance Fund.

2. The next 11 digits “inform” about the type of income and which budget the payment will go to. The three most commonly used sets of numbers are:

- 000-1-00-00-000-00… - income.

- 000-2-00-00-000-00… - free transfers.

- 000-3-00-00-000-00… - income from business or other entrepreneurial activity.

3. The next block of 4 numbers indicates the type of payment.

4. The last 3 digits reflect the type of economic activity.

New KBK 2016

The Ministry of Finance of the Russian Federation approved new BCCs in 2015. Now, when filling out payment orders, you need to focus on the new BCCs, since many old ones have been excluded. It is expected that the new codes will continue to be in effect in 2016.

Payers of the simplified tax system, who take into account expenses, at the end of the year have an obligation to pay a minimum tax - 1% of income. The minimum tax is paid if its amount is greater than the tax under the simplified tax system calculated in the general manner. The taxpayer has the right to include the difference between the minimum tax and the tax calculated in the general manner into expenses under the simplified tax system.

The BCC on the simplified tax system is the same for both LLC and individual entrepreneur. BCCs differ depending on the object of taxation. In addition, in 2015-2016, a separate budget classification code for the minimum tax appeared.

The period in payment orders must be indicated as follows:

- For the 1st quarter - KV.01.2015.

- For the 2nd quarter - PL.01.2015.

- For the 3rd quarter - KV.03.2015.

- For the 4th quarter - GD.00.2015.

KBK object “income” under the simplified tax system in 2016

|

The tax levied on taxpayers under the simplified tax system is 6%, that is, those who have chosen income as the object of taxation (for recalculation, arrears, debts to pay payments, as well as canceled transfers) |

182 1 05 01011 01 1000 110 |

|---|---|

| Tax levied on taxpayers who have chosen income as an object of taxation (penalties on the corresponding payment) | 182 1 05 01011 01 2100 110 |

| Taxes that are transferred by payers who have opted for such a taxable object as profit (based on the percentage of transfers of this type) | 182 1 05 01011 01 2200 110 |

| BCC for the simplified tax system 6% - for those taxes paid by legal entities and individual entrepreneurs who have chosen income as an object, which is taxed (the amount of the accrued fine for such a transfer in accordance with the procedure of regulations) | 182 1 05 01011 01 3000 110 |

KBK object “income minus expenses” in 2016

| Tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (STS 15%) | 182 1 05 01021 01 1000 110 |

|---|---|

| The amount of tax paid by payers who chose as the object of taxation profit reduced by costs (penalties on such transfers) | 182 1 05 01021 01 1000 110 |

| 182 1 05 01021 01 2100 110 | |

| Amounts of taxes paid by entrepreneurs and legal entities who have chosen the object of taxation in the form of income, which is reduced by the amount of expenses (interest on such transfers). | 182 1 05 01021 01 2200 110 |

| Fees in the form of taxes that are levied from payers of the simplified tax system who chose to be taxed in the form of profit reduced by the amount of costs (the amount of the fine for such a transfer in accordance with regulations). | 182 1 05 01021 01 3000 110 |

| In 2015, the BCC of the minimum tax of the simplified tax system, if it is paid to the treasury of a territorial district of Russia (the amount of transfers, arrears, debts on such payments, including canceled ones). | 182 1 05 01050 01 1000 110 |

| Transfer of the minimum tax, which is sent to the treasury of the regional district of Russia (penalty on such payments). | 182 1 05 01050 01 2100 110 |

| Payment of the minimum tax to government agencies of a constituent entity of the Russian Federation (interest on transfer). | 182 1 05 01050 01 2200 110 |

| Payment of the minimum tax (the amount for enterprises that operate on the simplified tax system is 1%), which is sent to the budget of the constituent entity of the Russian Federation (a fine for such a transfer in accordance with the legislative acts of Russia). | 182 1 05 01050 01 3000 110 |

Deadlines for filing taxes, fees, filing declarations

Tax payment is made once a quarter if there is income. Tax must be rounded to the nearest ruble. If the amount of income is 0 rubles, no tax is paid.

Note

Dear readers! For representatives of small and medium-sized businesses in the field of trade and services, we have developed a special program "Business.Ru", which allows you to maintain full warehouse accounting, trade accounting, financial accounting, and also has a built-in CRM system. There are both free and paid plans.

Reporting deadlines:

- I quarter (3 months) – until April 25.

- II quarter (six months) – until July 25.

- III quarter (9 months) – until October 25.

- IV quarter (year) – for individual entrepreneurs until April 30, for LLCs until March 31.

The simplified tax system declaration is submitted to the tax office once a year before April 30 for individual entrepreneurs and until March 31 for organizations.

According to the procedure for filling out the declaration, the annual minimum tax is reduced by the amount of advance payments for the reporting periods. Whether advance payments have been paid or not does not matter. It is necessary that the amount of payments does not exceed 50% of the tax amount. There is no need to submit an application to offset payments against the minimum tax. If the amount of advance payments is higher than the amount of the minimum tax, there is no need to transfer it to the budget.

KBC for fines and penalties for late submission of reports

To pay penalties and fines, we change two numbers in the penultimate block:

- KBK for tax transfer - 182 1 05 01011 01 10 00 110.

- KBK for payment of penalties – 182 1 05 01011 01 21 00 110.

- BCC for interest – 182 1 05 01011 01 22 00 110.

- BCC for a fine –182 1 05 01011 01 30 00 110.

What penalties are provided for late submission of reports to the Pension Fund:

- If the delay is less than 180 days - 5% of the payment amount for each month, but not more than 30% and not less than 100 rubles.

- If there is a delay of more than 180 days - 30% of the amount plus 10% for each month, but not less than 1 thousand rubles.

What penalties are provided for late filing of a declaration with the tax office:

- If the delay is less than 180 days - 5% of the tax amount, but not more than 30 percent of the specified amount and not less than 1 thousand rubles.

- If the payment is overdue for more than 180 days - 30% of the tax amount plus 10% for each month.

In other words, if the simplified tax system has been paid, but the declaration has not been submitted, the fine is 1 thousand rubles. Fines and penalties are not reflected in the declaration. In the absence of payments of taxes and contributions to the Pension Fund, a penalty of 1/300 is provided, multiplied by the payment amount and the refinancing rate.

Nuances of using KBK for individual entrepreneurs on the simplified tax system

For an individual entrepreneur, it is difficult to clearly distinguish between property for everyday use and property for business activities. For this reason, it is quite problematic to determine profit: if income is received after operations related to the activities of an individual entrepreneur, it is included in the tax base of the simplified tax system. If the profit is not related to the business, you will have to take into account the amounts in personal income tax. In other cases, the procedure for using the KBK USN 2015 does not differ from the procedure provided for legal entities.

If an incorrect BCC is specified

If you indicated an incorrect budget classification code in your reporting, you need to write an application to transfer the BCC. See below for a sample application.

Fig. 1 Sample application for transfer of BCC

If you cannot submit your reports in person

If you cannot personally submit reports to the Federal Tax Service, the Social Insurance Fund and the Pension Fund of the Russian Federation, submit the documents through a proxy. To do this, you need to issue a power of attorney. The pension fund requires that the power of attorney be certified by a notary. See below for a sample power of attorney for filing reports.

Rice. 2 Samplepowers of attorney for reporting

Reports can be sent by mail in a valuable letter with a list of attachments in two copies. The documents are accompanied by a floppy disk with an electronic copy. The reporting submission date will be the day you send the letter.

Select category 1. Business law (235) 1.1. Instructions for starting a business (26) 1.2. Opening an individual entrepreneur (27) 1.3. Changes in the Unified State Register of Individual Entrepreneurs (4) 1.4. Closing an individual entrepreneur (5) 1.5. LLC (39) 1.5.1. Opening an LLC (27) 1.5.2. Changes in LLC (6) 1.5.3. Liquidation of LLC (5) 1.6. OKVED (31) 1.7. Licensing of business activities (13) 1.8. Cash discipline and accounting (69) 1.8.1. Payroll calculation (3) 1.8.2. Maternity payments (7) 1.8.3. Temporary disability benefit (11) 1.8.4. General accounting issues (8) 1.8.5. Inventory (13) 1.8.6. Cash discipline (13) 1.9. Business checks (17) 10. Online cash registers (14) 2. Entrepreneurship and taxes (413) 2.1. General tax issues (27) 2.10. Tax on professional income (7) 2.2. USN (44) 2.3. UTII (46) 2.3.1. Coefficient K2 (2) 2.4. BASIC (36) 2.4.1. VAT (17) 2.4.2. Personal income tax (8) 2.5. Patent system (24) 2.6. Trading fees (8) 2.7. Insurance premiums (64) 2.7.1. Extra-budgetary funds (9) 2.8. Reporting (86) 2.9. Tax benefits (71) 3. Useful programs and services (40) 3.1. Taxpayer legal entity (9) 3.2. Services Tax Ru (12) 3.3. Pension reporting services (4) 3.4. Business Pack (1) 3.5. Online calculators (3) 3.6. Online inspection (1) 4. State support for small businesses (6) 5. PERSONNEL (103) 5.1. Vacation (7) 5.10 Salary (6) 5.2. Maternity benefits (1) 5.3. Sick leave (7) 5.4. Dismissal (11) 5.5. General (22) 5.6. Local acts and personnel documents (8) 5.7. Occupational safety (9) 5.8. Hiring (3) 5.9. Foreign personnel (1) 6. Contractual relations (34) 6.1. Bank of contracts (15) 6.2. Conclusion of an agreement (9) 6.3. Additional agreements to the contract (2) 6.4. Termination of the contract (5) 6.5. Claims (3) 7. Legislative framework (37) 7.1. Explanations of the Ministry of Finance of Russia and the Federal Tax Service of Russia (15) 7.1.1. Types of activities on UTII (1) 7.2. Laws and regulations (12) 7.3. GOSTs and technical regulations (10) 8. Forms of documents (82) 8.1. Primary documents (35) 8.2. Declarations (25) 8.3. Powers of attorney (5) 8.4. Application forms (12) 8.5. Decisions and protocols (2) 8.6. LLC charters (3) 9. Miscellaneous (25) 9.1. NEWS (5) 9.2. CRIMEA (5) 9.3. Lending (2) 9.4. Legal disputes (4)simplified taxation system income (6%)

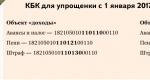

KBK for payment of simplified taxation system income (6 percent)

KBK for payment of penalties under the simplified tax system income (6 percent)

simplified tax system income minus expenses (15%)

BCC for payment of the simplified tax system income minus expenses (15 percent)

BCC for payment of penalties under the simplified tax system (USN) income minus expenses (15 percent)

Minimum tax (until 01/01/2016)

KBK for payment of the minimum tax under the simplified tax system (until 01/01/2016)

FILES

Important clarifications on the BCC for paying taxes under the simplified tax system

“Simplified” is the most attractive tax system for small and medium-sized businesses. Its popularity is explained by its minimal tax burden and the simplest reporting and accounting procedure among all systems. This is especially convenient for individual entrepreneurs. The two versions of this system differ in the tax rate, base and method of calculating taxes:

- STS - Income (or STS -6%): 6% of the entrepreneur’s profit is allocated to the state;

- Simplified tax system -- Income minus expenses (or simplified tax system-15%): the state is entitled to 15% of the difference declared in the title of the tax.

Should I follow one or the other of these varieties? An entrepreneur can change the decision annually by notifying the tax authority of his intention before the end of the year.

Can everyone choose the simplified tax system?

In order to switch to the “simplified” system, the enterprise must meet some conditions that are not difficult for small businesses:

- have less than 100 employees;

- do not aim at an income of more than 60 thousand rubles;

- have a residual value of less than 100 million rubles.

For legal entities, these requirements are supplemented by a ban on branches and representative offices and a share of participation of other organizations exceeding a quarter.

IMPORTANT INFORMATION! A pleasant tax innovation regarding the simplified tax system: the 6% rate on the simplified tax system - Income, already the lowest among taxation systems, can be reduced to 1% from 2016 according to a regional initiative. And the USN-15 rate can turn into 5% if regional legislation so dictates.

We pay a single tax

A tax that replaces several deductions common to other tax systems (personal income tax, VAT, property tax) is called united. Regardless of what type of simplified tax system is chosen by the entrepreneur, it must be deducted in advance payments at the end of each quarter.

The tax amount at the end of the year will need to be calculated, taking into account the advance payments made.

To transfer the tax amount to the budget, you must fill out the payment order correctly, because taxes cannot be paid in cash.

In field 104 you must indicate the correct BCC for payment single tax on the simplified tax system:

- for simplified tax system-6% - 182 1 05 01011 01 1000 110;

- for simplified tax system-15% - 182 1 05 01021 01 1000 110.

If advance payments were not made on time, for each missed day a penalties. To pay them, you need the following BCCs:

- for simplified tax system-6% - 182 1 05 01011 01 2100 110;

- for simplified tax system-15% - 182 1 05 01021 01 2100 110.

If at the end of the annual period the tax was not paid based on its results, then in addition to penalties, fine 20% of the amount of arrears. It will need to be paid according to the following BCC:

- for simplified tax system-6% - 182 1 05 01011 01 3000 110;

- for simplified tax system-15% - 182 1 05 01021 01 3000 110.

By choosing a simplified system with the “income” object, firms and entrepreneurs pay tax on all their revenue. Expenses are not deductible. The rate under the simplified tax system “income” is 6%. In 2016, regions received the right to lower rates at the local level. The organization chooses the object of taxation independently, taking into account the characteristics of its work and material benefits.

In which line should I enter the KBK according to the simplified tax system 6%

When choosing income as an object of taxation, firms and individual entrepreneurs pay 6% of profits quarterly and at the end of the year. The code in the payment order is entered in line 104 “payment purpose”.

KBK in 2016 on the simplified tax system “income” - 1821 05 01011 01 1000 110.

KBK income simplified tax system - minimum tax

The minimum must be paid in two cases:

- the enterprise incurs losses;

- The company's income is so small that the tax is minimal.

The BCC of the minimum tax does not depend on the object of taxation. Firms using the simplified tax system “income” and the simplified tax system “income minus expenses” transfer the minimum tax from

The minimum rate on the simplified tax system is 1% of income.

KBK income from paying fines and penalties

Penalties and fines are listed indicating individual BCCs.

BCC for penalties on the simplified tax system 6% - 182 1 05 01011 01 2100 110.

Penalties are paid for each day of tax delay. Quarterly payments are due by the 25th day of the month following the end of the quarter. And at the end of the year - until March 31 of the next year (organization) or until April 30 of the next year (individual entrepreneur). In 2016, April 30 falls on a day off, so the deadline is moved to May 4. If the taxpayer fails to meet these deadlines, penalties will be assessed.

BCC for fines on the simplified tax system 6% - 182 1 05 01011 01 2200 110.

Fines are assessed for gross violation of payment deadlines. A fine, unlike a penalty, is assessed and paid once, and not for each overdue day.

KBK table for simplified tax system income 2016

KBK income under the simplified tax system for individual entrepreneurs

The indication of the Budget Classification Code is not related to the legal status of the organization. Both companies and individual entrepreneurs indicate in the line “purpose of payment”

KBK - 182 1 05 01050 01 1000 110.

This code is provided for all legal entities and individual entrepreneurs using the simplified tax system “income”.

Frequently asked questions FAQ

Let's consider the issues that concern accountants when paying income to the simplified tax system and indicating the KBK.

What code is correct to pay for the simplified tax system 6% and what to do with payments with an incorrect BCC?

BCCs change periodically. It is recommended to check the background information before paying.

BCC for simplified tax system 6% in 2016 - 182 1 05 01050 01 1000 110.

It hasn't changed since last year. But if they still listed the wrong code, then this problem is easily solvable. If an error is discovered, a reconciliation report is ordered from the tax office. Based on the results of the reconciliation, the tax authority clarifies the payment and transfers it to the correct code. You can clarify the necessary details without conducting a reconciliation - by writing an application to the tax service in any form. The clarification is made within 10 days. If the tax service considers the payment to be overdue due to an incorrect code and charges a penalty, this can be challenged in court. Based on practice, the courts take the side of the taxpayer in this matter. According to the law, non-compliance of codes is not a basis for recognizing payment deadlines as violated (clause 2, clause 3). After all, if a sum of money was received into the corresponding treasury account, then it entered the budget system of the Russian Federation. This is enough to ensure that the amount paid cannot be considered arrears. This is confirmed, in particular, by. The organization or entrepreneur will not face a fine for incorrectly indicated in the payment order by KBK. The tax office can charge penalties, but they can also be challenged in court.

Which BCC should I indicate when submitting an updated declaration and paying the simplified tax system of 6% for earlier periods?

The updated declaration does not have a special form. It is submitted on the same form as a regular declaration, only with a different adjustment number. Clarifying information for periods that have already passed is submitted on the form that was in force during that tax period (clause 5). If in 2016 an error is discovered in the 2013 data, then clarifying information is submitted on the 2013 form. The same rule applies to indicating the BCC. If a payment is made for any of the past years, then the old BCC of that year is indicated in the “payment purpose” field. At the same time, if the code has changed, it will not be a mistake to deposit funds using the new code. The money is still transferred to the correct budget item. Therefore, it is easier to use the code of the current period to correct errors from previous years. For the simplified tax system 6% this is 182 1 05 01050 01 1000 110. The BCC for the simplified tax system 6% “income” has not changed since 2012.

Is it necessary to adjust advances already made if an individual entrepreneur using the simplified tax system has moved to a region with a different tax rate?

If an individual entrepreneur changes his place of registration to a region where a different tax rate is established according to the simplified tax system, there is no need to recalculate advances already made since the beginning of the year. At the new rate, advance payments are calculated from the period in which the move occurred and the annual tax is paid. This is an explanation from the Ministry of Finance, which was given in Letter No. 03-11-11/13037 dated 03/09/2016. Let us remind you that since 2016, regional authorities can lower the tax rate on the simplified tax system for both the “income minus expenses” object and the “income” object. Previously, regional rates applied only to simplified taxation system payers with the object “income minus expenses.”

Are the new BCCs the same for all regions or different?

The codes are the same for all regions. Changes in BCC values occur at the federal level. New codes are established by orders of the Ministry of Finance. The tax levied on taxpayers who have chosen income as the object of taxation is paid on

KBK 182 1 05 01050 01 1000 110.

The specified code is valid for payments in 2012, 2013, 2014, 2015 and 2016.

Is it possible to offset a tax overpayment against a tax payment (advance payment) that has a different BCC?

When offsetting tax overpayments in the form of advances, differences in the code do not matter. It is important that the type of payment be respected: federal taxes are included in the federal budget; regional - to the regional budget; local - to local. If the payments are of the same type, then the tax service cannot refuse to offset the funds due to different BCCs. Such a refusal is unlawful. If an organization pays two taxes going to the same budget (for example, to the federal budget), then the overpayment for one of them can be offset against the other, even though the payment codes are different. The same approach is applied when calculating penalties and fines. To offset the tax overpayment against advance payments, an application is submitted to the Federal Tax Service.