Financial and management accounting. Management and financial (accounting) accounting Financial and management accounting as sources of indicators

Introduction…………………………………………………………………………….3

1. Theoretical foundations of management accounting ………..5

1.1. The essence and purpose of management accounting ………………………………….5

1.2. Subject and object of management accounting ……………………………….6

1.3. Components of management accounting ……………………………….8

1.4. Management accounting systems………………………………………………11

2. The general concept of financial accounting……………………..14

3. Financial accounting and management accounting in market conditions …………………………………………………………………………...18

3.1. Comparative characteristics of financial and management accounting……………………………………………………………………………..18

Conclusion……………………………………………………………………..27

List of used literature…………………………………………………29

Introduction

The main purpose of management accounting is to provide information to managers. A competent management accounting system allows you to accurately answer the questions on what the company earns money and where it spends it, which of the products it produces or which line of business brings the greatest income, what is the effectiveness of a particular management decision. In addition, management accounting allows you to plan activities, evaluate the work of employees and is a fairly subtle tool for motivation.

In a market economy and the transition to it, the enterprise is an independent element economic system, which interacts with business partners, budgets of various levels, owners of capital and other entities, in the process of which financial relations arise with them. In this regard, there is a need to manage the company, i.e. development of a certain system of principles, methods and techniques for regulating financial resources that ensure the achievement of tactical and strategic goals of the organization. The object of management is the financial resources of the enterprise, in particular their size, the sources of their formation, and the relationships that develop in the process of formation and use of the financial resources of the company. The results of management are manifested in cash flows (value and timing) flowing between the enterprise and budgets, capital owners, business partners and other market agents.

The basis for making management decisions at the enterprise is information of an economic nature. The decision-making process itself can be divided into three stages: planning and forecasting, operational management, control (financial analysis) of the enterprise. Decisions are made not only by the administration of the organization, but also by other external users of economic information (interested parties outside the firm and in need of information to make decisions regarding this enterprise). Internal users operate accounting information, external - the data of the financial statements of the organization. Both those and other data are formed in the process of accounting of the enterprise.

All this makes it possible to specify the goals of accounting and reporting at the enterprise level, which in general can be defined as an assessment:

The solvency of the enterprise (security of its accounts payable, liquidity, etc.);

profitability;

Degrees of responsibility of persons engaged in economic activities, within the framework of the powers granted to them to dispose of the means of production and labor.

The purpose of this term paper- compare management and financial accounting, consider similarities and differences, as well as theoretically explore all their areas, their relationship, based on the study of scientific and special literature.

1. Theoretical foundations of management accounting

1.1. The essence and purpose of management accounting

The management process provides for the timely receipt by the manager of reliable information for making optimal decisions. The formation and provision of such information is the main task management accounting, the emergence and development of which are connected precisely with the needs of management.

At a certain stage of economic development, traditional accounting no longer satisfies the complicated requirements of enterprise management.

Over time, a new area of activity for accountants has emerged, which is a synthesis of calculation, analysis, forecasting, economic and mathematical methods, where the accountant becomes a full and respected member of the management team.

Such an accountant should be able to use accounting data for planning and controlling the activities of the enterprise, interpret information depending on its nature and the essence of management decisions that are made on its basis.

Development market relations causes an increase in the need for information necessary for planning, monitoring and making managerial decisions.

Based on this, the interest of accountants and managers in management accounting, the possibilities of its application in their enterprises is growing.

Management accounting is an integral part of the management process that allows you to receive information for such purposes as:

Determining the strategy and planning for the organization's future operations;

Controlling its current activities;

Optimization of resource use;

Evaluation of the effectiveness of activities;

Reducing the level of subjectivity in the decision-making process.

The ultimate goal of management accounting is to help management achieve the strategic goals of the enterprise. Therefore, management accounting is necessary for the implementation of management control.

Management control it is the process of influencing the members of the organization to carry out its strategy.

Management control design covers:

Determination of the overall goal of the enterprise and its intermediate goals;

Definition of responsibility centers;

Development of performance indicators for motivation and agreement of the goal;

Measurement of actual performance indicators and reporting.

1.2. Subject and object of management accounting

An essential element of the enterprise management system is management accounting. Describing the essence of management accounting, its most important feature should be noted - management accounting connects the management process with the accounting process.

The subject of management is the process of influencing an object or management process in order to organize the activities of people in order to achieve maximum production efficiency. Management implements the impact on the subject of management through planning, organization, stimulation and control. It is these functions that management accounting performs, forming its own system that meets the goals and objectives of management.

Currently, there are no clear definitions of the subject of management accounting. The authors are limited to presenting the understanding of the essence of accounting in general and management accounting in particular.

The theory of management science forms the concept of the subject of management accounting.

Subject Management accounting in general terms is a set of objects in the process of the entire cycle of production management. The content of the subject is revealed by its numerous objects, which can be combined into two groups:

Production resources that ensure the expedient work of people in the process economic activity enterprises;

Economic processes and their results, which together make up the production activity of the enterprise.

Production resources include:

Fixed assets are the means of labor (machinery, equipment, industrial buildings, etc.), their condition and use;

Intangible assets - objects of long-term investment (the right to use land, standards, licenses, trademarks, etc.),

Material resources - objects of labor intended for processing in the production process with the help of means of labor.

These resources in management accounting are represented by production stocks in the warehouses of the enterprise, and storerooms and in areas, warehouses of the production department and in the process of their movement, but the stage of the production cycle to the warehouse of finished products.

The second group of management accounting objects includes the following activities;

Supply and procurement activities - acquisition, storage, provision of production with raw materials, auxiliary materials and production equipment with spare parts intended for its maintenance and repair, marketing activities related to supply processes;

Production activity - the processes caused by the production technology, including the main and auxiliary operations; operations to improve manufactured and develop new products;

Financial and sales activities - marketing research and operations to form a sales market for products; direct marketing operations, including packaging, transportation and other types of work; operations that contribute to the growth of sales, from product advertising to establishing direct relationships with consumers, quality control of products;

Organizational activity.

Another grouping of management accounting objects can be chosen, but in any case, it must meet the main management objectives.

1.3. Components of management accounting

Comparative characteristics of financial and management accounting draws attention to the commonality of objects - these are the production resources of the enterprise. Functioning in the production process, they make a circuit, change, turn into a product, are constantly in motion, wear out and undergo other changes.

Enterprises in the transition period to the market need analytical information that characterizes the use of production resources, the feasibility of investing in them, and the return on investment. These tasks can be solved with the help of management accounting, as evidenced by the existing practice of economically developed countries.

The financial report generates generalized information about the material, labor and financial costs of production for the enterprise as a whole, for types or groups of products, for orders. Accounting for costs by responsibility centers in Russia has not yet been established. Heads of departments do not have in the system accounting operational and current information on costs by cost centers and indicators of the effectiveness of their activities, on the costs of their units in the context of homogeneous elements and expense items, on their compliance with the maximum costs.

A significant drawback of modern production accounting remains the problem of determining the real contribution of each unit to overall results enterprise activities.

Awareness of managers is the main factor in improving the efficiency of the entire management system from the lowest levels to the highest.

When developing a management accounting system, its fundamental feature should be cost accounting by areas of activity in close connection with determining the effectiveness of each area.

This approach to the organization of accounting allows the allocation as components of management accounting:

Supply and procurement activities;

production activities;

Accounting for production costs and production costs;

Accounting for financial and marketing activities;

Management accounting of organizational activities;

Controlling.

Supply and procurement activity in the management accounting system occupies its original position, since this is the first redistribution of production. It should reflect the following areas of activity: expanding bulk purchases, increasing the volume of production of individual products, choosing a procurement method (produce on your own or purchase from a supplier). Effective information about the supply and procurement activities is used to calculate the critical point of the supply volume.

Management accounting of production activities is the central link in the management accounting system. Here, information about costs is grouped by goals, functions and their behavior. A significant place in production accounting is given to the rationing of costs - material, labor and overhead costs, methods of reflecting actual and standard costs. At the same time, production accounting is organized as a single process of cost accounting and costing.

Accounting for financial and marketing activities - collects, processes and generates information on the range of products, its profitability, on the composition of buyers, market trends, advertising and packaging costs, on shelf life and quantity in warehouses of finished products. In this section of accounting, the most profitable factors for the production of products that affect the size of the marginal income of both the entire volume of production and individual products are determined.

Managers are provided with information to make decisions that maximize profits in the short term.

Management accounting of organizational activities is necessary to meet the requirements of managers of different levels of management in terms of information about their own costs, the principles of formation of transfer prices, the optimal level of specialization and division of labor in the enterprise, the correct choice of the size of units, the validity of the application of the principle "costs - volume" in relation to production units. processing of raw materials - profit".

Here they draw up and control the execution of cost estimates for organizational activities, carry out accounting and analytical calculations of the critical point of production volume, variable and fixed costs, total cost, transfer prices of profit. Controlling - is a process management system for the implementation of the ultimate goal of the enterprise, and also acts as a regulator entrepreneurial activity enterprises, as it performs specific functions:

Informational - information is formed that provides a methodology for making decisions and their coordination;

Managerial - normative, planned and actual data, deviations identified by the enterprise and its structural divisions are used in order to coordinate the methods, methods and tasks of achieving the ultimate goal of the enterprise;

Control - focuses on monitoring the efficiency of the enterprise and its divisions.

Controlling functions allow us to formulate its differences from management accounting and audit. All components of management accounting are interconnected, the list of information that is formed in them characterizes the level of organization and improvement of management accounting at the enterprise and the management system as a whole.

1.4. Management accounting systems

The production capacities of enterprises and the actual production volumes determine the scope of application of management accounting systems. The management accounting system is characterized by the volume of information, the goals set for it, the criteria and means for achieving the goals, the composition of the elements and their interaction. Classification of management accounting systems:

I. Breadth of coverage of information:

Complete system;

A system with a target set of problems;

II. The degree of interconnection between financial and management accounting:

Integrated (monistic);

Autonomous;

III. Cost efficiency:

Actual (past, historical);

Standard (normalized);

IV. Completeness of inclusion of costs in the cost price:

Partial.

According to the breadth of information coverage of activities, the organizational structure of an enterprise, products, complete systems are distinguished, consisting of a combination of systematic and problematic accounting, and systems with a target set of their components.

Systematic cost accounting - financial Accounting production costs with its regulation on the composition of costs, methods of registration, identification and grouping, reporting. The elements of systematic accounting are:

1) measurement and evaluation of costs for the acquisition and use of production resources;

2) control in natural measurements of the processes of supplying production, sales;

3) grouping of costs by items of expenditure and elements, by places of occurrence, by types of products, works and services, as well as the procedure for including costs in the cost price;

4) internal and external reporting that satisfies its users in terms of timing, content and frequency of presentation.

Problem accounting generates information about the economic technological, design and organizational preparation of production; on prices and sales of products; on the management of inventories and rationalization of the consumption of production resources.

According to the degree of interconnection between financial (systematic accounting of costs and income) and management accounting, two options are used in the practice of foreign countries: monistic and autonomous systems.

The monistic system combines systematic and problematic accounting on the basis of direct and feedback on the accounts of accounting. Systematic accounting by reflecting on the accounts of production costs, finished products makes it possible to evaluate the activities of the enterprise, its financial position. By supplementing financial information with internal reporting data, the administration can assess the rationality of the organization of production in any of its areas. From the operational information and reporting of materially responsible persons, positive and negative deviations from the current standards are determined. This creates the prerequisites for the organization of the current system of control over costs and income.

An autonomous system is a separate creation of systematic and problematic accounting. The connection between financial management accounting is carried out using the so-called paired control accounts of the same name.

According to the efficiency of costs, the systems are divided into a system for accounting for actual (past, historical costs) and a system for accounting for standard (normalized) costs. Efficiency of costs is one of the criteria for the effectiveness of a system focused on increasing efficiency.

The completeness of the inclusion of costs in the cost is one of the signs of the classification of accounting systems used in practice. There is a full cost accounting system and a partial cost accounting system. These are two options that meet different goals in management accounting.

2. General concept of financial accounting

Accounting financial accounting provides accounting information about the results of the organization's activities to its external users: shareholders, partners, creditors, tax and statistical authorities, financing banks, etc. From these positions, financial accounting data does not represent a trade secret. Financial accounting is carried out on a mandatory basis and in a strictly regulated form in accordance with the requirements of the law. Financial accounting is characterized by compliance with generally accepted accounting principles, the use of monetary units of measurement, periodicity and objectivity.

The main documents regulating accounting (financial) accounting are the Federal Law “On Accounting”, “Regulations on Accounting and Accounting in the Russian Federation”, which ensure the unity of the accounting and reporting methodology in the country, the procedure for its maintenance, compilation and presentation of financial statements. The Federal Law “On Accounting” sets forth the following tasks of accounting:

Formation of complete and reliable information about the activities of the organization and its property status;

Providing information necessary to monitor compliance with the legislation of the Russian Federation in the course of the organization's business operations and their expediency, the availability and movement of property and obligations, the use of material, labor and financial results in accordance with approved norms, standards and estimates;

Prevention of negative results of economic activity and identification of on-farm reserves, ensuring its financial stability.

In the business management system of an enterprise, accounting performs a number of functions:

Information function- one of the main functions of accounting. Accounting data is the main source of information used at different levels of management. Accounting information is used in management for planning, forecasting, developing tactics and strategies for the activities of organizations. In order for this information to satisfy all users, it must be reliable, objective, timely and operational.

Feedback function means that accounting generates and transmits feedback information, i.e. information about the actual parameters of the development of the control object. The main components of the feedback information system in relation to accounting are:

as input - unordered data;

as a process - data processing;

· As a conclusion - ordered information.

Analytic function- accounting data serve as the main information for analyzing the financial condition of the organization.

Accounting is based on a number of principles. The principles of accounting (financial) accounting are universal provisions used to solve practical problems. They are of a general nature and are the basis for building the concept of accounting. At present, the principles of accounting generally accepted in world practice are used in domestic accounting.

The principles used in international accounting practice can be divided into two groups.

Basic principles that assume certain conditions created by an economic entity when setting up accounting, which should not change. Such basic principles are called assumptions. These include:

1) property isolation of an economic entity (the principle of an economic unit). The property and obligations of an economic entity exist separately from the property and obligations of the owners of this organization;

2) business continuity. This assumption assumes that the entity will continue in operation for the foreseeable future. It is assumed that the organization has no intentions and no need to significantly reduce or eliminate its activities, change its nature. This assumption is important, on the one hand, for choosing methods for assessing property, and on the other hand, for creditors. They can be sure that the obligations of the organization will be repaid in the prescribed manner;

3) the sequence of application of accounting policies. This assumption means that the selected accounting policy should be applied in the accounting of an economic entity consistently from one reporting period to another. This will make it possible to obtain comparable reporting figures;

4) temporal certainty of the facts of economic activity. This assumption assumes that business transactions should be attributed to the reporting period in which they were made, not related to the time of receipt or payment. Money according to these transactions.

The basic principles mean that the accepted rules of organization and accounting will be observed. These basic principles are called requirements. These include:

1) the requirement for completeness - all business transactions must be reflected in accounting without any exception;

2) the requirement of prudence - this principle means that expenses (losses) and liabilities should be more readily reflected in accounting than income and assets, not allowing the creation of hidden reserves;

3) the requirement of timeliness - in the accounting and financial statements of the organization, it is necessary to ensure the timely reflection of the facts of economic activity;

4) the requirement for the priority of content over form is based on the fact that the facts of economic activity in accounting should be reflected not only on the basis of the legal form, but also on the basis of the economic content and business conditions;

5) the requirement of consistency implies the identity of analytical accounting data to turnovers and balances on synthetic accounts on the first day of the month, as well as reporting indicators to synthetic and analytical accounting data;

6) the requirement of rationality lies in the economical and efficient accounting, depending on the conditions of economic activity and the size of the organization.

The implementation of the above principles is directly related to the development of the conditions for building the accounting process and each business entity.

3.Accounting financial accounting and management accounting in market conditions

3.1.Comparative characteristics of financial and management accounting

There are many similarities between financial and management accounting.

Firstly, both types of accounting are based on the same accounting information system (unity of source information). The enterprise uses the same chart of accounts, reflecting the objects of accounting (enterprise funds, their sources, business processes). One of the elements of the accounting system is production accounting, which reflects data on production costs used in both managerial and financial accounting. Production accounting data is used to determine the cost in the preparation of the profit and loss statement of the enterprise, this is the application of information in financial accounting. The same production accounting data will be the basis for setting prices for finished products; this is an example of their application for management accounting purposes.

Secondly, management and financial accounting data are used to make decisions. Thus, financial accounting data help creditors assess the financial position of the enterprise and make a decision on granting loans and loans to this organization. Management accounting data is used by managers, for example, to make decisions on the production of a particular product.

Thirdly, both financial and management accounting are largely based on the principle of responsibility. Financial accounting is responsible for the entire enterprise as a business unit. Management accounting is responsible for individual divisions of the enterprise, as well as for the activities of each individual employee responsible for cost accounting.

However, these two types of accounting have significant differences from each other.

Scale of information. Reporting, compiled on the basis of financial accounting, is of a general nature, as it covers the activities of the entire enterprise. On the other hand, management accounting provides special-purpose information used for specific, narrower purposes.

AT modern conditions management in the information field of the organization there are three accounting systems, the purpose of which is to meet the information needs of users of accounting information.

At the output of the information system of the organization, reports are generated:

1) for external users of accounting information;

2) for the purposes of periodic planning and control;

3) to make decisions in non-standard situations and selection of the optimal policy of the organization.

Regulation. Financial accounting performs the functions of system accounting, built in accordance with the principles and norms of international standards. The task of financial accounting is the preparation of financial statements that can be used by both external and internal users. At the same time, external users of accounting information can be shareholders and creditors (both real and potential), suppliers, buyers, representatives of tax services, etc.

Tax accounting provides the organization with information on the correct and full use of tax benefits and determines the choice of accounting policy. Depending on the methods of accounting and asset valuation chosen in it, different indicators of the balance sheet and reporting are formed. To improve performance, the organization seeks to minimize the total amount of tax payments within the law.

Each company independently develops a management accounting system based on its own ideas about the information necessary to make rational management decisions. In this regard, in management accounting, in principle, there is no single universal decision on what information should be collected and analyzed. Accordingly, there is no single universal level of detail.

The question of the differences between management and accounting is not only theoretical, the technology of management accounting directly depends on its solution, and hence the cost and efficiency of the process. Many managers believe that accounting should be actively involved in the construction of management accounting. This happens in 80% of enterprises, and often the result is deplorable.

First of all, today's accounting departments are mainly engaged in financial accounting, and now also tax accounting, which differ significantly from management accounting in terms of technologies and data presented. Financial accounting is accurate, must comply with strict legal requirements and is significantly late in relation to the event.

Management accounting is not limited by law and should only meet the requirements of a particular manager. Information about the changes that have taken place in finance and in production should come very quickly, almost instantly. The movement of financial and material flows in the enterprise with a detailed study can provide a lot of information. For example, a detailed analysis of an accounts receivable account will show how much casual and regular customers owe you; studying how regular customers paid in the past will help to predict the receipt of money in the account for the next month.

Today's accountants, already tormented by innovation, often resist fiercely attempts to involve them in internal reforms. Financial departments at new enterprises or planning and economic departments at old ones turn out to be more adapted for management accounting.

It is no secret that in many enterprises the financial director and Chief Accountant are in a state of secret, and sometimes overt confrontation. The appearance in the company of the position of financial director - a new and higher status link in the chain of financial management - often brings confusion into the established system of relationships.

In the initial period of the formation of domestic business, the priorities were most often the maximization of cash and the rapid acquisition of new assets. Accounting was aimed mainly at minimizing taxation. Now, the tasks of effective management come to the fore, which cannot be solved on the basis of the previous accounting system.

In addition, as companies integrate into the global economy, they increasingly require a new management accounting system integrated with accounting. In some companies, the chief accountant becomes the financial controller (German model), responsible for all accounting in the company - accounting, tax and international. In others, the chief accountant remains the company's chief tax lead expert, developing corporate standards and reporting procedures and overseeing relations with the relevant authorities. He also conducts internal tax audits and advises colleagues.

Purpose of accounting. Financial accounting is intended for the preparation of financial statements of the established form and content, mainly focused on external users. The purpose of management accounting is to provide managers of the organization with the information necessary to solve the internal problems of managing the company.

Financial accounting is mandatory for the enterprise, management accounting is not. The obligation to maintain financial records using analytical accounts is defined by law, which applies to all organizations located on the territory of the Russian Federation.

The question of whether to keep management accounting at the enterprise is decided by the organization itself. The collection and processing of information for management is considered appropriate if its value for management is higher than the costs of obtaining the relevant data.

Financial accounting covers all business operations of the enterprise, but it is an accounting of the fact, accounting does not include predictive values. Management accounting is mainly cost-benefit accounting, identifying deviations from optimal use household funds. Both types of accounting for management include calculated expected, predictive planned values.

Regulation. Financial accounting should be carried out in accordance with normative documents Governments of the Russian Federation and bodies that have been granted the right to regulate accounting. Liability under the law is provided for violation of the methodology of financial accounting. The methodology of management accounting is not regulated by state bodies and legislation. Management accounting is carried out according to the rules established by the organization itself, taking into account the specifics of its activities, the features of solving certain managerial tasks.

information users. The users of financial accounting and reporting information are mainly owners, creditors, investors, tax authorities, off-budget funds, public authorities, i.e. external consumers. Personally, their composition is unknown to the enterprise and everyone is presented with the same data contained in the financial statements. Management accounting information is intended for enterprise managers (managers) of different levels of authority and responsibility. Naturally, each of them needs an individual list of credentials for management, corresponding to his rights and obligations.

reporting objects. Financial accounting is carried out as a whole for the enterprise, considering it as a single economic complex. Costs and results of activities, settlements with suppliers and buyers, taxes and other obligatory payments, reserves and earmarked receipts are taken into account in the amounts generalized for the organization, without subdividing them by type of activity, structural divisions. Management accounting is maintained by market sectors, cost centers, responsibility centers, causes and perpetrators of deviations, and only if necessary is generalized for the whole enterprise.

User reporting deadlines. Not only the content is different, but also the frequency and timing of reporting. In financial accounting, reporting can be compiled based on the results for the month, quarter, year, the time of its submission - after a few days, weeks, months. In management accounting, the frequency of submission of relevant data is daily, weekly, monthly. Part of the reporting data is generated as needed or by a certain, predetermined deadline.

Financial accounting information characterizes the result of fait accompli and business transactions for the past period, reflects them on the basis of "as it was." Management accounting data are guided by the decision "as it should be" and control over the implementation of the decision. Accounting for actual values for management accounting is also important, but mainly as a basis for decision-making and analysis of their effectiveness. Since management accounting does not cancel financial accounting, it uses its information about actual costs and performance, changes in the value of assets and sources of their formation, debt obligations, etc.

The accuracy of financial and management accounting, the calculation of their reporting indicators can be different. Financial accounting data must be fairly accurate, otherwise external users will be distrustful of the content of financial statements. Approximate estimates, probabilistic calculations, indicative indicators are acceptable in management accounting. Here, accuracy may not play a decisive role, and the speed of obtaining information for control, its multivariance, and ease of use are of paramount importance.

Reporting frequency. Detailed financial statements are published once a year, in a less detailed presentation - once a quarter, half a year. Management accounting reports can be prepared monthly, daily, but strict periodicity is not observed.

Units. Financial documents, being the final product of financial accounting, are compiled in monetary units. In management accounting, the "future" ruble or dollar is often used, since it becomes necessary to estimate the amount of expected business operations, profits, output, investments. In management accounting, natural meters can be used, as well as concepts such as the hour of the machine, man-hour, norm-hour, labor hour, etc.

Accounting methods. In financial accounting, business transactions are necessarily recorded using the double-entry method, and financial statements are prepared on the basis of the closing balances of all ledger accounts. In management accounting, you can use any system for collecting and analyzing information.

A responsibility. For incorrect financial accounting, penalties may be imposed on the enterprise by regulatory authorities. Management accounting data is not intended for the general public. In case of making mistakes, the executor, the manager, is responsible to the management of the enterprise.

Ultimately, management accounting, unlike financial accounting, is not accounting for the actual value of property, costs and income, the state of settlements and obligations, but accounting for factors, circumstances and conditions that affect the production, economic and financial activities of the organization. Its purpose is to provide information for decision-making on the management of the enterprise's economy and to verify the effectiveness of the implementation of the decisions made.

The content of the concept of "management accounting" in different countries is different. It was first used by authors writing in English. In Germany, this term is not used at all, preferring to call the corresponding training course and practical work "Calculation of costs and benefits." Accordingly, the scope of planning, accounting, control and cost analysis is limited mainly to sales revenue and current year costs. In English-speaking countries (USA, England, Canada), management accounting is considered more widely. Its scope includes financial and industrial investments, the results of their use. In France, they prefer to deal with the concept of "margin accounting" and limit it to the search and justification of management decisions for the future using indicators of marginal profit.

Conclusion

The purpose of financial accounting, subject to standard requirements and principles, is to obtain data for the preparation of financial statements of the enterprise, intended for both internal and external users (investors, employees, creditors, tax authorities). External consumers of information of a company usually use three main ones to make decisions. financial statements: balance sheet, income statement, cash flow statement published in the annual report.

An accountant in the field of financial accounting plays an important role, but he cannot fully provide the information that is necessary for the managing director, sales director, internal auditor to make a certain decision. Financial accounting does not provide in full the necessary information for the sphere of management. The main purpose of management accounting is to provide persons in the management of the enterprise (including managers responsible for achieving specific performance indicators) with the information necessary to make the right management decisions. In everyday activities at the enterprise, a significant amount of operational information arises, which in any form (whether it is an object of accounting or not) is important for the manager and which provides the initial data for the formation of management accounting information.

Management accounting expands financial accounting to cover more deeply manufacturing operations. A management accounting specialist is free to choose the forms, methods and techniques of analysis, the main thing for him is to correctly grasp the essence of the economic processes taking place at the enterprise and give timely advice to the head, the administration of the enterprise.

Thus, management accounting is a part of the accounting system of an enterprise that provides the management apparatus with information for planning activities, making tactical and strategic decisions, operational management, monitoring the activities of the organization, stimulating employees of the enterprise in performing tasks, evaluating the activities of departments, individual employees within the organization.

The subject of management accounting is the economic (industrial and commercial) activities of the enterprise as a whole and its individual units throughout the entire management process. The objects of management accounting include the costs and income of the enterprise and its individual structures, which are reflected in various ways.

In management accounting, in addition to elements of the financial accounting method, such as documentation and inventory, accounts and double entry, balance sheet and financial statements, statistical, economic and mathematical methods, and methods of economic analysis are often used.

Given all of the above, we can conclude that the importance of management accounting will increase in the future. The ability of an enterprise to survive in our time during the period of economic and political changes taking place in the world is directly related to the reaction of the administration to these changes, and, undoubtedly, the role of management accounting in such circumstances will only increase.

Bibliography

1. Federal Law of the Russian Federation of November 21, 1996 No. 139-FZ "On Accounting"

2. Civil Code of the Russian Federation Part 1 and 2 // Consultant Plus. Legislation

3. Regulation on accounting "Accounting statements in the organization" PBU 4/99 dated July 6, 1999 No. 43n // Consultant Plus. Legislation

4. Sotnikova L.V. Accounting statements of the organization for 2007: Textbook / Garant 2007.- 400 p.

5. Kuter M.I. Accounting theory: Textbook / M.: Finance and statistics, 2007.- 592 p.

6. Vakhrushina M.A., Pashkova L.V. Accounting for small businesses. - M.: Vuzovsky textbook, 2006

7. Vakhrushina M.A. Accounting management accounting. - M.: Finstatinform, 2007. - 359 p.

8. Glushkov I.E. Accounting (tax, financial, management) accounting at a modern enterprise. M.: "KNORUS", Novosibirsk: "EKOR-book", 2006. -120 p.

9. Drury K. Introduction to management and production accounting. M.: Audit, 2005

10. Klimova M.A. Accounting. - M., 2005. - 200s.

11. Kozlova E.P., Babchenko T.N., Galanina E.N. Accounting in organizations. - 5th ed., revised. and additional - M., 2006. - 768s

12. Markaryan E.A. Management analysis in industries. - M., 2007. - 320s

13. Polyakova S. I. Accounting. - M., 2005. - 72s

14. Pushkar M.S. Accounting in the management system. - M.: Finance and statistics, 2008

15. Directory of the director of the enterprise / Ed. Prof. M.G. Lapusty. 6th ed., Rev., and add. - M.: INFRA-M, 2006

16. Ray VV, Paliy V. Management accounting. M.: Infra-M, 2007.

17. Relyan Ya.R. Analytical basis for making managerial decisions. - M.: Finance and statistics, 2005

18. Savitskaya. B. Analysis of the economic activity of the enterprise. - M., 2007. - 512s

19. Accounting for production costs and costing of products (works, services) / Ed. Yu.A. Babaeva. - M.: Vuzovsky textbook, 2007

20. Sheremet A.D. Management accounting: Textbook - 2nd ed., corrected - M.: ID FBK - PRESS, 2006. - 512 p.

21. Shim J, Siegel J.G. Methods of cost management and cost analysis. - M.: Filin, 2008

Many practices oppose management and accounting, as they serve different purposes, they use different methodologies, different reports are produced. The purpose of this article is to prove that this is not quite correct, or rather, not at all correct statement.

Let's start with the basics. The basis of any accounting is a business transaction, if quite simply - an event. An event gives rise to its registration in one form or another. Let's say they released the goods from the warehouse. What is an accountant interested in? Whether the fact of the sale took place or is it a delivery on account of an advance payment, or transportation from one warehouse to another. What is interesting for a manager? How many goods he has in stock, what is the cost of transportation, at what cost is the goods released, in which warehouse is it more profitable to store it.

All this information describes the same event, but in different ways, down to dates, volumes and numbers. Does this mean that the information is different? No. It is evaluated according to various criteria for use in a particular area.

Not finding available ways extracting information (or simply not knowing about it), users invent their own ways of collecting and processing it. Paper media, spreadsheets, self-written programs and finished products, formed for a specific need, are used. All this can work well in a small company where there is no need to consolidate homogeneous information at a higher level. Otherwise, the problem arises of bringing the data structured, collected, processed and generalized into a single whole in various ways.

Here the question arises: what will satisfy various needs without creating excessive information flows? Creation of the system. By a system, we understand the rules for collecting, processing and presenting information that are agreed upon and generally used in a certain community.

What does this mean? An agreement is formed between various users on the minimum required set of information related to a particular type of business transactions. For example, payment data should include all the information that is indicated in payment document, as well as the date of acceptance of the goods or works, the number and date of the internal document that approved the feasibility of the actions taken, their volume and cost, and if they were part of a larger project, also information about the details of the latter. At first glance, there is information overload, but in reality, the formation of such data is carried out in fairly simple and effective ways.

- Separation of powers - each participant in the process is assigned a certain administrative role (offer, approve, confirm, agree, enter data into the system, etc.) depending on the degree of his participation and interest in the result.

- Classification of events - each significant type of events must be agreed in advance by all parties and codified (it must be assigned a specific code) in order to be reflected in the accounting system.

- Determination of formats and directions for reporting - each of the interested and, no less important, information consumers influencing the process and result is obliged to formulate their requirements for the form and volume in which they wish to receive reports on what happened. Ideally, a minimum number of formats should be formed that sufficiently satisfies the needs of all interested parties. This will ensure that the services that generate the reports are reasonably efficient.

Non-specialists know that accountants form a chart of accounts, balance sheet, income statement and cash flow statement, but not everyone knows what it is. But almost everyone in their life has come across such documents as lists of products for purchase in a store or on the market, a list of materials and the cost of work when repairing an apartment, a set and cost of housing and communal services. Although accounting documents look quite specific to the uninitiated, accountants use the same sources of information in compiling them as other employees.

Let's look at the situation abstractly. In accounting, there are "synthetic" ("artificial") accounts. They were invented in order to achieve uniformity in design for those who do not care in which particular industry their money is invested. These investors need standard accounting and reporting principles for a company, whether it produces coffee or underwear. This is external reporting, the formation of which uses an appropriate accounting system and several generally accepted principles. They are focused on the investor - the one who invested the money, or the lender - the one who lent it.

Now let's think about those who multiply this money. These are hired employees of various levels - from a handyman to a general director.

The three most important components that interest the manager in terms of monitoring the result are resources, volumes and deadlines. Exactly in that order. As for resources, there are several main components:

- money;

- people;

- time.

All of them are complementary and interchangeable. The more people, the less time is needed, but the more money is required. The less money, the less people can be hired or the lower their quality will be, respectively, the more distant the result will be, etc.

Volumes are set within the terms of reference. Timing is theoretically a function of resources and volumes. However, in practice, a huge number of variables come into play that can significantly affect the result, controllable and uncontrollable factors.

In fact, there are no uncontrollable factors at all. The only question is who controls them and at what level. As the size of your company grows, you will be able to influence more and more factors. Costs can be regulated through the competitive selection of suppliers, revenue, respectively, through participation in such competitions. Burdened with knowledge of the realities, the reader will smile and twist his finger at his temple, but still control in the process of negotiations, purchases and sales is possible, however, in a very truncated form. The signed contract binds you to conditional obligations. However, no one bothers to agree on others, subject to a change in the situation, or, for example, if you felt that you had made the wrong decision. It all depends on the interest of the counterparty in continuing cooperation, a well-drafted contract and the acceptability of the terms of its revision. Let's get back to accounting.

The most important areas of management accounting control are:

- current expenses;

- capital expenditures;

- working capital.

All these concepts belong to the area of resources.

Current costs are usually measured in monetary units per unit of output. This measurement is often referred to as "specific". Here are the variable and fixed costs. It should be noted that expenses can be called as such only for a specific period of time. For example, costs that are fixed during a year may become variable within a two-year period.

Example 1 You have bought a new mobile plan. The previous tariff - fixed and prepaid - you have used for five years. Now the cost depends on the traffic and all operations are paid after the fact. Costs were fixed, but became variable.

This is of course a very simplified example. In manufacturing, there are many types of costs that depend on volume with a time lag. Changing the required power capacity, the required labor force, the number of pieces of equipment, depending on the technology used, can significantly affect the budget. These costs are fixed in the short run and variable in the long run.

Here you can use analytical accounts, which allow you to track costs in relation to the object (what you spend on), the subject (who spends), the goal (why you spend) and many other parameters. It is only important to decide which information is most valuable. Otherwise, the risk of unproductive overload of services with the work of entering the appropriate codes into the system and errors during this entry increases.

Example 2 You spent 10 thousand rubles. for the purchase of paints and varnishes that can be used in different industries. So far, you are only interested in knowing who ordered these materials, according to which approval document, when payment was made, when delivery will be made, and to which warehouse. Each of the components can be designated by its own alphanumeric code, which will be linked to the accounting entry, and if necessary, it can be used to compile a report based on the system data. Next, you released the materials from the warehouse to production. The credit of this transaction will contain exactly the same codes as the debit of the previous one, and the debit of the new transaction will include the codes of the product for the production of which these materials are intended, the materially responsible person, the place of application, the time of work, etc.

Thus, analytical accounts supplement each of the accounting entries, including the information necessary for a particular user.

Analytical accounts can be codified in various ways. Their designations may depend on the accounting system you use, the industry you work in, the shop or service where they apply. Their advantage and at the same time a disadvantage is that the set, content and purpose of these accounts are most often determined by people who are far from accounting. These people often do not even suspect that these can be called bills.

Example 3 The shop manager wants to have information about how many parts are produced on each of the machines per shift, i.e. he is interested in:

- inventory number of the machine, compliance with production requirements and degree of wear;

- the name of the worker who uses it, his qualifications and experience;

- the quantity of parts and the quality of their workmanship.

This process involves the worker himself, his foreman, a machine tool engineer, a timekeeper, a quality control department employee, a worker at the warehouse where parts are received, and, of course, an accountant.

For an accountant, the event will look very simple (Table 1).

Table 1. Accounting type posting report

The main goal is to reflect this event in such a way that it appears correctly in the balance sheet and income statement.

What is required for management accounting in this case? As part of the loan, additional details appear (the number and type of detail may be different). The information will be reflected not in one transaction of the form “credit of one account and debit of two others”, which will suit the accountant, but in two transactions crediting the same account with the same details, but at the same time debiting different accounts with different additional features. This will filter the data according to the required criteria. The credit of the Production Costs account will include the machine number, worker name and production volume already mentioned above. Depending on whether the produced part from the warehouse goes directly to further production or sale, or is sent for revision or disposal, it will be possible to draw a conclusion about the performance of a particular machine or worker. This information will provide the manager with food for thought: due to what the overall and useful productivity of the machine and the employee working on it differ. It can be represented, for example, in the following form (Table 2).

Table 2. Management Posting Report

This table should be supplemented with more detailed data on machines and employees, which are also contained in the system with appropriate settings. It is quite possible to combine such heterogeneous information in a single database, and without any special additional labor costs and requirements for information storage devices.

It is worth distinguishing between sub-accounts of synthetic accounts and analytical accounts, although, in fact, they perform the same function - clarification of information. However, sub-accounts are parts of a synthetic account, and analytical accounts are additional data organized on the basis of criteria not directly related to accounting, but accompanying events in the interests of the persons involved / responsible.

Capital expenditures are (should be) a tool for developing a company or at least keeping it afloat. Such maintenance is associated, as a rule, with the replacement and / or modernization of available capacities within the existing production facilities. Development is associated primarily with the implementation of new investment projects on its own or the acquisition of existing and operating facilities as part of the company's strategy. In all cases, the decision is made on the basis of forecasts of the main indicators of investment efficiency, and further tracking within the framework of management accounting.

Here, additional codes in accounting entries can indicate the work classification structure and the cost classification structure. Most often, the structure of work relates to areas of activity (design, procurement, logistics, implementation, management). The cost structure is closer to accounting understanding, i.e. it reflects the composition of the costs for the implementation of a particular object (the cost of equipment and materials, transportation, storage, installation and construction, debugging, testing, commissioning, etc.). In principle, these two components can be represented as a matrix, where the elements of the structures can be located vertically or horizontally, and at their intersection there will be specific cost centers that can be grouped for taxation, accounting and management accounting purposes.

Example 4 Consider the costs of the project in the context of work and costs. In table. 3 you can see what makes up the final cost of the project, including internal and external costs.

Table 3 Cost matrix in the context of the elements of the structure of work and costs, thousand rubles.

In this case, our task is to determine which of the intersections is the most important, and which of them should be given attention. With regard to investment, the same principle applies as in medicine - "do no harm." Those costs that are controlled within the company must be correlated with utility, i.e. cost and effectiveness of their control. At the same time, we will keep in mind that initially the potential efficiency of capital investments is determined not by accounting indicators, but by such indicators as the internal rate of return, net present value, profitability index. These indicators are not reflected directly in the reporting, but can be calculated based on the data that it provides. They directly depend on the resources, volumes and terms already indicated above. The longer the project implementation period, the greater the required resources, the larger the volume of capital investments, the lower the performance indicators.

Why are cost elements used in one or another plane? First of all, to track the progress of the project in comparison with the planned indicators. Knowing that the initial budget is being executed in accordance with the forecast, we can conclude about the degree of literacy of its preparation and the professionalism of its implementation. This is not only a way to evaluate the current project, but also the possibility of selecting personnel for future ones.

Any project initially has its own execution schedule, usually very optimistic. It has already been said above that time is converted into money. Accordingly, it makes sense to control the implementation schedule. How? By introducing checkpoints. Our task is to break the action into intervals and determine the resources needed to reach the next point. More precisely, it is the job of those who request resources, in addition to this, their tasks include the implementation of the idea, the report on how the resources were spent, and the receipt of the next tranche of funding. This is where the earned value chart comes in handy. I don't like the word "development" in economics in general, but in this case it is quite applicable. Let us briefly consider the principles for constructing such a schedule: the initially declared costs for production volumes over time during the implementation of the project are adjusted for the same factors. What factors do you mean? For example, at the initially declared costs, by a certain moment, certain objects in such and such a quantity (a certain percentage of the expected result) should be built. During the interim control, management evaluates what percentage of the work has been completed: how many facilities have been built to date and how much money has been spent on it. As a rule, the picture is depressing, but it happens otherwise.

Example 5 It is meaningless to give a schedule for a specific project here, but it makes sense to describe the principles of its construction. The abscissa shows time, the ordinate shows costs. The graph reflects three indicators for the entire period of the project, divided into actual and forecast data:

- how much should have been done at the prices declared during the defense of the project, and how much should remain;

- how much has been done in real prices compared to what was planned at a particular moment, and what is forecast now;

- what would the initial forecast of terms look like, taking into account the current price level.

This analysis gives a fairly complete picture of the ability of the project team to plan and carry out activities for the implementation of the project.

Working capital is one of the most important management tools. Simplifying, we reduce it to the main components: stocks, receivables and payables. For all these categories, the most important criterion is time. Let me remind you that the proceeds awaiting payment become accounts receivable. Payable - this, respectively, the costs presented for payment. Stocks can be both materials purchased for production, and finished products that are not sold to the consumer. Based on our ideas about efficiency, the issue of management accounting is the turnover, or "age" of the position in the accounting system. The longer the receivables or inventory is on the balance sheet, the more costs the company incurs and the less free cash it has. Conversely, the more it delays the payment of accounts payable without penalty, the better its balance of payments, so management accounting in the area of working capital is mainly focused on timing.

However, it is also important in which departments, when working on which projects and under whose leadership certain problems or breakthroughs arise in relation to working capital, therefore, in addition to the “age” of a particular position, it is important to indicate this information.

In this article, management accounting is considered as a necessary addition to accounting or financial accounting. To combine these types of accounting, additional elements ("tags") of the posting are used, which can be analytical accounts, information about dates, persons, documents, and other attributes inherent in any action in real life, even outside the scope of economic activity. It is enough to take a closer look and evaluate what kind of information you are interested in and how much you are willing to pay for it.

Currently, general accounting in the West is divided, as a rule, into two subsystems: external - financial and internal - managerial (production, operational). Such a division is due to the difference in the goals and objectives of external and internal accounting.

In financial accounting, information is created on the current expenses in the element-by-element section and the income of the company, on the status of receivables and payables, on the size of financial investments and income from them, the state of funding sources, etc. One of the main tasks of such accounting is the reliability of accounting for the financial results of the enterprise, its property and financial condition. In this case, information consumers are mainly external to the enterprise users, state tax authorities, stock exchanges, banks, financial institutions, suppliers and buyers, potential investors. Financial statements are not a commercial secret of the enterprise, they are open for publication and, as a rule, are certified by an independent audit organization. Maintaining financial accounting for enterprises and firms is mandatory.

International accounting standards, basic accounting principles are related specifically to financial accounting systems. As for the internal accounting system at the enterprise, the question of whether to create it or not is decided by the administration of the company itself. In the internal accounting system, first of all, information about costs is created.

Production costs are one of the main objects of management accounting. They are grouped and accounted for by types, places of their occurrence and cost carriers. Cost centers are structural units and departments in which the initial consumption of production resources (workplaces, teams, workshops, etc.) takes place. Under the cost carriers understand the types of products (works, services) of the enterprise, intended for sale on the market.

In the management accounting system, such accounting objects as “responsibility centers” are necessarily distinguished. Cost management occurs through the activities of people who should be responsible for the appropriateness of the occurrence of one or another type of expenditure. Responsibility center - a structural element of the enterprise, within which the manager is responsible for the appropriateness of the costs incurred.

The administration decides for itself how to classify costs, how detailed the cost centers are, and how to link them with responsibility centers.

Another object of management accounting are results, which can also be accounted for by cost centers and cost carriers. In the process of comparing the costs and results of various accounting objects, the efficiency of production and economic activity is revealed. To ensure economic relations between the internal divisions of the enterprise, a transfer pricing system is being created. The transfer price (also an object of management accounting) is the price used in settlements between the internal structural divisions of the enterprise for products, works and services transferred to each other.

Management accounting information is usually trade secret enterprise, is not subject to publication and is confidential. The administration of the enterprise independently establishes the composition, timing and frequency of submission of internal reporting, which is also one of the objects of management accounting. This accounting system is practically not regulated by Western legislation.

Thus, we can say that every Western enterprise or firm has its own management accounting system.

Accounting information should not be formed for the sake of accounting itself, but be useful to its internal and external users, serve as the necessary basis for the implementation of forecasting, planning, standardization, analysis and control processes, i.e. be an important means of making effective management decisions. It is obvious that in order to meet all the requirements listed above, it is necessary to use various methods for collecting, processing and displaying information. In economically developed countries, this problem has been solved by dividing the entire accounting system into two subsystems: financial and managerial.

Financial accounting covers information that is used not only for internal management, but also communicated to counterparties, i.e. third party users. This information should satisfy the needs of both fiscal government agencies and shareholders of companies, holders of bonds and other securities, and potential investors. The norms and rules of financial accounting are regulated not only by national, but also by international standards.

Management accounting is intended to solve internal problems of enterprise management and is its "know-how". Unlike financial accounting, management accounting is subjective and confidential, but it is he who bears the main burden of ensuring high-quality management decision-making and it is implemented by high-level professionals.

Most of the elements of financial accounting can also be found in management accounting:

- in both accounting systems, the same business transactions are considered. For example, data on the types of costs (raw materials and materials, wages, depreciation charges) reflected in the financial accounting system are used simultaneously in management accounting;

- on the basis of the production or full cost calculated in the management accounting system, a balance sheet assessment of the assets manufactured at the enterprise in the financial accounting system is made;

- methods of financial accounting are also used in management accounting;

- operational information is used not only in management accounting, but also for the preparation of financial documents. Therefore, in order to avoid duplication, the collection of primary information should be carried out in accordance with the interests of both financial and management accounting.

However, the most important feature that unites the two types of accounting is that their information is used to make decisions.

The degree of interrelation between the systems of financial and management accounting largely depends on the specifics of the structure of the current Chart of Accounts.

Financial and management accounting are interdependent and interdependent components of a single accounting. But along with this, there are fundamental differences in the following issues:

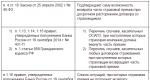

1. Compulsory record keeping.

The maintenance of financial accounting is provided for by law, i.e. necessarily. In accordance with Art. 18 of the Law of the Russian Federation “On Accounting” “heads of organizations and other persons responsible for organizing and maintaining accounting, in case of evading accounting in the manner prescribed by the legislation of the Russian Federation ... distortion of financial statements and failure to comply with the deadlines for its submission and publication are subject to administrative or criminal liability in accordance with the legislation of the Russian Federation. Accounting financial records are kept in the required form and with the required degree of accuracy, regardless of the desire of the company's management.

2. Purposes of keeping records.

The purpose of financial accounting is the preparation of financial documents for external users. As soon as the financial statements are ready, the goal is considered to be achieved.

The purpose of management accounting is to provide intra-production planning, management and control. The goal of management accounting over time is continuous, permanent and achieved for a short moment.

3. Users of information.

Consumers of financial accounting information are external users.

Management accounting information, in contrast, is prepared for internal users.

4. Accounting methods.

The most important elements of the financial accounting method are accounts and double entry, documentation and inventory.

Management accounting uses these techniques, but not always. Information is not necessarily recorded in a dual system.

5. Freedom of choice.

Financial accounting is based on generally accepted principles that govern the recording, evaluation and communication of financial information, i.e. it is centralized to a certain extent. Public financial statements are subject to mandatory audit.

Management accounting, on the contrary, is organized on the basis of the goals and objectives of managers, is not regulated by the state in any way, serves only the interests of the enterprise, which is its advantage over financial accounting. General principles this account are reduced to providing the management with useful information as much as possible. Management accounting is more based on logic and experience or general acceptability. In this sense, we can talk about the decentralization of management accounting.

6. Used meters.

As you know, financial records are kept in the Russian currency - rubles. Financial statements must also be prepared in ruble terms.

7. Grouping costs.

In financial accounting, costs are grouped according to economic elements. An element is a homogeneous type of production cost. The grouping of costs by elements is intended to answer the question: what was spent on production in the reporting period? It does not take into account where and for what the funds are spent. PBU 9/10 “Expenses of the Organization”1 for the purposes of financial accounting, the following list of economic elements is defined: material costs; labor costs; deductions for social needs; depreciation; other costs.

This classification of costs allows you to determine in financial accounting the result (profit or loss) for ordinary activities.

In management accounting, costs are grouped by cost carriers in the context of costing items. The cost carrier is understood as the types of products (works, services) of the enterprise intended for sale both on the external market and within the organization. The classification of costs by costing items gives an answer to the question: what are the resources spent on and where? The list of cost items is established by the organization independently. This is due to the fact that the organization of production accounting as an element of management accounting is the policy of the enterprise in the field of cost management, i.e. "domestic" policy.

As a result of differences in approaches to grouping costs in financial and management accounting, information on profit is formed in different ways. According to financial accounting data, it is possible to calculate the financial result of the activities of the entire organization (this information is presented in the form No. 2 of the financial statements “Profit and Loss Statement”). From the information of management accounting, you can find out how profitable this or that type of product (work, service) is.

8. The main object of accounting.

In financial accounting, the economic activity of the enterprise is perceived as a whole.

In management accounting, the focus is on responsibility centers - structural units headed by managers who are responsible for the results of their work. So, the centers of responsibility can be a workshop, a site, a team - at an industrial enterprise, a section - at a trade enterprise, a department - in a research organization, a department - in a medical institution, etc. At the same time, only such indicators of costs and revenues that he can have a real impact on (the so-called adjustable costs and revenues) are included in the responsibility of the head of the unit. Therefore, sometimes management accounting is called responsibility accounting.

Responsibility for the implementation of the relevant indicators lies with the head of the center. Breaking the enterprise into profit centers, management considers this indicator to be the main one for evaluating the performance of its managers. (This approach has been practiced in the UK for over 40 years.)

Taking profit as the main estimated indicator, they are guided by the following rules:

- the growth of the profit of the unit should not lead to a decrease in the profit of the entire company;

- the profit of each division must be formed objectively, regardless of the size of the profit of the entire company;

- the results of the activities of one manager should not depend on the decisions of other managers.

In addition to the allocation of cost centers and profit centers at the enterprise, management accounting allows the formation of investment centers.

The level of detail of cost centers and their linkage with responsibility centers are established by the administration of the enterprise. Thus, in management accounting, attention is focused both on economic activity as a whole and on individual functions.

9. Frequency of reporting.

In financial accounting, the frequency of reporting is established by legislative regulations. A full financial report is compiled by the enterprise at the end of the year, less detailed - quarterly.

In management accounting, reports are compiled as needed: monthly, weekly, daily, and sometimes immediately. The administration of the enterprise independently establishes the composition, timing and frequency of submission of internal reporting. The main principle is expediency and economy.

10. The degree of reliability of information.

Financial accounting is documented, but despite this, its estimates may not be absolutely accurate.

Management accounting information is largely of a calculated nature and is often not related to operations on accounting accounts. The administration of the enterprise needs timely information, and here it is often possible to go for a certain relaxation of the requirements for its accuracy in favor of efficiency. As a result, estimates are often used in management accounting.

11. The degree of openness of information.

The financial statements are not trade secrets. It is open, public and in some cases certified by independent auditors.

Management accounting information, as noted above, is usually a commercial secret of the enterprise. It is not subject to publication and is confidential.

12. Binding in time.

Financial accounting reflects the financial history of an organization. In accordance with the principle of documentary validity, accounting entries are made after the business transaction is completed. Although financial accounting data is taken into account in planning, they are still of a “historical” nature.

Management accounting contains both "historical" information and estimates and plans for the future. Therefore, they often say: the purpose of financial accounting is to show “how it was”, and management accounting is “how it should be”.

13. Basic structure.

Financial accounting is based on the well-known capital equation:

Asset = Equity + External Liabilities.

The structure of management accounting information depends on the requests of users of this information.

14. Methodology for calculating financial results.