Open iis in the bank opening. Opening an individual investment account - how to make the right choice of a company. What to look for when choosing

From January 1, 2015 in Russia, in order to increase citizens' investments in stock market new type of account individual investment account (IIA). In this article, we will describe in more detail what an IIS is, as well as its features.

What is an individual investment account?

IIS is a regular brokerage account (or an account in management company), which allows you to invest in the stock market directly (in bonds, stocks, mutual funds, futures, options, etc.), or entrust it to a management company.

Any citizen of the Russian Federation (to be more precise, a resident of the Russian Federation) can open an IIS in a brokerage or management (investment) company. Now many companies (including largest banks and brokerage organizations) offer similar services.

The main differences between IIS and a regular brokerage account:

Example: In 2018, Betonov L.A. opened an investment account in brokerage company and put 1 million rubles on it. Through the Internet program, he independently monitors the account and invests in the stock market (buys / sells securities). After 3 years, Betonov L.A. can close the IIS and withdraw the funds (it is possible to close the account earlier, but in this case he will not be able to receive a deduction).

Example: In 2018 Grechikhina A.A. opened an IIS in a management company. She chose the Risk-Free Bond product. After that, Grechikhina A.A. can track the return on investment, and all purchases and other actions are carried out by the company.

tax deductions

By opening the IIS, you can get one of two tax deductions:

- IIS contribution deduction. You can return 13% of the amount of the contribution to the IIS (clause 2, clause 1, article 219.1 of the Tax Code of the Russian Federation), but not more than 52 thousand rubles (this is 13% of 400 thousand rubles). If during the year you deposit any amount into the account in the range from 400 thousand rubles to a maximum of 1 million rubles, you can return no more than 52 thousand rubles. If you receive investment income, you will have to pay income tax at a rate of 13%.

- Earned profit deduction. Instead of receiving a deduction on contributions, you can exempt all profits received on the IIS account from income tax (clause 3, clause 1, article 219.1 of the Tax Code of the Russian Federation). Accordingly, if you receive income as a result of investing, then you will not need to pay tax on it.

Note: You can use only one type of deduction. You cannot use two (clause 2, clause 4, article 219.1 of the Tax Code of the Russian Federation).

More detailed information about deductions (with examples, comparison, etc.) you can find in our article: Tax deduction for IIS.

How to open IIS?

At the moment, many companies on the market offer the service of opening IIS. Of these, it is worth highlighting:

- Brokerage companies, which offer both independent trading in the stock markets and ready-made products (you choose a product, and the company invests money according to your choice). Examples of large brokerage companies: FINAM, BCS, KIT Finance.

- Management companies. These companies offer you to choose one of the ready-made investment strategies (you choose the type of securities in which you invest money and the risks you are willing to take), and the management company itself invests the money. Examples of large management companies: Sberbank, VTB 24, Otkritie.

The opening process is basically as follows:

- you enter into a contract;

- You deposit funds;

- You choose an investment product or trade on the stock exchange yourself (usually through an online client).

Which company to choose?

First of all, you need to decide whether you want to trade on the stock exchange yourself or whether you want to entrust the management of your funds to a financial company (choose a ready-made product). After you have made this decision, look at the offers major players on the offered products, commissions and guarantees. Based on these data, choose what is closer to you.

If you are served in any bank and want to minimize your time costs, you can find out about opening an IIS in it.

Should I open an IIS? Pros and cons.

On the websites of most brokers and management companies you will find information that IIS is more profitable than bank deposits. However, in practice, things are not so clear cut.

If you are already trading on the stock exchange (and are ready to invest for 3 years), then you should open an IIA, because in addition to regular trading, you will be able to take advantage of tax deductions.

If you have never used investment products or traded on the stock exchange, but have always wanted to do so, then IIS is a great opportunity to try.

When choosing between a bank deposit or an IIS account to save Money and earning income, you should pay attention to the following:

- Companies often indicate that you receive 13% (more than on deposit) only from the tax deduction. This is not entirely true. You get 13% one-time, and the money will have to lie on the account for 3 years. That is, the "deductible" income from the funds deposited in the first year on IIA will be only (13% / 3 years = 4.3% per annum).

- If the company's product does not have guaranteed risk protection (there are such products on the market), then you can lose money by reducing the value of the assets in which they are invested (and state of the art market, it is rather difficult to make forecasts for 3 years).

If the product has a similar guarantee, at least you will get your money back. - Potential returns are directly proportional to risks. For example, by investing in government bonds (directly or through a finished product), your risks are minimal, but the yield is also small (maybe lower than that of bank deposits). If you invest in high-risk assets (in the hope that they will grow), then you bear the risk that they, on the contrary, will "fall" in price (ie, you will lose money). Pay attention to all sorts of "money management" fees. They can reach several percent per year and this can significantly affect the overall profitability.

If you are not sure, then do not immediately transfer all the money from deposits to IIS, but start with small investments. In the future, you can always increase the amount of contributions to IIS (also, if you keep money both on deposits and in IIA, you reduce your risks).

In conclusion, it is worth noting that in most foreign countries people rarely keep money on deposits, but more often invest it in the stock market. So maybe you should start investing too.

How and where is it better to open an individual investment account (IIA) in 2019?

Many prominent entrepreneurs have repeatedly spoken out about such a useful thing as long-term investments. So, Warren Buffett, who heads Berkshire Hathaway, constantly talks about this in his regular letters to the company's shareholders. This is what John Bogle, the legendary founder of the Vanguard Group, says.

For a non-specialist, this is essential, since he is especially at risk of losing funds on the exchange if he starts to engage in intraday transactions on it.

The Russians have an excellent tool, which is an individual investment account. This is hosted by a brokerage service - which, in turn, helps an individual (subject to certain restrictions on the part of the latter) to make serious profits due to tax benefits.

The domestic market saw such a mechanism for the first time in 2015, the reason for this was the update of the legislation on the share market, along with updates in Tax Code countries.

Important to know about IIS

An account can only be created by a private trader, both with a brokerage company and directly with a bank. Of the requirements - taxation on the territory of the Russian Federation (presence in the country from 183 days a year). At the same time, there is a rule: one account - one individual.

Which brokerage company is best to open an investment account? Check out the rating best brokers Russia in 2017.

The account itself is not limited in time, but in order for tax benefits to be applied, it is necessary to meet the minimum investment period, the value of which is 3 years and which starts from the date of signing the contract.

The account is allowed only in rubles, and within 12 months it can be replenished in the amount of no more than 1 million rubles, although until 06/18/17 the limit was 400 thousand rubles. It is not necessary to replenish the IIS additionally annually. However, it is unacceptable to withdraw part of the funds back.

You should also remember about banking and brokerage commissions for working with securities.

IIS tools

At the same time, any investment options are possible that are applicable to the leading Russian trading floors Moscow and St. Petersburg. It:

- shares of Russian and foreign enterprises;

- bonds of municipalities, corporations, sovereign;

- currency;

- shares of mutual funds;

- derivative methods (option, futures trading, etc.).

It should be noted that some brokers and banking institutions do not allow you to work with a number of instruments, issuers, etc. Full list Supported investment methods can be obtained from the broker.

IIS and tax deduction

The main plus of the account is the return of part of the investment, which ultimately increases profitability. Moreover, 2 types of tax preferences are provided for IIS owners.

Deductionfor a fee

In this situation, an individual is provided with a 13% refund of the amount that was credited in the previous year, however, its largest amount is limited to 130,000 rubles.

Important: the deduction is possible when the investor has declared profit for past period(i.e. there was a tax payment), and the maximum refund cannot be more than the tax amount.

If less than 3 years have passed since the opening of the IIA, its replenishment, application for a refund and its subsequent receipt, the law obliges the investor to return the funds to the state.

If the investor closes the account, then 13% tax will be withheld from the profits received.

Deductionon income

Such a deduction exempts an individual from taxation on personal income tax form from the amount of all income credited in the course of IIS operations. The law provides for the application of a deduction without the obligatory possession of other taxable income.

An individual can count on such a return only after 3 years from the date of creation of the IIS. If it is closed before 3 years from the moment of its formation, the state will withhold personal income tax in the amount of 13%, similar to the brokerage account scheme.

It is important to take into account all the nuances and details of investment when choosing the type of deduction, including the method of investment and tax rate at a profit. For example, personal income tax does not apply to payments on coupons and domestic government bonds. In the case of the purchase of OFZ, for example, you can get a refund on the contribution.

Getting a tax deduction

If we are talking about a deduction for replenishment (contributions), the investor applies to the tax office in the year following the one in which the replenishment was made. In this case, it is necessary to confirm the contributions with the 3-NDFL declaration, attaching the following documents to it:

- confirmation of receipt of last year's profit with a tax rate of 13% (say, a certificate 2-personal income tax from the organization in which the individual works);

- confirmation of the creation of the IIS and the transfer of funds to it (can be provided by a broker);

- application for a refund, for this you will need to provide bank details.

If a deduction for income is implied, then an individual must, upon termination of the contract, give the bank or broker a certificate from the tax office stating that there are no cases of receiving deductions for replenishment.

The bank, therefore (or the broker), will not be able to pay out the money with the withholding of 13% personal income tax.

Many people have heard about the IIS. But the information is mostly superficial. You need to invest money, buy something with it, and you can still get money from the state from this. And what, how and where is not clear. Is it reliable? Or another scammer? How much can you earn on this and is it worth contacting the IIS. In this article, we have collected the most popular questions about individual investment accounts.

What is IIS

IIA or individual investment account is a special brokerage account opened by individuals that allows you to receive one of two possible tax benefits.

The program started on January 1, 2015. According to the government, the main goal is mass stimulation of the population to invest money in the stock market.

tax incentives

IIS owners are provided with 2 types of accounts. Allowing you to claim only one tax credit.

- Receiving a tax deduction of 13% of the amount of funds contributed (but not more than 52 thousand per year).

- Exemption from paying taxes on income received from investments.

You need to choose one. A decision in favor of one or another can be made within 3 years.

The return of 13% looks the most attractive. But in some cases, . To receive a deduction, you must have official income on which taxes have been paid.

After all, 13% is a refund of taxes paid by an individual.

How to get a tax deduction

If you choose a 13% refund, then the procedure for receiving money is as follows:

- At the end of the reporting period (from the next year after depositing funds into the account), you need to contact the tax office at the place of residence. Having provided a package of documents: an agreement to open an IIS, an extract for crediting money to an IIS (can be printed from the bank’s personal account), a certificate of income 2-NDFL, an application for a refund of 13%.

- Within 3 months (the maximum period), the declaration is being verified.

- After verification, another 1 month is given to transfer funds to a bank account.

- We receive money and rejoice.

Much easier and faster to serve. Through the personal account of the taxpayer. No visit tax office. The procedure for filling out the declaration takes just a couple of minutes.

IIS validity period

IIS is opened for a period of 3 years. It is valid from the moment of conclusion of the contract, and not the first deposit of funds to the account.

It is not prohibited by law to keep "empty" investment accounts. By the way, many people do just that. Conclude a contract for the opening of IIS. Waiting 3 years. And at the end of the end of the three-year period (for 1-2 weeks), funds are deposited into the account.

At the end of the 3-year period, the money can be withdrawn immediately. And get a tax deduction of 13% of the deposited amount.

What is the maximum and minimum amount of IIS replenishment

There are no restrictions on the minimum amount as such. You can contribute at least a thousand, at least one ruble. Another thing is that with little money you can hardly buy anything. Yes, and a deduction of 13% from a couple of thousand contributed will be completely ridiculous.

The main thing in another is the tariffs and terms of service of brokers. Many introduce a minimum amount to maintain an account. Usually about several tens of thousands of rubles (from 30-50 thousand).

In a year, you can replenish IIS in the amount of up to 1 million rubles. Total for the operation of the IIS - the maximum possible contribution - 3 million rubles.

But the maximum amount of the deduction received is limited to 52 thousand rubles a year. Or 156 thousand for a three-year period.

It is not advisable to replenish for a larger amount than 400 thousand (if you have chosen the IIS of the first type).

How to open IIS

To open an investment account, you need to contact a broker and conclude an agreement for brokerage services with him. The procedure itself is similar to opening a bank deposit. You will need a passport, SNILS and TIN number.

The list of brokers providing IIS opening services is presented on the Moscow Exchange website.

Almost all top brokers allow you to open accounts online without visiting the office.

For example,

- Zerich.

How many IIS can be opened

One person can only open one account.

But you can open accounts for other people (relatives, friends) who do not plan to participate in the tax deduction program. Or rather, they open accounts, and you deposit your own money. And you get the 13% required by law. Perhaps share some of the money with them "for the inconvenience".

What can I buy on IIS

The following securities are available for purchase to investors who have opened an account:

- shares of Russian companies;

- debt securities: bonds federal loan(OFZ), municipal and corporate bonds;

Is it possible to buy currency on IIS?

All securities traded on the Moscow Exchange are available for purchase on IIS. And the currency as well.

Is it possible to withdraw money early

In principle, there are no restrictions on withdrawal. You can sell securities and withdraw money at any time.

But according to the law, with a full or partial withdrawal of funds, the owner of the investment account loses the right to receive tax benefits.

And if a tax deduction for previous years has already been received, then this amount will need to be returned to the budget.

How much can you earn?

Depending on what financial instruments you will invest in.

If these are stocks, then the run-up is quite large. For 3 years, you can either earn (20, 30 or even 100%) or lose. No one can give you any guarantees here.

For beginners, it is better to buy fixed income securities - bonds.

First of all, pay attention to the most reliable - federal loan bonds.

On the this moment you can get a yield of around 8% per annum. Summing up with a return of 13%, we get a yield of about 21% for the first year.

If you contribute 100,000 to IIS every year, you will be able to earn 87,000 rubles in 3 years. This is without reinvestment. That is, you will spend all the profits you receive.

If you buy more OFZs for the resulting deduction, the total profit grows to about 100 thousand rubles.

The average annual yield of the IIS owner is 15% per annum.

Compare this to bank deposits. And draw a conclusion.

Is it reliable?

The opening of IIS is associated with investments in the stock market. Securities traded on the stock exchange have a different degree of reliability.

If we talk about stocks, then you can not only earn nothing, but even lose. So we pass by.

Bonds are a fixed income instrument. The most reliable among bonds are OFZ. The state is responsible for the obligations. The best option is to invest in government bonds for the duration of the IIA.

Are accounts insured like bank deposits? What will happen to my money if the broker goes bankrupt.

No, they are not insured. Here is a slightly different scheme. The assets purchased by the investor are not stored with the broker, but in . It used to be that all shares and other securities had paper form. Now all data on the owners and turnover of securities is stored in the depository (special server).

And even if the broker is suddenly closed, the right to own shares, bonds will be available. You just need to switch to another broker.

By the way, the situation with brokers on Russian market stable. A few years ago, the requirements for brokers were tightened. And their number has decreased several times. All sorts of small "sharashkin offices" left the market and only the largest and most reliable ones remained.

What is better IIS or PIF

They also allow you to invest in the stock market. And earn accordingly.

The main advantage of a mutual fund over IIS is the ability to withdraw money at any time.

Otherwise, the mutual fund outright loses to investment accounts:

- You can not get an additional 13% in the form of a deduction.

- The purchase of securities is limited by the strategy of the mutual fund. That is, if you choose a stock fund, then only stocks will be in the portfolio. If you need bonds, you need to buy shares of another fund. Of course, there are mixed funds that buy both stocks and bonds. But there are not many of them. Typically, the management company invests money only in a certain direction.

- The main disadvantage of mutual funds is high trading costs. Shareholders are forced to pay a certain percentage every year. Regardless of whether a profit is made or not.

Why is it not profitable to invest through a mutual fund?

Typically, the fund takes from its shareholders an average of 3-4% of the amount of assets in the account. Annually. Add to this the fee for buying (1-2%) and selling (0.5-1%) shares.

IIS commissions are much more modest:

- depository fee - approximately 100 rubles per year;

- exchange commissions - 0.01% of the transaction amount;

- broker commission - an average of 0.05%.

For example. Contributed to IIS 400 thousand rubles. And they bought bonds with all the money. The total cost will be a little less than 300 rubles. When selling after 3 years, pay how much.

In total, all your expenses will amount to 600 rubles per transaction + 300 rubles per depository (100 rubles each for 3 years).

IIS expenses - 900 rubles for 3 years.

When investing for a similar amount and term through a mutual fund, you will immediately pay 400 rubles only for the purchase. And for 3 years of ownership, 9-12% of the amount on the account or 3,600-4,800 will go in the form of commissions.

Total expenses in the mutual fund - 4,000 - 5,200 rubles.

What is the difference between an IIS and a regular brokerage account

As in the case with mutual funds, you can withdraw money from a regular brokerage account at any time. But it is not subject to tax benefits inherent in IIS.

Otherwise, there are no differences. For the same broker, the tariffs and conditions between IIS and a regular brokerage account are identical.

Is it worth it to open an IIS

- If you have extra money that you are willing to invest.

- You know for sure that you will not touch the money for 3 years.

- Do you want to receive a guaranteed increased income from investments (1.5 - 2 times higher than the rates on bank deposits).

If the answer is “yes” to all points, then it is probably worth opening an investment account.

For example. At the moment, deposits in Sberbank give about 4-4.5% per annum. Buying bonds with fixed income (even the same Sberbank) will allow you to make a profit of 1.5-1.8 times more. Plus 13% as a deduction.

Total for the first year you can get at least 20% per annum.

30.01.19 111 884 80

A detailed guide to IIS for those who want to quickly understand everything

Number of individual investment accounts on the Moscow Exchange recently exceeded half a million.

Evgeny Shepelev

private investor

A good reason to put everything on the shelves for those who do not yet have IIS - or already have, but there are still questions.

I have collected in this article the questions about IIS that we are most often asked in T-Z. If you have additions, write in the comments.

The main thing about IIS: what, why and how to open

What is IIS? An individual investment account is an investment method that appeared in Russia in early 2015.

In fact, this is a brokerage account with preferential taxation and some restrictions. There is also an IIS with trust management, where all operations on the account are performed by the management company. Restrictions and privileges - the same.

What are the advantages compared to a brokerage account? First of all, tax deductions for Russian tax residents. You can return personal income tax in the amount of 13% of the amount paid to the IIS, up to 52,000 rubles per year: this is a deduction for the contribution. Or you can not pay personal income tax on income received on IIS: this is a deduction for income.

Another plus is deferred taxation. In the case of a contribution deduction, tax on profitable transactions on IIS is calculated only when the account is closed, and not every year, as on a brokerage account. This is good: as long as the money has not gone to the tax office, you can invest it in something and get additional income.

Are there any downsides? There is. In order for an investor to qualify for a tax deduction, the account must exist for at least three years. Withdrawal of money from the account will lead to the closure of the IIS:

For example, if an IIA was opened on December 20, 2018, then it can be closed on December 21, 2021 or later without loss of deductions.

If you close the IIA earlier, the right to deduct disappears, and the tax already returned from the budget will have to be returned to the state with the payment of penalties for the use of the refunded personal income tax: 1/300 of the Central Bank rate from the returned tax for each day of using this money.

During a calendar year, no more than 1 million rubles can be deposited on IIS, and foreign currency cannot be entered.

In my opinion, the cons are not very significant, but the pros make IIS a very interesting tool.

How to open IIS? To issue an IIA with self-management, you need to contact a broker that provides such a service. These are, for example, Tinkoff Investments, VTB, Zerich.

IIS with trust management can be opened in a management company, for example, Sberbank Asset Management, Alfa Capital. When opening an account, you will need to select investment strategy from those offered.

To open an IIS in the office of a broker or management company, a passport is enough, it is also desirable to know your TIN. Some brokers and management companies allow you to open an account remotely through their website, for example, with identification through public services.

If you open an account with a broker, you usually do not need to immediately replenish the IIS: it can be empty. In the case of a management company, when opening an account, you usually immediately need to deposit money. Of course, exceptions are possible: their rules may differ.

Which is better: IIS with self-management or with trust? What is the difference? If you have a self-managed account, you make all decisions and all transactions yourself. At the same time, you pay a commission to the broker for transactions and for the storage of securities. All brokers have their own commissions.

If you have an IIS with trust management, the management company will do everything for you according to the strategy you have chosen. It's easier than managing it yourself, but every year the MC will take a few percent of your capital as a commission.

MC does not guarantee profitability. Moreover, even if there is a loss on the IIS, the management company will still take a management fee.

Can civil servants use IIS? It is possible: there are no restrictions in the laws on the opening of IIS by civil servants or their relatives.

At the same time, some civil servants cannot invest in foreign financial instruments, which are available, including through IIS. When investing in certain Russian securities, civil servants may have a conflict of interest. For example, if you own shares in a company that, on duty, must be checked for compliance with laws. In such a situation, it will be necessary to trust management or sell papers.

Find out if you are prohibited from investing only in permitted assets.

Is it possible to have both an IIS and a brokerage account at the same time? Can. Brokerage accounts, by the way, can be opened as many as you like, unlike IIS, which can be only one.

Is it possible to turn an existing brokerage account into an IIS? No, that won't work. It is necessary to open the IIS.

How long does the IIS open for? Should it be closed after three years? The validity period of IIS is not limited either by laws or by an agreement with a broker. Three years from opening date - minimum term the existence of IIS, which is needed to receive tax deductions.

You can use the account even after three years, it will not close itself.

What will happen when withdrawing money from the IIS? The account will be automatically closed. If this happens less than three years from the date of opening, you will lose the right to tax deductions on this IIA. We will have to return to the state already received deductions for contributions and pay penalties.

Is it possible to close the IIS, open a new one and use the deductions on the new IIS? Can. There are no restrictions on this in the legislation.

Are IIS investments insured? No that's not Bank deposit. DIA does not insure either IIS or brokerage accounts. But if the broker stops working, then the assets can be transferred to another broker.

How to choose a broker for IIS? On the Moscow Exchange website there are top 25 brokers and management companies in terms of the number of clients and the number of IIS. I advise you to choose a broker from this list: these are large reliable companies with all the necessary licenses. Consider the size of commissions, the set of available tools, read reviews about the service.

Where and when is the deduction due? The tax authority will return personal income tax to the details that you indicate in the application. The tax office has three months to desk audit and a month to transfer funds.

How quickly the tax authorities transfer the money depends on the inspection and your luck: for some, personal income tax is returned in a couple of months, for others at the end of the fourth, and sometimes the tax violates the deadlines and sends money later than it should.

What can be done with the resulting deduction? You decide for yourself, there are no restrictions: it's your money. For example, you can deposit this amount on the IIS and buy a little more securities, or you can save it in the "airbag" or spend it on life.

Is it possible to return personal income tax if there is no white salary? It is possible if you have paid personal income tax, for example, from renting an apartment or selling some property.

Is it possible to return taxes using IIS if I am an individual entrepreneur? Only if selected OSN mode. In other cases, the individual entrepreneur does not pay personal income tax at a rate of 13%. Individual entrepreneurs usually choose more favorable taxation regimes, such as simplified taxation or imputation. But there is no income tax at the rate of 13%. Hence, there will be nothing to return.

But if you are an individual entrepreneur and at the same time paid personal income tax on some other income, then personal income tax can be returned. For example, an individual entrepreneur on the simplified tax system can sell an apartment and pay tax on the sale amount. This tax can be returned or offset using the IIS deduction.

Is it possible to receive deductions for the contribution after three years of the existence of the IIS? Can. The main thing is that the conditions are met: the account is replenished, personal income tax is withheld from salary or other income, and you are a tax resident of Russia.

Is it possible to combine the contribution deduction with the property or social deduction? It is possible, but there is a "but". The return of personal income tax cannot exceed the amount of personal income tax paid.

For example, your personal income tax for 2018 was 40,000 rubles. In 2018, you contributed 300,000 rubles to IIS and spent on paid treatment 100,000 rubles. You can return 39,000 rubles with the help of IIS and another 13,000 for paid treatment. In total, this is 52,000 rubles, but the tax will return only 40,000 - as much as personal income tax withheld from you this year.

What is the income deduction (type B)? This deduction exempts the investor from payment of personal income tax from income received with the help of IIS, regardless of the amount of income. True, the tax on dividends will still be withheld.

For example, at the beginning of 2016, you opened an IIS and deposited 300,000 rubles into it. You took a risk and successfully invested in stocks, which soon rose noticeably in price. At the beginning of 2019, we decided to sell the shares and close the IIS. After the sale of shares, the account became 800,000 rubles, that is, your income after deducting commissions is 500,000 rubles.

Personal income tax could amount to 65,000 rubles, but you chose a deduction for income, so these 65,000 will remain with you.

If you made millions, the tax due to this deduction would still not be withheld.

How to get an income deduction? Must be taken in tax certificate that on this IIS you have never used the deduction for contributions. Give the broker a certificate before closing the account, and the broker will not withhold personal income tax from profitable transactions on the account.

Is it possible to combine deductions of type A and B? No. You can use only one type of deduction. If at least once you use the deduction for contributions (type A), the deduction for income (type B) for this IIS can no longer be applied.

What type of deduction is better to choose? Depends on the amount on the account, the return on investment, the amount of personal income tax paid. In most cases, the deduction for contributions is more profitable, but there are nuances.

Can the IRS refuse a deduction? Maybe if, for example, you have two IIS at the same time. Or if it decides that you are depositing money into IIS only for the sake of deducting, but are not going to invest. This can theoretically happen if you deposited money into the account only at the end of the third year, did not make transactions with securities and almost immediately closed the IIA, after which you asked for a deduction.

- Can I change the type of deduction?

What is an Individual Investment Account (IIA)?

Individual investment account - a personal account for internal accounting of funds and securities of an individual who is a client of a broker, bank or management company (trustee). The owner of the IIA is entitled to receive an investment tax deduction, provided that the contract is valid for at least 3 years. The annual amount of enrollment in IIS cannot exceed 1,000,000 rubles.

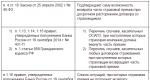

What types of tax deductions are provided for IIS?

The IIS owner has the right to choose one of two types of tax deductions:

The deduction for contributions is presented based on the funds contributed in the calendar year to IIS, but not more than 400,000 rubles. The refund is made from personal income tax withheld at a rate of 13% (except dividends) for the specified taxable period. This means that they will refund you 13% of the amount paid to IIS, but at the same time no more than the tax paid to the budget for this year. This deduction can be received annually if you deposit funds to IIS every year and have official income for the same year;

The deduction for income involves the exemption from personal income tax of a positive financial result obtained from operations with securities and derivatives financial instruments on IIS. The deduction is provided upon closing the IIA after at least 3 years from the date of conclusion of the contract.

Are there any peculiarities when opening and using IIS?

Yes, there are a number of restrictions when opening and using IIS.

IIS can only be opened by an adult natural person who is both a citizen and tax resident RF.

One individual is entitled to have only one IIS.

You can choose the type of deduction throughout the entire term of the contract for the maintenance of IIS. At the same time, it is not allowed to combine two types of deductions on one IIS.

The minimum holding period for IIA is 3 years, early closure of the account will result in the loss of tax benefits. If you have already received a deduction for contributions, then the amounts received will have to be returned with the payment of interest. If you intended to receive a deduction for income, then it will not be provided upon early closure. The maximum period of ownership of IIS is unlimited.

Partial or complete withdrawal of assets leads to the closure of the IIS.

Replenishment of IIS is possible only in Russian rubles for an amount not exceeding 1,000,000 rubles per calendar year under the contract. Only the owner of the IIS can deposit funds from his bank account.

What products on IIS does Otkritie Broker offer? What is the difference between them?

The IIS products offered by Otkritie Broker differ in the way of capital management, asset structure, potential financial result. Clients can choose an investment product on IIS that best suits the target investment period, the level of expected return and risk. So, by choosing "Independent management of IIS", the investor can, at his own discretion, choose instruments and form a portfolio, determine the investment horizon and the risk / return ratio. Trading on recommendations within the Savings IIA, Independent IIA and Profitable IIA products is suitable for investors who do not have a sufficient level of experience or time to invest on their own. Those who are ready to fully entrust the management own capital For professional managers, Otkritie Broker offers a wide range of products: Protective IIS, Stable IIS, Optimal IIS, Balanced IIS, Market IIS, structural products with capital protection.

You can learn more about existing financial solutions on IIS in the section "" or by phone: 8 800 500 99 66 (ext. 2).

How do I get a tax deduction on IIS income?

You can receive a tax deduction for income (type "B") at the end of the contract for the maintenance of IIS, but not earlier than 3 years from the date of conclusion of the contract.

This tax deduction can be obtained in one of the following ways:

- independently when submitting a 3-NDFL declaration to the tax office after the calendar year when the IIS was closed.

- through a broker, subject to the submission of a certificate from the Federal Tax Service Inspectorate prior to the closing of the IIS.

The certificate contains information that the taxpayer did not receive a deduction for the contribution during the term of the IIA maintenance agreement and did not have several IIAs at the same time (with the exception of changing a professional participant with the transfer of all assets, in this case IIA doubling is possible within a month).

What documents do I need to collect in order to receive a deduction for contributions?

To receive a deduction, you must submit tax authorities at the place of registration, a declaration in the form 3-NDFL, attaching the following documents to it:

1. Certificate in the form 2-NDFL. The document can be obtained from the tax agent (employer, broker). Otkritie Broker clients can order the original 2-NDFL certificate through their personal account - in the "Reports and taxes" section, the "Original documents" tab.

2. Documents confirming the transfer of funds to IIS:

- - broker's report. Otkritie Broker clients can order the original report through their personal account - in the "Reports and taxes" section, the "Original documents>" tab.

- - payment order. This document can be obtained from the bank from which the money was transferred to the IIS.

3. Application for accession to the regulation. When concluding an IIS agreement, Otkritie Broker clients are given a copy of the application for accession to the regulations. This document confirms that the IIS has been opened. If the document is missing for any reason, the client can contact the broker (by phone, e-mail [email protected] or in person at any of the offices) to receive a scanned copy of the original document. Besides tax inspectors has the right to demand a contract for the maintenance of IIS. Scans of certified documents are posted on the official website of the broker in the "Documents" section.

4. Application for return. AT this document you must specify the details of the personal bank account to which the refund will be made personal income tax amounts. When filling in hard copy, the application form for 2018 can be taken from Appendix No. 8 of the Order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8 / [email protected] or at the tax office. If the declaration will be submitted through the service " Personal Area taxpayer”, then after the declaration is uploaded to the inspection program, you will have an overpayment, which you can dispose of by filling out a refund application.

How long does it take to file a tax return to receive a tax deduction?

When choosing a deduction for contributions (13% of the amount paid for the reporting period to the IIA, but not more than the personal income tax paid), the owner of the IIA can apply for it for the next year. To receive a deduction, you must submit a declaration in the form of 3-NDFL and attach supporting documents to it. Please note that each year has its own declaration form.

A declaration for a deduction can be submitted at any time within 3 years following the expired tax period. For example, a declaration for 2018 can be filed in 2019, 2020 or 2021.

How to file a tax return through the "Personal account of the taxpayer"?

After receiving the documents necessary for processing the tax deduction in in electronic format you should enter the taxpayer's personal account on the website of the Federal Tax Service (you can enter through the portal "Gosuslugi").

How to file a paper tax return with the Federal Tax Service?

Detailed step-by-step instruction available at .

How to file a paper tax return with the Federal Tax Service?

We take digital data from the example of filling out a declaration through the "Taxpayer's Personal Account": the total amount of income of an individual was 545,700 rubles. Employer as tax agent withheld personal income tax in the amount of 70,941 rubles. During the tax period, he contributed 400,000 rubles to IIS.

Detailed step-by-step instructions are available at.

My individual investment account is 3 years old. Am I required to close it?

An individual investment account (IIA) is opened for an unlimited period and no documents for prolonging the contract need to be signed. Three years is the minimum period for holding an IIA, after which it can be closed without losing the right to a deduction, the maximum period is not set - you can continue working on the account and receive deductions. Therefore, if your IIS is three years old, you have the right to close it on any day. However, when opening a new IIS, you will have to keep it again for at least three years so as not to lose the right to deduct.

Before closing an account, carefully consider whether it is really beneficial for you to withdraw funds from the account or change the type of deduction. And our experts will help you with the calculations.

Please note that until you close the IIA, personal income tax is not withheld from your investment profit (except for coupons and dividends), and these funds can be invested profitably. Even when investing in an account in conservative and virtually risk-free instruments, such as federal loan bonds, coupled with deductions, you can receive a significant return. And return with the same contribution deductions in whole or in part the taxes that you paid to the state.

Our “Savings” model portfolio, consisting of OFZs, could bring its owners more than 47% 1 in less than three years, and this without taking into account tax deductions - another 13% 2 .

If you have not received the desired profitability on IIS, do not rush to close positions and the account, especially if a loss has formed on the account. It cannot be carried forward to deferred earnings or balanced against the earnings of a regular brokerage account.

1 For the period from December 30, 2014 to October 31, 2017, at closing prices, the profitability of the “Savings” model portfolio was 47.98%. When making calculations, reference, information and analytical materials prepared by specialists of Otkritie Broker JSC were used.

2 An individual investment account gives the right to receive up to 52,000 rubles annually, based on the funds contributed to IIA for the calendar year, but not more than the amount of personal income tax paid at a rate of 13% for the corresponding period, or income tax individuals your income received from transactions with securities and derivative financial instruments on an individual investment account after at least 3 years from the date of signing the agreement is not taxed.

How long do I have to receive deductions?

With a contribution deduction of 13% of the annual IIA contribution, you have 3 years to make a refund. If you opened an account and deposited money into it in 2018, you can file a declaration for a deduction for the contribution for 2018 in 2019, 2020 or 2021.

With deduction on income - exemption of investment income from personal income tax - you have no time limits if you receive the deduction through a broker.

Can I change the type of deduction?

If during these three years you have already received a contribution deduction, it is unfortunately not possible to change it to an income deduction. Accordingly, you need to close the current IIS and open a new one. If you do not want to close the current IIS, offer to open the IIS to your next of kin, for example, spouse or parents.