How to fill out a loan application. How to apply for a loan at Sberbank: step-by-step instructions, documents and recommendations How best to fill out a loan application

Volodya asks

Hello! Tell me how to fill out an application for an online loan on a card? They say that because of mistakes they can refuse a loan. How to avoid them?

Hello Volodya! Online application is fast way contact the bank for a loan. However, if it is submitted illiterately, then the lender may refuse the applicant for a loan, often without explaining the reasons for the refusal. Just a message of the corresponding content comes to the phone.

I would like to draw your attention to the fact that even an applicant with an excellent credit history and stable solvency at the time of sending the questionnaire can receive a negative answer, which is especially offensive.

First of all, state the purpose of the loan. If you have a clear idea of what is required cash It will not be difficult for you to decide on the size of the loan.

Of course, there is no guarantee that the bank will agree to provide the amount specified in the application. Its specialists will analyze your financial solvency and only after that they will give out as much as, in their opinion, you can return. The interest rate is taken into account.

Knowing the size and purpose of the loan, you choose a loan program and, according to its terms, prepare a package of documents. Please note that the dates stamped on them are not out of date.

All information that you will enter in the columns of the questionnaire, carefully check. The main thing is accuracy. Be sure to leave a phone number by which the lender can contact you to clarify this or that information.

Correctly indicate the place of work and position held. It is highly likely that a financial institution specialist will call the place of work to verify the authenticity of the specified data, as well as some documents (in particular, income statements).

You need to be honest. If there are debts or open loans, it makes no sense to hide information about them. The bank will certainly get acquainted with the credit history of a potential borrower and, having found inconsistencies, will refuse without explanation. Moreover, the actions of the applicant who tried to mislead the creditor will be qualified as fraud.

Volodya, keep in mind that your application will be considered in stages. The department manager is the first to work on it. If there are no complaints, the application is sent to Main office. There it is analyzed by experts of the credit commission. If a positive decision is made, the client is contacted and invited to the office to conclude an agreement.

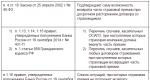

Questionnaires of different banks may differ in terms of the number of points. If you have a small online form consisting of one page, then you will complete the questionnaire by phone or at the bank office. A complete application for a loan normally contains the following fields and sections:

- Information from the borrower's passport: series, document number, by whom and when it was issued, the date of birth of the applicant, his full name, address of registration and residence. This part of the application must be filled out very carefully. Do not make mistakes, do not make abbreviations, rewrite the information exactly as indicated in the document. There may also be a section for filling in information about a secondary document (SNILS, TIN, rights, etc.).

- Information about marital status, number of children. If the applicant is married, the bank may ask for the spouse's phone number. When calling, if it will be made, the second half of the applicant must confirm awareness of the submitted application.

- Job details: full name of the employer, work address, position of the applicant, his general length of service and length of service at the current place of work. The bank will also ask you to provide a fixed work phone, some credit organizations require the phone number of the direct supervisor of the potential borrower. Here is the size monthly income the applicant after all required deductions (taxes, alimony, etc.). If the program assumes, income is confirmed by certificates.

- Information about contact persons. These are 1-2 people (relatives, friends) who can confirm information about the borrower. The bank can call these citizens, they must be warned about this.

- Information about current and repaid credit obligations. You need to indicate the banks whose lending services you used before. Here the applicant talks about his existing debts. It is useless to hide the amounts, as they are reflected in credit history. Moreover, the concealment of this information will be regarded as data forgery, so the loan will be denied.

Filling out the questionnaire online

The procedure for submitting an online application for a loan differs from the standard process when applying to a bank office. Almost all credit organizations have switched to the method of receiving applications from citizens through the Internet. This makes lending programs more accessible, and the bank itself saves its own resources.

How to complete and apply for a loan online:

- You should choose the appropriate loan program by studying the websites of banks. In doing so, you can use online loan calculator, which will help you navigate the optimal loan parameters and choose the best offer.

- There is an application form on the bank's website. Usually a link to it is on the product description page. Fill in all fields and wait for the decision. An answer to a potential borrower may come in a few minutes, but so far the decision will be preliminary. Usually, soon the applicant will receive a call from a bank employee who conducts a full telephone survey.

- If the bank issues an affirmative answer, it invites the applicant to its office. Here the borrower is identified, his documents are checked. If everything is in order, the funds are issued.

Remember that even if the loan is pre-approved, the decision may change at the office. Perhaps the bank will suspect data forgery. In addition, if the applicant incorrectly indicated the details of his passport in the application form, the approval will also be canceled.

The procedure for filling out an application at the bank office

For convenience, you can pre-print an application for a loan from the bank's website and fill it out in a relaxed atmosphere. Or you will fill out a paper version of the questionnaire in the office credit institution. Applying directly to the office looks like this:

- The client comes to the office of the bank of interest, where there is a lending department (information can be clarified by hotline this institution). Here the manager will provide a paper version of the questionnaire to fill out or will conduct a survey orally.

- After filling out the application, it goes for consideration. The time for data analysis depends on the type of loan requested. For applications for standard programs, a decision is made within 1-3 days, for express products within a day or even an hour. In the process of checking information, the borrower can be called and asked various questions. Contact persons can also be called.

- The applicant is informed about the decision by the phone number indicated in the questionnaire. If this is approved, a citizen with a passport again visits the bank's office, where the direct receipt of the loan will already take place.

When filling out an application at the office, keep in mind that the manager also evaluates you. You should behave appropriately, you should not have problems providing information about yourself. If you behave rudely, suspiciously, if your appearance does not match personal data, you will be denied a loan.

Most microfinance organizations offer a convenient online loan form. For getting loan funds the citizen does not have to go anywhere. He simply goes to the website of the selected microfinance company, determines the parameters of the loan and fills out the proposed questionnaire. Upon approval, the money is transferred to the card, bank account, online wallet or transferred to the borrower by other means.

When applying for a remote microcredit, the most important thing is to correctly fill out the loan application form. Based on the data that is indicated in it, the MFI will make a decision on the online application. It is in the interests of the borrower to carefully approach the process of filling out the questionnaire.

What is an online questionnaire?

This is an application form with empty fields, which the borrower fills out on his own. Microfinance organizations use two options for filling out an online application for a microcredit:

- Filling out a simple questionnaire.

- Registration personal account on the site.

In any case, you must provide key information about yourself. A potential borrower must follow the proposed algorithm for filling out a loan application form and provide up-to-date information.

What will you need to indicate in the application form?

Each MFI develops its own type of questionnaire; there is no single standard. But usually the questionnaires of all creditors are similar in their main points. The applicant records the following information:

- your passport details. This is the most important part of the loan application. You should enter data without abbreviations and be sure to check the information for errors and typos;

- employment and income data. This information does not need to be confirmed by certificates, everything is indicated only from the words of the borrower;

- Contact Information. It is important to indicate as your number included on this moment telephone. It will be needed for further processing;

- information about contact persons. These are people close to the borrower, their phone numbers should be indicated. At the same time, it is advisable to warn these persons that you are applying for a loan, since the MFI may make phone calls when considering the application;

- details for crediting funds in case of approval, if you apply for a remote loan.

The MFI will analyze the information you entered in the questionnaire and make a decision on the application. After filling out, be sure to double-check the information entered, and only then send the application for a loan for consideration.

An online application is a convenient sales channel for financial products. Everyone uses it big banks and regional market representatives. The effectiveness of remote treatment is high and has advantages for both the lender and the client. The first ones reduce financial costs and the load on their offices, the second ones save time on visiting branches.

Banks themselves are interested in protecting the client. Therefore, they use the encryption of transmitted information using the SSL (Secure Sockets Layer) protocol. This prevents data interception and controls secure communication with the bank's server. At the time of online application, the browser must have a secure connection icon.

It looks like this: https://www.sberbank.ru, exactly https.

The applicant himself must also be careful:

- secure your Internet access;

- do not transfer your data to third parties;

- make sure that the questionnaire is filled out on the official website of the bank, and not on a fraudulent clone.