How to get money back for treatment. How to get a tax deduction for treatment - we return money for paid childbirth What you will learn

During a medical examination at a polyclinic, I had to incur significant expenses for taking tests. Is it possible to receive a social deduction for personal income tax in relation to these expenses, and if so, how? Do I need any other documents besides payment documents for this?

Right of deduction

Subparagraph 3 of paragraph 1 of Art. 219 of the Tax Code of the Russian Federation provides for a social tax deduction for personal income tax in the amount of expenses for medical services provided by medical organizations and individual entrepreneurs engaged in medical activities. It is provided in relation to medical services specified in the list established by Decree of the Government of the Russian Federation dated March 19, 2001 No. 201 (hereinafter referred to as the List). The List includes services for diagnosis, prevention, treatment and medical rehabilitation in the provision of outpatient medical care to the population (including in day hospitals and by general (family) practitioners), including medical examination.

According to the All-Russian Classifier of Economic Activities, Products and Services OK 004-93, approved by the Decree of the State Standard of Russia dated 08/06/93 No. 17, laboratory analysis services refer to outpatient treatment services provided by polyclinics (code 8512000 “Outpatient treatment services provided by polyclinics and private medical practice" includes the code 8512400 "Laboratory tests provided in polyclinics"). Thus, since the delivery of tests is included in the medical services specified in the List, in relation to the costs of paying for tests, a social tax deduction for personal income tax, provided for in subpara. 3 p. 1 art. 219 of the Tax Code of the Russian Federation. The Ministry of Finance of Russia confirms that if medical services for the delivery of paid tests are included in the List, the taxpayer is entitled to receive a social tax deduction in the amount of expenses incurred by him to pay for the tests (letter dated 04.27.2016 No. 03-04-05 / 24414).

Please note that on the basis of paragraph 3 of Art. 210 and paragraph 1 of Art. 219 of the Tax Code of the Russian Federation, the deduction is provided only for income subject to personal income tax at a rate of 13% (this, in particular, wages, remuneration under civil law contracts, income from renting property, etc.). In the absence of such income, the right to deduction does not arise. For example, pensioners whose only income is a pension cannot receive a deduction, since state pensions and labor pensions assigned in the manner prescribed by current legislation are not subject to personal income tax (clause 2, article 217 of the Tax Code of the Russian Federation, letter from the Ministry of Finance of Russia dated 07.08.2015 No. 03-04-05/45660).

The maximum amount of the deduction is 120,000 rubles. for a calendar year (clause 2, article 219 of the Tax Code of the Russian Federation). At the same time, this amount includes other social tax deductions listed in subpara. 2-5 p. 1 art. 219 of the Tax Code of the Russian Federation (for education, payment of pension contributions under the contract (contracts) of non-state pension provision and (or) voluntary pension insurance, as well as voluntary life insurance, payment of additional insurance contributions to the funded pension). If there is a right to several social tax deductions, the taxpayer independently chooses which types of expenses and in what amounts are taken into account within the maximum amount of the social tax deduction.

Supporting documents

The Tax Code does not say which documents are required to confirm the right to a deduction. In a letter dated March 21, 2016 No. 03-04-05 / 15472, the Ministry of Finance of Russia noted that on the issue of a list of documents confirming the actual costs of medical services provided, one should contact the tax office.

Federal Tax Service of Russia letter dated November 22, 2012 No. ED-4-3/ [email protected] sent to the lower tax authorities exhaustive lists of documents attached by taxpayers to personal income tax returns in order to receive tax deductions. It follows from the letter that in order to provide a social deduction for the costs of paying for medical services, a copy of the treatment agreement with annexes and additional agreements to it (if concluded) and a certificate of payment for medical services (original) are needed. That is, if the contract was not concluded, one certificate of payment for medical services will be sufficient to receive the deduction. The Ministry of Finance of Russia confirms that the taxpayer has the right to exercise his right to receive a deduction by submitting a personal income tax declaration and a certificate of payment for medical services to the tax authority (letter of the Ministry of Finance of Russia dated 12.03.2015 No. 03-04-05 / 13176).

The form of a certificate of payment for medical services was approved by order of the Ministry of Health of Russia No. 289, the Ministry of Taxes of Russia No. BG-3-04 / 256 dated 07/25/2001. It is filled in by all healthcare institutions licensed to carry out medical activities, regardless of departmental subordination and form of ownership. The certificate is issued at the request of the person who paid for medical services, upon presentation of payment documents confirming payment. Note that the certificate is subject to issue not only when paying for services at the cash desk of a medical organization, but also when paying for medical services through a bank (decision of the Supreme Court of the Russian Federation dated May 23, 2012 in case No. AKPI12-487).

Thus, to obtain a certificate, you need to contact the clinic where the tests were taken and present payment documents confirming the payment for the services provided for the tests.

How to get a deduction

The deduction can be provided by the tax office or the employer (clause 2, article 219 of the Tax Code of the Russian Federation).

To receive a deduction from the tax authorities, after the end of the calendar year in which the costs of paying for the analyzes were made, you must submit a personal income tax return to the tax office at the place of residence. Its form was approved by order of the Federal Tax Service of Russia dated December 24, 2014 No. MMV-7-11 / [email protected] The declaration can be submitted within three years from the year when the right to receive a deduction arose (letter of the Federal Tax Service of Russia for Moscow dated June 26, 2012 No. 20-14 / [email protected]). In addition to the above documents confirming the right to deduction, the declaration must be accompanied by the details of the bank account to which the tax authorities will return the excess tax withheld. We also recommend that you have copies of payment documents, as some tax offices require their submission.

You can not wait until the end of the year and get a deduction from the employer. To do this, you need to take a notification from the tax authority at the place of residence confirming the right to a social tax deduction. Its form was approved by the order of the Federal Tax Service of Russia dated October 27, 2015 No. MMV-7-11 / [email protected] To receive a notification, you must submit an application to the tax authorities and attach documents confirming the right to deduct to it. When filling out an application (its form is usually given at the inspection), it will need to indicate the name, TIN and KPP of the employer who will provide the deduction. The notification is issued by the tax authorities within 30 days from the date of submission of the application and documents (clause 2, article 219 of the Tax Code of the Russian Federation).

Then you need to apply with an application for a deduction to the employer and attach the received notice to it. The employer will provide a deduction starting from the month in which the employee applied to him for its receipt (clause 2 of article 219 of the Tax Code of the Russian Federation).

In 2011, I underwent a long and expensive treatment. To return % of the treatment, some documents are required. Question: if during the whole treatment I needed to monitor blood readings and I took such tests in paid laboratories, is % returned for such tests? Do you need any other documents besides checks from laboratories? Also, if the visit to the doctor was paid and there is an agreement and checks, can % be returned for this too? The treatment took place in the Privolzhsky District Medical Center.

In accordance with subparagraph 3 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation, when determining the tax base for personal income tax, a taxpayer has the right to receive a social tax deduction, in particular, in the amount paid in the tax period for expensive treatment services provided to him by medical institutions of the Russian Federation.

Decree of the Government of the Russian Federation dated March 19, 2001 No. 201 approved the List of expensive types of treatment in medical institutions of the Russian Federation, the amount of actually incurred expenses, which are taken into account when determining the amount of social tax deduction. The classification of medical services rendered as an expensive type of treatment is within the competence of medical institutions.

The deduction of the amount of payment for the cost of treatment is provided to the taxpayer if the treatment is carried out in medical institutions that have the appropriate licenses to carry out medical activities, as well as when the taxpayer submits documents confirming his actual expenses for treatment.

To receive this deduction, you need to submit to the tax office at the place of registration a declaration in form 3-NDFL, a certificate of income in the form 2-NDFL, a contract for the provision of medical services, a certificate of payment for medical services and payment documents.

Deduction for tests and doctor's appointments

Ludmila R / October 14, 2014

Can I get a deduction for tests in the Invitro laboratory (my own and my spouse) and for doctor's appointments at the clinic. In what form should these documents be submitted for tax purposes? Thank you.

Sufiyanova Tatyana, Tax consultant / answer dated October 14, 2014

Lyudmila, good afternoon.

When paying for services for treatment, you have the right to return income tax, receive a tax deduction for treatment. The deduction for treatment is 120 thousand rubles. in year.

According to sub. 3 p. 1 art. 220 of the Tax Code of the Russian Federation, a citizen has the right to receive a deduction in the amount paid for the tax period (year) for:

Please read the procedure for receiving a deduction for treatment.

Tax return information

Who and in what cases must file a 3-NDFL declaration?

The 3-NDFL tax return is a document using which citizens (individuals) report to the state on income tax (NDFL).

At the end of the calendar year, the 3-NDFL declaration must be filled out and submitted to the tax authority by the following groups of persons:

- from the sale of the car;

- from the sale of an apartment/house/land;

- from renting out housing;

- from winning the lottery;

- etc.

Example: In 2016 Pushkin A.S. sold the apartment, which he owned for less than 3 years. At the end of 2016 (before April 30, 2017), Alexander Sergeevich submitted to the tax authority a declaration in the form of 3-NDFL, in which the tax payable as a result of the sale was calculated.

I can also fill out and submit the 3-NDFL declaration citizens who want to receive a tax deduction(to return a part of the paid tax). For example:

What is the deadline for filing a 3-NDFL declaration?

Citizens who declare their income (for example, from the sale of property) must submit a 3-NDFL declaration no later than April 30 of the year following the one in which the income was received.

Example: Tyutchev F.I. in 2016, he sold an apartment that he had owned for less than 3 years. Accordingly, until April 30, 2017 Tyutchev F.I. you need to submit a 3-NDFL declaration (which reflects the sale of an apartment) to the tax authority.

The April 30 deadline does not apply to citizens who submit a declaration in order to receive a tax deduction. They have the right to file a declaration at any time after the end of the calendar year. The only limitation is that income tax can only be refunded for three years.

Example: Zoshchenko M.M. received a paid education in 2014 and worked in parallel (paid income tax). Zoshchenko M.M. has the right to file documents for a tax deduction (tax refund) for 2014 at any time before the end of 2017.

Note: There is a very common misconception that the tax return must also be filed by April 30th. Once again, we note that this is an erroneous misconception, since the deadline of April 30 applies only to cases when income is declared.

How to file a 3-NDFL declaration?

Declaration 3-NDFL is always submitted to the tax authority at the place of registration (registration).

Example: Citizen Ivanov I.I. registered (registered) in Ivanovo, but has a temporary registration in Moscow. In this case, Ivanov I.I. must submit a declaration to the Ivanovo tax office.

You can submit a declaration to the tax authority in the following ways: in person, by mail (by a valuable letter with a list of attachments), via the Internet. You can read a detailed description of each filing method with all the subtleties in our article Submitting a 3-personal income tax return to the tax authority

How to fill out a 3-personal income tax declaration?

You can fill out the 3-NDFL declaration in the following ways:

- use the convenient service on our website. The program does not require special knowledge. By answering simple and understandable questions, as a result, you will be able to download the 3-NDFL declaration ready for submission to the tax authority.

- fill out the form manually. On our website you can find Forms and Forms of the 3-NDFL declaration, as well as Samples of filling out.

- use the program from the FTS. The program requires some understanding of the 3-NDFL form and knowledge of your tax office and OKTMO code.

- in person at the nearest tax office;

- by registered mail;

- on the site nalog.ru.

Responsibility and penalties for failure to submit and late deadlines for the submission of the 3-NDFL declaration

If the 3-NDFL declaration is not submitted on time, the tax inspectorate may impose a fine under Article 119 of the Tax Code of the Russian Federation. The amount of the penalty will be 5% of the unpaid tax amount (which must be paid according to the declaration) for each full or partial month from the date of delay (April 30). In this case, the minimum amount of the fine is 1,000 rubles, and the maximum is 30% of the tax amount.

Example: In 2015, Sidorov Semyon Semenovich sold the apartment and had to pay 70,000 rubles. tax on income from this sale. Sidorov S.S. missed the deadline for submitting the 3-NDFL declaration (April 30, 2016) and submitted it only after a letter from the tax authorities on June 10, 2016.

The amount of the fine Sidorova C.S. will be: 2 months. x (70,000 x 5%) = 7,000 rubles.

Note that the penalties apply only to cases where the submission of 3-NDFL is mandatory (for example, when receiving income from the sale of property) and does not apply to voluntary cases of filing a 3-NDFL declaration (for example, when receiving tax deductions).

Reimbursement for test fees

What documents are needed to submit a Tax Return to the Tax Service for a refund of 13% for the analysis fee?

Do I need a contract with a medical institution?

Documents required to submit to the tax office for a tax deduction for analyzes:

1. copy of the contract

2. copy of payment documents

3. copy of the license

4. certificate of payment for honey. services

Declaration 3-NDFL, certificate 2-NDFL on salary

Add a comment Cancel reply

Hello. In 2017, my husband and I bought an apartment. In 2018, they filed declarations for a tax refund for 2017 for both me and my husband. Can we file returns again this year and get a tax refund for 2015-2016?

Good afternoon. Tell me, the apartment was bought in 2017 with a mortgage for 800 thousand, and in the same year another was sold for 300 thousand owned for less than 3 years. And mortgaged. What declaration sheets need to be filled in order not to pay tax

Good afternoon! In 2015, expenses were incurred for treatment, in 2016 she underwent additional studies at a driving school to obtain category D rights. In 2015-2016, she did not officially work. Can I reflect the expenses of 2015-2016 in the declaration of 3 personal income tax for 2017? Thank you!

Hello. In January 17, my husband sold 1/2 of the apartment he inherited (the second part of the apartment was bequeathed to his sister) in 16. The sale agreement was drawn up alone, in the amount of 1480 thousand rubles. When filling out the declaration, he was charged a tax in the amount of 31,200 rubles. The husband buys a car, completes the construction of the house (purchased unworthy back in 2000), in October 17 he had to move ...

If the husband is registered in another region, and I am currently on maternity leave since 2016 (from 10.04), which tax office should I apply for a deduction for my own and the treatment of a child (under 18 years old) at my husband’s place of residence? Or where I live? - if the return for 2017 and 2018 (later) is issued to the husband

How can a child who has reached the age of 18 and has no income (the student has a scholarship) receive a social deduction for his treatment?

Good afternoon! The apartment was bought on a mortgage and in common joint ownership with her husband, under a shared construction agreement in 2016. The cost of the apartment is 1424150 tr. The acceptance certificate was signed on December 29, 2017. We will write with a statement on the distribution of income, is the date of the statement important for the tax? Interest paid to the bank since 2016 and at the moment 193226.71 tr Tell me how to go ...

Hello. I have a question regarding the priority of the return of personal income tax. If medical expenses and real estate purchase expenses were made in the same period, which deduction is returned first? I realized that it is necessary to reflect both those and other expenses in one declaration. But then it turns out that the property deduction will completely cover the entire personal income tax for the year. And go...

How to get money back for treatment

Instructions for those who were treated in a paid clinic

I hate being treated in public clinics.

It’s easier for me to pay than to stand in lines to a tired doctor grandmother. Therefore, for any disease, I go to a paid clinic.

In 2015, I spent 18,800 R on diagnostics, consultations and procedures. In 2016, I filed a tax deduction for treatment and returned 2500 R. I’ll tell you how to do the same.

What is a tax deduction for medical treatment

A tax deduction is money that the state returns to you from the personal income tax you paid if you do something useful for the state. There are tax deductions for the purchase of an apartment and education. Today we will talk about the deduction for paid medical services.

How to take your 260 thousand from the state

Under medical services, the tax code includes a doctor's appointment, diagnostics, medical examination, testing, hospitalization, day hospital treatment, dentistry, and prosthetics. The list includes everything that a sick person usually encounters.

Operations, including plastic, IVF, treatment of serious diseases, are classified as expensive treatment. They get a different deduction for them, but more on that next time.

You can also get a deduction for voluntary health insurance if you paid for the policy yourself. If it was paid by the employer, then the deduction will not be made.

The amount of the deduction depends on the cost of treatment: the more you spent, the more you will be refunded. But the maximum cost of treatment, which is taken into account when calculating the deduction for treatment, is 120,000 R. This is the general limit for almost all social deductions, in particular for the costs of treatment and education (see paragraph 2 of article 219 of the Tax Code of the Russian Federation). Even if you paid a million at the hospital, you will receive a deduction as if you paid 120 thousand.

Who can get a deduction

If you receive a salary or have income on which you pay personal income tax, you can receive a deduction. Non-working pensioners, students and women on maternity leave do not have such income, they do not pay personal income tax, therefore they do not specifically claim this deduction.

You will also receive a refund if you paid for the treatment of your parents, spouse, children under 18 years of age. To do this, you need a document confirming kinship: a marriage certificate or a birth certificate. You will not be given a deduction for paying for the treatment of your mother-in-law or father-in-law.

For whom the contract for treatment is drawn up - it does not matter. But the payment document must be issued to the one who will receive the deduction.

For example, an elderly father is hospitalized and the daughter wants to make a deduction for his treatment. The contract can be drawn up either for the father or for the daughter, but payment documents - only for the daughter. If payment documents are issued to the father, the clinic will not give the daughter a tax certificate. It is best if both the contract and the payment papers contain the data of the person who will draw up the deduction. In our example, daughters.

How much money will be returned

The amount of the deduction depends on your salary and the cost of treatment. In any case, the tax authorities will not return more money than the personal income tax paid for the year. Let's look at an example:

Vasily works as a manager and receives 40,000 R per month. For the year he earned 480,000 R.

He gives 13% of his salary to the state as a tax (personal income tax). For the year he paid 480,000 × 0.13 = 62,400 R.

In 2015, he spent 80,000 rubles on treatment. Vasily collected documents and applied for a tax deduction.

After submitting the application, the tax authority will deduct the amount of treatment from Vasily's income for the year and recalculate his personal income tax: (480,000 - 80,000) × 0.13 = 52,000 R.

It turns out that Vasily had to pay 52,000 R, but in fact he paid 62,400 R. The tax authority will return the overpayment to him: 62,400 − 52,000 = 10,400 R.

The deduction can be issued within three years from the date of treatment. In 2017, you can receive a deduction for treatment in 2016, 2015 and 2014. The day and month don't matter.

How it works

To receive money, you first need to collect evidence that you were treated and paid: contracts, checks and certificates from the clinic. Then fill out a 3-personal income tax declaration on the tax website and send it along with scanned documents for verification.

After the declaration is approved, it is necessary to write an application for a refund. According to the law, one month after filing the application, the tax must transfer money to your account.

We talk not only about deductions, but also about how not to overpay for treatment, save money from scammers, earn more and spend rationally.

You can do everything gradually. I was in no hurry and prepared the documents for about three months.

At the cash desk or reception of the clinic, you will be given an agreement and a receipt. Save these documents: only they confirm the fact of payment for the treatment. Attach the check to the contract with a paper clip or stapler. Then you are tormented to look for which contract which check.

Agreement and check from a paid clinic

Agreement and check from a paid clinic

Go to the registry or accounting department and ask for a tax certificate. Present your passport, TIN, agreement with the clinic, all checks.

Passport, agreement with the clinic and TIN - take these documents with you when you go to get a tax certificate

Passport, agreement with the clinic and TIN - take these documents with you when you go to get a tax certificate

Some clinics do not require receipts. They take information about the services provided from their database. But not everyone does this. I lost several checks, and the girl at the reception did not include them in the amount of the certificate.

If you are making a deduction for the treatment of relatives, bring your marriage certificate or birth certificate along with the documents and ask for a certificate to be issued in your name.

In the clinic that I visited, a certificate is made in a maximum of 5-7 days. I came at a deserted time, so I got a certificate in half an hour.

Help for the tax. Pay attention to the service code: it must be 1 or 001

Help for the tax. Pay attention to the service code: it must be 1 or 001

If you doubt that the certificate is issued correctly, check whether it complies with the instructions of the Ministry of Health. Usually this problem does not occur. If the clinic has a license, it is obliged to issue a correctly executed certificate.

Together with the certificate, you will be given a copy of the license to carry out medical activities. If the clinic does not have a license or its validity has expired, the tax office will not return anything to you. A copy of the license remains with you, it does not need to be sent to the tax office.

Check the license expiration date. Most often, the license is issued indefinitely, but it is better to play it safe.

Check the license expiration date. Most often, the license is issued indefinitely, but it is better to play it safe.

Scan a certificate from the clinic and an agreement to send them to the tax office remotely. If you receive a deduction for the treatment of parents, spouse, children under 18, then make a scan of your marriage certificate or birth certificate.

The tax website accepts .txt, .doc, .docx files,

.pdf, .gif, .bmp, .jpg, .jpeg,

.png, .tif, .tiff, .zip, .7z, .rar,

.arj, .xls, .xlsx

Take a certificate 2 - personal income tax in the accounting department at work. The data from this certificate will be needed to fill out the declaration. It doesn't need to be scanned.

Documents can be submitted in three ways:

The first two methods did not suit me: I did not want to stand in lines. I spent the evening and filed documents on the site.

How to apply for a deduction on the tax website

Submitting documents to the tax office is easy. The general logic is as follows: fill in personal data, indicate income and upload proof of treatment costs. So that you do not get confused, we have prepared a six-step instruction.

1. We go to the personal account of the taxpayer and select the section " Income tax FL"→ personal income tax.

2. Fill in the passport data. If you indicated the TIN, then the date, place of birth, passport details and citizenship can be omitted.

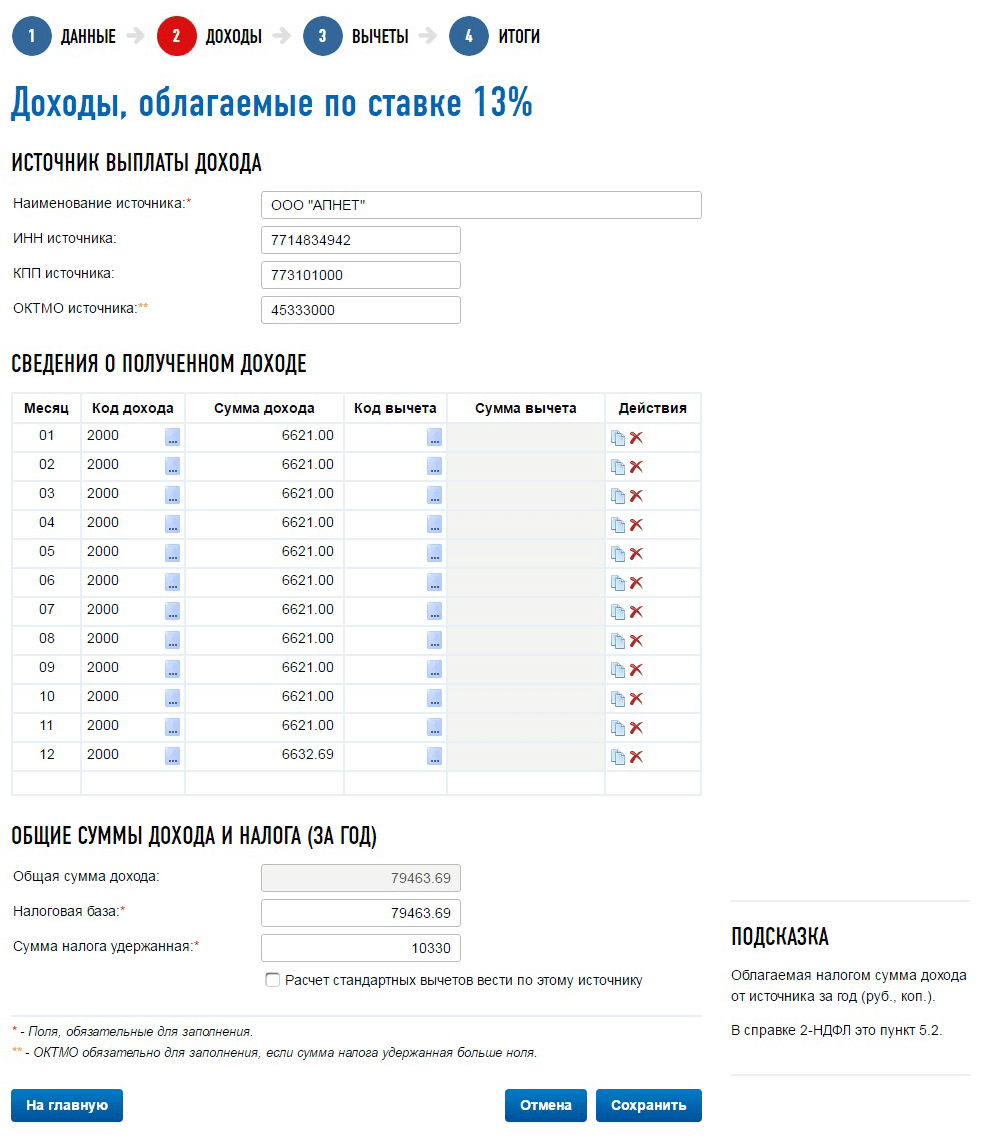

3. We indicate the employer and income. Here you will need a certificate 2 - personal income tax. The first paragraph of the certificate contains information about the employer (TIN, KPP and OKTMO).

4. Choose the deduction that we want to receive. The deduction for treatment is in the group "Social tax deductions". Enter the amount you have spent in the "Treatment Expenses" window.

Please note: the cost of treatment and the cost of expensive treatment are two different things. We are only talking about the deduction for treatment.

5. Check the numbers and press the red button "Generate a file to send."

6. Add scanned certificates and contracts. We sign with an electronic signature and click "Sign and send." If you do not have an electronic signature, issue it in your personal account in the section "Profile" → "Obtaining a certificate of the electronic signature verification key".

That's it, you sent the declaration to the tax office. The inspector is obliged to check it within three months. There are no notifications about the verification of the declaration, so I checked my personal account once a month.

A month and a half later, my declaration was approved.

Even if your declaration is approved, the money will not be returned without an application. Again we go to the website of the Federal Tax Service:

In the application, full name, passport data will be loaded automatically. You need to enter the details of the account where you want to receive money.

See details in your personal account on the bank's website. In Tinkoff Bank, go to your personal account on the "About account" tab:

After you send the application, the money will be credited to your account within a month. You will receive a message from the bank about this.

SMS for refund. 042 202 001 - details of the Interdistrict Federal Tax Service of Russia No. 2 for the Nizhny Novgorod Region. Your tax code may be different

SMS for refund. 042 202 001 - details of the Interdistrict Federal Tax Service of Russia No. 2 for the Nizhny Novgorod Region. Your tax code may be different

Expenses for tests

Right of deduction

Subparagraph 3 of paragraph 1 of Art. 219 of the Tax Code of the Russian Federation provides for a social tax deduction for personal income tax in the amount of expenses for medical services provided by medical organizations and individual entrepreneurs engaged in medical activities. It is provided in relation to medical services specified in the list established by Decree of the Government of the Russian Federation dated March 19, 2001 No. 201 (hereinafter referred to as the List). The List includes services for diagnosis, prevention, treatment and medical rehabilitation in the provision of outpatient medical care to the population (including in day hospitals and by general (family) practitioners), including medical examination.

According to the All-Russian Classifier of Economic Activities, Products and Services OK 004-93, approved by the Decree of the State Standard of Russia dated 08/06/93 No. 17, laboratory analysis services refer to outpatient treatment services provided by polyclinics (code 8512000 “Outpatient treatment services provided by polyclinics and private medical practice" includes the code 8512400 "Laboratory tests provided in polyclinics"). Thus, since the delivery of tests is included in the medical services specified in the List, in relation to the costs of paying for tests, a social tax deduction for personal income tax, provided for in subpara. 3 p. 1 art. 219 of the Tax Code of the Russian Federation. The Ministry of Finance of Russia confirms that if medical services for the delivery of paid tests are included in the List, the taxpayer is entitled to receive a social tax deduction in the amount of expenses incurred by him to pay for the tests (letter dated 04.27.2016 No. 03-04-05 / 24414).

Please note that on the basis of paragraph 3 of Art. 210 and paragraph 1 of Art. 219 of the Tax Code of the Russian Federation, the deduction is provided only for income subject to personal income tax at a rate of 13% (this, in particular, wages, remuneration under civil law contracts, income from renting property, etc.). In the absence of such income, the right to deduction does not arise. For example, pensioners whose only income is a pension cannot receive a deduction, since state pensions and labor pensions assigned in the manner prescribed by current legislation are not subject to personal income tax (clause 2, article 217 of the Tax Code of the Russian Federation, letter from the Ministry of Finance of Russia dated 07.08.2015 No. 03-04-05/45660).

The maximum amount of the deduction is 120,000 rubles. for a calendar year (clause 2, article 219 of the Tax Code of the Russian Federation). At the same time, this amount includes other social tax deductions listed in subpara. 2-5 p. 1 art. 219 of the Tax Code of the Russian Federation (for education, payment of pension contributions under the contract (contracts) of non-state pension provision and (or) voluntary pension insurance, as well as voluntary life insurance, payment of additional insurance contributions to the funded pension). If there is a right to several social tax deductions, the taxpayer independently chooses which types of expenses and in what amounts are taken into account within the maximum amount of the social tax deduction.

Supporting documents

The Tax Code does not say which documents are required to confirm the right to a deduction. In a letter dated March 21, 2016 No. 03-04-05 / 15472, the Ministry of Finance of Russia noted that on the issue of a list of documents confirming the actual costs of medical services provided, one should contact the tax office.

The Federal Tax Service of Russia, by letter No. ED-4-3 of November 22, 2012, sent to the lower tax authorities an exhaustive list of documents attached by taxpayers to personal income tax returns in order to receive tax deductions. It follows from the letter that in order to provide a social deduction for the costs of paying for medical services, a copy of the treatment agreement with annexes and additional agreements to it (if concluded) and a certificate of payment for medical services (original) are needed. That is, if the contract was not concluded, one certificate of payment for medical services will be sufficient to receive the deduction. The Ministry of Finance of Russia confirms that the taxpayer has the right to exercise his right to receive a deduction by submitting a personal income tax declaration and a certificate of payment for medical services to the tax authority (letter of the Ministry of Finance of Russia dated 12.03.2015 No. 03-04-05 / 13176).

The form of a certificate of payment for medical services was approved by order of the Ministry of Health of Russia No. 289, the Ministry of Taxes of Russia No. BG-3-04 / 256 dated 07/25/2001. It is filled in by all healthcare institutions licensed to carry out medical activities, regardless of departmental subordination and form of ownership. The certificate is issued at the request of the person who paid for medical services, upon presentation of payment documents confirming payment. Note that the certificate is subject to issue not only when paying for services at the cash desk of a medical organization, but also when paying for medical services through a bank (decision of the Supreme Court of the Russian Federation dated May 23, 2012 in case No. AKPI12-487).

Thus, to obtain a certificate, you need to contact the clinic where the tests were taken and present payment documents confirming the payment for the services provided for the tests.

How to get a deduction

The deduction can be provided by the tax office or the employer (clause 2, article 219 of the Tax Code of the Russian Federation).

To receive a deduction from the tax authorities, after the end of the calendar year in which the costs of paying for the analyzes were made, you must submit a personal income tax return to the tax office at the place of residence. Its form was approved by order of the Federal Tax Service of Russia dated December 24, 2014 No. MMV-7-11 / The declaration can be submitted within three years from the year when the right to receive a deduction arose (letter of the Federal Tax Service of Russia for Moscow dated June 26, 2012 No. 20-14 /). In addition to the above documents confirming the right to deduction, the declaration must be accompanied by the details of the bank account to which the tax authorities will return the excess tax withheld. We also recommend that you have copies of payment documents, as some tax offices require their submission.

You can not wait until the end of the year and get a deduction from the employer. To do this, you need to take a notification from the tax authority at the place of residence confirming the right to a social tax deduction. Its form was approved by order of the Federal Tax Service of Russia dated October 27, 2015 No. ММВ-7-11 / To receive a notification, an application must be submitted to the tax authorities and documents confirming the right to deduct must be attached to it. When filling out an application (its form is usually given at the inspection), it will need to indicate the name, TIN and KPP of the employer who will provide the deduction. The notification is issued by the tax authorities within 30 days from the date of submission of the application and documents (clause 2, article 219 of the Tax Code of the Russian Federation).

Then you need to apply with an application for a deduction to the employer and attach the received notice to it. The employer will provide a deduction starting from the month in which the employee applied to him for its receipt (clause 2 of article 219 of the Tax Code of the Russian Federation).

Can I get a tax deduction for paid tests?

This article was written for a more detailed answer to one of the questions of the site's visitors. In my articles, I have already touched on the topic of tax deduction for dental treatment and general issues of tax deduction for treatment. Here we will consider the issue of obtaining a tax deduction for paid analyzes.

Question from Galina: Hello! Is it possible to get a tax deduction not for treatment, but for paid tests?

And the second question. The medical center only issues a receipt for a cash receipt, there is no cash receipt. They say that they are not obliged to issue both a receipt and a check, just one is enough. They are right? Or will they still not make a deduction for me without a cashier's check? Thank you.

It should be recalled that the medical tax deduction is a kind of social deduction provided to the taxpayer in the event that he incurs expenses for paying for treatment services at a medical institution and purchasing medicines.

It should be recalled that the medical tax deduction is a kind of social deduction provided to the taxpayer in the event that he incurs expenses for paying for treatment services at a medical institution and purchasing medicines.

Subparagraph 3 of paragraph 1 of Art. 219 of the Tax Code of the Russian Federation provides that medical deductions are provided in the amount paid by the taxpayer in the tax period for medicines and treatment services provided to him, his spouse, parents, children under the age of 18 years.

Decree of the Government of the Russian Federation of March 19, 2001 N 201 approved the lists of medical services and expensive types of treatment in medical institutions of the Russian Federation, medicines, the amounts paid at the expense of the taxpayer's own funds are taken into account when determining the amount of social tax deduction.

The deduction is applied to payment for those types of expensive treatment, medical services and medicines that are named in the lists approved by Decree of the Government of the Russian Federation of March 19, 2001 N 201 (hereinafter - Decree N 201).

To the list medical services included the following services:

- Diagnostic and treatment services in the provision of emergency medical care to the population.

- Diagnostic Services, prevention, treatment and medical rehabilitation in the provision of outpatient medical care to the population (including in day hospitals and by general (family) practitioners), including medical examination.

- Services for diagnostics, prevention, treatment and medical rehabilitation in the provision of inpatient medical care to the population (including in day hospitals), including the conduct of a medical examination.

- Services for diagnostics, prevention, treatment and medical rehabilitation in the provision of medical care to the population in sanatorium-and-spa institutions.

- Public health education services.

- FEDERAL LAW OF THE RUSSIAN FEDERATION dated July 19, 2011 No. 247-FZ On social guarantees for employees of the internal affairs bodies of the Russian Federation and amendments to certain legislative acts of the Russian Federation (As amended […]

- Article 15. Resignation of a Judge Federal Law No. 169-FZ of December 15, 2001 amended Article 15 of this Law The effect of Article 15 (with the exception of paragraph 3) of this Law is extended to judges who have retired since this […]

In this list, there is no direct indication of the type of medical service - "analysis".

It should be assumed that the analysis is a research method and a necessary component of the diagnosis. In medicine, diagnosis is the process of establishing a diagnosis, that is, a conclusion about the nature of the disease and the patient's condition.

Paragraph 2 of Decree No. 201 of the list of medical services provided to the taxpayer indicates diagnostic services, prevention, treatment and medical rehabilitation in the provision of outpatient medical care to the population (including in day hospitals and by general (family) practitioners), including medical examination.

According to the All-Russian Classifier of Economic Activities, Products and Services OK 004-93, approved by the Decree of the State Standard of Russia dated 06.08.93 N 17, laboratory tests are indicated under the code - 8512400 (Laboratory tests provided in polyclinics).

Paragraph 3 of Decree No. 201 also provides as a medical service - diagnostic service.

Thus, it turns out that not only the treatment itself in the literal sense, but also such a diagnostic method as analysis is considered as a service.

I believe that from the above it follows that the taxpayer has the right to receive a tax deduction, as a medical service - diagnostic services, in particular, by analysis, but subject to other conditions, to receive a tax deduction established by the Tax Code of the Russian Federation.

Tax inspections indicate that Decree N201 and the Tax Code of the Russian Federation itself do not contain a direct indication of this type of medical service, and therefore the taxpayer will have to defend this position. Also, you have the right to apply for official clarifications to the tax office.

As for the second part of the answer, according to paragraph 2. Art. 2 “Organizations and individual entrepreneurs, in accordance with the procedure determined by the Government of the Russian Federation, may carry out cash settlements and (or) settlements using payment cards without the use of cash registers when providing services to the public subject to the issuance of appropriate strict reporting forms by them.

The procedure for approving the form of strict reporting forms equated to cash receipts, as well as the procedure for their accounting, storage and destruction is established by the Government of the Russian Federation. Decree of the Government of the Russian Federation of 06.05.2008 N 359 approved the Regulations on the implementation of cash settlements and (or) settlements using payment cards without the use of cash registers.

The Regulation states that organizations and individual entrepreneurs providing services to the population can independently develop and apply documents equated to cashier's checks intended for cash settlements and (or) settlements using payment cards without the use of cash registers. Thus, it follows that documents (receipts, tickets, coupons, etc.) are drawn up on strict reporting forms, which must contain all the details specified in clause 3 of the Regulation.

Contract for the sale of an object of construction in progress and a land plot City ________ "__" ___________201_ We, gr. Russian Federation ___________________________________, __ _________ Born 19__, passport of a citizen of the Russian Federation __ __ […] Law of the Russian Federation of May 29, 1992 N 2872-I "On Pledge" (as amended and supplemented) (repealed) Law of the Russian Federation of May 29, 1992 . N 2872-I "On Pledge" As amended and supplemented on: July 26, 2006, July 19, 2007, December 30, 2008, November 21, […]

Last modified 01/04/2018

How to return money for paid childbirth, treatment, paid tests, purchase of medicines, etc.

Our state provides for a tax deduction, if you underwent paid treatment in medical institutions or bought medicines, you can recover the paid income tax (13%). Unfortunately, this payment has a number of "pitfalls", like all other payments () for women who have given birth.

Let's figure it out so as not to beat the thresholds of the tax authorities. Let's take a situation when you were preparing for pregnancy, gave birth, passed a bunch of paid tests, ultrasound, treated your teeth, etc., i.e. conventional medical services. We will not delve into expensive treatment and other excluding moments of this “freebie”

So, briefly about the rules:

- The tax deduction can be returned for the previous 3 years.

Those. if you paid for treatment in 2016 (2014 or 2015), then we submit documents for the deduction in 2017. Thus, this year is the last year for filing documents for the deduction for 2014. If you were treated in 2016, then you have time until 2019, but it is better not to delay. - The tax deduction for treatment cannot exceed the amount of 120,000 rubles.

Those. the maximum amount for which you can collect documents is limited to 120,000 rubles, you will receive 13% * 120,000 = 15,600 rubles in your hands. However, you can apply for this amount every year. - Who can get a tax deduction?

Working taxpayers, and you can receive 15,600 rubles or less only if you paid this amount in tax during the year. If for some reason you did not work or you do not have enough deductions, your next of kin (parents, husband or wife, children) can apply for you.

It is important! The year in which the payment for treatment took place is taken! And this year it looks like how much money your employer transferred to the income tax budget (about 13% of the official salary).

4. Can I get a tax deduction if checks are lost?

At the discretion of the tax authority, they may refuse. So I advise you to immediately make copies of receipts (they are very quickly erased and become unusable, this is now used cheap paint)

Documentation:

- Certificate of income in the form of 2-NDFL from each place of work (original).

Important! A certificate is required exactly for the year in which payment for treatment or medicines was made - Contract with a medical organization (copy).

- Certificate of payment for medical services (original).

- License from a medical organization (certified copy, i.e. with a blue seal)

We ask for points 2, 3 and 4 at a medical institution, usually they themselves know what the tax authorities require and it’s enough just to inform that you need a set of documents to receive a tax deduction.

5. Payment documents (copies).

6. Prescription forms with prescriptions for medicines (copies)

7. Details of the Sberbank account where the money will be transferred (copy)

8. If for a child - a birth certificate (copy)

9. If for the spouse (wife) - marriage certificate (copy)

10. Copy of passport (main + registration)

11. TIN (copy)

12. Completed declaration 3-NDFL (original)

To fill out 3-personal income tax, it is best to contact a specialist. This service will cost you 500 rubles, but you will be completely sure that the filling is correct and you will not have to go to the tax office again.

13. Application for money transfer (original)

Advice! If you want to receive money for passing paid tests in such laboratories as Medlab, Helix, Citylab, etc. Keep in mind that for each procedure they issue an agreement along with a receipt, I strongly recommend that you keep both, because if the agreement is lost, they are very reluctant to restore everything, you will have to spend your nerves and time.

(Visited 732 times, 1 visits today)

Payments to large families: Land capital in 2019…

Payments to large families: Land capital in 2019…

20.01.17 1 136 974 70

Instructions for those who were treated in a paid clinic

I hate being treated in public clinics.

It’s easier for me to pay than to stand in lines to a tired doctor grandmother. Therefore, for any disease, I go to a paid clinic.

In 2015, I spent 18,800 R on diagnostics, consultations and procedures. In 2016, I filed a tax deduction for treatment and returned 2500 R. I'll tell you how to do the same.

What will you learn

We regularly tell you how to get the maximum payments and benefits

Ekaterina Kondratieva

received a tax deduction for medical treatment

What is a tax deduction for medical treatment

A tax deduction is money that the state returns to you from the personal income tax you paid if you do something useful for the state. There are tax deductions for the purchase of an apartment and education. Today we will talk about the deduction for paid medical services.

Under medical services, the tax code includes a doctor's appointment, diagnostics, medical examination, testing, hospitalization, day hospital treatment, dentistry, and prosthetics. The list includes everything that a sick person usually encounters.

Operations, including plastic, IVF, treatment of serious diseases, are classified as expensive treatment. They get a different deduction for them, but more on that next time.

You can also get a deduction for voluntary health insurance if you paid for the policy yourself. If it was paid by the employer, then the deduction will not be made.

The amount of the deduction depends on the cost of treatment: the more you spent, the more you will be refunded. But the maximum cost of treatment, which is taken into account when calculating the deduction for treatment, is 120,000 R. This is a general limit for almost all social deductions, in particular for the cost of treatment and education (see paragraph 2 of article 219 of the Tax Code of the Russian Federation). Even if you paid a million at the hospital, you will receive a deduction as if you paid 120 thousand.

Who can get a deduction

If you receive a salary or have income on which you pay personal income tax, you can receive a deduction. Non-working pensioners, students and women on maternity leave do not have such income, they do not pay personal income tax, therefore they do not specifically claim this deduction.

You will also receive a refund if you paid for the treatment of your parents, spouse, children under 18 years of age. To do this, you need a document confirming kinship: a marriage certificate or a birth certificate. You will not be given a deduction for paying for the treatment of your mother-in-law or father-in-law.

For whom the contract for treatment is drawn up - it does not matter. But the payment document must be issued to the one who will receive the deduction.

For example, an elderly father is hospitalized and the daughter wants to make a deduction for his treatment. The contract can be drawn up either for the father or for the daughter, but payment documents - only for the daughter. If payment documents are issued to the father, the clinic will not give the daughter a tax certificate. It is best if both the contract and the payment papers contain the data of the person who will draw up the deduction. In our example, daughters.

How much money will be returned

The amount of the deduction depends on your salary and the cost of treatment. In any case, the tax authorities will not return more money than the personal income tax paid for the year. Calculate the amount of your deduction on the calculator.

How to get reimbursed for treatment

To receive money, you first need to collect evidence that you were treated and paid: contracts, checks and certificates from the clinic. Then fill out the 3-NDFL declaration on the tax website and send it along with the scanned documents for verification.

After the declaration is approved, it is necessary to write an application for a refund. According to the law, one month after filing the application, the tax must transfer money to your account.

You can do everything gradually. I was in no hurry and prepared the documents for about three months.

Collect checks and contracts for treatment

At the cash desk or reception of the clinic, you will be given an agreement and a receipt. Save these documents: only they confirm the fact of payment for the treatment. Attach the check to the contract with a paper clip or stapler. Then you are tormented to look for which contract which check.

Get help from the clinic

Go to the registry or accounting department and ask for a tax certificate. Present your passport, TIN, agreement with the clinic, all checks.

Some clinics do not require receipts. They take information about the services provided from their database. But not everyone does this. I lost several checks, and the girl at the reception did not include them in the amount of the certificate.

If you are making a deduction for the treatment of relatives, bring your marriage certificate or birth certificate along with the documents and ask for a certificate to be issued in your name.

In the clinic that I visited, a certificate is made in a maximum of 5-7 days. I came at a deserted time, so I got a certificate in half an hour.

If you doubt that the certificate is issued correctly, check whether it complies with the instructions of the Ministry of Health. Usually this problem does not occur. If the clinic has a license, it is obliged to issue a correctly executed certificate.

Together with the certificate, you will be given a copy of the license to carry out medical activities. If the clinic does not have a license or its validity has expired, the tax office will not return anything to you. A copy of the license remains with you, it does not need to be sent to the tax office.

Prepare documents for declaration

Scan a certificate from the clinic and an agreement to send them to the tax office remotely. If you receive a deduction for the treatment of parents, spouse, children under 18, then make a scan of your marriage certificate or birth certificate.

The tax website accepts .txt, .doc, .docx files,

.pdf, .gif, .bmp, .jpg, .jpeg, .png,

.tif, .tiff, .zip, .7z, .rar, .arj, .xls, .xlsx

Get a 2-NDFL certificate from the accounting department at work. The data from this certificate will be needed to fill out the declaration. It doesn't need to be scanned.

Submit documents to the tax office

Documents can be submitted in three ways:

- in person at the nearest tax office;

- by registered mail;

- on the site nalog.ru.

The first two methods did not suit me: I did not want to stand in lines. I spent the evening and filed documents on the site.

How to apply for a deduction on the tax website

The general logic is as follows: get an unqualified electronic signature, indicate income and upload proof of medical expenses. So that you do not get confused, we have prepared instructions.

1. Get an electronic signature. This is a simplified electronic signature - it can only sign documents on the tax website. We go to the taxpayer's personal account, then to the profile and select the "Get ES" tab. You will be asked to enter a password to access the electronic signature certificate - the main thing is to remember it. We send a request. We are waiting for the tax office to generate an electronic signature. If you did the EP earlier, skip this step.

2. Go to the section "Life situations" → select "Submit a 3-personal income tax declaration" → "Fill out online".

3. First select the year for which you are filing a declaration.

4. Add a source of income: indicate the employer, code and amount of income. Here you will need help 2-NDFL. The first paragraph of the certificate contains information about the employer (TIN, KPP and OKTMO). If the employer has already submitted annual reports, income data can be downloaded from the data that he submitted to the tax office. To do this, tick the employer and click the "Fill from the certificate" button. If your employer has not yet submitted reports, you will have to fill out the section manually based on your 2-NDFL certificate.

5. We choose the deduction we want to receive. The deduction for treatment is in the group "Social tax deductions". We enter the amount that we spent in the window "Amount of expenses for treatment, with the exception of expensive."

6. Add scanned certificates and contracts.

Apply for a refund

Even if your declaration is approved, the money will not be returned without an application. The application can be filled out immediately after sending the declaration or later - some time after sending the 3-NDFL declaration, information about the amount of tax overpayment will appear in the "My taxes" section of your personal account. In the same line there will be a special button - "Dispose".

See details in your personal account on the bank's website. In Tinkoff Bank, go to your personal account on the "About account" tab:

After you send the application, the money will be credited to your account within a month. You will receive a message from the bank about this.

Remember

- The tax deduction will be returned if you paid for your own treatment or the treatment of your parents, spouse, child under 18 years old.

- You can apply for a deduction within three years after the year in which you paid for the treatment.

- Keep your receipts and contracts to receive the deduction. Ask the clinic for a tax certificate, and at work - a 2-personal income tax certificate.

- Scan the documents and submit an application on the tax website. After you send the application, the money will be credited to your account within a month.

People who have to pay large sums for medical services are entitled to a tax deduction for tests, drugs and some other activities.

The rule for obtaining a tax deduction for treatment, payment for tests and the purchase of expensive drugs is prescribed in Russian tax legislation, namely in 219 Art. It is worth noting that the Law refers to the possibility of receiving a refund not only for oneself, but also for relatives who are paid for by the taxpayer. The procedure for obtaining a tax deduction for medical services is quite simple, but can take several months. However, the return for medical services can be quite large, unlike other types.

Tax deduction for receiving medical services

The tax refund is a measure of social support for Russian citizens who have an official job and receive a salary. As you know, 13% of taxes go to the state treasury from each earnings. This is how much the taxpayer can return if he paid for expensive treatment, diagnostic procedures or bought medicines during the year.

A tax deduction is a state support for citizens who have to bear a lot of expenses. It is not only about medical services, but also about education and charity. In addition, certain categories of citizens who are socially unprotected can also use the return.

Back to index

Return policy

Many Russian citizens who have to spend a lot of money on treatment are wondering how to apply for a tax deduction for medical services. There is nothing difficult in this, since it is enough just to collect a certain package of documents and submit it for consideration to tax officials. After that, there will be several months of waiting, and then the refund will be transferred to the applicant's personal account.

The list of medical services for a tax deduction includes not only medical, but also expensive diagnostic procedures. A Russian citizen can receive a refund of part of the money that was spent for treatment services personally for him or his close relatives - this includes children who have not reached the age of majority, spouses and parents. Moreover, the purchase of medicines can also be a reason for issuing a refund. At the same time, it does not matter to whom the medicines were intended, that is, the applicant himself, his children or parents.

Separately, it is worth highlighting insurance. It is also included in the list of medical services from which you can get a refund. If a voluntary insurance contribution has been made for the taxpayer himself, or if a spouse, children or parents are insured, you can count on the return of some part of the contribution.

You can use the possibility of issuing a refund only when all conditions are met. This applies primarily to the licensing of a medical organization. If the receipt of medical and diagnostic services was carried out in an institution with an expired or invalid license, then it will not be possible to issue a deduction.

Only a Russian citizen who has an official job and income can apply for a tax refund, that is, taxes in the amount of 13% are transferred to the state treasury.

In addition, the applicant must have all documents for the tax deduction for medical services, which will be proof of expenses associated with treatment or tests. With the purchase of medicines, everything is somewhat simpler, but even here you will need proof that the expensive funds were intended for the applicant or his close relative.

A complete list of medical services from which you can receive a refund is prescribed in government decree No. 201. This includes 27 items, among which a large part is occupied by surgical interventions. You can apply for a tax deduction for an operation if the heart, blood vessels, eyes and joints are affected. The list includes surgical intervention, which is aimed at getting rid of the pathologies of the respiratory and digestive organs. In addition, the list includes a range of therapeutic, holistic and diagnostic medical procedures. You can get a deduction for paying for services for nursing premature babies, when using IVF for the treatment of infertility.

It is worth noting that the tax deduction for paying for medical services will not be provided to those who do not pay taxes. This should include the unemployed, including those who receive benefits, individual businessmen conducting their activities without paying personal income tax.

Back to index

The amount of the tax deduction

If we are talking about receiving medical services, then you need to clarify which category they belong to. For example, when making a refund for the purchase of expensive drugs or for paying for tests, certain restrictions will apply. As in most cases with tax deductions, the maximum for calculating the deduction will be 120 thousand. If the reason for the paperwork is the cost of treatment, then there are no restrictions on payments.

It is worth considering that if the return falls into the category where certain annual limits apply, then all social payments will be taken into account, that is, not only for medical services, but also for education, pension contributions, and so on. The total amount for one person should not exceed more than 120 thousand. 13% is deducted from this money, which will be returned to the taxpayer.

Moreover, it is necessary to take into account the acceptable time limits. You can submit a package of papers to receive a tax deduction from paid medical services no later than 3 years after payment.

Back to index

Required documents

First of all, you need to fill out an application for a tax deduction. It must be accompanied by a declaration 3-NDFL and a certificate of employment in the form 2-NDFL. This is a very important point, as it makes it possible to calculate the amount of taxes paid in order to determine the basis for the refund. Form 2-NDFL is submitted for the past year.

Next, you need to collect a number of documents that are issued directly at the medical institution. This includes an agreement with the hospital for the provision of paid services and all additions, if any. It is mandatory to provide a certificate for a tax deduction for medical services, which is issued by the institution itself.

Among the documents must be payment documents that are issued exclusively in the name of the applicant. If a person underwent diagnostics or treatment in a sanatorium-resort organization, a certificate is required stating that this was prescribed by a doctor. When buying expensive medicines, prescriptions and payment receipts must be included. It is worth noting that you can get a deduction only for those purchased medicines that were prescribed by a specialist, that is, they were vital.

In the event that the documents will be drawn up not for the taxpayer himself, but for his relatives, it is necessary to provide a certificate confirming the relationship. It can be a marriage certificate or a birth certificate.