How to "spend" net profit correctly. How is profit distributed in an LLC? Accrued dividends to shareholders are paid from net profit

The founders of an LLC receive income from the profits from the activities of the enterprise. But payments occur in a strictly defined order. You can't just withdraw funds from circulation.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and IS FREE!

How are LLC dividends paid in 2020? Legal entities registered as LLCs have the right to send part of the profits received to payments to the founders of the company.

The distribution of funds is carried out in accordance with the procedure predetermined by law. What is the procedure for paying dividends to the founders of an LLC in 2020?

General points

The founders of the LLC are the direct owners of the enterprise. Why not just spend the profits?

This is due to the fact that any waste of the company must be justified and documented. Of course, the founders of the society are its owners.

But the owner of the property is the organization. And the property of the LLC is separated from the personal property of the founders.

Company money can be taken for three reasons:

- Under the report, when something is purchased for cash for the organization.

- which must be returned to the company.

- Dividends, which are income from the activities of the enterprise and which can be spent at your discretion.

But the distribution of dividends is carried out in a strictly defined order. If you display a brief scheme of actions, you will need:

- determine the amount of dividends;

- make a decision on payment;

- pay dividends and keep .

Despite the seeming simplicity of the process, each stage requires proper design. How to pay dividends to an LLC?

What you need to know

First of all, you need to understand what dividends are. According to Russian tax legislation, a dividend is any income received by the participants of the organization after the payment of taxes.

Moreover, LLC income is distributed in accordance with the shares of the founders. Thus, dividends are paid exclusively from the net profit of the enterprise.

Taxes are paid from the income received, transfers are made to funds. Only after that the profit is distributed among the participants.

Here it should be noted such a nuance that the norm regarding the procedure for determining the amount of profit is contained in.

According to its provisions, net profit is based on information financial statements. does not contain instructions on the procedure for determining profit.

In this case, the principle of applying norms by analogy applies. That is, LLCs determine the amount of net profit in the same way as OJSCs, guided by accounting documents.

You cannot distribute dividends in such cases as:

- pay authorized capital not in full;

- the share of the participant withdrawing from the company has not been paid;

- there are signs or their occurrence will be facilitated by the distribution of profits.

What is their role

The main task of paying dividends is to ensure the income of the company's participants. Any LLC is created for the purpose of obtaining benefits, that is, commercial activities must bring.

The basis for starting work is the authorized capital. In the process of activity, the company's assets are multiplied by generating income.

But in addition to income, the organization has certain expenses. It is necessary to pay employees, reimburse production costs, pay taxes and mandatory fees.

Everything that remains after the deduction mandatory expenses is retained earnings. There is no concept of "net" profit in the legislation.

Therefore, accounting data, confirmed by accompanying applications, are taken as the basis.

The balance sheet includes a line indicating retained earnings or uncovered loss, that is, the economic result. This indicator becomes the basis for calculating dividends.

Legal framework

Details on the dividends of LLC participants are stated in Article 28 of the Federal Law No. 14 of February 8, 1998 “On LLC”. According to this standard, the payment of dividends is carried out on the basis of a decision of the general meeting of participants.

However, there are certain legal restrictions that must be taken into account when making a decision.

The procedure for paying dividends is regulated by a number of regulations, namely:

Registration procedure

When distributing dividends to an LLC, the following procedure must be observed:

| Calculation of net profit and determination of the amount of income available to receive | The organization has the right to pay dividends only if the amount of net income is more than the authorized capital |

| Deciding on the payment of dividends | A general meeting of founders is convened. Participants approve financial statements, discuss ways to share profits and determine the timing for making payments. To calculate the amount of dividends for each participant, the total amount of accrued dividends is multiplied by the percentage of the share of the founder |

| Paying dividends and paying taxes | Dividends are paid at the appointed time. At the same time, 13% for residents of the Russian Federation and 15% for non-residents are withheld from them. The tax is transferred the next day after the payment to the participants. Information about amounts paid and tax withheld is displayed in the quarterly and annual reports ( , ). Insurance premiums dividends are not charged |

Terms of payment of dividends in LLC

If we talk about the conditions for paying dividends to an LLC, then it should be noted that payments cannot be made in case of bankruptcy or the risk of its occurrence.

For example, the value of net assets corresponds to the amount of authorized capital. It is clear that any payments in favor of the founders will reduce the working capital of the company.

In addition, the presence of debts to retired founders also makes it impossible to distribute profits.

By law, each participant in an LLC, upon leaving the company, has the right to receive the value of his share. Therefore, in the first place, the shares of former participants are paid.

In 2020, there is no need to pay the authorized capital before registering an LLC. Participants can make their part of the payment within 4 months after registration.

But during this time, the organization may have a net profit that can be distributed. But for payment, the authorized capital must be paid in full.

How long after the decision

The frequency of profit payments is determined by the founders. But regardless of the approved periods, the payment period cannot exceed 60 days.

Accordingly, within two months, each participant must receive the part of the profit due to him.

Moreover, payment can be made not only in cash, but also in property, if such an option is enshrined in the Charter.

If the participant has not received the required dividends within the period established by law, then he has the right to file a lawsuit in court. The fact of non-compliance with the deadlines is recognized as a violation of the rights of the founder.

Important! When determining the frequency of payment of dividends, the participants must be guided by the Articles of Association. If the Articles of Association state that profits are distributed once a year, then dividends cannot be paid more often.

To change the schedule, you need to make appropriate changes to the constituent documents.

List of documents

To pay profits to LLC participants, proper documentation is required.

You will need to prepare:

- decision on payment made by the founder;

- protocol and decision of the general meeting;

- and their payment.

The distribution of profits in an LLC is accompanied by the submission of reports:

Decision-making

The decision to issue dividends to the founders is made by the participants by convening a general meeting.

Such a meeting can be held not earlier than the financial statements for the relevant period will be prepared. If it's about annual accounts then it must be approved.

Moreover, the approval of the reporting is carried out in the period from March 1 to April 30 of the year following the reporting one.

Approval of reporting and the issue of distribution of profits can be resolved within the framework of one meeting.

The fact of holding the meeting is documented in the protocol form approved by the LLC.

Moreover, it is allowed to indicate in the minutes a single amount of dividends due for payment. The division takes place in proportion to the shares or in accordance with the provisions of the Articles of Association.

Note! Dividends may be paid in property, but such payment is treated as a sale.

This will result in the need to pay additional taxes. That's why cash payments more appropriate.

sample protocol

The minutes of the general meeting of participants shall contain the following information:

- the place and date of the general meeting;

- data of the chairman and secretary of the meeting;

- complete list of participants;

- share in the authorized capital of each founder;

- agenda;

- adopted resolutions.

The minutes of the general meeting of LLC participants can be. In addition to the minutes, a decision of the general meeting is drawn up.

It becomes the basis for the payment of dividends and is referred to in the relevant order.

The decision establishes the exact term for making payments and the method of payment (in money or property).

The total payment period cannot exceed 60 days. But if the participant has not received the dividends due to him, then he has the right to apply for their payment within three years.

Emerging nuances

The nuances that arise when paying dividends relate to the method of payment. Most often paid cash. Moreover, both cash and non-cash payments can take place.

Video: how to calculate, pay and withhold taxes from them

If a decision is made to pay dividends in property, then participants can receive their part of the payments in fixed assets, products, and securities.

However, the payment of dividends by the property of an LLC is equated to the sale of property values.

Since the property changes ownership, it is assumed that the company received a certain income. Hence the need to pay taxes.

On the OSNO, income tax is paid and on. The income received is taken into account as additional income.

Are there any restrictions

When distributing the profits of an LLC, legal restrictions must be taken into account. At tax authorities Claims may arise if dividends are paid:

Sole founder

If the LLC has a single founder, then there is no need to draw up a protocol. The participant independently makes a decision, drawing it up in a free form.

The decision states:

- the total amount of dividends;

- billing period;

- place and date of drawing up the document;

- founder's signature.

The sole founder has the right to arrange the payment of only part of the dividends, and allocate the remaining funds for other needs. In addition, dividends can be accumulated.

Making a profit is a right of the owner, not an obligation. The decision to pay dividends to the sole founder of an LLC is possible.

Upon liquidation

In the event of liquidation of the LLC, its activities are completely terminated. The order of succession in relation to rights and obligations is not provided.

This means that all calculations must be made before the official closing of the company, including the distribution of profits.

But you can receive dividends only at the expense of the organization's funds, free from debt obligations.

Therefore, upon liquidation of an organization, the following payment procedure is observed:

- Employee salaries.

- Payment of debts to the budget and off-budget funds.

- Settlements with creditors/counterparties.

- Payment of participants' shares from the remaining funds.

When one of the LLC members simultaneously holds any position in the company, he is first paid a salary as an employee. Then he equally participates in the distribution of profits.

You need to know that after the completion of all settlements with third parties, the accrued but not paid profit is first distributed among the participants.

Then the calculation of profit for the current period is carried out and its distribution is performed.

The payment of dividends upon liquidation of an LLC does not eliminate the need to pay income tax in full.

The article analyzes and summarizes non-standard situations that arise in practice in the distribution of profits in cases of payment of dividends (including intermediate ones) and changes in the composition of participants and their shares in the authorized capital. Specific examples show the solution of complex problems from the practice of tax consulting.

In some cases, in the absence of a clear legal regulation non-standard situations, the procedure for solving problems given in the article is based on the recommendations of the financial and tax departments.

The distribution of profits based on the results of financial and economic activities in an LLC is within the competence of the general meeting of participants. Recall that a limited liability company is a company created by one or more persons, the authorized capital of which is divided into shares. The participants of the company bear the risks of losses associated with the activities of the company, within the value of their shares, and upon receipt of profit, the general meeting of the participants of the company makes a decision on the distribution of net profit in accordance with the adopted policy of the company.

The main documents regulating the activities of limited liability companies, which are the Civil Code of the Russian Federation (Articles 87–94) and Federal Law No. 14-FZ of February 8, 1998 (as amended on November 30, 2011) “On Limited Liability Companies” (hereinafter - Federal Law No. 14-FZ), it is determined that net profit can be directed:

To replenish the company's funds, production development and the creation of reserves;

Social programs and bonuses for employees;

Payment of part of the profit to the participants of the company.

You should immediately pay attention to two features related to the distribution of net profit in an LLC.

Firstly, the term "dividends" for an LLC in normative documents not given. In relation to such societies, it is correct to speak of profit distribution according to Art. 91 of the Civil Code of the Russian Federation, Art. 28, 29 of Federal Law No. 14-FZ. However, the term "dividends" has become widespread in practice, not only in relation to joint-stock companies, but also to limited liability companies. Therefore, considering only the solution of practical situations, we will adhere to this generally accepted term.

Secondly, as a general rule, the announcement of the amount of the annual income of the company's participants (dividends) based on the results of activities for the year refers to events after reporting date(clause 3 PBU 7/98), and in the reporting period for which net profit is distributed, no accounting entries are made. An exception to this rule is when the goals for which the net profit should be directed and the conditions for how the net profit is distributed are indicated directly in the charter of the company: once a quarter, once a half year or once a year. The payment of interim dividends is just such a case. Therefore, the accountant has every right, on the date of the decision of the general meeting of participants on the payment of part of the net profit (subclause 7, clause 2, article 33 of Federal Law No. 14-FZ), to reflect the accrual of dividends for the first quarter, six months, nine months, using the account retained earnings of the reporting year.

Having defined general rules, regulatory documents and features of determining the income of LLC participants, let's move on to the analysis of specific situations.

Situation 1

The founders of Triumph LLC with an authorized capital of 250 thousand rubles. are individuals: the first participant has a 24% share in the authorized capital, the second participant (non-resident) - 25%, and the third participant - 51% of the share in the authorized capital.

Is it possible to distribute the profit received at the end of 2011 in the amount of 1 million rubles. disproportionately to their shares, for example, 30% for the first and second participants and 40% for the third, if such a decision is made by all participants on general meeting? What are tax implications such a decision?

In accordance with paragraph 2 of Art. 33 of Federal Law No. 14-FZ, making decisions on the distribution of the company's net profit is the exclusive competence of the general meeting of participants. Moreover, paragraph 2 of Art. 28 of Federal Law No. 14-FZ expressly allows the right of organizations established in the form of an LLC to establish a special procedure for distributing profits - disproportionately shares in the authorized capital of the company.

Note! The procedure for distributing profits can be changed with the consent of all participants in the company and when changes are made to the relevant sections of the company's charter. No other procedure is provided for by the current legislation of the Russian Federation.

If the decision on the distribution of profits disproportionately to the shares of participants is made at the general meeting, and no changes are made to the constituent documents, another problem may arise.

For income individuals- LLC participants received by them during the distribution of profits are legally established preferential tax rates for personal income tax. Yes, pp. 3, 4 art. 224 of the Tax Code of the Russian Federation provides for rates of 9% for individuals who are tax residents Russian Federation, and 15% for persons who are not tax residents of the Russian Federation.

In the event that at the end of the year a decision was made to distribute profits disproportionately to the shares of participants, for example, as shown in Table. 1, the application of a preferential personal income tax rate may cause disagreements with inspection and regulatory organizations.

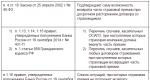

|

Table 1. Profit distribution among LLC participants |

|||

|

LLC member |

By decision of the meeting of participants |

Within the share of the participant in the authorized capital |

Deviation |

|

Total | |||

Thus, according to the Russian Ministry of Finance, part of the net profit distributed among participants disproportionately to their shares is not recognized as a dividend for tax purposes. Accordingly, these payments are taxed at the general rate for both legal entities and individuals (letters dated June 24, 2008 No. 03-03-06/1/366, January 30, 2006 No. 03-03-04/1/65).

An essentially similar position was expressed by the Federal Antimonopoly Service of the North-Western District when considering disputes related to the taxation of personal income tax payments in the form of dividends (Resolutions dated June 27, 2011 No. A13-2088 / 2010, January 12, 2006 No. A44-2409 / 2005-7).

In other words, according to financial and judiciary, the overpaid part of the net profit does not meet the criteria of a dividend and a preferential rate (9 or 15%) cannot be applied to it.

Note! The official opinion boils down to the fact that it is necessary to tax at a preferential rate (in particular, at rates of 9 or 15%) only that part of the distributed profit that is proportional to the size of the share. The remainder must be paid to general order .

For the analyzed situation, a preferential rate of 9% should be applied to the income of the first participant within his share, that is, to the amount of 240 thousand rubles, 13% - to income in excess of his share - 60 thousand rubles.

For the second participant - a non-resident, a preferential rate of 15% is applied to the tax base of 250 thousand rubles, 30% - to income in the amount of 50 thousand rubles.

For the third participant, a preferential rate of 9% is applied to the entire amount of income.

Summing up the above, it can be recommended in this situation, before making changes to the constituent documents, to distribute net profit companies at the end of the calendar year according to the decision of the general meeting of participants, and when taxing "dividends" to use a preferential personal income tax rate on that part of the income that is distributed in proportion to their shares in the authorized capital of the company.

But you can do otherwise. When accruing income, apply preferential rates to the entire amount of income of participants in accordance with the decision of the general meeting, that is, disproportionately to their shares in the authorized capital, and pay income to participants after registration of changes in the constituent documents. After all, it is necessary to withhold tax on income (dividends) when they are paid (clause 2 of article 214, clause 4 of article 226, clause 2 of article 275, clause 4 of article 287 of the Tax Code of the Russian Federation).

In the event that the procedure for distributing net profit is not only changed with the consent of all participants in the company, but is also registered by amending the relevant sections of the company's charter, the participants' income (dividends) are taxed at preferential rates.

Situation 2

Let's change the conditions of the previous situation. Members of the company - individuals and residents of the Russian Federation - were accrued and paid dividends based on the results of I quarter and half year of 2011 (Table 2). In December (10.12.2011) the third participant sold a part of his share in the authorized capital in the amount of 20% to a new participant and instead of 51% became the owner of a share of 31%. The composition of the participants has changed, about which an entry was made in the Unified State Register of Legal Entities. Is it possible to distribute the annual profit taking into account the time during which the fourth participant was actually a participant in the company? Is such a decision legal if it is taken by a majority of votes at the general meeting of participants?

In accordance with Part 1 of Art. 28 of Federal Law No. 14-FZ, a company has the right to make a decision on the distribution of its net profit among the participants of the company quarterly, once every six months or once a year. The decision to determine the part of the company's profit to be distributed among the company's participants is made by the general meeting of the company's participants.

In our opinion, the issue of distribution of profit at the end of the year between the participants in the case when changes in the charter were registered in December 2011, and interim dividends were distributed based on the results of the 1st and 2nd quarters, in our opinion, can be resolved as follows.

For joint-stock companies, there are the concepts of "interim dividend" and "final dividend", which are determined on the basis of the final result of profit for the past calendar year.

In essence, the interim dividend is in the nature of an advance payment, the amount of which is taken into account when declaring the final dividend. When paying the final dividend, its size is determined in the total amount for the year, taking into account advance payments of interim dividends.

Note! Although the concept of a dividend refers to a portion of the net profit in joint-stock companies, an essentially similar approach can be applied to the distribution of net profit among the participants in an LLC.

In other words, in intermediate periods, for example, based on the results of the first quarter, half a year, advance payments are accrued, and the final amount of dividends or part of net profit in limited liability companies is determined at the end of the year.

So, according to the results of the first quarter, dividends were accrued and paid in this situation (see Table 2):

The first participant - 48,000 rubles. (24% × 200,000);

The second participant - 50,000 rubles. (25% × 200,000);

Third participant - 102,000 rubles. (51% × 200,000).

The following dividends were accrued and paid at the end of the first half of the year:

The first participant - 72,000 rubles. ((24% × 500,000) - 48,000);

The second participant - 75,000 rubles. ((25% × 500,000) - 50,000);

Third participant - 153,000 rubles. ((51% × 500,000) - 102,000).

|

Table 2. Profit to be distributed among LLC participants |

|||

|

LLC member |

According to the resultsIquarter, rub. |

At the end of the half year, rub. |

At the end of the calendar year, rub. |

|

Fourth | |||

|

Total |

1 000 000 |

||

When paying the final income to the participants of the company, its size is determined in the total amount for the year, but with an offset of advance payments. Then, at the end of the year, dividends should be accrued and paid:

The first participant - 120,000 rubles. ((24% × 1,000,000) - 48,000 - 72,000);

The second participant - 125,000 rubles. ((25% × 1,000,000) - 50,000 - 75,000);

Third participant - 55,000 rubles. ((31% × 1,000,000) - 102,000 - 153,000);

The fourth participant - 200,000 rubles. (20% × 1,000,000).

The part of the LLC's profit intended for distribution among its participants is distributed in proportion to their shares in the authorized capital of the company. A different procedure can be established by amending the charter of the company by decision of the general meeting of participants in the company, adopted by all participants in the company unanimously (part 2 of article 28 of Federal Law No. 14-FZ).

Given the above procedure, it should be concluded that if the participants in the company decide to distribute profits in proportion to the time during which the new participant was actually a member of the company, then such a decision will not comply with the law. The requirements of the new participant for the payment of dividends in full at the end of the year will be recognized as legitimate. As an example judgments on a similar issue, we can cite the Resolution of the Federal Antimonopoly Service of the North-Western District of March 23, 2009 in case No. A56-11686 / 2008.

Please note that in this situation, interim dividends for the first quarter and six months were not accrued and were paid in a larger amount than was due to all four participants at the end of the year. However, this does not always happen.

Situation 3

Let's keep the conditions of the previous situation, but let's assume that according to the results of 2011, the profit for distribution amounted to 1 million rubles. At the same time, the profit according to the results of the first half of the year amounted to 1.3 million rubles, that is, in the second half of the year the company received a loss. How should interim dividends already paid be redistributed among the new participants?

The financial result of the organization's activities can be both profit and loss. According to Art. 29 of Federal Law No. 14-FZ, limited liability companies cannot make decisions on the payment of dividends:

Until full payment of the entire authorized capital;

Until the payment of the actual share or part of the share of a member of the company in cases provided for by law;

If the company meets the signs of insolvency (bankruptcy) or there is a possibility of such signs appearing as a result of the payment of dividends;

If the value of the net assets of the company is less than the authorized capital and reserve fund or will decrease as a result of the payment of dividends.

pay attention to last condition. Recall that the net assets indicator is calculated as the difference between assets and liabilities. So if accounts payable company is significant, net assets may well be less than the authorized capital. In this case, it is illegal to pay dividends.

But let's assume that there are no signs of bankruptcy, the value of net assets exceeds the size of the authorized capital, and at the end of 2011, a profit was received for distribution among the participants in the amount of 1 million rubles. The only obstacle is the overpaid dividends in the amount of RUB 1.3 million.

In this case, the general meeting of the company's participants may decide to credit the overpaid dividends against the upcoming dividend payments in subsequent years or to return them to the company's cash desk. However, the return of the amounts paid is carried out by the participants of the company - individuals voluntarily, the company is not entitled to forcibly demand their return.

And vice versa: a company member is not entitled to demand payment of a part of the net profit to him, if the decision on the distribution of profit was not made by the general meeting of the company participants (subparagraph “b”, paragraph 15 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 90, Plenum of the Supreme Arbitration Court of the Russian Federation No. 14 dated 09.12 .1999 "On some issues of the application of the Federal Law "On Limited Liability Companies"").

Also, one cannot ignore a number of ambiguous situations regarding the distribution of profits as dividends in organizations with special regimes taxation (USN, ESHN, UTII), in the application of which organizations are exempted from paying income tax. Consider one of these questions using the example of the following situation.

Situation 4

LLC applies the simplified tax system with the object "income minus expenses". Is the sole founder, who is also the director of the company, entitled to accrue dividends to himself and not switch to common system taxation?

In a company consisting of one participant, decisions on issues related to the competence of the general meeting of participants in the company are taken by the sole participant of the company individually and are drawn up in writing (Article 39 of Federal Law No. 14-FZ, letter of the Federal Tax Service of Russia for Moscow dated April 19, 2007 No. 20-12/ [email protected](a)).

The simplified taxation system is one of the four special tax regimes in force in the Russian Federation (clause 2, article 18 of the Tax Code of the Russian Federation). It is focused on simplifying the calculation and payment of taxes in the entrepreneurial activities of small and medium-sized businesses. When applying the simplified tax system, the taxpayer is exempt from paying a number of taxes, including income tax (clauses 2, 3 of article 346.11 of the Tax Code of the Russian Federation). Moreover, when working on the simplified tax system, organizations have the right not to keep accounting records, with the exception of accounting for fixed assets and intangible assets(Clause 3, Article 4 of the Federal Law of November 21, 1996 No. 129-FZ (as amended on November 28, 2011) “On Accounting”).

However, it should be emphasized that not to use the traditional accounting system organizations-"simplified" have the right, but not the obligation.

In the case when it comes to the distribution of profits, accounting will be the main documentary evidence the possibility of accruing dividends and applying preferential tax rates for personal income tax.

Profit for distribution, or "net" profit, in the case of the application of the simplified tax system, is determined in accordance with the procedure provided for in paragraph 23 of PBU 4/99. A similar opinion was expressed in a letter from the Federal Tax Service for Moscow dated January 15, 2007 No. 18-11 / 3 / [email protected]

In other words, an organization that applies the simplified tax system and is exempt from paying income tax is entitled to accrue and pay dividends in full when maintaining accounting records. At the same time, there is no need to switch to the general taxation system.

Income in the form of dividends due to individuals is subject to personal income tax in accordance with Ch. 23 of the Tax Code of the Russian Federation. Therefore, in the situation under consideration, the organization - the source of dividends must fulfill the duties of a tax agent for payment of personal income tax according to paragraph 2 of Art. 214 of the Tax Code of the Russian Federation. The tax agent determines the amount of personal income tax separately for each taxpayer in relation to each payment of the specified income: at the rates of 9% - for individuals who are tax residents of the Russian Federation (clause 4 of article 224 of the Tax Code of the Russian Federation), 15% - for individuals who are not tax residents of the Russian Federation (clause 3 article 224, paragraph 3 article 275 of the Tax Code of the Russian Federation).

When receiving income from monetary form date of actual receipt of income is defined as income payment day, including transfers of income to the taxpayer's accounts in banks or, on his behalf, to the accounts of third parties (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

The status of an individual (incorporated or not in the state of the founder) does not matter for the accrual and payment of dividends. This is important only when choosing an accounting account on the basis of the Instructions for the Application of the Chart of Accounts for Accounting Financial and Economic Activities of Organizations.

So, if the founder performs the duties of a director, then the accrual of dividends is reflected on the credit of account 70 “Settlements with personnel for wages” sub-account “Settlements with employees for the payment of dividends (income from participation in authorized capital)” in correspondence with account 84 “Retained earnings ( uncovered loss).

Note. In accordance with paragraph 1 of Art. 28 of Federal Law No. 14-FZ, the participants in the company have the right to make a decision on the distribution of profits remaining after taxation among themselves, that is, on the payment of dividends, on a quarterly basis, once every six months or once a year. Thus, the distribution of profits is a right, not an obligation. And if the founder of the organization does not want to receive dividends, but wants to use the profit for something else, he can do it.

And one more nuance related to the situation when the sole founder is the head of the company. Rostrud in a letter dated December 28, 2006 No. 2262-6-1 notes the following. Cases when the sole founder of a legal entity is also its leader (for example, the general director) are not uncommon. According to Art. 56 "Concept employment contract. Parties to an employment contract” of the Labor Code of the Russian Federation, an employment contract is concluded between the employee and the employer. In this situation, according to Rostrud, in relation to to CEO his employer is missing.

However, the non-application of ch. 43 "Peculiarities of labor regulation of the head of the organization and members of the collegial executive body of the organization" of the Labor Code of the Russian Federation to the relations that arise when the head is at the same time the sole founder of the organization, does not mean that other norms of labor legislation do not apply to these persons. From Art. 16 "Bases for the emergence of labor relations" of the Labor Code of the Russian Federation it follows that labor Relations arise between the employee and the employer on the basis of an employment contract concluded, among other things, as a result of appointment to a position or approval in a position. At the same time, in this situation, on the basis of Art. 20 "Parties of labor relations" of the Labor Code of the Russian Federation, an employer is a legal entity (organization) that has entered into labor relations with an employee, and not an individual - the head of the organization.

It is not uncommon that in such situations they try to save on payroll taxes by accruing and paying the director only dividends, including intermediate ones.

But non-payment wages to the director during the period when he, as a head, carries out activities to manage the organization, sign financial documents and make decisions, including on the payment of dividends, in our opinion, does not comply with labor law. Such a situation can be the basis for disputes and conflicts with regulatory and inspection bodies, and if facts of unjustified non-calculation of wages are revealed, the organization can be involved not only in tax, but also in administrative responsibility(Article 5.27 "Violation of the legislation on labor and labor protection" of the Code of Administrative Offenses of the Russian Federation).

Regulation on accounting“Events after the reporting date” (PBU 7/98), approved by Order of the Ministry of Finance of Russia dated November 25, 1998 No. 56n (as amended on December 20, 2007).

Regulation on accounting "Accounting statements of the organization" PBU 4/99, approved by Order of the Ministry of Finance of Russia dated 06.07.1999 No. 43n (as amended on 08.11.2010).

General provisions. According to corporate law, dividends exist only in JSCs. The LLC legislation does not use the word "dividends"; it only refers to the distribution of net profit among LLC participants.

Tax legislation uses the concept of "dividends" for both JSCs and LLCs. For simplicity of presentation, we will further use the tax approach and call the distribution of net profit between participants in joint-stock companies and LLCs (as well as between participants in a partnership, members of a production cooperative) the payment of dividends.

In the Civil Code of the Russian Federation, the Tax Code of the Russian Federation, the Federal Law on JSCs and OOs and other regulatory documents, different definitions of a dividend are given. Let us dwell on the following: dividends are recognized as the income of the participant of the legal entity on his shares (stakes) in the UK, received from the legal entity in the distribution of net profit in proportion to the shares (stakes) of the participant in the authorized capital of these legal entities.

Dividends also include any income received from sources outside the Russian Federation, related to dividends in accordance with the laws of foreign states.

Not recognized as dividends (clause 4, article 43 of the Tax Code of the Russian Federation):

1) payments to the participants of the legal entity upon its liquidation in cash or natural form not exceeding the participant's contribution to the authorized capital of the company;

2) payments to shareholders of the company in the form of transfer of shares of the same company into ownership;

3) payments to a non-profit organization for the implementation of its main statutory activities (not related to entrepreneurial activity) produced by economic companies, the authorized capital of which consists entirely of the contributions of this non-profit organization.

Use of the net profit of the legal entity. The payment of dividends is one of the ways in which the legal entity's net profit is used. Other directions for using net profit: in the production development of legal entities (construction, acquisition of fixed assets, etc.); formation of reserve and other funds of the legal entity in the manner and in the amount provided for by the charter of the legal entity; covering losses of previous years; increase in the Criminal Code of legal entities; payments to employees from net profit (for vouchers, financial assistance organization of recreation, cultural and sports events, etc.); remuneration of members of the board of directors; charitable purposes, etc.

There is an age-old problem: how to find the optimum between the part of the net profit of a legal entity directed to the development of production, and the part directed to the payment of dividends. In world practice, more than 50% of the net profit of joint-stock companies is directed to the payment of dividends. In Russia, only 1/3 of all OJSCs declare dividends.

The classification of dividends paid by legal entities is shown in fig. 18.1.

Rice. 18.1. Classification of dividends

Sources of payment of dividends. The source of dividend payment is the profit of the joint-stock company of the reporting year after taxation (net profit). Retained earnings of previous years are also taken into account. The net profit of a joint-stock company is determined according to the company's financial statements.

Therefore, legal entities applying the simplified tax system (simplified taxation system) and paying dividends must keep accounting records.

Dividends on preferred shares of certain types may also be paid to JSCs at the expense of special funds of the company previously formed for these purposes.

Decision making and payment of dividends. The decision to pay dividends based on the results of the JSC's activities is taken by the general meeting of shareholders (this is its exclusive competence).

Moreover, this is a right, not an obligation of the general meeting. This means that shareholders are not entitled to demand the payment of dividends if the decision on the distribution of net profit has not been made.

The decision can be taken by a simple majority of votes at the regular (annual) general meeting of shareholders (in case of payment of dividends at the end of the financial year) or at an extraordinary meeting (in case of payment of dividends at the end of the first quarter, six months and nine months of the financial year). In both cases, the terms for making such a decision must be established in the charter of the company.

The law establishes the following restrictions on the timing of the decision to pay dividends (distribution of net profit):

1. A decision on final (annual) dividends must be made in a JSC not earlier than March 1 and not later than June 30 of the year following the financial year (in LLC - not earlier than March 1 and not later than April 30 of the year following the financial year).

2. A decision on interim dividends must be made within three months after the end of the relevant period (first quarter, six months, nine months).

The decision on the payment of dividends for each category (type) of shares determines the amount of dividends, the form and terms of their payment.

The dividend amount is determined as the amount of net profit in rubles and kopecks per share of a certain category and type, excluding withholding tax.

The amount of dividend per ordinary share should not exceed the amount recommended by the Board of Directors of the JSC.

The amount of dividend per preferred share is set in the charter of the JSC. If such amount is not determined, then it is determined in the same manner as for ordinary shares.

Information about declared dividends, their amount, form and terms of payment is posted on the JSC's website on the Internet.

In an LLC, net profit is generally distributed (in whole or in part) among its participants in proportion to their shares in the authorized capital. However, the charter of an LLC may provide for a disproportionate distribution of profits. Provisions relating to this issue can be included in the charter only if they are accepted by all participants of the LLC unanimously.

Profits and losses of a full partnership are distributed among the partners in proportion to their shares in the share capital, unless otherwise provided by the memorandum of association or other agreement of the partners (for example, equally). The same documents determine the timing of the decision on the distribution of net profit between partners (quarterly, every six months, a year or at the end of the transaction).

The investor of a limited partnership has the right to receive a part of the net profit due to his share in the share capital, in the manner prescribed by the founding agreement.

The net profit of a production cooperative (PC) is distributed among its members in accordance with their personal labor and (or) other participation, the size of the share contribution, and among the members of the PC who do not take personal labor participation in the activities of the cooperative, in accordance with the size of their share contribution. By decision of the general meeting of PC members, part of the PC's net profit may be distributed among its employees.

The part of the net profit distributed among the members of the PC in proportion to the size of their share contributions should not exceed 50 percent of the profit of the PC to be distributed among the members of the cooperative.

Dividends are paid in money, and only in cases provided for by the charter of the company, in other property. For example, dividends can be paid in products, fixed assets, shares (including shares of subsidiaries), etc. At the same time, the types of property that can be transferred on account of dividends must be specified in the charter of the economic organization. Property valuation may be made by agreement of the parties and may be lower than the book value of the property.

With regard to LLC, the law does not say anything about the form of distribution of net profit. By default, the distribution of net profit in the form of property is legal, but this method it is also desirable to fix in the charter.

The term and procedure for the payment of dividends is determined by the charter of the HO or by the decision of the general meeting of participants on the payment of dividends. It should not exceed 60 days from the date of the decision to pay dividends.

If the decision to pay dividends is made, then their payment becomes the responsibility of the joint-stock company. If the dividends were not paid on time, then the limitation period for receiving dividends is three years from the date when 60 days expire from the date of the decision by the general meeting of the legal entity on the payment of dividends. The charter of a legal entity may provide for more than long term reclamation, but not more than five years. The statute of limitations is waived for cases where the participant was unable to receive his dividends under the influence of threat or violence. In other cases, the missed period is not restored.

With the entry into force of Federal Law No. 409-FZ of December 31, 2010, the same rules as in JSCs, the rules on the timing and procedure for paying dividends are also valid in LLCs.

If the participant of the economic organization was not paid dividends in a timely manner, he may also demand interest from the company in the amount of the refinancing rate of the Central Bank of the Russian Federation.

The Company is not entitled to provide an advantage in the timing of dividend payments to individual owners of shares of the same category (type). Payment of declared dividends on shares of each category (type) must be carried out simultaneously to all owners of shares of this category (type).

If the dividends were not received by the company's participants, then upon expiration of the period limitation period the amounts of unclaimed dividends are restored as part of the company's retained earnings.

The adjustment of the tax base in terms of the restoration of dividends is made from the date on which they were recorded as income for income tax purposes due to the expiration of the limitation period for receiving dividends.

If dividends have been accrued, but the company is not able to pay them, then the unreceived dividends, the limitation period for which has expired, the participant of the company cannot take into account as part of its tax expenses as losses (letter of the Ministry of Finance of Russia dated March 20, 2012 N 03-03-06-1 / 133).

JSCs cannot decide to reduce the authorized capital until the moment of full payment of the declared but not paid dividends, as well as before the expiration of the period established for the shareholders to submit claims for the payment of declared dividends.

There is no prohibition on reducing the LLC's charter capital if the company has an unpaid part of the distributed profit.

Recipients and order of payment of dividends. The right to receive dividends is held by shareholders who owned shares as of the “registry closing” date (the date of compilation of the list of persons entitled to participate in the shareholders' meeting).

This date is determined by the board of directors annually, usually 1-2 months before the general meeting of shareholders. In the event that a shareholder sells his shares before the “registry closing” date, the right to receive dividends passes to the new owner of the shares. If the shares are acquired after the “closing of the register” date, then the right to dividends remains with their former owner, since he will be indicated in the list of shareholders.

The list of persons entitled to receive dividends is compiled by the registrar (the company itself or the registrar). To compile it, the nominee shareholder provides data on the persons in whose interests he owns the shares.

Dividends in JSCs are set and paid separately for preferred and ordinary shares. Owner preferred shares has an advantage in receiving dividends over the owner of ordinary shares. In turn, the owners of different types of preferred shares may have a different sequence in their receipt (see Fig. 18.2). The decision to pay dividends on shares of a lower order cannot be taken until dividends on shares of a higher order are declared.

Rice. 18.2. Order of payment of dividends in JSC

Restrictions on the payment of dividends. Dividends are accrued and paid only on fully paid shares. The following groups of shares do not accrue dividends:

Not placed (not released into circulation);

Acquired (repurchased) and on the balance sheet of the JSC by decision of the board of directors (general meeting of shareholders);

Received at the disposal of JSC due to the buyer's failure to fulfill its obligations to purchase them.

JSC is not entitled to decide on the payment (declaration of dividends) on shares:

Until full payment of the MC JSC;

Before the redemption of shares that the JSC must redeem, when the shareholders have the right to demand the redemption by the company of their shares;

If the JSC meets the signs of bankruptcy or becomes liable as a result of the payment of dividends;

If the requirement on the amount of the JSC's net assets is not met: the value of the JSC's net assets as of the date of the decision to pay dividends is less than its authorized capital, the reserve fund and the excess of the liquidation value of the placed preferred shares over their nominal value, or will become less as a result of such a decision;

If the value of the LLC's net assets is less than its authorized capital and reserve fund or becomes less than their size as a result of this decision.

The company is not entitled to pay dividends to its participants, the decision to pay which was made, if at the time of payment of dividends:

The company meets the signs of bankruptcy or will become liable as a result of the payment;

The value of the company's net assets is less than its authorized capital and reserve fund or will become less as a result of the payment.

As these circumstances cease, the company is obliged to pay the participants the profit, the decision on the distribution of which among the participants of the company has been made.

In the event of an unjustified refusal of the company to pay out distributed profits, the participants have the right to apply to court of Arbitration on the recovery from the company of their part of the profits.

In the event that the decision of the general meeting on the payment of dividends was made in the presence of circumstances limiting the possibility of such a decision, or after its adoption, circumstances arose that preclude the possibility of paying dividends, the court is not entitled to satisfy the requirements of the participant.

Upon termination of these circumstances, dividend payments should be resumed.

Taxation of dividends. When paying dividends, a legal entity must fulfill the duty of a tax agent in terms of calculating, withholding and transferring the following taxes to the budget:

1) income tax (if dividends are paid to a participant - legal entity);

2) personal income tax (if dividends are paid to a participant - an individual).

The obligation to calculate, withhold and transfer tax on dividends arises from the legal entity - the source of payment of dividends (tax agent), regardless of which tax regime (STS, UTII or UAT) the legal entity applies.

If the recipient of dividends is not an income tax payer, then the tax agent does not have an obligation to transfer tax on dividends. This takes place, for example, when paying dividends on shares (stakes in the UK) that are state or municipal property; when paying dividends investment funds located in trust management management companies; on shares owned by the Bank for Development and Foreign Economic Affairs - Vnesheconombank.

From the amount of dividends that are paid to a legal entity applying the simplified tax system, a tax agent (legal entity that pays dividends) must withhold income tax. This is due to the fact that in relation to the dividends received, such legal entities are not exempt from income tax. LE - the recipient of dividends will be transferred dividends minus income tax.

If the legal entity - the recipient of dividends is not transferred to UTII, then the tax agent must withhold income tax from the amount of dividends due to him. A legal entity that is on UTII is exempt from paying income tax only in relation to profits received from activities transferred to UTII, dividends do not apply to such income.

The tax rate differs depending on the recipient of dividends (see Table 18.1).

The calculation of the amount of tax withheld upon payment of dividends is made for each recipient of dividends separately and depends on whether the paying legal entity itself received dividends or not.

If the legal entity distributing profits did not itself receive dividends, then the amount of withholding tax on dividends paid to Russian participants will be calculated according to the formula

where H i- amount of withholding tax i-th shareholder (participant), rub.; Dv i- the amount of dividends due i th shareholder (participant), rub.; St- tax rate on dividends, %.

If the legal entity distributing profits was the recipient of dividends, then the amount of tax on dividends paid to Russian participants is calculated according to the formula

where Dv- total amount of dividends due to be paid, rub.; Dp- the total amount of dividends received by the company itself in the current and previous periods (excluding dividends taxed at a rate of 0%).

Table 18.1

Income tax and personal income tax rate when paying dividends

If the amount of tax on dividends is negative, the obligation to pay tax does not arise and no reimbursement from the budget is made.

If a Russian legal entity pays dividends to a foreign individual or legal entity, then the tax base is determined for each such payment and the tax is calculated in the same way as by formula (18.1).

If dividends are paid to the heir, then personal income tax is withheld from them, although income transferred by inheritance is not subject to personal income tax. But this rule applies if the income is received from an individual, and here the income is received not from an individual, but from a legal entity.

Both income tax and personal income tax withheld when paying dividends are transferred to the budget tax agent who made the payment, no later than the day following the day of payment (clause 4, article 287 and clause 6, article 226 of the Tax Code of the Russian Federation).

Personal income tax on dividends that the legal entity pays to participants - individuals, the legal entity pays to the Federal Tax Service, where it is registered with the legal entity, even if the participants are registered in another region of the Russian Federation (clause 7 of article 226 of the Tax Code of the Russian Federation). The IFTS, where the legal entity is registered, transfers data on dividends paid and personal income tax withheld to the IFTS according to the place of residence of each participant, when the legal entity reports on the results of the year, in the form 2-NDFL (clause 2, article 230 of the Tax Code of the Russian Federation).

According to the Ministry of Finance of Russia (letter of the Ministry of Finance of Russia dated June 24, 2008 N 03-03-06 / 1/366), a part of the net profit of a legal entity distributed among its participants disproportionately to their shares in the management company of a legal entity (which may be in LLC and business partnerships in in accordance with their constituent documents) is not recognized for tax purposes as dividends, but is treated as a payment from net profit. For taxation purposes, payments made in excess of the amount of dividends (net profit of the legal entity distributed among the participants of the legal entity in proportion to their shares in the capital of the legal entity are taxed at the general tax rate (13% for individuals - residents of the Russian Federation and 15% - non-residents; 20% for legal entities - residents and 30% for non-residents).

A legal entity can pay dividends not only for the year, but also interim dividends (for the quarter, six months, nine months). The total amount of interim dividends may turn out to be more than the net profit of the legal entity at the end of the year. The resulting difference is included in the participants' income and is taxed in the general manner (at a rate of 13% for personal income tax and at a rate of 20% for income tax).

When paying dividends in cash, the object of VAT does not arise.

The payment of property dividends (if it is provided for by the charter of a legal entity) is considered a sale in connection with the change of ownership and is subject to VAT. Property valuation can be made by agreement of the parties.

Dividends are not subject to insurance contributions (only payments for labor and civil law contracts the subject of which is the performance of work, the provision of services).

LLC members? When can dividends not be distributed? What is important to consider when distributing and paying dividends in order not to lose on taxes?

According to the results of 2015, limited liability companies must decide on the payment of dividends in the period from March 1 to April 30, 2016 (clause 3, article 28, article 34 of the Federal Law of February 8, 1998 No. 14-FZ "On limited liability companies”, hereinafter referred to as Law No. 14-FZ).

The concept of dividends

A few words about the very concept of "dividends". Note that the civil legislation of the Russian Federation does not contain a clear definition of "dividends". In particular, Law No. 14-FZ does not contain the concept of "dividends", instead of it the concept of "distribution of net profit" appears.

The term "dividends" is used only in federal law dated December 26, 1995 No. 208-FZ “On Joint Stock Companies”, which states that it has the right to make decisions (announce) on the payment of dividends on outstanding shares (clause 1, article 42 of Law No. 208-FZ) and in tax legislation (Clause 1, Article 43 of the Tax Code of the Russian Federation).

True, the concept of "dividends", used for tax purposes, is broader than in civil law.

Deadlines for making a decision on the distribution of profits

Law No. 14-FZ allows the payment of dividends to participants quarterly, every six months or once a year. The decision to determine the part of the company's profit to be distributed among the company's participants is made by the general meeting of the company's participants (clause 1, article 28 of Law No. 14-FZ).

Important!

However, when deciding to pay interim dividends (more than once a year), the organization has the risk of recognizing such payments as gratuitous property. If the profit received at the end of the year turns out to be less than the dividends paid, such payments are classified as donated funds (letter of the Federal Tax Service of the Russian Federation of March 19, 2009 No. ShS-22-3 / [email protected]).

Distribution of dividends

As a rule, part of the profit is distributed by the organization among the participants in proportion to their shares in the authorized capital. However, by decision of the general meeting of participants in the company, this distribution procedure may be changed. Thus, the amount of dividends payable can be distributed in equal shares between the company's participants (clause 2, article 28 of Law No. 14-FZ).

For example, the total amount of the company's dividends distributed between two participants is 1 million rubles. The share of one of the participants is 30%. The company's charter establishes that the amount of dividends due to be paid is distributed disproportionately to the shares of participants in the authorized capital. Thus, participants distribute dividends in equal shares, i.e. in the amount of 500 thousand rubles for each participant.

Tax risks in case of disproportionate dividend payments

From the point of view of civil law, such a distribution procedure is acceptable, but the concept of "dividends" in tax legislation implies a proportional distribution of shares in the authorized capital. It is the keyword "proportionately" that becomes a stumbling block in the qualification of such payments for the purposes of calculating income tax and personal income tax. Despite the possibility of disproportionate distribution of dividends, the regulatory authorities believe that a portion of profits distributed in this way is not recognized as dividends for tax purposes. So, in order to recognize dividends in tax accounting and be able to apply a reduced income tax rate, the following conditions must be simultaneously met (clause 2 of article 43 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of the Russian Federation dated 09.09.2013 No. 03-04-06 / 37090, dated July 30, 2012 No. 03-03-10/84):

payments are made from net profit;

the decision to pay dividends is documented;

payment of dividends is carried out in proportion to the shares of participants in the authorized capital.

On this basis, the controllers conclude that dividends distributed disproportionately are not recognized as dividends for tax purposes, and therefore, such payments must be subject to the “non-dividend” tax rate on income tax in the amount of 20%. The existing arbitration practice confirms this position (decisions of the Federal Antimonopoly Service of the Volga District of May 24, 2012 No. A65-18467 / 2011, the North-Western District of April 28, 2012 No. A13-7191 / 2010 and of April 18, 2012 No. A13- 13347/2010).

Terms and procedure for payment of dividends

As a general rule, the period and procedure for paying dividends are determined by the charter of the company or by the decision of the general meeting of the company's participants on the distribution of profits between them.

Important!

Dividends must be paid to a member of the Company no later than 60 days from the date of the decision on the distribution of profits.

If the period for paying dividends is not determined by the charter or the decision of the general meeting of the company's participants on the distribution of profits, then the specified period is also equated to 60 days from the date of the decision on the distribution of profits between the participants (clause 3 of article 28 of Law No. 14-FZ) .

Law No. 14-FZ provides for a deadline for paying dividends to an LLC participant. So, if in set time dividends are not paid, then the participant has the right to apply within three years after the expiration of the specified period to the company with a demand for their payment.

At the same time, the charter of the company may provide for a longer period for filing this claim, but not more than 5 years from the date of expiration of the total period for paying dividends.

After the expiration of the specified period, the part of the profit distributed and unclaimed by the participant is restored as part of the undistributed profit of the company (clause 4, article 28 of Law No. 14-FZ).

List of situations when dividends cannot be distributed

One of the conditions for the payment of dividends is the presence of net profit. In certain situations, the LLC is not entitled to decide on the payment of dividends. Thus, dividends are not subject to distribution in the following cases (Article 29 of Law No. 14-FZ):

incomplete payment of the authorized capital;

until payment real value shares or parts of the share of an LLC participant;

if, at the time of the decision to pay dividends, the LLC meets the signs of bankruptcy or will have such signs after the payment of dividends;

if the value of the LLC's net assets is less than its authorized capital and reserve fund or becomes less than their size as a result of the decision to pay dividends;

This indicator is taken from balance sheet. The decision is made at the general meeting of founders.

The structure of the authorized capital of LLC

The authorized capital of a limited liability company has its own structural features. It is divided into shares, the size of which corresponds to the monetary equivalent of the contribution of each participant.

The size of the share is calculated either as a percentage of the total authorized capital, or in parts of the total amount in monetary terms, for example, 30% or 1/3 of the capital.

Profit can be distributed quarterly, every six months or once a year according to the decision made at the meeting of the founders. The payment decision is made executive agency represented by the director of the enterprise or the head of the board.

The executive body cannot independently make decisions on the distribution of profits, but is responsible for fulfilling obligations to shareholders (founders).

Distribution of net profit in LLC

The net profit of LLC is determined according to the accounting documents at the end of the reporting period. The decision on the distribution of net profit is made by voting. If at the meeting the participants did not come to a common agreement, the meeting is postponed to another period.

The funds can be used for the following purposes:

- improvement and expansion of business and production;

- replenishment of funds at the enterprise;

- formation of financial reserves of the organization;

- increase the authorized capital;

- making payments under social programs;

- payment of bonuses to employees of the organization;

- repayment of losses of previous years;

- other payments to LLC participants (dividends).

Not always the directions for making payments and the terms are prescribed in the charter of the company.

If the terms of payments are regulated by the charter, at the meeting of the founders, the reporting on their implementation is read out in accordance with the financial statements.

If the payment date is set directly at the meeting, the report on the work performed is read out after the reporting date, since in accounting documents entries have not yet been made.

Distribution of profits between LLC participants

According to the Letter of the Ministry of Finance of the Russian Federation dated March 20, 2012 No. 03-03-06 / 1/133, previously undistributed profit of an LLC when making payments from it is equated to dividends and is taxed at the rates in force at the time of making payments in accordance with the law.

When making dividend payments to participants from the profits of previous years, the enterprise must provide a supporting document stating that the profit has not been distributed before.

If the profit was distributed earlier, the dividends are subject to tax in accordance with Article 284 of the Tax Code of the Russian Federation when making subsequent payments.

The decision to pay dividends must be approved at the meeting of shareholders.

The form of payment of dividends is not regulated by law, so they can be paid in cash and non-cash funds as well as in natural form.

It should be remembered that the distribution of profits between the participants of the LLC is not made in the following cases:

- when the amounts of the authorized capital have not been paid in full;

- the enterprise has signs of bankruptcy or was declared bankrupt at a meeting of founders (shareholders);

- if the value of net assets is less than the value of the authorized capital (at the time of the decision to make payments);

- in other cases provided for by law.

Terms of payment of dividends LLC

Dividends (distributed net profit) are paid no later than 60 days from the date of the decision.

The term of payments can be changed downwards only at the general meeting of shareholders. The frequency of payments is regulated by the charter or a decision at the meeting of the founders.

If no payment was made to any of the participants after the decision on the distribution of profits was made, he has the right, within three years after the expiration of the dividend payment period, to demand his part of the payments in accordance with the law.

If the participant applied at a later period, payments will not be made due to the statute of limitations. The period for applying for the payment of dividends can be changed, this fact must be fixed in the charter without fail.

At the end of three years, the distributed shares of profit unclaimed by the participants are restored to the undistributed profit of the LLC.

Controversial questions about the payment of dividends

If new members enter the company before dividend payments are made, disputes may arise in the distribution of profits.

In this case, the net profit is distributed among the participants according to the shares of the contribution to the authorized capital, regardless of when these participants arrived at the enterprise.

If the payment of dividends in kind is not provided for by the charter, it is considered lawful in accordance with the law.

At the meeting of shareholders, the same issue is not considered twice. If for some reason the decision on the payment of dividends (distribution of profit) has not been made, an extraordinary meeting of shareholders is convened after a while.

The decision on the distribution of profits made at such a meeting can be canceled in court only if a violation of the rights of any of the participants is recognized.

Undistributed net profit can be transferred to increase the share of the authorized capital without making payments to the participants, if a corresponding decision is made at the meeting of the founders.

Discussing non-standard issues of profit distribution in LLC

Video on the topic: “Distribution of LLC profits”