pamm account. Pam system. Account lifetime

PAMM accounts allow you to combine traders and investors into one account and share profits among themselves.

What are PAMM accounts and how to understand them

Name PAMM comes from the English abbreviation Percent Allocation Management Module, PAMM, which stands for Percent Allocation Management Module.

In simple terms, a PAMM account is a trader's account in which investors can invest, and the broker controls the distribution of profits and losses.

How does a PAMM account work?

- The trader opens a PAMM account and starts trading on Forex, showing a confident and stable profit. The broker provides a rating of managers, which displays data on profitability, losses, capital. The trader sets an offer for investors, which indicates the minimum contribution to his account, minimum term investments, for example, a week, as well as % of the commission from the profit, for example, the trader will keep 40% of the profit from the investor's money, giving the investor 60% of the profit.

- The investor looks at the broker's rating and finds a profitable PAMM account, which brings 4-6% profit every month. He registers with a broker, replenishes his personal account and transfers money to the selected account of the manager. For example, the investor's contribution amounted to 1000 USD, and the managing trader brought 10% profit in a month.

This is where the work of the PAMM account as a profit distribution begins.

10% of $1000 is $100 of which $40 will go to the trader as a commission (40%), and the investor will have $60 left. In total, the investor received 6% of net profit for the month.

The highlight is that an unlimited number of investors can invest in one manager, and the profit will be divided in proportion to their contribution. A trader with a large number of investors will receive 40% of all profits of all investors, being in a very favorable position, this motivates him to bring more and more stable and better performance. If there are 50 investors and each invests $1,000 and receives $60 each (under the conditions of the example above), then one trader will receive $40 from each investor, which will be $2,000.

- Nevertheless, it is his merit and to collect a large number of investors, a trader should be not just a professional, but consistently make a profit. This is exactly what the investor needs and benefits.

PAMM accounts appeared in 2008 and are patented by a broker.

Later, they began to appear with other brokers, some of which turned out to be scammers and left along with the money of investors and traders.

Alpari remains the leader in terms of quantity and quality of PAMM accounts, where there are accounts with a capitalization of more than $2,000,000.

Pay attention to profitability indicators. The term of operation of many successful accounts exceeds a year, which is already an indicator of stability. Below we show a couple of examples of monitoring individual managers:

Pay attention to the amount in management ( on the screen above it is 4.5 million dollars, on the screen below 421 thousand), as well as indicators of profitability for Last year and half a year.

When investing, you must use the rules of diversification, that is, you need to invest in several PAMM accounts at the same time in order to reduce risks.

Video about what PAMM accounts are - expert opinion

Main contributors

The main participants are managing traders and investors. The former trade on the market, while the latter place their funds in order to earn from the trade of the former. The system is very simple and, at the same time, extremely effective.

What is the interest of the managing trader?

Why does he need investors at all, because he can earn on the markets himself? The fact is that not every trader, no matter how good a specialist he is, has a huge capital for trading. That is why many people open PAMM accounts in order to get more funds for trading. In addition, the managing trader usually receives a share of the profits ( percent) from successful transactions and earn even more.

Investor risks

The investor bears 100% of the risk of his investment. In other words, the manager does not limit the risks of investors.

But investors have learned to reduce all risks to zero by creating portfolios - simultaneously investing in 10-15 or more PAMM accounts. Not a single trader can constantly trade in plus, so if someone brings a loss for the current month, the rest of the PAMM accounts from the portfolio will block it with their plus.

Portfolio investments in PAMM accounts have become the basis for the investor.

If the manager has brought a loss to the investor, say (-7%), then until he brings his capital into a plus, the manager's commission will not be withdrawn. The manager's commission comes only from the investor's profit.

How to invest in PAMM accounts

Since 2009, many brokers have begun to offer the PAMM service, but to date, only the founder of this system has remained successful - a broker that is already working over 17 years. More than 65 thousand investment accounts and by the way, the broker has more than 120 billion of trading turnover per month.

On the this moment the most successful PAMM account has $2.9 million under management.

This speaks not only of the success of the manager, but also of the popularity of such investments among investors.

And the popularity of these investments is easily explained, because the minimum investment starts from 10 dollars which is available to almost everyone.

With only $150 you can already become a portfolio investor and make a profit doing nothing.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

Investing in PAMM accounts is one of the best ways to get passive income for those who do not want to spend their own time studying strategies and tracking events that may affect the return on investment. This method is also convenient for novice investors, as it does not require prior knowledge and significant experience in participation in foreign exchange trading.

What is a PAMM account

PAMM accounts got their name from the English "PAMM", an abbreviation that means a percentage distribution management module. In the most general terms, the system can be described as the transfer of funds to a trader for trading on the international Forex currency exchange.

Manager with some experience foreign exchange market, opens an account on the Forex exchange with the help of a broker (dealing center), after which he attracts investors who will transfer their finances to him for trust management.

As a result, money from many investors is collected on a single balance sheet, which the trader then uses to buy and sell currencies. The difference from other methods of investing on the Internet is that any trading means are available to the manager, he does not report to investors about upcoming operations and does not have to obtain permission for them - this greatly simplifies the work and contributes to greater profits.

At the same time, investments in PAMM are protected from theft, because the trader cannot use them otherwise than in trading operations. Thus, the investor is protected from the possibility of withdrawal and theft of money by the trader. The terms of investments, the percentage of profit received by the trader, the rules for withdrawing funds, and other details are negotiated by an offer - an agreement concluded between the investor and the manager.

After receiving the profit and deducting the interest paid to the manager in accordance with the agreement, the funds are distributed among all investors according to their share in the total capital.

We have invested part of the capital in these projects:

Investment Example

A trader working on Forex independently receives a monthly average profit of 5%. In this case, when investing personal $ 1000, the yield will be $ 50. The same strategy does not limit the volume of transactions, but the increase in capital increases profits accordingly. Therefore, opening a PAMM account allows you to attract money from third parties and use it in trading operations.

It turns out that if two investors decide to invest in PAMM accounts, the total amount of funds increases. $1,000 came from the first, $3,000 from the second. Given the investment of $1,000 of the trader's own money, the total amount of money will be $5,000.

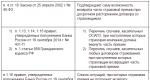

If the average yield remains the same at 5%, the profit per month will already be $250. The average percentage of the manager's remuneration prescribed in the offer is about 40%, which are deducted from the total earned amount, and the remaining money is distributed between the two investors in accordance with the amount invested in the turnover. The distribution result can be viewed in the table below:

If the results of trading do not bring profit, losses are distributed between investors and the trader in the same way - in accordance with the percentages that form part of the total account. This leads to a greater interest of the manager of the success of the trade.

Benefits of investing in PAMM accounts

Before the advent of such a scheme, the depositor and the trader worked directly, the first was forced to provide the second with access directly to his trading account. In this case, the trader could only be interested in an account with significant investments - managing small amounts took a lot of time compared to the possible profit, so the entry threshold was too high.

The second option for cooperation is the transfer of money directly to trust management. Trading with this approach could not be checked by the investor in any way, and the manager had the opportunity to use other people's money, which led to facts of fraudulent actions.

Investments in PAMM accounts are free from the disadvantages of the described methods and have the following advantages over them:

- The account is opened on the site of a broker, who acts as a guarantor, both to the trader and to the investor, in compliance with both of their obligations.

- It is possible to access the history of the movement of finances on the account, access to the statistics of each of the managers is also provided by the brokerage company.

- The funds received from investors can only be used in the process of trading; the manager is not able to withdraw them on his own.

- Convenience in terms of diversification - the final balance can be replenished once, and then the entered finances are distributed among different managers, provided that they work on a single platform.

- The risk of losing investments is not only for investors, but also directly for the traders themselves - they must invest their own money in PAMM accounts, a small percentage of the manager's funds becomes a negative factor for an experienced person, in which case it is extremely difficult to attract money.

- PAMM brokers strive for convenience, so ratings are compiled based on a quick search for a trader.

- The process of entering the trade does not require coordination and lengthy negotiation of conditions - it is enough for a potential investor to familiarize himself with the terms of the offer and confirm agreement with them by pressing one button.

The general advantages that investments have include the following factors:

- Low entry threshold - you can start investing as little as $10.

- Any possibility of fraud is excluded - the manager has no other access, except in the process of trading, to the money on the balance sheet, both to initial investments and to profit.

- Investing in a PAMM account, unlike most other methods, does not require specialized experience and special knowledge - to make a profit, it is enough to choose the right manager and correctly distribute investments.

- Money can be withdrawn at the request of their owner at any time convenient for him, the operation does not require waiting or ordering in advance.

- Trader's actions can be tracked from the personal account and analyzed.

- The manager faces risks not only of losses own funds, but also reputation - poor performance will alienate other possible co-investors from him.

- The choice is facilitated by the simplicity and accessibility of settings - a person can select PAMMs, which managers use various strategies, receive different income and play with different degrees of risk.

The only negative is the risk of losing money, but this is a property of almost any investment, especially those based on human factor. The danger can be minimized by a serious attitude to the choice of a manager, an analysis of the strategies used by him and other indicators.

Diversification is the main principle of professional investments

The basic rule that is mandatory for investment is risk diversification. It must be applied at the stage of preparing investments. This concept includes both the investment of money in PAMM and their distribution among various managers.

You should not invest all the money intended for investment only in PAMMs, they should account for no more than 40% of your investment portfolio.

You can avoid losses from potential risks as much as possible and get the greatest profit when money is transferred not to one, but to several managers. At the same time, it is worth analyzing the strategies that they use in trading and choosing players who use different methods.

Some brokerage sites offer effective assistance in compiling a PAMM portfolio that can increase overall profitability and reduce the risk of losses. Another type of diversification is the division of money by sites and currencies traded.

Types of PAMM investment strategies

All existing strategies are divided into three types and can be conservative, moderate and aggressive. To find out the strategy used by a particular manager, you can view the following indicators:

- Deposit load - determines the percentage of money at risk in relation to the total invested amount of the account.

- Drawdown - losses measured as a percentage of the total amount collected in the account.

An aggressive strategy brings the highest returns, but also carries the greatest share of risk. Shows the following indicators:

- Profitability - not less than 10% per month and more than 120% per year.

- Drawdown - from 50%.

Moderate accounts with medium returns and risks:

- Profitability - 5-10% per month, 60-120% per year.

- Drawdown - 30-50%.

A conservative strategy with low risks and returns:

- Profitability - about 5% per month, for the year - 60%.

- Drawdown - no more than 30%.

These parameters and characteristics can be seen in the indicators of the PAMM account in which it is planned to invest.

Selection rules

In addition to choosing a strategy, you will need to study a number of specific factors:

Trader experience

The lifetime of the investee makes it possible to better analyze the information. It is advisable to invest in PAMM, which is at least 12 months old. During this time, the manager should have at least one drawdown - his reaction to losses will show the ability to cope with the difficulties that have arisen. Otherwise, you may encounter a situation where, during the first drawdown, a person drains all available funds.

You can find another PAMM operated by the same trader - it will demonstrate the profitability and style of work, and if the money was drained, it will provide an opportunity to see the reason for the failure.

Drawdowns

Inevitable drawdowns in work allow you to decide what level of risk an investor can expect. You can choose the offer, the level of drawdowns of which you can afford: someone decides to take money with a drawdown of 20%, for another, even 50% does not become a reason for withdrawing funds. The best option: a maximum drawdown of 30%, the exit from which lasts no longer than 2 weeks.

Yield

It is worth paying attention not so much to the monthly profitability, but to the indicator for the entire time of work. Another characteristic is the change in returns throughout the trade.

Equity capital

It is better to invest in a PAMM account, the manager of which attracts large own funds - the higher his own risk, the greater the interest in increasing profitability. The trader's capital should not be less than $1,000.

Total amount under management

The more money is given to the "disposal" of the trader, the higher the confidence in him. Other investors also analyze the strategy and ways of managing money, and if they decide to invest, then such a check has justified itself. Conclusion - the larger the total amount, the more reliable the investment.

Rating

Brokerage companies provide an opportunity to use such a tool as the rating of managers, in which they are ranked from best to worst. It is advisable to look for data for a contribution in the top twenty.

Creation of a PAMM portfolio

Based on the foregoing, a PAMM portfolio is a set of different accounts in which money is simultaneously invested. This is one of the principles of diversification that allows you to increase profitability and reduce the risk of losses. You can make a portfolio yourself or invest in one that was prepared in advance by the manager.

Self-selection of a portfolio

Most dealing centers provide an opportunity to use a financial instrument called a PAMM account constructor. Thanks to him, you can choose the accounts that are added to the portfolio. Funds are distributed after it is drawn up, and the principle of investment depends on the degree of risk tolerance and the desired return. For example, a lot of money goes to managers with a moderate strategy, and the remaining money goes into management in aggressive accounts.

Ready portfolios

Such portfolios are compiled by the managers themselves and include the most reliable, in their opinion, options. A trader can invest himself in portfolios created for investors - this demonstrates a serious approach to choice. After new investments are made in the accounts included in the portfolio compiled by the manager, he receives remuneration from their owners.

Investment Tactics

In addition to choosing PAMM accounts, you should adhere to certain tactics for working with them. The following tools are used for this:

Loss limit

Most brokerage platforms provide the ability to automatically withdraw funds in case of losses that the investor begins to bear. Such a tool allows you not to track events, but to set an acceptable risk limit, the excess of which automatically withdraws money from the account.

Reallocation of funds

After the end of a certain period, funds are redistributed between accounts in accordance with the previously selected scheme. An aggressive strategy allows you to achieve a larger amount of funds in the account, but can lead to a drawdown, as a result of which most of them will be lost. Transferring money to a moderate account will avoid the risk of losing your investment.

Investment horizon

Differs from redistribution in that funds are transferred from aggressive measures to moderate strategic actions or conservative PAMMs not partially, but completely. The more aggressive the strategy, the less time should be kept in the work of the profit.

"Cleaning" the portfolio

Accounts that are consistently losing money should be removed from the portfolio and replaced with new ones.

In conclusion, we can say that investing in PAMM accounts becomes a reliable method of obtaining passive permanent income in case right choice successful traders, building a portfolio and adhering to the right investment tactics. This is the key and the only factor on which the profit received by the investor depends.

Video lecture from an expert:

By investing in a PAMM account, you transfer money to a trader who trades on the foreign exchange market and give a part of your profit for this.

PAMM account is a modern investment solution offered by Alpari. With its help, having neither special knowledge nor trading experience, you get the opportunity to earn on the Forex currency market. For beginner traders, a PAMM account is a great alternative to independent Forex trading.

Technically, PAMM accounts work on the basis of electronic platform(Internet site) of a broker, called a PAMM service (for example, ). On this platform, first of all, the trader himself trades. In addition to this, the broker provides a PAMM account service: you can select a trader's PAMM account in the rating, invest money in it and manage your investments in PAMM accounts via the Internet. Once a month, part of your profit will be transferred to the manager as a reward.

Each PAMM account is a trader's trading account, to which investors can connect their funds. When the manager publishes a PAMM account, he creates an investment offer, where he indicates the percentage of profit that he takes for management. Under the terms of this offer, investors invest in a PAMM account. Each trader can open one or more PAMM accounts.

Once you have invested in a PAMM account, you will be able to keep track of your funds in personal account on the broker's website. You can withdraw funds or replenish your account at any time, all operations with PAMM accounts are performed via the Internet and take no more than a day.

An example of how a PAMM account works

Let's consider all the main stages and principles of the PAMM account using the example of investing in a PAMM account by Ivan Petrov, one of the most experienced traders at the moment (April 2014).

1. The manager opens a PAMM account

It all starts with the fact that the manager opens a PAMM account with a broker. To open a PAMM account, a trader must register, verify his identity, deposit at least $300, create and activate an offer for investors.

Initial data investment account:

Balance: 1000$

Funds: 1000$

Manager commission: 0$

Net funds: $1000

Net profit: 0$

Yield: 0%

According to Ivan's offer, his commission is 20% of your profit from the PAMM account.

4. First month after investment

Let's say for the first month a PAMM account showed a yield of + 10%.

(before paying commission to the manager):

Balance: 1000$

Funds: $1100

Manager commission: $20

Net funds: $1080

Net profit: $80

Yield: 8%

The manager's commission is charged only for the amount of funds that exceeds the balance: $1100 - $1000 = $100. Commission = $100 * 20% = $20.

Once a month, the trading interval is closed: the profit is transferred to the balance, the commission is transferred to the manager.

Investment account data after 1 month:

(after paying commission to the manager):

Balance: 1080$

Funds: $1080

Manager commission: 0$

Net funds: $1080

Net profit: $80

Yield: 8%

5. Second month after investment

Let's say for the first month the PAMM account brought a loss of -5%.

Investment account data after 2 months:

Balance: 1080$

Funds: $1080 - $54 = $1026

Manager commission: 0$

Net funds: $1026

Net profit: $26

Yield: 2.6%

At the end of the second month, the funds are less than the balance, so the manager's commission is not charged and will not be charged until the funds exceed the balance, i.e. until the manager brings the PAMM account out of the drawdown.

6. Deposit and withdrawal of funds

You can deposit and withdraw funds from your PAMM account at any time without waiting for the end of the month. Profits can also be withdrawn at any time.

In terms of time, operations are executed according to the PAMM account scheduler, but no longer than a day. Operations on Ivan's PAMM account are executed once a day at 23:00 server time, i.е. at 24:00 Moscow time (daylight saving time).

When withdrawing funds, a minimum of $10 must remain on the PAMM account. If you want to withdraw all funds, do the account closing operation.

Let's say you decide to replenish your account with +100$.

Investment account data after replenishment:

Balance: 1180$

Funds: $1126

Manager commission: 0$

Net funds: $1126

Net profit: $26

Yield: 2.6%

How to invest in a PAMM account?

To invest in a trader, you just need to open and fund your investment account on his PAMM account. After that, the funds will automatically participate in the trader's trade, and you can check your balance, deposit or withdraw funds at any time.

Let's see how PAMM accounts work and what this type of investment is.

The content of the article:

What is a PAMM account - definitions in simple words

PAMM accounts is a way to invest in traders on the exchange, where each of them has its own rating, profitability and trading volumes for all assets for all time.

To understand what PAMM accounts are, let's turn to Wikipedia.

PAMM account (from English. Percent Allocation Management Module, PAMM - percentage distribution management module) - a specific mechanism for the functioning of a trading account, which technically simplifies the process of transferring funds on a trading account to a trust management of a selected trustee for conducting transactions in financial markets.

If we talk about what is a PAMM account in simple words, then a PAMM account is a special trader's account, in which an unlimited number of investors can invest money, and the profit from the manager's trading is distributed in proportion to the deposits.

PAMM account manager is a trader who knows how to make profitable transactions on the stock exchange while observing his own unique trading strategy. The trader takes a commission from 10 to 50% of .

Initially, PAMM accounts caused great skepticism not only from traders, but also from investors. Nine years later, investments in PAMM accounts no longer frighten people, but on the contrary, they occupy stable positions and a trusting relationship, which is calculated in specific numbers as a percentage of return.

How PAMM accounts work – Real examples and screenshots

talking plain language, you transfer your funds to an experienced specialist and receive income from the investment without leaving your home and without making any effort.

Profitability can range from 3 to 40% per month, which on an annualized basis already gives very serious figures.

Consider the process in the context of its participants:

- Broker- a link between the currency, traders and investors.

- Trader(manager) - he carries out trading operations on the stock exchange.

- Investor- makes investments in the account of the managing trader.

To better understand what PAMM accounts are and how to invest in them, let's take a concrete example.

The diagram shows that a PAMM account is a single wallet in which the funds of the trader and investors are added.

Step 1.

The more funds in management, the more motivation a trader has to conduct accurate and low-risk trading.

We have prepared a mini-instruction that will help you build an action plan for investing.

We have prepared a mini-instruction that will help you build an action plan for investing.

- Choosing a broker and registering- You can look at many brokers, but see for yourself that 98% of this market is occupied by more than 3000 PAMM accounts.

- Choosing a PAMM account– compare the indicators of traders in the rating of PAMM accounts and choose the best ones.

- Investment– on the manager's PAMM page, click the “ Invest“, enter the amount and confirm the action.

- Profit withdrawal- you can withdraw only the profit, its part, part of the entire deposit or the entire deposit - that is, any amount at any time.

I would like to note that it is better to spend time researching the rating than to invest in the wrong place in a hurry.

"Failure comes more often from lack of energy than from lack of capital."

Daniel Webster

A smart approach to investing is to invest in several traders at once so as not to put all your eggs in one basket. In financial parlance, this is called diversification.

You can simultaneously invest in different PAMM accounts, reducing investment risks.

For example, out of 10 traders, two will make a loss. In this case, the 8 remaining ones will cover it with their profit and bring your total portfolio to a plus.

When did PAMM accounts appear and who invented them

The service and the very concept of PAMM were created by leading analysts of the largest broker in the Russian Federation in 2008, and this name is registered as a trademark of Alpari.

The service and the very concept of PAMM were created by leading analysts of the largest broker in the Russian Federation in 2008, and this name is registered as a trademark of Alpari.

Later, since 2010, other brokers began to borrow this system to attract investor capital. In the early years, there was a large influx of not only investors, but also traders, among whom were inexperienced beginners, as a result of which all investors lost money.

After 5-6 years, the only broker left on the market of leaders in the field of PAMM accounts is Alpari, since they have high minimum amounts for traders when opening PAMM accounts, and all PAMM accounts are checked by a foreign world-famous.

Conclusion

Now you also know what PAMM accounts are and how they work.

PAMM in the environment financial services built and maintain an excellent reputation. This is the best and most profitable way to manage money. Many people of various levels of income and employment join the ranks of active investors every day.

You can start investing in PAMM accounts already from $10, but for portfolio investments it is desirable to have $200-300 . Broker Alpari provides the largest, and the company itself serves more than 1 million clients.

If you find an error, please highlight a piece of text and click Ctrl+Enter.