Can a company exist without a chief accountant. If the company does not have the position of chief accountant. Why LLC is an accountant

By law everything Russian organizations required to keep accounting records. Does this mean that every organization should have an accountant on staff? No, it doesn't mean there are other options. Details are in our article.

Is an accountant required for an LLC?

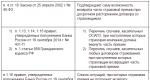

Let us turn to Article 7 of Law No. 402-FZ of December 6, 2011. "On Accounting", which regulates the rules for organizing accounting.

According to this article, the leader has three options:

- Assign accounting responsibilities to the chief accountant or other employee of the organization. With the exception of credit institutions, it is the chief accountant who should be responsible for their accounting.

- Conclude an agreement for accounting services with a specialized organization or with a private specialist. At the same time, the individual performer must comply with the requirements of paragraph 4 of Article 7 of the same law, and the performer-organization must have a specialist on staff who meets these requirements.

- Work without an accountant and do accounting on your own, but only if the organization keeps accounting in a simplified form and submits simplified reporting, that is, it belongs to the category of small enterprises.

As you can see, the law does not oblige to have a full-time accountant. An LLC without an accountant is not a violation. The organization itself decides whether to hire an accountant on staff or outsource this function.

In-house accountant or outsourcing

Many businessmen, by inertia, continue to believe that a full-time accountant who sits at their side is more convenient and reliable.

Arguments in favor of a full-time accountant are usually as follows:

- He is always there, you can turn to him at any time, so work in progress faster.

- He can be loaded with additional work within his working hours (and sometimes outside), even if this work is not directly related to his duties.

- It is easier to trust your person, he is more concerned for the well-being of the company.

- Your specialist can keep double bookkeeping and cover up the “sins” of the management.

If we operate with bare facts, then it turns out that “convenient” is not equal to “effective” and “profitable”.

All these problems can be avoided by shifting accounting functions and responsibilities to an outsourcing company.

Often, businessmen simply do not fully understand what outsourcing is all about. For them, this is just some kind of third-party office, where you need to send documents, which is difficult to contact and from which you have to wait a long time for the result. Therefore, they choose the usual option - an accountant in the state. Until they run into problems.

We will tell you what modern outsourcing is and why it is more profitable.

Benefits of accounting outsourcing

Let's start with the most obvious - you save money.

Let's calculate how much the salary of one qualified accountant costs.

For example, your accountant receives 50 thousand rubles in his hands, that is, after personal income tax deduction. To do this, you must charge him 57,471 rubles.

In total, in order for an employee to receive 50 thousand rubles in his hands, the company must fork out 74,827 rubles.

And now let's look at the approximate price list of 1C-WiseAdvice:

Approximately the same amount accounting services organizations with a turnover of 25 to 50 million rubles a year.

For example, we took a relatively small salary for a good specialist. If you pay an accountant from 70 to 100 thousand "clean", and for large cities this is the norm, then the company's expenses only for salaries will already be in the range of 100-150 thousand rubles.

This is a calculation for only one specialist, and as a rule, several of them are needed: a specialist in taxes, wages, production accounting, etc.

In addition, we did not take into account other costs:

- To equip the workplace with furniture and appliances.

- For accounting software.

- For advanced training and professional literature.

If you take into account all these costs, the monthly amount of expenses will be even higher.

Outsourcing company you pay only a fixed amount under the contract. Selection and training of specialists, taxes for employees, salary indexation, technical equipment and software are not your concern. At the same time, not one multi-station employee works for you, but a whole staff of narrow specialists, including a specialist in taxes, production accounting, calculation wages, foreign economic activity, lawyer, etc.

Except financial side, there are other benefits that are often overlooked.

Qualification and quality of work of employees on outsourcing is higher

Why are we so confident about this? Judge for yourself. If an outsourced accountant performs poorly and the client refuses our services, our reputation will suffer, client flow will decrease and profits will fall. And if the accountant also messes up so that the client incurs losses, we will reimburse them at our own expense, because this is provided for by the contract.

Naturally, this is not profitable for us, so we meticulously select employees, test them, and then strictly monitor the quality of their work. We also pay them well, so only the best work for us.

1C-WiseAdvice's liability to customers is insured for 70 million rubles. The policy includes an extended list of insured events.

But recovering losses from a full-time accountant is much more difficult, and often simply impossible. If it is possible to recover part of the salary from him by court decision, the losses will have to be compensated for a very long time.

Outsourced accounting works without interruptions and failures

If a staff accountant falls ill, he will not come to work, because he has the right to do so. And we are not. Our employees are people too. They get sick, rest, go on vacation, etc., but you do not know about it and this does not affect the work under the contract. If our employee falls ill, it is not your concern who will do his work.

You can outsource only part of the functions

For those who do not want to give up the usual option, when an accountant is at hand, there is an option to outsource only certain areas of accounting that cause difficulties or for which there are no specialists.

You can transfer the functions of the chief accountant to outsourcing, and leave the routine and daily workflow to full-time ordinary employees. Or vice versa, leave only the functions of the chief accountant, transferring everything else to outsourcing.

Instead of "black bookkeeping" - legal ways to save money

An outsourcing company will not double-entry bookkeeping and cover up fraudulent schemes, but this is not necessary. Laws are broken from a lack of knowledge and experience. There are many legitimate ways to save a company money and pay less taxes.

These and other advantages have already been appreciated by our customers who have come to accounting services in 1C-WiseAdvice, including companies with a worldwide reputation.

Order service

Based on Law No. 402-FZ of December 6, 2011, all commercial enterprises, regardless of the taxation regime, are required to submit reports and keep accounting records. For an LLC, this means that it is necessary to register and summarize in monetary terms information about the company's obligations, its property, and the flow of funds. All business transactions must be confirmed by primary documents, reflected by postings to special accounts.

Responsibility for the organization of accounting is borne personally by the head of the company. Upon detection of violations in accounting, they are imposed monetary penalties. For tax evasion tax deductions or deliberate distortion of the amounts transferred to the budget, the director is criminally liable.

According to part 4 of Art. 6 federal law dated 06.12.2011 No. 402-ФЗ “On Accounting”, only heads of small and medium-sized businesses can independently maintain accounting records, with the exception of the entities listed in Part 5 of Art. 6 of Law No. 402-FZ. The heads of other organizations must assign the responsibility for accounting to the chief accountant (another official) or conclude an agreement on the provision of relevant services (part 3 of article 7 of Law No. 402-FZ). Therefore, in such organizations CEO cannot be a chief accountant. At the same time, the current legislation does not provide for liability directly for violation of this rule.

- Small Business Criteria- the average headcount is not more than 100 people and the income is not more than 800 million rubles. Minimum 51% authorized capital LLC must be owned by individuals or organizations - SMP. The share of organizations that are not related to SMEs should not exceed 49%, the share of the state, regions or NGOs - 25% (paragraph "a", paragraph 1, part 1.1, article 4 of Law N 209-FZ).

- Criteria for microenterprise- the average headcount is not more than 15 people and the income is not more than 120 million rubles. The restrictions on the structure of the authorized capital are the same as for small enterprises.

- Medium Enterprise Criteria- the average headcount is not more than 250 people and the income is not more than 2 billion rubles. The restrictions on the structure of the authorized capital are the same as for small enterprises.

The average headcount and income are estimated for the previous year, income is calculated according to the data tax accounting without VAT.

If the CEO of a small or medium-sized enterprise, who is given this opportunity, will keep accounting on his own, two options are possible:

- option - when the general director will perform the duties of the chief accountant part-time. This is possible if the staffing table of the enterprise provides for a separate position of the chief accountant. In this case, it is necessary to conclude an employment contract with the general director on internal part-time employment, as well as pay extra for this part-time job (Article 60.1 of the Labor Code of the Russian Federation).

- option is the assignment of responsibility for maintaining accounting to the CEO, that is, when bookkeeping will be part of his main job. In this case, there is no need for the position of chief accountant in staffing . And also, neither a combination nor a part-time job needs to be formalized (Articles 57, 275 of the Labor Code of the Russian Federation). To do this, it is necessary to include the relevant labor function in his employment contract or job description which is an integral part of the employment contract. Such a decision can also be issued by an order imposing on the head of the duties of the chief accountant of the following content:

Due to the absence of the position of chief accountant in the staff list of Amber LLC, I assume the responsibility for accounting and compiling financial statements from such and such a number.

Why LLC is an accountant

The main requirement of the law is that accounting should be reliable and objective, and reporting should be submitted in the prescribed form and within the strictly allotted time. Sale of products, purchase of materials or stationery, payment of salaries, depreciation, payment of rent for premises - all operations are confirmed by contracts, invoices, acts, invoices, disbursement orders etc. Each transaction is reflected twice - both as a debit and as a credit, on the respective accounts. At the same time, the timeliness of postings is important - in accounting, transactions must be recorded at the time they are made.

Accounting for income and expenses, accrual and payment of taxes and other payments, timely delivery Reporting is one side of an accountant's job. His responsibilities include organizing primary documentation, payroll, opening and closing current accounts. Add to this the preparation of advance reports and cash documents, control over accounts payable and accounts receivable, formation of accounting registers. Personnel records in small and medium-sized enterprises are also usually kept by an accountant.

A good specialist with practical experience is able to protect the company from fines and penalties. A professional will resolve problems with regulatory authorities, help optimize taxation and reduce financial costs. If the manager takes on the solution of these problems, he simply will not physically have the time and energy to focus on his own business.

In-house accountant or outsourcing?

Until quite recently, almost every LLC had one or more staff accountants. Today, the leaders of even large companies often do not hire employees, but completely outsource accounting and tax accounting or leave one employee to process primary documentation, and entrust other issues to specialized firms.

The cost of maintaining a full-time accountant:

- Wage;

- insurance premiums;

- Organization of the workplace (6 sq.m. of premises, furniture, computer, etc.);

- Stationery, consumables;

- One-time expenses for specialized software, monthly - for access to information and reference systems.

So that the accountant does not lose his qualifications and is always aware of changes in legislation, you will also need to regularly pay for his training - attendance at specialized seminars. Consider in advance who will perform the duties of an employee during his vacations, training and temporary disability.

If there is only one accountant in the state, there is always a risk that he may make a mistake, and as a result, the head will be responsible before the law.

Outsourcing of accounting services

The transfer of accounting and tax accounting to third-party specialists is primarily financially beneficial. The cost of outsourcing services is less than the cost of maintenance staff member. In addition, payment under an outsourcing agreement can be attributed to expenses, thus reducing the taxable base.

Accounting costs are minimal when working with a private accountant, however, any freelance has high risks related to incompetence, leakage of confidential information, sudden absence of an accountant due to illness or other reasons. To avoid these problems and organize professional accounting allows cooperation with outsourcing organizations with a full staff professional accountants and auditors.

Benefits of accounting outsourcing:

- The cost of outsourcing services is much less than the cost of maintaining the staff of your own accountants.

- There is no need to control the work of staff, look for a replacement for vacations, study or illness.

- Accounting and tax records are maintained taking into account current changes in legislation.

- By concluding an outsourcing agreement with a company, and not with one accountant, you get the opportunity to attract highly specialized specialists to optimize taxation, resolve tax disputes, conduct audits, etc.

- Payment under the contract of outsourcing services can be attributed to the expenses of the LLC.

The company "AMBER" accepts for outsourcing accounting at any stage of the company's existence. When registering an LLC or sole proprietorship, we will help you choose the best tax regime taxation and properly organize accounting. For those who are already leading economic activity, we additionally offer services for

The LLC does not provide for the position of chief accountant, the position of an accountant is provided.

Is the accountant entitled to sign the accounting and tax reporting?

After considering the issue, we came to the following conclusion:

In the absence of the position of chief accountant (accounting service as a structural unit) in the staff of the organization, accounting is carried out by an accountant.

The accountant of the organization has the right to sign the financial statements by virtue of the law. The accountant of the organization has the right to sign the tax reporting in the presence of a power of attorney.

Rationale for the conclusion:

The basic principles of organizing accounting in an organization are set out on November 21, 1996 N 129-FZ "On Accounting" (hereinafter - Law N 129-FZ).

An authorized representative of a taxpaying organization may also be a person acting on the basis of an order from an organization and a power of attorney (, Tax Code of the Russian Federation). A power of attorney is a written authorization issued by one person to another person for representation before third parties (the Civil Code of the Russian Federation). On behalf of the legal entity, the power of attorney is signed by its head or another person authorized to do so by the founding documents.

Publication

Primary accounting documents are taken into account if they are compiled according to the form contained in the albums of unified (standard) forms of primary accounting documentation(clause 13 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 N 34n). When calculating VAT, a unified invoice form is used, approved by Decree of the Government of the Russian Federation of December 2, 2000 No. 914.

Comply with the requirements

Increasingly, tax authorities are refusing organizations to accept VAT deductions, citing the absence of the necessary details in the invoice, typos, blots, and the lack of decoding of the signatures of the head and chief accountant.

Position tax authorities supports the Ministry of Finance of Russia, explaining that invoices in which the necessary details are incorrectly filled out or not reflected are considered as drawn up in violation of the requirements of the Tax Code of the Russian Federation, and VAT amounts on these invoices are not subject to deduction (letter of the Federal Tax Service dated May 25, 2007 No. 19-11/048795).

If VAT on the basis of such invoices has already been deducted by the taxpayer, then the tax authorities require it to be restored and paid to the budget, applying penalties (clause 1, article 122 of the Tax Code of the Russian Federation).

In addition, the taxpayer will be required to pay a penalty for each calendar day of delay on unpaid VAT. Interest rate the penalty is assumed to be equal to 1/300 of the refinancing rate in force at that time Central Bank Russian Federation(clause 4, article 75) and is paid simultaneously with the payment of the amounts of tax and duty or after payment of such amounts in full (clause 5, article 75).

Attention

Full responsibility for the organization of accounting in organizations, compliance with the law when performing business operations, is borne by the heads of organizations (clause 1, article 6 of the Federal Law of November 21, 1996 N 129-FZ "On Accounting").

Article 169 of the Tax Code of the Russian Federation provides only General requirements for preparing invoices. Clause 5 of this article simply lists the required details. At the same time, the Tax Code of the Russian Federation does not explain exactly how to fill them out. Tax inspectors, on the other hand, check with particular care how invoices are drawn up and whether the taxpayer has legally presented VAT for deduction.

The conditions for accepting VAT for deduction are established by Ch. 21 of the Tax Code of the Russian Federation. First, goods (works, services), property rights must be acquired for transactions subject to VAT. Secondly, they are taken into account. Thirdly, the taxpayer must have a properly executed supplier invoice, in which the VAT amount is highlighted as a separate line.

Accountants should pay attention to important points associated with the signing of invoices. The tax authorities will be suspicious if:

there are no transcripts of signatures on the invoice;

the invoice is signed by one person for both the head and the chief accountant;

the invoice issued by the taxpaying organization does not contain the line "Individual entrepreneur (signature) (full name) (details of the certificate of state registration individual entrepreneur)";

According to paragraph 6 of Art. 169 of the Tax Code of the Russian Federation, the invoice must contain the signatures of the head and chief accountant of the organization or other persons authorized to do so by an order (other administrative document) for the organization or a power of attorney on behalf of the organization.

authorized to sign

Head and Chief Accountant organizations have the right to delegate the authority to sign invoices to other employees of the organization. Authorized persons act either on the basis of an order of the director, or on the basis of a power of attorney drawn up on behalf of the organization.

Taking into account that these persons are authorized to sign invoices with the relevant administrative document, it is recommended to indicate in the invoice instead of the names and initials of the head and chief accountant of the organization after the signature, the surname and initials of the person who signed the corresponding invoice. If it also contains the names and initials of the head and chief accountant of the organization, then such a document should not be considered as drawn up in violation of the requirements tax code.

The Tax Code and the Rules for accounting for received and issued invoices, books of purchases and books of sales when calculating value added tax (approved by Decree of the Government of the Russian Federation of 02.12.2000 N 914, hereinafter referred to as the Rules) changes and additions to the details of the invoice form provide. Accordingly, it is not necessary to enter information about the position of an authorized person of the organization and the details of the corresponding power of attorney. At the same time, if the invoice contains additional details for persons authorized to sign the invoice (for example, the position is indicated), then such an invoice should not be considered as drawn up in violation of the requirements of the Tax Code.

Some organizations enter into contracts for the provision of accounting services with a specialized firm or a specialist - an individual. This is allowed by paragraph 2 of Art. 6 of the Federal Law "On Accounting" dated November 21, 1996 N 129-FZ. In this case, the signature on the invoice instead of the chief accountant is put by the one who is entrusted with the duties of the chief accountant - the head of the organization, the accountant-specialist with whom a civil law contract has been concluded, or an authorized representative of a specialized company that maintains accounting in the organization.

Often, invoices for managers and chief accountants are signed by other persons who are not authorized to do so by order or power of attorney. If during the tax audit your supplier will have such invoices, then you will not be entitled to deduct VAT.

chief accountant

If the organization does not have the position of chief accountant, then its functions can be performed by the head of the organization. Accordingly, he will sign invoices instead of the chief accountant with the same signature in the signature fields of the head and chief accountant. This is possible on the basis of the relevant order with the following content: "I, the General Director of the "Name of the organization", assume the duties of the chief accountant ...".

According to paragraph 2 "d" Art. 6 of the Federal Law "On Accounting", the heads of organizations may, depending on the volume of accounting work, conduct accounting personally. This rule assumes the possibility of having the same signature on invoices for the head of the organization and for the chief accountant.

The invoice is signed by the individual

If the invoice is issued individual entrepreneur, then he signs a document indicating the details of the certificate of state registration of IP. However, he does not sign instead of the chief accountant - the line remains empty. After all, according to the legislation of the IP, he himself is responsible for maintaining accounting records.

Chapter 21 of the Tax Code does not contain a ban on signing an invoice on behalf of an entrepreneur by a person authorized by him. A taxpayer may participate in relations that are regulated by the legislation on taxes and fees through a legal or authorized representative, unless otherwise provided by the Tax Code (clause 1, article 26 of the Tax Code of the Russian Federation). An authorized representative of a taxpayer - an individual will exercise his powers on the basis of a notarized power of attorney or a power of attorney equivalent to a notarized one in accordance with civil law (clause 3, article 29 of the Tax Code of the Russian Federation).

Fax and digital signature

Many people are still interested in the question of whether it is possible to endorse invoices with an electronic digital signature (EDS) or a facsimile. It is especially relevant for organizations with a large workflow. Meanwhile, financiers traditionally prohibit the use of facsimiles and digital signatures.

Invoices signed by facsimile, digital signature or signatures reproduced using electronic printing devices are considered drawn up and issued in violation of the procedure and cannot be the basis for accepting VAT for deduction (reimbursement). This opinion is expressed by the Ministry of Finance of Russia in letters dated January 22, 2009 N 03-07-11/17 and dated September 30, 2008 N 03-02-07/1-383.

Judicial practice on this issue is ambiguous. According to the position of some arbitration courts, the presence on the invoice of a facsimile reproduction of the signature of the head and accountant of the supplier organization cannot be a basis for refusing to refund VAT paid to product suppliers (Decree of the Federal Antimonopoly Service of the North Caucasus District dated September 29, 2008 No. F08-5786 / 2008, dated September 22, 2008 No. F08-5128 / 2008, dated August 20, 2008 No. F08-4547 / 2008, Federal Antimonopoly Service of the Moscow District dated May 15, 2006 No. KA-A40 / 2894-06, Federal Antimonopoly Service of the Volga District dated October 30, 2008 No. А57-253/08, Federal Antimonopoly Service of the Urals District dated November 18, 2008 No. Ф09-8604/08-С2, dated April 19, 2007 No. Ф09-2754/07-С2).

At the same time, there are judgments who support the tax authorities in their demands (decisions of the FAS of the Far Eastern District of July 28, 2008 No. F03-A37 / 08-2 / 2876, of April 07, 2008 No. F03-A73 / 08-2 / 918, FAS of the Volga District of July 19, 2007 No. А65-3666/2006, June 21, 2007 No. А57-4833/06-33, May 03, 2007 No. А57-4249/06).

Higher Court of Arbitration in one of the definitions, he indicated that the affixing of a facsimile signature on invoices, if there is an agreement to this effect, does not indicate a violation by the company of the requirements established by Article 169 of the Tax Code. Read more about the position of the Supreme Arbitration Court of the Russian Federation in the "PB" for May on page 70.

berator "VAT from A to Z"

If the invoice for the head or chief accountant is signed by other persons who are not authorized to do so by order or power of attorney, then you are not entitled to accept VAT for deduction on the basis of such a document.

If you still want to avoid disputes during verification, certify the invoice with a real signature. At the same time, you will also avoid the claims of customers who, knowing the requirements of the tax authorities, often refuse to accept documents with a facsimile instead of a signature.

Fixing bugs

An erroneously affixed signature in the invoice, as well as other errors in this document, can be corrected. The procedure for making changes to invoices is regulated by clause 29 of the Rules. Such corrections must be certified by the signature of the manager and the seal of the seller indicating the date the corrections were made.

At the same time, keep in mind that the timely correction of identified violations in the preparation of invoices cannot serve as a basis for refusing to apply VAT tax deductions, provided that the actions of the taxpayer are in good faith. This opinion is shared by many arbitration courts.

Comments

07/22/2014 Natalia

Great article.

There was a question. If the head signs all the documents himself. Is it necessary to reflect the order for the right to sign in the documents themselves? Or, as a director, the question of the right to sign for the chief accountant will no longer arise? Is it allowed, for example, 3 identical signatures on the delivery note on the shipping side?

Reply

08/12/2014 Alexey

On the invoice there is only the signature of the accountant, but the head did not sign. Will the invoice be considered valid?

Reply

Good afternoon, Alexey

In accordance with paragraph 6 of Art. 169 of the Tax Code of the Russian Federation, the invoice is signed by the head and chief accountant of the organization or other persons authorized to do so by an order (other administrative document) for the organization or a power of attorney on behalf of the organization.

When issuing an invoice by an individual entrepreneur, the invoice is signed by an individual entrepreneur or another person authorized by a power of attorney on behalf of an individual entrepreneur, indicating the details of the certificate of state registration of this individual entrepreneur.

The third paragraph of paragraph 2 of Article 169 of the Tax Code of the Russian Federation establishes that failure to comply with the requirements for an invoice that are not provided for in paragraphs 6 of Art. 169 of the Tax Code of the Russian Federation, cannot be a basis for refusing to deduct tax amounts presented by the seller.

If you intend to accept VAT deductible on this invoice, we strongly recommend that you request an invoice signed by the manager and chief accountant.

Reply

08/14/2014 Oksana

Yes, the article is very good. Also a question.

If the organization we work with requests an invoice for last year. Do the new director and accountant have the right to sign? And does a new employee have the right to sign documents from 2011 with a power of attorney from 2014?

Reply

Good afternoon, Oksana.

The organization can issue duplicates of the act, invoice and invoice in connection with their loss by the counterparty and put on them the signature of the new head, chief accountant or other person authorized by order (power of attorney). The main thing is that the recovered documents should match the amounts lost by the counterparty of the organization with acts and accounts and contain all their indicators and details. It is also possible to provide the counterparty with a certified copy of a document confirming the appointment of a new manager, chief accountant or an order (power of attorney) for signing documents by an authorized person.

Neither the Civil Code of the Russian Federation, nor the Tax Code of the Russian Federation says anything about the procedure for issuing duplicates of the act, invoice and invoice in the event of the loss of their copies by the counterparty of the taxpayer.

But in this case, the organization requesting a duplicate invoice may run the risk of deducting VAT on this invoice (especially for 2011). This is confirmed by judicial practice.

The Decree of the Federal Antimonopoly Service of the Volga District dated August 10, 2009 N A06-2176/08 notes that the tax legislation does not contain a ban on the restoration of invoices by issuing duplicates of these documents. However, the recovered documents must match the disputed invoices in terms of amounts, contain the details of the disputed invoices and indisputably confirm the fact of payment of these invoices.

The Decree of the Federal Antimonopoly Service of the Moscow District dated May 25, 2012 N A40-110048 / 10-140-598 explicitly states that the signing of duplicate invoices issued to replace the lost originals by other authorized persons in connection with the change of the head of the seller of goods (works, services) is lawful and does not deprive the buyer of the right to tax deduction on such invoices. The signing of invoices by different officials was caused by reasons beyond the control of the taxpayer - a change in the heads of counterparties in the relevant periods.

09/05/2014 Victoria

The counterparty requires that the OGRNIP be indicated in the invoice in addition to the state registration certificate. Yes, he also wants to be printed ... My program does not allow this.

How to justify rejection?

Reply

Good afternoon Victoria.

According to paragraph 1 of Art. 169 of the Tax Code of the Russian Federation, an invoice is a document that serves as the basis for the buyer to accept the tax amounts presented by the seller for deduction when the requirements established by this article are met.

The list of mandatory details that must be indicated in the invoice issued when selling goods (works, services), transferring property rights, is established by paragraphs 5, 6 of Art. 169 of the Tax Code of the Russian Federation. According to paragraph 6 of Art. 169 of the Tax Code of the Russian Federation when an invoice is issued by an individual entrepreneur, the invoice is signed by an individual entrepreneur indicating the details of the certificate of state registration of this individual entrepreneur. According to the regulatory authorities, in order to legally deduct VAT on an invoice from an individual entrepreneur, the date, series, number of the certificate of state registration must be indicated (Letter of the Federal Tax Service of Russia dated 09.07.2009 N ShS-22-3 / [email protected]).

Reply

12/15/2014 Oleg

Good afternoon.

How to pay for the delivered goods correctly: by invoice or invoice, and what is the difference?

Reply

High-quality accounting services are necessary for all organizations without exception, including small businesses. However, not every company can afford to maintain a full-fledged accounting service. Nikolai Vizer, Senior Legal Counsel at Turov and Poboykina-Sibir law firm, will tell you what to do if the company does not have the position of chief accountant.

The approved forms of many financial documents contain such details as the signature of the chief accountant. Accordingly, the absence of this employee in the organization can create additional difficulties. Let's figure out how to solve possible problems.

In law

The situation with the absence of an accounting service and the position of chief accountant in the organization is quite typical. Moreover, the law provides such an opportunity, it is expressly provided for in Article 7 of the Federal Law “On Accounting”. This rule allows for several options for organizing accounting, depending on the type and size of the business. So, for small and medium-sized companies, the presence of such an employee in the staff list and office is not necessary. Here the question may arise - how to understand if my company belongs to these types of legal entities? Let me remind you that in Russia there is a Federal Law “On the development of small and medium-sized businesses in the Russian Federation”. It defines the criteria for classifying organizations as small and medium-sized businesses, including: the total share of participation of the state and large business entities (up to 25%); average annual number of employees (up to 250 people); the amount of annual revenue (not more than one billion rubles) and the book value of assets. It must be understood that the indicators established in the law may change over time.

The accounting option chosen by the head must be registered in. In the future, it can be changed by the director of the company at any time. It should be borne in mind that the company may exceed set targets. True, it is not systemic. If violations of the criteria are repeated for two years in a row, then the company may lose the status of a small or medium-sized business, which will entail corresponding changes in the organization of accounting.

staff specialist

Most organizations that cannot afford or do not need an accounting service, as a rule, hire an accounting specialist, as they write in vacancies, "in the singular" or "with the function of the head." Please note: in employment contract such a specialist needs to spell out in detail his duties, including signing. In addition, the manager must issue an appropriate order giving this employee the right to sign papers.

Since record keeping has been transferred to another legal entity or an entrepreneur, they are not at all required to be located at the location of the organization, as well as its documents and accounting base. This sometimes makes it possible to protect papers and data during unscheduled inspections by various government agencies.

As for "autographs" on primary documents, then Article 9 of the Law "On Accounting" requires that such papers indicate the position of the person signing them. In this case, you need to write "accountant". This may entail additional difficulties of a purely bureaucratic nature. Those organizations that are careful about primary documentation may require a set of documents confirming that the responsibility for keeping records is assigned to this particular specialist. This behavior is especially typical for government organizations and large companies. Those who often encounter such problems always have a scanned package of documents ready. Most likely, you will have to provide an accounting policy and an order. This should suffice, although some businesses with a "corporate culture" may make the most incredible demands.

You can, of course, leave the title of the position “Chief Accountant” in the paper. As a rule, this eliminates unnecessary questions, but entails two new problems. Firstly, the accounting rules are violated, although not rudely, and responsibility for them is not provided. But during the tax or audit auditors will certainly take note of this. Secondly, such a document will not meet the formal requirements imposed by law, which, in turn, will give the inspectorate a reason to exclude this paper from the list of documents that reduce the taxable base.

On a contract

The organization has the right to conclude an agreement on accounting with an individual entrepreneur or a relevant company. Some firms outsource bookkeeping to an individual who is not an IP. However, such actions may Negative consequences. The Inspectorate has the right to reclassify such relations as labor relations. In this case, the company is waiting for additional accrual of all relevant taxes and contributions, along with penalties and fines.

The specialist directly involved in record keeping must meet the requirements established by law. They concern the presence vocational education, work experience in the specialty and the absence of a criminal record.

On a note

A document signed by an accountant "with the function of the chief" will not comply with the formal requirements imposed by law, which, in turn, will give the inspectorate a reason to exclude this paper from the list of documents that reduce the taxable base.

The transfer of accounting functions to an individual entrepreneur or an authorized accounting department should also be reflected in accounting policy companies. In confirmation of the fact that accounting is maintained by a person who is not on the staff of the organization, the counterparty may require the presentation of an agreement with the relevant company or individual entrepreneur. For this reason, it is recommended that such contracts either do not include a confidentiality clause, or specifically stipulate cases of disclosure of the terms of the contract to third parties.

It is important to understand that since accounting has been transferred to another legal entity or entrepreneur, they are not at all required to be located at the location of the organization, as well as its documents and accounting base. This sometimes makes it possible to protect papers and data during unscheduled inspections by various government agencies.

As for the “primary”, instead of the chief accountant, the document can be signed by an individual entrepreneur or the head of the organization to which accounting has been transferred. Instead of the words “chief accountant”, then “individual entrepreneur” and his full name are written. If we are talking about a company, then it is necessary to indicate its name, organizational and legal form, the title of the position of the head and his full name.

As in the previous case described, you can try to make life easier for yourself and your counterparties, but the consequences will be identical.

All in one hand

The head of the company can also keep records. This is the least time-consuming and low-cost method. The legislation does not prohibit the director from having an assistant who will actually deal with the execution of all documents. It is only important that the boss signs all accounting papers and is responsible for its content.

As in previous cases, the head draws up his decision in the accounting policy of the organization.

When filling out the “perivichka”, in this case, the name of the head of the organization is indicated in the field “chief accountant” and his signature is put. As a rule, such paperwork raises few questions from both counterparties and various kinds of inspectors. However, given that self-management accounting is allowed only for small and medium-sized businesses, the organization will need to confirm this status. To do this, you will need to provide the counterparty with an up-to-date (“freshness” by each company is determined independently) extract from the Unified State Register of Legal Entities, which will indicate the founders, information on the average number of employees for the previous calendar year (form 1110018) for the last 2 years, as well as the organization’s balance sheets for the same period .

Thus, the current legislation provides a sufficient number of options for organizing accounting in a company. This allows any entrepreneur to choose the form that is convenient for him. It is important to take into account the features of each option and not treat them formally. Then the problems will be reduced to a minimum.

Nicholas Vizer, Senior Legal Counsel of Turov and Poboykina-Sibir law firm, for Calculation magazine

Encyclopedia of Accounting and Taxation Rules

Berator online is a unique electronic encyclopedia that allows you to use the most relevant information for an accountant wherever there is a computer and the Internet.