Accounting policy for an individual entrepreneur on the basis. Accounting policy basic and envd combined sample. Simplified form of accounting

Individual entrepreneur Ivanov I.I.

ORDER #3

on approval of the accounting policy for tax purposes Moscow 30.12.2016 I ORDER:

- Approve the accounting policy for taxation purposes for 2017 in accordance with the appendix.

- I am responsible for the execution of this order.

Individual entrepreneur

I.I. Ivanov Attachment 1

to the order dated December 30, 2016 No. 3

Accounting policy for tax purposes

1. Keep tax records personally.

2. Apply the object of taxation in the form of the difference between income and expenses.

Reason: article 346.14 tax code RF.

3. Keep a book of income and expenses automatically using the standard version of "1C: Entrepreneur 8".

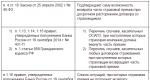

Reason: article 346.24 of the Tax Code of the Russian Federation, clause 1.4 of the Procedure approved by Order of the Ministry of Finance of Russia of October 22, 2012 No. 135n, subparagraph 1 of part 2 of Article 6 of the Law of December 6, 2011 No. 402-FZ.

4. Entries in the book of income and expenses should be made on the basis of primary documents for each business transaction.

Reason: Clause 1.1 of the Procedure approved by Order No. 135n of the Ministry of Finance of Russia of October 22, 2012, part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. Accounting for depreciable property

5. The initial cost of a fixed asset is determined as the sum of the actual costs of its acquisition, construction, manufacturing in the manner prescribed by the legislation on accounting.

Reason: subparagraph 1 of part 2 of article 6 of the Law of December 6, 2011 No. 402-FZ, subparagraph 3 of paragraph 3 of article 346.16 of the Tax Code of the Russian Federation.

6. Subject to payment, the initial cost of the fixed asset, as well as the costs of its additional equipment (reconstruction, modernization and technical re-equipment) are reflected in the book of income and expenses in equal shares starting from the quarter in which the paid fixed asset was put into operation and until the end of the year. When calculating the share, the value of partially paid fixed assets is taken into account in the amount of the partial payment.

7. Share of the value of the fixed asset ( intangible asset) acquired during the period application of the simplified tax system to be recognized in reporting period, is determined by dividing the initial cost by the number of quarters remaining until the end of the year, including the quarter in which all conditions for writing off the cost of the object to expenses are met.

8. If a partially paid fixed asset is put into operation, then the share of its value recognized in the current and remaining until the end of the year quarters is determined by dividing the amount of partial payment for the quarter by the number of quarters remaining until the end of the year, including the quarter in which the partial payment for the commissioned facility.

Reason: subparagraph 3 of paragraph 3 of article 346.16, subparagraph 4 of paragraph 2 of article 346.17 of the Tax Code of the Russian Federation. Accounting for inventory items

9. Composition material expenses includes the purchase price of materials, the costs of commission fees to intermediaries, import customs duties and fees, transportation costs, as well as the costs of information and consulting services related to the acquisition of materials. The amounts of value added tax paid to suppliers when purchasing inventories are reflected in the income and expense ledger as a separate line at the time the materials are recognized as expenses.

Reason: subparagraph 5 of paragraph 1, paragraph 2 of paragraph 2 of article 346.16, paragraph 2 of article 254, subparagraph 8 of paragraph 1 of article 346.16 of the Tax Code of the Russian Federation.

10. Material expenses are taken into account as part of the costs as they are paid. At the same time, material costs are adjusted for the cost of materials not used in commercial activities. The adjustment is reflected as a negative entry in the income and expense ledger on the last date of the quarter. To determine the amount of the adjustment, the method of valuing materials at the cost of a unit of inventory is used.

Reason: subparagraph 1 of paragraph 2 of Article 346.17, paragraph 2 of Article 346.16, paragraph 1 of Article 252, paragraph 8 of Article 254 of the Tax Code of the Russian Federation.

11. Expenses for fuel and lubricants within the limits of the standards are taken into account as part of material expenses. The date of recognition of expenses is the date of payment for fuel and lubricants.

Reason: subparagraph 5 of paragraph 1 of article 346.16, paragraph 2 of article 346.17 of the Tax Code of the Russian Federation.

12. The standards for recognition of expenses for fuel and lubricants as part of the costs are calculated as trips are made on the basis of waybills. An entry is made in the book of income and expenses in the amount not exceeding the standard.

Reason: paragraph 2 of article 346.17 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia for Moscow dated January 30, 2009 No. 19-12 / 007413.

13. The cost of goods purchased for further sale is determined based on the price of their purchase under the contract (reduced by the amount of VAT presented by the supplier of goods).

Reason: subparagraphs 8 and 23 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation.

14. The cost of goods purchased for resale is taken into account as part of the cost as the goods are sold. All goods sold are valued using the average cost method.

Reason: subparagraph 23 of paragraph 1 of article 346.16, subparagraph 2 of paragraph 2 of article 346.17 of the Tax Code of the Russian Federation.

15. The amounts of value added tax presented for goods purchased for resale are included in costs as the goods are sold. In this case, the VAT amounts are reflected in the book of income and expenses as a separate line.

Reason: subparagraphs 8 and 23 of paragraph 1 of article 346.16, subparagraph 2 of paragraph 2 of article 346.17 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated December 2, 2009 No. 03-11-06/2/256.

16. The costs associated with the purchase of goods, including the costs of servicing and transporting goods, are taken into account as part of the costs as they are actually paid.

Reason: subparagraph 23 of paragraph 1 of article 346.16, paragraph 6 of subparagraph 2 of paragraph 2 of article 346.17 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated September 8, 2011 No. 03-11-06/2/124.

17. An entry in the book of income and expenses on the recognition of materials as part of the costs is carried out on the basis of a payment order (or other document confirming the payment of materials or expenses associated with their acquisition).

The entry in the book of income and expenses on the recognition of goods as part of the costs is carried out on the basis of an invoice for the release of goods to the buyer.

Reason: subparagraph 1 of paragraph 2 of article 346.17 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated January 18, 2010 No. 03-11-11 / 03, paragraph 1.1 of the Procedure approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n. Cost Accounting

18. The expenses for the sale of goods purchased for resale include the costs of storing and transporting goods to the buyer, as well as the costs of servicing the goods, including the costs of renting and maintaining commercial buildings and premises, advertising costs and remuneration of intermediaries selling products.

Expenses for the sale of goods are taken into account as part of the costs after their actual payment.

Reason: subparagraph 23 of paragraph 1 of article 346.16, paragraph 6 of subparagraph 2 of paragraph 2 of article 346.17 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated April 15, 2010 No. 03-11-06 / 2/59.

19. The amount of expenses (with the exception of expenses for fuel and lubricants) taken into account when calculating the single tax within the limits of the standards is calculated quarterly on an accrual basis based on the paid expenses of the reporting (tax) period. An entry on the adjustment of normalized costs is made in the book of income and expenses after the corresponding calculation at the end of the reporting period.

Reason: clause 2 of article 346.16, clause 5 of article 346.18, article 346.19 of the Tax Code of the Russian Federation.

20. Interest on borrowed funds are included in expenses within the refinancing rate of the Central Bank of the Russian Federation, increased by 1.8 times, for ruble obligations and a coefficient of 0.8 for debt obligations in foreign currency.

Reason: clause 2 of article 346.16, clause 1 of article 269 of the Tax Code of the Russian Federation. Loss accounting

21. An individual entrepreneur reduces the taxable base for the current year by the entire amount of loss for the previous 10 tax periods. In this case, the loss is not transferred to that part of the profit of the current year, in which the amount of the single tax does not exceed the amount minimum tax.

Reason: paragraph 7 of article 346.18 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated July 14, 2010 No. ШС-37-3/6701.

22. An individual entrepreneur includes in expenses the difference between the amount of the paid minimum tax and the amount of tax calculated in accordance with the general procedure. Including increases the amount of losses carried forward to the future.

Reason: paragraph 4 of clause 6 of Article 346.18 of the Tax Code of the Russian Federation.

ORDER No. _____

on approval of accounting policy for tax purposes

__________ "_____" _______

I ORDER:

1. Approve the accounting policy for tax purposes for 20___ according to the appendix.

2. Control over the execution of this order is entrusted to myself.

Individual entrepreneur Petrov P.P.

Accounting policy for tax purposes

1. Tax accounting is carried out personally.

Possible option:

- tax accounting is maintained by a third-party organization providing specialized services in accordance with the contract.

2. Accounting for property, liabilities and business transactions is carried out separately according to each of the following activities:

- services Catering;

- rental of real estate.

Grounds: paragraph 7 of the Procedure approved by order of August 13, 2002 of the Ministry of Finance of Russia No. 86n, paragraph 6 articles 346.53 of the Tax Code of the Russian Federation.

3. In relation to activities related to the leasing of non-residential premises, the patent system of taxation is applied.

Reason: subparagraph 19 of paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation.

6. Professional tax deduction recognized in the amount actually produced and documented expenses directly related to the generation of income.

The composition of expenses accepted for deduction is determined in the manner prescribed by Chapter 25 Tax Code of the Russian Federation.

In case of impossibility documentary evidence expenses professional tax deduction is recognized in the amount of ___ percent of the amount of income from entrepreneurial activity.

Reason: Article 221 of the Tax Code of the Russian Federation.

10. Separate accounting is maintained for the costs of operations, both taxable and not subject to VAT. subject to taxation (exempted from taxation).

Reason: paragraph 4 of article 149, paragraph 11 of article 346.43 of the Tax Code of the Russian Federation.

11. Tax amounts presented by suppliers for goods (works, services) used in activities for the provision of catering services subject to VAT are accepted for deduction in the manner prescribed article 172 Tax Code of the Russian Federation, without restrictions.

Reason: paragraph 3 of clause 4 of article 170, article 172 of the Tax Code of the Russian Federation.

12. Amounts of tax presented by suppliers on goods used in activities related to lease of real estate taxed under the patent system is not accepted for deduction and is not taken into account when calculating personal income tax.

Reason: subparagraph 3 of paragraph 2, paragraph 4 of article 170, paragraph 11 of article 346.43 of the Tax Code of the Russian Federation.

13. The amounts of tax presented by suppliers on goods used simultaneously in the provision of catering services and in the activity of providing real estate for rent are recorded in the purchase book during the quarter for the entire amount indicated in the invoice.

The amount of deductions is adjusted according to the results of the tax period (quarter).

Adjustment is carried out in proportion to the proceeds from activities taxed under patent system, in the total revenue of the entrepreneur for the quarter.

However, in terms of revenue does not include income recognized as non-operating in accordance witharticle 250 Tax Code of the Russian Federation.

This adjustment is made for each invoice according to as of the last day of the tax period (quarter).

Tax amounts subject to recovery at the end of the quarter are not included in the cost of goods (works, services), including fixed assets, and are not taken into account when calculating personal income tax.

Reason: paragraph 4 of article 149, subparagraph 2 of paragraph 3, paragraph 4 of article 170 of the Tax Code of the Russian Federation.

Individual entrepreneur Petrov P.P.

In this regard, in practice, the question arises of the possibility of mirror application of the above 5% rule - non-use separate accounting if the costs of VATable transactions are less than 5%. Letter No. 03-07-11/48590 of the Ministry of Finance of the Russian Federation dated August 19, 2016 contains an explanation about the impossibility of such a broad interpretation of the law. Thus, the possibility of refusing separate accounting exists only in the case expressly provided for by law: if the costs of UTII are less than 5% of their total volume. Separate accounting for the calculation of income tax Separate accounting of income UTII payers are exempted from the need to account for income and pay income tax (clause 4 of article 346.26 of the Tax Code of the Russian Federation), because in accordance with clause 1 of Art. 346.29 of the Tax Code of the Russian Federation, the object of taxation of tax is recognized as imputed income, determined by calculation.

Accounting policy envd: combination with basic, usn, sp

IMPORTANT! Among the consequences of incorrect distribution of expenses is the additional charge of income tax and liability under Art. 122 of the Tax Code of the Russian Federation. For example, in one of the cases, the organization charged the cost of purchasing furniture entirely to OSNO in the absence of primary documents separate accounting. The court recognized as lawful the proportional distribution of costs made by the tax authority (decree of the 10th AAC dated February 18, 2016 No. 10AP-14788/15 in case No. A41-56968/15).

Controversy often arises when tax authority does not recognize the correct method of cost sharing, adopted on the basis of the division of areas allocated for different areas of work. Distribution of premises and areas by type of activity One of the frequently encountered controversial situations in separate accounting for the application of OSNO and UTII is the distribution of costs by area and premises involved in 2 types of activity.

How to create an accounting policy for envd and basic

Attention

Tax Code of the Russian Federation). But let's talk about everything in order. The Tax Code of the Russian Federation does not contain clear instructions on how separate accounting should be organized in an organization when combining UTII and OSNO. Each taxpayer decides this question independently. Wherein specific ways separate accounting must be recorded in the order on accounting policy for tax purposes.

Info

As part of separate accounting, it is necessary to separately take into account indicators that are somehow involved in the calculation of taxes. These include:

- income and expenses. As you remember, UTII is calculated based on the amount of imputed income, and the actual income of the payer is not taken into account (Article 346.29 of the Tax Code of the Russian Federation). On the contrary, the income tax payable under DOS is determined precisely on the basis of the difference between the income received and the expenses recognized in accounting (Art.

247, paragraph 1 of Art. 274 of the Tax Code of the Russian Federation).

Is it possible to combine the modes of envd and basic in 2018

The only thing that the Ministry of Finance draws attention to is the need to ensure the unambiguity of assigning indicators between types of activities in different tax regimes. For these purposes, the accounting policy provides explanations for the components of the working chart of accounts - the names of the accounts and sub-accounts opened for them. It is convenient to open two sub-accounts for each account, each of which will keep records of indicators for different special modes.

This point needs to be clarified in the accounting policy. With regard to tax policy, it is necessary to clearly distinguish between the accounting of income and expenses of the company. It is these indicators that will allow you to correctly calculate the single special tax for the simplified regime.

How to keep separate accounting when combining basic and envd?

For example, if wholesale and retail trade is carried out in the same trading floor, then the costs of renting this hall according to the norms of the Tax Code of the Russian Federation should be accounted for proportionally. However, the taxpayer can fix in the accounting policy the distribution of expenses according to the area allocated for a particular type of activity. When applying this method of separate accounting, it is necessary to take into account the explanation given in paragraph.

12 information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation of March 5, 2013 No. 157 (review of practice under Chapter 26.3 of the Tax Code of the Russian Federation): a conclusion about the existence of an independent trade organization object can only be made on the basis of inventory and title documents. In this regard, it is advisable not conditional (on the diagram), but physical (permanent partitions) separation of the parts of the premises used for different directions, reflected in the documents (for example, in the annex to the lease agreement).

Separate accounting of expenses and VAT for UTII and basic

Can an enterprise combine regimes when conducting activities in respect of which different systems? What are the rules for combining UTII and OSNO in 2018? If the company conducts one type of activity, then make a choice tax system, it will not be difficult to keep records and calculate taxes. But what about in the case when several types of operations are carried out, in respect of which it is impossible to use UTII or another regime?

- General information

- Combination of tax regimes of OSNO and UTII

- Emerging Questions

Yes, and there is also no desire to completely switch to OSNO due to the high tax burden. If you are also faced with such a problem, you should figure out how and when you can use UTII and OSNO at the same time.

How to keep separate accounting for basic and envd?

The accounting policy of the entity in UTII should take into account the peculiarities of the organization of accounting for various indicators in order to competently maintain accounting and correctly calculate the tax burden. In this regard, the policy under consideration is divided into two components - accounting and tax. The task of the first is to determine the rules for accounting, the second is to contribute to the correct calculation of taxes.

Often the procedure for maintaining the same indicators for the purpose of accounting and tax accounting differ, which necessitates the formation of a separate policy for these purposes. The principles of accounting policy are fixed in writing, approved by the head and subject to mandatory execution. A new company must do this no later than ninety days from the date of creation.

Envd and basic

Companies are required to calculate and pay taxes on different types activities in accordance with the applicable regime. If separate accounting is not maintained, then there is no reason to consider the enterprise as a violator, and it cannot be held accountable. But if separate accounting is not maintained, unpleasant consequences may arise:

- Distortion of the tax base for individual payments.

- Wrong tax payment.

- Inability to apply to deductions input VAT, as well as accounting for it in costs, which are deductible when calculating income tax legal entities(art.

The formed policy is to be applied until there are changes in the activity or the applied tax regime that will affect the accounting methods fixed at the moment. There is no need to submit a drafted and approved policy anywhere. The regulatory authorities can verify its existence and the correctness of the provisions during on-site inspections. The absence or incorrect content of the accounting policy entails a fine due to violation of the accounting rules (up to 3,000 rubles). As for the tax policy, there is no separate penalty for its absence, however, an LLC, without clear rules, may incorrectly calculate the tax, which will cause penalties for non-payment. Accounting policy for LLC at UTII Accounting policy "Vmenenschiki" of the organization are required to keep accounting, and therefore must have a properly drawn up accounting policy of an accounting nature.

Transition conditions Transition to OSNO is carried out in the following cases:

- if the organization does not meet the requirements of the preferential regime or has violated them when using the special regime;

- if the company must issue VAT invoices, that is, it is a payer of such a tax;

- if the company is among the beneficiaries of income tax;

- if the company simply does not know about the possibility of using other tax systems;

- if the entrepreneur worked on the patent USN, but did not pay for the patent on time.

You do not need to notify about the use of OSNO. The organization switches to this mode by default from the moment it opens or loses the right to work for special system. There are no restrictions on the use of OSNO, that is, it can be used by all legal entities and individuals without exception.

Ivanov A.A.

ORDER No. 5

On approval of accounting policy for tax purposes

Moscow 31.12.2012

I ORDER:

1. Approve the accounting policy for tax purposes for 2013 in accordance with

application.

2. Control over the execution of this order I take upon myself.

Individual entrepreneur Ivanov A.A.

Accounting policy for tax purposes

1. Keep tax records personally.

2. Accounting for property, liabilities and business transactions is carried out separately according to

Each of the following activities:

– catering services;

- Renting out real estate.

Income tax individuals

6. Professional tax deduction to recognize in the amount of actually produced and

Documented expenses directly related to the generation of income.

The composition of expenses accepted for deduction shall be determined in the manner prescribed by Chapter 25

Tax Code of the Russian Federation. In case of impossibility of documentary evidence of expenses

Professional tax deduction to recognize in the amount of 20 percent of the amount of income from

Entrepreneurial activity.

13. Tax amounts presented by suppliers for goods used simultaneously in

Activities for the provision of catering services and in activities for the provision of

Renting real estate, during the quarter are recorded in the book of purchases for the entire amount,

specified on the invoice. The amount of deductions is adjusted based on the results of the tax period

(quarter).

Adjustment is carried out in proportion to the proceeds from activities taxed under

Patent system, in the total revenue of the entrepreneur for the quarter. However, in terms of revenue

Does not include income recognized as non-operating income in accordance with

Tax Code of the Russian Federation. This adjustment is made for each invoice according to

Status on the last day of the tax period (quarter).

The amounts of tax subject to recovery at the end of the quarter in the cost of goods (works,

Services), including fixed assets, are not included and are not taken into account when calculating personal income tax.

Individual entrepreneur Ivanov A.A.

Accounting policy of IP on OSNO (sample filling)

Many individual entrepreneurs work fully without even knowing about the accounting policy and why it is needed. But this document should be in every business entity, without exception. Accounting policy (UP) is a set of provisions, rules and methods that determine accounting. There are no mandatory forms according to which the accounting policy of the IP on the OSNO is prepared. A sample filling can be found in the public domain, and the content can be determined independently.

Legislation clearly defines some aspects of accounting and tax accounting, but there are also moments in which variations are allowed. In this article, we want to tell you whether an accounting policy is needed for an individual entrepreneur and what exactly is provided for in it. Having determined for yourself how and what you will take into account, you thereby simplify the process of organizing and keeping records, and also create an additional argument in disputes with regulatory services.

IP accounting policy on OSNO

Entrepreneurs filling out a book of accounting for income and expenses may not keep accounting. Individual entrepreneurs who have chosen OSNO can use this opportunity without any problems. Accordingly, in the absence of accounting, an accounting policy is also not needed. But without compiling a tax UE is indispensable. According to the norms of the Tax Code of the Russian Federation, the tax accounting policy should indicate:

- income recognition methods;

- ways of fixing, as well as recognition of expenses;

- methods for evaluating, distributing and accounting for other performance indicators used in the calculation of taxes;

- persons responsible for keeping records, as well as the formation and submission of reports.

The accounting policy of an individual entrepreneur on OSNO should disclose everything related to taxes calculated and paid by him. The main tax in this case is personal income tax. Entrepreneurs pay it from the difference between income and expenses of activity. It is necessary to prescribe in the UE all the moments of their calculation that are not defined by law, including:

- the moment of recognition of certain types of income;

- the specifics of depreciation;

- the accounting procedure for goods and materials in the context of the recognition of expenses;

- the procedure for processing cash transactions and the forms of relevant documents, etc.

If an entrepreneur pays VAT, and also uses other taxation systems (SNO) in addition to the OSNO for certain types of activities (UTII, USN), then all these points should be spelled out in the UE, including the distribution of income and expenses for different SNOs.

Accounting policy of individual entrepreneurs on the simplified tax system, PSN and UTII

Entrepreneurs who have chosen the simplified tax system, regardless of its type, must also draw up a tax accounting policy. Individual entrepreneurs on a simplified system of 6% prescribe in it only what concerns income accounting. IP on the simplified tax system, taking into account both expenses and income, make up an accounting policy in almost the same way as entrepreneurs on the OSNO (taking into account the difference between the simplified tax system and personal income tax). The first paragraph of this document in both cases will be an indication of which object of taxation is used - only income or income and expenses.

As for entrepreneurs on UTII, it is important for them to indicate in the UE the applicable tax calculation formulas to the smallest detail. When combining UTII with any other taxation system, it should be clearly described how income and expenses will be distributed between activities that fall under different SNOs. It may also contain forms of primary documents used in the process of processing various business transactions.

An example of an IP accounting policy on OSNO

You can compose UE in any form. There are also no special requirements for content. As a rule, the following information is indicated:

- a person who maintains tax records;

- the system of taxation used;

- what means are used to record income and expenses (books, magazines, special accounting programs etc.);

- basis for making entries;

- specifics of depreciation;

- features of accounting for goods and materials, expenses and losses;

- when combining types of activities, the procedure for dividing income and expenses is indicated;

- the procedure for calculating expenses for personal income tax;

- specifics of VAT calculation (if the individual entrepreneur is a payer).

Summing up the above, we can say that the accounting policy is an important organizational document in any business. Its compilation saves the entrepreneur in the future from the need to each time choose a method for accounting for certain controversial issues. In addition, the consistent use of the same accounting methods makes it possible to make its results more transparent and objective. And the employees of the Federal Tax Service will not be able to recalculate taxes in their favor if the UE is drawn up correctly and in strict accordance with the current legislation.