Personal finance. The essence and functions of personal finance Financial management is the conscious influence of government bodies on the finances of the country, territories, economic entities to achieve and maintain balance and financial stability

The financial system of Russia consists of public finances, finances of economic entities (enterprises, organizations, institutions) and household finances. A person does not exist outside of society, so we can say that personal consumption is impossible separately from public consumption. At the same time, consumption does not exist without the production process. This determines the connection between personal finance and government and corporate finance. Payments of various kinds in favor of the state (for example, taxes, purchase of government securities, etc.) and, if necessary, transfer payments in the opposite direction (pensions, scholarships, wages for public sector employees and civil servants, unemployment benefits, etc.). personal finances are linked to public finances. In turn, through wages, investments in securities, etc. personal finances are linked to corporate finances.

Only a citizen, and not his family or household, can enter into financial relations of this nature. Therefore, the name “personal finance” more accurately describes these financial relationships than “household finance.”

Unlike public finance, which satisfies various types of public consumption, the purpose of personal finance is to ensure the process of personal consumption of the individual, regardless of what place he occupies in society.

World experience shows: those who do not think about their future today risk losing what they have achieved tomorrow. Throughout life, every person constantly has desires. The life path (from birth to death) consists of certain stages that are characteristic of the vast majority of people. And at each stage a person has certain life goals that serve as guidelines on a given life path. Consciously setting goals and managing your life is not easy. It requires thought, analysis and discipline. By generalizing and enlarging the goals that are consciously set for oneself, a life plan arises (professional self-determination, continuation of the family line and family traditions, purchase of housing, etc.). Planning your life is like planning a trip. If you don’t know your destination, it’s unlikely that you’ll be able to create the right route. Without planning, you may not get anywhere at all.

Some earn a lot, others barely make ends meet, but both of them are sorely lacking in funds. Finance allows people to feel secure and free, to be confident in their future and in the future of their children. Many people sooner or later come to the realization that life will be much better if their funds are under control. Such control is carried out through financial planning. The absence of a personal financial plan for wealthy people means the risk of losing everything and not being able, due to age, to maintain their previous income and status. For less wealthy people, this is a risk of moving from poverty to poverty.

Ongoing financial planning and budgeting

Personal financial plan (LPP) represents a rational strategy for achieving specific financial goals, based on effective combinations of certain financial instruments based on capabilities in specific conditions, as well as predicted needs.

The construction of LFP is based on the following stages:

- 1) setting goals;

- 2) generation and analysis of personal financial statements;

- 3) adjustment of goals;

- 4) determining ways to achieve goals (building an investment plan).

Based on the breadth of coverage and the nature of the activities controlled by the personal financial plan, the following plans are distinguished:

- express plan, taking into account only one, the most important goal for the subject;

- investment plan, developed on the basis of the amount possible for investment,

- full (complex) financial plan, adjusted, as necessary, to all current investment and financial activities of the entity.

Subtypes of a comprehensive and investment plan include target, anti-crisis and pension personal financial plans.

The primary task in financial planning is to translate dreams and desires into goals. Thus, a goal set within a specific time frame for its expected achievement, as well as the amount of money required for this, turns into a task that can be directly solved. Without a goal, i.e. question - why, everything else loses its meaning. You should have a clear idea of what you want to achieve. Goals should be clearly stated, not vague and abstract. In other words, if you want to earn a million, buy an apartment, a car, or arrange a holiday in the form of a trip, then budget planning will be your best friend and assistant in this matter. Thus, in the most general form, the basis of LFP is the redistribution of funds, subject to the logic of the planned achievement of a consciously set goal.

The next stage of building a physical therapy program, after setting a goal, is assessment of the current financial condition: income, expenses, assets and liabilities, as well as the current market situation for subsequent financial calculations, in order to ultimately show whether the set goals are achievable under the given conditions.

The assessment of the current financial condition is usually divided into points.

- 1. Defining goals.

- 2. Determination of income.

- 3. Determination of expenses.

- 4. Analysis of assets and liabilities.

- 5. Making decisions, monitoring their implementation. Anyone who has ever managed personal finances has probably encountered the problem of not having enough money. You have to either look for an additional source of income to cover all expenses, or refuse to make any expenses, since there is no longer any income left to cover them. Many also believe that their financial situation would improve once and for all if their income increased, because then it would be enough to cover all expenses. However, there is a tendency that as the level of income increases, the level of expenses also increases. The higher a person’s income level, the less he limits his needs and the more expenses he is willing to make to satisfy them.

When drawing up a personal financial plan, you should take into account not only your goals and capabilities, but also your needs, as well as the adequacy of your goals and desires. Only by realizing how thoughtful, justified and expedient the expenses are, can one assess how far a person is from his goal (or, on the contrary, how close he is to it) and what actions need to be taken to achieve the desired result. It is not enough to simply execute a personal budget - you need to do it effectively.

The most important concept in finance is budget.

Budget is a scheme of income and expenses of a specific person (family, business, organization, state, etc.), established for a certain period of time, usually one year. Personal finance management begins with regular accounting of expenses and income, allowing you to control cash flow.

Here are some budgeting tips:

- record the correct amounts;

- analyze the budget for past months, which will allow you to identify unnecessary expenses and their reasons; you can also create a summary budget schedule for a certain period of time, for example, a year, and find ways to increase funds;

- give preference to expenses, i.e. record an expense in the plan if there is a likelihood of it occurring due to reasons dependent or beyond our control, so that there is no budget deficit.

With the help of budgeting, you won’t be able to completely avoid unnecessary expenses, but reducing them to a minimum is an achievable goal. Careful planning and monitoring the implementation of your plans will help you become a more disciplined, responsible and purposeful person.

In the course of his life, a person enters into economic relations both with other people and with various organizations and the state. When these relationships are mediated by the movement of income and expenses of an individual, the latter constitute financial relationships. Personal finance, or population finances, are financial relations as a result of which the income of the population is generated and the directions for their spending are formed, i.e. expenses. Personal finance involves different types of financial relationships. These include tax relations with the state, and relations with one or another organization regarding payments, such as wages, dividends, etc., and relations with the bank, and relations with insurance organizations, etc.

On the one hand, the same person may have income from several sources, on the other hand, the personal income of family members is combined with the income of its other members, so the division of the group can only be conditional. As a result, the income of the population is taken into account only by type of income received (Table 16.1).

Table 16.1. Peculiarities of income of certain groups of the population

One and the same person can have several types of income at once, and therefore belong to several groups at the same time. For example, pensioners or students work part-time, so their income comes from both social assistance and wages. In addition to cash income, the population can also have income in kind (keeping poultry, livestock, growing vegetables, picking mushrooms, berries, etc.).

So, the first step in drawing up a personal budget is to take into account your income. The second step is accounting for expenses. People don't know where their money is going until they start analyzing their own spending. In this regard, the question arises: why do people who can be called wealthy clearly control all their expenses and have good so-called financial habits? The possible answer to this question is not that they are rich, but quite the opposite: they became rich because of these habits.

Bad financial habits can be many: overspending, constant debt, a huge amount of unnecessary things, endless unpaid bills and a small balance in your wallet and savings account. Bad financial habits include:

- impulse purchases. Many young people cannot pass by a store with attractive windows without entering it. And there it is already difficult to resist buying even unnecessary things, not to mention things that are necessary;

- abuse of consumer loans (in general, any purchase on credit, even the most insignificant and inexpensive thing, indicates improper planning of your own expenses);

- lack of any control over expenses;

- late payment of bills and debts due to forgetfulness]

- buying unnecessary things often occurs in large self-service stores that stock everything a consumer might need.

However, you can’t just throw bad financial habits out of your life; you can, for example, try using a “30-day shopping list”. Desired non-essential purchases are added to the list. If after a month the purchase is still necessary, relevant, desirable, then it is worth making.

In order to have a clear and clear picture of your financial situation, you should write down your expenses and income.

Collect all checks, invoices and other payment documents for the month in which records are kept. Calculate monthly income, wages, add other income received, for example from renting out real estate, interest on bank deposits, dividends on shares, etc. Next, it is advisable to keep track of expenses for one month or any other period of time (Table 16.2) .

Table 16.2. Budget

|

Income/Expenses |

Month |

|

INCOME |

|

|

Wage |

|

|

Total |

|

|

EXPENSES |

|

|

Transport |

|

|

Payment for Internet access |

|

|

Clothes and shoes |

|

|

Personal care products |

|

|

Education |

|

|

Sports and entertainment |

|

|

Total |

|

|

(Income - expenses) |

|

|

Saving |

|

|

Increase in assets |

|

|

Reducing liabilities |

In the age of information technology, thanks to the widespread use of inexpensive and easy-to-use programs, organizing personal finance accounting using computer programs (1C: Money, Home Accounting, etc.) has become very popular.

By controlling the movement of money, you can not only take into account individual income and expenses, but also draw up a balance.

Balance sheet is a form of accounting that allows you to evaluate the current financial position as of a certain date using income and expenses, assets and liabilities.

Price assets (housing, land, cars, durable goods, cash, etc.), although it changes, can always be assessed with a sufficient degree of accuracy. It is more difficult to assess the value of intangible assets - education, experience, entrepreneurial abilities. Assets vary in their degree of liquidity. Liquid assets include assets that can be quickly and without loss converted into cash.

Liabilities - these are debts and loans. The difference between assets and liabilities, or, in other words, the value of assets minus liabilities, represents net assets:

Assets - Liabilities = Net assets.

By controlling the movement of cash flows, you can reduce your personal balance to a positive balance and use it to accumulate assets. The accumulation of net assets (houses, cars, etc., including free cash) creates the basis of what is commonly called personal capital.

With the spending of borrowed money, not only the value of assets increases, but also the value of liabilities, and without paying due attention to the financial aspects of their lives, many remain with a negative value of this indicator, and life begins to depend not on themselves, but on those who give the funds to their existence.

Analyzing the resulting financial report will help you understand how realistic your financial plan is. In the event of a discrepancy between desires and capabilities, a person has a need to make a choice in favor of one of two possible options for further actions: either limit his own desires, or increase his own capabilities.

After passing these stages, you need to adjust your goals so that they become realistic and achievable.

It is important to note that sometimes adjustments occur in the direction of increasing desires, since the prepared financial statements can clearly show opportunities that were not previously visible.

The previous stages of building a personal financial plan should clearly show that money for investment can be found in your own budget if you learn to control it correctly. However, often the problem is not that a person cannot find funds, but that he does not know how to manage them correctly.

At this stage, three questions need to be answered: how much, when And in the direction invest? This is the most difficult stage after setting goals, since it is necessary to invest funds throughout the entire period of implementation of the personal plan. It is important to realize that investing is always a big risk, which means a new task arises - building your own investment strategy, the main rule of which is diversification, which means: “don’t put all your eggs in one basket.”

Correctly diversify funds into instruments with varying degrees of risk. In what proportions to invest depends on many factors, such as: personal preferences, available funds, risk appetite, age of the investor, etc.

Typically, the higher the return, the greater the risk. But there are exceptions to every rule. If the initial amount is small, you can try to concentrate it in the most profitable instruments. As capital increases, you can distribute funds across other instruments, thus receiving a loss in one place, while capital will continue to grow through other investments.

Of course, if you follow the plan, everything will work out. However, no one is immune from mistakes. Unplanned expenses can range from a broken TV to treatment after an injury or job loss. To do this, it is always necessary to have a reserve, a reserve liquid fund (the savings of which can be used at any time), ensuring financial security. This is an amount, the so-called financial safety net, on which you can live for about six months without reducing your standard of living.

The above is just one part of a larger set of budget planning activities. At the same time, one should not elevate economy above the entire principle of existence. It is important to understand that rare, although unplanned, expenses will not make a significant hole in the budget. And unexpected pleasant purchases can cheer up not only yourself, but also your family and friends.

In modern conditions of economic development, personal finance is of great importance for the financial system. They influence the volume of resources of the state budget system, the capacity of the domestic market, and the dynamics of the investment process. Analysis of the state of personal finances serves as the basis for determining the standard of living in the country. However, despite the great importance of personal finance in the state economy, scientific interest in this area arose relatively recently. As a result, the patterns and factors of their formation, the relationship of personal finance with other parts of the financial system, as well as their impact on macroeconomic processes have not been fully studied.

The purpose of this article is to identify factors and features of the formation of personal finance in Russia and their manifestations.

Personal finance is a system for the formation and use of monetary income of individuals in accordance with their decisions. There are 2 types of solutions: using income for consumption and using income for accumulation.

The main sources of information about the personal finances of the population are the system of national accounts, the balance of income and expenses of the population, data from statistical studies of personal finances conducted by state statistical bodies.

The structure of personal finances is influenced by internal and external factors.

1. Internal factors - the amount of total monetary income of the household, the degree to which the needs of the household are met through subsistence farming, the level of organization of the household budget, the level of material and spiritual needs of household members.

2. External factors - the level of retail prices for goods and services consumed by the household, the amount of government subsidies, the amount of taxes and other obligatory household payments, the level of development of consumer credit in the national economy.

Features of the formation of personal finance in Russia are associated with the transitional nature of the Russian economy. The Russian economic system is characterized by such features as uncertainty of property relations, poor development of the institutional foundations of the economy and financial market, as well as incomplete structural restructuring.

In Russia, the following features of the formation of personal finances are observed:

1. Decrease in the share of income from business activities and property.

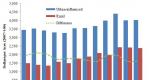

Let's consider the dynamics of the share of income from business activities and property in the overall structure of income of the population over the past 5 years.

Rice.

During this period, there was a decrease in the share of income from business activities and property, while in the period from 2000 to 2008 there was no stable trend in this indicator. This is due to the influence of the economic crisis of 2008-2009. and macroeconomic instability in the transition economy in Russia.

2. A lower share of wages for employees in Russia's GDP by income than in developed countries.

The share of labor income in GDP in Russia is significantly lower than in developed countries, which reduces the capacity of the domestic market and restrains the growth of personal income, consumption and savings.

3. Dependence of the formation of personal finances on the conditions of the world energy market, expert and raw material orientation of the macroeconomy.

Oil and gas revenues are a regular source of income for corporate finance and government finance. For example, in 2012, the share of oil and gas revenues in the structure of revenues of the actually executed federal budget was 46%, and in 2013 - 50.1%. Corporate finance and public finance closely interact with personal finance, as a result of which changes in income from oil and gas exports cause changes in the structure of personal finance.

4. Strong differentiation of incomes of the population.

In Russia, there are significant differences between the incomes of different groups of the population, as well as an excess of the growth rate of income of the part of the population with high incomes over the growth rate of income of the middle and poor segments of the population.

5. High share of foreign currency in income, expenses and savings of the population.

This feature was clearly manifested in 2014, when the volume of funds placed by the population on deposits of Russian banks increased by 0.4%, while the volume of funds placed in rubles fell by 2.2%. The volume of household funds in bank accounts in foreign currency reached a record high of $94.8 billion (the previous maximum value was observed in 2009 and amounted to $67.6 billion), which is 20.4% of the total volume of funds placed by individuals persons in Russian banks.

6. A significant volume of capital export from the country, the formation of a significant part of the personal savings of Russian residents abroad, deep differentiation of wages.

7. Preservation of a large number of low-performing enterprises.

In the 1st half of 2014, the share of unprofitable enterprises was 32.4%, which is 0.1% more than in the same period in 2013. Unprofitable enterprises have a demand for low-skilled labor and pay wages to employees at the subsistence level. The income of employees of these enterprises goes almost entirely to current consumption and increases its share in the overall structure of household expenses.

8. High concentration of hidden income - gray wages (unofficial wages not taken into account for taxation, which are issued in envelopes, in the form of insurance premiums through insurance companies, etc.) and business income.

In Russia, effective forms of control over household income and expenses have not yet been developed, which makes it possible to hide their income in order to reduce taxes paid and create more savings.

9. Strong differentiation of personal income between regions of the country.

As a result, high transaction costs arise and the complexity of redistribution financial processes arises.

Thus, many features of the formation of personal finance in Russia are associated with the transitional nature of the Russian economy, the export and raw material orientation of the Russian economy and macroeconomic instability. Overcoming the negative features of personal finance in the Russian Federation should be aimed at increasing the efficiency of their formation. The main criteria for such efficiency include: increasing the standard of living due to stable income growth, increasing the capacity of the domestic market, and increasing the importance of personal finances in the investment process.

An increase in the standard of living of the population is possible provided that the inflation rate decreases and real interest rates increase. The result of increasing the capacity of the domestic market will be a qualitative and quantitative increase in individual consumption, which will stimulate domestic producers. Increasing the importance of the role of personal finance in the investment process is a factor of economic stability and can help transform individual savings into an important source of future personal income.

1The article presents points of view on the essence and role of personal finance in the economic system, both Russian and foreign. The share occupied by the population's income in the gross domestic product of the Russian Federation is analyzed, the composition of the population's income and expenses is considered. The main factors influencing the adoption of personal financial decisions are studied, the role of the personal budget and the balance of assets and liabilities is noted. A classification of financial decisions made by the population is given, issues of using investment instruments are raised in order to create and increase the population's savings. An important role is also given to the assessment of personal financial risks, the application of the concept of the time value of money when making personal financial decisions, and the discounted cash flow method when making financial investments of the population.

saving

personal risk management

financial decision making

personal finance

1. Barulin S.V. Finance. - M.: KNORUS, 2010. - 640 p.

2. Gross domestic product at current prices [Electronic resource]. - Access mode: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/accounts/ (access date: 08/05/2013).

3. Zvi Body, Robert K. Merton. Finance. - M.: Williams Publishing House, 2008. - P. 204.

4. Volume and structure of cash income of the population by source of income [Electronic resource]. - Access mode: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/population/level/ (access date: 08/05/2013).

5. Finance / under. ed. prof. V.G. Knyazeva, prof. V.A. Slepova. - M.: Master. SIC INFRA-M, 2012. - 656 p.

An urgent problem solved in every economic system is ensuring the financial security of the citizens of the state. Within the framework of economic and financial policies, ways to attract citizens' funds as investment resources are provided, as well as programs to stimulate pension savings and insurance programs. Financial resources of the population are one of the most important sources of financing for commercial and non-profit organizations, as well as the state, since citizens are the main consumer of products and services produced by enterprises. All of the above determines the importance of personal financial decisions made within the framework of state financial policy. On the part of the population, the most pressing issue is managing their own financial resources in order to maintain, preserve and improve their personal standard of living. Before talking in more detail about the process of making personal financial decisions, it is advisable, from our point of view, to define the category “Personal Finance” and its composition.

Currently, it is more appropriate to talk about personal finance, since in fact, the financial flows of individuals in the aggregate add up to the financial flows of households. As a result, the owner of any enterprise, organization, company is an individual, and also, paradoxically, in a unitary state system, it is often found that the property of the state is nominally owned by the people, which can also indirectly be considered confirmation of the thesis about the ultimate owner of the property - a citizen of the state.

In general, academic economists are characterized by a definition of personal finance similar to that given by Professor V.G. Knyazev, speaking about the system of formation and use of citizens’ cash income, depending on the decisions made. There are points of view that define personal finance as a set of monetary relations or as funds created by households. There is also an opinion that limits personal finance only to financial relationships between individuals within the same family. In our opinion, all the above points of view describe only individual facets that characterize this economic category.

Ultimately, the following facts remain undoubted - personal income accounts for over 50% of the income of the gross domestic product produced in Russia (Table 1). Personal finance is present at every level of distribution and redistribution of GDP in the form of income received for labor, from investing resources, social payments of various types, entrepreneurial activities, etc., these resources form personal monetary funds and are used for the purposes of consumption, savings and investment .

Table 1 - Dynamics of changes in the level of income of the population of the Russian Federation, billion rubles.

The critical importance of personal finance is characterized by the fact that they become a source of resources for economic recovery at all levels in a crisis situation. Thus, if other sources of financial resources are exhausted or absent, historically states borrow money from the population, increase the tax burden, introduce expropriation measures, etc. Personal finances of citizens also act as the basis for the well-being of any state, since through the tax system they form a significant part of the income of budgets of all levels.

It should be noted that, in addition to the goals of consumption and saving the financial resources of the population, the issues of investing personal financial resources are of no less importance. Investment activity is typical both for individuals in the process of creating pension savings and preserving the value of savings, and for individual entrepreneurs carrying out financial relations, forming and using funds for the purpose of making a profit. Personal finance, therefore, is part of the created national income, which remains at the disposal of citizens of the state and forms monetary funds used for the purposes of consumption, savings and investment.

Consequently, we can propose the following definition of personal finance as a system of cash flows and funds of monetary resources formed in the process of distribution and redistribution of national income and ensuring the life of an individual.

Traditionally, for Russian science, the use of the term “household” is more common. It can be noted that this term is usually used in connection with the identification of this sector of the economy by the System of National Accounts and its use in the process of collecting, processing and comparing economic information. At the same time, the composition of households varies from one person to a large number of members of one family, and a family can either live in the same premises and consolidate its income, or, without living together, also consolidate its financial flows. On the other hand, in practice there are also situations where citizens live in the same residential premises, but do not consolidate their financial resources. As Western economists, and recently an increasing number of Russian economists, note, the decision of an individual becomes decisive in financial relations. Thus, it is appropriate to talk about personal finance, especially in light of the increasing trend of income segregation and individualization in society.

In any case, there is no doubt that citizens in the course of their lives, on the one hand, spend money, save part of the money resources in the form of savings, which constitute funds intended for placement using various financial and investment instruments. The interaction of personal finance occurs with all areas of financial relations.

The literature notes the following main factors influencing decisions in the field of formation and use of personal finance: human capital, characterized by professional and educational level; macroeconomic situation; level of development of the state; possibility of inheriting property. From our point of view, the list needs to be supplemented with such a factor as the form of ownership of property in force in the state, since private ownership of property stimulates accumulation processes. While its absence leads to a desire to spend the resources received, and the state in such periods can resort to methods of forced formation of savings, for example, in the form of investments in government bonds.

Let's consider the composition of income and expenses of the population. Let us note that the population can receive income in cash and in kind. Cash income includes wages, social payments, interest income on bank deposits, income from business activities, income from property, income from investing funds and others. Income received in kind (for example, growing vegetables for personal consumption) should also not be overlooked, since income in kind has a monetary expression through saving money for the purchase of these items, property or products from cash income, and in In case of sale, sales may be expressed at market prices.

Personal income can be classified as follows.

- Income from production activities (salaries, additional earnings).

- Income from business activities.

- Income received in the form of various social payments from the budget.

- Income from the sale and provision of property for use.

- Investment income.

- Payments under insurance contracts.

- Funds received in the form of inheritance, gifts, financial assistance.

- Other income.

The basis of personal finance is employee compensation. The level of this indicator is regulated by the state. For example, in Russia there is a minimum wage, which affects basic social benefits and is used to monitor employers; in France, a minimum wage level has been established. Income from business activities is more typical for individual entrepreneurs; this group also includes income received from the sale of copyright works (musical, literary, artistic, etc.), from the provision of services by lawyers, notaries, since they, like entrepreneurs, to some extent, are characterized by a probabilistic nature of occurrence. Let us note that personal income is generated from various sources; the predominance of any one depends on the economic relations permitted by the state, the segment of the life cycle in which a person is located, and the ability to form and allocate his financial resources.

Personal expenses are classified depending on the time interval into short-term, medium-term and long-term. Depending on the functional purpose, there are expenses for personal consumption, mandatory payments to the budget, funds allocated to personal savings and savings, investment expenses, etc. Operating and capital expenses are also distinguished.

The ideal situation in the field of personal finance management is the preparation of a personal budget and a balance sheet of assets and liabilities. A personal budget is a summary of income and expenses for a certain period of time, usually a calendar year, broken down by month. The budget characterizes a person’s cash flows associated with receiving funds and spending them. A budget surplus shows the amount of money that can be used for savings. Also, from the point of view of analyzing personal financial status, it makes sense to draw up a balance sheet of assets and liabilities, which is a reflection of the property status of an individual, expressed in monetary terms as of a certain date, where the citizen’s property and funds are in the form of assets, and his liabilities are his liabilities. .

When comparing personal assets and liabilities, the so-called net wealth or well-being of a citizen is revealed, which characterizes the threat of bankruptcy. The analysis data cannot be overestimated from the point of view of the rather high debt burden of the Russian population and the great influence of its results on the process of making personal financial decisions.

Having considered the essence and composition of the category of personal finance, which are necessary for further research, let us proceed directly to the consideration of financial decisions in the field of personal finance. It should be noted that the factors that most significantly influence the financial decision-making of citizens are the goals that a person sets for himself, his social status, marital status and income level. It is advisable to pay attention to foreign scientific experience in the field of studying personal financial decisions. According to Professors Z. Body and Robert K. Merton, the main decisions made by citizens fall into four main types:

- decisions on consumption and saving of funds;

- investment decisions;

- financing decisions;

- decisions related to risk management.

Characterizing each type of decision, we note that the most important area is determining the structure of personal expenses, sources of monetary resources, the share of income allocated to savings, the choice of assets intended for savings, making decisions regarding the use of borrowed funds, their volume, term and cost , reducing the level of financial risk and protecting against the risk of adverse events.

The basis for making any financial decision is personal financial goals and their priority for a particular person. As a rule, the main personal financial goals include providing food, clothing and housing, protection, travel, education, and increasing personal wealth. The predominance of any of the goals ultimately affects the formation of the structure of personal financial resources.

Decisions in the field of savings are made from the point of view of placing funds in various types of assets and depend on the needs of people, interests that can affect the activities of companies, for example, the so-called conflict of interests of company owners and managers. For the owner, the most important thing is the maximum efficiency of using his property, while for management it may be important to quickly increase the volume of wages.

All decisions in the field of personal finance involve the use of certain financial instruments, for the selection of which it is necessary to determine the following main points: the time value of money and the use of the cash flow discounting method, the impact of inflation on savings, the degree of need for a particular instrument and its value for a particular person from the point of view in terms of risk.

The time value of money is of great importance when choosing instruments for creating savings for old age, a non-state pension fund or long-term insurance programs for survival or long-term deposits; assessing the profitability of a savings certificate or bond and similar types of assets. Such savings can be formed, for example, to pay for children’s education or serve as a “financial safety net” in a highly liquid form.

The time value of money plays an important role in the decision-making process on increasing or decreasing the share of funds allocated for consumption; for example, inflationary expectations in society provoke an increase in consumption costs. In this situation, citizens seek to transfer their financial resources to an asset that loses its value to a lesser extent, or to make large purchases, thus trying to reduce the risk of depreciation of cash savings.

It is also advisable to use the discounted cash flow method to select a personal investment solution. Since it allows you to evaluate the profitability of a project or instrument after some time, as well as determine the optimal set of sources for creating investments and savings, allowing you to take into account alternative instruments and their profitability.

To assess the effectiveness of personal financial decisions taking into account inflation, it makes sense to use nominal and real interest rates. The real interest rate allows you to estimate the future value of the purchased asset taking into account changes in the level of inflation and make more informed financial decisions, and also allows you to more accurately plan your family or personal budget.

When making investment decisions and decisions on spending an individual’s funds, it is also necessary to take into account tax payments and the possibility of applying tax benefits. So, for example, a competent combination of investment decisions and decisions in the sphere of consumption makes it possible to find additional opportunities to strengthen social and financial security.

The choice of investment decision is made by comparing different options for using assets or funds and comparing the level of profitability. The information basis for making such decisions can be data from financial markets that provide alternative ways to invest resources. Other methods are also used to evaluate various investment instruments based on profitability, risk level assessment, etc. So, for example, when evaluating shares, both the price growth potential for a given security and its investment opportunities based on the results of dividend payments are assessed. Risk assessment is of particular importance in this situation. The main risks that are taken into account when planning in the field of personal finance are the risks of illness, disability, death, unemployment, the risk of losses incurred during the use of a car, real estate, civil liability risks and investment risk. Part of the responsibility for reducing the risk of an individual is assumed by the state, but still most of the risk falls on the individual himself. Therefore, in the field of personal finance, risk assessment is an assessment of the costs that a person may incur when a risk occurs. Different decisions at different stages of a person's life cycle can either increase or decrease risk. The use of risk reduction tools allows, on the one hand, to ensure some social stability, and on the other hand, to partially reduce one’s expenses at the expense of the state.

In conclusion, I would like to note that certain financial decisions of individuals are aimed at improving the quality and standard of living of a person, which is achieved by individual financial planning. This allows you to determine the age when it is necessary to start creating pension savings, the amount of financial resources allocated for these purposes, assess the need and effectiveness of any major purchase, and the feasibility of attracting credit resources.

Reviewers:

Knyazeva E.G., Doctor of Economics, Professor of the Department of Insurance, Ural Federal University named after the first President of Russia B.N. Yeltsin", Yekaterinburg.

Yuzvovich L.I., Doctor of Economics, Associate Professor of the Department of Insurance, Ural Federal University named after the first President of Russia B.N. Yeltsin", Yekaterinburg.

Bibliographic link

Kuklina E.V. PERSONAL FINANCIAL DECISION MAKING: RELEVANCE AND TRENDS // Modern problems of science and education. – 2013. – No. 6.;URL: http://science-education.ru/ru/article/view?id=11690 (access date: 09/18/2019). We bring to your attention magazines published by the publishing house "Academy of Natural Sciences"

One of the most important elements of the financial system is personal finance.

Note. Personal finance is financial flows associated with the receipt of income by individuals, the accumulation and use of this income.

Sources of personal finance are income from self-employment (salaries, business income), income from property (interest, dividends, rent). In addition, personal income is generated through social transfers (pensions, benefits), inheritances, insurance payments, grants, and tips.

The main areas of use of personal finance are: formation of current consumption (expenses for the purchase of food and clothing, payment for housing); insurance premiums; investments in real estate, own business, securities, bank deposits; savings for purchasing durable goods; purchase of foreign currency and jewelry.

In the process of its formation and use, personal finance is in close interaction with state, municipal and corporate finance. Their relationships take the form of cash flows (Fig. 2.1):

From corporate cash funds to the sphere of personal finance (in the form of wages, income from business activities and property);

From the sphere of personal finance to the public sector (in the form of direct and indirect taxes);

From the public sector to the sphere of personal finance (in the form of wages of employees of budgetary organizations, pensions and benefits);

Within the sphere of personal finance, in particular in the formation of income of persons engaged in self-employed activities and persons of liberal professions.

Personal finance in the distribution and redistribution of national income

Personal finance plays a big role in the functioning of the national economy. The level of income of individuals and what part of this income they save for savings and what part they use for immediate consumption determine the overall level of effective demand in the economy. For example, if they are not confident in their future, they begin to save more for a rainy day and spend less. Because of this, companies may sell less clothing, furniture or cars, their income decreases, and therefore economic growth as a whole slows down.

Savings of the population play an equally important role in the country's economy. If these savings are not a wad of banknotes hidden under a pillow, but a deposit in a bank, then as a result of the population's savings, the total financial resources of the country increase. Enterprises can obtain a loan from banks to purchase new, more advanced equipment, build new factories and factories. As a result, the country's production capacity increases, enterprises can produce more competitive products, which leads to accelerated economic growth. Countries where people spend less and save more tend to have higher rates of economic growth.

Inflation plays a big role in the process of transforming personal finances into investments. The depreciation of money predetermines the instability of the formation of savings and increases the differentiation of individual incomes. It causes increased wealth inequality, since it primarily leads to the depreciation of wages, pensions and benefits. Their recipients are less able to use measures to protect their financial assets against inflation. In addition, they have limited ability to influence the indexation of their income.

The impact of inflation on savings and investment largely depends on the characteristics of the macroeconomic situation in a particular country and the methods of conducting economic policy. These circumstances ultimately determine the impact of inflation and measures to reduce it on the formation of personal finances.

Personal finance as an indicator of the well-being of the population. The well-being of the population is determined not only by the total volume of personal financial assets accumulated in the country, but also by the degree of differentiation of personal finances.

It is generally accepted in economic theory that a reduction in income inequality will have a positive impact on economic development. It is confirmed by the experience of a large number of countries.

Indeed, let us imagine a situation where income inequality in society increases, i.e. Instead of individuals with average incomes, many poor people and a small number of rich people appear. Obviously, the poor are forced to limit their spending on food, clothing, medicine and spend less than they spent before. At the same time, the rich are unlikely to spend significantly more, even if their income is thousands of times higher than the income of the poor - a person cannot eat a hundred loaves of bread a day or put on a hundred suits. As a result, overall demand for goods decreases, leading to slower economic growth. Of course, the rich have a demand for luxury goods, but the production of luxury goods can hardly serve as the engine of the economy. Bread is always needed, the fashion for oysters comes and goes. Another negative consequence of income inequality is that individuals with low incomes cannot spend enough on education and health care. As a result, the quality of the workforce decreases.

The equalization of individual incomes in both developed and developing countries is achieved through high rates of economic growth, increased investment, and reduced inflation.

An important role in overcoming income inequality is played by targeted programs for professional retraining of representatives of undemanded professions, support for small and medium-sized businesses, giving individuals with low incomes a chance to start life over. Financial support is also used for regions lagging behind in their development and the creation of new industries in such regions.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http://www.allbest.ru/

- Introduction

- 1. Concept of the financial system

- 1.1 Fundamentals of finance

- 1.2 Concept of the financial system

- 2. The concept of personal finance and the relationship with the country’s economy

- 2.1 Features of personal finance

- 2.2 Savings of the population as an investment resource

- 2.3 Analysis of the volume and structure of household deposits in banks as one of the investment resources of the country’s economy

- Conclusion

- Bibliography

Introduction

Public finances are one of the least studied elements of the financial system. However, recently the attitude of researchers towards public finances as an independent link in the financial system has changed. A significant number of scientific works are appearing devoted to the study of personal finance, their role and interaction with other elements of the state’s financial system.

The importance of personal finance management at the present stage is determined by their special role in the financial system. Decisions made in personal finance have a direct impact on public and corporate finance. In addition, personal finance determines the volume of effective demand in the economy.

The main areas of personal finance management are: the formation of human capital (in particular, obtaining an education and subsequent professional development); rational attraction of borrowed resources; tax payment management; optimization of expenses for current consumption; formation of personal savings; transforming personal savings into investments and maximizing their profitability; risk management of personal investments; health insurance; pension insurance and formation of pension savings; personal property and life insurance.

The relevance of the topic of the course work lies in the fact that personal finance plays a large role in the country’s economy. In the last decade, scientific publications have appeared devoted to the study of household finances and their role in the country’s financial system. An increasing number of scientists are talking about the importance of household finance and its fundamental role for the country's financial system.

The purpose of the course work is to consider personal finances and show their relationship with the country's economy. The object of the study is the financial system of the Russian Federation.

The subject of the study is the specifics and prospects for the development of the financial system of the Russian Federation.

Research objectives:

Study the theoretical principles of the financial system and personal finance;

Consider the features of personal finance;

Conduct a comparative analysis of the volume and structure of household deposits in banks as one of the investment resources of the country's economy.

During the research, articles from periodicals were used, as well as scientific works of the following authors: Lavrushin O.I., Ivanova I.D., Ershov M.V., Gelvanovsky M.I. and etc.

1.The concept of the financial system

1.1 Fundamentals of finance

From a historical perspective, the meaning of the concept of “finance” has continuously changed. In the explanatory dictionary V.I. Dahl (1882 edition) interprets finance as “the state treasury and its accounts; everything that relates to the receipts and expenditures of the state.”

In the dictionary of foreign words (1964) finance (French finance, financia - cash, income) - in a broad sense - cash, cash turnover; public finances - the totality of all funds at the disposal of government authorities.

In the Big Financial and Economic Dictionary by A.G. Finance a brewer - conduct financial transactions with money; finance is capital involved in a project; income; facilities.

Finance arose in conditions of constant commodity-money circulation in connection with the development of the state and its needs for resources.

The subject of finance science is public finance. Here we are talking about the study, economic analysis and assessment of the public sector of the economy (Public Economics or Public Sector Economics), with the central focus being the study of the use of government revenues and expenditures, which are reflected in the state budget. Babich A.M. Finance and money circulation, M.: Credit, 2012

Government revenues and expenditures are used as financial and political instruments to achieve certain goals. However, studying only total income and expenses is insufficient in many cases. Thus, the execution of public administration tasks, depending on the field of activity, is reflected mainly in the budget. The state can not only widely use financial and political instruments, but also apply direct financial control, centralized financial planning, regulation of prices and production volumes (at state-owned enterprises), legislation (holding legislation, environmental protection laws, national security laws, etc. .) and monetary policy. These instruments are not always independent of financial and political decisions, since there are often several alternative instruments (for example, setting acceptable air pollution standards).

Before considering the essence and content of finance, it is necessary to find out its nature and history of its appearance in human society.

Human society, from an economic point of view, represents the unity of two equal and interconnected parties: productive forces and production relations.

Productive forces characterize people's relationship to nature and represent the connection of a person (labor force) with the means of production (material and technical base).

Industrial relations are relationships between people that they enter into for joint activities.

Production relations arise between people in the process of movement of a social product from production to its consumption.

Industrial relations are of two types: organizational and economic.

Organizational production relations arise in the process of production as such, for example, the relationship between employer and employees, manager and engineers, etc. These relationships are caused by the division of labor between working people and characterize the state of production.

Economic industrial relations - these are relations between people regarding their appropriation of the means of labor and products of production, i.e. property relations.

Natural relations are realized through the withdrawal of part of the production products in kind.

Monetary relations are manifested through the circulation of money. In the process of circulation, money becomes capital.

Capital is money intended for profit. Thus, money creates the conditions for the manifestation of finance as an independent sphere of functioning of monetary relations.

Finance is monetary in nature. Money is a prerequisite for the existence of finance. No money - no finances.

According to the cultural and historical periodization developed at the end of the 19th century. American ethnographer and historian of primitive society L. Morgan and German economist F. Engels, human society in its development passed through three eras: savagery, barbarism, civilization. Each of them consists of three levels: lower, middle, higher.

Finance as a historical category is a product of civilization. They arose at the highest stage of civilization with the advent of trade and develop as its derivative part.

The division of social labor and the division of society into separate classes led to the disintegration of the tribal system and its replacement by a social system in the form of a state. Herds of animals, household utensils and other household items moved from ancestral (family) property to private property and became the subject of exchange. Thus, they turned into a commodity.

The development of commodity exchange required the appearance of a sign of exchange, that is, an intermediary of the exchange process. Money becomes such a sign of exchange.

The process of evolution of money and the attitude towards it in society are interesting. For non-specialists in the field of money, finance and credit, as the American economist Nobel Prize laureate F.A. Hayek, money we daily; put into action, remain a completely incomprehensible thing, they at the same time fascinate, perplex and repel. However, an ambivalent attitude towards it is even more common: money is perceived simultaneously as both the most powerful instrument of freedom and the most malicious weapon of oppression. In other words, money can be spent on both good and negative things.

People who had a lot of money began to play an increasingly important role in society. This led to the formation of a merchant class and the emergence of capital, the separation of trade from production, the division of labor between artisans and peasants (i.e. between city and countryside), and subsequently the division of urban labor into separate industries.

The development of the processes of buying and selling goods for money led to the emergence of monetary credit and money exchange points, and with them interest arose as a payment for a loan, and usury appeared.

Usury (usury) refers to any activity of lending at interest. A usurious loan is a monetary loan for the use of which the borrower is charged high interest rates, which differ sharply from generally accepted norms. As a general rule, usury is contrary to “economic morality”, since it enormously enriches the propertied (even those who do not participate in economic life) at the expense of the borrowers who participate in it.

International credit appeared as a specific type of usurious loan under feudalism. It was used mainly to finance wars, crusades and the maintenance of the royal houses of Europe.

Thus, over time, part of the money turns into capital, that is, it becomes money intended for profit.

The desire for profit is precisely what allows for the most efficient use of resources. Prices and profits are tools that help an entrepreneur expand the limits of what he can see, just as binoculars help a soldier, hunter, sailor or pilot.

The market process provides most people with the material and informational resources they need to acquire what they would like to acquire. However, only the theory of marginal utility really explains how demand and supply are determined, how the production volumes of various goods are brought into line with needs, and how the measure of the relative scarcity of goods, established through the process of mutual adjustment in the market, governs the actions of individuals. From now on, the market process is understood as a process of information transfer that allows people to master and put into action a much larger volume of knowledge and skills than what would be available to them individually.

The development of capital subsequently led to the emergence of securities: shares, bonds, bills, i.e. substitutes for money.

Gradually, the forms of capital transformed. In addition to the monetary form of capital, material or property (land, real estate, etc.) and intangible (knowledge, human abilities, etc.) forms appeared.

On the other hand, to perform its functions, the state required material and material resources (food, fodder, etc.) and funds, which it collected in a forced form through various fees and taxes.

To protect against all kinds of unforeseen circumstances (droughts, floods, famine, etc.), commodity producers, merchants and the state needed to create excess reserves of property assets, which led to the emergence of insurance, first in the form of insurance in kind, and then in cash.

This is how national finance and the financial system of the state appeared. Kakovkina T.V. The principle of systematic financial control and the mechanism for its implementation // Finance. 2011. No. 8. .

S.Yu. Witte wrote that from the end of the 18th century. the word “finance” began to mean the entire totality of state property and, in general, the state of the entire state economy . In the sense of the entire totality of material resources at the disposal of the state - its income, expenses and debts - this word is still understood. Thus, the science of finance can be defined as the science of the best ways to obtain material resources by the state and the expedient organization of their expenditure for the implementation of the highest tasks of the state union or, in short, as the science of the ways to best satisfy the material needs of the state.

Consequently, finance and the financial system were created by the very life of man and human society represented by the state as the central social institution.

With the development of the state, the financial system developed and changed.

These changes can be most clearly seen in the history of taxation.

In Ancient Greece (VII-V centuries BC) an excise tax was introduced on city gates. In ancient Rome, there were no taxes on citizens in peacetime. The costs of governing the city were negligible, since the elected masters performed their duties free of charge. Being elected master was very honorable. The city generated revenue primarily from leasing public lands.

In European countries until the 17th century. there was no financial apparatus for determining and collecting taxes. The state determined only the total amount of taxes, which it instructed the city community or tax farmer to collect.

In the 16th century A network of state financial institutions arose that set tax rates and controlled tax collection.

Taxes were collected mainly by the tax farmer, that is, a private individual who received from the state for a specified period the right to collect taxes and other income.

Since the 19th century the state completely assumes the functions of establishing and collecting taxes. The number and types of taxes are constantly changing. The state tax service, tax inspectorates, etc. appear.

Capital transactions take a wide variety of and quite complex forms. Capital enters the external (i.e. international) market and leads to an acceleration of cash flow. The need to manage capital and all cash flow led to the emergence in the second half of the 20th century. financial management as a specific system for managing cash flows, the movement of financial resources and the corresponding organization of financial relations.

With the development of finance, knowledge about it also develops, i.e. the science of finance.

Financial management is the conscious influence of governing bodies on the finances of the country, territories, and economic entities to achieve and maintain balance and stability of the financial system. Financial management includes the management of budgets, extra-budgetary funds, government credit and other parts of the financial system.

Financial management is carried out through a set of measures aimed at the effective functioning of the financial system as a whole and its individual links.

Rice. 1. Personal finance structure

1. Public financial management is one of the main functions of any state, its implementation is carried out through the creation of a financial mechanism adequate to economic conditions. Vostrikova L.G. Financial law: Textbook for universities. - M.: Justitsinform, 2012

The financial mechanism is a system of forms, types and methods of financial relations established by the state. The financial mechanism consists of a set of organizational forms of financial relations, the procedure and methods for the formation and use of centralized and decentralized financial resources, methods of financial planning, financial legislation (including the system of legislative norms and standards, rates and principles that are used in determining government revenues and expenses , organization of the budget system of extra-budgetary funds, enterprise finance, securities market, insurance services, etc.).

Rice. 2. Consumption and savings during the life cycle of an individual Bulatov, S. Economics: A textbook on the course of economic theory / S. Bulatov. - M., 2012.- p. 120.

A person’s participation in the compulsory social insurance system can be considered a special method of insurance. In a number of countries (Germany), employees make insurance contributions to the compulsory social insurance system on a parity basis with employers. In this case, individuals are both policyholders and insured persons.

Three mitigation strategies can be used for the same risk. Thus, the risk of temporary loss of health (illness) and associated expenses can be insured under self-insurance (a person creates a fund of funds for unforeseen expenses). At the same time, he can buy an insurance policy from a medical insurance company as part of voluntary insurance.

When managing personal finances, everyone must find solutions to mutually contradictory problems. This is due, for example, to the fact that an increase in current costs leads to a decrease in savings and undermines long-term financial sustainability. On the contrary, an increase in the savings rate causes a reduction in current consumption. Attracting loans can increase current consumption, which inevitably decreases in the future due to the payment of interest on loans.

1.2 Concept of the financial system

In scientific and socio-methodological literature, there are different approaches to defining the concept of “financial system”. It is predominantly considered either as a “form of organization” or as a “set of organizations”, “set of various financial relations”, set of “institutions and markets”, etc.

Today, there are two points of view regarding the possibility of identifying household finances as an independent object of study in financial science. Some researchers believe that household finance cannot be used as an independent category of financial science and cannot be classified as an element of the financial system, while others consider the use of this category to be quite acceptable.

In particular, among the scientists who do not share the point of view on the possibility of including households in the sphere of financial relations is Professor B.M. Sabanti, although he admits that “household finance” is becoming a common term.

Financial relations at the household level are not imperative, they represent the least regulated area of financial relations, and are determined not by mandatory instructions and methods, but by many (economic, social, psychological, etc.) factors. But, in the opinion of S.A. Belozerova, on this basis, relations regarding the formation of funds of funds, which have a huge impact on the process of development of the national economy, should not be excluded from the field of view of financial science.

A number of financial researchers believe that in the conditions of a modern market economy, the sphere of finance is not limited to relations regarding the formation and use of centralized monetary funds of the state, saying that with the development of commodity-money relations, an increase in the scale of production and the expansion of state activities, financial relations received further development. Bulatov, S. Economics: Textbook for the course of economic theory / S. Bulatov. - M., 2012.- p. 246.

Doctor of Economics, Professor I.D. Matskulyaka notes that one of the main subsystems of finance is the finances of the population or households.

Moreover, some researchers in the field of finance believe that in the second half of the twentieth century, the sphere of financial relations expanded sharply, and today any sector of the economy is permeated with a network of financial relations. These scientists believe that the development of large-scale commodity production, associated with the emergence of national and transnational corporate-type organizations, led to the improvement of ways of mobilizing, using, and distributing funds between various participants in the reproduction process. The movement of funds, separate from the movement of goods, acquires a special place in this distribution process. It is associated both with various forms of credit, and with the distribution and redistribution of the value of the total social product between various economic entities, which is the actual sphere of financial relations. The content of the concept of “household finance” is of undoubted interest.

Personal finance is a system for the formation and use of monetary income of individuals in accordance with their decisions. Individuals make decisions about using income for consumption and savings.

Household finance is a system for the formation and use of monetary income of groups of persons living in the same premises and leading a common household for the purpose of joint consumption and accumulation.

Personal financial assets are part of personal property in the form of cash, shares, bonds and other securities. Personal financial assets and other personal property (real estate, land, cars, yachts) together constitute the individual’s personal wealth.

Personal financial potential is a forecast indicator, which is a monetary expression of the accumulation of human capital.

The terms “household finances”, “population finances”, “family finances” are, according to R.S. Ekshembiev, synonyms.

In the financial system, personal finance plays a special role and is characterized by features that distinguish it from public (state and municipal) and corporate finance.

Firstly, personal finance is primary in relation to public and corporate finance, since the decisions of individuals regarding the use of their monetary savings and human capital determine the pace of economic development and, accordingly, the conditions for the formation of public and corporate finance.

Secondly, personal finance serves as the basis for the development and expansion of public and corporate finance, since the income of production factors - labor and capital, which form added value, are, respectively, fully and partially personal.

Thirdly, personal finances, in contrast to public and corporate ones, are formed at all stages of the distribution and redistribution of income. Gurova T., Kobyakov A. Economics / T. Gurova, A. Kobyakov // Expert. - 2012. - No. 1. - c. 12.

Distribution and redistribution of national income is one of the most complex economic processes. The specificity of this process is due to the interweaving of its individual elements, the presence of several levels, and its cumulative nature.

The first level of this process is the distribution of national income between factors of production and the formation of business income (profit), wages and income from property. This level can be considered the main one. Primary financial relations are formed on it - relations regarding the formation and use of primary income. At the same time, the formation of these incomes themselves occurs as the material embodiment of financial relations. As a result of the distribution of national income between factors of production, the most important macroeconomic proportion is formed between the income of labor and capital, which determines the ratio of consumption and saving (accumulation) and thereby determines the volume of investment in the economic system.

The second level is the formation, with the help of tax and budget systems, of the income of public sector workers (doctors, teachers, officials, military, etc.), as well as public investments. The resources that make up these investments subsequently flow to the private sector through government procurement and construction contracts.

At the same level, simultaneously with the income of public sector workers, the income of persons in the non-material sphere who are not employed at state and municipal enterprises is formed. This category of citizens includes doctors engaged in private practice, lawyers, teachers of private educational institutions, security service employees, etc.

The third level is the territorial redistribution of financial resources in the form of creating budget funds to assist regions and municipalities. The funds from these funds are used to provide financial support to the constituent entities of the Federation and municipalities with low levels of budgetary security - the amount of income per capita. The result of redistribution in this case is the equalization of social payments and guarantees across regions of the country, and, consequently, the income of individuals. Another form of territorial redistribution is the removal of income received in the form of profits from business activities and wages from the regions of their receipt to the regions of permanent residence of the recipients.

The fourth level is the redistribution of income between the living and future generations. It occurs due to the uneven distribution of the tax burden over time. Excess state and municipal borrowings carried out during the life of one generation result in interest payments and correspondingly increased taxes paid by subsequent generations.

The fifth level is the intertemporal redistribution of income within the life cycle (life) of a particular individual. It is associated with the unevenness of consumption at specific stages (phases) of the life cycle, as well as with the need to form savings for the period of disability in old age.

The sixth level is the redistribution of income between two or three living generations of one family. It is carried out in the form of financial assistance from parents to children, their families and grandchildren, as well as assistance from children and grandchildren to parents and grandparents. Such assistance is especially noticeable during economic crises.

The seventh level is the redistribution of the inheritance left by deceased relatives. However, as practice shows, this type of income concerns mainly individuals with high incomes. So, at the end of the 90s of the XX century. 39% of the richest US households received inheritances and only 14% of the poorest.

The eighth level is a change in the value of property and financial assets of individuals as a result of external influences (positive and negative externalities). An example of such redistribution, or more precisely, allocation (location), is the construction of a highway or an airfield near a private house. It is clear that under these conditions the price of the house will decrease. On the contrary, the price of a hotel, restaurant or car parking will increase in such a “neighborhood”. It should be noted that allocation occurs as a result of decisions made in both the public and private sectors.

The ninth level is the redistribution of income as a result of charitable activities of organizations and citizens. Such income plays a significant role for the poorest segments of the population who receive assistance in the form of clothing and food. In developed countries, charitable foundations provide citizens with grants for education or one-time payments for medical services.

In practice, all of the above levels of national income redistribution are mutually intertwined and influence each other. Their separation is possible only for the purposes of theoretical analysis.

Public (state and municipal) finances are formed as a result of the redistribution of income at the first four levels; corporate - at the first level.

Personal finance covers relationships that develop at all nine levels of the redistribution system. The formation of financial assets of individuals is the ultimate goal of these processes. At the same time, it should be noted the unity of the financial system, expressed in the interconnection of public, corporate and personal finance. This unity is based on the objectivity of the existence of public and private goods in the economic system. It is impossible to imagine an economic system in which private goods would not exist, i.e. items of personal consumption and, accordingly, personal (private) property. Just as an economy is unthinkable without the production and consumption of public goods - roads, sidewalks, street lighting, traffic lights, equipped street crossings, fire protection, etc. Gurova T., Kobyakov A. Economics / T. Gurova, A. Kobyakov // Expert. - 2012. - No. 1. - c. 21.

Fourthly, personal finances directly determine the volume of effective demand in the economy.

In the structure of personal finance, a current consumption fund (food, clothing, utilities), as well as a fund for the consumption of durable goods, are formed. Their total volume determines individual effective demand, which is one of the most important factors of sustainable economic development.

Fifthly, in the sphere of formation of personal finances, there is a transformation of personal savings into investments.

One of the important characteristics of a developed economy is the degree to which income exceeds current consumption. In such an economy, individuals provide the bulk of investment through their savings.

Sixth, personal finances are the main indicator of the well-being of the population.

The well-being of the population is determined not only by the total volume of personal financial assets accumulated in the country, but also by the degree of differentiation of personal finances.

personal savings financial investment

2. The concept of personal finance and the relationship with the country’s economy

2.1 Features of personal finance