The foreign exchange market does not include. Currency market. World foreign exchange market

The international exchange of goods, services and capital involves the foreign exchange market in its orbit. Importers exchange national currency for the currency of the country where they buy goods and services. Exporters, in turn, having received export proceeds in foreign currency, sell it in exchange for national currency. Investors, investing capital in the economy of a particular country, feel the need for its currency.

The market in which international transactions with currencies take place is called the international (world) foreign exchange market.

Currently, when making payments in foreign trade, it is necessary to exchange national currency for foreign currency, since there is no single means of payment that could be used as an international means of circulation.

The term “currency” usually refers to all foreign monetary units, securities expressed in them, means of payment, as well as precious metals.

The special market in which foreign currency can be bought or sold is called the foreign exchange market.

The foreign exchange market is a special institutional mechanism that determines relations regarding the purchase and sale of foreign currency, where most transactions are concluded between banks, as well as with the participation of brokers and other financial institutions. At the same time, this is a relationship not only between its subjects, i.e. banks, but also between banks and clients.

The prerequisites for the formation of world markets for currencies, loans, and securities are:

concentration of capital in manufacturing and banking;

internationalization of economic relations;

development of interbank telecommunications.

Foreign exchange markets perform the following tasks:

create conditions for the exchange of national money, provide communication between a huge number of separate national systems;

establish an effective exchange rate;

serve as a source of short-term foreign currency loans and foreign currency liquidity management;

create conditions for managing currency and credit risks, for conducting speculative and arbitrage operations.

Foreign exchange markets ensure the prompt implementation of international payments, the interconnection of world foreign exchange markets with credit and financial markets. With the help of foreign exchange markets, foreign exchange reserves of banks, enterprises, and the state are replenished. The mechanism of foreign exchange markets is used for government regulation of the economy, including at the macro level within a group of countries (for example, the EU).

From an institutional point of view, foreign exchange markets are a collection of exchanges, brokerage firms, banks, various kinds of funds, and corporations.

The foreign exchange market consists of the exchange and interbank markets. Its functions are as follows:

servicing the international circulation of goods, services and capital;

formation of the exchange rate based on supply and demand;

development of a mechanism for protecting against currency risks and the application of speculative capital;

an instrument of the state for monetary and economic policy purposes.

Depending on the volume, nature of foreign exchange transactions and the number of currencies used, foreign exchange markets differ into global, regional and national (local).

World currency markets are concentrated in global financial centers: London, New York, Frankfurt am Main, Paris, Zurich, Tokyo, Singapore, etc. Here, transactions are carried out with currencies that are widely used in global payment turnover, and almost no transactions are made with currencies of regional and local significance, regardless of their status and reliability.

Regional and local markets deal with certain convertible currencies.

Trading on the Russian foreign exchange market takes place mainly through a system of currency exchanges, such as the Moscow, St. Petersburg, Siberian and Asia-Pacific Interbank Currency Exchanges, the Ural Regional Currency Exchange, the Rostov and Nizhny Novgorod Currency and Stock Exchanges, and the Samara Currency Interbank Exchange.

Currently, the over-the-counter interbank foreign exchange market is also actively developing. True, for now it is limited only to Moscow, where the majority of banks are concentrated and the interbank credit market is developed. Its competitive advantages lie in the speed of settlements for foreign exchange transactions and relative cheapness, since the payment of exchange commissions is not required.

As a survey of Russian commercial banks showed, the domestic foreign exchange market is the main one for them both when buying currency and when selling it. At the same time, banks operate equally in both the exchange and over-the-counter markets, without giving particular preference to either one or the other.

To give a more complete structural description of the foreign exchange market, it is necessary to list its participants and consider some of the features of their activities. As a rule, there are three main groups of participants, each of which is not homogeneous in its composition.

The foreign exchange market is predominantly an interbank market. Therefore, its main actors are primarily banks and other financial institutions, which constitute the first group of its participants. They can carry out transactions both for their own purposes and in the interests of their clientele. In this case, participants can work in the market, coming into direct contact with each other, or act through intermediaries. In this category, commercial banks primarily stand out, with a special place in it occupied by the central banks of countries. In addition, various financial institutions play a significant role, such as financial branches of large industrial and financial groups that have entered the world stage. The scale of their activities in the foreign exchange market is constantly increasing, and they have grown especially rapidly in the last decade. For example, large companies operating in any field of production (electronics, aerospace engineering, chemical production, energy, automotive, energy production and processing, etc.) have their own banks or financial divisions operating in the foreign exchange market.

To conduct foreign exchange transactions, large commercial banks have deposits in foreign financial institutions that are their correspondents. At the same time, not all even large banks in Western European countries act as permanent participants in the foreign exchange market.

The first group of participants operating in the foreign exchange market includes central banks. They occupy a special position in this group. First of all, by their status they are not commercial institutions and for this reason alone they differ significantly from commercial banks and other financial institutions. Central banks also have a dealing department within their structure. However, foreign exchange transactions occupy a subordinate place in the activities of central banks, since they serve primarily only as a means of performing basic functions and, as a rule, are not aimed at directly generating income.

In addition, central banks have different types of counterparties and perform different functions. On the one hand, they are guided by the orders of their government (in those countries where the central bank does not enjoy full independence) or participate in the implementation of economic policies agreed with it (in countries where the central bank is more independent). They also coordinate their actions in the foreign exchange market with the policies of central banks of other countries (in particular when conducting foreign exchange interventions) and are guided by the provisions of regulatory documents of international financial organizations.

On the other hand, the function of central banks is to monitor the state of the foreign exchange market and regulate it. First of all, this concerns the exchange rate of the national currency, the adjustment of which in the desired direction is carried out, in particular, through interventions in the foreign exchange market, as well as with the help of foreign exchange reserves of the central bank. In addition, this may also affect the operations of the country's commercial banks and other financial institutions, as well as brokers, who are obliged to unconditionally provide the central bank with relevant information.

The second group of foreign exchange market participants consists of independent brokers and brokerage firms. In addition to conducting their own foreign exchange transactions, they carry out information and intermediary functions, which are closely interrelated. Their information function is that they inform other market participants of the exchange rates at which the latter are willing to make transactions. The intermediary function is that brokers concentrate in their hands orders for the sale and purchase of currencies and provide useful information to bank dealers, which greatly facilitates the activities of the latter. Both individual brokers and brokerage firms have a wide network of correspondents and receive income (brokerage commissions) on each transaction from both the seller and the buyer of the currency.

The authority of a particular broker in the foreign exchange market, as a rule, depends on the scale of its activities, the size and solidity of its clientele, and the names of correspondents are the subject of trade secrets. This practice is of particular interest to some financial institutions that do not want to disclose their position in any currency until a certain point. In general, the activities of brokers help revive business activity and increase the efficiency of the foreign exchange market. At the same time, it should be noted that the role of brokers in this market is gradually decreasing while the share of transactions carried out through an automated dealer network is increasing. Currently, only about 1/3 of the total number of foreign exchange transactions is carried out by brokers.

In the field of foreign exchange transactions, brokerage firms, like banks, have their own structure consisting of departments, each of which works with one or more currencies. Accordingly, within the department, each broker specializes either in spot transactions or deals with transactions for a certain period, focusing on a specific group of correspondents. The largest and most famous brokerage firms in Western Europe are concentrated in London. These are international companies that have representatives or branches not only at London, but also at other currency exchanges

The third group of foreign exchange market participants includes everyone who does not personally carry out transactions with currencies, i.e. those who do not act here directly, but use the services of banks. First of all, these include legal entities (enterprises of industry, trade and other sectors of the economy, some financial non-banking institutions), as well as individuals.

Among the financial non-banking institutions that do not directly carry out transactions in the foreign exchange market themselves are, in particular, pension funds, insurance companies and hedge funds (or hedging companies). Being able to accumulate significant financial resources, they can also operate in international markets and are important participants in the foreign exchange market, acting through intermediaries.

A foreign exchange exchange is an element of the foreign exchange market infrastructure, whose activity consists of providing services for organizing and conducting trading, during which their participants enter into transactions with foreign currency.

On the currency exchange, free purchase and sale of national currencies is carried out based on the exchange rate relationship between them (quotes) that develops in the market under the influence of supply and demand. This type of exchange has all the elements of classical exchange trading.

Quotations on currency exchanges depend on the purchasing power of the currencies being exchanged, which in turn is determined by the economic situation in the issuing countries.

Transactions on foreign exchange exchanges are based on the convertibility of the currencies exchanged for them. Currency convertibility is the ability to exchange monetary units of one country for the currencies of other countries and for internationally recognized means of payment. There are freely convertible, partially convertible and non-convertible currencies.

Freely convertible is the currency of those states in which there are absolutely no restrictions on its exchange for other foreign monetary units. Therefore, according to the terminology adopted by the International Monetary Fund (IMF), such a currency is also called “freely usable” (or “freely convertible”). Among such currencies are primarily the US dollar, the German mark, the Japanese yen, the British pound sterling and the French franc.

Partially convertible currencies are national monetary units of countries that maintain some restrictions in the field of foreign exchange transactions.

Non-convertible, or closed, currencies include the currencies of states where there is a direct ban on currency exchange, which applies to both residents and non-residents.

The direct purpose of currency exchanges is to determine the exchange rate, which represents the value of foreign currency. On the stock exchange as an organized market, the value of the national currency is established during trading. Here, transactions are made in the interests of persons who have funds in foreign currency, received from foreign economic activity and for other reasons, and persons who, on the contrary, need foreign currency for their economic activities, but do not have independent sources of its receipt. Transactions on the export and import of goods, services and results of intellectual activity form the basis for determining the value of the national currency. Thus, the main task of the currency exchange is not to obtain high profits, but to mobilize temporarily free foreign exchange resources, to redistribute them by market methods from one sector of the economy to another, and to establish the actual market rate of national and foreign currencies in conditions of fair and legal trade.

The foreign exchange exchange acts as an intermediary in foreign exchange transactions. In some of the countries where currency exchanges exist, transactions with foreign currency are allowed only through them.

Participants in exchange trading in currencies in most countries are credit organizations, less often - other financial organizations, for example, insurance and pension funds, investment companies operating through brokerage firms.

All currency transactions of trading participants are reflected in the accounts of exchanges, and the exchange in this case acts as a guarantor of settlements.

Thus, the foreign exchange market is a complex structure consisting of a number of interconnected elements.

The foreign exchange market is a set of economic and organizational forms associated with the purchase or sale of currencies of different countries. The foreign exchange market as a system includes a subsystem of the foreign exchange mechanism and foreign exchange relations. The first refers to legal norms and institutions that represent these norms at the national and international level. The second includes everyday communications into which individuals and legal entities enter into for the purpose of carrying out international payments, credit and other monetary transactions aimed at purchasing or selling foreign currency.

The foreign exchange market includes two unequal, but influencing each other parts:

International currency market;

National foreign exchange market.

The first consists of a system of regional markets closely connected by high-speed channel or satellite communications. Currently, there are the following regional markets: European - with centers in London, Zurich and Frankfurt; Asian - with centers in Tokyo, Hong Kong and Singapore; American - with centers in New York, Chicago and Los Angeles. On regional foreign exchange markets, freely convertible currencies and currencies of local national markets are traded. Regional currency markets do not differ from each other in the nature of operations, national ones differ in the degree of convertibility of the national currency, in the volume of foreign trade and foreign exchange transactions, in the degree of integration into the world community, the level of stability and openness of the economy, the level of development of communications and the degree of government regulation foreign exchange transactions.

A special feature of the Russian national currency market is the fact that since the beginning of the 90s, the country has essentially had a dual-currency monetary system, where, along with the Russian ruble, the American dollar circulates. The net import of dollars into Russia amounted to 1 billion in 1994. If we convert this amount into rubles at the current exchange rate, then the volume of cash dollars imported into the country is more than twice the cash ruble supply. Despite the ban on the use of dollars as a means of payment, they appear in settlements between economic agents. Not only small, but also large enterprises accept them as payment for their products and services. The country has essentially created a parallel economy that operates in cash dollars. This circumstance is one of the causes of inflation, because it allows taxpayers to avoid paying taxes to the budget. The government and the Central Bank, unlike other countries, without limiting the nature of operations in the domestic market, are striving to use economic methods to create conditions for the gradual de-dollarization of the economy.

The functioning of the foreign exchange market is associated with the use of a number of economic categories and generally accepted concepts. Let's look at some of them

EXCHANGE RATE is the price of a unit of foreign currency expressed in units of domestic currency. The exchange rate in Russia is expressed in the number of rubles per unit of foreign currency. When the price of a unit of foreign currency in rubles increases, the ruble depreciates (cheaper); when the price of a unit of foreign currency in rubles falls, the ruble rises in price, that is, the rise in price of the ruble corresponds to the depreciation of the foreign currency.

As noted above, the exchange rate is influenced by the state of the country’s balance of payments, the level of inflation, the ratio of supply and demand of freely convertible currency, the competitiveness of a given country’s goods on the world market, political and military factors, as well as a number of other circumstances.

QUOTE is the establishment of foreign currency exchange rates in accordance with established practice and legislative norms. In world practice, there are two methods of quotation.

1. Direct quotation, when one unit of foreign currency is equal to a certain amount of national currency. For example, in Russia 1 US dollar is equivalent to a certain number of rubles, or in the USA 1 German mark is equivalent to a certain number of dollars or cents. This quotation is currently used in most countries of the world community.

2. Indirect quotation, when a unit of national currency is equated to a certain amount of foreign currency. A similar system is used in a small number of countries.

When concluding purchase and sale transactions on the foreign exchange market, the following types of rates are used:

The cross rate is the relationship between two currencies, which is established from their rate in relation to the rate of the third currency. Situations often arise in which it is impossible or unprofitable to directly purchase the foreign currency of interest to the buyer. In this case, cross rates are used.

The spot rate is the price of a unit of foreign currency of one country, expressed in units of the currency of another country and established at the time of conclusion of the transaction, subject to exchange of currencies by correspondent banks on the second business day from the moment of conclusion of the transaction.

Forward (terms rate) is the price at which a given currency is sold or purchased subject to its transfer at some specific date in the future. Thus, when concluding such transactions, the parties try to guess the level of the exchange rate.

If on the date of the transaction the exchange rate differs from that stipulated in the contract, then one party will receive additional profit from the exchange rate difference, and the other will incur losses. For example, in January 1995, an agreement was concluded to purchase currency on December 1, 1995 at the rate of 4,600 rubles per 1 US dollar. However, on December 1, 1995, the rate was 4,800 rubles to 1 dollar, resulting in an additional gain of 200 rubles for every US dollar. If the exchange rate on December 1, 1995 had been set at 4,500 rubles per 1 US dollar, then the loss would have been 100 rubles for every US dollar.

Futures is the rate in the future, that is, the price at which a transaction will be carried out after a certain period of time. It is determined at the time the contract is concluded. For example, a deal concluded in August provides for the exchange rate in October at the rate of 5,100 rubles per dollar, although in August the dollar exchange rate was 4,800 rubles. Before the transaction is executed, a small amount compared to the transaction amount is paid as a guarantee.

Settlements for international transactions between direct participants are carried out through banks, which consider foreign exchange transactions as one of the ways to generate income. In this regard, when quoting banks, they set two exchange rates:

buyer's rate - the rate at which the bank buys currency;

seller's rate - the rate at which the bank sells currency.

To cover the costs of servicing operations and making a profit, there is a difference between these rates, called margin.

CONVERTIBILITY - the ability of a currency to be exchanged for other currencies. This is a very important characteristic of a currency. According to the degree of convertibility, currencies are divided into the following types:

Freely convertible;

Partially convertible;

Non-convertible;

Clearing.

Freely convertible currency (FCC) - freely

and is unlimitedly exchanged for the currencies of other countries

and is used in all types of international payment

th turnover. Currently, only some states

states have freely convertible national

currencies: Austria, Great Britain, Denmark, Canada, the Netherlands, New Zealand, Singapore, Germany, Japan, the United States of America and others. Free convertibility primarily indicates the stability of the country's economy, the possibility of its economic growth and, as a consequence, confidence in its national currency on the part of foreign partners. Some freely convertible currencies are reserve currencies.

Reserve currencies are those that are primarily used for international payments and are held by the central banks of other countries. These include the US dollar, pound sterling, Swiss franc, Japanese yen, and German mark. These five currencies make up almost 100 percent of the world's foreign exchange reserves. The presence of a reserve currency creates additional benefits for the issuing country, allowing it to have a negative balance in the balance of trade and payments for a long time without damaging the national economy, because such currency is not presented for payment in the form of a demand for the supply of goods or other assets, but remains in other countries in the form of reserves.

Partially convertible currency - exchanged for a limited number of foreign currencies and used in international payments with restrictions. The presence of restrictions is due to the instability of the country's economic situation and the imbalance of the balance of payments. Restrictions are imposed by the government or the Central Bank. They consist of the regulation of transactions with currency and currency values. Most countries in the world, including Russia, have partially convertible currencies.

Non-convertible (closed) currency - is not exchanged for other foreign currencies and is used only within the country. Non-convertible currencies are those that are subject to restrictions on import, export, purchase, sale and to which various currency regulation measures are applied.

Clearing currency - settlement currency units that exist only as money of account in the form of accounting records of banking transactions for mutual supplies of goods and provision of services between countries participating in clearing settlements.

Further deepening of economic reform in Russia requires maintaining and improving the free foreign exchange market.

Its formation began under conditions of a state monopoly on foreign trade, unsatisfied consumer demand, including for imported goods, rapidly accelerating inflation and the absence of a legislative framework for conducting transactions with foreign currency. At the same time, economic and political instability stimulated legal entities and individuals to transfer their ruble assets into dollar ones.

At the very beginning of inflation, these factors led to a high initial demand for foreign currency, which did not correspond to its supply. As a result, the exchange exchange rate was almost 50 times higher than the real one, that is, reflecting purchasing power. As the foreign exchange market develops and domestic prices rise due to inflation, this gap is narrowing and currently the exchange exchange rate exceeds the real one by approximately three times.

Thus, in the first quarter of 1995, the exchange rate of the dollar in rubles averaged 1:4200. According to calculations by the expert institute of the Russian Union of Industrialists and Entrepreneurs, the parity purchasing power of the Russian ruble in relation to the American dollar at the cost of a consumer basket of 265 items of goods and services in the first quarter of 1995 was in the ratio of 1:1300. As can be seen from the information in the newspaper “Financial News” (February 26, 1995), the real exchange rate of the ruble increased from January to September 1995 by 60 percent. This is due to rising prices and rising costs of domestic production, but did not have an impact on the cost of functioning fixed and working capital.

Until the exchange and real rates match and the revaluation of fixed and working capital is achieved, it seems advisable to apply a special rate for foreign investments. At the same time, ruble funds received by foreign investors during the exchange of foreign currency at a special rate could be used for the acquisition of Russian assets by a foreign investor.

The potential of the Russian foreign exchange market is evidenced by calculations of the European Bank for Reconstruction and Development (EBRD), according to which foreign currency savings of Russian enterprises and individual citizens amounted to more than 43 billion US dollars in mid-1995. Of these, about 10 billion are kept in the form of deposits in foreign currency accounts in Russian banks; more than 15 billion - withdrawn from circulation and kept in the hands of the population; over 18 billion left Russia, moving to accounts in foreign banks.

The procedure for the functioning of the foreign exchange market in Russia, the powers and functions of currency regulation and currency control bodies, the rights and obligations of legal entities and individuals in relation to the possession, use and disposal of currency values, responsibility for violation of currency legislation are determined by the Law of the Russian Federation “On Currency Regulation and Currency Control” ", adopted by the Supreme Council of Russia in 1992. The law and regulations issued on its basis provide that all payments in foreign currency are carried out only through authorized banks, that is, banks licensed by the Central Bank to carry out foreign exchange transactions.

Licenses obtained by commercial banks are divided into general, internal and extended internal.

A GENERAL LICENSE gives a commercial bank the right to the following actions:

Conducting a wide range of banking transactions in foreign currency both in Russia and abroad;

Formation of part of its authorized share capital in foreign currency at the expense of Russian, foreign and international enterprises and organizations;

Creation of reserve, insurance and other funds from

profits in foreign currency;

Participation in the creation of banking institutions in Russia and abroad as a founder or shareholder using foreign currency for these purposes;

Opening of its branches and representative offices abroad.

An INTERNAL LICENSE grants commercial banks the right to carry out a full or limited range of banking operations in foreign currency only on the territory of Russia. Under this license, the bank can carry out the following banking operations:

Opening and maintaining accounts in foreign currencies for legal entities and individuals (residents and non-residents), as well as ruble accounts for non-residents;

Carrying out correspondent relations with Russian banks that have a general license from the Central Bank;

Organization, through banks with a general license, of settlements related to export-import operations of bank clients in foreign currencies in the form of a documentary letter of credit, collection, bank transfer, as well as in other forms used in international banking practice;

Foreign exchange services for legal entities and individuals, including the purchase and sale of foreign currencies in accordance with current legislation;

Attracting and placing funds in foreign currency of legal entities in the form of loans, deposits and other forms, as well as issuing guarantees in favor of bank clients within the limits of the bank’s own funds in foreign currencies.

An extended domestic license gives a commercial bank the right to carry out the same operations in Russia as with a domestic license, but, in addition, gives the right to open a limited number of correspondent accounts in specific foreign banks.

To obtain a license of any of the listed types, a commercial bank submits to the CBR a set of documents, the content and procedure for execution of which are regulated by separate instructions.

The main functionaries of the foreign exchange market are commercial banks that have the appropriate license. They are called authorized banks and carry out the following operations:

Purchase and sale of foreign currency at the expense of

the bank's own funds and at the expense of servicing funds

my clientele;

Payments in foreign currency related to the export of goods and services, as well as various types of non-commodity transactions;

Establishment of correspondent relations with other Russian authorized and foreign banks;

Passive and active transactions in foreign currency;

Deposit and conversion transactions in international money markets;

Exchange of foreign currency for ruble and ruble for foreign currency for the population;

Transactions with checks and other securities in foreign currency.

As an example, let us consider the activities in the foreign exchange market of two large Russian banks - St. Petersburg and Mosbusinessbank. 1,150 clients, including 680 enterprises and organizations and 470 individuals, keep their funds in foreign currency accounts opened at Bank St. Petersburg. All international payment transfers are carried out using the SWIFT system. Bank Saint Petersburg is the most active user of this

a generally recognized international financial telecommunications system. Connecting to it allowed the bank to ensure reliability and confidentiality of operations, control over their implementation, efficiency in making payments and a relatively low cost of services. Thanks to the connection to the international system of interbank communications, international payments were fully automated and the costs of making currency transfers were significantly reduced.

The Bank introduced two of the most advanced dealing systems, which ensured the conduct of relevant operations on international foreign exchange markets. Currently, the bank is one of the largest users of the Reuters system (“REUTER”). The efficient work of dealers has secured Bank Saint Petersburg's leadership among regional banks in the foreign exchange market.

The bank became the first market maker in St. Petersburg, that is, an intermediary providing Russian banks with information on currency quotes on the international foreign exchange market. The presence of “clean” forex lines abroad and the ability to conduct “Swap” operations provided the bank with cheap foreign exchange resources throughout 1994. The volume of conversion transactions increased to 40-50 million US dollars per day.

In 1994, Bank St. Petersburg, together with the largest banks in Moscow, began to conduct operations on the derivatives foreign exchange market within the country, intensifying its participation in the formation of this market. In 1994, currencies worth more than 40 million US dollars were sold and purchased under forward and option contracts.

Before the introduction of the currency corridor, one of the main types of transactions in terms of volume and level of profitability was the purchase and sale of non-cash currency in the domestic market of Russia. In addition to the purchase/sale of currencies circulating in over-the-counter circulation, Bank St. Petersburg conducted transactions on the three largest Russian currency exchanges: Moscow, St. Petersburg and Siberian. In 1994, the bank was especially active in its exploration of the Siberian foreign exchange market: the volume of purchases and sales of currencies on the Siberian International Interbank Currency Exchange for the year amounted to 27.4 million US dollars and 4.2 million German marks.

The emergence of new independent states on the territory of the former USSR, the introduction by some of them of their own national currencies while maintaining traditional trade and economic ties with Russia, stimulated the development of transactions with new, “soft” types of currencies. The bank has taken a leading position in the city in working with currencies of the CIS countries and neighboring countries.

In 1994, the bank significantly increased the volume of banknote transactions carried out. The wide opportunities that the bank currently has make this sector of the foreign exchange market one of the main sectors in the structure of the income portfolio. All bank branches and exchange offices accept traveler's checks and credit cards for payment.

Enterprises and organizations, regardless of their form of ownership, including enterprises with foreign capital, carry out the mandatory sale of 50 percent of foreign exchange earnings from the export of goods (works, services) in the domestic market of the Russian Federation through authorized banks on interbank currency exchanges. The mandatory sale of 50 percent of foreign exchange earnings can also be carried out in addition to the exchange on the interbank foreign exchange market. It is carried out as follows.

Receipts of foreign currency in favor of enterprises and organizations, including proceeds from the sale of goods (works, services) for foreign currency in Russia, are credited to accounts in authorized banks. In this case, two accounts are opened simultaneously:

Transit currency account for crediting receipts in foreign currency in full;

Current foreign exchange account for crediting funds in foreign currency after the mandatory sale of part of the export proceeds. In case of receipt of export proceeds in favor of the client, the authorized bank informs him about this.

The client is obliged to give instructions to the bank within seven days for the right to sell currency on one of the interbank currency exchanges. If such an order is not received within fourteen days, then the bank, over the next seven days, independently carries out the mandatory sale of 50 percent of the foreign currency received in the transit account at auction on one of the interbank currency exchanges at the rate valid at the time of sale.

The amount of revenue in foreign currency of enterprises and organizations exporting goods (works, services), subject to mandatory sale, is determined on a “Net” basis, that is, minus foreign exchange costs for transportation, insurance and freight forwarding, as well as payment of export customs duties in foreign currency and payment for customs procedures.

As noted above, banks licensed to conduct foreign exchange transactions carry out the sale and purchase of foreign currency. However, in order to reduce risks and minimize the impact of speculative transactions in foreign exchange markets, banks are set appropriate limits - the so-called open position of selling and purchasing currency on their own behalf and at their own expense. The limit of an open currency position is determined by the Central Bank based on the end of the working day of the authorized bank. Its size is calculated as the difference between the amount of foreign currency purchased by the bank at its own expense starting from January 1 of the reporting year, and the amount of foreign currency sold by the bank at its own expense during the same period of time. The limit is set depending on the size of the bank's own funds. Thus, a bank with a capital of 1 to 5 billion rubles in 1994 had a limit of 500 thousand US dollars, and with a capital of 5 to 10 billion rubles, the limit was 1 million US dollars. For authorized banks with own funds (capital) over 10 billion rubles - according to the individual standard established by the Department of Foreign Operations of the Central Bank.

In 1995, the limit on the open foreign exchange position was significantly reduced: the calculation does not include transactions for the purchase and sale of cash foreign currency for rubles, usually carried out by exchange offices. Compliance with the open currency position of commercial banks is controlled by the Main Territorial Directorates of the Central Bank. If the limit on an open currency position is exceeded, the following measures are applied to banks that have committed such violations in accordance with current legislation:

Collection of a fine;

Suspension of the bank’s right to maintain an open currency position;

Petition to the Central Bank for revocation of the license for the right to carry out transactions in foreign currency.

Thus, in the first half of 1995, the Central Bank Directorate in Moscow collected fines from nine authorized banks and suspended the right to conduct foreign exchange transactions from two banks.

Considering that the Russian currency is limitedly convertible, to characterize the rights and obligations of foreign exchange market entities, it is important to divide market participants into two groups. One includes residents, the other includes non-residents. The first category includes individuals permanently residing in Russia, as well as those temporarily located outside its borders. Residents also include legal entities and organizations created in accordance with Russian legislation and not having such status, including their representative offices abroad. The second group includes individuals permanently residing abroad, including those temporarily staying in Russia. This even includes legal and non-legal entities, as well as their representative offices and companies created in accordance with the laws of a foreign state and operating on the territory of Russia.

When considering the rights of participation of residents and non-residents in operations on the Russian foreign exchange market, it is necessary to keep in mind that all operations related to the movement of foreign currency are divided into two types - current and related to the movement of capital.

Current operations include:

Transfers to or from Russia of foreign currency for making settlements without deferred payment for the export and import of goods, works and services, as well as settlements related to lending for export-import transactions, for a period of no more than 180 days;

Receiving and providing financial loans for a period of no more than 180 days;

Transfers to and from Russia of interest, dividends and other income on deposits, investments, loans and other operations related to the movement of capital;

Non-trade transfers to and from Russia, including transfers of wages, pensions, alimony, inheritance, as well as other similar transactions.

Foreign exchange transactions related to capital movements include:

Direct investments, that is, investments in the authorized

capital of enterprises for the purpose of generating income and semi

understanding the rights to participate in the management of the enterprise;

Portfolio investment, i.e. acquisition

valuable papers;

Transfers in payment for buildings, structures, and other property, including land and its subsoil, classified as real estate under the legislation of its location;

Providing and receiving deferred payment for exports and imports for a period of over 180 days, as well as providing and receiving financial loans for the same period.

Current foreign exchange transactions are carried out by residents, as a rule, without any restrictions. Residents have the right to freely buy and sell purchased currency on the domestic foreign exchange market through authorized banks.

Customs control rules allow the import of foreign currency into Russia in any amount. Export of foreign currency from the country in excess of the established limit (more than 500 US dollars) is allowed only with the appropriate permission from the authorized bank.

Non-residents have the right:

Without restrictions, transport, import and send currency valuables to Russia in compliance with customs rules;

Buy and sell foreign currency for Russian currency, transfer and send it from Russia in accordance with the legislation of the Russian Federation.

For example, foreign currency can be exported from Russia without restrictions if it was previously imported and it was formalized in accordance with the requirements of customs rules. Non-residents have the right to pay remuneration for labor in foreign currency only to non-residents.

A two-level foreign exchange market has developed and operates in Russia. The first level is the exchange interbank foreign exchange market. Operations here are carried out through the intermediation of currency exchanges, through whose accounts all foreign exchange transactions between banks take place and which act as guarantors of settlements. Regular transactions with large quantities of currencies are carried out here. Bidders are authorized commercial banks. The exchange rate formed in this market is the most representative: all other participants in the foreign exchange market are guided by it. The second level is the over-the-counter market. It carries out transactions directly between banks, as well as between banks and their clients. All risks for these operations are borne by the banks themselves.

The dominant role in the Russian foreign exchange market belongs to currency exchanges. The main one among them is the Moscow Interbank Currency Exchange (MICEX). In addition, there are five more currency exchanges operating in Russia.

The dollar exchange rate at trading on regional currency exchanges deviates slightly from the rate on the Moscow Interbank Currency Exchange.

The difference in exchange rates opens up the possibility of arbitrage operations. The volume of transactions on the foreign exchange market in 1994 compared to 1993 increased significantly: for example, the trading turnover of the St. Petersburg Exchange Exchange doubled in foreign currency and quadrupled in ruble equivalent.

In 1994, 29 billion US dollars and almost 3 billion German marks were sold on Russian exchanges, and the entire turnover of the exchange and over-the-counter markets, taking into account interbank foreign exchange turnover, is estimated at 83 million dollars and about 8 billion German marks. In addition, turnover in other currencies and currencies of the CIS countries increased sharply. At the same time, the development of the Russian foreign exchange market is characterized not only by volume parameters. Its most important qualitative changes include the following:

Thanks to the adopted regulations, regulated

those that contribute to internal currency turnover and foreign economic

economic activity, the foreign exchange market takes on features

meeting international standards and requirements;

A mechanism for self-development of the currency exchange is being formed

market, due to the fact that in relations between participants

Competition has become more and more active in the market.

At the same time, their voluntary associations are created,

developing general, not regulated by the state

Thanks to the active participation of the Central Bank in operations on the foreign exchange market in the form of regulating the dynamics of the exchange rate, the impact on it of random, unpredictable factors is reduced;

The development of Russia's foreign economic relations determines the further intensification of foreign exchange turnover and an increase in its liquidity;

The communication system is being improved and trust between market participants is growing. This facilitates the integration of markets operating in different regions of the country into a single system.

As an example of organizing the activities of an exchange in Russia, let us consider the procedure for conducting transactions on the Moscow Interbank Currency Exchange. The ruble exchange rate in US dollars fixed on this exchange is the official exchange rate of the Central Bank and is used to implement currency regulation and control, as well as to calculate the cross rate of other foreign currencies.

Trading on the exchange is carried out using the “fixing” method, which has proven its simplicity and effectiveness, as well as a high degree of protection of the interests of all trading participants. Before the start of trading, participating banks submit applications to the exchange broker indicating the amounts they offer for the purchase or sale of foreign currency. The preliminary application includes the amount of purchase or sale of foreign currency at a rate not higher (for purchase) and not lower (for sale) fixed at the previous auction. The minimum amount for purchasing or selling currency (lot) is 10 thousand US dollars, 10 thousand German marks, 10 million karbovanets, 1 million tenge, 10 million Belarusian rubles, etc. All amounts specified in preliminary and additional applications must be multiples of the minimum lot. The last fixed rate is used as the initial foreign currency exchange rate to the ruble.

Having accepted applications from all participants, the broker announces the beginning of the next exchange session and announces the amounts of orders for purchase and sale (initial demand and supply) corresponding to the specified rate, as well as the difference between them. From this moment on, bidders, through their dealers, can submit additional applications to change the purchase or sale amount. However, these changes are made only in such a way as to reduce the difference between supply and demand. If demand exceeds supply, the dealer has the right to either add currency for sale, or withdraw his order (or part of it) to buy currency. The opposite situation occurs when supply is greater than demand. If the total supply of foreign currency at the beginning of trading exceeds the total demand for it, then the exchange broker lowers the exchange rate against the ruble. Otherwise, he announces a depreciation of the ruble. The minimum step in changing the exchange rate is officially considered to be one ruble, but in reality, to speed up trading, a step of up to 20 rubles is most often used.

The step size is determined by the exchange broker depending on the market situation and dealer activity. As soon as demand equals supply, the broker announces a “fixing” and the exchange session ends. All settlements between trading participants are made at the rate and within the framework of those orders that were recorded at that moment. Thus, there is no selling or buying rate on the exchange: the currency is bought and sold at one price fixed at the end of trading.

Settlements between trading participants and the exchange occur no later than on the second business day after trading. During settlements, the exchange deducts a commission from participants. Each currency has its own settlement procedure based on trading results. For example, payments in rubles for transactions with US dollars are made through the CBR cash settlement center in Moscow. For this purpose, trading participants also open their correspondent accounts in rubles with the RCC, which speeds up settlements. Payments in dollars for transactions in US dollars concluded at auctions in Moscow are made in the United States through the Bank of New York. Between him. and the MICEX have an agreement on conducting relevant operations.

Trading participants open their correspondent accounts in US dollars with US banking institutions that are members of one of the interbank clearing systems. Bidders who do not have accounts with US banking institutions may settle their trades in US dollars through other bidders who do have such accounts. A trading participant carrying out settlements on behalf of other participants is obliged to provide to the interbank exchange a written guarantee that he will fulfill all obligations in US dollars arising from the results of exchange trading for those participants for whom he performs settlements.

After the completion of exchange trading, transactions concluded on them are formalized with exchange certificates, which record the obligations of the exchange and trading participants to each other. To participate in trading as net buyers, member banks of the exchange must first transfer funds in rubles sufficient to purchase currency to its account at the RCC. Based on exchange certificates, trading participants issue payment orders for the transfer of funds in US dollars in favor of the exchange within a time frame that ensures timely crediting of funds to its account at the Bank of New York. Funds in US dollars are debited from the correspondent accounts of trading participants and credited to the exchange account on the first business day (including holidays in the USA) after the day of exchange trading. To do this, the exchange issues payment orders for the transfer of funds in rubles in favor of sellers

currencies. The exchange gives orders in foreign currency in favor of buyers. Based on such instructions, money is credited to the corresponding correspondent accounts of sellers or buyers.

Funds in dollars are debited from the exchange's account at the Bank of New York on the second business day after trading (including holidays in the United States). During the same period, dollars are credited to correspondent accounts of Russian purchasing banks opened with the same bank. If the participant’s dollar correspondent account is located in another foreign bank, then the money is credited within the time limits established by the relevant banks. If trading participants violate their obligations to the exchange, a system of fines and temporary suspension from participation in trading is provided. In case of prolonged or systematic violations of obligations, a trading participant may be expelled from the exchange membership.

The prospect for the development of the Russian foreign exchange market is associated with the formation of an over-the-counter interbank foreign exchange market. Currency exchanges, having played their role in the formation and development of the foreign exchange market, will eventually lose their dominant importance. In 1994, the share of foreign exchange transactions in the US dollar accounted for 34 percent of turnover, and in the over-the-counter market - 66 percent, in trading in the German mark - 37 and 63 percent, respectively. According to the Prime news agency, in mid-1995, 45 banks carried out transactions on the over-the-counter market in Moscow alone, their turnover amounted to $1 billion per day

The active development of the over-the-counter foreign exchange market in the future is due to the following circumstances. Until 1995, exporters were required to sell 50 percent of foreign exchange earnings only through the exchange. In 1995, they were granted the right to conduct this sale on the over-the-counter market, which would entail an outflow of currency from the exchange market. Already in 1994, many enterprises that sold currency in excess of the mandatory sale limit did not use the services of the exchange for the following reasons:

Banks' trust in each other has increased;

Foreign exchange transactions carried out without intermediaries reduce circulation costs and speed up settlements.

One of the necessary conditions for the development of the over-the-counter foreign exchange market is to increase the role of the Central Bank as the organizer and controller of foreign exchange transactions. The current situation in the foreign exchange market has been criticized by practitioners and scientists. The question of the role of state regulation of operations in the foreign exchange market and the choice of the ruble exchange rate model - regulated, free-floating, fixed - is being discussed.

The state of the foreign exchange market and possible ways to overcome the negative phenomena existing here were studied at the Institute of World Economy and International Relations of the Russian Academy of Sciences (IMEMO RAS). The research results are presented in articles by Academician SM. Borisov, published in a number of issues of the newspaper “Economy and Life” for 1995. He notes that the law on currency regulation, in accordance with which the internal convertibility of the ruble was introduced, provided for a limited range of current foreign exchange transactions and transactions related to the movement of capital, and the latter requires permission from the Central Bank. Thus, it is meant that in the foreign exchange market there will be a sale and purchase of foreign currency for rubles to service real economic transactions and, above all, those related to foreign trade.

In practice, currency exchanges have withdrawn themselves from selecting foreign exchange transactions based on these criteria. They accept for execution any applications for the purchase and sale of currency from commercial banks participating in the auction, which in turn do not control the division of foreign exchange transactions into current and capital. Consequently, in violation of the Law, in both exchange and interbank transactions, any transactions involving the exchange of ruble funds for foreign currency, including purely financial transactions involving the transfer, are carried out without hindrance. transfer of money from one area to another, as well as speculative sale and purchase of currency in order to profit from exchange rate fluctuations. Numerous exchange offices operating in cash foreign currency operate in the same practically uncontrolled regime.

As a result, the entire infrastructure of the domestic foreign exchange market (currency exchanges, authorized commercial banks, exchange offices), which should serve only real foreign economic transactions, has in fact largely turned into an intermediary ensuring the free circulation of unproductive and speculative capital between the ruble and monetary spheres.

Calculations made at the IMEMO of the Academy of Sciences show that, for example, in 1993, out of the total amount of foreign currency sold on the Russian foreign exchange market, in the amount of 15 billion dollars, only 8 billion were intended to pay for import purchases, and the remaining 7 billion . dollars went to replenish the foreign exchange funds of private commercial structures and moved to Western banks.

In this regard, it seems advisable to strengthen the role of state regulation of operations in the foreign exchange market. This does not mean a return to the state currency monopoly that took place in the past, but a transition to a system of state regulation that other countries use in crisis situations in the economy. Given the current economic and political situation in Russia, the need for the gradual implementation of separate but interconnected measures is obvious. These, in particular, could include:

Strengthening government control over the activities of participants in the exchange and over-the-counter foreign exchange markets in order to comply with laws on foreign exchange transactions under all conditions;

Changing the official exchange rate policy, first by establishing a more reasonable exchange rate relationship between the ruble and foreign currencies, taking into account quotes from regional currency exchanges and the over-the-counter market, and then by moving to a regulated fixed rate;

Increasing the role of the ruble in international payments and the transition to its external convertibility, which would be important for attracting foreign investment;

Displacement of the dollar from economic and monetary circulation within the country by limiting and then stopping its circulation;

Carrying out a restrictive policy regarding the admission of commercial banks to carry out foreign exchange transactions, by concentrating such operations in a relatively small number of the largest banks, working in close cooperation with the Central Bank and ensuring the implementation of a unified monetary policy.

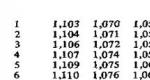

Some of these measures are debatable, but their application is possible in conditions of reducing inflation, equalizing domestic and world price levels, growing industrial and agricultural production and the production of competitive products. At present, participation in operations on the foreign exchange market significantly affects the structure of the balance sheets of commercial banks. Investments in foreign currency reach an impressive proportion of total assets, in many cases exceeding the relative size of loans provided to enterprises. The share of foreign currency liabilities is comparable to the share of balances on current accounts and deposits of enterprises. This is confirmed by the data presented in table No. 22.

It is noteworthy that in nine out of ten banks considered in table No. 22, the share of foreign currency assets exceeds the share of corresponding liabilities. The same situation has developed in almost all Moscow banks. The structure of assets and liabilities of their consolidated balance sheet indicates that the largest share in the balance sheet currency is occupied by foreign currency and settlements on foreign transactions. Accordingly, the share of these

funds in the asset balance is 45.3 percent, and in liabilities - 41.5 percent. This indicates the priority of operations in the foreign exchange market in comparison with industrial lending operations.

The current trend, although caused by objective reasons independent of banks, should be regarded as negative. A reduction in inflation rates, stabilization of the economy and the introduction of restrictions on the amplitude of exchange rate fluctuations will inevitably lead to a reorientation of banks from the foreign exchange to the credit market in terms of providing loans to the real sector of the economy.

Currency market - is a system of stable economic and organizational relations associated with transactions of purchase and sale of foreign currencies and payment documents in foreign currencies.

Foreign exchange markets can be classified according to the following criteria:

By type of operation . For example, there is a global market for conversion transactions (in it one can distinguish segments of conversion transactions such asEurodollaror dollar/yen), as well as the global market for credit and deposit transactions.

By territorial basis . It is customary to distinguish the following large markets: European, North American, Asian. They include large international monetary and financial centers: in Europe -London,Zurich,Frankfurt am Main,Parisetc.; in North America -NY; in Asia -Tokyo,Singapore,Hong Kong. We can talk about the existence of national currency markets (for example, the internal currency market of the Russian Federation), which are characterized by certain currency restrictions on the purchase, sale,lendingand making payments in foreign currency.

How the intersection of territorial markets and markets by type of transaction. For example, it is legitimate to talk about the existence of a European dollar marketdepositsor the Asian euro/Japanese yen conversion market.

foreign exchange market participants:

The main participants in the foreign exchange market are:

- Private individuals . Citizens carry out a wide range of operations, each of which is small, but in total they can create significant additional demand or supply: payment for foreigntourism; money transfers of wages, pensions, fees; purchases/sales of cash currency as a store of value;speculativecurrency operations.

Central banks . Their function is to manage governmentforeign exchange reservesand ensuring exchange rate stability. To implement these tasks can be carried out as directcurrency interventions, and indirect influence - through regulation of the levelrefinancing rates, reserve standards, etc.

Commercial banks . They spend the main volumeforeign exchangeoperations. Other market participants hold accounts in banks and carry out through them the conversion and deposit and credit operations necessary for their purposes. Banks concentrate the aggregate needs of commodity and stock markets in currency exchange, as well as in attracting/placing funds. In addition to satisfying customer requests, banks can conduct operations independently at their own expense. carrying out foreign trade operations . Total requests from importers form a stable demand for foreign currency, and from exporters - its supply, including in the form of foreign currency deposits (temporarily free balances in foreign currency accounts). As a rule, firms do not have direct access to the foreign exchange market and conduct conversion and deposit operations through commercial banks.

International investment companies, pension And hedge funds, Insurance companies . Their main task is diversified asset portfolio management, which is achieved by placing funds insecuritiesgovernments and corporations of various countries. At the dealerslangthey are simply called funds.funds ). This type can also include largetransnational corporations making foreign industrial investments: creating branches, joint ventures, etc.

Currency exchanges . In a number of countries, national currency exchanges operate, the functions of which include the exchange of currencies for legal entities and the formation of a market exchange rate. The state usually actively regulates the level of the exchange rate, taking advantage of the compactness of the local exchange market.

Foreign exchange brokers . Their function is to bring together the buyer and seller of foreign currency and carry out conversion or loan-deposit operations between them. For their intermediation, brokerage firms charge a brokerage commission as a percentage of the transaction amount. But the amount of this commission is often less than the difference betweenloan interestbank and the bank deposit rate. Banks can also perform this function. In this case, they do not issue a loan and do not bear the corresponding risks.

Foreign currency purchase and sale transactions are carried out, firstly, between two authorized banks (this means that the Central Bank has issued them a license to conduct banking operations in foreign currency), and secondly, by clients of the bank, entering into a relationship with it (the bank).

It is prohibited to carry out transactions for the purchase and sale of foreign currency bypassing banks.

Based on the legal status of participants in the foreign exchange market, both banks (counterparties) and clients, a distinction is made between residents and non-residents.

Residents - these are individuals permanently residing on the territory of the Russian Federation, and legal entities created in accordance with the legislation of the Russian Federation and located on the territory of the Russian Federation.

Non-residents - these are individuals permanently residing abroad and legal entities created in accordance with the laws of a foreign state and located on its territory.

The foreign exchange market operates in two areas:

- transactions are made on the foreign exchange exchange;

- transactions for the purchase and sale of foreign currency are carried out on the interbank foreign exchange market, when banks enter into relationships bypassing the exchange.

The functions of the foreign exchange market show the importance of the foreign exchange market for the economy:

servicing international turnover (payments) of goods, works, services;

the foreign exchange market forms the exchange rate under the influence of supply and demand;

the foreign exchange market acts as an instrument of the state (Central Bank of the Russian Federation) for conducting monetary policy;

The foreign exchange market acts as a mechanism to protect economic entities from currency risks and speculative transactions.

Onforeign exchange market a wide range of operations are carried out on foreign trade settlements, tourism, capital migration, insurance of foreign exchange expenses, diversification of foreign exchange reserves and the movement of foreign exchange liquidity, various measures of foreign exchange intervention are carried out, purchase and sale are carried out, exchange of foreign currency, checks, bills, cash settlements related to foreign trade, foreign investment, tourism, etc.

The main subjects of the foreign exchange market are large transnational banks and exchanges. The role of certain currencies onforeign exchange market determined by their place in international economic relations. Most of the transactions are in US dollars, etc. for German marks, British pounds sterling, Japanese yen, French and Swiss francs. Recently, international means of payment - ECU, SDR - have also been included in circulation. Territorial foreign exchange markets are usually tied to large banking and currency exchange centers (London, Paris, New York, Singapore, Tokyo, Frankfurt am Main, etc.)

In recent years, the Forex currency market (FOREX) has become very popular in Russia.

The foreign exchange market of the Russian Federation can be represented as follows:

- – from a functional point of view, the foreign exchange market ensures the timely implementation of international payments, insurance against currency risks, diversification of foreign exchange reserves, foreign exchange intervention, and generation of income in the form of differences in exchange rates;

- – from an institutional point of view, the foreign exchange market is a collection of authorized banks, investment companies, exchanges, brokerage houses, foreign banks carrying out foreign exchange transactions. Authorized bank is a commercial bank that has received a license from the Bank of Russia to conduct currency transactions;

- – from an organizational and technical point of view, the foreign exchange market is a set of telephone, telegraph, electronic and other communication systems that connect banks of different countries, carrying out international payments and other foreign exchange transactions.

Foreign exchange markets can be classified according to the following criteria (Fig. 4.1):

- – by area of distribution;

- – attitude towards currency restrictions;

- – types of exchange rates;

- – degree of organization.

By distribution area, those. by the width of coverage, we can distinguish international And interior currency markets. In turn, both the international and domestic markets consist of a number of regional markets, which are formed by financial centers (exchanges, banks) in certain regions of the world or a given country.

International currency market This is a system of monetary relations within the world community, secured by interstate agreements.

It contains the following elements;

- – functional forms of world money (previously – gold, currently – reserve currencies);

- – regime of mutual convertibility of currencies;

- – regulation of the components of international currency liquidity (i.e., the components of the country’s gold and foreign exchange reserves, which currently are reserve currencies, gold, SDRs and the reserve position in the IMF);

- – regulation and unification of forms of international payments;

- – interstate institutions that regulate currency relations within the world community;

- – a network of international and national banks carrying out international settlements and credit operations.

The main goal of the world monetary system is to ensure the effective development of international economic relations, primarily international trade.

Rice. 4.1.

Regional foreign exchange market consists of almost the same elements and pursues the same goal as the world monetary system, but within the region, and not the world community as a whole.

International currency market – Forex (Foreign exchange market) is a chain of closely interconnected systems of cable and satellite communications of the world regional currency markets. There is a flow of currency between them depending on current information and forecasts regarding the possible position of individual currencies. Currently, the following global regional currency markets are distinguished: Asian (with centers in Tokyo, Hong Kong, Singapore), European (with centers in London, Frankfurt am Main, Paris), American (with centers in New York, Chicago, Los Angeles).

On these markets, not all currencies are usually quoted, but only those most used by participants in this market, i.e. local currencies and a number of leading freely convertible (reserve) currencies. The main currencies that account for the bulk of all market transactions Forex, Today the US dollar, euro, Japanese yen, British pound sterling and Swiss franc are recognized.

The international foreign exchange market is characterized by high liquidity: trading turnover on it has increased over the past three years by 65% and reached an average volume of $3.2 trillion per day. Therefore, investors can carry out large transactions at any time, and they will not have problems finding counterparties. It is important that players are dispersed all over the world and currency trading takes place around the clock from Monday to Friday.

Market Forex unites all the many participants in foreign exchange transactions: banks and central banks, investment institutions, firms, individuals.

It should be noted that significant changes in exchange rates occur over a fairly long period of time. Thus, over six years, the American dollar fell in price relative to the euro by 53%, and over the same period, shares of Sberbank of Russia increased in price by 116 times. However, on Forex It is possible to use leverage when the broker lends funds to the client in a ratio of 1: 100 or more. If the exchange rate changes in the “right” direction by just 0.1%, you can earn as much as 10%. Another advantage that leverage gives is a low amount of entry into the market. Many companies allow those with less than $1,000 to participate in currency trading.

High leverage is fraught with danger. If the rate moves in the “wrong” direction, then the trading participant’s loss will accrue catastrophically quickly.

Domestic foreign exchange market – these are currency relations in any country, enshrined in national legislation. It includes:

- – national monetary system;

- – mode of its convertibility;

- – exchange rate regime;

- – national market regime (types of applied currency restrictions or their complete absence);

- – regulation of the country’s international liquidity (i.e. its gold and foreign exchange reserves, which are a source of repayment of external debt);

- – national institutions that carry out currency regulation in the country.

The domestic foreign exchange market allows the country to integrate into the system of world economic relations, ensure the stability of the national currency and, to a certain extent, protect the domestic market in the context of economic globalization.

Russia's entry into the IMF in April 1992, which today includes 184 states, indicates that Russia has entered the international currency market. Membership in the IMF allowed Russia to receive stabilization loans to cover the budget deficit and maintain the national currency. According to the Russian Ministry of Finance, a total of about $22 billion was received from the IMF.

Since 1999, Russia has not taken out a single new loan and by 2005 it had fully paid off the IMF. Today, the main interest in participating in the work of the IMF is related to attempts to return the debts of third world countries to Russia.

The main centers of power in the IMF include the United States (16.41% in capital, respectively the same number of votes) and the European Union (30.3%). The US share gives the right to unilaterally veto any decision (a minimum of 85% is required to approve a decision).

The Russian domestic foreign exchange market consists of domestic regional markets. These include foreign exchange markets with centers in interbank currency exchanges.

Interbank currency exchanges are specialized exchanges that have licenses from the Bank of Russia to organize transactions for the purchase and sale of currency for rubles and carry out settlements for transactions concluded on them and in the trading of which the Bank of Russia participates.

In addition to the Moscow Interbank Currency Exchange (MICEX), there are currently the St. Petersburg Currency Exchange, the Ural Regional Interbank Currency Exchange (Ekaterinburg), the Siberian Interbank Currency Exchange (Novosibirsk), the Asia-Pacific Interbank Currency Exchange (Vladivostok) , Rostov Interbank Currency Exchange, Samara Interbank Currency Exchange, Nizhny Novgorod Interbank Currency Exchange.

Only shareholders of the exchange, as well as banks and financial institutions accepted as members of the exchange, have the right to carry out transactions with currency on the exchange. Only dealers and exchange employees involved in organizing and conducting trading are allowed into the exchange trading room. Based on the results of trading, the currency exchange carries out fixing, those. establishing the official exchange rate of one currency in relation to another.

By in relation to foreign exchange restrictions It is possible to distinguish between free and non-free currency markets.

Currency restrictions is a system of government measures (administrative, legislative, economic, organizational) to regulate the procedure for conducting transactions with currency values.

Currency restrictions are applied to reduce the outflow of currency and increase its inflow into the country in order to concentrate significant foreign exchange reserves in the hands of the state and stabilize the exchange rate of the national currency. Currency restrictions include measures for targeted regulation of payments and currency transfers abroad, including repatriation of profits, complete or partial prohibition of the purchase and sale of currency, etc. Currency restrictions can be applied both for current international settlement and payment transactions, and for transactions related to the movement of capital. A foreign exchange market with foreign exchange restrictions is called unfree market, and in their absence - free foreign exchange market.

The number and types of currency restrictions applied in the country determine the convertibility regime of the national currency.

Convertibility means the possibility of exchanging currency at the official rate and the extent of its use in any monetary transactions. Depending on the convertibility mode, the following types of currencies are distinguished: freely convertible, partially convertible and non-convertible ("closed" ).

Freely convertible currency is a currency that can be freely and unrestrictedly exchanged for the currencies of other countries.

This currency is available in countries that have virtually no exchange restrictions.

Partially convertible currency – This is a currency with limited external and internal convertibility.

In the first case, the ability of non-residents (foreign legal entities and individuals) to exchange currency for a national currency is limited, and in the second case, for residents to exchange a national currency for currency.

A non-convertible (“closed”) currency is a currency that functions only within one country and is not exchangeable for other currencies.

The exchange rate is the price of one country's currency expressed in another country's currency (for example, the US dollar) or in an international collective currency (euro).

The establishment of the exchange rate is called currency quotation. The quotation can be direct or reverse.

Direct Quote – this is an expression of the price of a currency in a national monetary unit (for example, 1 dollar = 30.5 rubles).

Reverse quotation is an expression of the price of a national monetary unit in currency (for example, 1 ruble = 0.032786 dollars).