Internet bank home loan service. Home credit bank personal account. My personal information has changed

Home Credit Bank has been operating in Russia since 2002. It was then that it was acquired by the Group Home Credit Bank "Technopolis", the first branch was established in Nizh. Novgorod. Some time later, a cooperation agreement was concluded with a number of popular retail chains. Today, Home Credit Bank is rightfully considered a leader in consumer lending.

Personal Area

You can enter the “My Credit” cabinet of “Home Credit Bank” on the official website https://mycredit.homecredit.ru/. You need to specify your login (your phone number) and date of birth, then the verification code. Your phone will receive one-time password in an SMS message, which will need to be entered in a new window. You can use the new service if you have an Internet bank connected.

If you do not yet have access to Personal Area, you can connect it. This can be done either by contract number or by number credit card.

Register by contract number

- Enter your contract number.

Register with credit card number

- Enter your card number.

- Indicate your passport data (series and passport number).

- Enter the verification code and click Continue.

- Then follow the instructions and prompts of the system.

Home Credit Bank- a large foreign bank that provides a wide range of services to the population: debit and credit cards, cash loans, deposits, settlement accounts. Service at Home Credit Bank is very convenient thanks to a personal account, the entrance to which is carried out with a login and password. All customers of the bank can use Internet banking, it is enough to register in the system once.

To enter the full version of the personal account of Home Credit Bank, the client must go to https://ib.homecredit.ru and enter your username and password on the page that opens.

If you do not want to constantly enter your login on the page, then you can check the box "Remember login" and you only need a password to enter. This feature is not recommended for use on someone else's computer.

Please note that the client is given only 3 attempts to enter. After three incorrect password entries, the account is locked for security purposes. In this situation, it's not worth the risk - use the password recovery option under the login form.

The possibilities of the personal account of Home Credit Bank are as follows:

- Information about connected bank products (cards, deposits, loans, accounts)

- Analysis of income and expenses (for the required period)

- Payment for services (housing and communal services, mobile communications, Internet and TV, taxes and fines)

- Money transfers (between own accounts, to other banks)

- Order debit card(new or reissue)

- Credit card order

- Card blocking

- Making a deposit

- Making an online application for a loan (a loan can be obtained immediately on the card of any bank in the country)

- Currency exchange at a favorable rate

- Search for the nearest offices and ATMs

- Pre-approved loan and credit card offers

- Contact support via Home Chat

Home Credit Bank has several versions of its personal account, each of which is responsible for a specific banking product:

- Internet bank(full Internet banking functionality)

- My loan(only a bank loan is displayed, the list of options is also limited to a loan only)

- Goods in installments(for customers who bought goods in installments in one of the partner stores)

- Benefit program(viewing information about the accumulated points in the loyalty program from the bank)

This personal account (My loan) is intended for bank customers who took a loan from it. The functionality of the client cabinet is limited to an active loan. You can view important information, such as: the amount of the debt, the date of the next payment, interest rate, payment schedule.

To enter you will need on the bank's website https://mycredit.homecredit.ru include your phone number and your date of birth.

You can register your personal account on the official website https://reg.homecredit.ru/. The system will prompt you to specify the contract number or 16 digits bank card(optional) and enter your passport details. If the data is correct, then your phone will receive an SMS with a registration confirmation code, after entering which you will need to come up with a login and password. Now you can use Internet banking.

There are also other ways to gain access to your personal account:

- Visiting the nearest bank office with a passport (do not forget to bring your passport with you)

- ATM of the bank (in the section "Internet banking" - "Connect")

Loyalty program "Benefit" from Home Credit Bank

Home Credit Bank cards are especially pleasant to use if they are connected to the "Benefit" loyalty program. Within the framework of this program, the user is awarded bonus points for each spending made on the card, which can later be exchanged for rubles. The number of bonuses depends on the customer's purchase category:

- The largest reward for purchases in partner stores (from 5% to 10%)

- AT certain categories remuneration is 3% of the amount spent (gas stations, travel, cafes)

- If your purchase does not fit any of the above items, then you will receive 1% bonuses

Please note that bonuses are not awarded for withdrawing money from an ATM, for transferring funds, for replenishing electronic wallets for buying lottery tickets. Bonuses are awarded to the client only for purchases in stores.

And it doesn't matter where you shop - in Russia or abroad. You will still earn bonus points.

The most important- you can exchange points for rubles in the personal account of the "Benefit" loyalty program. Exchange rate: 1 point = 1 ruble. The minimum exchange amount is 100 points, the exchange is made in your personal account.

Points are credited within 7 business days. You can check the charges by following the link https://polza.homecredit.ru/ in personal account bonus program"Benefit". Points are valid for 1 year from the moment they are credited to the bonus balance.

You can use your personal account not only on a computer, but also on your phone, thanks to mobile application "Mobile bank- Home Credit". The program is available for download to all users of devices based on iOS and Android.

You can download the software to your smartphone in the App Store and Google Play by entering the phrase "Home Credit Mobile Bank" in the search bar and clicking the "Install" button.

Advice! On first start mobile bank you can set up quick access to the application using a PIN code and a fingerprint.

Hotline of Home Credit Bank

To obtain the necessary information on bank services, as well as to clarify the balance and other things, you can call hotline Home Credit:

- +7 495 785-82-22 - for calls within Russia and from abroad (according to the tariffs of your operator)

Customer support takes calls around the clock. You can also quickly get an answer by asking your question in the online chat in your personal account.

In the contact center you can: clarify the balance of the card, find out the balance of the debt on the loan, check the status of the money transfer, find out the status of the consideration of the loan application and much more.

If you urgently need money, then you can apply for a loan at Home Credit. The time for consideration of an application takes an average of 5 minutes, for regular customers the time for making a decision is even faster.

A distinctive feature of a loan at Home Credit Bank is the ability to receive money on a card of any Russian bank.

The conditions for a cash loan at Home Credit Bank are as follows:

- Credit amount: from 10,000 rubles to 1,000,000 rubles

- Interest rate: from 9.9% per annum

- Term: 1 to 5 years

- Required documents: passport of a citizen of the Russian Federation

- Early repayment: available

- Application processing time: 1 minute (may take longer to decide in some cases)

The loan is available to citizens of the Russian Federation with permanent residence permit aged 22 to 70 with good credit history and a permanent source of income.

Leave online application To get a loan at Home Credit, you can:

To replenish a credit card or pay a loan, you can not enter your personal account. Just go to the bank's website at https://www.homecredit.ru/payment-online and provide details.

To replenish a credit card, it is enough to indicate the card number and date of birth, and to pay for the loan, you will need to enter the number loan agreement and account number for crediting funds.

You can also use any other payment method:

- Deposit cash at an ATM

- At the bank's cash desk (you can find the nearest branch in the application)

- In the personal account "My credit" (no commission with a card of any Russian bank)

- In the Internet bank of any bank (for example, through Sberbank Online)

- Cash at the Russian Post Office

- Cash through the system money transfers"Gold Crown"

- Through payment system Qiwi

- Through the terminal Eleksnet

Please note that when paying for a loan at any bank other than Home Credit, a transfer fee is charged. It is most advantageous to replenish a credit account through a bank.

Any new card jar must be activated before use. This can be done remotely on the bank's website. To activate the card and receive a pin code, go to https://www.homecredit.ru/pin/. The system will ask you to enter your card number and the series and number of your passport.

After entering the data on your phone specified during registration, you will receive an SMS with a registration confirmation code. Then follow the prompts of the system to complete the procedure.

I can’t log into my Home Credit account: what should I do?

First of all, you should check that the password is entered correctly. If you can’t log into your personal account on the first try, then you should use the password recovery option to avoid blocking account. If the next login attempts are unsuccessful, then you should contact the bank's contact center to resolve this issue.

How to change the pin code of the Home Credit card?

To change the PIN code of a Home Credit bank card, you need to call the hotline and provide the code word, card number and passport data. After that, the bank employee will switch you to the bank's automatic system, which allows you to change the pin code.

Home Credit Bank was founded in 1997 in Amsterdam, and today has offices in eleven countries. The main direction is consumer credit.

To enter, you need to go to the official website homecredit.ru and click "LOGIN" in the upper right. Home Credit Bank has two types of personal account:

- "My Credit"

- "Internet bank".

My loan is designed to control your loan, where you can see all the information about the loan, its balance, amount and date of the next replenishment. Internet banking is a personal account where the client can manage in cash from your deposit or card, make transfers, pay a loan or all possible payments.

Home Credit: enter by phone number and date of birth

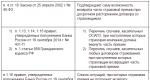

If you have a loan at Home Credit Bank and you are interested in all the information on the loan, then you are in your personal account "My Credit". The entrance is carried out from the main site, enter and then follow the link My credit (https://mycredit.homecredit.ru/mycreditweb/Account/Login?ReturnUrl=%2fmycreditweb%2f#/). Next, you will be taken to the login window, the picture of which is located below. To enter enter the following information:

- Enter number mobile phone specified in the loan agreement

- Enter the date of birth of the client for whom the loan was issued

- Enter the code from the picture, it is usually 5 digits.

- Next, use the sent code to confirm your identity.

Login to your Home Credit account by number and date of birth

You get into your personal account, where you can control everything, until what date you need to make a payment, how much you need to deposit, payment schedule, etc.