ruble exchange rate december Nervous December. What awaits the ruble, dollar and euro in the last month of the year? Dollar exchange rate forecast for the near future

The exchange rate of foreign currencies in relation to the Russian one in recent days has attracted increased attention from the public of our country due to sharp fluctuations, which, although characteristic of the foreign exchange market, occur unexpectedly every time.

The Bank of Russia significantly lowered the rates of major world currencies on Tuesday, December 13. The dollar fell by 1.72 rubles to 61.58 rubles, the euro fell by 2.14 rubles to 65.07 rubles. The cost of the dual-currency basket (0.55 dollars and 0.45 euros) decreased by 1.91 rubles compared to the previous indicator, after which it stopped at the level of 63.15 rubles.

If you look at the situation that developed on the Moscow Exchange last night, it becomes clear that the dollar and the euro had a very difficult fight with the ruble, when many factors pointed against the foreign currency. In particular, according to the data at the close of the trading session, namely at 23:44 Moscow time, the dollar fell by 1.43 rubles, and the euro by 1.14 rubles. Accordingly, these currencies were worth 61.06 rubles against the ruble at that moment. and 64.91 rubles.

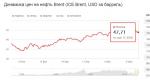

As for oil quotes, they do not think to stop their growth, which has been taking place for several days in a row. According to the latest data, the cost of a barrel of "black gold" of Brent brand reached $55.79.

Exchange rates: dollar exchange rate forecast for December 2016

The current significant strengthening of the Russian currency is mainly due to rising oil prices, which the day before reached $57, if we talk about a mixture called Brent. This figure is a record for the last year. As you know, "black gold" so strikingly moved up in its value after the OPEC countries managed to agree with those states that are not members of the cartel, so that the level of production began to systematically decrease from January 1, 2017. Many experts called this deal a historic one, highlighting the huge role in its achievement - Russia, namely President Vladimir Putin.

Several conclusions can be drawn from the forecast of the expert community for December 2016: most likely, they note, the strengthening of the Russian currency will soon stop and the ruble will begin to weaken. The current growth allows US shale producers to conclude more lucrative contracts. For this reason, pressure on quotes starts, which will entail a backlash - the dollar will begin to rise in price. In turn, the euro in such realities will continue to decline and may well reach the level of the value of the US currency.

At the same time, experts note that the decision of the US Federal Reserve on the rate, which will be announced this week, may contribute to the further growth of the domestic currency. At the moment, many are expecting a rate increase from the American regulator, which should happen with a probability of almost 100 percent. In addition, next year the rate can be adjusted upward at a much more confident rate than in 2016.

At the end of the year, Russians traditionally become more interested in the American currency. Before the New Year holidays, citizens begin to massively buy dollars. Experts learned what exchange rates of the ruble against the dollar and the euro should be expected in December, what factors will affect them and whether it is worth buying massive amounts of American currency.

Alexander Egorov, Leading Analyst at TeleTrade Group of Companies:

Until the end of December, many significant events will still take place: a meeting of the US Federal Reserve, which will determine the dollar exchange rate on the international market and will affect its positions on the local market, a meeting of the Bank of Russia, etc. But at the same time, you should not panic when buying foreign currency. The ruble receives support from the growth of oil, the deal on the privatization of Rosneft by non-residents and a large influx of foreign currency for this deal has a positive effect. Apparently, the dollar exchange rate by the end of December will not go beyond 60-65 rubles. with a high probability of fixing in the middle of the range. That is, most likely, the dollar will cost about 63 rubles. Euro - 65–67 rubles.

Pavel Salas, Regional Director of eToro in Russia and the CIS:

The main event that kept the ruble under pressure is already behind us: OPEC members agreed to reduce production, and the ruble received a temporary respite.

The only thing that can disturb the calm is the meeting of the FOMC (Federal Open Market Committee in America), which will discuss the possibility of raising the interest rate. If the majority of committee members vote for the changes, then the dollar will receive additional support against other currencies. At the moment, analysts' expectations regarding changes in credit policy are almost equal to 100%, which means that this outcome is already included in the price, and one should not expect much strengthening of the dollar. However, the domestic currency may weaken at the moment to 65 rubles. per dollar.

Foreign investors are returning to Russia, the trend is expected to continue in 2017, which will certainly provide support for the ruble, and thanks to the moderately restrained policy of the Central Bank, inflation is expected to decrease to 4%. If expectations are justified, the ruble may again become one of the most profitable assets, as it already was in 2016.

Sergey Kozlovsky, head of the analytical department at Grand Capital:

The ruble is growing against the backdrop of strengthening oil, but already on December 14, when the US Federal Reserve announces a decision on the rate, the situation may change. Emerging markets will come under pressure, the ruble will also be subject to sales that will continue until the end of the year, even if oil remains above $50 per barrel. Our target level for the dollar / ruble pair is 64, euro / ruble - 69.

You shouldn't succumb to "mass hysteria", of course, it makes sense to diversify your investment portfolio, but if over the past few years we have not included the ruble in the basket of currencies, now we propose to leave at least 20% in the national currency.

Sergey Melnikov, Chief Analyst at GLOBAL FX:

At the end of the year, the ruble was helped by the dynamics of quotations of “black gold”. Not so long ago, the OPEC countries agreed to cut oil production, which led to a significant increase in the cost of hydrocarbons. As a result, the Russian currency also strengthened. However, less than a month later, the world again saw data on the record production of the oil cartel. To agree is not to do. Subsequently, the rise in commodity prices slowed down a little, which, in turn, stabilized the Russian ruble.

In mid-December, a meeting of the US Federal Reserve will take place, at which, with a probability of more than 90%, they will raise the key rate. The tightening of monetary policy in the United States will lead to the growth of the dollar against all major currencies, including the ruble. Moreover, oil prices may sink a little more and put additional pressure on the Russian currency. Most likely, the dollar against the ruble will be in the range of 65-67. The euro, in turn, may soon catch up with the US currency, but this will most likely happen as early as 2017.

Stanislav Werner, Vice President, IFC Financial Center:

The end of the year brings back unpleasant memories for Russians of what happened last year and the year before last. A reflex is triggered: if you are waiting for the New Year holidays, give yourself peace of mind, buy some currency. Despite the fact that the Russian financial system has become stronger and less vulnerable to shocks, nevertheless, the current situation on the market speaks in favor of moving into the dollar. There are several reasons for this. This and the increase in the key rate by the Fed in the middle of next week, which could cause a wave of flight into the dollar. This is also a potential reversal in oil prices, which at the moment reflect more positive expectations regarding the effect of the OPEC deal, rather than fundamental data. And according to them, OPEC produced 34.2 million barrels per day in November, while Nigeria, Libya and Iran are ready to add another 0.5 million barrels per day by January. 32.5 million barrels per day since January may turn out to be a myth, given the low discipline within OPEC, which is now reinforced by the controversial actions of Saudi Arabia, which offers discounts to Asian customers and produces the largest amount of oil since the summer.

There are also domestic factors: a currency deficit in the face of large payments on external debt, the overhang of rubles as a result of the traditional acceleration of budget spending at the end of the year. Therefore, dollar purchases in the zone of 62.8-63.5 rubles. look justified. By the end of December-January, the dollar may once again rise in price to 65-66 rubles, and with a deeper correction in oil prices, it could swing to higher levels.

Tamara Kasyanova, Managing Partner of JSC 2K:

At the beginning of the month, the ruble is subject to the influence of OPEC statements, which caused an increase in oil prices. Also, now the Russian currency is receiving support from the decision of the Russian Federation to join the reduction in oil production - this supports oil quotes, and hence the ruble. The ruble received a serious positive from the news about the privatization of Rosneft - the fact that a European company has become one of the buyers can seriously change the investment background in the country. This, of course, provides the Russian currency with serious support.

However, it is difficult to say whether the market's positive attitude towards the ruble will last until the end of the year. The dollar may play against the ruble, which may receive support from the US Federal Reserve on the issue of the key rate. The euro also has upside potential after an impulsive depreciation as a result of the situation in Italy. In addition, by the end of the month, today's growth of the ruble will have to be cleared of the speculative component, which always turns on at sharp jumps. Perhaps by the end of the month the ruble will return to the levels of 64-64.5 rubles. per dollar.

Today I decided to tell you about the latest dollar exchange rate forecast for December 2016. As always, experts have different points of view, but they all agree on one thing: the ruble exchange rate in December depends on the behavior of the price of black gold.

At the moment, the dollar is worth 65 rubles. Some experts say that in December the ruble will strengthen, while others will become cheaper. But due to the fact that the ruble has been slowly depreciating over the past 2 weeks, we can say with confidence that this trend will continue in the future. Many experts say that November and December are the last months of calm, when the ruble will gradually become cheaper.

Surprising is the fact that at the moment there is an increase in the cost of oil on the market, which, in turn, should stop the depreciation of the ruble. Raiffeisenbank experts are confident that the ruble will not strengthen due to the sale of the state-owned stake in Rosneft. Such a development is only possible if the company itself buys back its shares. As a result, there will be a shortage of foreign exchange liquidity, which will lead to a depreciation of the ruble.

Dollar exchange rate forecast for December 2016

Experts assure that in December the dollar/ruble pair will experience short-term fluctuations. The head of Rosneft, Igor Sechin, said that privatization would not affect the foreign exchange market.

Another factor that can lead to destabilization in the market is an increase in geopolitical tensions. Instead of lifting existing sanctions, the US and EU countries are planning to introduce new sanctions. New sanctions will arise as a result of the conflict in Syria. Another factor that will not allow the currency to strengthen is the unresolved conflict in Ukraine.

Experts are confident that the gradual weakening of the ruble only has a positive effect on the state's economy. As a result of the depreciation of the currency, the country reduces the budget deficit, and Russian entrepreneurs gain a competitive advantage.

In general, almost all dollar exchange rate forecasts for December 2016 are pessimistic. The price of the American currency in the last month of the year will fluctuate in the range of 62-68 rubles.

This forecast of the dollar exchange rate for December 2017 will come true only if the price of oil does not fall to 30. Until November 15, the cost of black gold only increased to 45.42 dollars per barrel.

If the cost of black gold reaches 50, then the ruble may reach 62. At the moment, the increase in the cost of oil is the result of the efforts of the OPEC countries, which are aimed at reducing production. Today, Qatar, Venezuela and Algeria are looking for ways to resolve the contradictions between the major oil-producing countries. Earlier, the Minister of Economy of Saudi Arabia called on all OPEC members to come to a common denominator in order to reduce oil production. The next meeting of the cartel is scheduled for November 30, 2016.

Fresh euro exchange rate forecast for December 2016

The EU is still unstable. The Eurozone countries are still unable to cope with the consequences of Brexit. The euro/dollar pair continues the downtrend, which will last until the end of 2016.

Forecasts of the euro exchange rate for December 2016 are similar in that the depreciation trend for the euro will continue this month. At the moment, the EU has a large number of problems, including emigrants. To improve the current situation, the ECB left a record low interest rate, and also left the quantitative easing program in operation.

At the moment, European countries are not going through the best of times. Inflation for the current year is 0.2%, which is 10 times lower than the target value - two percent. GDP growth in the next three years will remain at the level of 1.6%, which also scares many experts. The threat of deflation encourages the ECB to continue measures to improve the economy. The discount rate of the bank remains at a low level, but the rate on deposits is minus 4%. The negative value of the rate negatively affects the banking sector, as a result of which many credit institutions are not in the most advantageous position. Deutsche Bank is also in a deplorable state, and this is already a threat to the entire stability of the system. Seasoned experts say huge sums of money may soon be required to support the financial sector, which will negatively affect the economy.

At the moment, European countries are not going through the best of times. Inflation for the current year is 0.2%, which is 10 times lower than the target value - two percent. GDP growth in the next three years will remain at the level of 1.6%, which also scares many experts. The threat of deflation encourages the ECB to continue measures to improve the economy. The discount rate of the bank remains at a low level, but the rate on deposits is minus 4%. The negative value of the rate negatively affects the banking sector, as a result of which many credit institutions are not in the most advantageous position. Deutsche Bank is also in a deplorable state, and this is already a threat to the entire stability of the system. Seasoned experts say huge sums of money may soon be required to support the financial sector, which will negatively affect the economy.

The EU is also suffering because of the British exit, as well as because of the huge number of emigrants, which only exacerbates the differences between EU members. Experts assure that after the final withdrawal of the UK from the EU, trade volumes will sharply decrease. This development threatens the continued existence of the European Union, which, of course, affects the mood of depositors.

The latest euro exchange rate forecast for December 2016 says that the euro will continue to depreciate in the future. According to APEKON, in December the euro will cost 64-68 rubles. If the price of oil rises in the future, then the price of the euro in December could reach 64 rubles.

Despite numerous attempts by APEKON to cut oil production, there is still a lot of black gold on the market. In addition, the agreement reached earlier between the major oil-producing countries is under great threat due to the position of Iran and Iraq. Experienced analysts do not exclude another collapse in oil prices, which, of course, will deal a blow to the Russian economy and lead to a depreciation of the national currency.

Despite numerous attempts by APEKON to cut oil production, there is still a lot of black gold on the market. In addition, the agreement reached earlier between the major oil-producing countries is under great threat due to the position of Iran and Iraq. Experienced analysts do not exclude another collapse in oil prices, which, of course, will deal a blow to the Russian economy and lead to a depreciation of the national currency.

In December 2016, the euro exchange rate against all world currencies will decrease. But what will happen to our currency at the end of the year depends on the further cost of oil. The latest forecast of the euro exchange rate for December 2016 says that in December the euro will cost 62-68 rubles.

This article is for informational purposes only and is not a guide to action.

In order to be aware of all the latest news on the financial market, subscribe to my newsletter. I wish you all good luck and good profits!

Is it worth it to accumulate this currency now, in which case it can bring you profit, and how high this profit will be - we will find answers to all these questions in this material.

How much will the dollar be worth in December 2016

In December 2016, the dollar is predicted to strengthen and, accordingly, increase in price. According to the most modest forecasts, this currency will rise after a slight decline of 1.5% in November.

Accordingly, the average dollar price for this period will be 66.31 rubles. The minimum value of the dollar for December will be, according to the same forecasts, 65.55 rubles.

There may be several reasons why the price of the dollar will rise in this period. However, among the main analysts, as for this period, it is the end of the year with its conclusion of new contracts, which means a new round of hype for the dollar.

In addition, it is during this period that a large number of mutual settlements in foreign currency are usually carried out so as not to leave debt at the beginning of the next period. At the same time, which is also important, usually the population spends a large amount of foreign currency in preparation for the New Year holidays.

That is why a situation is being formed in the market in which the sale of the dollar is the simplest and most profitable for all groups of currency holders. But its purchase remains a business not very profitable.

Speaking about one of the most common and important international currencies, one cannot ignore the second one - the euro.

Forecasts for it are not as bright as for the dollar, but they have the same trend - after a slight November subsidence of this currency, its next strengthening is expected, although, unfortunately, the dynamics will also remain negative.

How much exactly? Speaking of which, experts in the field of finance agree that this currency will drop the rate of decline by about 1.2%.

Due to this, already at the beginning of the month the value of the euro will be fixed at the level of 73.07 rubles. But at the end of the month, the main currency of Europe can be purchased already at 72.12 rubles.

Such dynamics is caused by an increase in the number of transactions with foreign partners that will be paid in euros, as well as an increase in the level of currency sales, also associated with preparations for the New Year and Christmas holidays.

A larger drawdown of this currency in the near future is not expected. However, it is quite likely that in case of any negative events on the European stock exchange or in the economy of some countries that are members of the EU, the pace of the fall of the euro may increase even more.

At the moment, it is not worth buying this currency even at the rate, at first glance, the most attractive for the year. The fact is that analysts cannot yet determine when the next round of growth of the main European currency will begin, and whether it will be at all.

So there remains a high possibility that the euro will sink even more, and you will not receive the expected profit from trading it. But in the current period, it is very profitable to buy currency for your expenses while traveling around Europe, especially since they are organized quite often during the holidays.

Having dealt with what will be, we can move on to the question of the benefits of investing in this currency or investing money in euros in order to determine whether you should accumulate such funds in this period. Or at the moment it is worth choosing for yourself completely different investment options available to a wide number of people.

Is it worth investing in currency during this period?

In December, investments in foreign currency, be it the dollar or the euro, can hardly be called successful. Due to further exchange rate fluctuations, you may lose your investment. A similar situation, unfortunately, will be for those who decide to put dollars or euros on deposit during the same period.

Due to low interest rates on foreign currency deposits, such investments can also result in losses. However, here you need to make a small clarification: if you make a deposit for six months or more, you can still expect profit from a dollar deposit - in the spring this currency is predicted to grow, and by the summer it will bring you a certain income.

As for the euro, there are no such bright prospects here; perhaps no one will undertake to guarantee you the stability of such a currency. Even deposit accounts in this currency, due to their low interest rate, will certainly not bring you the expected benefits in the coming year.

Today, securities are called the best in this field, as well. With them, you can be more free to determine the timing of the investment.

In addition, by choosing the right strategies for working with such assets, both for beginners and amateurs, you will never become bankrupt and you can easily change the direction of investment at any time if you need to.

Along with the first snow and frost, many private traders and investors asked common questions: what will happen to the exchange rate of the ruble, dollar and euro in November 2016, as well as in January and February 2017? In what currency to keep money and what financial instruments should be included in your investment portfolio at the end of 2016? Will there be a devaluation of the ruble?

What is the forecast for the ruble against the dollar and the euro at the end of 2016?

The Russian ruble has gained more than 16% against the US dollar since the beginning of 2016, the second-best result among so-called “emerging” currencies. The first place is occupied by the Brazilian real, which showed an increase of 25% in the first three quarters of 2016. Is everything so cloudless? We answer right away: unfortunately, at the end of 2016 there is a high risk of a weakening of the Russian ruble.

In December 2016, the price of the dollar may rise to 80 rubles per unit of US currency. The euro exchange rate in December 2016 may rise above 90 rubles per unit of the European currency.

However, many experts warn that the weakening of the ruble in winter may be followed by a new wave of strengthening, which will begin in the spring of 2017. For example, pAccording to analysts from ING Bank, in late 2016 - early 2017, the dollar exchange rate may drop sharply, and the price of oil may fall to $40 per barrel. Nevertheless, it is not worth getting rid of the Russian currency, analysts believe: in the new calendar year, the USD/RUB pair may drop to 58 rubles.

What factors will affect the ruble exchange rate in the winter of 2016?

Oil price: likely to decline

First of all, the ruble will react to changes in oil prices. In the fall of 2016, it became obvious that one should not hope for an increase in oil prices in the coming months. Despite the fact that in September the OPEC member countries agreed on the need to freeze oil production to stabilize prices, the market no longer believes in empty promises. At the end of October, OPEC countries reached a new record in terms of production, Russia is also not far behind, and even shale companies in the United States are resuming production. This is because the current price level is not critically low, which means that oil companies around the world will increase production.

The key event for the oil market is the OPEC meeting in Vienna, which is scheduled for November 30th. A month before the meeting, it became clear that Libya, Nigeria and Iraq did not intend to limit production. Even if some formal agreement is reached, the market is unlikely to believe in its effectiveness.

Fed rate: expected to increase in December 2016

Despite the fact that on November 2 the US Federal Reserve decided to keep the federal funds rate unchanged, US officials almost convinced the market that the rate will be raised in December. In the III quarter, the US economy grew by almost 3%, while inflation is above 1.5%. The latest statistics on the US labor market for October also confirms the recovery of the US economy. According to the Chicago Stock Exchange, the rate will be increased by 25 bp in December. with a probability of more than 70%, and some market participants are already waiting for the second increase in a row in February 2017.

In anticipation of the meeting in December, a sharp rise in the US currency is likely, as the Fed's decision has not yet been fully priced in. Further dynamics of the dollar will, of course, depend on the Fed's rhetoric and updated economic forecasts. How many rate hikes will the US regulator hint at in 2017? According to our forecasts, the Fed will try to soften the impact of its rate hike decision on the markets and refrain from overly optimistic estimates for the next calendar year. In this case, the growth of the dollar in January and February 2017 will be limited, however, it will not be easy for the dollar/ruble pair to fall below 65 rubles per dollar.

In what currency should you keep money in the winter of 2016 (November, December, January)?

Despite all market fluctuations, private investors should not forget the golden rule of risk diversification: the most reliable way is to divide your savings into three parts and place them in rubles, euros and dollars on a bank deposit. If you have less than half a million rubles, attempts to play on the dynamics of exchange rates can work against you, so choose classic and proven approaches.

Of course, the choice of investment currency depends on your goals and on the terms for which you plan to invest. For example, if you need currency for the New Year holidays, it is better to buy it now, in November. Before the Russian foreign exchange market entered the phase of winter “chatter”, which has already become familiar to us over the past two years.