Passport loan with instant decision. The best credit cards by passport with an instant decision. Choosing a bank to open

On this page we have collected the best credit card offers for you. The big advantage is that they can be issued online in 5 minutes. Almost instantly learn about the solution and receive your credit card without providing proof of income.

Credit cards by passport with instant decision

TOP 7 credit cards with the best conditions

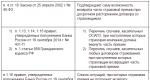

| Bank | Limit | Percent | Without % days | Request |

|---|---|---|---|---|

| 300 000 | up to 28% | up to 90 days | ||

| 300 000 | from 12% to 29.9% | up to 55 days | ||

| 500 000 | from 11.99% to 30.86% | up to 110 days | ||

| Credit Europe Bank | 600 000 | 29,9% | up to 55 days | |

| 299 000 | 30,5% | up to 120 days | ||

| 600 000 | from 26.5% to 49% | up to 110 days | ||

| 1 000 000 | from 25.9% to 59% | up to 62 days |

To date, Tinkoff Bank, Alfa-Bank and Vostochny offer the most interesting and favorable conditions for credit cards. Each bank has its own advantages and disadvantages, but there are positive points that unite them:

- you can apply online;

- there is a grace (interest-free) period;

- no issuance fee;

- no proof of income is required;

Renaissance Credit Bank is suitable for those who need a credit card urgently. Fill out an online application, find out the decision in 5 minutes - and pick up your card on the same day.

Alfa-Bank has more serious requirements for customers, and the release of "plastic" will take at least 3 days. But here is the longest Grace period- as much as 100 days without interest.

Credit card without proof of income

| Tinkoff Bank | Oriental | Alfa Bank | |

|---|---|---|---|

| Credit limit | Up to 300,000 rubles. | Up to 200,000 rubles. | Up to 300,000 rubles. |

| Grace period | Up to 55 days | Up to 90 days | 100 days |

| Registration and receipt | 1-2 days | 1 hour | 1 hour |

| Free release | Yes | Yes | Yes |

| No proof of income | Yes | Yes | Yes |

| cashback | Yes | Yes | Not |

The lowest interest rate is declared by Tinkoff Bank and Vostochny Bank, but you should not focus on the minimum level. The final percentage is still set individually, it depends on the client, his credit history and provided documents. To find out your rate, it makes sense to apply online for credit cards at several banks at once.

For cash withdrawals from credit Tinkoff cards The bank and Renaissance Credit charge 2.9% of the amount plus 290 rubles. Alfa-Bank takes twice as much, but even when withdrawing cash, it “turns on” its 100-day interest-free period.

Get a credit card

Apply for a credit card online at Tinkoff Bank

Main advantages:

- Loan amount up to 300,000 rubles

- Interest rate from 15% per annum

- Returns up to 30% in points from any purchase

- Free card issuance

- Delivery anywhere in Russia

Summary: key advantage Tinkoff Bank is that cards are opened here almost without refusal - even if you have a bad credit history. Another plus of the bank is free delivery of the card to your home or office.

Credit cards according to the passport in Vostochny bank

Main advantages:

- Cashback up to 5%

- Loan amount from 55,000 to 300,000 rubles

- Loan term up to 60 months

- Minimum package of documents (passport only)

- Online decision making

Summary: One of the most loyal banks in our rating, for issuing a credit card, you only need a passport, and the bank also charges interest on the balance of its own funds in the account.

Credit card without income statements at Raiffeisen Bank

Main advantages:

- Leave an application and get approval in 5 minutes without income statements.

- Renewable credit limit up to 600 000 ₽ is always at hand.

- Use the card and do not pay interest on debt repayment up to 52 days.

- Get up to 5% back on all purchases.

Summary: One of the few banks that are willing to issue a credit card without income statements. The bank also allows you to choose the categories of increased cashback.

Credit cards without refusal at Renaissance Bank

Main advantages:

- Card issuance and maintenance free of charge

- Credit limit up to 200,000 rubles

- Same day pick up

- Annual card maintenance - 0 rub.

Summary: The bank is very loyal to its current and future customers. He does not have the highest credit limit, but free service throughout the life of the card.

Applying for a credit card online: procedure and requirements for the borrower

Now, to order a credit card, you do not need to visit a bank branch, spending personal time for this - just leave an application on the Internet. Our site has made your task easier by collecting the most optimal options offered by Russian financial institutions. To apply for a credit card, you do not need to look for anything, apply to two or three banks, get a personal offer, compare, and now you have cards with the best conditions in your hands.

Applying: what needs to be done?

To apply for a credit card, you will need to perform the following manipulations:

- choose the option(s) whose conditions suit you;

- go to the official website(s) of banks;

- indicate your full name and phone number (the latter will need to be confirmed by entering the password from the SMS message);

- allow the system to process personal data;

- to enter data from the passport, date of birth, as well as addresses of registration and actual stay.

- confirm employment. (If you want to)

- enter information about the marital status, the number of children, as well as the presence of outstanding loans taken from other banks (the latter is carefully checked through the BCI).

After receiving approval, visit the bank and pick up a personalized credit card, taking your passport with you. You can do without going to the branch by ordering the delivery of the card and the contract for its service by courier.

Issuing a credit card: what are the requirements?

Due to the widespread alternative ways lending banks had to significantly reduce the requirements put forward to customers. Therefore, in order to receive a card, they will need to confirm compliance with a minimum number of conditions, including:

- Russian citizenship. The borrower must have a permanent registration in the territory of the Russian Federation. At the same time, the requirements of creditors may differ: some put forward as mandatory condition residence in the region where the bank is located, others do not require binding to a branch.

- coming of age. The client must not be less than 18 years of age. Older borrowers are given loans as long as they can prove their ability to work.

- official employment with a stable monthly income. Unlike MFIs, banks require clients to have a minimum seniority(from 3 to 4 months). Only on this condition can they be issued a credit card.

The Loans Online website contains a list of financial institutions in which the chance of getting a refusal is practically reduced to zero. By the way, when sending an application to several banks at the same time, the probability of its approval will increase significantly.

Card issuance procedure: what documents may be required?

When filling out the application, a passport must be at hand. In some companies, issuing a card is not possible without providing the following documents:

- driver's license;

- SNILS;

- international passport (in it they look through the marks on the commission of trips abroad for the last year);

- personalized debit card;

- compulsory medical insurance policy;

- 2-NDFL certificate and a document confirming the position held (in case of issuing a card with a high limit).

Conditions under which credit cards are issued

The rules for issuing cards have minor differences, and the reason for this is the different policies in banking institutions. Among others, we have selected options that differ in similar conditions:

- grace period for loans. During it, the client can pay off debts without unnecessary overpayments, because at this time interest is not charged. The creditor institution determines the duration and application of this period. So, its duration can vary from 55 days to 3 years, and it can only be used for a specific purpose ( cashless payments or shopping at partner stores).

- accrual of interest at the end of the grace period. The value of the interest rate also fluctuates depending on the requirements of the bank: the minimum is 10%, the maximum is 50%.

- mandatory minimum payment (if it is impossible to return the full amount of the debt). As a rule, its size is approximately 3-8% of the debt.

- imposing a penalty on passing minimum payment on duty. Remember: your credit history will be hopelessly damaged if you do this regularly.

- issuance of a plastic card on a paid or free basis. Financial institutions that issue free credit cards charge fees for other types of services: work with loan debt, annual maintenance, insurance, informing the client using SMS messages, etc.

Among other things, upon receipt plastic carrier customer can apply for virtual card. It acts as an auxiliary tool that greatly simplifies the process of making purchases on the Internet. Now such an opportunity is provided by many banks - do not miss it.

A credit card is a popular banking product with which you can use borrowed funds. When you pay off the debt or part of it, the money is returned to your account and you can spend it again. In all the variety of such programs is not easy to understand. The Banki.ru portal has selected overdraft cards especially for you, which can be issued in the city of Moscow.

The portal offers to use a special form to search for a product that is beneficial for you. Here you can specify the desired credit limit in the currency you need, as well as note the presence of a grace period during which no interest will be charged for the use of borrowed funds. Choose which category of plastic you would like to receive. It is possible to choose plastic according to functional features: for example, only one that has contactless payment technology (PayPass, PayWave, etc.).

Directly on the Banki.ru website, you can apply for the product you like without contacting the bank directly. After receiving a request credit organisation promptly checks it, issues a card and invites the client to come to the office for it, or even sends a package of documents by courier. Then you can use plastic and enjoy its benefits.

Separately, it is worth considering this type of product.

At the same time, it is absolutely not necessary to fill out large questionnaires or be present at a bank branch.

Fast get a credit card without checks and rejection is possible with the help of a virtual service, which is available to all users, regardless of personal financial condition. The card is issued on the basis of the user's personal request. Previously, the client must provide a copy of the passport, where the basic information is present. To get it, it is enough to send an online application to the bank. Registration on a virtual basis is available to all citizens from 18 years old, 20 years old and the unemployed.

Get a credit card even with a bad history

It is often impossible to get a credit card with a bad history. After all, many banking institutions do not want to deal with unreliable customers who are unable to repay loans. However, thanks to the new online service and more favorable conditions lending, each user has the opportunity to receive a card on the day of application without references. When applying through the site, the lender already has all the necessary information about the history of payment of previous loans.

The issuance of a passport card is carried out in several stages:

- Submission of a personal application through the company's website.

- Consideration of the application by the creditor company.

- Issuance of a card within a few hours with home delivery.

- Activation of a credit card without refusal online.

- Acquaintance with the terms and conditions of the contract.

After receiving and activating the card, the client can use instant loans subject to the current restrictions on the loan amount. When filling out an application, it is important to indicate only valid personal data. After all, the speed of consideration of the application depends on the correctness of entering information. Courier delivery of the card is possible at the address of residence. Sending by mail is carried out at the place of residence or to any post office in the area.

Where to urgently get a credit card without refusal

You can get a credit card instantly and without providing certificates at special banking institutions that support the possibility of online registration and issuance of cards, regardless of the credit history. Any citizen can quickly take a card, and it is not necessary to provide a certificate of employment. There are several advantages of lending in this way:

- saving time and money;

- lending on favorable terms;

- availability of card design;

- a wide selection of credit cards;

- references are not required.

Institutions that support fast online registration of cards through the site issue credit cards urgently and without technical delays. The client does not need to come to the bank, stand in line or explain the reasons for the current financial position banking agent. The whole procedure is carried out on anonymous terms, while information about loans is available only to the user.

Credit cards occupy a significant place in the life of almost every person. This is a convenient tool for paying bills, making purchases, as well as borrowing money until payday. But it happens that you only have a debit card, and the money is needed urgently. Waiting two weeks for credit approval is too long. Our rating will come to the rescue. The interest rate in these options is higher than in other large financial institutions, but the decision is made instantly, you only need a passport.

These cards are issued directly at the bank office. As a rule, they are not registered, because it takes time to engrave a name and surname. A bank employee has a lot of blanks in the safe, which he can instantly draw up and issue to the client.

"Simply" (Vostochny Bank)

Terms:

- rate: from 0% to 10%;

The decision on the card is made instantly upon contacting the bank office and providing a passport. Online application is not provided. The issue of a credit card is free, if there is a debt, its maintenance costs 30 rubles a day. Withdrawal limit - up to 100,000 rubles. per day and up to 1,000,000 rubles. per month. There is no additional fee for using terminals of other banks: this applies to both balance requests and withdrawals.

On the balance of own money in the account accrue annual interest: 2% if there are more than 500,000 rubles left, and 4% - from 10 to 499,999 rubles. You can use your own money by crediting it to the card.

At Eastern Bank there is a cashback service, according to which you can return up to 40% of money for purchases made with partners. Specify the list of partners on the website or at the bank office. Bonuses come within 2-6 weeks. Also, bank news and up-to-date information on a credit card are sent using SMS notifications. Such a servant costs 89 rubles per month and turns on instantly by default. If you decide to cancel it, please contact the bank.

During the grace period, you only pay for servicing the card. The duration of this period is determined individually. If you do not repay the debt within the agreed time, a fine of 10% per annum will begin to accrue. For repayment, a minimum of 1% of the debt amount (plus money for maintenance) must be paid monthly. If a mandatory payment miss, you will receive a large fine - 36.5% per annum.

To apply for a “Prosto” card, you must provide a passport to confirm your age: from 18 to 71 years old. Take this one, however, there are requirements for persons under 26 years of age: a mandatory work experience of at least a year. The client must have the citizenship of the Russian Federation and a residence permit, certified on the corresponding page of the passport.

"Travel" (Rosselkhozbank)

Terms:

- rate: from 23.9%;

- credit limit: up to 1,000,000 rubles;

- grace period: up to 55 days;

- service cost: from 99 to 1,899 rubles.

When withdrawing cash from any ATMs and PVN, the commission is 3.9%. For ATMs of Rosselkhozbank in the first three months of using a credit card, the commission is 0%. For one session, you must withdraw at least 350 rubles. The withdrawal limit per day is 150,000 rubles, per month - up to 1,000,000 rubles. You can use your money. Account balance request costs 45 rubles (at third-party ATMs).

The credit card "Traveling" has a bonus loyalty program. For any purchases, special points are awarded, which can then be used to pay for travel tickets, car rentals, hotel rooms, and goods from the Ozon online store. In the first two months from the start of using the card, for every 100 rubles spent in general categories, 4 points are instantly awarded, as well as 6 points for every 100 rubles from the Travel category. Full list categories, see the bank's website. From the third month, the number of bonus points is reduced to 2 for the general and to 3 for "Travel". It is allowed to collect a maximum of 10,000 bonuses per month (they are valid for 2 years). You will learn about the status of the bonus account, as well as other operations with the card using free SMS informing.

To repay the loan, you must pay at least 3% of the primary debt monthly (plus accrued interest). If a payment is missed, the penalty will be 20% per annum. If the debt with interest exceeds the agreed credit limit, an additional penalty will be 40% per annum. To, use special services: it is much easier to operate with specific amounts than with interest.

The card is issued to persons aged 21 to 65 upon presentation of a passport. Registration in the region is not required. A certificate from the employer in free form will affect the adoption of an instant positive decision. He must confirm not your income, but the length of service: you need to work in one place for 4 months in a row. The total experience must be 1 year or more.

"Simple" (Geobank)

Terms:

- rate: 0%;

- credit limit: up to 70,000 rubles;

- grace period: up to 1850 days;

- service cost: from 0 to 10,950 rubles.

Please note that for the first year of using the card, the credit limit is 15,000 rubles. It is increased to 70,000 by the decision of the bank's employees only from the second year.

Issue is free, maintenance - 30 rubles per day (free if there is no debt). You can use your own resources. If the account balance is from 10,000 to 499,999 rubles, interest is charged on it - 4% per annum. For a balance equal to or higher than 500,000 rubles - 2% per annum. Cash withdrawals from Geobank and other ATMs are free of charge, as is balance inquiry. You can instantly withdraw up to 100,000 rubles. per day and up to 1,000,000 rubles. per month.

The bank has a cashback service, according to which up to 40% of the amount spent with the bank's partners is returned to the client. SMS messages inform about the status of the bonus account, as well as other operations. The first month of using the service is free, then - 89 rubles. per month. You can request an extract with data on the money spent on your e-mail.

To repay, you must pay monthly at 1% of the debt amount (plus a service fee). If you do not repay the loan within the agreed period, the bank will charge a penalty on the credit card in the amount of 10% per annum for the entire period of using the loan, including the grace period. For further passes, the penalty will be 36.5% per annum.

For an instant positive decision, you must be over 18 and under 71. Show your passport with permanent registration in Russia. Income does not need to be confirmed, but the required work experience in one place is at least 3 months. Those under the age of 26 cannot apply for a credit card online.

"Credit" (Renaissance Credit)

Terms:

- rate: from 24.9% to 45.9%;

- credit limit: up to 200,000 rubles;

- grace period: up to 55 days;

- maintenance cost: free.

This credit card also allows you to use own funds. However, they do not charge interest. The rate of 45.9% per annum is valid only if you cash out credit funds. If the transactions are non-cash, the interest instantly decreases to 24.9-29.9%. You will be told the exact number when deciding whether to issue a credit card.

Cash withdrawals from ATMs and PVN of any bank are subject to an additional commission: 2.9% of the amount + 290 rubles. You can withdraw no more than 700,000 rubles per month. The bank sets the daily limit on an individual basis. SMS notifications inform about completed transactions, the cost of the service is 50 rubles. per month. It is instantly connected with the issuance of the card.

For customers there is a bonus program "Simple Joys". Money spent on purchases from bank partners is converted into points (1 ruble = 1 point). Bonuses can be used to pay utility bills, as well as replenish your mobile account. For repayment per month, you must pay at least 5% of the debt amount (minimum 600 rubles). If you violated one of the conditions of the loan agreement, the fine will be 20% per annum.

The card is issued to citizens of the Russian Federation aged 21 to 65 years. An income statement is not required, but be sure to bring your passport. For a positive decision, you must provide evidence of work experience at one place of work for at least 3 months.

Card Credit Plus (Credit Europe Bank)

Terms:

- rate: from 25% to 39%;

- credit limit: up to 600,000 rubles;

- grace period: up to 55 days;

- service cost: from 0 to 948 rubles.

Issuing a card is free, maintenance is also free if you make purchases of 15,000 rubles or more every month. Otherwise, the service fee will be 79 rubles. per month. The card can be used as a debit card. Cash withdrawal from ATMs of Credit Europe Bank is subject to a commission of 4.9%, from other ATMs - 5.5%. The commission does not operate abroad. Requesting a balance at third-party ATMs costs 30 rubles. The minimum amount you can withdraw is 400 rubles. Withdrawals of 60,000 rubles from ATMs and up to 180,000 rubles from cash withdrawals are allowed on a credit card per day. SMS with information about the status of the account and transactions cost 59 rubles per month.

Along with the issuance of a credit card, the bonus program is instantly activated. For paying for goods and services in the categories "Clothing", "Cafes and restaurants", "Cinema", "Beauty and health" you get points in the amount of 5% of the spent money (1 ruble = 1 point). For purchases in other categories - 1%. Bonus limit - 5,000 per month. They are valid for a whole year, and you can spend them on purchases from bank partners.

To repay the loan, you must pay at least 2% of the debt amount per month (plus accrued interest and the amount for servicing the card). If the payment is missed, the penalty is 20% per annum. For subsequent delays, the fine increases to 59.9% per annum. If an unauthorized overdraft appears on the card (that is, you spent more than the amount of the approved limit), a fine of 109.5% per annum is instantly charged. Per non-cash payment annual percentage - 25%, for other transactions, including transfers from one card to another - 39%.

For a positive decision, you must be over 18 years of age (confirmed by showing a passport). There is no upper age limit set by the bank. If the credit limit approved for you is below 350,000 rubles, you will not need to confirm your income, but you must provide evidence that you have been working at your last (current) job for at least 3 months. The decision does not depend on the presence of registration in the Russian Federation, bank employees do not look beyond the first pages of the passport.

Postal Express (Post Bank)

Terms:

- rate: 0%;

- credit limit: up to 5,000 rubles;

- grace period: up to 720 days;

- service cost: from 300 to 3,900 rubles.

This credit card is well suited for those who want to instantly receive a small amount of money. They release it for free. Maintenance costs 300 rubles per year, but no fee is charged if the card is not used for the entire period.

It is possible to use credit debit card. In this case, cash withdrawals at any VTB Group ATM are not subject to commission. Withdrawal of credit funds costs 300 rubles. For one operation it is allowed to cash out up to 5,000 rubles; per month, the amount should not exceed 30,000 rubles. A balance request at third-party ATMs costs 50 rubles. SMS with information the first 2 months are free, starting from the 3rd - 49 rubles. per month.

At least per month, you must deposit 10% of the credit limit approved by the bank. For a missed payment, a fine of 300 rubles; for the second and subsequent passes - 500 rubles. For an instant positive decision, you must provide a passport and be over 18 years old. Registration in the Russian Federation is optional. Work experience is also not required.

"With a grace period" (UBRD)

Terms:

- rate: from 27% to 32%;

- credit limit: up to 299,999 rubles;

- grace period: up to 120 days;

- service cost: from 0 to 1,900 rubles.

This is one of those if you love shopping and do not agree to make them only from partners of a certain bank. 1% is returned for any purchases with no limits on the amount. Even from the largest spending you will receive a bonus. You can also use your own money, for which cashback is also credited.

The issue of the card is free, maintenance is 1,900 rubles per year. If you spend 150,000 rubles in a year, you will be refunded the entire amount for servicing a credit card. Any ATM withdrawals are subject to a 4% fee. You can withdraw at least 500 rubles. Information about transactions using instant messages costs 50 rubles. per month.

The decision on interest on a loan is influenced by proof of income. If you provide it, the interest per annum will be 27%. If not, 32%. You must pay at least 3% per month credit debt. If a payment is missed, the penalty is 20% per annum. Citizens of the Russian Federation aged 21 to 75 can use the instant credit card issuance service from UBRD. Required work experience is at least 3 months in the last position. From required documents- only a passport with a residence permit.

Summing up

Among the advantages of such offers is instant decision making and a minimum of documents required for this (often only a passport). With additional confirmation of income, the interest rate may be reduced. Also, many banks have a long grace period for which annual interest is not charged. You can pick up a credit card with bonuses and cashback that will allow you to save on many services.

The disadvantages include high interest rates, as well as large penalties for breach of obligations under loan agreement. not available on these cards. The percentage is fixed, and if the penalty has already been accrued, then it cannot be reduced in any way. Many banks charge a large commission for cash withdrawals. Therefore, choosing conditions that are comfortable for you, weigh the pros and cons of each offer well.

Credit cards with a passport in Moscow can be obtained on the day of application. Banks offer to take such a loan without refusal. Unlike classic proposals You don't need to show anything other than your passport. This option is perfect for those who want to get.

Conditions for obtaining a credit card with a passport in Moscow

There are Msk banks that are ready to deliver a banking product to your home. For this:

- filling out a questionnaire

- goes to the bank

- upon approval, the manager calls back,

- the courier with all the documents comes to your home or to work.

Getting a credit card in Moscow with a passport in this way is quite simple, but be sure to prepare a document in advance. The courier will check the data in it and in the contract.

If the card is issued for the first time, the credit limit will be small. As the client pays off the debt on time, the amount in the account increases. Its upper limit is determined by objective circumstances: the level of solvency, the presence of additional conditions.

Moscow banks offer a long grace period on a credit card and low interest rates. Profitable offer created for owners of a positive credit history and reliable clients, for example, payroll.

Credit cards on the basis of a passport without certificates are issued to persons over 18 years of age. The maximum age is 79 years, but there are banks in which it is much less than this mark. If you want to receive funds for a large purchase, it is best to provide additional documents. On our website, you can fill out an online application for a credit card in Moscow in several financial institutions. This will increase your chances of a positive outcome and getting the right amount.