High refinancing rate of the Central Bank. Refinancing rate - what is it in simple words? Where is the refinancing rate used?

Recently, the following trend has been observed: more and more people are interested in the economy, as they directly observe the impact of its laws and indicators on the current situation of both the country as a whole and individually each of its citizens. Modern conditions require access to a large amount of information, mainly thanks to the Internet. In order to understand exactly what is being discussed in the next news release, they will answer the question: refinancing rate - what is it in simple words? You can find out the answer from this article.

Refinancing rate - what is it in simple words: definition and features

The concept of a refinancing rate was introduced quite a long time ago. However, in recent years it has lost its influence as the key bet took over. However, a number of functions remained behind this instrument of monetary policy. This is a kind of indicator that serves as a determinant of the value of money in the country. It can be stated that the refinancing rate, in simple words, is an interest rate, the size of which determines the conditions under which Russian banks will cooperate with the population in relation to loans and deposits, since it is with this in mind that commercial banks receive credit resources from the Central Bank of the Russian Federation. If a commercial bank is able to obtain borrowed funds at 10% per annum, it can offer them to the public at 15% or 17%, with the difference being its profit. The higher the rate set by the Central Bank, the more the population will have to overpay for using the money of the servicing bank.

There are two main reasons that force banks to apply to the Central Bank of the Russian Federation for loans:

- the need to repay an existing loan, the terms of which are less favorable;

- the desire to receive funds that will increase the loan term.

The name of the rate itself indicates its initial value, because loan refinancing is, in simple words, the receipt of borrowed funds to pay off current debt, as a result of which new loan obligations arise, but on more favorable terms.

Additional functions performed by the refinancing rate

The refinancing rate also influences other processes in the economy. It is used if there is a need to display the overall efficiency of processes occurring in the country’s economy. It is worth noting that the rate is calculated not only on loans, but also on deposits. Moreover, its size plays a role in calculating the level of profitability of deposits at which it is not subject to tax (personal income tax definition).

In addition, the concept of refinancing rate can be found in such areas.

- In the Tax Code, where it is included in the calculation of the amount of fines and penalties for non-compliance with the procedure for paying established taxes and fees.

- It may be noted that the refinancing rate is used in situations where borrowed funds or value under loan agreements have been used, but interest is not specified.

- The liability that arises in case of late payment of wages to employees is also measured based on the established refinancing rate.

- This value is used when calculating special payments aimed at providing support to entrepreneurs.

Thus, we can conclude that such an indicator as the refinancing rate plays an important role in many ongoing economic processes. In general, it can be noted that its decrease has a stimulating function.

Current refinancing rate of the Central Bank of the Russian Federation for 2019

Today the current refinancing rate is 7.5% per annum.

There are several areas that are affected by the Central Bank's real refinancing rate:

- The amount of tax on income from a bank deposit.

- The amount of compensation for the employer’s financial liability to the employee in a situation of delayed payment. If the salary was not paid on time, the employer is obliged to compensate for the costs (pay a penalty) in the amount of at least one three hundredth of the refinancing rate of the Central Bank of the Russian Federation for each day of delay.

- The amount of monetary penalty for late payment on a loan.

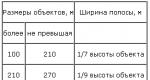

There is data on the refinancing rate for 2019. The Central Bank, however, does not publish this information on the official website. In January 2016, it was decided that the refinancing rate would not be set by the government. In the table below, the rate in force in some years is compared with the inflation rate. Since the refinancing rate often changed several times a year, the table shows data at the end of each year.

Inflation rate | Central Bank refinancing rate |

|

On central channels, in the summary of economic news, you can often see headlines: “The Central Bank lowered the key refinancing rate” or left it unchanged. What does it mean? How often is it recalculated, who changes it, and what does it affect? Read about all this below.

What is the refinancing rate in simple words

Refinancing rate- this is the interest rate at which the Central Bank (CB) gives loans to commercial banks. Also, penalties, delayed wages, etc. are calculated at this rate. Measured as a percentage.

The refinancing rate in Russia was introduced on January 1, 1992. Below is a table with the full history of changes in this rate.

From January 1, 2016, the key rate became equal to the refinancing rate. In fact, they are one and the same.

The decision on changes in the refinancing rate is made by the Central Bank at scheduled meetings. At the same time, there may be unplanned changes to this rate in cases of force majeure. An example of such an event is 2014, when the Central Bank sharply raised the rate by 7% (from 10.5% to 17%) in order to stop the rapid collapse of the ruble (in a couple of days the ruble to dollar exchange rate increased from 45 to 67 rubles, reaching a peak of 81) .

How to find out the current refinancing rateCurrent data on the refinancing rate can be found on the official website of the Central Bank of the Russian Federation: cbr.ru

What does the refinancing rate affect?

The refinancing rate has a strong influence on the population, since all banks are guided by it when choosing the rate on loans and the rate on bank deposits. Inflation also depends on these processes.

For example, the loan rate may not be lower than the refinancing rate.

It affects a bank deposit as follows: If the bank offers a deposit rate higher than the refinancing rate by 5 basis points, then you must pay tax on income above. For example, the deposit rate is 14%, and the refinancing rate is 8%. In this case, you will have to pay tax on 1% income.

Also, the key rate of the Central Bank affects bond yields. Primarily government bonds OFZ. It displays the risk-free yield curve.

In the US, the key interest rate is called the "Federal funds rate". It is set by the US central bank - the Federal Reserve. Since the dollar is the dominant currency in the world, and the FFR rate has an almost decisive influence on its value, the currency markets, commodity prices, and stock markets react to its forecasts and changes very emotionally.

Table of the refinancing rate of the Central Bank of the Russian Federation for all years

| Validity | % | Regulatory document |

| 26.03.2018 - | 7.25 | |

| 12.02.2018 - 25.03.2018 | 7.50 | |

| 18.12.2017 - 11.02.2018 | 7,75 | |

| 30.10.2017 - 17.12.2017 | 8,25 | |

| 18.09.2017 - 29.10.2017 | 8,50 | |

| 19.06.2017 - 17.09.2017 | 9,00 | |

| 02.05.2017- 18.06.2017 | 9,25 | |

| 27.03.2017 - 01.05.2017 | 9,75 | |

| 19.09.2016 - 26.03.2017 | 10,00 | |

| 14.06.2016 - 18.09.2016 | 10,50 | |

| 01.01.2016 - 13.06.2016 | 11,00 | Directive of the Bank of Russia dated December 11, 2015 N 3894-U |

| 14.09.2012 - 31.12.2015 | 8,25 | Directive of the Central Bank of Russia dated September 13, 2012 No. 2873-U |

| 26.12.2011 - 13.09.2012 | 8,00 | Directive of the Central Bank of Russia dated December 23, 2011 N 2758-U |

| 03.05.2011 - 25.12.2011 | 8,25 | Directive of the Central Bank of Russia dated April 29, 2011 N 2618-U |

| 28.02.2011 - 02.05.2011 | 8,00 | Directive of the Central Bank of Russia dated February 25, 2011 No. 2583-U |

| 01.06.2010 - 27.02.2011 | 7,75 | Directive of the Central Bank of Russia dated May 31, 2010 No. 2450-U |

| 30.04.2010 - 31.05.2010 | 8,00 | Directive of the Central Bank of Russia dated April 29, 2010 No. 2439-U |

| 29.03.2010 - 29.04.2010 | 8,25 | Directive of the Central Bank of Russia dated March 26, 2010 No. 2415-U |

| 24.02.2010 - 28.03.2010 | 8,50 | Directive of the Central Bank of Russia dated February 19, 2010 No. 2399-U |

| 28.12.2009 - 23.02.2010 | 8,75 | Directive of the Central Bank of Russia dated December 25, 2009 No. 2369-U |

| 25.11.2009 - 27.12.2009 | 9,00 | Directive of the Central Bank of Russia dated November 24, 2009 No. 2336-U |

| 30.10.2009 - 24.11.2009 | 9,50 | Directive of the Central Bank of Russia dated October 29, 2009 No. 2313-U |

| 30.09.2009 - 29.10.2009 | 10,00 | Directive of the Central Bank of the Russian Federation dated September 29, 2009 No. 2299-U |

| 15.09.2009 - 29.09.2009 | 10,50 | Directive of the Central Bank of Russia dated September 14, 2009 No. 2287-U |

| 10.08.2009 - 14.09.2009 | 10,75 | Directive of the Central Bank of Russia dated August 7, 2009 No. 2270-U |

| 13.07.2009 - 09.08.2009 | 11 | Directive of the Central Bank of Russia dated July 10, 2009 No. 2259-U |

| 05.06.2009 - 12.07.2009 | 11,5 | Directive of the Central Bank of Russia dated June 4, 2009 N 2247-U |

| 14.05.2009 - 04.06.2009 | 12 | Directive of the Central Bank of Russia dated May 13, 2009 N 2230-U |

| 24.04.2009 - 13.05.2009 | 12,5 | Directive of the Central Bank of Russia dated April 23, 2009 N 2222-U |

| 01.12.2008 - 23.04.2009 | 13 | Information from the Central Bank of Russia dated November 28, 2008 |

| 12.11.2008 - 30.11.2008 | 12 | Directive of the Central Bank of Russia dated November 11, 2008 N 2123-U |

| 14.07.2008 - 11.11.2008 | 11 | Directive of the Central Bank of Russia dated July 11, 2008 N 2037-U |

| 10.06.2008 - 13.07.2008 | 10,75 | Directive of the Central Bank of Russia dated 06/09/2008 No. 2022-U |

| 29.04.2008 - 09.06.2008 | 10,50 | Directive of the Central Bank of Russia dated April 28, 2008 No. 1997-U |

| 04.02.2008 - 28.04.2008 | 10,25 | Directive of the Central Bank of Russia dated 01.02.2008 N 1975-U |

| 19.06.2007 - 03.02.2008 | 10 | Telegram of the Central Bank of Russia dated June 18, 2007 N 1839-U |

| 29.01.2007 - 18.06.2007 | 10.5 | Telegram of the Central Bank of Russia dated January 26, 2007 N 1788-U |

| 23.10.2006 - 28.01.2007 | 11 | Telegram of the Central Bank of Russia dated October 20, 2006 N 1734-U |

| 26.06.2006 - 22.10.2006 | 11.5 | Telegram of the Central Bank of Russia dated June 23, 2006 N 1696-U |

| 26.12.2005 - 25.06.2006 | 12 | Telegram of the Central Bank of Russia dated December 23, 2005 N 1643-U |

| 15.06.2004 - 25.12.2005 | 13 | Telegram of the Central Bank of Russia dated June 11, 2004 N 1444-U |

| 15.01.2004 - 14.06.2004 | 14 | Telegram of the Central Bank of Russia dated January 14, 2004 N 1372-U |

| 21.06.2003 - 14.01.2004 | 16 | Telegram of the Central Bank of Russia dated June 20, 2003 N 1296-U |

| 17.02.2003 - 20.06.2003 | 18 | Telegram of the Central Bank of Russia dated February 14, 2003 N 1250-U |

| 07.08.2002 - 16.02.2003 | 21 | Telegram of the Central Bank of Russia dated 06.08.2002 N 1185-U |

| 09.04.2002 - 06.08.2002 | 23 | Telegram of the Central Bank of Russia dated 04/08/2002 N 1133-U |

| 04.11.2000 - 08.04.2002 | 25 | Telegram of the Central Bank of Russia dated November 3, 2000 N 855-U |

| 10.07.2000 - 03.11.2000 | 28 | Telegram of the Central Bank of Russia dated 07/07/2000 N 818-U |

| 21.03.2000 - 09.07.2000 | 33 | Telegram of the Central Bank of Russia dated March 20, 2000 N 757-U |

| 07.03.2000 - 20.03.2000 | 38 | Telegram of the Central Bank of Russia dated 03/06/2000 N 753-U |

| 24.01.2000 - 06.03.2000 | 45 | Telegram of the Central Bank of Russia dated January 21, 2000 N 734-U |

| 10.06.1999 - 23.01.2000 | 55 | CBR telegram dated 06/09/99 N 574-U |

| 24.07.1998 - 09.06.1999 | 60 | Telegram of the Central Bank of Russia dated July 24, 1998 N 298-U |

| 29.06.1998 - 23.07.1998 | 80 | Telegram from the Central Bank of Russia dated June 26, 1998 N 268-U |

| 05.06.1998 - 28.06.1998 | 60 | Telegram of the Central Bank of Russia dated 04.06.98 N 252-U |

| 27.05.1998 - 04.06.1998 | 150 | Telegram of the Central Bank of Russia dated May 27, 1998 N 241-U |

| 19.05.1998 - 26.05.1998 | 50 | Telegram from the Central Bank of Russia dated May 18, 1998 N 234-U |

| 16.03.1998 - 18.05.1998 | 30 | Telegram from the Central Bank of Russia dated March 13, 1998 N 185-U |

| 02.03.1998 - 15.03.1998 | 36 | CBR telegram dated 02.27.98 N 181-U |

| 17.02.1998 - 01.03.1998 | 39 | CBR telegram dated 02.16.98 N 170-U |

| 02.02.1998 - 16.02.1998 | 42 | Telegram of the Central Bank of Russia dated January 30, 1998 N 154-U |

| 11.11.1997 - 01.02.1998 | 28 | Telegram from the Central Bank of Russia dated November 10, 1997 N 13-U |

| 06.10.1997 - 10.11.1997 | 21 | Telegram from the Central Bank of Russia dated 01.10.97 N 83-97 |

| 16.06.1997 - 05.10.1997 | 24 | Telegram of the Central Bank of Russia dated June 13, 1997 N 55-97 |

| 28.04.1997 - 15.06.1997 | 36 | Telegram of the Central Bank of Russia dated April 24, 1997 N 38-97 |

| 10.02.1997 - 27.04.1997 | 42 | Telegram from the Central Bank of Russia dated 02/07/97 N 9-97 |

| 02.12.1996 - 09.02.1997 | 48 | Telegram from the Central Bank of Russia dated November 29, 1996 N 142-96 |

| 21.10.1996 - 01.12.1996 | 60 | Telegram from the Central Bank of Russia dated October 18, 1996 N 129-96 |

| 19.08.1996 - 20.10.1996 | 80 | Telegram of the Central Bank of Russia dated August 16, 1996 N 109-96 |

| 24.07.1996 - 18.08.1996 | 110 | Telegram of the Central Bank of Russia dated July 23, 1996 N 107-96 |

| 10.02.1996 - 23.07.1996 | 120 | Telegram of the Central Bank of Russia dated 02/09/96 N 18-96 |

| 01.12.1995 - 09.02.1996 | 160 | Telegram of the Central Bank of Russia dated November 29, 1995 N 131-95 |

| 24.10.1995 - 30.11.1995 | 170 | Telegram from the Central Bank of Russia dated October 23, 1995 N 111-95 |

| 19.06.1995 - 23.10.1995 | 180 | Telegram of the Central Bank of Russia dated June 16, 1995 N 75-95 |

| 16.05.1995 - 18.06.1995 | 195 | Telegram of the Central Bank of Russia dated May 15, 1995 N 64-95 |

| 06.01.1995 - 15.05.1995 | 200 | CBR telegram dated 01/05/95 N 3-95 |

| 17.11.1994 - 05.01.1995 | 180 | Telegram from the Central Bank of Russia dated November 16, 1994 N 199-94 |

| 12.10.1994 - 16.11.1994 | 170 | CBR telegram dated 10/11/94 N 192-94 |

| 23.08.1994 - 11.10.1994 | 130 | CBR telegram dated 08.22.94 N 165-94 |

| 01.08.1994 - 22.08.1994 | 150 | Telegram of the Central Bank of Russia dated July 29, 1994 N 156-94 |

| 30.06.1994 - 31.07.1994 | 155 | Telegram of the Central Bank of Russia dated June 29, 1994 N 144-94 |

| 22.06.1994 - 29.06.1994 | 170 | Telegram of the Central Bank of Russia dated June 21, 1994 N 137-94 |

| 02.06.1994 - 21.06.1994 | 185 | Telegram of the Central Bank of Russia dated 01.06.94 N 128-94 |

| 17.05.1994 - 01.06.1994 | 200 | Telegram from the Central Bank of Russia dated May 16, 1994 N 121-94 |

| 29.04.1994 - 16.05.1994 | 205 | Telegram of the Central Bank of Russia dated April 28, 1994 N 115-94 |

| 15.10.1993 - 28.04.1994 | 210 | Telegram from the Central Bank of Russia dated October 14, 1993 N 213-93 |

| 23.09.1993 - 14.10.1993 | 180 | Telegram of the Central Bank of Russia dated September 22, 1993 N 200-93 |

| 15.07.1993 - 22.09.1993 | 170 | Telegram of the Central Bank of Russia dated July 14, 1993 N 123-93 |

| 29.06.1993 - 14.07.1993 | 140 | Telegram of the Central Bank of Russia dated June 28, 1993 N 111-93 |

| 22.06.1993 - 28.06.1993 | 120 | Telegram of the Central Bank of Russia dated June 21, 1993 N 106-93 |

| 02.06.1993 - 21.06.1993 | 110 | Telegram of the Central Bank of Russia dated 01.06.93 N 91-93 |

| 30.03.1993 - 01.06.1993 | 100 | Telegram of the Central Bank of Russia dated March 29, 1993 N 52-93 |

| 23.05.1992 - 29.03.1993 | 80 | Telegram from the Central Bank of Russia dated May 22, 1992 N 01-156 |

| 10.04.1992 - 22.05.1992 | 50 | Telegram from the Central Bank of Russia dated April 10, 1992 N 84-92 |

| 01.01.1992 - 09.04.1992 | 20 | Telegram of the Central Bank of Russia dated December 29, 1991 N 216-91 |

See also video: what is the refinancing rate

The current refinancing rate (key rate) of the Central Bank of the Russian Federation is 7.50% (valid from June 17, 2019 to the present)

Refinancing rate– this is another way of supplying money to other banks. The Central Bank of Russia lends money to commercial banks and other financial organizations, and they, in turn, give loans to both ordinary citizens (individuals) and various companies and organizations (legal entities).

In practice, it looks like this: a commercial bank can take from the Central Bank, say, one million dollars. After a year, he is obliged to return to the central bank the total amount of a million American money + interest that accrued during this time at the same refinancing rate. During this year, a commercial bank lends money to the population and organizations at a higher interest rate than the refinancing rate - and makes a profit. The population receives loans, the Central Bank is not left at a loss either - everyone seems to be happy.

In numbers, this may look like this: let’s say the refinancing rate is 10% (you can find out the exact rate today at the end of the article). The bank borrows a certain amount of money from the Central Bank of Russia at 10% per annum, and then gives this money to ordinary citizens, for example, at 18% per annum. The bankers pocket the resulting difference.

Why doesn't the state Central Bank lend money directly to people?

The Central Bank works only with large sums; there are not millions, but tens and hundreds of millions of dollars circulating there. To put it simply, “it’s not the king’s business to give loans to every old woman.”

It turns out that banks act as intermediaries, but this is even to our benefit, since banking organizations have an extensive structure with hundreds of offices and ATMs throughout the country, which allows ordinary citizens to find the branch closest to their home and receive the necessary financial services.

Can a commercial bank get more and cheaper money from the Central Bank, and distribute its loans at a higher price?

Roughly speaking, yes, it can. But commercial banks cannot make a very big difference - competition, however!

If you “tear three skins”, clients will run away to another bank. And you will be left with the state sum of money, but you have to return it!

Therefore, as a rule, lending rates in different credit institutions do not differ much.

True, there are exceptions to the rules here. We are talking about credit institutions that provide loans in large stores, as well as lending using cards sent by mail. Examples of such organizations: Home Credit Bank, Russian Standard, OTP Bank, Alfa Bank, Renaissance Credit and others. Interest rates in such cases can reach 30-70%. This is achieved due to the psychological aspects of people’s behavior, as well as a low level of financial literacy.

Where does the specific refinancing rate come from?

The refinancing rate is determined based on the current economic situation in the country and. If the inflation rate rises, the central bank increases the refinancing rate. If the inflation rate decreases, the Central Bank lowers the refinancing rate.

It usually looks like this: when the refinancing rate is low, loans become available. Interest rates on loans are falling and people are willing to take them out. Of course, you will have to overpay a little, then borrowing money is profitable. You can buy a lot of things and pay off little by little.

Even better for businesses. The more money they attract into their business and the cheaper this money is, the more goods they can produce and the more revenue they will receive.

Even better for businesses. The more money they attract into their business and the cheaper this money is, the more goods they can produce and the more revenue they will receive.

As a result, when people have a lot of money in their hands, there are more purchases, as a result of which goods usually begin to become more expensive. People are starting to sweep everything off the shelves. There are not enough goods for everyone and sellers begin to raise their prices. Along with this, inflation begins to rise.

Let me remind you that at different periods of time, for the same amount of money, you can buy different quantities of the same product.

A high level of inflation affects people's well-being. The higher the inflation, the lower the level of well-being of people and the more dissatisfied they are. And this is already a threat to the government of the country, since dissatisfied people can rebel and choose other rulers.

That's why, refinancing rate acts as a certain tool to influence the level of inflation in the country. To reduce inflation, the refinancing rate is raised. What makes loans more expensive? It becomes unprofitable and expensive for people to take them, which ultimately affects their purchasing power.

People have less money and people start spending less. The funds earned go only to the essentials. We have to give up delicacies and newfangled gadgets. Because of this, sales in stores fall and sellers begin to reduce prices on goods. All this leads to lower inflation.

Refinancing rate and taxation

It is worth noting that in addition to the cases listed above, the refinancing rate is also applied in taxation.

- In particular, income is taxed on income that exceeds the refinancing rate + 5 percentage points. For example, if you opened a deposit at 15 percent per annum, and the refinancing rate was 10%. Then, to calculate, we add 5 to 10 and get the same 15%. That is, no tax will be charged on deposit income. But if you then open a new deposit at 16% per annum at the same refinancing rate, then you will have to pay a tax of 35% on 1% of the income received on the deposit.

- Also, the refinancing rate helps determine the amount of compensation that the employer is obliged to pay to the employee in the event of delays in wages, vacation pay or money due upon dismissal. According to the law, the employer is obliged to reimburse the amount due + monetary compensation in the amount of not less than 1/300 of the established refinancing rate for each overdue day.

- And finally, the refinancing rate is used to determine penalties for persons who owe taxes and various fees. To do this, use the following formula:

Changes in the refinancing rate from 1992 to the present day:

| DATE | |

| from June 17, 2019 to present | 7.50 |

| from 12/17/2018 to 06/16/2019 | 7.75 |

| from 09/17/2018 to 12/16/2018 | 7.50 |

| from 04/27/2018 – to 09/16/2018 | 7.25 |

| from 03/23/2018 – to 04/26/2018 | 7.25 |

| from 02/12/2018 – to 03/22/2018 | 7.50 |

| from 12/18/2017 – to 02/11/2018 | 7.75 |

| from 10/30/2017 – to 12/17/2017 | 8.50 |

| from 09/18/2017 – to 10/29/2017 | 8.50 |

| from 06/19/2017 – to 09/17/2017 | 9.00 |

| from 05/02/2017 – to 06/18/2017 | 9.25 |

| from 03/27/2017 – to 05/01/2017 | 9.75 |

| from 09/19/2016 – to 03/26/2017 | 10 |

| from 06/14/2016 – to 09/18/2016 | 10.50 |

| 01/01/2016 – 06/13/2016 | 11 |

| 09/14/2012 - 12/31/2015 | 8.25 |

| 12/26/2011 - 09/13/2012 | 8 |

| 05/03/2011 – 12/25/2011 | 8.25 |

| 02/28/2011 – 05/02/2011 | 8 |

| 06/01/2010 – 02/27/2011 | 7.75 |

| 04/30/2010 – 05/31/2011 | 8 |

| 03/29/2010 – 04/29/2010 | 8.25 |

| 02/24/2010 – 03/28/2010 | 8.5 |

| 12/28/2009 – 02/23/2010 | 8.75 |

| November 25, 2009 – December 27, 2009 | 9 |

| 10/30/2009 – 11/24/2009 | 9.5 |

| 09/30/2009 – 10/29/2009 | 10 |

| 09/15/2009 – 09/29/2009 | 10.5 |

| 08/10/2009 – 09/14/2009 | 10.75 |

| July 13, 2009 – August 9, 2009 | 11 |

| 06/05/2009 – 07/12/2009 | 11.5 |

| 05/14/2009 – 06/04/2009 | 12 |

| 04/24/2009 – 05/13/2009 | 12.5 |

| 12/01/2008 – 04/23/2009 | 13 |

| 11/12/2008 – 11/30/2008 | 12 |

| 07/14/2008 – 11/11/2008 | 11 |

| 06/10/2008 – 07/13/2008 | 10.75 |

| 04/29/2008 – 06/09/2008 | 10.5 |

| 02/04/2008 – 04/28/2008 | 10.25 |

| 06/19/2007 – 02/03/2008 | 10 |

| 01/29/2007 – 06/18/2007 | 10.5 |

| 10/23/2006 – 01/28/2007 | 11 |

| June 26, 2006 – October 22, 2006 | 11.5 |

| 12/26/2005 – 06/25/2005 | 12 |

| 06/15/2004 – 12/25/2005 | 13 |

| 01/15/2004 – 06/14/2004 | 14 |

| 06/21/2003 – 01/14/2004 | 16 |

| 02/17/2003 – 06/20/2003 | 18 |

| 08/07/2002 – 02/16/2003 | 21 |

| 04/09/2002 – 08/06/2002 | 23 |

| 04.11.2000 – 08.04.2002 | 25 |

| 07/10/2000 – 11/03/2000 | 28 |

| 03/21/2000 – 07/09/2000 | 33 |

| 03/07/2000 – 03/20/2000 | 38 |

| 01/24/2000 – 03/06/2000 | 45 |

| 06/10/1999 – 01/23/2000 | 55 |

| 07/24/1998 – 06/09/1999 | 60 |

| 06/29/1998 – 07/23/1998 | 80 |

| 06/05/1998 – 06/28/1998 | 60 |

| 05/27/1998 – 06/04/1998 | 150 |

| 05/19/1998 – 05/26/1998 | 50 |

| 03/16/1998 – 05/18/1998 | 30 |

| 03/02/1998 – 03/15/1998 | 36 |

| 02/17/1998 – 03/01/1998 | 39 |

| 02/02/1998 – 02/16/1998 | 42 |

| 11.11.1997 – 01.02.1998 | 28 |

| 10/06/1997 – 11/10/1997 | 21 |

| 06/16/1997 – 10/05/1997 | 24 |

| 04/28/1997 – 06/15/1997 | 36 |

| 02/10/1997 – 04/27/1997 | 42 |

| 12/02/1996 – 02/09/1997 | 48 |

| 10/21/1996 – 12/01/1996 | 60 |

| 08/19/1996 – 10/20/1996 | 80 |

| 07/24/1996 – 08/18/1996 | 110 |

| 02/10/1996 – 07/23/1996 | 120 |

| 12/01/1995 – 02/09/1996 | 160 |

| 10/24/1995 – 11/30/1995 | 170 |

| 06/19/1996 – 10/23/1995 | 180 |

| 05/16/1995 – 06/18/1995 | 195 |

| 01/06/1995 – 05/15/1995 | 200 |

| 11/17/1994 – 01/05/1995 | 180 |

| 10/12/1994 – 11/16/1994 | 170 |

| 08/23/1994 – 10/11/1994 | 130 |

| 08/01/1994 – 08/22/1994 | 150 |

| 06/30/1994 – 07/31/1994 | 155 |

| 06/22/1994 – 06/29/1994 | 170 |

| 06/02/1994 – 06/21/1994 | 185 |

| 05/17/1994 – 06/01/1994 | 200 |

| 04/29/1994 – 05/16/1994 | 205 |

| 10/15/1993 – 04/28/1994 | 210 |

| 09/23/1993 – 10/14/1993 | 180 |

| 07/15/1993 – 09/22/1993 | 170 |

| 06/29/1993 – 07/14/1993 | 140 |

| 06/22/1993 – 06/28/1993 | 120 |

| 06/02/1993 – 06/21/1993 | 110 |

| 03/30/1993 – 06/01/1993 | 100 |

| 05/23/1992 – 03/29/1993 | 80 |

| 04/10/1992 – 05/22/1992 | 50 |

| 01/01/1992 – 04/09/1992 | 20 |

Conclusion

We hope that our article helped answer your question: What is the refinancing rate of the Central Bank of the Russian Federation and why is it needed? And if you still have questions, you can ask them below in the comments.

→ What is the “refinancing rate of the Central Bank of the Russian Federation”?

What is the “refinancing rate of the Central Bank of the Russian Federation”?

What is the refinancing rate in simple words?

The refinancing rate is the amount of interest on an annual basis payable to the Bank of Russia for loans that it has provided to credit institutions. Simply put, this is the interest rate at which the Central Bank provides loans to commercial banks and other financial institutions. From September 14, 2012, the refinancing rate is 8.25%.

In practice, everything happens as follows: a commercial bank takes, say, 100 million rubles from the Central Bank. After a year, he is obliged to repay the borrowed amount plus interest that accrued during this time at this same refinancing rate, that is, 108.25 million.

During this year, a commercial bank provides loans to individuals and legal entities, of course, at a higher interest rate than the refinancing rate, making a profit.

What is refinancing?

Refinancing itself is a process during which the borrower repays the lender for the previously obtained (outstanding) loan with the help of a newly raised low-cost short-term loan. Refinancing allows the borrowing bank to solve the following problems:

- reduce your expenses by attracting a new loan on more favorable terms;

- reduce customer lending rates, increasing your competitiveness;

- extend the loan term, defer payment;

- additional loans are additional resources for commercial banks to lend to clients.

Where is the refinancing rate applied?

- When taxing income on deposits. In accordance with the Tax Code of the Russian Federation, the tax rate is set at 35% in relation to interest income on bank deposits, in part of the excess of the amount calculated taking into account the refinancing rate. Personal income tax (NDFL) is levied on interest exceeding the refinancing rate by more than 5 percentage points. Payments to the state are made by the bank.

- When calculating the amount of penalties for late payment of taxes and other contributions to the state. In accordance with the current Tax Code, the interest rate of penalties is set at 1/300 of the refinancing rate of the Central Bank of the Russian Federation.

- When calculating the employer’s financial liability for delays in wages, vacation pay and other payments due to the employee by law. In accordance with the Labor Code of the Russian Federation, in this case, the employer is obliged to pay the employee monetary compensation in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation from amounts not paid on time for each day of delay.

Here's how the refinancing rate has changed in recent years:

They learned what the refinancing rate in Russia is in 1992. Then it was set at 20%. However, she was able to hold out at this level for only a short time, beginning to grow rapidly.

The refinancing rate reached its historical maximum in 1993 - then it was set at 210(!)%. The minimum rate - 7.75% - was set on June 1, 2010. It remained at this level until the beginning of 2011.

Share information on social networks:What is the Central Bank rate, what is it for? We often hear about this indicator, but not everyone understands its significance. The article explains in clear language the meaning of the refinancing percentage of the Central Bank of the Russian Federation.

Quite simply

The refinancing rate of the Central Bank of the Russian Federation is the interest at which commercial banks and financial organizations borrow money from the Central Bank of the country. The Central Bank acts as a creditor of the entire banking system. The indicator is calculated in annual percentages.

In a simple example, the borrowing process looks like this:

A commercial bank receives 100,000,000 rubles from the Central Bank at 10.5% per annum. After a year, he must repay the amount of debt and interest in the amount of 10,500,000 rubles. Total 110,500,000 rubles.

Receiving money at the refinancing rate, banks, in turn, issue it to the population and business in the form of loans, consumer loans, and mortgage loans.

It is clear why banks issue money at higher interest rates than the Central Bank rate - the difference is their income.

In the end, everyone is happy: the population and business receive loans, banks and the Central Bank make a profit.

The question may arise why the Central Bank of the Russian Federation does not issue loans to borrowers directly? The answer is simple: the regulator works only with large structures, issuing borrowed money in tranches of tens and hundreds of millions of dollars.

Banks act as intermediaries in this scheme, having branches and offices in every locality and issuing loans for different amounts, from several thousand rubles.

How is the Central Bank indicator determined?

The Central Bank sets the refinancing percentage taking into account the current situation in the economy, focusing on the inflation rate. The higher the inflation, the higher the Central Bank rate, and vice versa.

How does this affect ordinary borrowers? It's simple: if the refinancing rate is low, then loans for the population become available: banks reduce their interest rates, receiving cheaper money from the Central Bank.

As a result, private borrowers and business representatives strive to obtain favorable loans. Consumption is growing, and profits for manufacturers and retail chains are increasing. It would seem that everything is fine!

But this process also has a downside: if people have a lot of cheap money in their hands, then they are ready to buy a lot. Goods begin to rise in price, sellers raise prices, trying to maximize their income. And inflation and money depreciation begin to rise.

High inflation leads to a decrease in the well-being of the population and an increase in discontent. And this leads to threats to power and political changes. Therefore, the refinancing percentage of the Central Bank of Russia is a kind of instrument that regulates inflation.

To reduce it, the Central Bank raises the rate. Loans become more expensive, borrowers refuse them and consumption levels decline. Following this, inflation decreases.

Central Bank rates and bank interest rates

In conclusion, we will provide background information on the rates of the Central Bank of the Russian Federation and examples of some loan offers relevant in 2016.

Table 1. How the refinancing rate changed in the period from 2005 to 2016

| date | Bid (%) |

| 14.06.2016 – | 10.50 |

| 01.01.2016 – 13.06.2016 | 11,00 |

| 14.09.2012 – 31.12.2015 | 8,25 |

| 03.05.2011 – 25.12.2011 | 8,25 |

| 30.04.2010 – 31.05.2010 | 8,00 |

| 25.11.2009 – 27.12.2009 | 9,00 |

| 12.11.2008 – 30.11.2008 | 12 |

| 29.01.2007 – 18.06.2007 | 10.5 |

| 15.06.2004 – 25.12.2005 | 13 |

Table 2. Tariffs of commercial banks for consumer loans in 2016.

| Bank | Tariff (%) | Amount (rub.) |

| Post Bank | From 19.9 | Up to 1,000,000 |

| CitiBank | From 15 | Up to 2,000,000 |

| Raiffeisenbank | From 17 | Up to 2,000,000 |

| VTB 24 | From 17 | Up to 3,000,000 |

Where is the refinancing rate used?

The Central Bank of the Russian Federation does not set rates every day. Usually the indicator is valid for several months before the next change.

Read also:

Banks and the state rely on the refinancing percentage in matters of taxation and calculations of the profitability of bank deposits. Some examples:

- Taxes are levied if income on ruble deposits exceeds 5% of the rate of the Central Bank of the Russian Federation. Today the rate is 10.5%. Thus, the owner of the deposit who received an income of over 15.5% per annum will pay tax. For amounts exceeding this value, you will have to pay income tax in the amount of 35%.

- The Tax Service collects penalties and fines on the amount of violations at a percentage of the Central Bank. Private taxpayers and business representatives who have overdue the date of obligatory payment of taxes and fees will pay a penalty for each day of delay at the Central Bank rate.