Limitation period for demand cards. How is the statute of limitations for overdue loans calculated? When the bank goes to court

Telephone consultation 8 800 505-91-11

The call is free

Term limitation period by credit card

Has the limitation period for a credit card been reset to zero after giving written testimony to the district police officer that I took the card and do not refuse to pay.

Hello Ekaterina! No, giving written testimony to the district police officer does not nullify the statute of limitations.

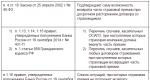

Hello Ekaterina! In accordance with Art. 196 of the Civil Code of the Russian Federation, the general limitation period is three years. According to paragraph 2 of Art. 199 of the Civil Code of the Russian Federation, the limitation period is applied by the court only at the request of a party to the dispute, made before the court makes a decision. The expiration of the limitation period is the basis for the court to issue a decision to dismiss the claim. When pointing out to the court that the plaintiff missed the limitation period, it must be borne in mind that according to general rule the limitation period begins to run from the day when the person learned about the violation of his right (Article 200 of the Civil Code of the Russian Federation). If there are discrepancies in the application of this rule, it is necessary to draw the attention of the judge to the fact that in disputes over the collection of debts under a loan agreement, the day when the creditor learned about the violation of his right should be considered the day when he became aware that the borrower was not fulfilling his obligations. obligations to repay the loan - in particular, when the next monthly payment in repayment of the loan. At the same time, the limitation period for claims for overdue time payments, including payments under a loan agreement, is calculated separately for each overdue payment (for example, the Appeal ruling of the Moscow City Court dated January 24, 2018 in case No. 33-1978 / 2018). The limitation period in such cases applies to claims for the recovery of debt and interest filed outside the three-year limitation period. There are quite a few positions of the courts on interrupting the limitation period by recognizing a debt (part 1 of article 203 of the Civil Code of the Russian Federation): 1. To what situations does part 1 of art. 203 of the Civil Code of the Russian Federation: 1.1. The running of the limitation period is interrupted by any actions indicating that the debtor has acknowledged his obligation to the creditor (position of the Supreme Court of the Russian Federation) 1.2. Written confirmation by the debtor of the existence of the debt interrupts the limitation period (position of the Supreme Court of the Russian Federation) 1.3. The direction by the debtor to the creditor of a letter of guarantee (letters), in which the debtor undertook to repay the debt, interrupts the limitation period (position of the Supreme Court of the Russian Federation). 2. To what situations does Part 1 of Art. 203 of the Civil Code of the Russian Federation: 2.1. As a general rule, the recognition of a part of the debt does not indicate the recognition of the debt as a whole (the position of the Supreme Court of the Russian Federation) 2.2. Recognition of a part of the debt does not interrupt the running of the limitation period for other parts, if the obligation should have been performed in installments (the position of the Supreme Court of the Russian Federation) 2.3. Recognition by an obligated person of the principal debt does not interrupt the running of the limitation period for additional requirements and a claim for damages (the position of the Supreme Court of the Russian Federation) 3. How do other rules of law apply to relations regulated by Part 1 of Art. 203 of the Civil Code of the Russian Federation: 3.1. The burden of proving the circumstances testifying to the interruption of the limitation period rests with the plaintiff (the position of the Supreme Court of the Russian Federation) 3.2. The performance by the debtor's representative of actions indicating the recognition of the debt interrupts the limitation period, provided that the representative had the appropriate authority (the position of the Supreme Court of the Russian Federation). In my opinion, in your situation there is no interruption of the limitation period by the recognition of debt.

Credit card statute of limitations.

3 years from the date of the estimated last payment, according to the loan agreement and schedule.

If the repayment of the loan is determined by the repayment schedule, then the claim period is three years for each monthly payment. That is, if the payment term, for example, is every 10th day of the month, then the payment period starts from the 11th day of this month. And so on for each payment. Within three years, the bank can collect this payment from the borrower. But the defendant must declare in court that the statute of limitations has passed. If the application is not received, the court will collect everything that the bank asks for.

There is a lawsuit to recover credit card debt. The statute of limitations has passed, but I have no receipts. How to prove and what to do.

Apply Article 196 of the Civil Code of the Russian Federation, the limitation period is three years, it has a declarative character. Request a bank statement.

Hello Vladimir! It is necessary to write objections to the statement of claim indicating that the bank has missed the limitation period. This will be enough for the court to dismiss the claim.

Vladimir, when applying to the creditor's court, declare the application of the limitation period, which is three years Art. 196, 199,200 of the Civil Code of the Russian Federation.

All your documents and the movement of money on the account are attached to the claim.

Does the statute of limitations apply to credit cards? And what to do if you didn’t pay on a credit card for 5 years, didn’t communicate with the bank for the same amount, but the justice of the peace made a decision (order) on recovery (February 5, 2019). I did not receive an order. A week ago I learned about the opening enforcement proceedings. The bailiff who opened the IP on sick leave did not receive the Order (copy) in his hands. Haven't been sent to work yet. How to do it right?

Hello Artyom! You need to file an objection with the court for annulment.

Hello. Write an application to the court to cancel the court order.

Familiarize yourself with the case materials in court, obtain a copy of the court order (SP). Submit within 10 days from the date of receipt of a copy of the JV, your objections to its execution. In your objections, ask for an extension of the deadline for filing objections. After registering objections in court, the bailiff file an application for the suspension of IP in connection with the filing of your objections. Attach a copy so that there is a seal of the court on acceptance. The joint venture is canceled, then I will send the bailiff an application for the termination of the IP with a copy of the court ruling on the cancellation of the joint venture.

When the limitation period for a credit card (loan in the form of an overdraft) has expired, if the last overdraft issued was on 07/24/2014, and the last account replenishment transaction was made on 08/11/2014. Billing period under the contract 1 calendar month Pay period 10 calendar days following the billing period. Grace period of crediting is 40 days.

Hello Zlata! The statute of limitations is counted from the date of the last payment made by you, i.e. from 08/11/2014 Plus 3 years, so it expired on 08/11/2017

From what moment does the limitation period for a credit card expire, and in what cases is it interrupted?

If when calculating interest, then from the date of each specific payment. When calculating the amount of debt - from the date of the last payment. The limitation period is not interrupted. It is either missed or not.

What is the statute of limitations for a credit card if no payment has been made.

Hello. The limitation period will be considered from the moment when the creditor learned about the violation of his rights. Next day of delay.

Hello Olga. The general limitation period is 3 years from the moment when the creditor found out or should have found out about the violation of his right, i.e. the day after the day you were to make the next payment...

The credit card statute of limitations expired, the bank sued, the court ruled without my participation, bailiff sent performance list to the accounting department of the organization, there was a deduction from the salary according to the writ of execution, it turns out now the statute of limitations has been violated?

Hello! Was a court order or court decision issued and a writ of execution issued?

Hello! In this case, obviously, a court order was issued, which is accepted without the participation of the parties. You need to get a copy of this order from the court and file your objections within 10 days, along with a motion to extend the time limits for appeal. After the cancellation of the court order, the bank has the right to apply to the court with a claim for consideration of the case on the merits. Here in court you can file a motion to skip the statute of limitations. Good luck to you and all the best.

How is the statute of limitations for a credit card and MFI calculated?

Hello! The limitation period is applied only by the court and only at the request of the party in the court session. It is not applied automatically. There is a practice to count the statute of limitations from the last payment on a loan (credit)

How is the limitation period for a credit card calculated if the bank that issued the card was declared bankrupt and a bankruptcy trustee was appointed? 3 years Is it considered from the date of the last day of validity of the credit card, or does 3 years begin to flow again from the date of appointment of the bankruptcy trustee? Thanks for your reply.

Hello. 3 years is counted from the date of the last transaction on the card, whether withdrawal or replenishment.

Please see if the statute of limitations has expired on this credit card. And then the collectors tortured to call. They want us to pay them. They say that they bought this loan from the bank under an assignment agreement. And how can I prove the expiration of the statute of limitations in court? How to draw up a statement or petition if they suddenly sue?

Hello, Natalia! The statute of limitations expires in July 2019. If your debt was bought by collectors, then the assignment agreement can be invalidated and your debt written off! According to the content of the Agreement, you were not given the opportunity to refuse to assign the debt to third parties, the form is drawn up in such a way that it does not allow the borrower to express his will!

The statute of limitations began to run again from the moment of the last payment made - that is, in 2018.

Hello. The statute of limitations is now counted from the date of the last payment.

If you made a payment outside of the statute of limitations.. i.e. three years have passed since 2015 until the partial payment was made .. this does not interrupt the statute of limitations .. If the bank sells the debt to collectors, then I'm not sure that they will sue .. but they will get you .. then you will have to challenge assignment agreement.

So you yourself reset the SID and recognized the entire debt since 2015.

The limitation period for credit cards.

The general rule by which a credit card statute of limitations is set is related to the day the last payment from the borrower is made. AT standard conditions the bank sends the first request to close the credit line 90 days after last installment. The statute of limitations will apply for a period of three years after formal contact between the parties. A card on which no payment has been made on account of repayment will be determined by the day the funds were withdrawn from the credit account.

According to paragraph 1 of Article 196 of the Civil Code Russian Federation, the general limitation period is three years from the date determined in accordance with Article 200 of this Code. Article 200. Beginning of the running of the limitation period 1. Unless otherwise provided by law, the running of the limitation period begins from the day when the person knew or should have known about the violation of his right and about who is the proper defendant in the claim for the protection of this right. 2. For obligations with a definite performance period, the limitation period begins upon the expiration of the performance period. For obligations, the period of performance of which is not defined or is determined by the moment of demand, the limitation period begins to run from the day the creditor presents a demand for the performance of the obligation, and if the debtor is given a period for the performance of such a requirement, the calculation of the limitation period begins upon the expiration of the period provided for the performance of such an obligation. requirements. In this case, the limitation period in any case may not exceed ten years from the date the obligation arises. 3. For recourse obligations, the limitation period begins from the date of performance of the main obligation.

In 02,2013 there was a loan agreement on the card! Last payment was 10,2013! The statute of limitations has passed since the bank filed in December 2018, and canceled the court order! On January 15, 2019, he filed a claim with the district court! When the court sent me the documents, I saw forged signatures and my last name! I wrote a response to the statute of limitations, what if they extended the contract with these signatures?! The court then rejects☝ the question - HOW MUCH TIME WILL I HAVE to write a statement of claim to the district court for recognition loan agreement invalid? And at the same time, the case will be sorted out on February 7, 2019 in a simplified manner!

You need to report forged signatures, not the statute of limitations.

What is the statute of limitations for credit cards? If you have not paid by cards for about 4 or more years? what can be done in this case? They call and invite you to the office to sign an interest-free repayment. Of course, I don't go anywhere. This is how they find me on social media. networks and write there.

Good afternoon! Don't forget you owe them money. The fact that you are not going to sign new documents is correct. There is a statute of limitations, but again, perhaps you have already been sued, have you checked this? There is information about this on the FSP website. What is your debt? Who should?

Since the last payment.

Can I apply for a credit card statute of limitations if more than 3 years have passed since the last payment date?

If you believe that the plaintiff has missed the statute of limitations, you may file a motion to omit the statute of limitations. If this petition is not filed, the court, on its own initiative, will not apply the deadline.

Good afternoon. In order to accurately answer your question and help you need to know the details. Have you received a court order or received a statement of claim?

It is not possible but necessary if the court is considering a claim for recovery from you.

When does the credit card statute of limitations begin? And does it begin to be calculated anew, in case of assignment of the right of claim to the collection bureau? The last credit card payment was made on 11.2014, the assignment was on 04.2016. I received no notification from the bank about the assignment of the right to claim.

Thanks in advance!

Good afternoon. In order to accurately answer your question and help you need to know the details. Contact a lawyer on our website in person or write to him on his email. mail (usually it is indicated under the answer), state everything in detail, he will provide you with legal assistance.

No, it doesn't start leaking. Deadline passed.

The assignment does not affect the limitation period.

Hello! The limitation period in your case starts from the moment of the last payment (mandatory payment) on the card. Limitation period. Civil Code of the Russian Federation Article 201. Limitation period in case of change of persons in an obligation The change of persons in an obligation does not entail a change in the limitation period and the procedure for its calculation.

What is the statute of limitations for credit cards?

Hello. Three years from the date of the last payment.

Alexander, the limitation period is 3 years, article 196 of the Civil Code of the Russian Federation.

3 years from the date of the date of fulfillment of the obligation under the contract. The limitation period may be suspended and interrupted if there are grounds provided for in Art. 202-203 of the Civil Code of the Russian Federation.

Help me calculate the statute of limitations on a credit card the last payment was made on 05 09 2015 there was a court order on 18 102017 canceled within 5 days now filed a claim 12 12 2018 has the statute of limitations expired? Since the last payment, I have not communicated with the bank and have not signed the dock.

The limitation period is counted not from the date of the last payment, but from the date of expiration of the loan agreement. If repayments are made on schedule, a three-year limitation period is set for each payment.

Please tell me how the limitation period for credit cards of Russian Standard Bank is calculated?

Hello Svetlana! The general statute of limitations is three years. And this does not depend on which banks have loans or credit cards. Three years must be counted from the date you made your last payment on the loan.

Hello Svetlana! Three years from the date of the last payment. In this case, you still need to look at your contract. Some banks write in the conditions that the date of the debt payment comes at the request of the bank. In such a situation, the period will be calculated from the date of the written request of the bank.

It is necessary to look at the documents that were concluded with the bank, all cases are individual, there are several rules for calculating SID, it’s hard to say so. Either from the date of the last payment it is necessary to count, if there is a schedule of mandatory payments, they often count from them, every month separately, if there was a requirement for early repayment of the loan, it must be counted from the date indicated in such a requirement, it is also necessary to look at whether there were grounds for restoration, breaks in the flow of time. In a word, you need to look at the documents and count them, there are many nuances.

Is there a chance to apply the limitation period on a credit card if the last movement of funds on the card was on February 26, 2014 and the bank was required to pay all the debt no later than this date. The bank filed for a court order after 4 years 5 days, the court order was canceled. Now the bank has filed in the district court. More than 4 years have passed.

Hello Lyudmila! Since the application for the recovery of the court order was filed already outside the limitation period, it is necessary to write a response to the statement of claim and ask to apply the limitation period - three years from the date of the last payment on the loan.

The general statute of limitations is 3 years. If the period has expired, then you must make a statement in court about the application of the consequences of missing the limitation period, which is sufficient grounds for dismissing the claim (Article 199 Civil Code RF).

Be sure to declare in court if there was a requirement, in theory, the cuts came out a long time ago. You will have a natural debt, credit history forever corrupted.

Tell me please. From what moment does the limitation period for a credit card begin to operate if the bank has gone bankrupt and does not remind of itself in any way? The last credit card top-up was in July 2015, but is the card valid until April 2019?

The statute of limitations is 3 years from the date of the last payment.

Hello. 1. Unless otherwise provided by law, the running of the limitation period begins from the day when the person knew or should have known about the violation of his right and about who is the proper defendant in the claim for the protection of this right. 2. For obligations with a definite performance period, the limitation period begins upon the expiration of the performance period. For obligations, the period of performance of which is not defined or is determined by the moment of demand, the limitation period begins to run from the day the creditor presents a demand for the performance of the obligation, and if the debtor is given a period for the performance of such a requirement, the calculation of the limitation period begins upon the expiration of the period provided for the performance of such an obligation. requirements. In this case, the limitation period in any case may not exceed ten years from the date the obligation arises. 3. For recourse obligations, the limitation period begins from the date of performance of the main obligation. Article 200 of the Civil Code of the Russian Federation. Article 196 of the Civil Code of the Russian Federation. The general statute of limitations is 3 years.

Alexandra, most likely the term has already expired. But, periodically check the site of the court at the place of residence. Collectors can apply for a court order. It's all over the place. When issuing an order, judges do not take into account the statute of limitations.

When does the statute of limitations for credit card claims begin?

Hello. 1. Unless otherwise provided by law, the running of the limitation period begins from the day when the person knew or should have known about the violation of his right and about who is the proper defendant in the claim for the protection of this right. 2. For obligations with a definite performance period, the limitation period begins upon the expiration of the performance period. For obligations, the period of performance of which is not defined or is determined by the moment of demand, the limitation period begins to run from the day the creditor presents a demand for the performance of the obligation, and if the debtor is given a period for the performance of such a requirement, the calculation of the limitation period begins upon the expiration of the period provided for the performance of such an obligation. requirements. In this case, the limitation period in any case may not exceed ten years from the date the obligation arises. 3. For recourse obligations, the limitation period begins from the date of performance of the main obligation. Articles 200,196 of the Civil Code of the Russian Federation. The general statute of limitations is 3 years.

And if there was no payment at all on the credit card. Then how to prove the statute of limitations in court?

Hello. 1. Unless otherwise provided by law, the running of the limitation period begins from the day when the person knew or should have known about the violation of his right and about who is the proper defendant in the claim for the protection of this right. 2. For obligations with a definite performance period, the limitation period begins upon the expiration of the performance period. For obligations, the period of performance of which is not defined or is determined by the moment of demand, the limitation period begins to run from the day the creditor presents a demand for the performance of the obligation, and if the debtor is given a period for the performance of such a requirement, the calculation of the limitation period begins upon the expiration of the period provided for the performance of such an obligation. requirements. In this case, the limitation period in any case may not exceed ten years from the date the obligation arises. 3. For recourse obligations, the limitation period begins from the date of performance of the main obligation. Article 200 of the Civil Code of the Russian Federation.

Hello Yuri. Then it must be indicated in the application. Because there will be nothing to refute your words, and irremovable doubts about the guilt of the person are interpreted in favor of the accused.

Good afternoon. The limitation period, according to the rules of Article 200 of the Civil Code of the Russian Federation, begins from the day when the person found out or should have found out about the violation of his right and about who is the proper defendant in the claim for the protection of this right. However, in the case of a credit card (where there is no contract validity period), the limitation period is calculated from the date the creditor submits a demand to fulfill the obligation (part 2, article 200 of the Civil Code of the Russian Federation). To do this, the bank issues a final invoice to the debtor and gives a period for repayment of the loan and interest. And it is from the date of issuing such an invoice, in this case, that the limitation period will be calculated.

If a court order has been issued, then I will give you a hint for calculating taking into account the following: Will the limitation period be interrupted if an application for a court order is filed and a subsequent ruling is made to cancel the issued court order? December 4, 2015 Having considered the issue, we came to the following conclusion: In connection with the filing of an application for the issuance of a court order, the limitation period is not interrupted. The statute of limitations in this case does not run from the date of application to the court throughout the entire time that judicial protection is being carried out. In case of cancellation of the court order, the limitation period, which began before the filing of an application for the issuance of a court order, continues from the moment the court order is canceled. Justification for the conclusion: First of all, we note that from the date of entry into force federal law dated May 7, 2013 N 100-FZ (that is, from September 1, 2013), which introduced a number of changes to the provisions of the Civil Code of the Russian Federation on the limitation period, the limitation period is interrupted solely by the performance by the obligated person of actions indicating recognition of the debt. After a break, the limitation period begins anew, and the time elapsed before the break is not included in new term(Article 203 of the Civil Code of the Russian Federation). Until the above date, the limitation period was also interrupted by filing a claim in the prescribed manner (Article 203 of the Civil Code of the Russian Federation as amended until September 1, 2013), including the submission by the creditor of an application for a court order (paragraph three, clause 15 of the resolution Plenum of the Supreme Court of the Russian Federation of November 12, 2001 N 15, decision of the Plenum of the Supreme Arbitration Court RF dated November 15, 2001 N 18). To date, the consequences of applying for judicial protection in relation to the limitation period are provided for in Art. 204 of the Civil Code of the Russian Federation. By virtue of paragraph 1 of this article, from the date of applying to the court in the prescribed manner for the protection of the violated right, the limitation period does not run throughout the entire time while judicial protection is being carried out. As explained by the Plenum of the Supreme Court of the Russian Federation in paragraph 17 of the resolution of September 29, 2015 N 43, these rules also apply when applying for a court order. According to paragraph 2 of Art. 204 of the Civil Code of the Russian Federation, if the court leaves the claim without consideration, the limitation period that began before the filing of the claim continues in general order unless otherwise follows from the grounds on which the exercise of judicial protection of the right is terminated. Finally, by virtue of paragraph 2 of the same article, if, after leaving the claim without consideration, the unexpired part of the limitation period is less than six months, it is extended to six months, unless the action (omission) of the plaintiff served as the basis for leaving the claim without consideration. http://www.garant.ru/consult/civil_law/674543/ Yours faithfully, the lawyer in Volgograd - Stepanov Vadim Igorevich.

My name is Julia. Tell me on a credit card there is a statute of limitations or it is indefinite, since a long credit period is given on a credit card.

See how debt payments are calculated. And so for each payment a separate statute of limitations; Part 2 of the Civil Code of the Russian Federation, Part 3 of the Civil Code of the Russian Federation, Part 4 of the Civil Code of the Russian Federation "Civil Code of the Russian Federation (Part One)" dated November 30, 1994 N 51-FZ (as amended on August 3, 2018) (as amended and supplemented , entered into force on 01.09.2018) "" Civil Code of the Russian Federation Article 200. The beginning of the limitation period ConsultantPlus: note. The positions of the higher courts under Art. 200 of the Civil Code of the Russian Federation ">>>" (as amended by the Federal Law of 07.05.2013 N 100-FZ) (see the text in the previous "edition") ""1. Unless otherwise provided by "law", the running of the limitation period begins from the day on which the person knew or should have known about the violation of his right and about who is the proper defendant in the claim for the protection of this right. ""2. For obligations with a certain performance period, the limitation period begins at the end of the performance period. ConsultantPlus: note. 10-year period specified in paragraph 2 of Art. 200, starts flowing from 09/01/2013. The refusal to satisfy the claim made before 09.01.2017 due to the expiration of this period can be appealed (FZ of 12.28.2016 N 499-FZ). "" For obligations, the term for the performance of which is not determined or is determined by the moment of demand, the limitation period begins to run from the day the creditor presents a demand for the performance of the obligation, and if the debtor is given a period for the fulfillment of such a requirement, the calculation of the limitation period begins upon the expiration of the period provided for fulfillment of such a requirement. In this case, the limitation period in any case may not exceed ten years from the date the obligation arises. ""3. For recourse obligations, the limitation period begins from the date of fulfillment of the main obligation.

The limitation period for a credit card is the period during which the creditor bank can require the cardholder to return borrowed money and full repayment of related obligations.

Choose a credit card

As long as the limitation period has not expired, the bank retains the right to recover the funds due to it in court.

At the end of the limitation period, the creditor loses the right to present claims directly related to unfulfilled financial obligations to the debtor.

This does not deprive the creditor of the right to apply to the court even after the expiration of the term. But in order to satisfy his claims, the applicant will need to somehow prove that the limitation period has not yet expired or the need to extend this period.

The basis for extending the limitation period may be some actions of the borrower: his request for debt restructuring, doing business with the creditor even in the absence of loan payments.

These are the main provisions of the law regarding the statute of limitations.

Credit card statute of limitations is not a special phenomenon, but one of the aspects of credit obligations. There are no special differences in the limitation period for a regular loan and a credit card. There are only specific nuances associated with the onset and termination of certain deadlines.

How long is the statute of limitations on a credit card?

- It lasts three years, as well as the statute of limitations for other loans.

But of particular importance when collecting debt on an overdue loan is not the statute of limitations known to everyone, but the beginning of its countdown.

However, there is no certainty even in the results judgments, but there are two common opinions:

- The limitation period begins from the moment the loan agreement ends;

- The statute of limitations begins on the date of the last payment made.

But if most loans are issued at a time according to the terms of the agreement, then credit cards function for quite a long time, their validity period does not coincide with the terms of repayment of borrowed funds.

In addition to the moment of the last payment, the limitation period for a credit card may begin from the date of the end of communication between the client and the creditor bank. The borrower may not pay the loan, but respond to the bank's claims, visit it.

Any actions of the client with a credit card, or an appeal to the bank with a request to defer payments or change their order ( Grace period, restructuring) do not allow the limitation period to start.

What is the best term for credit card debt?

- A client who is unable or unwilling to repay a loan definitely benefits from the shortest period of debt collection and liability.

- For creditor banks, the longer the statute of limitations, the better.

There are two reasons for this:

- The creditor bank has enough time for judicial and extrajudicial influence on the borrower.

- The longer the delay lasts, the more interest and penalties are charged on it.

So it becomes clear why many tend to “forget” about the defaulter, but remember him by the end of the possible limitation period.

Many customers are knowledgeable about the law in this regard, but banks are usually more professional and know many ways to make credit card statutes of limitations last as long as possible.

The best thing is to soberly assess your solvency, not to take "unsustainable" loans and repay those already taken on time.

We will not give advice to malicious non-payers, as this would be complicity in their crimes.

However, there remains a considerable number of people who, for various reasons, are no longer able to repay their loans, but do not want to part with their property.

They can also be understood, loans are taken in some circumstances, and they have to be repaid in others. Sometimes banks "impose" their loans, causing unreasonable "credit euphoria" in customers. Sometimes the terms of repayment of loans change, which is prescribed in advance in, although due attention is not paid to this when concluding it.

However, not only banks, but also other persons, primarily their families, can rely on the defaulter's funds, and a rare borrower will sacrifice the interests of the family for the sake of the bank.

Collectors constitute a separate, sometimes very acute problem.

Advice to non-payers that does not go beyond the law boils down to the following:

- If there is no opportunity to pay and is not expected, then any communication with the creditor only lengthens the limitation period, but does not solve the problem. Therefore, it is better to avoid such communication.

- Do not use a credit card, incl. do not make payments to the card account if they still do not cover the entire amount of the debt or its main part. Do not withdraw funds from it and do not carry out other operations.

- Consult a lawyer who is competent in this area.

- Remember that the statute of limitations applies not only to banks, but also to any collection and similar organizations.

- In case of violation of their legal rights, apply to law enforcement agencies and courts for protection.

The statute of limitations (let's call it SID) is the time during which the bank has the opportunity to sue a negligent borrower.

It should be noted that the claim credit institution the court will accept regardless of whether the term has expired (clause 1, article 199 of the Civil Code of the Russian Federation). Therefore, if in your opinion the time of the bank has passed, you should definitely declare this before a decision is made.

The statute of limitations for a loan

Some borrowers do not know what the statute of limitations for a loan is, others think that the statute of limitations is counted from the moment the loan agreement is opened. This is not true. P. 1, Art. 200 of the Civil Code of the Russian Federation states that the SID starts to go from the day the bank found out about the delay. Clause 2 states that for obligations with a specific deadline for fulfillment, the IIA begins to flow at the end of this period.

It should be noted that until recently, even the decisions of judges on this issue differed: sometimes they counted the period from the date the contract ended, sometimes from the date the last payment was made, and sometimes from the day the official letter was sent to the borrower about the repayment of the delay.

Resolution of the Plenum of the RF Armed Forces No. 43 dated September 29, 2015 put everything in its place. It states that, based on the meaning of Art. 200, the countdown of the limitation period for a debt that, according to the agreement, must be paid in parts, begins to be calculated separately for each such part. That is, the statute of limitations for overdue payments, interest, penalties, etc. is calculated separately for each outstanding contribution.

When does the statute of limitations for a loan start? Example: according to the agreement, the loan repayment date is every 12th day. The client has stopped making payments since November 12, 2016. In this case, the AID for the first overdue payment will begin on November 12, 2016, for the second - on December 12, 2016, for the third - on January 12, 2018, etc.

If the bank has filed a claim only for the recovery of the principal debt, then the AID for the remaining payments (for example, for the payment of a penalty) continues to go. At the same time, after the expiration of the limitation period for the main claim (clause 1, article 207 of the Civil Code of the Russian Federation), the period for writing off the debt on the loan expires for additional requirements (that is, forfeit, interest, collateral, etc.). But if it was determined by the agreement that interest is paid later than the principal debt, then the limitation period for them is considered separately and does not depend on the end of the SIA on the principal amount of the loan.

Suspension and break of time

Do banks write off debts on loans? The flow of the LED is suspended:

- if the filing of a claim was prevented by force majeure;

- as a result of a legal moratorium (i.e. delay);

- if the debtor is in martial law;

- upon suspension of the law (or other legal document) governing these relationships.

If the parties resorted to out-of-court settlement of the dispute, then the period is suspended for the duration of this procedure (or for six months, if there is no deadline). From the time of the end of the reason for which the suspension was made, the limitation period will continue to run.

Is it possible to write off a debt on a loan or take a break? A break in the flow of the IID occurs if the borrower performs actions that indicate that he recognizes the debt (Article 203 of the Civil Code of the Russian Federation). In accordance with the Decree of the Plenum of the RF Armed Forces No. 43, such steps can be:

- recognition of the claim;

- a change in the contract, from which it follows that the borrower accepts the debt;

- client's statement about changing the terms of the contract (for example, deferred payments);

- an act of reconciliation of mutual settlements, sealed with the signature of the bank.

But if a person simply responded to the bank's claim and did not indicate that he was responsible for this debt, then such a response is not considered recognition, so there will be no break.

Also, if the client acknowledged only part of the debt, including making a periodic payment, this does not mean that he agrees with the debt as a whole. That is, this contribution cannot be a reason for interrupting the flow of AID for the rest of the contributions.

When the steps indicating the recognition of the debt were made by the representative of the borrower, the IID is interrupted only if he had the necessary powers (Article 182 of the Civil Code of the Russian Federation). If the debtor simply does not take any action and does not sign anything, then the limitation period is not interrupted!

Please note that after the break, the LED does not continue, but starts again, that is, the time that has passed before the break will not be counted in the new period!

Example: the borrower had to pay the next payment on 04/15/2016, but overdue and did not pay for several months. Thus, from April 15, 2016, the limitation period began. On September 15, 2016, a person came to the bank and wrote an application for an installment payment, but then stopped paying again. In this case, the three-year TID will start anew from 09/15/2016.

Important! With all suspensions, the limitation period (clause 2, article 196 of the Civil Code of the Russian Federation) cannot exceed 10 years.

Can a bank claim a debt after the statute of limitations has expired?

Can the court write off the loan debt if the statute of limitations has expired? In most cases, the bank does not wait for the deadlines to pass and sues in a timely manner. But even if the AID has already passed, the borrower is unlikely to be left alone. Probably, employees of the credit institution will call, come, write letters, try to put pressure on guarantors or relatives. But the bank, most likely, will no longer sue, since if the debtor declares that the limitation period has passed, the court will still refuse to initiate a case.

When the lender decides that the debt is unlikely to be repaid, he can cede the problem loan to debt collectors. It is no secret that the methods of the latter often go beyond what is permitted, as there are a lot of eloquent reviews on the Internet.

There are a lot of articles on the net about the need to allegedly withdraw consent to the processing of your personal data, and the borrower will be left behind. Actually, it won't do anything. According to Art. 9 of the Federal Law No. 152, even with a revocation, the bank or collectors have the right to continue processing personal data if this is necessary to exercise their legitimate rights and interests. But few people know that Federal Law No. 230 was adopted not so long ago, which clearly stipulates who, when and how can “get” the debtor.

So, the collector does not have the right to come to the borrower more than once a week and call more often:

- 1 time per day;

- 2 times a week;

- 8 times a month.

It is forbidden to threaten, use force, harm health or property, mislead a person or put pressure on him, etc. It is forbidden to report debts to third parties, disclose information about the client himself or his debts.

Important! By law, the borrower may refuse to communicate with the lender or the collector. To do this, you must send him an application by registered mail or through a notary, or simply hand it over against receipt.

The limitation period for a loan (SID) is the time period during which the lender can demand the return of the debt, and the borrower will be obliged to return it according to the conditions. The creditor is given exactly 36 months from the moment when he learned that his rights were violated.

When the IID has expired, the borrower's obligation to repay the debt is canceled by law. Basically, banking organizations try not to reach the end of the limitation period by selling the client's debts to collection companies or sending a statement of claim to the court. It often happens that the lender misses the specified 3-year period. This gives the client the full right not to return the debt by law.

When does the SID start?

Art. 200 of the Civil Code of the Russian Federation regulates the time when the limitation period for a loan begins. Based on the article, it is clear that there are several options for counting:

- For loans with an indefinite repayment date, the AID should be counted from the day the creditor knew or should have known about the violation of his rights. That is, paragraph 1 of Art. 200 of the Civil Code of the Russian Federation states that the countdown of the SID begins from the 1st day of delay. After a failed payment, the credit institution found out about the violation of its rights to timely repayment. The lender was aware that the defaulting borrower would be the defendant in a possible claim. It was from that day on that the credit institution could go to court to protect its legal rights, which means that it is necessary to count the SID from this moment.

- For credits and loans for which the repayment period is set by the agreement, the AIT is calculated from the day following the day of the expected repayment of the debt. For example, if we are talking about a short-term loan that the client was supposed to repay on December 25, then the LID begins to flow from December 26, provided that the client has not repaid the debt.

In fact, everything is more or less clear only with short-term or long-term loans, for which a lump-sum repayment of the entire amount of debt is made.

By bank loans and credit cards with monthly payments, different courts interpret the law differently. The courts of first instance most often apply to such loans precisely paragraph 2 of Article 200 of the Civil Code of the Russian Federation and start counting not from the date of the first delay, but from the expected date of the end of the loan.

For example, a borrower took a loan for 2 years, paid for the first 3 months and did not pay any more. According to the content of Art. 200 of the Civil Code of the Russian Federation, the IID should begin after the expected date of the 4th payment, when the borrower did not pay it, and the creditor found out about the violation of his rights. However, the courts of first instance start counting from the last 24th payment in the debt repayment schedule. Most borrowers don't challenge such court decisions for some reason, but clients who take their case to the supreme court are more likely to win.

It is the supreme courts that cancel such decisions, noting that the IJD in this case should be considered in accordance with paragraph 1 of Art. 200 of the Civil Code of the Russian Federation, and not with clause 2.

Some courts start counting the SID from the moment when the deadline for the bank's final claim for the return of the debt ends. Usually, after 3-6 outstanding payments according to the schedule, banks send the debtor a final demand for the return of the debt in full. They attach payment details to such a letter and give 10-15 days to fulfill this requirement. From the day following the day of the end of such a period, some courts begin counting the limitation period for a loan.

Detailed examples

Consider situations using different points of the article on SID. For example, Vasya Pupkin issued a loan on December 20 for a period of 12 months. Thus, the last payment on the loan falls on December 20 of the next year.

Let's say Vasya Pupkin regularly paid 4 months, but after the payment in April, he did not pay the May installment. Thus, on May 21, he had an overdue debt. In this case, the courts of first instance will consider the beginning of the flow of the IIA not from May 21, when the bank learned about the violation of its rights, but from December 21 of the next year. It is on the day that follows the day of the alleged repayment of the debt in full. At the same time, the borrower should challenge such a court decision up to the Supreme Court, which can review the limitation period from May 21.

The second example concerns a lump sum loan. For example, Vasya Pupkin applied for a loan at the IFC on December 20 for 10 days. As a result, he must return the main part of the debt and accrued interest on December 30. The AID in this case will begin on December 31 - the day following the day of the expected repayment. This will be the correct interpretation of the article.

The third example: Vasya Pupkin issued a loan on December 20 for 12 months. The last payment is due on December 20 of the following year. The client paid the loan within 4 months, but did not make the fifth payment. As a result, the delay began on May 21.

The lender sent the borrower a final demand for the repayment of the entire amount of the current debt on August 5 and gave exactly 10 days for repayment. In this situation, the TID starts on August 15th. That is, from the moment when the term for the voluntary repayment of the debt at the final request of the bank ended.

What actions can interrupt the LED?

Certain customer actions may interrupt or suspend the running of the statute of limitations. Such actions are regulated by law. For example, Art. 202 and 204 of the Civil Code of the Russian Federation regulate the events in which the TID is temporarily suspended.

Such actions include filing a claim with the court from the creditor. The flow will be suspended from the date of the plaintiff's appeal to the court. If the judge decides to leave the case without further consideration, the JI will continue from the date of such decision. If the court issued an order to collect the debt, and the defendant canceled it, then the SID will continue from the day the order was canceled.

And here is Art. 203 of the Civil Code of the Russian Federation regulates events that completely interrupt the course of the LED. These include any actions that indicate the recognition of debt by the borrower:

- This may be making a payment or part of the debt in any way.

- Confession existing debt in a telephone conversation, in documents (signature on some new terms of lending, refinancing, etc.)

- Borrower's request for debt deferment, installment payments, etc.

All these actions cross out the flow of SID. From the moment of conscious or unconscious recognition of the debt, the limitation period is annulled and begins anew.

Borrowers should remember that a change of creditors (sale of debt under an assignment agreement) is not a reason to suspend the flow of AIT. This factor does not affect the statute of limitations.

What happens when the LED expires?

Debtors mistakenly believe that after the expiration of the limitation period, the bank will not be able to go to court and recover the overdue debt. He can, if the borrower does not interfere with this.

The fact is that the expired SID is not a reason for refusing to accept the statement of claim by the court. Even seeing that a SID has occurred on a loan, the judge cannot independently apply the article on the limitation period and refuse to accept the claim. This can only be requested by the defendant or his representative.

The borrower, notified of the commencement of court proceedings, must independently ask the court to refuse to consider the claim in connection with the expired IIA in accordance with Art. 196 of the Civil Code of the Russian Federation. The application must provide a detailed calculation on the basis of which the borrower applied this article.

After the application received from the borrower on the application of Art. 196 of the Civil Code of the Russian Federation on the expired IID, the court must determine the correctness of the borrower's calculation. If everything is correct, the credit institution will be denied satisfaction of claims due to expired statute of limitations on a loan.

Even after receiving a refusal to consider a claim or satisfy it, the creditor can again and again apply for the collection of overdue debts. The borrower must respond to this in a timely manner by sending an application to the court on the application of Art. 196 of the Civil Code of the Russian Federation.

Expired SID does not release the borrower from paying the debt in the truest sense of the word. If the client does not send such a request in a timely manner, the court will consider the claim of the creditor and satisfy it.

1. What is the limitation period

2. How much it is, what law regulates

3. When does it start

4. When it starts again - under what actions

5. What happens after the deadline

The statute of limitations is a rather problematic issue. This is primarily due to the fact that judicial practice on this issue is diverse. Very often the courts make opposite decisions on the same issue.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and IS FREE!

That is why each borrower should have a certain idea about the statute of limitations. The concept of limitation period is given in the legislation of our country. This is, in fact, the period during which the lender can and has the right to demand the repayment of the loan debt.

In this case, a certain procedure for calculating this period is provided.

The nuances of the contract

The loan agreement has certain nuances, which are taken into account when calculating the statute of limitations. Many courts adhere to the following principle: they calculate the statute of limitations from the date the contract expires, but a credit card contract does not have an expiration date.

Accordingly, the limitation period for a credit card begins to run from the date of the last payment.

Very often, in case of delay in payment, banks send a written request. If the owner of the credit card has received such a letter, then the period begins to be calculated from the moment such a request is received.

If the owner used the credit card, but never paid his debt, then the limitation period for the credit card in this case will be calculated from the moment the last transaction was made on it

Calculations

The total statute of limitations is 3 years. The courts consider that this period begins to be calculated from the moment the last payment is made. For example, if a Russian Standard credit card was issued in 2010, and the borrower made a loan payment in January 2012, then the limitation period is considered to have expired from January 2019.

Accordingly, from now on, the bank cannot demand the return of the debt. This is the view held by most courts. This is also evidenced by the practice of the Supreme Court.

But in order for the court to apply the limitation period, this fact must be proven. The time of the last payout can be proven by means of an account statement. In this case, the borrower must present an extract.

In practice, however, not all courts hold this view. Some courts believe that the limitation period is charged from the moment the loan agreement expires. Of course, this position is less common.

However, this does not apply to credit cards, the contracts of which do not have an expiration date. It is also important to be aware that many courts are based on formal negotiations between the parties. For example, if the borrower sent an application to the bank with a request to revise the terms of the loan agreement, and the bank decided to revise, then the calculation of the period will be suspended.

To do this, it is enough to conclude an appropriate agreement.

Nuances from the civil code:

When calculating the statute of limitations, it must also be remembered that the “sale” of a loan to another company does not entail the termination of its calculation. If the credit card is not activated, then the limitation period is not calculated: this period will begin to operate from the moment the first transaction on the card is made.

How to act

After the expiration of the statute of limitations financial institution cannot demand repayment of the debt, and the borrower can safely not pay the loan. If you have not made payments on the loan for a long time, then you can count on the application of the statute of limitations.

But even after the expiration of this period, the bank may sue in court. If the statement of claim was drawn up in accordance with all legislative requirements, then the court will accept it for consideration. In this case, it is necessary to take certain measures, because the law does not oblige the court to calculate the limitation period, and if the defendant "does not respond" to the claim, the court may decide to collect the debt.

And how to act in this case?

First of all, it is necessary to present an appropriate application for the application of the statute of limitations. The text of the petition must indicate the relevant facts that prove that the limitation period has expired. The application must also indicate legal regulations on which it is based.

A well-written petition can become the basis for making a decision in favor of the borrower, while the presentation of such a petition is mandatory, otherwise the court may simply not take into account the fact that the statute of limitations has expired.

In addition to drawing up a petition, it is imperative to go to court hearings and express your point of view, and this will also help to achieve a decision in your favor.

In practice, there are often cases when the statute of limitations has expired, but bank employees or collectors continue to call and disturb the borrower. Many collection companies do not want to give up their possible income and often resort to threats. At the same time, they constantly call, come to the borrower's home, disturb him at night, etc.

What to do in this situation?

First of all, it is necessary to collect relevant evidence that indicates the illegal actions of collectors.

These can serve as:

- recording telephone conversations;

- recording from surveillance cameras;

- testimonies of neighbors, etc.

Having collected all the necessary evidence, you can safely contact the prosecutor's office. Based on your application, a criminal case will be initiated, and you can breathe a sigh of relief and not worry about unpleasant calls.

In practice, some difficulties arise when the borrower dies. In this case, the loan has to be paid to his heirs. But if the borrower does not have any property, then the heirs feel free not to accept the inheritance and not pay the loan, since the bank will not be able to demand its payment in the future.

The statute of limitations, as in other cases, is 3 years.

In addition to obligations, borrowers have certain rights. One of the rights of the borrower can be considered his ability not to pay the loan after the expiration of the limitation period. But this right should not be neglected: it is better to try to solve the problem peacefully.

If you still decide to apply the limitation period, then you do not need to enter into negotiations with the bank, make any statements regarding changes in the terms of the loan agreement. Each action on the part of the borrower may be considered by the court as grounds for terminating the calculation of the limitation period. That is why if the limitation period has expired, you do not need to contact the bank or sign an agreement to change the terms of the loan agreement.

If a financial institution has filed a statement of claim in court, then it is necessary to seek help from a qualified one. This category of cases is the most complex, requiring special knowledge and relevant experience in this area. Without a legal education, the borrower cannot solve the problem on his own, also taking into account the inconsistency of judicial practice in such cases.

That is why the help of a lawyer in such cases is simply a necessity. Only an experienced specialist will be able to competently draw up a petition for the application of the statute of limitations and prove that this period has expired at the time the claim was filed in court. In addition, the lawyer will provide legal representation, if necessary, draw up a counterclaim and other documents.