Calculation of personal income tax from salary online calculator. How to calculate income tax on salary. How to calculate personal income tax from salary: formula

Citizens of the country, according to the law, are required to pay taxes on all types of income received, including wages.

The organization independently determines the deductible amount for each full-time employee according to the procedure approved by law and transfers it to the state budget, thus performing the functions of a tax agent.

In order to ensure that the amount of taxes is not erroneous, and that the regulatory authorities have no reason to find fault and fine the company, you need to thoroughly study the formula for calculating them.

The formula for calculating income tax is regulated by the Tax Code of the Russian Federation in the following articles:

- 210 – about the tax base,

- 217 – on non-taxable income,

- 218 – 221 – about deductions,

- 224 – 226 - about rates and calculations.

Officially working citizens who have been on the territory of the Russian Federation for more than 183 days over the past year (including trips to improve health and for training for up to six months) are considered residents and pay a tax of 13% of the amount of income. Otherwise, you will have to pay 30% of all revenues to the country’s treasury.

Among persons who are not residents, but have the right to pay only 13%, there are:

- refugees,

- citizens working under a patent,

- highly qualified specialists,

- natives of the EAEU countries.

Residence is checked every time personal income tax is calculated.

Tax is paid on the following receipts of funds:

- wages,

- awards,

- material incentives,

- vacation pay and temporary disability benefits,

- sick leaves.

Tax calculation is carried out in two stages:

- First, the tax base (TB) is determined - the employee’s total income for the past year is calculated, taking into account legal deductions.

- the fact of residence of the employee is verified.

Tax-free deductions include:

- standard deductions provided to working parents, disabled people, and guardians.

- social, relying on training, treatment or pension contributions,

- property, accrued for real estate transactions with ownership rights for more than 3 years,

- investment, received for securities or profits from a deposit.

The full list of deductions is described in Article 217 of the Tax Code of the Russian Federation. The most common of them are alimony, pensions, state benefits, donor rewards, and grants for scientific activities.

Calculation of personal income tax from salary

Contributions to the state treasury are calculated using the following formula:

N = NB * WITH, Where

NB – tax base, it is calculated from the beginning of the year to the current month, then to the previous one,

C – rate based on residence.

NB = D – V, where

D – the amount of employee income from the beginning of the year that is subject to taxation,

B – the amount of due deductions for the period.

For residents and exceptions to the rules, the tax is determined by the formula:

Personal income tax from the beginning of the year = NB from the beginning of the year * 13%.

To determine the tax for the current month, use the following calculation:

Personal income tax for the month = personal income tax from the beginning of the year – personal income tax for previous months.

It is important to remember that the tax is always rounded to whole numbers according to the rules of mathematics!

Example of personal income tax calculation

It is necessary to calculate the tax that will be transferred by the enterprise to the state treasury for a resident employee. The employee has a salary of 60,000 rubles, is raising a minor child, for which he has the right to a deduction in the amount of 1,400 rubles monthly. The employee received a one-time bonus for April in the amount of 10,000 rubles. How much will personal income tax be for an employee in April?

We calculate the NB from the beginning of the year:

NB = 60,000 * 4 + 10,000 – 1,400 * 4 = 244,400 rubles.

Tax for January – April will be:

Personal income tax = 244400 * 13% = 31772 rubles.

Tax withheld from an employee's salary for January - March:

Personal income tax = (60000 * 3 – 1400 * 3) * 13% = 22854 rubles.

Personal income tax for April will be:

Personal income tax = 31772 – 22854 = 8918 rubles.

Calculation of personal income tax from the amount in hand

There are organizations that pay part of their employees’ salaries unofficially “in an envelope.” Concealing income is a violation of the law.

Workers undergoing a job interview are often interested in the amount of money that they will receive in their hands “clean”. Knowing the amount issued without taxes, the amount of contributions to the budget can be calculated using the formulas:

Salary “gross” = Amount on hand / 87%, where

Salary "gross" - wages "dirty".

Personal income tax = Amount in hand * 13% / 87%.

Calculation example

A person interested in filling a vacant position is promised 40,000 rubles in hand, taking into account taxes deducted. What will be the salary of the “dirty” and the amount of budget contributions?

Salary “gross” = 40,000 / 87% = 45,977.01 rubles.

Personal income tax = 40,000 * 13% / 87% = 5,977 rubles (including rounding).

The company may also employ employees with financial obligations that do not reduce the size of the NB. For example, if an employee must pay alimony, it is deducted not from the amount paid out, but from the salary. According to the law, the amount of alimony is:

- a quarter of earnings - for one child,

- a third - for two children,

- half of the salary - for three or more.

Let's look at an example:

An employee of the organization received 30,000 rubles in April and must pay 25% of the income for a minor child according to a court decision.

NB for January - April in this case, taking into account the standard deduction, will be 30,000 * 4 - 1,400 * 4 = 114,400 rubles.

Personal income tax January – April = 114400 * 13% = 14872 rubles.

NB for January – March = 30,000 * 3 – 1,400 * 3 = 85,800 rubles.

Personal income tax January – March = 85800 * 13% = 11154 rubles.

The amount of alimony is 30,000 * 25% = 7,500 rubles.

Personal income tax for April = 14872 – 11154 = 3718 rubles.

In April, the employee will receive:

30000 – 7500 – 3718 = 18782 rubles.

Personal income tax for non-residents is calculated using the same formulas, but instead of a rate of 13%, 30% is substituted into the algorithm.

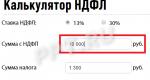

The income tax calculation service is simple. The first step is to choose a tax rate - 13 or 30 percent. It depends on whether the recipient is a tax resident or not. Residence is determined by the duration of continuous residence in Russia. If a citizen (regardless of nationality and citizenship) lives in the Russian Federation for 183 days or more within 12 months, then the personal income tax rate for him is 13%. This rule does not apply to military personnel, as well as government employees posted outside the country. They will always be considered tax residents, even if they actually perform work abroad for 183 days or more.

So, we chose a bet. Now you need to enter the amount from which tax is withheld. The calculation results will automatically appear in the columns “Tax amount” and “Amount excluding personal income tax”.

The calculator can also be used in reverse order. Let’s say you don’t know what the amount was before personal income tax was withheld, and you need to find out how much money will go to the budget. In this case, start filling out not the first line, but the last. For example, employee Petrov received “clean” 10,000 rubles. He wonders how much he had to give to the state. Enter 10,000 in the “Amount without personal income tax” field and automatically get the result.

If you want to calculate personal income tax (online calculator) with deductions for children (2019), you will first have to subtract the deduction itself. For example, Petrov is the father of four minor children. One of them, who was born third, has a certificate of disability. In this case, according to paragraphs. 4 paragraphs 1 art. 218 of the Tax Code of the Russian Federation, the tax deduction will be (a personal income tax deduction calculator is not needed here):

- 1,400 rubles each for the first and second child;

- 3,000 rubles each for the third and fourth child;

- and 12,000 rubles for a disabled child.

1,400 + 1,400 + 3,000 + 3,000 + 12,000 = 20,800 (rubles)

If Petrov receives 20,000 rubles “dirty”, then in principle they will not withhold tax from him during the year, since his income is less. If the salary is 40,000 rubles, then the personal income tax calculator 2 with online deductions should calculate the tax based on the following amount:

40 000 - 20 800 = 19 200

Petrov will receive:

16,704 + 20,800 = 37,504 (rubles)

Please note that the benefit is provided only until the amount of income per year exceeds 350,000 rubles. If the salary before tax is 20,000, then Petrov receives 240,000 for the year, which means he has the right to a deduction throughout the year. If the salary is 40,000 rubles, then the total annual income is already 480,000. In this case, the benefit is valid only for 8 months, for example, from January to August. In September, Petrov will receive a salary calculated without deductions, namely 34,800 rubles.

Let us remind you that the deduction for children is provided by the employer after receiving a corresponding application from the employee. Documents about birth, adoption or custody of children must be attached. Parents who raise children alone have the right to receive double the child deduction. But such a right arises if the second parent actually does not exist (died, declared missing). If the parents are divorced, this does not give the right to receive double benefits.

Lidia Ivanova

The personal income tax calculator is a quick online calculation of the amount of personal income tax.

Income tax (personal income tax) is what every person pays to the state on their income. Income is salary, money from the sale of property or from renting out an apartment, fees, and so on. On this page we have prepared an online personal income tax calculator, but first, a few basic points that are needed to understand the situation and in order to calculate income tax online (calculator) with children correctly.

Any individual in our country is considered a personal income tax payer (if, of course, there is official income). There are a few :

- 13% is the base rate, it applies to all basic income of a Russian tax resident;

- 30% - the rate that is taxed on the income of non-residents;

- 9% - rate for income on bonds;

- 35% - rate for winnings in lotteries and competitions, based on interest on bank deposits.

Let's figure out who residents and non-residents are (this will be useful when working with the calculator):

- a Russian tax resident is a person who resides in the country for at least 183 days over 12 consecutive months;

- a non-resident, accordingly, resides less than 183 days.

Interestingly, citizenship does not play any role in matters of personal income tax. Military and civil servants sent on business trips abroad are also always considered residents.

IMPORTANT! Pensions and state benefits (for example, maternity capital or unemployment benefits) are not considered income and do not need to pay personal income tax on them.

Online personal income tax calculator with deductions for children 2020

Personal income tax rate

Amount with personal income tax

Tax amount

Amount without personal income tax

Amount of children

up to 18 years old

Nuance: Personal income tax for an interest-free loan agreement

If a person takes out an interest-free loan agreement from the organization where he works, then he receives a material benefit. And this material benefit should be subject to personal income tax. Our personal income tax calculator for material benefits on a loan 2020 cannot calculate, but it is not difficult. Here's the formula to do it:

Material benefit = (loan amount) * 2/3 of the refinancing rate * number of loan days / 365

Tax amount = material benefit * 35%

Attention! The personal income tax rate for material benefits in rubles is 35% for tax residents and 30% for tax non-residents of Russia.

Calculation example:

Bukashka Alexander Borisovich received an interest-free loan from his employer - 100,000 rubles for 12 months.

His material benefit will be: 100,000 * (6.5 * 2/3) * 365/365 = 4,333 rubles.

The tax will be: 4333* 35% = 1516 rubles 55 kopecks.

Help: how to use the personal income tax calculator

Step 2: Enter your income amount(for example, salaries) in the “Amount with personal income tax” field. Afterwards, the calculator will automatically make calculations in the “Tax amount” and “Amount excluding personal income tax” fields.

Step 3. Try counting backwards: enter the money actually received in hand into the calculator in the “Amount without personal income tax” field and see how much was accrued BEFORE the tax was withheld.

In general, our 2-NDFL calculator with online deductions can count money both there and back.

Step 4. Calculate the tax amount taking into account tax deductions for children. To do this, indicate the number of children under 18 years of age (if you have a child who is a full-time student under 24 years of age, then count him too). Our online personal income tax calculator from salary - with deductions for children, it can calculate the amount of tax for parents.

As you will see, the online personal income tax calculator on our website handles deductions for children easily. It will automatically calculate the amount that you should receive in your hands, taking into account all the conditions you entered: an online personal income tax calculator will help you calculate it with 2 children, with one child, with a large number of minor dependents. It will also help large families.

Keep in mind that the amounts of personal income tax deductions for children this year are ():

- for 1 and 2 children - 1400 rubles (for a single parent - 2800);

- for 3 and subsequent children - 3000 rubles (for a single parent - 6000).

IMPORTANT! For a single parent, the deduction is provided in double amount, but our personal income tax deduction calculator has not yet learned to calculate it that way. That’s why we’ve given just above the full amounts that should be deducted from your salary - you’ll have to calculate the double deduction for a child under personal income tax yourself.

And the second point: such deductions. That is, if your salary is 40,000 rubles, then the employer will stop making deductions for children (and this is legal) from October.

One more point that we would like to draw your attention to: there is now active talk about increasing tax rates. There is a high probability that this will still happen. But for now, these are just discussions and conversations, and the rate is still the same - we pay a basic 13% for personal income tax for 2020. The calculator also calculates according to current rates: as soon as (and if) something changes, we will make this adjustment to the calculation algorithm.

We have made a personal income tax calculation (online calculator) 2020 - and your feedback is important to us!

Was it convenient for you to use our calculator? We tried to make the personal income tax calculation as clear as possible for you - an online calculator with deductions for children in 2020. If you notice any inaccuracies or errors or something is unclear to you, please leave a comment at the bottom of this page. And we will try to become even better!

Every citizen of Russia is a tax payer. Every month the state deducts interest from wages, which goes to maintaining the functioning of our country. Regardless of what a person does, he must make mandatory payments. At the same time, in addition to the tax on the profitable part, enterprises and organizations pay additional amounts that depend on the type of occupation.

Each of us knows that every month certain money goes into the state treasury from our wages. Their size is directly provided for by the Laws and is not subject to change at the local level.

Today we will try to understand this taxation system, which is withdrawn from profits. At the same time, we will consider exactly those payments that concern individuals, that is, ordinary citizens.

What is personal income tax

First of all, let's define the concept and its meaning. Personal Income Tax is an acronym that stands for personal income tax. As the name implies, personal income tax is one of the main types of taxation provided by the state to fill the state treasury.

The main feature of this phenomenon is that taxation is withdrawn exclusively from the profitable part of the tax entity, which in this case is represented by individuals:

- who are tax residents of our country (that is, those who stay in Russia for at least 183 days a year);

- who are not tax residents, but have profits in the territory of our state.

Like other taxes, such payments are calculated using interest rates. Personal income tax has its own unique nuance. Calculation of percentages of wages is possible after making deductions provided by the state. Such simplifications are intended exclusively for this tax. They reduce the person’s actual income by certain amounts depending on the type of deduction, and only after that the tax is calculated from the remaining amount.

Types of income tax and scope of its application

The division of income taxation into types has not only theoretical, but also practical significance. This is due to the fact that special categories give individuals the opportunity to decide whether there is a need to pay income tax or whether there is no such obligation.

That is why the law provides for income that is taxed and that is not subject to taxation. The first include:

- profit from the sale of property that was owned by a person for less than three years;

- income that a person has as a result of renting out certain property under a lease agreement;

- profit that came from the activities of a person outside the territory of Russia;

- income that was received as prizes and winnings;

- other profit.

The last paragraph denotes all other income, except:

- profit from the sale of property that was owned by a person for more than three years;

- income as a result of receiving an inheritance;

- profit received by donation exclusively from two categories: family members and close relatives;

- other profit provided for by law as such that is not subject to taxation.

Such a mandatory payment is characterized by the fact that the person provides certain amounts annually, that is tax period is one year. In addition, a system of tax payments has been introduced, which means that a person pays the tax quarterly in installments for the past three months. The last quarter and the necessary additional payment is made after the end of the tax period.

Every year, a person must provide the tax authority with a state-issued declaration, where he reports for the past tax period by providing information on tax amounts.

If you have not yet registered an organization, then easiest way This can be done using online services that will help you generate all the necessary documents for free: If you already have an organization and you are thinking about how to simplify and automate accounting and reporting, then the following online services will come to the rescue and will completely replace an accountant at your enterprise and will save a lot of money and time. All reporting is generated automatically, signed electronically and sent automatically online. It is ideal for individual entrepreneurs or LLCs on the simplified tax system, UTII, PSN, TS, OSNO.

Everything happens in a few clicks, without queues and stress. Try it and you will be surprised how easy it has become!

Tax rates of property payments

Personal income tax has different interest rates depending on how the income was received:

- 9%:

- from dividends received before 2015;

- on income from transactions with bonds issued before 2007.

- 13%:

- the person's salary;

- profit from the sale of property;

- income received from civil contracts.

- 15%:

- dividends from Russian legal entities to citizens who are not residents of our country.

- 30%:

- other income of non-residents of the Russian Federation.

- 35%:

- income in the form of prizes and winnings that were received during the organization of an event for the purpose of advertising goods or services;

- income from bank investments when limits are exceeded.

The most popular rate is 13%. This is due to the fact that the range of civil relations to which such percentages apply is the most used.

Calculation of tax from salary

In order to clearly familiarize yourself with taxes on the income side, we suggest looking at some examples. To find out the tax rate, you need to use a special formula:

N = PS * OS, Where:

- N – tax,

- PS – interest rate,

- OS – taxable amount.

It is worth considering that additional calculations may be necessary for the OS. This is due to the fact that in some situations deductions are used to the income side of a person - simplifications that help reduce the taxable amount for certain categories of persons. The OS formula in this case will be:

OS = DC – V, Where:

- PM – income part of the person,

- B – subtraction.

Example 1: Payroll taxation without deductions

Citizen Litvinov has a salary of 42,000 rubles. You need to know the amount of his monthly tax.

To do this, first of all, you need to decide on the interest rate. Since in this case the income part represents wages, we use 13%.

In this case:

- 42,000 rubles * 13% = 5,460 rubles.

This is exactly the amount of tax that citizen Litvinov should receive every month. His net income will be:

- 42,000 rubles – 5,460 rubles = 36,540 rubles.

Example 2: Payroll Taxation Using Deductions

Citizen Isakova has a salary of 56,000 rubles per month. Moreover, she has two minor children. She applied for . Let's calculate the amount of her monthly taxation.

First of all, let's find the amount of the deduction. Since we have two minor children, the state provides a simplification of 1,400 rubles for each of them. The total deduction amount will be:

- 1,400 rubles * 2 = 2,800 rubles.

We subtract the size of this simplification from Isakova’s total income:

- 56,000 rubles – 2,800 rubles = 53,200 rubles.

We directly calculate the amount of taxation from this difference. The bet remains the same as in the previous example:

- 53,200 rubles * 13% = 6,916 rubles.

For comparison, let’s calculate the tax amount without deduction:

- 56,000 rubles * 13% = 7,280 rubles.

As you can see, tax deductions must be taken into account when calculating the amount of taxation, since the amounts with and without their use will be different.

Example 3. Taxation on vacation pay

Quite often the question arises about whether vacation funds are taxed like other income? Having analyzed the legislation, it follows that this type of payment is considered additional wages, and therefore subject to taxation. The tax amount is calculated using exactly the same scheme and using the same percentage as when searching for the amount of mandatory payment from salary.

For example, citizen Fayansov received vacation funds in the amount of 25,000 rubles. The tax on such income will be:

- 25,000 rubles * 13% = 3,250 rubles.

Example 4

Citizen Mikheev received dividends in the amount of 30,000 rubles in 2014. First of all, let's decide on the interest rate. Since income of this kind belongs to the first group, it is necessary to use 9%.

The tax amount will be:

- 30,000 rubles * 9% = 2,700 rubles.

Calculation of certificate 2-NDFL

2-NDFL is a state-issued document in which a person indicates his income, wages and the amount of taxes paid. You can find it on the official website of the Federal Tax Service, in the tax department. The certificate requires the provision of the following data:

- information about the employer;

- information about the employee;

- profit, which is subject to a rate of 13%;

- subtraction;

- calculations of taxes, income and deductions.

Example of information that must be included in the certificate

Citizen Samsonov has a monthly income of 65,000 rubles. At the same time, deductions for a child of 6 years are used to his earnings. Let's find out what calculations he needs to make in order to fill out form 2-NDFL.

First of all, you need to find the amount of annual income:

- 65,000 rubles * 12 months = 780,000 rubles per year.

Next, we will calculate the amount of tax deduction. As noted in the previous example, the amount of simplification for one minor child is 1,400 rubles. At the same time, such benefits can be used only until the total income of citizen Samsonov exceeds 280,000 rubles. Therefore, we find out how many months he has the right to use the child deduction:

- 280,000 rubles / 65,000 rubles = 4 months.

- 4 months * 1,400 rubles = 5,600 rubles.

Let us subtract the amount of deductions from the total annual income:

- 780,000 rubles – 5,600 rubles = 774,400 rubles.

Let's calculate the amount of tax paid:

- 774,400 rubles * 13% = 100,672 rubles.

This means that citizen Samsonov needs to enter the following data into the 2-NDFL certificate:

- tax amount – 100,672 rubles;

- income amount – 780,000 rubles;

- the amount of deductions is 5,600 rubles.

The calculations are quite simple, the main thing is to have all the necessary information to calculate them.

Calculation of 3-NDFL

Certificate 3-NDFL is another special document intended to be filled out by certain categories of persons for carrying out activities related to a certain type of income. These include:

- persons who calculate the amount of taxation themselves (individual entrepreneurs, lawyers, etc.);

- residents of Russia whose profits were received outside the state;

- persons who have additional income.

In addition, the main use of such a document is also the ability to apply for the use of a deduction. To do this, it is necessary to carry out certain calculations and indicate the amount of simplification required for the return.

Example

Citizen Sokolov purchased residential premises, spending 1,500,000 rubles. This purchase was subject to tax. At the end of the year, Sokolov intends to submit an application for the return of tax payments for the purchase of housing. Let's calculate the size of such a return.

In this case, the transaction was taxed at the normal rate, therefore:

- 1,500,000 rubles * 13% = 195,000 rubles.

It is this amount that Sokolov has the right to indicate when submitting a certificate. The main thing is to confirm this figure with special documents (sale and purchase agreement, receipt for recalculation of the amount of money, etc.).

Calculation of penalties for personal income tax

Delay in income tax may result in penalties for the person. Currently, the amount of such a penalty is 20% of the debt amount. In this case, it is accrued for each subsequent day after the deadline for paying taxes.

Example

Citizen Samsonova delayed her tax payment by 5 days. At the same time, the amount of her obligatory payment was 2,600 rubles. Let's calculate what penalty she will need to pay along with the main tax.

Let's find out the amount of the penalty in one day:

- 2,600 rubles * 20% = 520 rubles.

Now let's calculate the total fine for all days:

- 520 rubles * 5 days = 2,600 rubles.

As we can see, in such a fairly short period of time, Samsonova will be obliged to pay an amount twice as large as what was necessary for the timely payment of the tax.

Individuals who receive income from work or business activities are required to contribute a certain portion of their income to the state treasury. Transfers can be made both by the payers themselves and by their tax residents, which include entrepreneurs or organizations. The accountant of the enterprise is obliged to calculate payments on a monthly basis based on the salary of each employee, and the organization must promptly transfer them to the state fund that collects taxes. There are a lot of nuances in the question of how to calculate personal income tax from a salary, which we will talk about later.

Basic tax rate

The employer calculates tax payments based on wages and other income accrued to the employee in this organization based on the result of work activity. A citizen can be a member of several companies at once. At the same time, each tax agent calculates deductions and draws up a reporting form independently. Payment of personal income tax is mandatory for all employees, regardless of whether they work temporarily or are on staff. The salary specified in the employment contract with the employee is taken into account.

According to the Tax Code of the Russian Federation, taxable:

- wage;

- allowances (qualification, territorial, for length of service);

- all types of bonus payments;

- benefits for temporary disability (sick leave);

- vacation pay.

Financial receipts that are not related to the work activity of an individual in a given organization are not subject to taxation . Such income includes:

- child support;

- pensions;

- student scholarships;

- severance pay paid to employees dismissed due to staff reduction;

- financial assistance (if its amount does not exceed 4 thousand rubles);

- travel expenses.

The tax base for personal income is calculated taking into account the tax benefits to which the employee is entitled. The legislation of the Russian Federation provides for preferential deductions of four types: standard, social, professional, for the acquisition of real estate. The first one is taken into account without fail when calculating personal income tax. The employee has the right to receive other payments only if he presents documentary evidence of the expenses incurred. After providing the necessary documents, the accountant will be able to determine the amount of the deduction and carry out the necessary calculations. The law provides for two ways to receive personal income tax payments. An employee can act through the accounting department of the enterprise where he works or submit an application to the tax authorities.

Tax deduction - basic concepts

The law provides tax benefits for certain categories of citizens. For example, standard deductions are available to employees with dependent children. In addition, the tax base may be reduced:

- heroes of the Soviet Union and Russia,

- participants of the Second World War and military operations,

- citizens with disabilities,

- victims of the Chernobyl explosion.

The maximum tax deduction for Russians is limited to 3,000 rubles. You can count on receiving it:

- parents, adoptive parents or guardians with three or more minor children or a disabled child;

- specialists and volunteers who took part in the liquidation of the Chernobyl accident and other similar events;

- disabled people of WWII or later military operations;

- participants in nuclear tests.

The amount of deductions is not cumulative, with the exception of benefits provided in the presence of children. If a citizen is entitled to several deductions, the calculation is made based on the larger number.

Formula for calculating income tax

Now, knowing which payments are subject to taxation, let’s create a general algorithm for calculating personal income tax. First, you need to calculate your salary, including all the necessary payments. After this, you need to exclude those amounts that are not subject to taxation. The remainder will be the taxable base. To determine the tax rate, you need to find out the payer’s status, that is, whether he is a resident or not. Then, from the base salary, deductions are made to which the employee is entitled. Based on the remaining funds, the tax payable is calculated.

The formula for calculating income tax on wages (taking into account the tax deduction) looks like this:

N=(D-V)×S

Here is the tax amount ( N ) is the difference between labor income ( D ), subject to personal income tax and tax deduction ( V ), multiplied by the base rate, ( S ) adopted in Russia.

Currently, the “income tax” on wages is levied at 13%. If we are talking about accounting for the income of foreigners (non-residents of the Russian Federation), it is 30%. This issue will be discussed in more detail a little later.

How to calculate income tax on salary if you have a child

The deduction for one or more children is determined by tax law, and its size depends on the number of dependents. Both parents, as well as guardians and adoptive parents can take advantage of the benefits. The calculation procedure and amounts of payments are reflected in Art. 218 Tax Code of the Russian Federation. The size of the standard preferential deduction is: for the first and second child - 1400 rubles, for the third – 3000 rubles. Having a disabled person on their hands, parents have the right to claim a deduction in the amount 12 thousand rubles. Guardians, trustees and adoptive parents will receive only half, that is 6000 thousand rubles

It should be remembered that the money is not returned to the taxpayer; personal income tax is simply not withheld from this amount. Not only parents of minors can reduce their tax base. The tax deduction is also applicable for parents whose children have reached the age of 18, but are students, graduate students or cadets. The legal age limit in this case is 24 years. Both parents are entitled to a mandatory tax deduction and receive it at the same time.

To understand how personal income tax is calculated on wages for parents of one or more children, let’s give an example. With a salary of 30 thousand rubles. monthly, an employee who has two dependent children aged 5 and 12 years has a tax deduction in the amount of 2800 rubles. Using the following formula - N=(D-V)×S, Let's calculate the amount of basic tax as follows:

(30000 – 2x1400)×13% = 3536 rub.

Please note that the child tax credit is not permanent. After the amount of annual income reaches 280,000, a citizen is required to pay tax on all income. In this case, the right to deduction is valid from January to September; in the remaining months, the salary is taxed in full.

Example of income tax calculation

Let's consider another example, for cases where an employee has the right to double tax deduction. An unmarried employee of the company, who has taken custody of two young children, has a salary of 40,000 rubles. Since the citizen is not married, she receives tax benefits. Its amount will be:

(1,400×2)×2 = 5,600 rub.

The monthly tax will be calculated as (40000 – 5600) × 13% = 4,472 rubles. At the same time, the accountant needs to take into account that the threshold of 280 thousand will be reached in July. If the employee gets married in May, then she will lose the right to double the deduction in June.

Calculation of personal income tax for foreigners

Citizens of other states operating on the territory of the Russian Federation are also required to pay tax contributions. To understand how to calculate income tax on the salary of an employee who comes from countries far and near abroad, you need to determine their status. According to Art. 207 (clause 2) of the Tax Code, citizens who have been on the territory of the Russian Federation for a total of no more than 183 days within 12 (consecutive) months are recognized as non-residents. They are subject to a tax rate of 30%. The status is not permanent; it may change throughout the year; this must be taken into account when calculating salaries.

After amendments were made to the Tax Code, the concept of “special status” was introduced when calculating personal income tax for foreign citizens. It is assigned to the following categories:

- highly qualified specialists,

- residents of countries included in the EAEU,

- participants in the resettlement program for compatriots,

- citizens working under a patent,

- refugees.

Let us give an example of how the salary of an employee who arrived from abroad after a two-year absence is calculated. In this case, the calculation takes into account the employee's tax status. Until the expiration of the due period, that is, 183 days, the employee remains a non-resident of the Russian Federation and the tax rate for him is 30%. With a salary of 40 thousand rubles. Personal income tax is 12,000 rubles. After 26 full weeks the rate will decrease to 13%.

Transfer deadlines and penalties for violation

Tax collections from income from the labor activities of employees are transferred to the budget the next day after wages are issued. If the transfer is made to a personal bank account, issues with timing, as a rule, do not arise. But some organizations still practice payment through the cash register, that is, they hand out cash to the employee. In this case, the starting point is the day when the funds were withdrawn from the company’s account.

Government organizations pay wages to employees twice a month. And here questions may arise about how personal income tax is calculated. Tax is not deducted from the advance payment; it is levied on the total amount only upon final payment. In a situation where an employee quits before the advance payment has been worked out, it is not possible to recover the payment. The employer is obliged to inform the tax authorities about this. Next, the personal income tax debt is transferred to the former employee, and he pays it off on his own.

It also happens that an organization or entrepreneur misses the deadline for paying taxes to the budget. The legislation provides for administrative liability for such violations. The fine is 20% percent of non-payment, in addition, penalties will be accrued daily on this amount, the amount of which is calculated based on the refinancing rate and is equal to one three hundredth. If the deadlines are violated again, the penalties will double. We are talking specifically about transferring funds to a state fund. Even if the tax agent collected funds from the employee, but they were not received as intended, a fine will be charged to him.

When calculating personal income tax, it should be taken into account that there is a sequence of deductions established by law. If an employee has other financial obligations, for example, to pay alimony or fines, income tax is collected first from his earnings, and only then everything else.