The procedure for conducting an inventory of property and liabilities. Inventory of financial obligations Basic concepts of inventory of property and financial obligations

An inventory of an organization’s property, as well as its financial obligations, is a necessary (and in some cases mandatory) event carried out for the purpose of actual control over the preservation of property assets and accounting for obligations. We will tell you more about the inventory procedure in our article.

Inventory of property and obligations of the organization (general provisions)

Inventory of property and obligations of the organization (general provisions)

Inventory is a set of verification activities carried out to establish the completeness of property assets and the state of the company’s financial obligations as of a certain date by comparing actual information with accounting data.

The regulatory framework governing inventory activities is:

- Guidelines for the inventory of property and financial obligations, approved by order of the Ministry of Finance of Russia dated June 13, 1995 No. 49 (hereinafter referred to as the Guidelines).

- Regulations on accounting and accounting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n (hereinafter referred to as the Regulations).

The main goals of inventory accounting include:

- determining the actual availability of property;

- monitoring the compliance of the organization’s property with accounting information;

- control over the reflection of liabilities and property on the books.

The tasks performed during inventory activities to achieve these goals include:

- monitoring compliance with the conditions for storing property assets and money, operating standards for machinery and other mechanisms;

- identification of low-quality property or property that has lost its useful properties;

- detection of unused property and/or valuables exceeding their declared standards;

- monitoring the adequacy of accounting for the property complex, liabilities, funds, expenses and other balance sheet items.

The tasks listed above can become stages in the process of conducting inventory activities.

Types of inventory of property and liabilities of an organization

An inventory of an organization’s property can be divided into types on various grounds:

- Thus, according to the composition of the inventory property complex, the inventory can be:

- complete (in relation to all property);

- partial (in relation to a certain group of property objects).

- By frequency:

- planned;

- unscheduled.

- By type of verification activities:

- natural (carried out by simple counting of the objects being checked);

- documentary (carried out through documentation verification).

According to clause 27 of the Regulations, mandatory inventory measures must be carried out:

- when transferring property for rent, in the event of redemption, sale, reorganization of a state or municipal enterprise;

- in anticipation of the formation of the annual accounting report, with the exception of property assets, the recalculation of which was carried out from October 1 of the reporting year;

- when changing materially responsible employees;

- when a shortage or damage to property is detected;

- in case of emergency situations caused by extreme conditions (fire, flood, etc.);

- when carrying out reorganization or liquidation measures in the company;

- in other legally provided cases.

Inventory of the organization's property - procedure

The procedure for carrying out inventory activities includes the following steps:

- Preliminary. This stage includes preparatory actions, which include:

- issuing an order to conduct an inventory;

- creation of an inventory commission;

- determining the periods for carrying out inventory activities and the complex of property being inspected;

- collection of documentation from financially responsible employees.

- The direct implementation of an inventory of the organization’s property, which consists in measuring the things being checked, including:

- weighing;

- measuring;

- counting

In addition, as part of this stage, inventories are compiled.

- Comparative, during which the inventory indicators are reconciled with accounting information. Reconciliation allows:

- identify discrepancies and misgrading;

- determine the reasons for data inconsistencies.

- Final, which includes:

- documenting the results of the inventory exercise;

- bringing accounting data into conformity with inventory results;

- bringing the perpetrators to justice.

Inventory commission

According to clause 2.2 of the Methodological Instructions, the inventory procedure is carried out by a special commission. At the same time, if there is a significant volume of inspected property complex and obligations, it is possible to create working inventory commissions. If the volume is small and the enterprise has an audit commission, it is possible to delegate inventory powers to it.

The composition of the commission is approved by order of the head. In this case, the composition should include (clause 2.3 of the Guidelines):

- delegates from the enterprise administration;

- accounting staff;

- other specialists (economists, engineers, etc.).

In addition, the inventory commission may include:

Don't know your rights?

- internal audit service specialists;

- representatives of the independent auditor.

Carrying out inventory activities requires the commission to be fully staffed in accordance with the order that approved its composition. Otherwise, the absence of even one of the persons specified in the order is grounds for declaring the inventory results invalid.

Carrying out these procedures precedes the submission of the latter at the time of audit of receipts, expenditure documents and reports on the movement of mat. valuables and funds of the inventory commission. The chairman endorses the specified documents with the note “Before inventory on (date indicated).”

Documents drawn up during property inventory

The inventory procedure is drawn up by drawing up a set of documents, which includes:

- Order from the company's management. This document initiates inventory activities and must contain information:

- on the composition of the inventory commission;

- dates of the inventory;

- completeness of inventory property and liabilities;

- the procedure and timing for documenting inventory results.

From 01/01/2013, enterprises can approve their own form of the order under consideration. For the sample, it is advisable to use form No. INV-22, which was approved by Decree of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

- Inventory lists, which are used to enter calculation data directly at the time of inventory actions. The inventory is filled out in at least 2 copies (manually or on a computer) according to the form approved by Decree of the State Statistics Committee No. 88 or established in the organization.

Corrections in the inventory are not allowed, therefore, if it is necessary to correct an error, you should cross out the incorrect data and write the correct values at the top. All edits are specified in the documentation and signed by members of the commission, as well as financially responsible employees. If corrections were made in a different way, it is necessary either to adjust the corrections as described above, or to rewrite the inventory. In addition to corrections, it should not contain empty columns, so all empty lines are crossed out.

The inventory is signed by members of the commission and financially responsible employees, who, in addition to signing, leave a receipt in the document stating that the inspection was carried out in their presence and there are no complaints against the commission.

Documenting inventory results

The results of inventory activities are also presented in documentary form. Based on the results of the inventory of the organization’s property, the following set of documents is formed:

- A matching statement is documentation that records discrepancies between the actual availability of inventory assets and accounting data. The matching statement is drawn up in 2 copies in the form approved by the specific organization.

The document must contain:

- document details (number and date of preparation);

- details of the order to assign inventory;

- indication of the period of events;

- brief description of the property being inspected;

- inventory results (surplus or shortage, quantity, cost);

- signatures of authorized persons (director, accountant, mat. responsible employees).

- Minutes of the inventory commission, which is drawn up based on the results of the meeting. The meeting is held after the property audit has actually been carried out and includes:

- analysis of identified discrepancies;

- establishing the reasons for the discrepancy between the actual and recorded amounts of property and the perpetrators;

- making decisions on editing accounting indicators.

- Inventory results are approved by order of the head of the enterprise, which provides instructions for leveling out the identified shortcomings. The final inventory order is the basis for adjusting accounting data.

When is an inventory of an organization's obligations carried out?

Not only the property/material objects of the enterprise need periodic reconciliation, but also the correctness of the amounts reflected in the accounting accounts. To do this, an inventory of financial obligations is carried out.

The frequency of the audit of financial obligations generally coincides with the frequency of inventory activities in relation to property assets, that is, it is carried out on days established either by law or by internal documents of the organization. At the same time, conducting a financial inventory on the grounds specified in regulations is mandatory.

In relation to autonomous or budgetary institutions, in addition to the general grounds (for example, when reorganizing an enterprise or replacing senior managers), a mandatory frequency of auditing financial obligations is established - once a quarter (clause 69 of the instructions approved by Order of the Ministry of Finance No. 33n dated March 25, 2011).

The inventory procedure for financial liabilities includes the following activities:

- Verification of settlements with creditor organizations, which consists of assessing the validity of the amounts recorded on the balance sheet and documenting the accuracy of settlements with credit organizations.

- Reconciliation of calculations for budget payments.

- Reconciliation activities with counterparties. In particular, the account “Settlements with suppliers and contractors” for paid supplies that are in transit and undocumented supplies should be checked. Reconciliation is carried out according to documentation in agreement with correspondent accounts.

- Inventory of advance reports for their intended use and each accountable person.

- An audit of debt to employees by the enterprise, during which underpaid wages and overpayments to employees may be identified.

- Checking settlements with members of the workforce for other obligations (loans, credits, shortages, defects, etc.).

- A general audit of the enterprise’s financial obligations in relation to all debtors and creditors, which includes information for each entity according to calculations:

- property insurance;

- personal insurance;

- insurance of risks in business and civil liability;

- claim settlements;

- contractual payments (rent, commission, assignment, etc.).

Verification is carried out through reconciliation reports.

How is an inventory of liabilities prepared?

An inventory of obligations is drawn up, as well as an inventory of the property complex, by issuing an order and filling out inventory lists.

In this case, the following information should be reflected in the inventory:

- total debt (principal with interest);

- the amount of unpaid interest, fines, penalties;

- debt obligations (both with and without confirmation);

- overdue debt.

The list of settlements with counterparties should include:

- information about the organization's debt;

- counterparty data;

- the amount of debts broken down on various grounds;

- expired debts;

- confirmed and unconfirmed debt.

The inventories are signed by all members of the commission and the chairman.

Thus, the inventory of the property complex and the inventory of the financial obligations of the enterprise are very similar processes in many respects. However, these activities also have distinctive points - mainly not in the procedure, but in the form of documenting the results, related to the characteristics of the object being inventoried. These nuances should be taken into account when conducting and completing the audit.

The reliability of the organization's accounting and reporting data is ensured by an inventory of property and financial obligations, during which their presence, condition and valuation are verified and documented.

Inventory is a clarification of the actual availability of property and financial obligations by comparing them with accounting data as of a certain date. There are several types of inventory:

- partial inventory - carried out once a year for each object; this is a reliable method of verification that does not require a high level of internal organization and, as a rule, does not interfere with the production process;

- periodic inventory - carried out within a specific time frame depending on the type and nature of the property;

- complete inventory - checking all types of property of the organization. It is carried out at the end of the year before the preparation of the annual report, as well as during a full documentary audit, at the request of financial and investigative authorities;

- selective inventory - occurs in organizations with a large range of valuables in places of their storage and processing, as well as in individual areas of production or when checking the work of materially responsible persons, for example, checking cash at the cash desk, removing the balances of various types of materials, etc.

The number of inventories in the reporting year, the dates of their conduct, the list of property and liabilities checked during each of them is established by the organization, except in cases where an inventory is required.

Carrying out an inventory is mandatory:

- when transferring property for rent, redemption, sale, privatization, as well as transformation of a state or municipal unitary organization;

- before drawing up annual financial statements, except for property, the inventory of which was carried out no earlier than October 1 of the reporting year;

- when changing financially responsible persons (on the day of acceptance and transfer of cases);

- when establishing facts of theft or abuse, as well as damage to valuables;

- in case of fire, natural disasters or other emergencies caused by extreme conditions;

- during reorganization, liquidation of an organization in other cases provided for by the legislation of the Russian Federation. All property and all types of financial assets are subject to inventory

obligations. The inventory is carried out in stages and within the following time frames:

- for fixed assets - once every three years, and for library funds - once every five years;

- for capital investments - once a year, but not earlier than December 1 of the reporting year;

- for work in progress and semi-finished products of own production, finished products, raw materials and supplies - no earlier than October 1 of the reporting year;

- for goods, raw materials and materials in areas located in the Far North and similar areas - during the period of their smallest balances.

Inventory of funds at the cash desk, in current and foreign currency accounts, credits, borrowings, etc. is carried out once a month (usually on the 1st day of each month). When calculating the actual presence of banknotes and other valuables in the cash register, cash, securities and monetary documents are taken into account.

Inventory of funds in transit is carried out by reconciling the amounts listed in the accounting accounts with the data from receipts of the bank establishment, post office, copies of accompanying statements for the delivery of proceeds to bank collectors, etc.

Inventory of funds held in banks in settlement (current), foreign currency and special accounts is carried out by reconciling the balances of amounts listed in the corresponding accounts, according to the organization’s accounting department, with data from bank statements.

An inventory of settlements with banks and other credit institutions for loans, with the budget, buyers, suppliers, accountable persons, employees, depositors, other debtors and creditors, amounts of debt for shortages and thefts is to verify the validity of the amounts listed in the accounting accounts.

In case of collective (team) financial responsibility, inventories are carried out when there is a change of manager (foreman), when more than 50% of its members leave the team (team), as well as at the request of one or more members of the team (team).

Subject. Inventory of property and financial obligations

Types and procedure for inventory.

Documentation of inventory

Identification of inventory results and their reflection in accounting.

Concept, tasks and mandatory inventories.

Accounting monitoring of the condition and movement of economic assets is carried out using documents. However, there may be discrepancies between accounting records and actual fund balances. To ensure the reality of accounting indicators and to control the safety of funds, an element of the accounting method is used - inventory.

Inventory - an accounting method that makes it possible to ensure that accounting data on property and liabilities corresponds to their actual state through recalculation, measurement, and weighing. Inventory is a mandatory addition to documentation.

The rules for conducting an inventory are determined by the Federal Law of the Russian Federation “On Accounting and Reporting in the Russian Federation (No. 129-FZ dated November 21, 1996), Methodological Guidelines for the Inventory of Property and Liabilities, approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49 in accordance with a number of adopted regulations. Enterprises (organizations) are required to conduct an inventory of fixed assets, capital investments, capital construction in progress, major repairs, work in progress, inventory, cash, settlements and other balance sheet items.

The main tasks of inventory are angry:

identification of the actual availability of fixed assets, inventory and cash, securities, as well as volumes of work in progress in kind;

control over the safety of inventory and cash by comparing actual availability with accounting data;

identification of unused, stale, slow-moving, obsolete inventory items,

checking compliance with the rules and conditions for storing material assets and funds, as well as rules for the maintenance and operation of machinery, equipment and other fixed assets;

checking the real value of inventory items recorded on the balance sheet, amounts of cash, accounts receivable and payable and other balance sheet items.

The number of inventories in the reporting year, the procedure and timing, the list of property and liabilities checked during each of them are established by the enterprise itself, except in cases where an inventory is mandatory. Carrying out an inventory Necessarily" .

when changing financially responsible persons (on the day of acceptance and transfer of cases);

when transferring property for rent, redemption, sale;

during the reorganization of an enterprise, i.e. when an enterprise changes owners, or changes its organizational and legal form, or is liquidated, or this enterprise merges with another;

before drawing up annual financial statements, except for property, the inventory of which was carried out no earlier than October 1 of the reporting year. An inventory of buildings, structures and other fixed assets can be carried out once every two to three years, and library collections - once every five years;

when establishing facts of theft or abuse, as well as damage to property;

in the event of a natural disaster, fire or other emergency situations caused by extreme conditions;

2. Types and procedure for inventory.

All inventories carried out in organizations are divided according to a number of criteria:

by property coverage: complete; partial.

At complete inventory All types of farm property are checked. Typically, such inventories are carried out at the end of the financial year before drawing up the annual report.

Partial inventory involves checking one or more types of property (for example, auditing a cash register).

By purpose: planned; sudden.

Planned inventories are carried out in accordance with the established schedule (before the preparation of the annual report), and unscheduled (sudden) - as necessary (change of financially responsible persons, natural disasters, theft, requirements of the auditor, judicial authorities, etc.). Sudden inventories carried out by order of the head, higher authorities and at the request of the investigative bodies of the judicial authorities and the prosecutor's office. Can also be carried out re-inventory in case of doubts about the reliability, objectivity, quality of the inventory.

Order of conduct inventory in the organization involves the creation of permanent inventory commissions consisting of:

the head of the enterprise or his deputy (chairman of the commission);

chief accountant; heads of structural divisions (services);

representatives of the public.

To directly conduct an inventory of property, they are created working commissions consisting of: a representative of the head of the enterprise who appointed the inventory (chairman of the commission); specialists (economist, accounting employee, engineer, technologist, commodity expert, storekeeper, etc.).

The commission should include experienced workers who are well aware of the property being inventoried, the procedure for pricing, and primary accounting.

The personnel of permanent inventory commissions, working inventory commissions and commissions carrying out inspections and random inventories is approved by order of the head of the enterprise (organization). The absence of at least one member of the commission during the inventory serves as grounds for declaring the inventory results invalid.

Before the start of the inventory, members of the working inventory commissions are given an order, and the chairmen are given a control seal. The order sets the start and end dates for the inventory work. By the beginning of the process, the processing of incoming and outgoing primary documents must be completed, all entries in analytical, synthetic accounting must be made and balances must be displayed, all valuables must be sorted by name, grade, size, etc. At the time of the inventory, the accountant draws up an inventory list.

During sudden inventories, all inventory items are prepared for inventory in the presence of the inventory commission, and in other cases - in advance.

Warehouse operations are not carried out during the inventory period; In this inventory, the warehouse manager gives a receipt that all warehouse documents are recorded in the materials warehouse card and submitted to the organization’s accounting department.

During an inventory, the actual availability of property is determined by mandatory counting, weighing, measuring directly in places where property is stored (secured). Verification of actual balances is carried out with the obligatory participation of financially responsible persons (cashiers, managers of households, storerooms, sections, trading enterprises, etc.).

3. Documentation of inventory

The inventory is carried out for each financially responsible person and storage location (warehouse), always in the presence of the financially responsible person. All data is entered in inventory recordssi or inventory acts at least in two copies. On each page of the inventory, the number of serial numbers of material assets and the total number of natural indicators recorded on this page are indicated in words, regardless of the unit of measurement. Unfilled lines are crossed out. On the last page of the inventory, a note must be made about checking prices, taxation and calculating the results signed by the persons who carried out this check. The inventories are signed by all members of the inventory commission and financially responsible persons.

The financially responsible person gives a receipt that all the valuables noted in the inventory have been accepted by him for safekeeping and he has no claims against the commission. Upon completion of the inventory, the completed inventory records are submitted to the accounting department, where they are checked, then the actual availability of funds is compared with the accounting data.

The comparison results are recorded in comparative formhomeness. It indicates the actual availability of funds according to inventory data (quantity and amount), the availability of funds according to accounting data and the results of comparison - surplus or shortage. Only those values for which surpluses and shortages have been identified are recorded in the comparison sheet, and the rest are shown in the statement as a total amount. The amounts of surpluses and shortages of inventory items in the matching statements are indicated in accordance with their assessment in accounting.

The inventory commission is obliged to identify the causes of shortages or surpluses discovered during the inventory. The conclusions and decisions of the commission are documented in a protocol approved by the head of the enterprise, after which the results of the inventory are reflected in the accounting and reporting of the month in which it was completed, and the results of the annual inventory are reflected in the annual accounting report.

For individual objects of property and obligations, if necessary, control checks the correctness of the inventory and compiled “ Act of control check of correctness of carrying out inventarization of valuables", in which the actual amounts of inventory and control checks are noted and discrepancies (plus and minus) are recorded. The act is signed by the person who conducted the control check, the chairman of the inventory commission, and members of the commission.

Separate lists are compiled for property leased or in custody.

4. Identifying inventory results and reflecting them in accounting.

Discrepancies between inventory and accounting data are documented by the accounting department by compiling a statement of results identified by the inventory.

Identified during inventory discrepancies in facts physical availability of property with accounting data that are regulated in accordance with the Regulations on Accounting and Reporting in the Russian Federation in the following order:

Fixed assets, material assets, cash and other property found in surplus subject to capitalization on the debit of the relevant accounts with its attribution to the financial results of organizations or an increase in funding (funds) from a budget organization with the subsequent establishment of the causes of the surplus and the perpetrators.

Reflection in the accounts of surpluses identified during inventory:

Debit 01 “Fixed assets”,Debit 10 “Materials”,Debit 41 “Goods”,

Debit 43 “Finished products”,Debit 50 “Cash”,

Credit 91 “Other income and expenses”, subaccount 1 “Otherincome."

All shortages material assets, cash and other property, within the limits of natural loss, approved in the manner prescribed by law, regardless of the reasons for their occurrence, are written off from the credit of the relevant accounts to the debit of account 94 “Shortages and losses from damage to valuables.” Attrition norms can be applied in cases where actual shortages are identified, and in the absence of such attrition norms, attrition norms are considered as a shortage in excess of the norms, which is attributed to the perpetrators. In the absence of such amounts, shortages are written off to the debit of account 99 « Profits and losses” from the credit of account 94 “Shortages and losses from damage to valuables”.

Reflection on the accounts of shortages identified during inventory:

A) Debit 94 “Shortages and losses from damage to valuables.”

Loan 01 “Fixed assets”.Credit 10 “Materials”,Credit 41 “Goods”, Credit 43 “Finished Products”, Credit 50 “Cash Office”;

b) in retail trade organizations:

Credit 41 “Goods”,Credit 42 “Trade margin”(in the "Red" way

reversal").

Write-off of shortages within the limits of natural loss:

Debit 20 “Main production”, Debit 23 “Auxiliary production”,Debit 25 “General production expenses”,Debit 26 “General business expenses”,Debit 29 “Service production”,

Debit 44 “Sales expenses”,Credit 94 “Shortages and losses from damage to valuables.”

Write-off of the shortage at the expense of the guilty party:

A) Debit 73 “Settlements with personnel for other operations”,

subaccount 2 “Calculations for compensation of materialdamage",

b) the difference between the amount to be recovered from the guilty person and the amount of the shortfall in account 43-2:

Debit 73-2 “Calculations for compensation of materialdamage",

Loan 98-4 “Deferred income” (Difference between the amount to be collectedobtaining valuables);

c) debt repayment:

Debit 98-4"Revenue of the future periods"(The difference between the amount to be collectedpunishment from the guilty parties, and the book value for notobtaining valuables),

Credit 91 “Other income and expenses”, subaccount 1 “About”whose income";

d) restoration of the amount of value added tax (VAT) from the value of missing assets:

Debit 94 “Shortages and losses from damage to valuables”,

e) assigning the amount of value added tax (VAT) to the guilty person:

Debit 73 “Settlements with personnel for other operations”,

subaccount 2 “Calculations for compensation of materialdamage",

Credit 94 “Shortages and losses from damage to valuables”;

f) compensation by the guilty person for the amount of the deficiency:

Debit 50 "Cash", subaccount 1 "Cash of the organization",Debit 70 “Settlements with personnel for wages”,

Credit 73 “Settlements with personnel for other operations”,subaccount 2 “Calculations for compensation of materialdamage."

Writing off the shortfall to financial results:

What are the expenses?

Write-off of shortfalls to financial results, the culprits of which have not been identified by court decision:

a) for the amount of the shortage:

Debit 94 “Shortages and losses from damage to valuables”,

Credit 10 “Materials”,Credit 41 “Goods”, etc.;

b) for the amount of value added tax (VAT) on missing values:

Debit 94 “Shortages and losses from damage to valuables”,

Credit 68 “Calculations for taxes and fees”;

c) writing off the shortage:

Debit 91 “Other income and expenses”, subaccount 2 “About”What are the expenses?

Credit 94 “Shortages and losses from damage to valuables.”

Mutual offset of surpluses and shortages as a result of regrading, with the permission of the head of the organization, it can only be admitted as an exception. In this case, inventory items must be of the same name, in identical quantities, for the same audited period, from the same audited person. Financially responsible persons provide detailed explanations to the inventory commission about any misgrading. The head of the organization makes the final decision.

An inventory of an organization's financial obligations, like any other inventory, is carried out to verify the accuracy of the data in the accounting and reporting registers. Methodological guidelines (clause 1.2.) present the financial obligations of enterprises and organizations (regardless of their form of ownership and legal status) in the following form:

- Debt to suppliers;

- Bank loans and loans from third parties (including related ones);

- Enterprise reserves (regardless of their intended purpose).

Inventory objects

Inventory objects are all liabilities of the enterprise (with the exception of equity capital).

The timing of such an inventory (as well as the procedure and frequency of its implementation) is established by the head of the enterprise on the basis of Order No. 142n of the Ministry of Finance of the Russian Federation dated November 9, 2010.

Mandatory inventory of liabilities is carried out in the following cases:

- Structural transformation (or liquidation) of an enterprise;

- Preparation of reports (quarter, year);

- Change of responsible persons.

It is customary for practicing accountants to divide the inventory of financial liabilities into two blocks:

- Inventory of calculations;

- Inventory of reserves.

Inventory of calculations

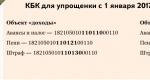

When checking the accuracy of the information on settlements with creditors reflected in the accounting records, the following calculations are subject to detailed reconciliation:

- With suppliers and buyers (for advances received) Accounts 60.62;

- For bank loans and borrowings. Accounts 66.67;

- Settlements with the budget and extra-budgetary funds (including insurance premiums). Accounts 68.69;

- Settlements with employees and accountable persons for payments and accruals. Accounts 70, 71, 73;

- Other creditors. Score 76.

The simplest (methodologically, but not technically) tool for checking the relevance and reliability of data on a company’s debts for goods shipped to it and services provided is the preparation and signing of reconciliation reports with each counterparty. The Methodological Guidelines offer a sample of such an act, but it is not normative and can be drawn up by an enterprise in any form.

When conducting an inventory of payments at a large enterprise, it makes sense to determine the lower limit of inventory debts and indicate it in the inventory order. This approach will significantly reduce the amount of work performed. At the same time, the quality of the inventory will practically not suffer - no one has canceled the “Pareto rule”.

The results of the inventory are recorded in regulatory registers. First, the results of reconciliations with each creditor are entered into a certificate, which is an appendix to the act in form INV-17 (Appendix U). This certificate states:

- Details of each creditor of the organization;

- Reason and period of debt occurrence;

- Amount of debt.

Based on such a certificate, an inventory report is drawn up for suppliers and other creditors in the INV-17 form.

The result of an inventory count is often the write-off of accounts payable. Such write-offs (more precisely, their eligibility) become objects of mandatory verification during subsequent inventories. This is especially important at large multi-industry enterprises, for which uninvoiced receipts of raw materials and supplies are almost an everyday occurrence.

Loan payments

Inventory of settlements for loans and credits includes checking all sources of borrowed funds in the context of each lender and each agreement. It is very important to correctly separate (and, accordingly, correctly reflect in the accounting registers) short-term (repayment period up to a calendar year) and long-term (repayment period more than a year) loans and borrowings.

Also, loans and borrowings must be ranked according to the degree of collateral and its type. It is desirable that the accounting registers of loans, for which the property of the enterprise was pledged as collateral, contain information about such property.

Accounting for debt on issued bonds must be kept separately by creditors, the list of which must separate individuals and legal entities.

Loans and credits for which repayment terms were violated are reflected separately in the inventory sheet.

In addition, the inventory procedure provides for a detailed check of the timeliness and correctness of the accrual and payment of interest.

Calculations with the budget

Reconciliation of settlements for taxes and other payments to the budget and extra-budgetary funds is no different from the inventory of settlements with suppliers. In both cases, the ultimate goal is to verify that the amount, date of occurrence and cause of the debt are correctly reflected in the accounting records.

During the inventory of tax calculations, the correctness of tax calculations and the timely submission of relevant reports to the tax authorities are also checked.

It is very important to rank tax debts as current (due for payment) and overdue. Penalties and fines must be taken into account separately.

Settlements with personnel

Inventory of payroll calculations is carried out in the context of accruals and payments. As a rule, these calculations are inventoried in parallel with the above-mentioned inventory of calculations for taxes and contributions to extra-budgetary funds. Reconciliation is carried out for each employee.

Amounts issued to the account are inventoried for each individual accountable person and each individual amount received by such persons. During such an inventory, not only the correctness of payments and the timely submission of reports on the use of accountable funds are checked. The reconciliation also checks the eligibility of the amounts used, sources of financing and the intended purpose of the funds used.

Based on the results of all the listed inventories, acts and statements are drawn up. If necessary, as in the case of an inventory of accounts payable, cards are compiled for each item being inventoried.

All these documents are drawn up in accordance with standards and signed by members of the inventory commission and financially responsible persons.

On-farm expenses

In small and medium-sized enterprises, accounting account No. 79 is not particularly “popular” and on-farm expenses at such enterprises are not inventoried due to the lack of them.

But at large multi-industry enterprises (holdings, corporations) this type of calculation requires close attention.

During the inventory of on-farm payments, the following operations are checked:

- Calculations for allocated property;

- Calculations for mutual release of material assets;

- Calculations for the sale of products, works, services,

- Calculations for the transfer of expenses for general management activities, wages for department employees, etc.

This is a general list. At each enterprise it can undergo significant changes because... the list of intra-company operations is very variable and is established in accordance with the structure and internal accounting policies of the enterprise.

Within the framework of this inventory, each division should be considered as a separate enterprise. The results should be formatted in the same way as the results of the accounts payable inventory described above are formatted.

Inventory of reserves

According to current federal tax laws and accounting standards, enterprises can create reserves, which can be reflected in both the liabilities and assets of the enterprise. As a rule, reserves have a clear purpose and are formed from certain sources. These goals and sources are determined by the accounting policies of the enterprise. The most popular (used by almost all business entities) are:

- Vacation reserve;

- Provisions for doubtful accounts receivable;

- Expenses and income of future periods.

In the process of conducting an inventory of reserves, the validity of their creation and compliance with the goals and objectives declared in the accounting policy are first checked.

Send your good work in the knowledge base is simple. Use the form below

Students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you.

Posted on http://www.allbest.ru/

INTRODUCTION

Inventory is one of the main elements of the accounting method, the essence of which is to compare the availability of property and obligations of the organization with accounting data.

Inventory is designed to solve many problems. But the main task is to control the safety of property by comparing actual availability with accounting data, as well as checking the reality of the amounts reflected in all balance sheet items.

The purpose of this work is a detailed description of inventory as an element of the accounting method.

1. Give the concept of inventory. Determine its types. Describe the audit procedure.

2. Consider the features of inventory of certain types of property and financial obligations.

3. Using the example of the company Ventos LLC, describe the procedure for conducting an inventory of funds and goods and recording the results of the inventory.

To write this work, educational and specialized literature on accounting, periodicals, and regulatory documents were used.

1. INVENTORY OF PROPERTY AND OBLIGATIONS OF THE ORGANIZATION

1.1 THE CONCEPT OF INVENTORY. ITS TYPES AND PROCEDURE FOR CARRYING OUT

Inventory is a check of the property and obligations of an organization by counting, measuring, weighing. It is a way to clarify accounting indicators and subsequent control over the safety of the organization’s property.

To ensure the reliability of accounting data and financial statements, organizations are required to conduct an inventory of property and liabilities, during which their presence, condition and valuation are checked and documented.

All property of the organization, regardless of its location, and all types of financial obligations are subject to inventory.

Depending on the extent of inspection coverage of property and liabilities, organizations distinguish between full and partial inventory. A complete inventory covers all types of property and financial obligations of the organization without exception. Partial covers one or more types of property and liabilities, for example, only cash, materials, etc.

Also, inventories can be planned or sudden.

The procedure (number of inventories in the reporting year, dates of their conduct, list of property and liabilities checked during each of them, etc.) of the inventory is determined by the head of the organization, except for cases when the inventory is mandatory. Cases of mandatory inventory:

· transfer of property for rent, redemption, sale, as well as transformation of a state or municipal unitary enterprise;

· preparation of annual financial statements (except for property, the inventory of which was carried out no earlier than October 1 of the reporting year). Inventory of fixed assets can be carried out once every three years, library collections - once every five years;

· change of financially responsible persons;

· identification of facts of theft, abuse or damage to property;

· cases of natural disaster, fire or other emergencies caused by extreme conditions;

· reorganization or liquidation of the organization;

· other cases .

Inventory objects are: fixed assets, intangible assets, financial investments, inventories, finished products, goods, other inventories, cash, other financial assets, accounts payable, bank loans, loans, reserves.

To carry out an inventory, a permanent inventory commission is created in the organization. The commission includes representatives of the organization’s administration, accounting employees, and other specialists (engineers, economists, technicians, etc.). The commission may include representatives of the organization’s internal audit service and independent audit organizations.

Before checking the actual availability of property, the inventory commission should obtain the latest incoming and outgoing documents or reports on the movement of material assets and cash at the time of inventory.

Before the inventory, preparatory activities are carried out. Material assets are sorted and stacked by name, grade, size; In storage areas, labels are posted indicating the quantity, weight or measure of the values being checked. All documents on the receipt and expenditure of valuables must be processed and recorded in analytical accounting registers. Before the inventory begins, a receipt is taken from each person or group of persons responsible for the safety of valuables. The receipt is included in the header part of the form - an inventory list or an inventory act, where information about the actual availability of property and the reality of recorded financial obligations is recorded.

Each inventory (act) is drawn up in at least two copies and is documented in a unified form. The forms are mandatory for use by organizations of all forms of ownership. The head of the organization must create conditions that ensure a complete and accurate verification of the actual availability of property within the established time frame.

1.2 INVENTORY OF CERTAIN TYPES OF PROPERTY AND LIABILITIES

Inventory of inventories is carried out by examining each item. Items of workwear and table linen sent for washing and repair must be recorded in the inventory list on the basis of statements - invoices or receipts of organizations providing these services.

Containers are included in the inventory by type, intended purpose and quality condition (new, used, in need of repair). For containers that have become unusable, the inventory commission draws up a write-off report indicating the reasons for the damage.

To take into account the actual availability of raw materials, finished products, goods and other material assets in warehouses during the inventory period in cases where, according to the conditions of the organization of activity (production), the inventory commission is not able to count material assets within one day and record them in the inventory inventory, an inventory label is used (form No. INV-2). The label is filled out in one copy by the responsible persons of the inventory commission and stored together with the recalculated inventory items at their location.

Data from form No. INV-2 are used to fill out an inventory list of inventory items (form No. INV-3). The latter is used to reflect data on the actual availability of inventory items in storage locations and at all stages of their movement in the organization.

Relevant reports are drawn up for unusable or damaged materials and finished products identified during inventory.

If material assets are identified that are not reflected in accounting, the commission must include them in the inventory list.

The act of inventory of inventory items shipped (form No. INV-4) is used when registering an inventory of the cost of shipped inventory items. When making an inventory of inventory items accepted for safekeeping, an inventory list of form No. INV-5 is used. To inventory inventory items in transit, an inventory report (INV-6 form) is used.

An inventory list of fixed assets (Form No. INV-1) is used to record inventory data of fixed assets.

· availability and condition of inventory cards, inventory books, inventories and other analytical accounting registers;

· availability and condition of technical passports or other technical documentation;

· availability of documents for fixed assets leased or accepted by the organization for storage. If documents are missing, it is necessary to ensure their receipt or execution.

If discrepancies and inaccuracies are found in accounting registers or technical documentation, it is necessary to make appropriate corrections and clarifications.

When making an inventory of fixed assets, the commission inspects the objects and records their full name, purpose, inventory numbers and main technical or operational indicators in the inventory. When making an inventory of buildings, structures and other real estate, the commission checks the availability of documents confirming the location of these objects in the ownership of the organization.

The availability of documents for land plots, reservoirs and other natural resource objects owned by the organization is also checked.

When identifying objects that have not been registered, as well as objects for which the accounting registers do not contain or contain incorrect data characterizing them, the commission must include in the inventory the correct information and technical indicators for these objects.

Fixed assets are included in the inventory by name in accordance with the direct purpose of the object. If an object has undergone restoration, reconstruction, expansion or re-equipment and, as a result, its main purpose has changed, then it is entered into the inventory under the name corresponding to the new purpose.

If the commission determines that capital work or partial liquidation of buildings and structures is not reflected in the accounting records, it is necessary to determine the amount of increase or decrease in the book value of the object using the relevant documents and provide data on the changes made in the inventory.

Machinery, equipment and vehicles are entered into the inventory individually, indicating the factory inventory number according to the technical passport of the manufacturer, year of manufacture, purpose, capacity, etc.

Fixed assets that are located outside the organization’s location at the time of inventory are inventoried until their temporary disposal.

For fixed assets that are not suitable for use and cannot be restored, the inventory commission draws up a separate inventory indicating the time of commissioning and the reasons that led these objects to be unusable (damage, complete wear and tear, etc.).

Simultaneously with the inventory of own fixed assets, fixed assets in custody and leased are checked. For these objects, a separate inventory is drawn up, which provides a link to documents confirming the acceptance of these objects for safekeeping or rental.

For fixed assets accepted for lease, an inventory is drawn up in triplicate separately for each lessor, indicating the lease term. One copy of the inventory is sent to the lessor.

In the inventory, the responsible person of the commission fills out the column about the actual availability of objects. When identifying objects that are not reflected in accounting, as well as objects for which there is no data characterizing them, the responsible persons of the commission must include the missing information and technical indicators for these objects in the inventory list.

By decision of the inventory commission, these objects must be capitalized. In this case, their initial cost is determined taking into account market prices, and the amount of depreciation is determined according to the technical condition of the objects with the mandatory execution of relevant acts.

Inventories are compiled separately for groups of fixed assets (production and non-production purposes).

When making an inventory of unfinished repairs of buildings, structures, machinery, equipment, power plants and other fixed assets, an inventory report of unfinished repairs of fixed assets is drawn up (form No. INV-10). It is filled out based on checking the status of the work. If an unreasonable overexpenditure is identified, its causes are identified and appropriate corrections are made in the accounting records. inventory property obligation order

The inventory list of intangible assets (Form No. INV-1a) is used to prepare inventory data of intangible assets received for use by the organization. The procedure for classifying objects as intangible assets and their composition are regulated by legislative and other regulations.

When inventorying intangible assets, you need to check:

· availability of documents confirming the organization’s rights to use it;

· correctness and timeliness of reflection of intangible assets in the balance sheet.

The inventory list is signed by the responsible persons and the person responsible for the safety of documents certifying the organization’s right to intangible assets.

If intangible assets are identified that are not reflected in the accounting records, the commission must include them in the inventory list.

When making an inventory of financial investments, actual costs in securities and authorized capital of other organizations, as well as loans provided to other organizations, are checked.

When checking the actual availability of securities, the following is established:

· correct registration of securities;

· reality of the value of securities recorded on the balance sheet;

· safety of securities (by comparing actual availability with accounting data);

· timeliness and completeness of reflection in accounting of income received on securities.

When storing securities in an organization, their inventory is carried out simultaneously with the inventory of cash in the cash desk.

An inventory of securities is carried out for individual issuers, indicating in the act the name, series, number, nominal and actual value, maturity dates and total amount. The details of each security are compared with the data of the inventories (registers, books) stored in the accounting department of the organization.

Inventory of securities deposited with special organizations (bank - depository - specialized depository of securities) consists of reconciling the balances of the amounts listed on the relevant accounting accounts of the organization with data from statements of these special organizations.

Financial investments in the authorized capital of other organizations, as well as loans provided to other organizations, must be supported by documents during inventory.

The inventory list of securities and forms of strict reporting documents (form No. INV-16) is used to reflect the results of the inventory of the actual availability of securities and forms of strict reporting documents and identifying quantitative discrepancies with accounting data.

If there are strict reporting document forms numbered with one number, a set is compiled indicating the number of documents in it.

On the last page of the form, before the signature of the commission chairman, two free lines are given for recording the last document numbers in case of movement of securities and forms of strict reporting documents during inventory.

An inventory report of future expenses (Form No. INV-11) is drawn up based on the identification of balances of amounts listed in the corresponding account from documents.

The act indicates the total (initial) amount of expenses - the total amount of expenses (expenses) incurred in a given reporting period or not completely written off in previous periods, but relating to future reporting periods. The act also indicates the date of actual expenses incurred if they are one-time (one-time), or the date of completion of the work if they are related to work on the development of new equipment, production and other work carried out during a certain period of time.

When taking inventory of work in progress in organizations engaged in industrial production, it is necessary:

· determine the actual presence of backlogs (parts, assemblies, assemblies) and unfinished products in production;

· determine the actual completeness of work in progress (backlogs);

· identify the balance of work in progress for canceled orders, as well as for orders whose execution is suspended.

Depending on the specifics and characteristics of production, before starting the inventory, it is necessary to hand over to warehouses all materials unnecessary for the workshops, purchased parts and semi-finished products, as well as all parts, components and assemblies, the processing of which has been completed at this stage.

Checking of work-in-progress reserves is carried out by actual counting, weighing, and re-measuring.

Inventories are compiled separately for each separate structural unit (workshop, site, department) indicating the name of the work, the stage or degree of their readiness, quantity or volume, and for construction and installation work - indicating the volume of work: for unfinished objects, their queues, start-up complexes, structural elements and types of work, calculations for which are carried out after complete completion.

Raw materials, materials and purchased semi-finished products located at workplaces that have not been processed are not included in the inventory of work in progress, but are inventoried and recorded in individual cases.

Rejected parts are not included in the inventory of work in progress, and separate inventories are compiled for them.

When taking inventory of reserves for upcoming expenses, the correctness and validity of the reserves created in the organization are checked:

· for the upcoming payment of vacations to employees;

· payment of annual remuneration for long service;

· for the payment of remunerations based on the results of the organization’s work for the year;

· expenses for repairs of fixed assets;

· production costs for preparatory work due to the seasonal nature of production;

· upcoming costs of repairing rental items;

· expenses for other purposes.

The reserve for the upcoming payment of regular (annual) and additional vacations provided for by law to employees, reflected in the annual balance sheet, must be clarified based on the number of days of unused vacation, the average daily amount of expenses for remuneration of employees (taking into account the established methodology for calculating average earnings), and the unified social tax.

The same applies to reserves for the payment of annual remunerations for length of service and based on the results of work for the year.

If the actually accrued reserve exceeds the amount of the calculation confirmed by the inventory in December of the reporting year, a reversal entry of production and distribution costs is made, and in the event of an underaccrual, an additional entry is made to include additional deductions in production and distribution costs.

An organization that uses the method of determining revenue from the sale of products (works, services) as goods are shipped (works, services are performed) and payment documents are presented to the buyer (customer) may have so-called doubtful debts. The inventory of their reserve consists of checking the validity of amounts that are not repaid within the time limits established by the agreements and are not provided with appropriate guarantees.

When creating other reserves permitted in the established manner to cover any other expected expenses and losses, the inventory commission verifies the correctness of their calculation and validity at the end of the reporting year.

The inventory list of reserves does not have a unified form and is approved by the organization’s regulations for the inventory of assets and liabilities.

1.3 INVENTORY OF COMMODITY AND MATERIAL VALUABLES IN THE WAREHOUSE

Inventory of inventories (inventory, finished products, goods, other inventories) has its own characteristics. When conducting an inventory of this property, it is necessary to take into account the provisions of Section IV of PBU 5/01 “Accounting for inventories”.

Objects are entered in the inventory for each individual item, indicating the type, group, quantity and other necessary data (article, variety, etc.).

Inventory of inventory should, as a rule, be carried out in the order in which the assets are located in a given room. When storing inventory items in different isolated premises with one materially responsible person, the inventory is carried out sequentially by storage location. After checking the valuables, entry into the premises is not allowed, and the commission moves to the next premises to work.

The commission, in the presence of the warehouse (storeroom) manager and other materially responsible persons, verifies the actual availability of inventory items by mandatory recalculation, reweighing or remeasuring them. It is not allowed to enter into the inventory data on the balances of valuables from the words of the financially responsible person or according to accounting data without checking their actual availability.

Inventory assets received during the inventory are accepted and accounted for according to the register or commodity report after the inventory. These inventory items are entered into a separate inventory under the title “Inventory items received during inventory.”

During a long-term inventory, in exceptional cases and only with the written permission of the head and chief accountant of the organization during the inventory process, inventory items can be released by financially responsible persons in the presence of members of the inventory commission. These values are entered in a separate inventory under the name “Inventory assets released during inventory.”

Inventory of inventory items that are in transit, shipped, not paid for on time by buyers, and located in the warehouses of other organizations consists of checking the validity of the amounts listed in the relevant accounting accounts.

Only amounts confirmed by properly executed documents can remain on the inventory accounts that are not under the control of financially responsible persons at the time of inventory (in transit, goods shipped):

· for those in transit - payment documents from suppliers or other documents replacing them;

· for shipped - copies of documents presented by buyers (payment orders, bills);

· for overdue documents - with mandatory confirmation by the bank institution;

· for those located in warehouses of third-party organizations - with safe receipts, reissued on a date close to the date of the inventory.

These accounts must first be reconciled with other corresponding accounts.

1.4 CASH INVENTORY

The cash register inventory is carried out in accordance with the procedure for conducting cash transactions in the Russian Federation, approved by the decision of the board of directors of the Central Bank of the Russian Federation dated September 22, 1993 No. 40 and communicated by letter of the Bank of Russia dated October 4, 1993 No. 18.

When calculating the actual availability of cash and other valuables in the cash register, cash, securities and monetary documents (postage stamps, state duty stamps, bill stamps, vouchers to holiday homes and sanatoriums, air tickets, etc.) are taken into account.

Checking the actual availability of securities forms and other forms of strict reporting documents is carried out by type of form, taking into account the starting and ending numbers of certain forms, as well as for each storage location and financially responsible persons.

An inventory of funds in transit is carried out by reconciling the amounts recorded in the accounting accounts with the data of receipts from a bank institution, post office, copies of accompanying statements for the delivery of proceeds to bank collectors, etc. An inventory of funds held in banks in settlement (current), foreign currency and special accounts is carried out by reconciling the balances of amounts listed in the corresponding accounts according to the organization’s accounting department with data from bank statements.

The cash inventory report (Form No. INV-15) is used to reflect the results of the inventory of the actual availability of funds, various valuables and documents (cash, stamps, checks (check books) and others) located in the organization’s cash desk.

During the inventory, operations for receiving and issuing cash, various valuables and documents are not carried out.

Inventory of settlements with banks and other credit institutions for loans, with the budget, buyers, suppliers, accountable persons, employees. Depositors, other debtors and creditors is to check the validity of the amounts listed in the accounting accounts.

The account “Settlements with suppliers and contractors” for paid goods in transit and settlements with suppliers for uninvoiced deliveries should be checked. It is verified against documents in accordance with the corresponding accounts.

Based on the debt to the organization's employees, unpaid amounts of wages are identified that are subject to transfer to the depositors' account, as well as the amounts and reasons for overpayments to employees. When inventorying accountable amounts, reports of accountable persons on advances issued are checked, taking into account their intended use, as well as the amount of advances issued for each accountable person (dates of issue, intended purpose).

The inventory commission, through a documentary check, must also establish:

· correctness of settlements with banks, financial, tax authorities, extra-budgetary funds, other organizations, as well as with structural divisions of the organization allocated to separate balance sheets;

· correctness and validity of the amount of debt recorded in the accounting records for shortages and thefts;

· the correctness and validity of the amounts of receivables, payables and depositors, including the amounts of receivables and payables for which the statute of limitations has expired.

2. CONDUCTING INVENTORY AT THE VENTOS LLC ENTERPRISE

2.1 GENERAL CHARACTERISTICS OF THE ENTERPRISE

Ventos LLC is an enterprise engaged in the retail trade of food products. He has a branded store “For Tea”, which offers a wide range of confectionery, bakery products and muffins.

The suppliers of Ventos LLC are both Russian and foreign manufacturers of confectionery and bakery products. The store "To Tea" presents the most famous brands of these food products.

The management of Ventos LLC considers maintaining the reputation and image of its company store to be one of the main tasks. To solve this problem, one of the main tools is to conduct inventories: both planned and unscheduled.

Scheduled inventories of inventory balances on the sales floor and in the store warehouse are carried out once a month. The main task is to identify the presence of surpluses or shortages of goods (mainly). Typically, payroll settlements with sellers are made after receiving the inventory results.

Unscheduled inventories are carried out in two cases:

1. When changing the sales team of the sales floor and warehouse;

2. If there are suspicions of a violation of order and theft of property, facts of theft, abuse or damage to property are revealed.

According to the Regulations on accounting and financial reporting in the Russian Federation, in these cases, inventory is not only unscheduled (for the organization), but also mandatory.

Ventos LLC has developed a special inventory regulation, in which the legislative norms on the inventory procedure are defined for its own activities.

This paper examines the case of an unscheduled partial inventory. It is due to the fact that there has been a change in sales workers. The team of sales workers (sellers) bears financial responsibility for the inventory items located in the sales area and in the warehouse of the company store "For Tea" of Ventos LLC, and for the funds in the cash register of the sales area. Moreover, financial responsibility is collective.

The following were subject to inventory:

1. All inventory items, including cash registers (cash registers);

2. Goods in stock.

A special inventory commission has been created at Ventos LLC. The order of the head of the enterprise approves the personal composition of the inventory commission, the task specifying the content, volume, procedure and timing of the audit.

2 . 2 CONDUCTING INVENTORY AT THE CASH AND WAREHOUSE OF THE ENTERPRISE

According to Order No. 12 of October 11, 2010, the inventory commission is obliged to conduct an inventory of goods on the sales floor and in the warehouse, and cash in the cash register on October 12, 2010 from 8.00 to 12.00. The inventory commission includes: an accounting service employee (accountant assistant), an economist and a database operator.

Before starting the inventory, a receipt is taken from the financially responsible persons.

Inventory acts are drawn up in triplicate. One copy was handed over to the accounting department of Ventos LLC, the second copy was given to the team of materially responsible persons who handed over the valuables, the third copy was given to the team of materially responsible persons who accepted the valuables.

The store is closed while the inventory is being taken.

First of all, an inventory of cash in the cash register is carried out. For this inventory, the unified form INV-15 “Cash Inventory Act” is used.

During the inventory of cash, operations to receive and issue cash are not allowed. The absence of anyone from the inventory commission is also not allowed. In addition, when filling out the inventory report, erasures and blots of any kind are not allowed. Corrections are negotiated and signed by all members of the inventory commission and materially responsible persons.

Accounting for the results of cash inventory will look like this:

Debit 94 "Shortages and losses from damage to valuables"

Credit 50 "Cash"

92 rub. 55 k. - the amount of the identified shortage.

Debit 73/2 "Settlements with personnel for other operations / settlements for compensation for material damage"

Credit 94 "Shortages and losses from damage to valuables"

92 rub. 55 kopecks - is divided into four parts in accordance with four financially responsible persons.

To carry out an inventory of the remaining goods on the sales floor and in the warehouse, the management of Ventos LLC has developed a simplified form of the inventory report. The goal is to make inventory easier for sales staff (understanding the requirements for filling out the form).

The act of inventory of goods in the sales area (similarly in a warehouse) contains: the name of the document, the name of the organization and structural unit, the date and number of the document on the basis of which the inventory is carried out, the date of the inventory. The form includes a receipt from financially responsible persons (similar to form INV-15).

The lines are numbered through the entire statement. The inventory of goods is carried out in the order in which the goods are located on display cases, shelves, etc.

The prices in the statement are retail prices.

The totals are summed up for each line (sum column).

The names of inventory goods and their quantity are indicated in the list of nomenclature and in the units of measurement used in accounting. On each page of the statement, indicate in words the number of serial numbers of goods and the total amount of quantity in physical terms recorded on this page, regardless of the units of measurement (pieces, kilograms) these goods are shown in.

Errors are corrected in all three copies of the statement by crossing out incorrect entries and placing correct entries above the crossed out ones. Corrections are also negotiated and signed by all members of the inventory commission and materially responsible persons.

It is not allowed to leave blank lines in the inventory; on the last pages, blank lines are crossed out.

Then the total for each page and the total balance of goods in the sales area and in the warehouse are calculated.

The inventory report is signed by all members of the inventory commission and financially responsible persons. Because the inventory is carried out in connection with the change of financially responsible persons, the receiving team signs for the receipt of goods, and the handing over team signs for the delivery of goods.

According to the Regulations on accounting and financial reporting in the Russian Federation, this surplus must be capitalized and written off to financial results. The following entry will be made in accounting:

Debit 41 "Goods"

Credit 91/1 "Other income and expenses / other income"

In the amount of 435 rubles. 00 kop.

CONCLUSION

Warehouse inventory is not only useful, but also a mandatory procedure for any enterprise.

The main purpose of the inventory is to identify the actual availability of the enterprise’s property and compare it with accounting data.

In the process of conducting an inventory of goods, it is necessary to be guided by general regulatory documents on the organization of accounting and inventory.

Inventory of goods, as a rule, should be carried out in the order in which the valuables are located in a given room. During inventory, a disorderly transition from one product to another should not be allowed.

During the inventory process, an inventory list of the actual availability of valuables is compiled.

Discrepancies (surpluses or shortages) identified during the inventory are documented by drawing up matching statements.

The final results of the inventory are determined in the accounting department and are documented in a matching statement of the results of the inventory of goods.

Periodic checking of the presence and condition of material assets (fixed and working capital) in kind, as well as cash, is the key to the safety of enterprise property.

In the second part of the work, an example of conducting a partial inventory at the Ventos LLC enterprise is considered. The procedure for conducting an inventory is determined by the head of the enterprise, in accordance with current legislation.

Carrying out an inventory made it possible to control the safety of goods and funds and transfer financial responsibility from one team of sales workers to another.

Before the inventory began, sales staff carried out preparatory activities. The goods are sorted and arranged by name and grade. The presence of price tags for all products is checked in the sales area. The goods were also sorted at the warehouse.

The statement of material flows (commodity report) and the statement of cash flows (cash report) were completed. The balance of funds at the beginning of the inventory (according to the report) and the planned balance of goods in the warehouse and on the sales floor (according to accounting data) are displayed.

As a result of an inventory of cash, a shortage of 92 rubles was identified. 55 kopecks The shortage occurred due to the fault of financially responsible persons. It refers to the perpetrators.

Having fulfilled all the mandatory requirements, the inventory commission received the following results for the inventory of goods on the sales floor and in the warehouse: the actual balance of goods amounted to 452,168 rubles. 00 kopecks, according to the plan, the balance of goods should be 451,733 rubles. 00 kop. A surplus of 435 rubles was identified for goods.

According to the Regulations on accounting and financial reporting in the Russian Federation, this surplus must be capitalized and written off to financial results.

The following conclusions can be drawn.

1. As a result of an inventory of cash, a shortage of 92 rubles was revealed. 55 kopecks

2. As a result of an inventory of goods in the warehouse and on the sales floor, a surplus of 435 rubles was identified. 00 kop.

3. One team of sales workers handed over, and the other accepted, valuables (goods and cash) for a total amount of 454,921 rubles. 45 kopecks

BIBLIOGRAPHY

2. Letter of the Ministry of Trade of the RSFSR dated May 21, 1987 No. 085 “On the norms of natural loss of food products in trade.”

4. Chart of accounts for accounting of financial and economic activities of enterprises and instructions for its use. - M., 2002. - 176 p.

5. Regulations on accounting and financial reporting in the Russian Federation. Approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n.

6. Resolution of the State Tax Service of the Russian Federation dated August 18, 1998 No. 88 “On approval of unified forms of primary accounting documentation for recording cash transactions and recording inventory results.”

7. Resolution of the State Tax Service of the Russian Federation dated March 27, 2000 No. 26 “On approval of the unified form of primary accounting documentation No. INV-26 “Record of results identified by inventory””.

8. Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49 “On approval of guidelines for inventory of property and financial obligations.

9. Gukkaev V.B. Accounting policy of the organization. - M., 2008. - 256 p.

10. Klimova M.A. Accounting: a manual for retraining and advanced training of accountants. - M., 2009. - 384 p.

11. Kondrakov N.P. Accounting. Tutorial. - M., 2008. - 640 p.

12. Malyavkina L.I. Inventory of property and liabilities. / Accounting. - No. 23. - 2010

13. Malyavkina L.I. Valuation and inventory of the organization's assets and liabilities. / Accounting. - No. 23, 24. - 2009

14. Parushina N.V. Inventory of funds. / Accounting. - No. 23. - 2008

15. Parushina N.V. Inventory of property and recording of its results. / Accounting. - No. 22. - 2009

Posted on Allbest.ru

...Similar documents