Auto insurance agent is an interesting modern profession. Auto insurance agent is an interesting modern profession Become an auto insurance broker

People of the older generation who hear the phrase “insurance agent” most often see before their eyes a person of uncertain gender and appearance, quite intrusively persuading you to “think about the future and buy a policy.” Indeed, just 15-20 years ago this profession was not at all popular; mainly citizens who had not succeeded in any other field were engaged in this type of activity.

Today, working as an insurance agent at home (MTPL, CASCO, property policies and much more) is quite prestigious and in demand, and, subject to certain conditions, can generate considerable income.

Who is an SK agent

Today's agents are ambitious young people, most often with higher education and considerable experience in communicating with clients. Having undergone special training, such a person is able to sell you anything - from a toothpick to a skyscraper, and he is absolutely not intrusive. The highest aerobatics is to conduct a transaction in such a way that the client is left with a full sense of his own importance and the understanding that he is the “master of the situation.”

As a rule, an insurance agent is not an insurance agent, but carries out its activities on the basis of an agreement or power of attorney. This means that in the event of any misunderstandings, all responsibility lies directly with the insurance company, and the intermediary seems to have “nothing to do with it.” However, this does not mean at all that the agent is not responsible for anything; just in case of discrepancies, he will answer to the insurance company, and not to the client.

Before becoming an insurance agent (MTPL, CASCO, etc.), you should still think carefully, since this profession belongs to the category of “legs feed the wolf,” that is, it does not involve a fixed salary, and for people who prefer a certain stability, it is not will do.

Who can be an agent of the Investigative Committee

In principle, in order to cooperate with insurance companies, you do not need to graduate from a certain university, like, for example, doctors and lawyers. The profile and scope of your education are not that important here. The main criterion for those who are interested in how to become an MTPL insurance agent is the availability of free time and the desire to communicate a lot. Most insurance companies will be happy to consider the following as freelance employees:

- students (current, former and future);

- pensioners;

- retired military personnel;

- young mothers;

- housewives;

- any person who does not have a permanent job, but wants to comprehend the wisdom

The easiest people to take root in this field of activity are those who already have extensive experience communicating with different people: salespeople, teachers, marketers, networkers, psychologists, doctors, former district police officers, and so on.

What should a good agent be like?

Those who have decided to clarify the question of how to become an MTPL insurance agent and try their luck in this field must have certain qualities. This:

- pleasant appearance - regardless of his income level, an insurance agent must be clean, neat, neatly cut and evoke positive emotions in potential clients;

- good memory - you should study and remember well the features of a particular insurance product, be able to correctly explain its advantages; in addition, it is worth remembering the “specifics” of clients, at least regular ones;

- sociability - you need to be able to establish contact and quickly find intelligible answers to various questions, not just pronounce a memorized text, but interest the interlocutor;

- resourcefulness - the ability to get out of an unfavorable situation is very useful, such as a combination lock at the front entrance or a huge dog of the owners who met you at the doorstep;

- resistance to stress - people are different, not everyone knows how to speak correctly, so remember: the client is always right, and you will have to react to even the most notorious rudeness with a polite smile;

- hard work - in this case, you won’t be able to sit on the bench; your earnings will directly depend on the number of clients you find;

I would go to the insurers, let them teach me

So, we’ve sorted out personal qualities, now let’s talk about how to become an agent of an insurance company under MTPL - INGOSSTRAKH, SOGAZ, RESO, VSK or any other company of your choice.

Of course, no company will allow the first person you meet to represent their interests and draw up contracts on behalf of the company - to obtain such a right, you must undergo special training directly from the future employer. These courses are most often free, where the future agent will be taught the basics of negotiation techniques and working with client objections. And, of course, they will analyze every insurance product offered by the company, its advantages and advantages over competitors.

Typically, courses last from one to two weeks to several months, training can be carried out both in groups and individually. Some companies also practice distance learning or remote webinars and Skype conferences. Before becoming an agent of an insurance company for MTPL, CASCO and other types of insurance, the applicant must not only successfully complete training, but also pass some exams and tests in the disciplines passed. In some companies, training can also be gradual - each new level opens up access to additional insurance products - the higher the level, the greater the range of policies that you can offer to clients.

Responsibilities

After completing the training, you can start working. The responsibilities of an insurance agent for compulsory motor liability insurance and any other types of insurance include:

- Finding and attracting new clients, expanding your own

- Concluding new contracts for all types of insurance and extending (renewing) existing ones.

- Self-assessment of damage - despite the fact that most often this is done by a specially designated employee, each agent must be able to do this independently.

- Strict accounting and ensuring the safety of documents - responsibility for storing contributions and forms rests entirely with the agent.

- Carrying out advertising events - the better an agent can present himself, the more clients he will have.

Of course, the first two points are fundamental; the income received directly depends on their quality implementation.

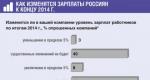

Salary - a lot or not

Before becoming an agent of an insurance company for compulsory motor liability insurance or other types of policies, you should understand that you will not receive a clearly defined income here. The salary of a freelancer directly depends on his activity, luck and hard work. The first time, while you develop a base, will be quite difficult. Active and properly motivated newcomers receive about 15 thousand rubles at first, and “shark agents” can earn more than 100 thousand rubles a month.

Of course, each company has its own remuneration system, but in general we can say that the salary of an insurance agent is 10-15% of the amount of concluded contracts. Some companies also offer certain bonuses and incentives for achieving good results.

The work of an insurance agent, although not easy, is still quite interesting, and under certain conditions allows you to quickly move up the career ladder and improve your skills. However, before becoming an insurance agent at OSAGO ROSGOSSTRAKH, for example, it is worth once again assessing the pros and cons of this profession .

All for

The advantages of this type of activity are quite obvious:

And against

Before becoming an MTPL insurance agent, it is worth soberly assessing the disadvantages of this profession:

- lack of stable projected income;

- independent search for clients - sometimes it can be quite difficult to figure out where to get them;

- irregular work schedule - there is a high probability that the client will want to see you on a holiday, day off or after 23.00;

- personal responsibility for the safety of documentation;

- work with “cash”, personal responsibility for the safety of insurance premiums.

Conclusion

To conclude the topic, let’s summarize what you need to become an MTPL insurance agent:

- Select a company that provides insurance services and inquire about availability of vacancies.

- Send your resume with contact information or fill out a form on the company’s website and wait for an invitation to a conversation.

- Visit the office of the insurance company, undergo a personal interview and sign up for the nearest training course.

- Upon completion of training, enter into a cooperation agreement and start working, but how quickly you can receive your first salary is up to you.

You can start car insurance without any start-up capital or your own investments. Many entrepreneurs first work as insurance brokers, collaborating with specialized companies, helping clients choose the right insurance product for a commission.

The difference between a broker and an agent is that the first specialist does not represent the interests of either party, he simply performs the functions assigned to him by the insurer or policyholder, receiving a certain monetary reward for this.

We have now spoken exclusively about individuals, since an insurance agent always acts as a private representative of a legal entity. This is one tiny unit of a huge front of insurance work, one might say, a persistent tin soldier infantryman.

An insurance broker performs slightly different functions - he should ideally represent the interests not of a specific insurer, but of the policyholder, considering all possible options for purchasing a policy and offering the most profitable and optimal ones.

To put it briefly and to the point, there is only one formal difference - the broker has the official status of a legal entity and must undergo licensing. Becoming an agent, of course, is much faster and easier, but a broker works with a large number of companies and clients and most often earns better accordingly.

In addition, the agent works “for someone else’s uncle,” although he does not have a direct superior telling him what to do, and the broker works for himself, so he has more incentive to try.

Insurance broker: nuances of work

Basically, insurance agents and insurance brokers sell auto insurance policies (CASCO and OSAGO), but they also have many other insurance products related to health, property, real estate, etc.

For some of them, the broker's sales commission can reach 40% of the price of concluded insurance contracts.

An auto insurance agent is a representative of the interests of a specific insurance company.

His functional responsibilities include:

- searching for clients;

- conducting negotiations with them;

- clarification of all conditions of the insurance policy, as well as the procedure for paying compensation;

- conducting an expert inspection of the insurance object;

- sale of insurance policy;

- maintaining related documentation;

- contacting the client on the issue of payments in the event of an insured event.

The profession appeared in ancient times. At first, the practice of non-commercial property insurance was relevant. Subsequently, insurance acquired a commercial orientation and appeared in its modern form.

In the process of formation of this industry, many institutions began to appear that provide insurance services. Now you can see insurance institutions of both public and private types.

An insurance agent works for one company. Clients can sign up for an insurance contract only on the terms and conditions provided by a particular insurance company.

If a person likes the insurance conditions of several companies at once, it is better to contact an insurance broker.

An insurance broker, unlike an agent, can work with several companies at once. He knows the range of all insurance services and accompanies the client during the validity of the policy.

Unlike an insurance agent, a broker offers the most favorable insurance conditions in different offices. Practice shows that brokers are better informed about the peculiarities of the insurance market than agents.

What do you need to know about insuring a country house? Read HERE about where and how best to insure your apartment. About the features of concluding property insurance contracts: http://strahovkunado.ru/dom/estate/dogovor-imushhestvo.html

How to become an insurance agent

The question of how to become an insurance agent at home will be of interest primarily to those who have a lot of free time, but do not have a permanent job. Insurance companies are ready to accept the following categories of applicants as agents:

In order to become a representative of an insurance company, you must take special courses directly from this organization. Training is free. The standard duration of courses is one to two weeks, but in some cases they reach several months.

Some companies practice distance learning via Skype conferences and webinars.

How to become an insurance agent for compulsory motor liability insurance and other types of insurance in various companies? An insurance agent's income is the percentage of sales that he receives for each policy issued to a client.

The question arises: is career growth possible for insurance agents? The majority of insurance companies determine career growth by increasing the amount of interest from the transaction paid to the insurance agent.

The agent himself may think: “I want to become an insurance broker. »

And, having accumulated 2-3 years of experience in this area, having built up a client base, the agent may well become an insurance broker for compulsory motor liability insurance and other types of insurance. Unlike an agent, an insurance broker primarily serves the client, selecting the best insurance option from a list of different insurance companies.

At the same time, the insurance broker selects those companies that maximally protect the risks required by the policy buyer.

Are you thinking about how to become an insurance agent from various insurers in order to process all insurance products, and with minimal investment of time and effort? Do this together with the federal network of insurance agencies "Gosavtopolis".

Use our franchise to open your own insurance agency in 20 days using a proven scheme.

Anyone who wants to work can become an insurance agent. To do this, it is enough to have a secondary education.

Having chosen a career at Ingosstrakh, you must clearly understand that this company needs agents who will move faster than the market.

What does it mean? This means that this particular company will both set high demands for you and provide ample opportunities. After all, by becoming an Ingosstrakh insurance agent, you will always be one step ahead of your competitors.

Among the priorities of such a vacancy, one should highlight prestige (the company is one of the leaders in the insurance market) and prospects.

By going to the company’s website, you can leave a request, after which you will be contacted for further cooperation. You will then need to complete a three-month training course, which is designed in a modular manner, allowing you to focus on the areas of your choice.

Such a training system will help you maximize your professional potential.

After completing the training, you will enter into a cooperation agreement with the company.

It should be noted that clients are attached to the insurance agents of this particular company forever, which will speed up the creation of your personal client base.

This is the most stable company in the insurance market, one of the three most famous Russian insurers.

You can receive royalties for sales directly after registering on the company’s website and receiving an electronic work account. Having studied in detail the operating procedure of the company, you will be able to work successfully in it and create your own personal website to optimize your activities.

The work is remote, which does not limit you at all; transactions take place through the Russian Auto Insurance System.

The procedure is pretty standard. All you have to do is call the company and sign up for training and an interview. Complete training courses, take tests and sign an agreement. The rest is up to you.

If you are a novice insurance agent, then you should pay attention to companies in which you will receive a certain rate plus interest. The activities of an insurance agent directly depend on sales, so it is profitable to receive good interest.

But at the start of your career, you should develop a client base, and without a rate you may be left without any income at all. Also pay attention to the fact that the insurance company is a leader in the services market, it has favorable commissions and acceptable terms of cooperation.

Most insurance companies train their staff. Your colleagues will explain the initial recommendations to you, and they will tell you in more detail during training.

Training can be presented in the form of courses, trainings, seminars, or be of a distance type. In the future, you should not forget that it is advisable to periodically improve your skills and undergo training to improve your skills.

If your candidacy suits the employer, he is obliged to sign an agency agreement with you. After the contract is signed, you will be given an insurer's identification, instructions for completing the documents you need, policy forms and a power of attorney, which gives you the right to sign them.

After training, get to work. It is necessary to successfully sell insurance products to receive compensation.

To do this, look for suitable clients. Pay attention to those familiar with cars and those who have chronic diseases.

Visit organizations and offer insurance services. Don't expect everything to happen quickly; skill will come with experience.

The work of an insurance agent requires composure and attentiveness. Plan your work, expand your client base, always complete everything on time. Show maximum patience and then the profession will reward you for your efforts with decent earnings.

Obtaining a license

The insurance law introduced two important innovations for brokers. First of all, this concerns the distinction with the profession of an agent, and the second is the licensing of brokerage activities.

Previously, a license was not required for this, but now certain difficulties have arisen in creating such organizations.

First of all, the requirements for personnel have become more stringent. A broker's responsibilities used to include reporting to tax authorities and insurance companies.

Now its activities are controlled by the state, that is, by the insurance authority. In addition, before you begin to obtain a license, you need to register as an individual entrepreneur.

Qualities that an insurance agent should have

Stress resistance

This skill can be called key, since this profession often involves conflict situations. If you are an impulsive and nervous person, you will make a terrible insurance agent.

The task of an insurance agent is to attract as many people as possible to any type of insurance.

It's simple - the customer is always right. Even if he yelled at you when you came to take out an insurance policy or gave you unflattering words, he is right, and you should come later.

It is worth understanding that you need to value every client and the last boor should be an interesting and good-natured person for you.

Sociability

The ability to find answers to all questions and find common themes with people will be useful everywhere. For an insurance agent, this is a necessary quality. The insurance agent is obliged not just to clearly tell the list of services, but to be able to interest the person.

How to master a profession

In order to master the profession of an auto insurance agent, you can move in several ways.

Can:

- Get a specialized education at a university. This option is suitable mainly for young professionals who are just starting their career and are deciding on a profession. The specialization “insurance business” is present in many universities in the faculties of economics or law. Professional education is not a mandatory criterion for hiring.

- Develop theoretical knowledge by studying paid and free video courses and attending special trainings. It will not be difficult for determined and active people to find and obtain a theoretical knowledge base using Internet resources.

- “Coaching” directly from an insurance broker. Many insurance companies prefer to train young and promising employees, giving them the opportunity to practice with experienced colleagues. Mentorship and the opportunity to see professionals at work is undoubtedly one of the most effective methods of mastering the profession of an auto insurance agent.

Thus, you can learn the initial necessary skills of an auto insurance agent in just a few weeks.

Mostly women work as insurance brokers. It is desirable that the consultant has a pleasant voice and appearance, as well as good diction.

Specialists cooperate with various insurance companies. They enter into agreements with them, in which they indicate the amount of commission for their work, that is, a percentage of the transaction. You will learn how to become an insurance broker in this article.

Franchise work

Establishing an insurance company will be the most costly and time-consuming of the available auto insurance options. Since such activities are strictly regulated by special laws, first of all, the future owner of such an enterprise needs to study the existing legislative framework.

The first indispensable rule is the establishment of a legal entity. To do this, a new enterprise must be registered in the manner prescribed by law with the tax service.

The next mandatory step is obtaining the appropriate license, which is handled by the insurance market department. To obtain a license suitable for opening an auto insurance company, certain documents are submitted to the licensing authority.

It is also important that the licensee meets the following basic requirements:

- had work experience in insurance activities (including CASCO and OSAGO) of 2 years. In order to gain sufficient experience, it is recommended to begin activities in the field of auto insurance by opening an agency or working as an insurance broker;

- availability of access to a systematic system of compulsory insurance;

– valid membership in the national union of auto insurers.

In addition, when licensing, attention is paid to the presence of a minimum authorized capital, which must be fully paid at the time of registration.

Another important rule is that to ensure financial stability, a car insurance company must have a wider range of services. Thus, OSAGO and CASCO should account for no more than 50% of its contributions from the total insurance portfolio.

Have you decided not only to find out how to become an insurance agent for several companies, but also plan to undergo training? Then it is better to get acquainted in advance with the peculiarities of working as an insurance agent.

There is a range of main responsibilities of this specialist:

- find out the needs of a potential client;

- provide assistance in selecting the necessary insurance product;

- calculation of policy options;

- informing about all conditions of insurance coverage and policy options;

- consultation on issues of obtaining compensation and payments in the event of insured events.

In addition, you need to not only become an auto insurance agent and serve clients who want to take out a policy, but also look for new clients, monitor existing contracts and promptly remind you of the need to renew policies.

Nothing complicated, the only important thing is to constantly replenish your portfolio of clients in order to increase your remuneration.

Like any other profession, the specialty of an agent has not only unconditional advantages, but also significant disadvantages.

So, the advantages of working as an insurance agent under MTPL:

- Flexible work schedule; this position can be combined with the main job if desired.

- Free education.

- Income is not limited. How much you earn is how much you will receive.

- Opportunity for increased career growth.

- Lack of stable income.

- Finding clients is a rather painstaking task.

- Irregular work schedule.

- Personal responsibility for the safety of documentation and funds.

Before choosing this profession, you should know what it takes to become an insurance broker?

Before you engage in this type of activity, you need to draw up a step-by-step business plan on how to become an insurance broker. First of all, you will need a computer and Internet access.

At first, you can do without an office. Registration of a legal entity is necessary to enter into contracts with various insurance companies.

To provide more services to your clients, try to establish partnerships with different companies.

To create your own company and enter into direct contracts, you need to spend a lot of time and money. Government agencies make high demands and take too long to make decisions, which is why many insurance brokers prefer to work on a franchise basis.

Among the advantages of this method are:

- Ready-made contracts with various insurance companies;

- Professional education

- Positive reputation;

- Large customer base;

- Legal support;

- Transparency of work.

Franchisees work with insurance companies that make full payments and also offer good discounts to their clients. If you approach your work wisely, you can make a good profit and count on long-term cooperation.

Insurance agents work for insurance companies and can have different specializations:

- personal insurance (life, health, various life events);

- property insurance;

- liability Insurance;

- business risk insurance.

Responsibilities of insurance agents

They are in many ways similar to the responsibilities of a sales manager, as they involve selling services. The duties of an insurance agent are:

- active sales (search for clients, telephone and personal negotiations, conclusion of contracts);

- maintaining the existing client base (renewal and expansion of insurance agreements);

- consultations on the features of various types of insurance;

- maintaining document flow (contracts, invoices, acts, etc.);

- resolving issues regarding damage assessment and insurance payments;

- analysis of the causes of contract violations and taking measures to eliminate them.

The functions of an insurance agent may also include:

- preparation of statistical reporting - weekly, monthly, annual;

- collection of insurance payments.

Insurance agent salary

Since you dream of becoming an insurance agent at Rosgosstrakh not for charitable purposes, the question of the amount of payment for such activities is important. After completing training and concluding an employment contract, the agent is left to his own devices and must search for and develop his own client base.

In most insurance companies, insurance agents do not have a fixed (guaranteed) salary. That is, wages consist entirely of interest from completed contracts. As a rule, this is up to 20% commission from the total amount of concluded contracts.

The salary of an auto insurer can be generated from the sale of compulsory insurance policies, which are called OSAGO, or from the sale of more extended policies - CASCO. Selling CASCO insurance with the inclusion of additional risks is much more difficult, but at the same time the earnings from them are much higher.

Thus, the more clients an agent has, the higher the salary. At the start of a career, it’s about 10-15 thousand rubles, with the development of a base and experience – up to 100,000 rubles.

An insurance agent's salary depends entirely on his hard work and activity. On average, an insurance agent receives 10-20% of transactions.

Actively working newcomers have at least 18 thousand rubles. per month. Insurance agents with extensive experience up to 50 thousand rubles. Some insurance agents with a very large client base have an income of 200 thousand rubles.

When starting to work as an insurance agent, you need to keep in mind that at first it will be very difficult to find clients. And this will definitely affect your salary.

Clients are money and they will not go into your hands. If you sit still, you won’t even earn a ruble.

It’s also worth understanding that not all people want insurance. You will have to put in a lot of effort and spend a lot of nerves to get your first salary. But over time, it will be easier to find new clients, and wages will increase.

The salary of an insurance agent depends on the amount of the agent's commission on concluded transactions, which ranges from 10 to 30%. The average monthly income of a beginner is 20 thousand rubles.

A successful insurance agent earns about 60-70 thousand rubles per month. Moreover, his maximum monthly income can reach up to 300 thousand rubles.

Activities

Insurance companies offer their clients various programs. The types of insurance brokers, accordingly, are also different. Professionals must be able to competently analyze possible risks. Only then can they offer the client a suitable package.

Several companies can be involved to conclude a contract. Thanks to this, brokers stimulate competition in the insurance market.

Their work includes:

- Protecting the client’s interests in the event of a dispute with the insurer;

- Consultation on services;

- Negotiations on the terms of insurance compensation;

- Preparation of contracts and settlement of losses;

- Providing guarantees.

If you decide to become an auto insurance broker, you need to learn how to choose the best options for your clients among the many types of insurance.

Different companies have different views on prices and conditions of insurance, so a specialist must be competent in any issues related to this area.

For example, some insurers offer more attractive conditions for premium cars, since owners treat them more carefully. Other companies consider it a priority to insure budget foreign cars, as well as domestically produced cars, since their repairs are much cheaper.

There are many options, so true professionals must be able to quickly navigate different situations.

Let's sum it up

The insurance market is diverse, so everyone can easily find a place for themselves in it. Now that you know how to become an insurance broker, you can start realizing your dream. In addition, if you are interested in the question,

You can find detailed instructions on our website.

At first glance, it may seem that there is too much competition in this area. In fact, finding real professionals is not so easy. If you do not stop there, over time you will be able to achieve the best results and make a career for yourself.

Today, the provision of brokerage services is a very attractive area for enterprises. Brokers are the link between policyholders and insurance companies. They help policyholders with a variety of issues related to building a relationship with an insurer. You will learn further about how to become an insurance broker.

Regarding the activities of an insurance broker, you should be clearly aware of the fundamental differences between an insurance broker and an agent, because these two concepts are often confused. The latter is a freelance employee of the insurance company and carries out activities in its interests. As a rule, an insurance agent has his own personal sales plan, and he also has the right to sign certain insurance documents. An insurance agent, as you know, is not a private entrepreneur or legal entity. According to the agency agreement, the insurance company withholds the agent's taxes from his commission. The insurance broker acts exclusively in the interests of the client and provides him with services for selecting insurance products that best meet the policyholder's needs for risk protection.

Often, insurance brokers enter into partnerships with insurance companies. The same companies usually provide the broker with a client base, because independently developing such a base is a very long and tedious task.

The activity of an insurance broker is aimed at helping clients choose the best insurer. To make a choice in favor of optimal insurance conditions, the broker must, of course, be competent in the nuances of insurance. On how to become a broker, or rather, an excellent specialist in the insurance business, it is better to first study a few facts from history.

In the Russian Federation, insurance brokers began to appear several years after the demonopolization of the insurance market. As the story goes, the first insurance broker was registered in early 1993.

In the nineties, the state had virtually no control over brokers, so their number grew steadily and soon exceeded a thousand. But it should be understood that many brokers on the register were, as they say, “dead souls.” They did not conduct any activity in the insurance market.

In January 2004, a new edition of the “Law on the Organization of Insurance Business in the Russian Federation” was adopted, and the status of brokers changed dramatically. They became subjects of the insurance business and were now subject to compulsory licensing. This innovation led to the fact that random people and “dead souls” left the insurance market. The hour of professionals has come.

Now insurance brokers are under the tireless control of the FSSN - the Federal Insurance Supervision Service. They must provide the FSSN with samples of contracts with partners and a certain list of documents, and also periodically report on their activities. All these factors contribute to the transparency of brokers.

What does it take to become an insurance broker?

Video - how to make money in car insurance and insurance. |

- First of all, you need to determine whether you have such qualities as patience, analytical thinking, excellent communication skills and stress resistance.

- Then you should start acquiring the necessary knowledge. A good basis for successfully mastering this profession will be the higher education you have received in economics and the completion of relevant courses. For example, there are preparatory courses certified by the Ministry of Finance of the Russian Federation, after which you pass an exam and receive a broker certificate.

- After completing the first two steps, all you have to do is obtain a license. Since March of this year, the Department of Access to the Financial Market has been licensing brokers in the Russian Federation. To obtain a license, you need to provide a list of documents, pay a state fee and wait to receive a broker's license, after which you can congratulate yourself on your newly acquired status.

Once you receive your license, you become a full-fledged insurance broker. But you shouldn’t quit your studies right away. On the contrary, continue to familiarize yourself with the literature on the insurance business. Contrary to popular belief, an insurance broker is a serious profession that can take you years to master.

In conclusion, I would like to add that the insurance market is very diverse, and everyone can find their own niche in it. Only at first glance it seems that there are a huge number of brokers and agents, and the degree of competition is off the charts. In reality, there are only a few professional specialists. Don't stop there and you can achieve the best results.

White salary This is the only legal form of remuneration. Many job seekers, when looking for work, are also faced with illegal types of payment: black and gray wages. In order to figure out whether the salary from a given employer is legal, you need to pay attention to the following signs.

Signs of a white salary:

- The full salary amount is indicated in the documents upon hiring.

- Bonuses and other incentive allowances are calculated by order.

- Money is transferred to the card or issued through the cash register. Cash payment must be made according to one of the following documents: cash order, payroll or payroll. Documents must be signed by the manager, chief accountant or authorized person. Opposite the name of a specific employee should be the amount that is issued in person.

- No additional amounts will be issued in envelopes.

- The actual amount of income is reflected in the 2-NDFL certificate and in the pay slip.

- All deductions are made from the entire amount of the employee’s income.

What is official wages?

Many people don't even think about the fact that they are receiving illegal income. They work without registration or receive part of their payment in envelopes, but do not understand that part of their income is hidden. For most employees, it does not matter that the amount of their actual income according to documents is less than their real earnings. Employees pay attention to ensuring that money arrives on time, without delays.

The official salary is calculated either according to the report card or according to the standards met. An employee should not register for a salary less than the minimum wage established by the state.

Salary structure

- Salary. For the calculation of which, the actual time worked according to the time sheet, or the standards actually fulfilled, are taken into account.

- Bonus (for length of service, qualifications, length of service, rank or others).

- Additional payments for work on weekends, for night work, for replacing an absent employee and others.

- Incentive payments, including bonuses.

- The regional coefficient established in a specific region.

When an employee is on sick leave, he is paid temporary disability benefits. When on a business trip, business trips. And when you go on vacation, you are paid vacation pay.

Features of employment

When hiring an employee, a hiring order must be issued. An employment contract is another fundamental document that describes the position, working conditions, rest, and the amount of remuneration for the duties performed.

You need to familiarize yourself with the following internal documents of the organization:

- Collective agreement.

- Bonus provisions.

- Inner order rules.

- Job descriptions.

- Taxes and salaries.

You need to understand the difference between accrued and paid wages. The difference between them is the withheld personal income tax (personal income tax), trade union dues, alimony and other deductions under the writ of execution.

Additionally, the employer pays mandatory contributions to the following extra-budgetary funds from all accrued employee income:

- Pension Fund of the Russian Federation (PFR).

- Compulsory Health Insurance Fund (MHIF).

- Social Insurance Fund of the Russian Federation (FSS).

Illegal types of wages

On the territory of the Russian Federation there is only one type of remuneration - official wages in accordance with the Labor Code of the Russian Federation. In common parlance, such earnings are called white wages. No other types of remuneration are legal; there are no legal concepts of black or gray wages.

Black salary

An employment contract is not concluded with the employee, no hiring order is made, and there is no documentation of the person in the organization. Such an employee receives his salary in cash in an envelope.

Obvious disadvantages of illegal sources of income:

- Lack of legal protection for employees.

- No tax transfers.

- Inability to officially go on vacation, sick leave or maternity leave.

The employee does not have any length of service and does not make any contributions to the Compulsory Medical Insurance Fund, the Pension Fund, or the Social Insurance Fund. In case of illness or dismissal, the employer often does not make the required payments. When the time comes to receive your pension, payments will be minimal.

The only advantage of such a source is the higher amount of illegal income. This option is convenient for business areas with a regular circulation of cash, which is subsequently used to pay earnings.

This method is also convenient for real estate organizations. Only a few people register with such companies, and the rest receive only a percentage of sales.

Gray salary

Partially the official salary is called gray. At the same time, employees are registered on the minimum wage. It is from this amount that the employer pays all taxes. Sometimes an employee is assigned to a position with a lower salary. The remainder is paid in an envelope.

This scheme allows the employer to reduce tax costs and allows for an increase in wages. However, sick leave, maternity leave, and vacation leave are, as a rule, calculated according to the minimum wage and their size is minimal. There is a high probability that after maternity leave the employer will offer to resign, and if you disagree, he will leave only the white part of the salary.

Another disadvantage of partially illegal earnings is that the employer regulates the amount in the envelope independently and can establish various fines and illegal deductions.

Scheme of illegal salaries disguised as dividends

Another way to pay salaries is through a scheme that includes a minimum salary and dividends. Each employee is given the opportunity to purchase shares of the organization, which he must sell upon dismissal.

These conditions are specified in the employment contract. A smaller part of the salary is processed and paid on time. The employee periodically receives most of the income in the form of dividends, which in fact make up the majority of his earnings.

Taxes are transferred only from the minimum wage. The frequency of dividends is not monthly, but quarterly. In this scheme, dividends are a good cover for illegal income. To identify this scheme, all employment contracts, minutes and documents of shareholder meetings, employee shares and the amount of payments are reconciled.

What does the employer risk?

Often, the employer is calm and confident that employees will not complain, since they will not be able to prove anything without official documents. However, illegal schemes are detected quite easily. To do this, an unscheduled inspection is carried out and the number of employees in the workplace and in the staffing table is simply compared.

Employee complaints to inspection bodies and witness testimony can help identify this scheme. Illegal payment of labor and tax evasion threatens the employer with heavy fines and even criminal liability.

Advantages and disadvantages of official earnings for an employee

- The main advantage is the social security of the employee. If there is a violation of labor obligations, you can file a complaint with the regulatory authorities.

- Registration of employees and payment of white wages is a sign of a stable organization.

- Taxes are charged on all earnings. In the future, the amount of pension payments will be calculated from these taxes transferred to the Pension Fund.

- Temporary disability benefits and vacation pay are calculated based on total earnings.

- When you go on parental leave, it will be easier to return to your position while maintaining your salary, since the registration is official.

You can confirm your income with a certificate; this is sometimes necessary to obtain a mortgage or loan. - The salary is fixed; the employer does not have the right to reduce it at will.

- If an employee is dismissed, the employer must pay all due payments.

- You can return part of your personal income tax from the budget using tax deductions. This is beneficial if you buy an apartment or house with a mortgage.

The disadvantages are not so obvious, but they still exist.

- Official income is usually less than illegal income. Because the employer reduces part of its expenses by cutting salaries.

- Most vacancies in private business are offered with illegal earnings, so it is more difficult to find a job with an official salary.

- Alimony and debts under writs of execution are withheld from official earnings; illegal income is easier to hide. In this regard, when registering an employee, the full amount will be deducted from the salary.

Advantages and disadvantages of a white salary for an employer

- The obvious disadvantage is the cost of taxes.

- Complex accounting reporting.

- Inability to fire an unsuitable employee, since according to the Labor Code this is difficult to do.

There are much fewer advantages for the employer:

- No liability for illegal wages and tax evasion.

- Good reputation and stability of the organization.

- Accounting transparency.

How to check whether an employee’s payment is official?

If an employee has doubts about whether he has official income, this can be checked as follows. You need to register in your personal account on the website of the Federal Tax Service and download the 2-NDFL certificate there. Organizations are required to submit these certificates annually by name. Having received a similar one in accounting, you can compare income by month.

Despite the obvious advantages of the white salary, most employers and employees settle on the gray version. When making such a choice, you need to weigh all the risks, since employees often lose more than they gain. It must be borne in mind that if the salary is illegal, the employer may delay its payment for an indefinite period, pay it not in full, or not pay it at all.

The profession of an insurance agent is very prestigious in large cities.

An agent is a person who acts on behalf of a particular company and enters into insurance contracts.

Now you can find a huge number of vacancies with fairly decent salaries. Is being an insurance agent really such a prestigious profession?

Insurance agent– a link between a large company and people who want to make their lives safer. The insurance agent is obliged to find out the client’s wishes, tell him about possible insurance conditions, current tariffs and compensation payments.

After these steps, an insurance contract is concluded on the most favorable terms for the client.

This profession has certain requirements for candidates. Fits sociable and goal-oriented people. Anyone who has reached the age of majority can become an insurance agent.

Responsibilities of insurance agents

- Search for clients. Insurance agent on one's own is looking for clients who will use its services. It is very difficult to develop a base at first and will require a lot of effort. Directly depends on the number of clients salary amount.

- Conclusion of contracts. An insurance agent must be able to conclude contracts for each type of insurance. This specialist also renegotiates contracts. Carries financial liability.

- Damage assessment. Often companies assign positions to special employees who assess material damage. However, every insurance agent must be able to do this on their own.

- Accounting and security of documents. The insurance agent is fully responsible for storage of insurance policies and contributions.

- Advertising of services. Insurance agents must make active advertising of its services to the population. Attracting new clients is a prerequisite for working as an insurance agent.

The main and main task of an insurance agent is Attraction of new clients.

Processing insurance policies and premiums is an agent’s daily job. Finding new clients largely depends on professionalism specialist

In order to develop a certain client base, you need to have skills that every insurance agent should have. An insurance agent has responsibilities that are fairly simple to perform, but not everyone can do it.

Qualities that an insurance agent should have

Stress resistance

This skill can be called key, since this profession often involves conflict situations. If you are an impulsive and nervous person, you will make a terrible insurance agent.

The task of an insurance agent is to attract as many people as possible to any type of insurance.

It's simple - the customer is always right. Even if he yelled at you when you came to take out an insurance policy or gave you unflattering words, he is right, and you should come later.

It is worth understanding that you need to value every client and the last boor should be an interesting and good-natured person for you.

Sociability

The ability to find answers to all questions and find common themes with people will be useful everywhere. For an insurance agent, this is a necessary quality. The insurance agent is obliged not just to clearly tell the list of services, but to be able to interest the person.

Why insure a refrigerator or food processor? You must explain that manufacturers have stopped monitoring the quality of the product, and you will help correct the situation - even if something breaks, the person will be able to buy a new device without loss. Or remind us of thieves who will not disdain even a refrigerator.

Hard work

You won’t be able to sit and do nothing with such a profession. Every minute you have to think about where to find new clients. And after smart thoughts come to you, go ahead and implement your ideas. Insurance agent - quite active work, which will not allow you to sit still. Irregular working hours involve providing insurance services both during the day and in the evening.

Resourcefulness

Insurance agents who sit at points and issue comprehensive insurance know that the worst thing in their professional work is making rounds in the private sector.

Every insurance agent who visited the houses of “nervous and embittered” people at least a couple of times doubted that he had chosen the right education. Not every insurance agent will be hired to work at a certain “point”, and even if they are hired, this does not mean that there will be an influx of clients.

So why is working in the private sector so scary? Just imagine, you had a fight with your husband, the dinner burned and the child broke a vase, and then an insurance agent came: “Come on, I’ll insure you for all occasions.”

Usually in this case the agent is asked to leave and refuses services, but there are other options - tell him everything you think about such “beggars”, swear, etc.

The second and most terrible thing that can meet you during the “detour” are dogs, of which there are a lot in private sectors. And don’t try to do anything to them - maybe they’ve already been insured! Any harm caused to these “harmless” animals, even if they try to bite you, will result in a fine.

Good memory

An insurance agent is required to remember all types of insurance and offer them to his clients. In addition, it is worth remembering the characteristics of certain people. If a person does not have a car, it makes no sense to offer him comprehensive insurance.

Presentable appearance

Regardless of gender, an insurance agent must inspire confidence. To do this, you will need to devote a lot of time to your appearance and be neat and well-groomed.

History of the profession and the main difference between an agent and a broker

The profession appeared in ancient times. At first, the practice of non-commercial property insurance was relevant. Subsequently, insurance acquired a commercial orientation and appeared in its modern form.

In the process of formation of this industry, many institutions began to appear that provide insurance services. Now you can see insurance institutions of both public and private types.

Insurance agent working per company. Clients can sign up for an insurance contract only on the terms and conditions provided by a particular insurance company.

If a person likes the insurance conditions of several companies at once, it is better to contact insurance broker.

An insurance broker, unlike an agent, can work immediately with several companies. He knows the range of all insurance services and accompanies the client during the validity of the policy.

Unlike an insurance agent, a broker offers the most favorable insurance conditions in different offices. Practice shows that brokers better informed about the features of the insurance market than agents.

How to become an insurance agent

Anyone who wants to work can become an insurance agent. For this it is enough to have secondary education.

Many insurance companies conduct their own training for employees. A person of any age can achieve success in this profession, the main thing is focus and desire to work.

Some vocational schools provide training to become insurance agents. You can also take special courses.

If you don’t have time to study theory, you can safely contact an employer who will provide you with quality training in practice.

An insurance agent is a profession that provides career growth and high wages. It all depends on the person and his desire to work.

Insurance agent salary

An insurance agent's salary depends entirely on his hard work and activity. On average, an insurance agent has 10-20% of transactions.

Actively working newcomers have at least 18 thousand rubles. per month. Insurance agents with extensive experience up to 50 thousand rubles. Some insurance agents with a very large client base have an income of 200 thousand rubles.

When starting to work as an insurance agent, you need to keep in mind that at first there will be very difficult to find clients. And this will definitely affect your salary.

Clients are money and they will not go into your hands. If you sit still, you won’t even earn a ruble.

It’s also worth understanding that not all people want insurance. You will have to put in a lot of effort and spend a lot of nerves to get your first salary. But over time, it will be easier to find new clients, and wages will increase.

The profession of an insurance agent, like any other, has its advantages and disadvantages. This specialty will allow you to quickly improve your financial situation and move up your career ladder, but not everyone will be able to achieve such success. If you don't know how to work with people, no other professional skills will help you find clients.