Corporate cards for legal entities: features, tariffs and conditions. Corporate cards for employees Using personalized cards as corporate cards

12/24/2004 No. 266-P.

In order for employees to be able to freely operate corporate cards, the company must:

Develop regulations on the procedure for using corporate cards (Part 1, Article 8 of the Labor Code of the Russian Federation);

Approve the list of positions whose job duties involve the use of corporate cards in the company (clause 1 of Article 847 of the Civil Code of the Russian Federation, paragraphs 2 and 7 of clause 1.12 of Bank of Russia Instruction No. 28-I dated September 14, 2006 “On opening and closing bank accounts, deposit accounts";

Familiarize all employees whose positions are listed in the list with the position against signature (Part 2 of Article 22 of the Labor Code of the Russian Federation);

Organize in the company accounting for the acceptance and issuance of corporate bank cards (Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, hereinafter referred to as Law No. 402-FZ, information No. PZ-10/2012 “On entry into force from January 1, 2013, Federal Law of December 6, 2011 No. 402-FZ “On Accounting”);

Register in the accounting method for recording accountable amounts in a special account (clause 7 of PBU 1/2008).

Regulations on the procedure for using corporate cards

In this article we will assume that the company decided to open a separate special card account.

The regulation on the procedure for using corporate cards is a methodological guide for all company employees who, due to their duties, are somehow involved in this process.

In the regulations on the use of corporate cards, we recommend setting:

List of expenses and transactions that can be made by an employee using a corporate card. Please note: the list of operations that are permitted within the Russian Federation differs from the list of transactions permitted abroad. Both lists are shown in the table;

Limits on corporate cards. These may differ for different positions;

The period after which the employee must return the card;

Order by cardholders regarding amounts spent;

The period during which the employee must submit an advance report to the company with supporting documents attached;

An approximate list of documents that are accepted as confirmation of expenses incurred. You can compile an album of their samples and make it an appendix to the position. Then employees will have a visual idea of what document to require when paying by card;

Requirements for ensuring the protection of PIN code information;

Procedure in case of loss of the card;

Types of violations of order and the procedure for compensation for damage by cardholders.

List of card transactions

| Type of operation | Purpose of expenses | Territory | |

| RF | outside the Russian Federation | ||

| Cash withdrawn in rubles from a corporate card | + | - | |

| Travel and expenses | + | - | |

| Cashless payment in rubles with a corporate card | Economic activities of the company | + | - |

| + | - | ||

| Cash withdrawn from a corporate card | Economic activities of the company | - | - |

| Travel and hospitality expenses | - | + | |

| Cashless payment in foreign currency using a corporate card | Economic activities of the company | - | - |

| Travel and hospitality expenses | - | + | |

An alternative to the provision on the procedure for using corporate cards can be a separate section on the use of corporate cards in another local regulatory act of the company. This section, for example, can supplement the provision on the procedure and amount of reimbursement of travel expenses, submission of advance reports on travel and business expenses of company employees. It is shown below.

Who has the right to use corporate cards in the company

Those employees on whom these cards are issued have the right to use corporate cards. When issuing corporate cards, the company submits to the bank an approved list of company employees who have the right to use the cards.

If the head of the company decides that it is more convenient to use non-named corporate cards, he issues an order to approve a list of positions, the replacement of which gives the right to use non-named corporate cards to pay for goods and services on behalf and in the interests of the company. See below for a sample order.

When compiling a list, keep in mind that it cannot completely duplicate the staffing table. It is necessary to conduct a reasonable sample and not include positions (professions) in which the performance of official duties does not involve payment for goods and services on behalf and in the interests of the company.

Familiarize employees with the regulations for signature

All employees for whom personalized cards have been issued and whose positions are listed in the order must be familiarized, against signature, with the approved regulations on the procedure for using corporate bank cards or with the local regulatory act that contains the corresponding section.

The fact of familiarization can be recorded on the last sheet of the regulation or in a separate document (for example, in a statement or journal).

Storage, issuance and return of corporate cards

To eliminate cases of loss of corporate cards, as well as misuse or theft, the company must establish strict control over the storage and movement of corporate cards.

Personalized corporate bank cards may be in the hands of holders, provided they comply with security requirements.

As a rule, non-personal corporate cards are issued to an employee to perform a specific task - payment of travel, entertainment or other expenses.

Documentation of the transfer of a card to an employee is not regulated by law. It is better to approve this procedure in the regulations on the procedure for using corporate cards. The order may be as follows:

The employee writes an application for the issuance of a non-personal corporate card, justifying the purpose of the intended expenditure of funds;

The manager endorses the employee’s application and indicates the limit of the non-personalized card. A sample application form is given below.

Please note: there are no exceptions in the law for the situation when the accountable person is the head of the company. But the company has the right to independently rank the conditions for using corporate cards by position.

Corporate cards are issued for a period determined by the regulations. A card can be issued for a longer period, different from that specified in the company regulations, on the basis of an order from the head of the company.

If an employee constantly travels on business trips, by separate order of the manager, he can be issued a corporate card for a longer period.

If the deadline for returning a non-named corporate card is missed, the person authorized to control their movement must inform the main person about this. Then a decision is made to block the card or another decision with the guilty accountable person.

Journal of corporate card movement

The date, period, purpose of issuing a corporate card, its number, limit, position and surname of the employee are recorded in the journal for registering the acceptance and issuance of cards (the journal for the movement of corporate bank cards).

The facts of receipt and return of a corporate card by an employee must be confirmed by signatures in the journal of the accountable person and the accounting employee who is responsible for their storage.

See below for a sample log.

How to report money spent

The procedure for reporting by employees on the expenditure of funds on a corporate card is not established by a separate regulatory act. But the company can develop it independently, based on the rules governing the procedure for reporting the expenditure of cash accountable amounts.

The deadline for submitting an advance report on the use of funds from a corporate bank card can be set in the regulations on the procedure for using corporate cards. It can be set in working days from the date of expiration of the period allotted for the execution of the order or return from a business trip.

You can use the unified advance report form No. AO-1, approved by Decree of the State Statistics Committee of Russia dated August 1, 2001 No. 55.

The company also has the right to develop its own, taking into account the peculiarities associated with the combination of spending cash and non-cash funds (clause 4 of article 9 of Law No. 402-FZ).

Please draw the attention of your accountable persons to one feature of drawing up an advance report on the expenditure of funds from a corporate card.

The receipt that an employee receives when withdrawing cash from an ATM cannot in itself be considered as a document confirming the employee's expenses.

The advance report must be accompanied by receipts (other documents) indicating the intended use of the cash withdrawn from the card. The employee must deposit the balance of unused cash withdrawn from the card into the company cash desk. The employee's advance report must be approved by the head of the company.

1) receipt of cash in the currency of the Russian Federation for making payments on the territory of the Russian Federation in accordance with the procedure established by the Bank of Russia related to the economic activities of a legal entity on the territory of the Russian Federation, as well as for paying expenses associated with the business trip of employees of the relevant legal entities within the Russian Federation, in the currency of the Russian Federation;

2) non-cash payment of expenses in the currency of the Russian Federation related to the secondment of employees of relevant legal entities within the Russian Federation;

3) non-cash transactions on the territory of the Russian Federation related to the main activities of a legal entity, in the currency of the Russian Federation;

4) non-cash transactions on the territory of the Russian Federation related to the economic activities of a legal entity, in the currency of the Russian Federation;

5) non-cash payment in the currency of the Russian Federation for expenses of a representative nature on the territory of the Russian Federation;

6) non-cash payment of expenses related to the business trip of employees of relevant legal entities to foreign countries, in foreign currency;

7) non-cash payment of entertainment expenses in foreign currency outside the Russian Federation;

8) receiving cash in foreign currency outside the Russian Federation to pay expenses associated with sending employees of relevant legal entities to foreign countries.

When performing transactions specified in subparagraphs 1 - 5 of this paragraph in the currency of the Russian Federation, funds may be written off from the accounts of resident legal entities in foreign currency.

In cases where settlements in foreign currency are permitted for legal entities by currency legislation, when performing transactions in foreign currency specified in subparagraphs 6 - 8 of this paragraph, funds may be written off from the accounts of resident legal entities in the currency of the Russian Federation. In this case, foreign currency purchased by the issuer at the expense of the client's ruble accounts for subsequent settlements on transactions made in foreign currency is not credited to the current foreign currency account of the client - the owner of the ruble account.

Funds written off from the account of a legal entity as a result of transactions specified in subparagraphs 1, 2, 4 - 8 of this paragraph are considered issued by the legal entity on account to the corporate card holder. Refunds of unspent funds are carried out in accordance with current legislation.”

· receive cash Russian rubles for settlements on the territory of the Russian Federation related to the economic activities of a legal entity in the territory of our country, as well as to pay expenses associated with business trips of employees around Russia;

· receive cash foreign currency outside the Russian Federation to pay expenses for business trips abroad;

· make non-cash payments for expenses in Russian rubles associated with business trips of employees within the Russian Federation, and in foreign currency for business trips abroad;

· carry out non-cash transactions on the territory of the Russian Federation related to the main activities of a legal entity in Russian rubles;

· make non-cash payments in Russian rubles for expenses of a representative nature on the territory of the Russian Federation and in foreign currency outside Russia.

It should be noted that most often organizations use plastic cards to pay hospitality and travel expenses. You can especially appreciate the convenience of using bank cards when sending employees on business trips abroad. Moreover, this is beneficial both for individuals traveling abroad (there is no need to bring cash with them, in addition, time is significantly saved on arranging a business trip) and organizations, since there is no need to open a foreign currency account to purchase cash currency. In accordance with Regulation No. 23-P, when funds in Russian rubles are written off from a client’s account to pay expenses in foreign currency, the foreign currency purchased by the issuing bank at the expense of the client’s ruble accounts is not credited to his current foreign currency account.

Note!

Funds written off from the account of a legal entity as a result of transactions specified in subparagraphs 1, 2, 4 - 8 of paragraph 4.6 of Regulation No. 23-P are considered issued by the legal entity on account of the corporate card holder. Refunds of unspent funds are carried out in accordance with current legislation.

The amount of remuneration that the bank charges for servicing a special card account in the organization’s accounting in accordance with paragraph 11 of PBU 10/99 “Organization expenses”, approved by Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n “On approval of the Accounting Regulations” Organizational expenses "PBU 10/99" (hereinafter referred to as PBU 10/99) are operating expenses and are accounted for as a debit to account 91.2 "Other expenses". In tax accounting, the amounts of remuneration withheld by the bank for servicing a special card account are taken into account when taxing profits in full in accordance with subparagraph 25 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

It should be noted that the correct organization of analytical accounting for the “Special Card Account” subaccount is of great importance.

Analytical accounting for this sub-account should be organized in the context of specific card accounts opened in a particular bank. In addition, the analytics are significantly influenced by the conditions for issuing and using corporate cards offered by the bank. So, for example, when concluding an agreement with a bank, the bank sets a condition that there is a minimum balance on the organization’s account (a security deposit that can be used for settlements in exceptional cases to cover exceeding the payment limit). It would be advisable to use second-order subaccounts “Special card account - minimum balance” and “Special card account - payment limit”.

Note!

Let's look at an example of how transactions using a corporate payment card are reflected in an organization's accounting.

In this example, the expenses for holding an official dinner in a restaurant represent organizations that, in accordance with paragraph 5 of PBU 10/99, are expenses for ordinary activities. In the accounting of trade organizations, entertainment expenses are taken into account as part of distribution costs and are reflected in account 44 “Sales expenses”.

The basis for recognition of entertainment expenses in this example are payment documents issued by the restaurant.

To calculate income tax, entertainment expenses associated with the official reception and service of representatives of other organizations participating in negotiations to establish cooperation are taken into account as part of other expenses associated with production and sales (subparagraph 22 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation). Let us remind you that for tax accounting purposes, entertainment expenses are subject to rationing. According to paragraph 2 of Article 264 of the Tax Code of the Russian Federation, entertainment expenses during the reporting (tax) period are included in other expenses in an amount not exceeding 4% of the taxpayer’s expenses for wages for this reporting (tax) period. In the example under consideration, for the reporting period (6 months), the organization can include entertainment expenses in the amount of 32,000 rubles (800,000 x 4%) as other expenses. Consequently, if the organization did not have other entertainment expenses, then payment for a formal dinner in a restaurant can be taken into account for profit tax purposes in a given reporting period in the full amount.

The amount of VAT paid to a restaurant can be deducted in full on the basis of paragraph 7 of Article 171 of the Tax Code of the Russian Federation after debiting funds from the organization’s current account and in the presence of an invoice issued by the restaurant (paragraph 1 of Article 172 of the Tax Code of the Russian Federation).

In accounting, the organization will reflect this with the following accounting entries:

|

Account correspondence |

Amount, rubles |

||

|

Debit |

Credit |

||

|

A corporate payment card was issued to an employee of the organization for payment of entertainment expenses. |

|||

|

The corporate payment card was returned by the accountable person |

|||

|

Receipt of cash is reflected |

|||

|

The costs of holding a formal dinner in a restaurant are reflected. |

|||

|

The amount of VAT on the cost of the official lunch is reflected |

|||

|

Funds were written off from a special card account based on a bank statement |

|||

|

Accepted for deduction of VAT on restaurant services. |

|||

Note!

If the amount of entertainment expenses exceeds the standard established by tax legislation, then for tax purposes the organization can accept only the standardized amount of entertainment expenses as expenses.

Amounts of “input” value added tax on standardized expenses are accepted for deduction in the amount corresponding to the specified standards. This provision is established by paragraph 7 of Article 171 of the Tax Code of the Russian Federation.

Note!

The organization’s use of account 57 “Transfers in transit” is due to the fact that slips and receipts are received by the accounting department and processed before receiving a statement from a special card account confirming the fact that funds have been written off from the legal entity’s account.

We have already drawn attention to the fact that funds debited from the account of a legal entity for transactions in subparagraphs 1, 2, 4 - 8 of paragraph 4.6 of Regulation No. 23-P are considered issued on account to the corporate card holder. In addition, the cardholder can use the payment card directly to withdraw cash. This transaction is reflected in accounting as follows:

When using borrowed funds in its activities, the borrower organization must be guided by Order of the Ministry of Finance of the Russian Federation dated August 2, 2001 No. 60n “On approval of the accounting regulations “Accounting for loans and credits and the costs of servicing them” PBU 15/01.” In accordance with paragraphs 16 and 17 of this document:

"16. The organization accrues interest on received loans and credits in accordance with the procedure established in the loan agreement and (or) credit agreement.

17. Debt on loans and credits received is shown taking into account the interest due at the end of the reporting period in accordance with the terms of the agreements.”

In the accounting of the borrowing organization, the amount of interest accrued for the use of borrowed funds is included in operating expenses (based on paragraph 11 of PBU 10/99) and is reflected in account 91 “Other income and expenses”.

Note!

Tax legislation classifies the amount of interest on debt obligations of any type as non-operating expenses (subclause 2 of clause 1 of Article 265 of the Tax Code of the Russian Federation). Moreover, Chapter 25 “Organizational Income Tax” provides for a special procedure for classifying interest on debt obligations as expenses taken into account for tax purposes, which is established by Article 269 of the Tax Code of the Russian Federation.

The maximum amount of interest recognized as an expense is accepted: either equal to the refinancing rate of the Central Bank of the Russian Federation, increased by 1.1 times - when issuing a debt obligation in rubles and 15% - for debt obligations in foreign currency, or equal to the amount received on debt obligations on comparable terms .

The repayment of the loan received and the payment of accrued interest is reflected in the credit of the cash accounting accounts in correspondence with the account ().

Example.

In January, the trading organization entered into an agreement with the issuing bank to receive and service a corporate credit card. The issuing bank, in accordance with the agreement, provided a loan in the amount of 224,200 rubles for a period of 4 months at a rate of 16%. The organization paid for goods intended for resale using this corporate credit card.

The amount of borrowed funds was transferred to the bank

In the example considered, the issuing bank, in accordance with the terms of the agreement, initially transferred the loan amount to the client’s special card account. However, this is not the only option that allows you to pay with borrowed funds using a corporate credit card.

Civil legislation allows for a situation where, in accordance with the bank account agreement, the bank makes payments to the client, despite the lack of funds in the current account, that is, short-term crediting of the account is carried out (Article 850 of the Civil Code of the Russian Federation). This type of loan is called an overdraft. An overdraft can occur if a bank finances a credit card transaction by conducting transactions that exceed the customer's payment limit.

When making payments using corporate credit cards, one should distinguish between both a provided overdraft and an unprovided one.

If the parties, when concluding an agreement for the issuance and servicing of a credit card, provided for the possibility of an overdraft, the conditions for its provision, repayment terms and interest, then such an overdraft is considered provided for.

It is usually revealed upon receipt of a bank statement. Since an overdraft is a type of short-term loan, it is reflected in accounting using an account. Having received a bank statement and identified an overdraft, the accountant must reflect it in accounting. The date of occurrence of an overdraft is the date when the bank made the payment from its own funds. In this case, the following entry is made in accounting:

Debit 55 “Special accounts in banks” sub-account “Special card account” Credit 66 “Settlements on short-term loans and borrowings”. Interest accrued on the provided overdraft is interest for the use of borrowed funds and is taken into account in the usual manner.

However, if, when concluding an agreement for the issuance and servicing of a corporate credit card, the parties did not provide for the possibility of short-term lending if the payment limit of the card was exceeded, then if the payment limit was exceeded, a so-called unforeseen overdraft occurs. In this case, the bank has the right to demand from the organization that allowed the unforeseen overdraft, reimbursement of its expenses and the amount of interest for the use of other people's funds (Article 1017 of the Civil Code of the Russian Federation). Interest is calculated for the use of other people's funds in accordance with the requirements of Article 395 of the Civil Code of the Russian Federation. In accordance with the requirements of civil law, interest on the use of funds received unjustifiably is calculated from the moment the organization learned of the unjustification of their receipt. That is, at the time of receiving an account statement, which will reflect the overspending.

You can find out more about issues related to accounting and taxation of transactions carried out using plastic cards in the book of JSC “BKR Intercom-Audit” “Settlements using plastic cards”.

1. List of expenses and transactions that can be made by an employee of an organization using a corporate card owned by the organization

The use of corporate cards in the business activities of any organization is very convenient and every year the number of organizations using them in their activities increases.

In order to use a corporate bank card in an organization, it is advisable to issue a regulation on the use of such a banking product, which will establish a list of positions of employees who have the right to use this card, payment limits on this card, as well as a list of expenses that each employee can make using this cards, liability for its loss and other operations necessary for control.

To eliminate possible disputes with employees, it is necessary in accordance with Part 2 of Art. 22 of the Labor Code of the Russian Federation, familiarize all employees who have the right to use this card with signature.

To record the movement of corporate cards, it is necessary to develop and approve forms of primary documents on the basis of which the acceptance and issuance of corporate bank cards will be recorded (Article 9 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”, hereinafter referred to as Law N 402 -FZ).

In the accounting policy, it is advisable to prescribe the method of accounting for accountable amounts in a special account (clause 7 of PBU 1/2008), as well as the accounting methodology, which will be discussed in this article

The list of expenses that can be included in expenses that reduce the tax base is determined according to general rules in accordance with the provisions of Art. 252 of the Tax Code of the Russian Federation (TC RF).

For accounting of transactions with corporate bank cards, accounts 51 “Current account” or 55 “Other bank accounts” are used. The write-off of funds from a bank card is reflected by a posting to the credit of account 51 “Current account” or 55 “Other bank accounts” in correspondence with the debit of the accounts for accounting for settlements or expenses, depending on the economic event reflected in the accounting records.

The list of transactions that can be performed by an individual using a bank card is established in the Regulations on the issuance of payment cards and on transactions performed with their use (approved by the Bank of Russia on December 24, 2004 N 266-P) (as amended on August 10, 2012) (Registered in the Ministry of Justice of Russia 03/25/2005 N 6431) (hereinafter referred to as Regulation N 266-P).

According to clause 2.3 of the said Regulations, an individual client carries out the following operations using a bank card:

- receiving cash in the currency of the Russian Federation or foreign currency on the territory of the Russian Federation;

- receiving cash in foreign currency outside the territory of the Russian Federation;

- payment for goods (work, services, results of intellectual activity) in the currency of the Russian Federation on the territory of the Russian Federation, as well as in foreign currency outside the territory of the Russian Federation;

- other transactions in the currency of the Russian Federation, in respect of which the legislation of the Russian Federation does not establish a prohibition (restriction) on their execution;

- other transactions in foreign currency in compliance with the requirements of the currency legislation of the Russian Federation.

A client - an individual can carry out, using payment (debit) cards, credit cards, the operations specified in this paragraph on bank accounts opened in the currency of the Russian Federation and (or) on bank accounts opened in foreign currency.

The client, an individual who is a resident, can carry out the operations specified in this paragraph using credit cards at the expense of the provided loan in the currency of the Russian Federation without using a bank account.

The use of a prepaid card by an individual client is carried out in accordance with the requirements of Federal Law of the Russian Federation N 161-FZ of June 27, 2011 N 161-FZ “On the National Payment System” (hereinafter referred to as Federal Law of the Russian Federation N 161-FZ) at the expense of the balance of electronic funds in the currency of the Russian Federation and (or) in foreign currency.

A client - an individual who is a non-resident, can carry out the operations specified in this paragraph using credit cards at the expense of the provided loan in the currency of the Russian Federation, foreign currency without using a bank account.

According to clause 2.4 of the said Regulation N 266-P, clients - individuals using payment (debit) cards, credit cards can carry out transactions in a currency other than the account currency, the currency of the loan provided, in the manner and on the terms established in the bank account agreement , loan agreement. Clients - individuals using prepaid cards can make electronic money transfers in a currency different from the currency of the electronic money balance. When performing the operations specified in this paragraph, the currency received by the issuing credit institution as a result of a conversion operation is transferred for its intended purpose without being credited to the account of the client - an individual.

According to clause 2.5 of Regulation N 266-P, the client - a legal entity, an individual entrepreneur, carries out the following operations using payment (debit) cards, credit cards:

- receiving cash in the currency of the Russian Federation for making payments on the territory of the Russian Federation, in accordance with the procedure established by the Bank of Russia, related to the activities of a legal entity or individual entrepreneur, including payment of travel and entertainment expenses;

- payment of expenses in the currency of the Russian Federation related to the activities of a legal entity, individual entrepreneur, including payment of travel and entertainment expenses, on the territory of the Russian Federation;

- other transactions in the currency of the Russian Federation on the territory of the Russian Federation, in respect of which the legislation of the Russian Federation, including regulations of the Bank of Russia, does not establish a ban (restriction) on their execution;

- receiving cash in foreign currency outside the territory of the Russian Federation to pay for travel and hospitality expenses;

- payment of travel and hospitality expenses in foreign currency outside the territory of the Russian Federation;

- other transactions in foreign currency in compliance with the requirements of the currency legislation of the Russian Federation.

A client - a legal entity, an individual entrepreneur can carry out, using payment (debit) cards, credit cards, the operations specified in this paragraph on bank accounts opened in the currency of the Russian Federation, and (or) on bank accounts opened in foreign currency.

The issuing credit organization is obliged to determine the maximum amount of cash in the currency of the Russian Federation that can be issued to a client - a legal entity or individual entrepreneur during one business day for the purposes specified in this paragraph. The issuing credit organization is recommended to establish for a client - legal entity, individual entrepreneur - the possibility of receiving cash in the currency of the Russian Federation for the purposes specified in this paragraph in an amount not exceeding 100,000 rubles during one business day.

The client is a legal entity, individual entrepreneur, using prepaid cards, transfers electronic funds, returns the balance of electronic funds in accordance with the requirements of Federal Law N 161-FZ.

According to clause 2.6 of the said Regulations, clients - legal entities, individual entrepreneurs using payment (debit) cards, credit cards can carry out transactions in a currency other than the currency of the account of a legal entity, individual entrepreneur, in the manner and on the terms established in the bank account agreement . When performing the operations specified in this paragraph, the currency received by the issuing credit institution as a result of a conversion operation is transferred for its intended purpose without being credited to the account of the client - a legal entity, an individual entrepreneur. Clients - legal entities and individual entrepreneurs using prepaid cards can make electronic money transfers in a currency different from the currency of the electronic money balance.

According to clause 2.7 of Regulation N 266-P, in the event of absence or insufficiency of funds in the bank account when the client performs transactions using a settlement (debit) card, the client, within the limit provided for in the bank account agreement, may be provided with an overdraft to carry out this settlement transaction if there is a corresponding condition in the bank account agreement.

According to clause 2.8 of Regulation N 266-P, credit institutions, when issuing payment (debit) cards and credit cards, may provide in a bank account agreement or loan agreement a condition for the client to carry out transactions using card data, the amount of which exceeds:

- the balance of funds in the client’s bank account if the conditions for providing an overdraft are not included in the bank account agreement;

- overdraft limit;

- the limit of the loan provided, defined in the loan agreement.

Settlements for these operations can be carried out by providing the client with a loan in the manner and on the terms provided for by the bank account agreement or loan agreement, taking into account the norms of these Regulations.

If there is no bank account in the agreement, and in the loan agreement there are no conditions for granting a loan to the client for these operations, the client’s repayment of the debt incurred is carried out in accordance with the legislation of the Russian Federation.

In accordance with paragraphs. b clause 1 part 1 art. 9 of the Law of the Russian Federation dated December 10, 2003 N 173-FZ) currency of the Russian Federation - funds in bank accounts. Foreign currency - banknotes in the form of banknotes, treasury notes, coins that are in circulation and are legal means of cash payment on the territory of the corresponding foreign state (group of foreign states) - paragraphs. and clause 2, part 1, art. 9 of the Law of the Russian Federation dated December 10, 2003 N 173-FZ.

Foreign currency is a type of currency value (clause 5) of Part 1 of Art. 9 of the Law of the Russian Federation dated December 10, 2003 N 173-FZ).

Alienation by a resident in favor of a non-resident of currency valuables, the currency of the Russian Federation on legal grounds, as well as the use of currency valuables, the currency of the Russian Federation as a means of payment is a currency transaction (subclause b, clause 9, part 1, article 9 of the Law of the Russian Federation dated December 10, 2003 N 173- Federal Law).

Based on this, payment with a corporate card in foreign currency is a foreign currency transaction; therefore, to reflect this operation in accounting, it is necessary to apply PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in foreign currency” (hereinafter referred to as PBU 3/2006 ).

PBU 3/2006 establishes the specifics of the formation in accounting and financial statements of information on assets and liabilities, the value of which is expressed in foreign currency, including those payable in rubles, by organizations that are legal entities under the legislation of the Russian Federation (with the exception of credit organizations and state ( municipal institutions) - clause 1 of PBU 3/2006.

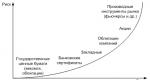

We offer a list of possible card transactions in Table No. 1.

Table No. 1. List of possible operations on the card.

2. Payment of travel expenses by employees of the organization in foreign currency on the territory of Russia and abroad using ruble corporate cards. Accounting Features

As mentioned above, it is allowed to pay travel and entertainment expenses in foreign currency outside the Russian Federation using a corporate card issued both in the currency of the Russian Federation and in foreign currency (clause 2.5 of Regulation No. 266-P).

Based on the norms of clause 5.2 of the Instruction of the Central Bank of the Russian Federation dated 04.06.2012 N 138-I “On the procedure for the submission by residents and non-residents to authorized banks of documents and information related to foreign exchange transactions, the procedure for issuing passports of transactions, as well as the procedure for accounting by authorized banks of foreign exchange transactions and control over their implementation" (hereinafter referred to as Instruction No. 138-I), when a resident carries out a foreign exchange transaction under a transaction (contract, loan agreement), the amount of obligations under which does not exceed the equivalent of 50 thousand US dollars, associated with the write-off of Russian currency from the current account resident in the currency of the Russian Federation, a transaction passport is not prepared.

Clause 3.1 of Instruction N 138-I establishes that a resident, when carrying out a currency transaction related to the debiting of Russian currency from his current account in Russian currency opened with an authorized bank, submits to the authorized bank at the same time the following documents: an order for the transfer of funds provided for by the regulatory an act of the Bank of Russia regulating the rules for transferring funds (hereinafter referred to as the settlement document for a currency transaction); documents related to the currency transaction specified in the settlement document for the currency transaction.

At the same time, clause 3.3 of Instruction No. 138-I, a settlement document for a currency transaction is not drawn up and is not submitted by the resident to the authorized bank when the resident carries out currency transactions using bank cards.

Based on the above, a resident, when carrying out foreign exchange transactions in the currency of the Russian Federation using bank cards, submits to the authorized bank documents related to the currency transaction without drawing up and submitting a settlement document for the currency transaction. At the same time, the deadline for submitting to the bank documents related to conducting currency transactions using bank cards is not directly provided for by Instruction No. 138-I. In our opinion, such a period should be agreed upon with the authorized bank before the commencement of foreign exchange transactions. We also recommend agreeing on the list of documents submitted to the bank (for example, invoices, acts confirming expenses made by employees).

If payment from a ruble corporate card occurs on the territory of the Russian Federation, there are no special features of accounting and tax accounting.

To correctly reflect in tax and accounting transactions for payment from a ruble corporate card outside the territory of the Russian Federation of any expenses, it is necessary to answer several questions.

- Is it necessary to record the conversion of rubles into other currencies in accounting?

- When does ownership of currency values pass to the organization: at the moment an employee receives currency from an ATM or at the time he makes a currency payment from a card?

- Do exchange rate differences arise in accounting for settlements with an accountable person?

In our opinion, ownership of currency values passes to the organization at the moment its employee receives currency from an ATM from a ruble corporate card (or at the time he makes a foreign currency payment from a ruble corporate card).

First, ownership of the currency passes to the organization, and then the organization issues the currency to its employee.

This conclusion is justified as follows.

According to Art. 30 of the Federal Law of December 2, 1990 N 395-1 “On Banks and Banking Activities”, relations between credit institutions and their clients are carried out on the basis of contracts.

According to paragraph 1 of Art. 845 of the Civil Code of the Russian Federation, under a bank account agreement, the bank undertakes to accept and credit funds received to the account opened for the client (account owner), carry out the client’s orders to transfer and withdraw the corresponding amounts from the account and carry out other operations on the account.

The agreement on the use of a bank account was concluded with a legal entity, therefore all relations regarding the agreement (withdrawal of money from the account, conversion of funds, etc.) take place between the bank and the legal entity. The corporate card is linked to the account and is actually only a means of payment.

According to the provisions of Art. 140 of the Civil Code of the Russian Federation, the ruble is legal tender, obligatory for acceptance at face value throughout the Russian Federation.

At the same time, currency values - foreign currency and external securities have a different legal regime (in particular, they are not a means of payment on the territory of Russia with some exceptions) in accordance with the provisions of the articles of the Federal Law of December 10, 2003 N 173-FZ “On Currency Regulation and Currency Control” "

Thus, rubles and currency are different objects of civil rights, including having different valuations in different periods of time. In this case, this difference must also be reflected in accounting and tax accounting.

In clause 2.6 of the Regulations on the issuance of payment cards and on transactions performed with their use, approved. The Bank of Russia on December 24, 2004 N 266-P (Registered with the Ministry of Justice of Russia on March 25, 2005 N 6431) established that clients - legal entities using payment (debit) cards, credit cards can carry out transactions in a currency different from the currency of the legal entity’s account in in the manner and on the terms established in the bank account agreement. When carrying out these operations, the currency received by the issuing credit institution as a result of a conversion operation is transferred for its intended purpose without being credited to the account of the client - a legal entity.

However, this does not mean that a business transaction involving currency conversion was not carried out. According to the provisions of Art. 9 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”, each fact of economic life is subject to registration as a primary accounting document. And it must be reflected in accounting.

It should be noted that when using ruble corporate cards of an organization, it is necessary to take into account that the commercial rate of the servicing bank used when converting currency, as a rule, differs significantly from the official rate of the Central Bank of the Russian Federation, which will be an additional expense for the organization. An organization has the right to take into account such costs as non-operating expenses when calculating income tax on the basis of paragraphs. 6 clause 1 art. 265 of the Tax Code of the Russian Federation.

Also, for carrying out conversion operations on behalf of the client, the bank may withhold a fee if such a condition is stipulated in the bank account agreement, which provides for settlements using a debit (payment) card. This point is also important when determining whether the conversion is to be made into the account of an organization or a third party (employee).

Accounting. Basic principles and features

Accounting for transactions with corporate bank cards depends on the account to which such a card is “linked”. If the card is “linked” to one of the company’s current accounts, then payments made using it are reflected in account 51 “Current Account”. If a separate account is opened for settlements, then such an account in accounting is account 55 “Other bank accounts”.

All write-offs of funds from a corporate bank card made by authorized persons of the company (receipt of cash and non-cash payments) are reflected by a posting to the debit of account 71 “Settlements with accountable persons” and the credit of account 51 “Current account” (55 “Other bank accounts”) , in case rubles are written off.

If an employee received foreign currency from a card, then, taking into account the above regarding the one-time transfer of ownership of foreign currency assets first to the organization, and then from the organization to the accountable person, this fact of economic life must be reflected in accounting. Due to the lack of a methodology for accounting for this operation in Russian accounting standards (RAS), the method used must be fixed in the accounting policy. In our opinion, to reflect the purchase of currency, you can use a transit account, for example, account 57 with a certain identification (D57 K55) and reflection of the amount in the currency of the accountable person at the rate of the Central Bank of the Russian Federation and reflection in expenses of the difference in purchase and conversion rates (D71, 91.2 K57). The basis for this operation must be a document from the bank confirming this operation.

Next, from account 71 “Settlements with accountable persons”, funds are written off to settlement accounts (60 “Settlements with suppliers and contractors”, 76 “Settlements with various debtors and creditors”), or expense accounts (20 “Main production”, 23 “ Auxiliary production and facilities”, 25 “General production expenses”, 26 “General business expenses”, 44 “Sale expenses”), depending on the essence of the economic event and primary documents.

Considering that primary documents can be drawn up in a foreign language, it is necessary to make a line-by-line translation into Russian (clause 9 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n “On approval of the Regulations on accounting and financial reporting in the Russian Federation", Article 68 of the Constitution of the Russian Federation), which can be carried out either by a professional translator or by an employee of the organization who speaks a foreign language (letter of the Ministry of Finance of the Russian Federation dated April 20, 2012 N 03-03-06/ 1/202)

Please note the following features. As mentioned above, this operation relates to a foreign exchange operation; accordingly, the organization must apply PBU 3/2006.

In accordance with clauses 4, 5 and 6 of PBU 3/2006, in accounting, an advance issued in a currency other than the currency of the Russian Federation is accounted for in rubles at the official exchange rate of the Central Bank of the Russian Federation established on the date of issue of money from the cash register. Based on clauses 7, 9 and 10 of PBU 3/2006, the recalculation of foreign currency debt into rubles at the end of the reporting period or at the date of approval of the advance report is not carried out. That is, the expenses of the accountable person are reflected in accounting at the exchange rate of the Central Bank of the Russian Federation on the date of issue.

However, there are exceptions. If an overspending of the advance payment is identified or the advance payment has not been fully spent, then the rate of the Central Bank of the Russian Federation as of the date of approval of the advance report will be applied to these amounts.

The employee must hand over the balance of accountable amounts to the organization's cash desk within three working days after returning from abroad (clause 26 of Resolution No. 749 of October 13, 2008 “On the specifics of sending employees on business trips”). Unspent currency should be credited to the cash desk with conversion into rubles at the exchange rate on the day the employee returned the money (clause 20 of PBU 3/2006 and clause 24 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n ).

Tax accounting. Basic principles and features

A positive exchange rate difference for the purposes of tax accounting for income tax is an exchange rate difference that arises when revaluing property in the form of currency values and claims, the value of which is expressed in foreign currency, or when depreciating liabilities, the value of which is expressed in foreign currency (clause 11 of Art. 250 of the Tax Code of the Russian Federation).

A negative exchange rate difference for the purposes of tax accounting for income tax is an exchange rate difference that arises when depreciating property in the form of foreign currency assets and claims, the value of which is expressed in foreign currency, or when revaluing liabilities, the value of which is expressed in foreign currency (clause 5 p. 1 Article 265 of the Tax Code of the Russian Federation).

At the same time, the specified norms of the Tax Code of the Russian Federation exclude exchange differences arising from the revaluation of advances issued from non-operating income and expenses.

The date of travel expenses in accordance with paragraphs. 5 paragraph 7 art. 272 of the Tax Code of the Russian Federation recognizes the date of approval of the advance report.

Until the moment specified in paragraphs. 5 paragraph 7 art. 272 of the Tax Code of the Russian Federation, an enterprise must have an extract from a ruble account and bank data on currency conversion. Based on documents from the bank confirming the conversion, the difference between the Central Bank rate and the currency conversion rate in accordance with paragraphs. 6 clause 1 art. 265 of the Tax Code of the Russian Federation and paragraph 2 of Art. 250 of the Tax Code of the Russian Federation is reflected in expenses in NU.

- In accordance with paragraph 10 of Art. 272 of the Tax Code of the Russian Federation, in the case of an advance transfer, expenses (approved advance report) expressed in foreign currency are converted into rubles at the official rate established by the Central Bank of the Russian Federation on the date of transfer of the advance (the date of debiting funds from the corporate card (in the part attributable to the advance). That is, within the limits of funds debited from the card, the rate will be equal to the rate of the Central Bank of the Russian Federation on the dates of debiting funds from the card.

- If there is an overexpenditure (economically justified) of the accountable amounts, the amount of the overexpenditure in expenses will be reflected at the exchange rate of the Central Bank of the Russian Federation on the date of approval of the advance report (clause 10 of Article 272 of the Tax Code of the Russian Federation).

For an example of accounting and tax accounting for a corporate card, we provide a table with catchy figures.

Table No. 2. Accounting and tax accounting using conventional figures and conventional examples

————————————————————————— ¦ 3. Procedure for using corporate bank cards ¦ ¦ ¦ ¦ 3.1. A corporate bank card is intended for employees to pay for travel and business expenses of the company. ¦ ¦ 3.2. A corporate bank card is issued in accordance with the order of the head of the company. ¦ ¦ 3.3. Corporate cards for business expenses are issued only to authorized employees with whom an agreement on full financial responsibility has been concluded. ¦ ¦ The employee to whom the card was issued gets the opportunity to manage ¦ ¦ money in a special card account of the company. The funds on the corporate card belong to the company. ¦ ¦ 3.4. The list of employees in whose name corporate cards are issued is given in Appendix No. 1. ¦ ¦ 3.5. The list of positions, the filling of which gives the right to use “unnamed corporate cards and manage funds” of the company, is given in Appendix No. 2 (sample on p. 91). ¦ ¦ 3.6. To receive a card, an employee must write an application for the issuance of a corporate card addressed to the head of the company. ¦ ¦ 3.7. Accounting for the acceptance and issuance of cards is kept in the corporate card accounting journal (Appendix No. 3). ¦ ¦ 3.8. The corporate card holder is responsible for the safety of the corporate bank card, as well as for spending funds on it within the established spending limits. ¦ ¦ The holder is obliged to immediately report the loss or theft of a corporate bank card to the credit institution that issued the card in order to block transactions. If, due to the fault of the cardholder, the account is not blocked in a timely manner, the amount of damage caused is recovered from the cardholder. ¦ ¦ 3.9. Information about the card PIN code is confidential information. Cardholders do not have the right to disclose this information to any third parties.

Using corporate bank cards

¦ ¦ 3.10. The basis for using a corporate bank card is an order to send an employee, an internal memo or an approved estimate of the company's business expenses. ¦ ¦ 3.11. The card holder can carry out operations on the card only within the limit established for the card under the agreement with the issuing bank. ¦ ¦ 3.12. When purchasing office supplies, normative and reference literature and paying other business expenses, the size of a one-time payment using a corporate card cannot exceed 50,000 rubles. under one agreement (account). ¦ ¦ 3.13. The limit for cash withdrawals in the Russian Federation is set at 100,000 rubles. in a day. Withdrawing foreign currency in cash on the territory of the Russian Federation is not permitted. ¦ ¦ 3.14. The limit for cash withdrawals outside the territory of the Russian Federation is set in an amount equivalent to 100,000 rubles. in a day. ¦ ¦ 3.15. Outside the territory of the Russian Federation, corporate cards may only be used to pay for travel and entertainment expenses. Payment by corporate card for business expenses outside the Russian Federation is not allowed. Amounts spent for these purposes are not accepted for reimbursement; they are withheld from the salary of the employee who violated this clause. ¦ ¦ 3.16. Employees whose work involves constant business trips have the right not to hand over their corporate card for three months. For other employees, the period is determined individually, but not more than one month. ¦ ¦ 3.17. An advance report on funds used through a corporate bank card is submitted in the manner and within the time limits provided for in clauses 2.2 and 2.3 of these Regulations. ¦ ¦ 3.18. In the absence of documents confirming the intended use of a corporate bank card, collection from the guilty employee of the amount used for other purposes is carried out in accordance with Art. Art. 238, 241 and 248 of the Labor Code of the Russian Federation. ¦ ¦ 3.19. The employee must return the amount spent for other purposes to the company's cash desk within 10 working days from the date of approval of the advance report. Otherwise, it will be deducted from your salary. ¦ ——————————————————————————

Source - "Salary", 2014, No. 4

Home — Articles

Opening a corporate plastic card

Resolve issues related to card registration

The card is issued after the corresponding agreement has been signed with the bank. However, before going to the bank, decide on the following important points.

How many cards do you need and for whom should you issue them?

A corporate card can only be personal. That is, only one employee of the company can use the card. The person for whom this card is issued. If an employee transfers the card to another, he himself will still be responsible for any abuse of the card. Therefore, if it is necessary for several people to have access to the company’s money using a card, an individual “plastic” card is issued for each.

To which account should it be issued?

The bank can issue a card for the current account. Then the card holder will actually have access to all the company’s funds. This is unsafe if the card, for example, is issued to an ordinary employee. Although, of course, a limit may be set on the card, but still... Therefore, many resort to another option - the card is issued to a special card account. You can transfer money to it in the amount that is needed. Thus, the funds that need to be issued for reporting will be separated from the company’s main money.

There are nuances. A corporate card can be issued to a company's current account. But it’s more convenient to use a specially opened card account.

Please note that the card can be opened not only for a ruble account, but also for a foreign currency account. For example, for cases when employees go on a business trip abroad and pay expenses there in foreign currency. Although, it is true, there is no need to have a foreign currency account specifically to pay expenses abroad - after all, you can always pay with a ruble corporate card. There will only be additional costs for conversion (clause

Regulations on corporate cards sample

2.6 Regulations of the Bank of Russia dated December 24, 2004 N 266-P).

How will it be replenished?

A corporate card can be a payment (debit) or credit card. Payments can be made using a debit card if there are funds in the account to which the card is linked. With a credit card, it is not necessary to have funds in your account. The bank itself will provide the required amount. Of course, for a fee and within the agreed limit. And then your company will repay the debt to the bank.

Keep in mind that not all banks offer different types of corporate cards. So, for example, some provide both credit and debit cards, while others provide only debit cards. Therefore, it is better to clarify this point in advance, and then contact the bank. He himself will determine the list of documents that will need to be completed. In any case, you will be required to submit an application, and in it you will indicate those employees in whose name the cards should be issued.

An important point. A corporate card is issued for a specific employee. To do this, an application is submitted to the bank indicating his full name.

When signing an agreement, pay attention to the terms of use of the card offered by the bank. Thus, banks often set a limit on the amount that can be withdrawn from the card during the day. As well as commission for cash withdrawals. It’s important to find out all this right away so you can plan your spending.

Let us note one more point. To activate a card, you often need to transfer a certain amount of money to your account, especially if we are talking about a special card account. The transferred money is used to cover the costs of issuing and servicing the card.

Notify tax authorities and funds about the opening of a special card account

If your corporate cards are linked to an existing current account, you do not need to inform anyone about their opening. It’s another matter when the card was issued with the opening of a special card account or it was necessary to open a new current account. Then it is necessary to notify tax authorities and extra-budgetary funds about this. This must be done within seven working days after opening (clause 1, clause 2, article 23 of the Tax Code of the Russian Federation, clause 1, clause 3, article 28 of the Federal Law of July 24, 2009 N 212-FZ).

Memo. The tax office and extra-budgetary funds must be notified of the opening of a special card account within seven working days.

Submit your report to the tax office using Form N S-09-1, given in Order of the Federal Tax Service of Russia dated 06/09/2011 N ММВ-7-6/362@. In the FSS of the Russian Federation - in the form approved by Order of the FSS of the Russian Federation dated April 12, 2011 N 67. And in the Pension Fund of the Russian Federation - in the form that you will find on the official website of the fund (www.pfrf.ru). To do this, enter the request “Message about opening an account” in the search bar on the main page of the site. You will see a link where you can download the required form.

Write down the procedure for working with corporate cards in an internal document

When the cards are received and accounted for, you can issue them to the employees for whom they were issued. But first, write down the procedure for issuing and using cards in a separate regulation and approve it as an internal document by order of the manager. Then familiarize all employees with it and sign it. In particular, it is advisable to provide for the following points in the regulation.

What expenses can be paid by card?

Indicate what expenses the card is intended to pay for. These may be costs associated with the business trip of employees, entertainment, as well as business expenses (clause 2.5 of the Bank of Russia Regulations dated December 24, 2004 N 266-P).

In what order are cards issued to an employee?

You can issue the card to an employee once, and he will use it as needed while working for your organization. Or you can issue a card only for the duration of specific tasks issued by order of the manager.

In any case, create a special register in which you will record the issuance of cards and their return. In the register, provide the following fields:

- card number and full name employee - card holder;

- date of issue of the card to the employee;

- signature of the employee when receiving the card;

- date of return of the card by the employee;

- signature of the person responsible for maintaining the register when the card is returned by the employee.

Advice. Keep a log or record of issuing corporate cards to employees. The document records the issuance of cards and their return.

Such control over the movement of cards is necessary to prevent cases of their loss or theft.

How to use the card

Make it clear that the card must be used directly by the employee. And it cannot be transferred to third parties.

Consider what is the basis for using the card. For example, an order from a manager to complete an official task. It is advisable to indicate in the order specific types of expenses and their allowable amount.

Whenever using a card - withdrawing cash or making payments on it - the employee must receive documents confirming the expenses incurred and keep them for reporting (checks, invoices, travel tickets, receipts, invoices, etc.).

How to report to employees

The employee reports the money spent to the accounting department by submitting an advance report and documents confirming the expenses incurred. Also indicate the deadline for submitting the advance report in the regulations. The law does not establish any time frames for non-cash payments, so you can focus on the time limits established when working with cash. Namely, the accountable person is obliged to report for the funds spent within three days after the expiration of the period for which the money was issued on account, or from the moment of going to work (paragraph 2, clause 4.4 of the Regulations on the procedure for conducting cash transactions, approved by the Bank of Russia on October 12. 2011 N 373-P, hereinafter referred to as Regulation N 373-P). The report must be approved by the head of the organization.

Record every fact of using the card in your records.

The issuance of a corporate card to an employee does not entail any accounting entry. You only record this operation in the corporate card accounting journal. But if an employee paid with a card or withdrew cash from it, then this circumstance must already be reflected in the accounting accounts. The transactions depend on which account the corporate card is linked to. If it’s a settlement account, then reflect any spending from the card based on the bank statement with the following posting:

Debit 71 Credit 51

- money was issued to the employee against a statement from the current account.

And if the card is opened to a special card account, the entry will be like this:

Debit 71 Credit 55

- money was issued to the employee on account from a special card account.

In both cases, the basis will be a bank statement.

Please note: bank statements may not arrive to you every day. In this case, you can quickly learn from employees about withdrawing money from the card. After all, they must save and attach to the advance report not only primary accounting documents, but also ATM and terminal receipts for the issuance (withdrawal) of money. If you find yourself in such a situation, record the issuance of money against the report using account 57 “Transfers in transit.” That is, based on the advance report, make the following entry:

Debit 71 Credit 57

And after receiving the statement, write off the funds from the account to which the card is linked:

Debit 57 Credit 51 (52, 55)

- debit of funds from the account is reflected.

Write off the debt from the accountable person based on the advance report approved by the manager. We repeat that the report must be accompanied by documents confirming the expenses incurred. Depending on the type of expenses, select the desired debit account, and the corresponding account will always be account 71 “Settlements with accountable persons”. The entry will be as follows:

Debit 20 (08, 23, 26, 44, 91) Credit 71

- expenses paid by the accountable are reflected.

Essence of the question. Write off the money spent on the card to the debit of account 71 based on bank statements. And after the employee submits an advance report, you will cover his debt to the organization.

Write down the amounts of expenses determined on the basis of the advance report in column 5 of section. I book of accounting for income and expenses, if you apply the simplified tax system with the object of taxation “income minus expenses”. And the type of costs paid by the employee is named in the list given in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation.

At the same time, do not forget about the write-off rules established for specific types of expenses. So, for example, if the accountant purchased a fixed asset, then include the spent amount in expenses from the moment the facility was put into operation, distributing the amount quarterly until the end of the year (clause 1 and paragraph 8, clause 3, clause 3, Article 346.16, clause 4 Clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

If an employee withdrew money from the card and did not spend it completely, credit the balance to the cash register by filling out a cash receipt order. In accounting, reflect the transaction by posting:

Debit 50 Credit 71

- the balance of unspent cash withdrawn from the card by the reporting employee is entered into the cash register.

Example. Using a corporate card

LLC "Persona", which uses the simplified tax system with the object "income minus expenses", in August 2013 issued a corporate card for its employee O.N. Galkina. The card was issued with the opening of a special card account. On August 30, the account was replenished in the amount of 30,000 rubles. The accountant reflected this transaction based on the bank statement with the following posting:

Debit 55 Credit 51

- — 30,000 rub. — money is transferred to the corporate card.

In September 2013, by order of the head of the organization O.N. Galkin is tasked with purchasing stationery for the organization. To pay these expenses, on September 9, the employee received a corporate bank card. A record of the card issuance was made in the corporate card register.

September 10 O.N. Galkin withdrew 5,000 rubles from the corporate card. With this amount he purchased office supplies.

The employee reported on the purchase on September 11, submitting an advance report and accounting documents confirming the purchase to the accounting department. On the same date, the report was approved by the manager.

On September 10, based on the bank statement, the accountant created the following entry:

Debit 71 Credit 55

- — 5000 rub. — money was issued on account by non-cash method to a corporate card.

Debit 10 Credit 71

- — 5000 rub. — stationery purchased by the employee was capitalized.

Also on September 11, the amount of expenses in the amount of 5,000 rubles. The accountant wrote down section 5 in column. I book of accounting of income and expenses based on paragraphs. 17 clause 1 art. 346.16 Tax Code of the Russian Federation.

On the day of approval of the advance report O.N. Galkin returned the corporate card. The accountant reflected this fact in the corporate card accounting journal.

Nuances that require special attention. Money withdrawn from a corporate card is considered funds issued on account. For each expense of funds on the card, the employee must report by submitting an advance report to the accounting department. Documents confirming the expenses incurred must be attached to the report.

Issuing a corporate card to an employee does not in itself constitute grounds for an accounting entry. The accountant makes entries only when funds flow through the card.

To control the movement of corporate cards, maintain a special card register. It can be called a journal or statement.

What documents need to be drawn up if money is issued through a corporate card for reporting?

Marina Marchuk, tax consultant

- Does the manager need to issue an order to issue money on account for each use of the card??

- Clause 4.4 of Regulation N 373-P states that only to receive cash, an accountable person needs to fill out an application. And the manager, in turn, indicates on this statement the amount and reporting period. Regulation No. 373-P says nothing about non-cash transfers of accountable amounts, including to a corporate bank card. This means that the director does not need to endorse an employee’s application each time if the money for the report is transferred to the card. In practice, the amount of the report is regulated by a limit. This can be either a card limit or a spending limit specified in the company’s internal documents.

- What about the statement of the accountable person? It is also only necessary when issuing cash.?

- Exactly. And if you use a card, that is, you issue money against a report in a non-cash manner, you can do without statements from employees. Corporate cards are precisely designed to minimize the amount of documentation and simplify the procedure for settlements with accountants.

- Do I need a manager’s order for each card issuance??

- When issuing a corporate card, such an order is necessary, but in the future, the issuance of the card to the employee and its return are regulated by the norms of the local act. For example, the regulations on corporate cards. In this document, it is advisable to resolve this issue in the most convenient way in accordance with the specifics of the company.

- Is an order from the manager required to replenish a special card account??

- I think this is also an optional requirement, since when making a non-cash transfer, the manager must certainly sign the payment order. That is, document your order to pay funds for the specified purpose. Accordingly, an order to replenish the account in this case will be unnecessary.

- Can an accountant complete a new task with payment by card without filing an advance report for the previous task?

- In practice this may be acceptable. After all, there is only a ban on issuing cash on account to a person who has not accounted for a previously issued advance. This is stated in the already mentioned paragraph 4.4 of Regulations N 373-P. However, this requirement does not apply to payments using corporate cards. In addition, no sanctions are provided for its violation. This is confirmed, for example, by Resolution of the Ninth Arbitration Court of Appeal dated May 13, 2013 N 09AP-10884/2013.

- A corporate card is issued for a specific employee. What happens if you give it to someone else??

- The person to whom it is issued will still be responsible for any abuse of the card.

- Should an accountable person paying by card comply with the payment limit of 100,000 rubles? in accordance with clause 1 of Bank of Russia Directive No. 1843-U dated June 20, 2007?

- No, this is not necessary, because the limit is set only for cash payments, and when using a corporate card, payments are made by non-cash method.

November 2013

Approximate regulations on the procedure for using corporate bank cards

I APPROVED Name of the organization ________________________________ REGULATIONS Name of the position of the head of the organization __________ N _____ _________ _____________________ Signature Explanation of signature __________________ ________________________________ Place of preparation date On the procedure for using corporate bank cards

1. Information about the PIN code of the corporate card is confidential information. Cardholders do not have the right to disclose this information to any third parties.

Corporate card: how to issue and use it correctly

A report on the targeted expenditure of funds on a corporate bank card is submitted to the organization’s accounting department:

- when using a corporate card exclusively for receiving cash - no later than 3 working days after the expiration of the period for which they were issued, and when issuing a card to pay for travel expenses - no later than 3 working days from the date of return from a business trip, excluding the day of arrival (for employees of divisions of the organization located in populated areas outside the location of the organization, submitting a report to the accounting department of the organization - no later than 5 working days);

- when using a corporate card for non-cash payment of expenses - no later than 15 working days from the date of payment in non-cash form, excluding the day of payment, or when making payment partially in non-cash form, partially in cash, excluding the day of payment.

In addition to documents confirming expenses, reports must be accompanied by receipts confirming payment by card.

3. If there are no documents confirming the intended use of funds, or if the director has not approved the advance report, then the amounts written off from the corporate card will be collected from the cardholder and will be deducted from his salary.

4. The list of employees in whose name corporate cards are issued is given in Appendix No. 1.

5. The issuance and return of cards is kept in the corporate cards register in the form according to Appendix No. 2.

6. In the event of loss or theft of a corporate bank card, the card holder is obliged to immediately notify the bank that issued the card to block transactions on it. If, due to the fault of the cardholder, the account is not blocked in a timely manner, the amount of damage caused is recovered from the cardholder.

Appendix No. 1

to position from _______ N __

List of employees ______________________________ (name of organization) in whose name corporate bank cards are issued —————————————————————————— ¦N ¦ Full name. ¦ Passport data ¦Card type¦ Card number ¦ ¦n/p¦ employee ¦(number, by whom and when issued)¦ ¦ ¦ +—+—————-+—————————+— ——+—————+ ¦1 ¦ ¦ ¦ ¦ ¦ +—+—————-+—————————+———+—————+ ¦2 ¦ ¦ ¦ ¦ ¦ +—+—————-+—————————+———+—————+ ¦3 ¦ ¦ ¦ ¦ ¦ —-+—————-+ —————————+———+—————-

Appendix No. 2

to position from _______ N __

Corporate card accounting journal ___________________________ (name of organization) —————————————————————————— ¦Number ¦F.I.O. ¦The period for which¦Date ¦Signature ¦Date ¦Signature ¦ ¦of the card ¦holder ¦the card was issued ¦issuing ¦the holder¦delivery of the ¦holder¦ ¦ ¦card ¦employee ¦card ¦ ¦card ¦ ¦ +———+——— -+—————-+——-+———+———+———+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +———+———-+—————-+ ——-+———+———+———+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +———+———-+—————-+——-+———+— ——+———+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ———+———-+—————-+——-+———+———+———-

Designed to pay expenses related to the business or core activities of the company, including overhead, entertainment, transportation and travel expenses, as well as receiving cash. The card cannot be used for payment of wages and social payments. At its core, a corporate card is an analogue of funds issued on account. Can be either debit or credit.

To issue a card, a legal entity must enter into an agreement with the bank on the issue and maintenance of corporate cards, which displays information about the employees who will use these cards. The agreement should be accompanied by employee applications for the issuance of cards and powers of attorney for them from the company. To open a card account, you must provide the relevant documents to the bank.

The possible number of cards to be opened per account is determined by each bank at its own discretion.

Advantages of using corporate cards for organizations:

Reducing operating costs and time associated with issuing accountable amounts. The company does not need to receive cash from the bank for business expenses, as well as deliver and store it;

There is no need to buy foreign currency for foreign business trips or open a foreign currency account, and there is no need to fill out declarations when crossing borders. Funds will be debited from the company's card account with automatic conversion into the currency of the country in which the cardholder is located;