The procedure for transferring wages to the employee's card. Non-cash procedure for paying wages Payroll through a bank

In this article I will tell you how to pay salaries in 1C ZUP 8.3 or 8.2 (version 3.0).

In the previous one, I described what configuration we use, under which employee we enter and how to configure this employee.

If you have an employee with the rights to make salary payments, you can use it:

Window 1C "Settlements and payments" will open:

Below, in the "Payments" window, right-click and select "Cashier Statement" in the drop-down list. We will get the same result if we follow the link "Payment to the cashier".

Get 267 1C video lessons for free:

In previous articles, we hired Dmitry Valentinovich Borovoy, head of the legal department, in September as well. The day of payment of wages for the last month in the company is the 10th day of the current month.

To keep other employees out of the list, I don't use the Fill button. By pressing the "Add" button, we add "Borovoy D.V." to the tabular part of the document. Filling in other columns ("For payment", "PIT" for transfer) occurs automatically:

We print the statement and click "Post and close."

We reflect the payment of salary through the bank

Features of the formation of "Payments to the Bank" in 1C ZUP 8.3 (8.2):

- The organization transfers the total amount of salary to the bank (banks). This amount is kept in some escrow account.

- The Bank, according to the submitted application from the organization, distributes this amount among the "Personal Accounts" of employees.

- "Personal accounts" are linked to "Salary projects". That is, if an employee indicates that he receives a salary on a card, he must be assigned to a salary project and have a personal account.

- If the field “Salary project” is left empty and the button “Fill in” is clicked, all employees who receive a salary on the card will be selected.

- If 1C ZUP 8.3 uses a standard (built-in) workflow system with a bank, the “Salary Project” is required!

T. PANCHENKO, Auditor, AF "AUDIT A"

The main documents regulating the mechanism for transferring wages to a special card account are the Labor Code of the Russian Federation (Articles 44, 73, 136), the Civil Code of the Russian Federation (Chapters 45 and 46), Regulation of the Bank of Russia dated April 1, 2003 No. 222 -P "On the procedure for making cashless payments by individuals in the Russian Federation". In addition, since April 10, 2005, Bank of Russia Regulation No. 266-P dated December 24, 2004 “On the Issuance of Bank Cards and on Transactions Made with the Use of Payment Cards” has been in force.<*>.

<*>Until April 10, 2005, Bank of Russia Regulation No. 23-P dated April 9, 1998 “On the Procedure for Issuing Bank Cards by Credit Institutions and Making Settlements for Operations Made with Their Use” was in force.Wages are usually paid directly to the employee, except as required by applicable law or the employment contract.

It is paid to the employee, as a rule, at the place of work or transferred to a bank account (Article 136 of the Labor Code of the Russian Federation).

The form of issuing wages and other payments using bank plastic cards must be fixed in an employment or collective agreement concluded in accordance with Art. 44 and 73 of the Labor Code of the Russian Federation.

If the terms of these contracts do not provide for a non-cash method of paying wages, and the organization decides to pay employees through "salary" cards, then it is necessary to make appropriate changes to the contracts. At the same time, the non-cash method can be applied only with the consent of all employees, i.e. each employee must submit an application with a request to transfer wages to a specific bank account.

The parties to the contractual relationship when using payroll card accounts are the organization, its employees and the bank.

An agreement is concluded between the bank - issuer of cards and a legal entity for the issuance and use of a salary card to the holder - an employee of the organization. According to this agreement, the bank issues (issues), personalizes, issues and maintains bank cards, opens card accounts with a special regime, credits funds on behalf of the legal entity to the card accounts of its employees, and the legal entity ensures the proper execution of settlement documents and payment bank services related to the production of a salary card and the transfer of funds to card accounts. To formalize the contractual relationship, the organization must submit the necessary package of documents to the bank.

After the conclusion of the contract, the bank opens a special card account (card account) for each employee, to which his salary will be credited, and also manufactures and issues bank plastic salary cards to the holders - employees of the legal entity. The surname and first name of the holder are indicated on the front side of the card, and his personal identification number (PIN code) is recorded on the magnetic tape.

With the help of a nominal salary card, each employee can dispose of his personal card account upon presentation of a passport or a document replacing it.

The organization communicates to all its employees information about phone numbers, addresses of the bank and its branches serving the card, the rules for using and expiration dates of salary cards, the types of operations that the holder can perform using the card; what actions to take if the bank incorrectly records transactions on his card account or he does not agree with the bank statements.

Debit transactions on card accounts are performed only on the basis of documents drawn up using bank cards.

The issuing bank is obliged to provide the cardholder with information on transactions that can be performed using a bank card, on the procedure for their completion, on all amounts charged from the holder.

Each employee is responsible for the loss of the card. If it is lost (or stolen), he is obliged to immediately notify the bank about the incident so that the latter has the opportunity to stop the movement of funds on his card account.

When an employee is dismissed, the organization must notify the issuing bank of the date of his dismissal in writing within the time limits stipulated by the agreement for the issuance and use of a salary card to the holder - an employee of a legal entity. The former employee may continue to use the card, but in this case, he will pay the costs of its maintenance on his own.

Note. The current Regulation "On the issue of bank cards and on operations performed using payment cards" mainly regulates the conclusion of direct agreements between the issuer of payment cards and the client, the owner of the card account. Unfortunately, this normative act does not fully reveal the relevant nuances of the tripartite relationship "employer - bank - employee". Meanwhile, the settlements of organizations with their employees on wages using payment cards are already widespread and continue to develop rapidly. Therefore, all parties to such settlements are interested either in the emergence of a special regulatory act, or a more complete disclosure of the relevant nuances of the tripartite relationship "employer - bank - employee" in Regulation No. 266-P.

If the organization has a current account with the issuing bank, then the money to the card accounts of employees opened in the same bank is transferred directly from it. In this case, the organization transfers to the bank the total amount intended for the payment of wages to all employees in one payment order. Simultaneously with the payment order, the bank receives a register of transfers to the card accounts of employees, which must contain bank details, personnel numbers, last names, first names, patronymics of employees, details of card accounts and the amount of wages to be credited.

The register is submitted to the bank both in paper form in two copies, and in the form of an electronic file in a format agreed with the bank and representing a copy of the register. Information sent to the bank in electronic form may be presented on a diskette or transmitted via electronic communication channels, subject to the conclusion of an appropriate agreement.

The register form is developed by each bank independently. The register must be signed by persons entitled to sign settlement documents, and certified by the seal of the organization.

The total amount indicated in the electronic file and the amounts of transfers to each card account must correspond to the amounts indicated in the register and the amount of the payment order.

When filling out a payment order for transferring money to card accounts, in the “Recipient” field, enter the name and address of the bank where employees' accounts are opened. In the field "Purpose of payment" indicate the purpose of the payment (for example, "transfer of wages"), as well as the date and number of the registry.

The organization must draw up a register and payment orders at least twice a month. It does not matter when an employee receives a salary on a card: the main thing for an organization is that the money goes to his card account, as a rule, they arrive the next day. In confirmation that the salary has been transferred, the bank issues an extract to the organization and returns one copy of the register with its mark, which is documentary evidence of the fact of repayment of debts to employees for the corresponding period.

Taxation with non-cash payment of wages

The organization independently withholds all taxes and insurance premiums provided for by law from its employees until the moment it submits documents to the bank for crediting funds to card accounts and is responsible for taxing the amounts of wages and other payments credited to employee card accounts.

Personal Income Tax

In accordance with paragraph 1 of Art. 226 of the Tax Code of the Russian Federation, all organizations from which or as a result of relations with which individuals receive income are required to calculate, withhold from their employees and pay to the budget personal income tax (PIT) at a rate of 13%. The amount of personal income tax is withheld by the tax agent organization directly from the income of the taxpayer employee when they are actually paid.

Since, according to paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, when transferring earnings from the organization's bank accounts to employees' accounts, personal income tax is paid to the budget no later than the day the income is actually transferred, simultaneously with a payment order for transferring wages to card accounts, the organization must submit to the bank a payment order for payment of personal income tax to the budget.

It is necessary to pay attention to the fact that the plastic card is the property of the issuing bank (this is indicated on its reverse side). Nevertheless, the organization, having paid the cost of its manufacture for the employee, must withhold personal income tax from him. This is due to the fact that, according to p.p. 1 p. 2 art. 211 of the Tax Code of the Russian Federation, income received by the taxpayer in kind includes, in particular, payment by the organization for the cost of services (in this case, the services of the issuing bank) rendered in its interests.

Personal income tax must also be withheld when the organization bears the costs of paying the bank commission for re-issuing and renewing the card in case of its loss, as well as the bank commission for issuing an additional card or re-issuing it in case of damage. Otherwise, the organization may be held liable in the form of a fine in the amount of 20% of the amount to be transferred for failure to fulfill the obligation of a tax agent to withhold and transfer tax on the basis of Art. 123 of the Tax Code of the Russian Federation. In addition, she may be charged penalties for the entire time of delay in fulfilling the obligation to pay tax.

Unified social tax

Monthly advance payments for the unified social tax (UST) in accordance with paragraph 3 of Art. 243 of the Tax Code of the Russian Federation, the organization must transfer to the budget no later than the 15th day of the next month.

Insurance premiums for compulsory pension insurance and insurance premiums for compulsory social insurance against accidents at work and occupational diseases

In addition to personal income tax, the organization must, no later than the day of the actual transfer of income, transfer insurance premiums for mandatory pension insurance to the Pension Fund of the Russian Federation and insurance premiums for compulsory social insurance against industrial accidents and occupational diseases to the FSS of the Russian Federation (clause 2, article 24 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation” and Clause 4, Article 22 of Federal Law No. 125-FZ of July 24, 1998 “On Compulsory Social Insurance against Occupational Accidents and Occupational Diseases ").

When issuing wages twice a month, when the company first pays an advance (for example, on the 15th), and the second part as a final payment (for example, on the 31st), there are some features of its taxation.

Since personal income tax is calculated at the end of each month, no tax is charged on the advance payment issued in the middle of the month (Article 226 of the Tax Code of the Russian Federation).

According to the UST, the reporting period is also a calendar month. Therefore, it is calculated only on the basis of the results of the month, i.e. after final settlement with employees.

tax accounting

For the purpose of calculating income tax, the amounts of accrued wages are recognized as labor costs (Article 255 of the Tax Code of the Russian Federation) and are related to expenses associated with production and sales (clause 2 of Article 253 of the Tax Code of the Russian Federation).

The amounts of unified social tax also relate to expenses related to production and sale, but are recognized as other expenses as the amount of taxes and fees, customs duties and fees accrued in accordance with the procedure established by the legislation of the Russian Federation on taxes and fees on the basis of paragraphs. 1 p. 1 art. 264 of the Tax Code of the Russian Federation.

Labor costs for personnel involved in the production of goods (performance of work, provision of services), as well as the amount of UST accrued on the indicated amounts, are classified as direct costs (clause 1, article 318 of the Tax Code of the Russian Federation).

In tax accounting, insurance premiums for mandatory pension insurance calculated in accordance with Law No. 167-FZ are not included in the taxpayer's expenses either for wages or as part of the costs of paying the UST, but they are subject to reflection as other expenses and, hence included in indirect costs.

Insurance contributions for compulsory social insurance against accidents at work and occupational diseases are included in other expenses associated with production and sales, on the basis of paragraphs. 45 p. 1 art. 264 of the Tax Code of the Russian Federation and relate to indirect costs (clause 1 of article 318 of the Tax Code of the Russian Federation).

The amount of indirect costs for production and sale, carried out in the reporting (tax) period, is fully related to the costs of the current reporting (tax) period in accordance with paragraph 2 of Art. 318 of the Tax Code of the Russian Federation. And direct costs incurred in the reporting (tax) period are allocated to the balances of work in progress, finished products in stock and shipped, but not sold in the reporting (tax) period of products.

Please note that Federal Law No. 58-FZ of June 6, 2005 amended Chapter 25 “Corporate Income Tax” of the Tax Code of the Russian Federation. In particular, the changes made to Art. 318 of the Tax Code of the Russian Federation and applicable to relations that arose from January 1, 2005, allow organizations to independently determine what is included in direct costs associated with production and sales. For example, an organization may attribute to such expenses insurance premiums for mandatory pension insurance accrued on the amount of wages.

Since the expenses incurred by the organization in cases of loss or damage to salary cards do not meet the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, they are not recognized as economically justified and therefore cannot be taken into account for the purposes of calculating income tax.

Accounting

In accounting, the accrued amounts of wages, unified social tax, insurance premiums for mandatory pension insurance and insurance premiums for compulsory social insurance against industrial accidents and occupational diseases are recognized as expenses for ordinary activities on the basis of paragraphs. 5 and 8 PBU 10/99 "Expenses of the organization", approved by order of the Ministry of Finance of Russia dated 6.05.99 No. 33n.How to reflect the payment of wages on plastic cards in accounting, consider a specific example.

Example.The trade organization transfers employees' wages to plastic bank cards in August. The company has two employees: Orlov V.S. (salary - 18,000 rubles) and Sokolova O.P. (salary - 12,000 rubles). According to the terms of the employment contracts that are concluded with them, the salary is issued on the 15th (an advance payment of 50% of the salary) and the 31st (final payment) of each month. In August, employees of the firm are no longer entitled to standard tax deductions.

Dt 57, Kt 51 - 15,000 rubles. [(18,000 rubles + 12,000 rubles) x 50%] - funds were transferred to pay advance payments on wages to card accounts of employees;

Dt 70, sub-account "Settlements with Orlov", Kt 57 - 9000 rubles. (18,000 rubles x 50%) - money was credited to Orlov's card account;

Dt 70, sub-account "Settlements with Sokolova", Kt 57 - 6000 rubles. (12,000 rubles x 50%) - money was credited to Sokolova's card account.

Dt 44, Kt 70, sub-account "Settlements with Orlov" - 18,000 rubles. - Orlov's salary was accrued;

Dt 44, Kt 70, sub-account "Settlements with Sokolova" - 12,000 rubles. - Sokolova's salary was accrued;

Dt 44, Kt 69, sub-account "Settlements for UST with the federal budget" - 6000 rubles. [(18,000 rubles + 12,000 rubles) x 20%] - UST is accrued from the salaries of employees paid to the federal budget;

Dt 44, Kt 69, sub-account "Settlements for UST with extra-budgetary funds" - 1800 rubles. [(18,000 rubles + 12,000 rubles) x 6%] - accrued UST from wages paid to off-budget funds;

Dt 69, sub-account “Settlements for UST with the federal budget”, Kt 69 sub-account “Settlements for pension insurance” - 4200 rubles. [(18,000 rubles + 12,000 rubles) x 14%] - contributions for compulsory pension insurance have been accrued;

Dt 44, Kt 69, sub-account "Calculations on insurance premiums for compulsory social insurance against industrial accidents and occupational diseases" - 90 rubles. [(18,000 rubles + 12,000 rubles) x 0.3%] - contributions to the FSS for compulsory social insurance against industrial accidents were accrued from the August salary;

Dt 70, subaccount “Settlements with Orlov”, Kt 68, subaccount “Personal income tax settlements” - 2340 rubles. (18,000 rubles x 13%) - personal income tax was charged on Orlov's salary;

Dt 70, subaccount “Settlements with Sokolova”, Kt 68, subaccount “Personal income tax settlements” - 1560 rubles. (12,000 rubles x 13%) - personal income tax was charged on Sokolova's salary.

When transferring wages on account of the final settlement, it is necessary to deduct the advance payment previously issued to employees and personal income tax from its total amount.

The amount to be transferred to the final settlement account will be:

18,000 - 9,000 (advance payment) - 2,340 (personal income tax) + 12,000 - 6,000 (advance payment) - 1,560 (personal income tax) = 11,100 rubles.

In accounting, when transferring salaries to the account of the final settlement, the following entries should be made:

Dt 57, Kt 51 - 11,100 rubles. - funds were transferred on account of the final payment of wages to the card accounts of employees;

Dt 70, sub-account "Settlements with Orlov", Kt 57 - 6660 rubles. (18 000 - 9000 - 2340) - money was credited to Orlov's card account;

Dt 70, sub-account "Settlements with Sokolova", Kt 57 - 4440 rubles. (12,000 - 6,000 - 1,560) - money was credited to Sokolova's card account.

The dates for the advance payment and wages are established by the collective agreement, the employment contract, as well as the internal labor regulations, but no later than 15 calendar days of the day for which it is accrued.

Step 1. Setting up advance payment and salary

In 1C ZUP 8.3, advance payment and salary dates are configured in the Settings section, Organization link: Settings –> Enterprise –> Organizations:

When you click on the Organization link, the Organization directory window opens. In this window, on the Accounting policy and other settings tab, using the Accounting and payroll link, go to the settings group, where we set the payment dates:

Step 2. Preparing for the advance payment

The amount of the advance in 1C ZUP is determined by one of three calculation methods:

- Fixed amount;

- Percentage of the tariff;

- Calculation for the first half of the month.

The advance payment method is indicated in the Hiring document of the Personnel section by clicking on the link Hiring, transfers, dismissals, or by clicking on the link Hiring: Personnel –> Create –> Hiring:

On the Remuneration tab, in the Advance payment field, by default, the advance payment method is set to Calculation for the first half of the month:

If the advance payment method is set to Fixed amount, then a field for entering the amount in rubles appears:

If the calculation method is set to Percentage of the tariff, then a field for entering percentages appears:

Step 3. How to change the calculation method or advance payment amount

In the future, you can change the method of calculation or the amount of the advance payment to the employee using the Change of pay or Personnel transfer documents.

The Change pay document is available in the Payroll section by clicking the Change pay for employees link:

In the opened form of the document Change remuneration, when the Change advance payment checkbox is checked, the fields for changing the method of calculation and the amount of the advance become available:

The Personnel Transfer document is available in the Human Resources section at the link Receptions, transfers, dismissals:

In the opened form of the Personnel transfer document, on the Payroll tab, when the Advance payment checkbox is selected, the fields for changing the method of calculation and the amount of the advance payment become available:

To change the calculation method and amount of the advance for the list of employees, use the Change advance payment document. This document can be found in the Salary section at the link of the same name:

Using the document Change advance in 1C 8.3 ZUP, you can temporarily change the advance. To do this, you need to add to the document form, using the command Change the form of the More button, an invisible by default element “by” from the Advance payment date group:

By clicking the Fill in button in the table of the document Change advance payment, employees of the organization working at the beginning of the month specified in the Change advance payment from field will be automatically selected.

If the Department field is filled in, then only employees of the selected department will be automatically selected in the tabular section. The composition of employees in the tabular section can be changed manually:

To set the advance payment method for the selected employees, assign the required value from the drop-down list in the Advance calculation method field:

When choosing the method of calculating the advance by Fixed amount or Percentage of the tariff for all employees in the tabular section:

- You can set the same amount of the advance by clicking the Set size button;

- The amount of the advance can also be adjusted manually in the Advance column:

If the advance payment calculation methods are set as Fixed amount or Percentage of the tariff, preliminary calculation before paying the advance payment is not required.

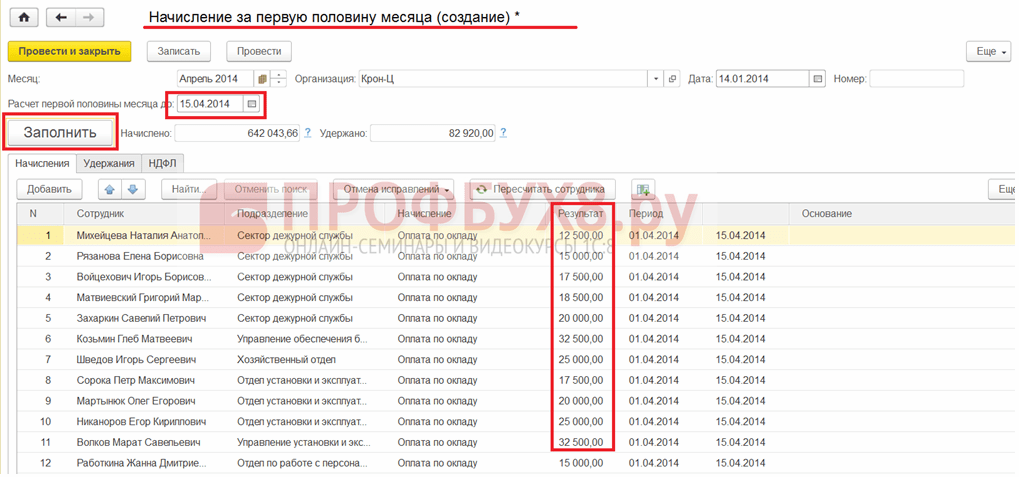

If the advance payment is calculated by Calculation for the first half of the month, a preliminary calculation of the advance is performed using the Accrual for the first half of the month document, taking into account the time worked by employees. This document is available in the Salary section at the All accruals link:

Also, the Accrual for the first half of the month document is available in the Salary section using the links Accrual for the first half of the month:

Document form in 1C ZUP 8.3:

Step 4. Preparing for the payment of the main part of the salary

Before paying the main part of the salary in 1C ZUP 8.3, it is necessary to perform a preliminary calculation using the document Payroll and contributions:

This document is available in the Salary section at the All accruals link:

Also, the document Payroll and contributions in 1C ZUP 3 is available in the Salary section at the link of the same name:

Step 5. Payment of advance payment and salary

The payment of the advance and the main part of the salary in 1C ZUP 3 (8.3) is carried out by special documents that are available in the Payments section at the appropriate links:

The use of a specific type of document in 1C ZUP 3 (8.3) is determined by the method of paying salaries:

- As part of the salary project - the Statement to the bank is used;

- By transfer to an arbitrary account in a bank - the List of transfers to accounts is applied;

- Via the cash desk - the Vedomosti to the cash desk is used.

The method of paying salaries in 1C ZUP 8.3 can be set for:

- All employees of the organization;

- Employees of any department of the organization;

- specific employee.

The payment method for all employees of the organization is specified in the Settings section, Organizations link: Settings –> Enterprise –> Organizations:

When you click on the Organization link, the Organization directory window opens. In the window that opens, on the tab Accounting policy and other settings, by clicking on the link Accounting and payroll - go to the settings group, where we set the method of paying advances and wages:

The method of payment to employees of any department of the organization is indicated in the Settings section, link Departments: Settings –> Enterprise –> Departments:

When you click on the Subdivisions link, the Subdivisions directory window opens. In the department card on the Accounting and payroll tab, go to the settings group, where we set the advance payment and salary payment method for the selected department:

The payment method for a particular employee is set in the employee card. The employee card is available from the Personnel section, link Employees: Personnel –> Employees:

Go to the settings group, where we set the method of advance payment and salary for a specific employee:

Important! In 1C ZUP 8.3, the payment method settings for an employee have a higher priority than the settings for a department or organization. And departmental settings take precedence over organizational settings.

That is, if the payment method is set for the organization Through the cashier, for the unit - by Crediting to the card, and for the employee - by Transfer to a bank account, then the payment method for this employee will be Transfer to a bank account.

If the payment method is not set for the employee, then 1C ZUP 3 will choose the payment method set for the department in which the employee works.

And only if the payment method is not specified either for the employee or for the unit, then the 1C ZUP 3 (8.3) program will use the payment method established for the organization.

What to do if the payroll sheet in 1C ZUP 8.3 is not filled out, see our video:

Method of payment of wages within the framework of a salary project

A salary project is an agreement between an enterprise and a bank on the transfer of enterprise funds to personal accounts of employees centrally opened in this bank as part of a salary project. A company may have several payroll projects.

To pay salaries in this way in 1C ZUP 8.3, you must first enter into the directories:

- Salary projects - information about the salary project;

- Counterparties - information about the bank with which the contract was concluded;

- Bank accounts of counterparties - “salary” bank account.

A salary project in 1C ZUP 8.3 is created in the Payments section, following the link Payroll projects:

A form for filling in information about the salary project opens:

Directory Counterparties is available for filling in the Settings section, link Counterparties: Settings –> Directories –> Counterparties:

Clicking the Counterparties link opens a window in which the Create button opens a form for entering data about the counterparty. After filling in all the fields, click the Write button and, using the active link Set a bank account, select the “salary” account created in the directory Bank accounts of counterparties:

For employees who are paid to cards as part of a salary project, the personal account number for this project must be indicated. Personal accounts can be specified manually in the employee card, which is available in the Personnel section, link Employees: Personnel –> Employees:

Go to the settings group, where the personal account number is indicated in the Personal account number field, and the period from which the personal account is valid is entered in the Valid from field:

To enter personal accounts for several employees at the same time, a special form is used, which opens in the Payments section by clicking on the link Enter personal accounts:

Filling out the form in 1C ZUP 8.3:

To pay salaries for a salary project in 1C ZUP, the Vedomosti to the bank document is used. This document can be found in the Payments section, by the link of the same name. When you click on the link, a window appears in which, by clicking the Create button, a new document, Statement to the Bank, is opened for filling out:

Also, the Statement to the bank document is available in the Payments section at the link of the same name:

When filling out the Statement to the bank document, you need to select the appropriate salary project. In the Pay field, the nature of the payment is indicated: Advance payment or Monthly salary, etc.:

By clicking the Fill button, the document table is filled in by employees who currently have the mark “Accounted to the card” and the selected salary project is indicated either in the employee card, or in the department card, or in the organization card:

If the salary project is not selected in the Statement to the bank document, then the tabular section is filled in by all employees whose salaries are transferred to the cards.

To create a printed form of the Statement to the Bank document, click the Print button on the document form and select the List of transfers item:

Method of payment of wages - Transfer to an arbitrary bank account

With this method, the salary is transferred to the plastic cards of employees without using the salary project. In this case, employees independently open bank accounts and provide the organization with account details.

To pay salaries by transfer to an arbitrary bank account in 1C ZUP 8.3, the document Sheet of transfers to accounts is used. This document is available in the Payments section, at the link of the same name:

Also, the Statement of transfers to accounts document is available in the Payments section, at the link of the same name:

When filling out the document Statement of transfers to accounts:

- By clicking the Fill button, the tabular part is filled in automatically by employees whose card indicates that the accounts are opened in this bank and there is a mark Transfer to a bank account:

- In the Bank field, select the appropriate bank:

- If the Bank field in the Statement of transfers to accounts document is not filled in, then all employees whose card indicates that the salary is paid by Transfer to a bank account will be automatically selected in the tabular section:

- In the Pay field, the nature of the payment is indicated: Advance payment, Monthly salary, etc.:

To generate a printed form of the document List of transfers to accounts, click the Print button on the document form and select the List of transfers item:

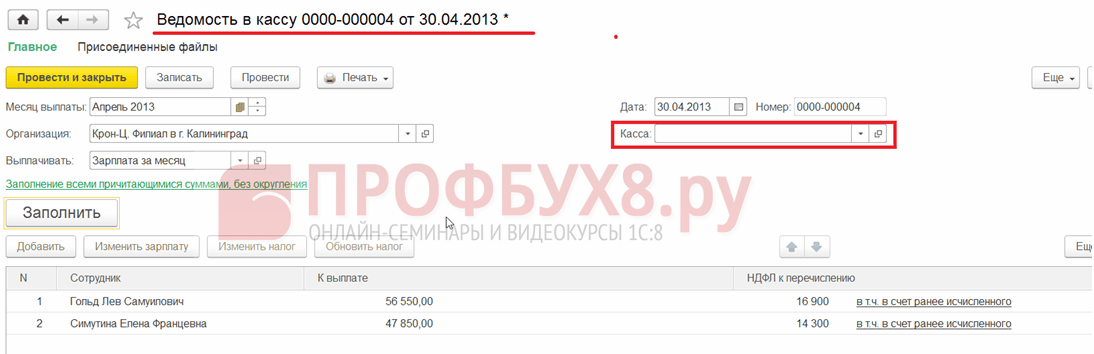

Method of payment of wages - through the cashier

You must first create cash registers in the Cashier directory. The specified directory is located in the Payments section, Cashiers link:

A new cash register in the directory is created using the Create button:

To pay salaries using the Via cash desk method, the Statement to the cash desk document is used. This document is located in the Payments section, following the link Statement to the cashier:

Also, the Statement to the Cashier document is available in the Payments section at the link of the same name:

If there is one cash desk in the organization, then in the Statement to the cash desk document, the Cash desk field is optional:

If the organization has two or more cash desks through which salaries are paid to different employees, then in the Cash desk field, you must specify the corresponding cash desk through which a particular unit or employee is paid.

By clicking the Fill button, the tabular part is filled in by employees for whom the mark “Via cash desk” is currently set:

And the selected cash desk is indicated in the employee's card, or in the department's card:

Or in the organization card:

If the Cash desk field in the Statement to the cash register document is not filled in, then all employees who have the Via cash register checkbox will be automatically selected in the tabular section.

In the Pay field, the nature of the payment is indicated: Advance payment, Monthly salary, etc.

From the form of the document Statement to the cash register, by clicking the Print button, you can generate the following printables:

Do you want to pay employees through a credit institution? This does not contradict the current legislation if the salary is transferred in full, within the time limits established by the Labor Code of the Russian Federation, the collective agreement and internal regulations.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and IS FREE!

Details necessary for the fulfillment of obligations must be agreed by the parties in advance.

Basic information

Remuneration is understood as remuneration calculated depending on the specialty, the features of the functions performed, their number, as well as various allowances of a compensatory and stimulating nature.

The dates for the transfer of funds are determined by the local document of the organization or by an internal agreement drawn up taking into account the current standards:

- payments are made at least twice a month;

- issued before the end of the current period

- full payment is carried out before the 15th;

- if the date of the salary coincides with a day of rest or a day off, obligations to the employee must be fulfilled the day before.

The method of transferring funds must be established in the employment or collective agreement.

At the same time, for an agreement signed directly with an employee, unilateral adjustment is possible only in the event of significant changes in the totality of factors in the production sector.

Changes must be notified two months prior to their entry into force.

Normative base

According to the Labor Code of the Russian Federation, remuneration for the performance of labor functions has a monetary form in the currency of the Russian Federation.

Payment is allowed in another form if the requirements below are met:

- the method of calculation is fixed in the local act of the company;

- there is a corresponding statement of the employee;

- there is no conflict with the current legislation.

Thus, in order for the transfer of wages to the employee’s card to be legitimate, it is necessary to adhere to the following algorithm:

- fix the possibility of a non-cash method of payment in a labor or collective agreement;

- enter into a bank account agreement that allows the credit institution to execute the client's instructions regarding financial transactions;

- coordinate with the employee the details for the transfer of funds.

Obligations are not considered settled on time if the money was sent without the written permission of the employee.

In this case, the following sanctions are applied to the employer:

- recovery of financial compensation calculated at the refinancing rate;

- administrative liability in the form of a fine or disqualification.

Is it necessary?

According to the norm prescribed in the Labor Code of the Russian Federation, the payment of earnings is made at the place of performance of labor functions or can be transferred to the bank account of the subordinate if two conditions are met simultaneously.

Namely:

- such an opportunity is provided for by the local act of the organization;

- there is a written request from the employee indicating the details for the financial transaction.

Thus, the choice of the method of transferring funds is carried out by agreement of the parties.

Advantages and disadvantages

With the development of information technology, companies are increasingly trying to organize payroll calculations using bank cards.

To date, this method is widely used among business entities and is recognized as quite convenient.

However, it has both positive and negative features.

For an employee

The attitude to non-cash payments is ambiguous and depends on the specific life situation.

For example, if an employee's account is foreclosed, the funds received can be withdrawn to pay it off.

On the other hand, in order to receive a reward, you do not need to spend time visiting the organization's cash desk, and many people find it convenient.

The table below summarizes some of these pros and cons:

For the employer

Among companies, the practice of making payments to personnel through the use of plastic cards is widespread. This reduces costs and simplifies the process of transferring money.

At the same time, in order to establish a system of cashless payments with subordinates, some efforts will have to be made:

- obtain written consent each employee;

- make the necessary changes in local acts of the company;

- conclude an agreement with a credit institution, which prescribes the procedure for opening accounts for employees and issuing plastic cards to them;

- collect and submit to the financial institution required package of documents;

- pay a commission for transactions;

- make transfers in accordance with the norms of the Labor Code of the Russian Federation so that the money is received by employees within the time limits established by law;

- prepare a payslip for each employee, containing information regarding the total amount of the payment, its components, as well as all kinds of accruals and deductions;

- fulfill obligations to withhold personal income tax no later than the day the funds are debited from the company's account and send the tax to the budget within 24 hours after the transfer of salaries to employees.

Transfer of wages to the employee's card in 2019

According to the current legislation, in order to transfer remuneration for work directly to the bank account of an employee, the following is required:

- fix the possibility of such a method of settlements with personnel in the local document of the company;

- receive a statement from the employee indicating the details for the operation.

The employee has the right to independently determine the credit organization and change it if he sees fit.

In addition, a draft is being prepared to punish those who impede freedom of choice. It is planned that the State Duma will consider it this autumn.

Who can become an initiator?

Any party to an employment or collective agreement has the right to demand the inclusion of a condition on the transfer of wages to the card.

However, the document can only be changed by mutual agreement.

Which one is possible?

The Code allows the employee to independently choose a credit structure to provide cashless salary payments and change the bank at his discretion.

A plastic card attached to an account is just a carrier of information that allows you to carry out financial transactions.

It can be of any kind, as it does not affect the procedure for crediting funds.

If there is a salary project

Often a situation arises when a beginner is not satisfied with the bank with which the company has an agreement to transfer remuneration for work to employee card accounts ().

In this case, the Labor Code of the Russian Federation allows you to write an application for changing the details for transferring funds.

The appeal must be submitted no later than five days before the date when the financial transaction is to be carried out.

No payroll project

If the employee wants the salary to be sent directly to his account, and such an opportunity is already provided for in the labor or collective agreement, then it is enough for him to convey his request in writing.

Otherwise, the relevant clauses will have to be added to the contract, which, in turn, is only possible thanks to the coordinated actions of both interested parties.

To the card of another person (husband/wife/relative)

The Labor Code of the Russian Federation allows the possibility of transferring wages to someone else's card at the request of an employee, if this is provided for by a local act of the organization.

The employee has the right to independently manage his own funds by submitting an appropriate appeal to the accounting department.

To minimize risks, it is important to properly prepare the following documents:

- an application, the form of which is free, at the same time, it must indicate the details, amount, term, period and basis for the transfer;

- to the employment contract is drawn up, which includes a reference to Article 313 of the Civil Code of the Russian Federation, which regulates the relevant right of the employee, the procedure for settlements, the amount and date of payment, the responsibility of the parties;

- a notification is sent to a third party, allowing to recognize the funds received;

- an instruction is sent to the bank to execute the payment, indicating the details of the recipient and the document that is the basis for the financial transaction.

For credit

The employee has the right to demand the transfer of salary to his personalized plastic card, confirming the existence of a bank account from which funds are debited to repay the loan.

But at the same time, he must take into account that:

- most often there is a commission for cash withdrawals;

- the employer is unlikely to bear the additional costs.

To the employee's personal card

If the company’s local act provides for the possibility of transferring wages to the employee’s bank account, then he has the right to independently choose a credit institution for carrying out operations and subsequently replace it at his own discretion.

True, sometimes unusual situations happen. For example:

The employee died unexpectedly and there was unpaid remuneration for the period actually worked. After the death of a subordinate, his agreement with the company is no longer valid. It is not possible to transfer funds to the selected account. In this case, it is necessary to be guided by, which establishes the procedure for issuing money to relatives of the deceased.

Minor child's salary

For persons under the age of 18, the Civil Code of the Russian Federation establishes different levels of legal capacity.

In this regard, two categories of workers can be distinguished:

- children over 14 can independently open bank deposits and manage funds within the limits of their earnings;

- underage citizens transactions on behalf of which legal representatives make.

Thus, in the first case, the salary can be transferred to a debit card registered directly in the name of the employee, and in the second case, the account will have to be opened in his parent or guardian.

For pension (social)

Persons applying for financial support in connection with the onset of a certain age or loss of health are often offered financial products on preferential terms.

For example, in Sberbank, a pension card is serviced free of charge, and 3.5% per annum is charged on the balance. Replenishment is possible by non-cash transfer of funds, including through third-party institutions.

To receive a salary on such an account, you must apply with the appropriate application to the accounting department of the organization.

How to document?

For the legitimacy of paying salaries by bank transfer, it is necessary to prepare:

- an additional agreement to the contract with the employee (if this form of remuneration for the performance of duties was not provided earlier);

- written consent of the employee.

What details are required?

There is no standard application form for the transfer of due earnings to the specified account. The document is filled in freely.

However, it must contain the following information:

- the name of the credit organization;

- number of settlement and correspondent accounts;

- Name of the recipient.

In one bank

For an employee who plans to transfer a salary to his card in full, other details other than those indicated above will not be required.

in different banks

If an employee decides to divide the payment into parts and send them to accounts in several institutions, then first of all he needs to obtain the consent of the employer.

The fact is that, according to the law, you can replace the financial structure, and not add another one.

The application will need to provide the following information:

- bank names;

- account numbers;

- amounts of money;

- date of transfer;

- execution period.

Sample application (consent)

Order (sample)

Accounting registration

If the organization uses plastic cards to pay salaries, then it is only necessary to draw up a payroll.

In this case, the following documents are sent to the bank:

- a register with information about employees, banks, amounts to be transferred, numbers and dates of payments, their number;

- orders for the transfer of funds and personal income tax.

Purpose of payment

In field 24, you must specify a text explanation of no more than 210 characters:

The salary for March 2019 is transferred according to register No. 6 Amount 95015-85.

Payment order (sample)

To properly prepare the document, you will need to carefully fill in the details of the recipient and the column for the purpose of payment:

postings

In accordance with the Instruction, the payment of wages to the card is reflected in the debit of account 70 (settlements with personnel for wages) and the credit of account 51 (settlement accounts).

Maintenance cost accounting

How to correctly take into account the cost of manufacturing maintenance of plastic media is shown in the table:

Questions

To date, transferring salaries to a card is a very common operation that generates many subjects for discussion. The most relevant ones are listed below.

What to do if Sberbank has not fully transferred money?

First of all, you should immediately contact the accounting department of the employer. Most likely, this is an error in the payment order, which was executed by a credit institution.

How to arrange everything correctly if the salary is gray?

In this case, only the official part of the income is subject to transfer to the card.

How to make a transfer to a foreign citizen?

Any payment in favor of a non-resident, if it does not relate to a retail sale or the provision of services, is considered a foreign exchange transaction and must be made in a non-cash form. Otherwise, the company faces penalties from the Federal Tax Service.

Therefore, a foreigner is obliged to provide details for the transfer of funds. The Labor Code of the Russian Federation does not apply to him and he has no right to refuse.

What if you transferred funds to a blocked card?

A plastic carrier is just a kind of key to a bank account. Money can be withdrawn by contacting the credit institution directly.

Are there specific enumerations for a deceased employee?

With regard to the deceased, local acts of the company cease to be valid and all further settlements are made with his relatives.

Do I need to register the transfer of funds to the card in the employment contract?

If this possibility was not provided, then non-cash settlements with a subordinate are impossible.

What to do with an erroneous transfer?

The organization and responsible officials will be fined, and the affected employee will be compensated for the delay.

When to pay VAT?

The tax must be sent to the budget no later than the day following the date of payment of salaries for the second half of the month.

Is it possible for an employee to refuse and receive money through the cashier?

The employee himself chooses one of the payment methods established by the contract. He must report changes no later than five days before the transfer of funds.

So, today the employee is vested with the right to independently determine the procedure for remuneration for work and, if necessary, make amendments.

The company, in turn, is obliged to organize payments every two weeks and compensate for the delays that have arisen.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the site.

- All cases are very individual and depend on many factors. Basic information does not guarantee the solution of your specific problems.

Learning to transfer salaries to a card (in 1C: Accounting 8.3, edition 3.0)

2016-12-08T12:42:54+00:00In this lesson, we will get acquainted with the capabilities of the "troika" (1C: Accounting 8.3, edition 3.0) in part salary payments employees through a bank.

Accountants who are faced with such payments for the first time have many questions, and today we will try to analyze the main ones.

So, let's begin

There are two ways to pay salaries through the bank:

- With the help of payroll.

- No payroll.

Under salary project means an agreement with a bank, according to which the bank opens for each employee organization personal account.

On payday, the organization transfers the wages of all employees to a special salary account in this bank one sum.

At the same time, the payment is attached statement indicating personal accounts of employees and amounts payable. The Bank, in accordance with this statement, itself distributes funds to the personal accounts of employees.

At the same time, different banks have different opportunities and requirements for working with a salary project when it comes to electronic document management, that is, when we transfer money to a salary account through a client-bank.

In this case (client bank), after sending the payment order, a letter is sent to the bank in any form with one of the following options attached to it (depending on the requirements and capabilities of the bank):

- printed and scanned statement of payments on personal accounts

- upload file directly from 1C

- download file from a special program provided by the bank

If we send a statement to the bank in the form of a file (upload), then usually the bank sends us a confirmation file in response, which we can also upload to 1C.

Creating a payroll project

Go to the section "Salary and personnel" item "Payroll projects":

We create a salary project for Sberbank:

Here is his card:

We intentionally do not check the box "Use the exchange of electronic documents" in order to analyze the case when we send the statement to the bank in printed form.

Entering personal accounts for employees

Suppose that the bank has created a personal account for each of the employees. How to enter these accounts into the system? By the way, why do we want to do this? Then, so that in the statement that we will form for the bank, opposite the full name of the employee, there is also his personal account.

If we have a lot of employees - you can use the processing "Entering personal accounts":

But in the example we have only 2 employees, so we will enter their personal accounts manually, directly into their cards (at the same time we will know where they are stored).

Go to the section "Salary and personnel" item "Employees":

Open the card of the first employee:

And go to the section "Payments and cost accounting":

Here we select a salary project and enter the personal account number received from the bank:

We do the same with the second employee:

Payroll

Go to the section "Salary and personnel" item "All accruals":

Calculating and posting payroll:

We pay wages

We create a new document in which we indicate the salary project and select employees (please note that their personal accounts are picked up):

We post the document and print the statement for the bank:

Here's what it looks like:

Based on the statement, we form a payment order:

In it, with a total amount, we transfer the salary to the salary account of the bank in which we have a salary project open:

Together with this payment, do not forget to attach a statement (with a register of personal accounts and payments) printed above in the form required by the bank (usually this is an arbitrary letter through the client's bank).

Uploading the register to the bank

Consider the possibility of uploading a statement (register) as a file to the bank. If your bank supports such an opportunity (or this is its requirement), then go to the "Salary and personnel" section, the "Payroll projects" item:

Open our salary project and check the box "Use the exchange of electronic documents":

Again we go to the section "Salary and personnel" and we see that two new items have appeared. We are interested in the item "Exchange with banks (salary)":

There are three basic options for uploading to the bank:

- Payroll

- Opening personal accounts

- Closing personal accounts

Let's stop at the first point. It allows us to upload our statement to a file, which is then sent by an arbitrary letter through the client-bank.

To do this, select the statement we need and click the "Upload file" button:

When a response comes from the bank, it will contain a confirmation file. You need to enter the same processing and upload this file through the "Download confirmations" button. With the help of this wonderful mechanism, we will be able to track which statements have been paid by the bank and which have not.

No payroll project

In this case each employee opens an account himself in any bank (at its discretion) and informs the organization of the full details of this account. The employee also writes an application for the transfer of his salary to this account.

On the day of payment, the organization transfers the amount due to the employee to his account in a separate payment order.

This way very inconvenient for accounting, especially when the company has a large staff, so many accountants prefer to remain silent about this possibility.

In this case, we do not indicate the salary project in the statement for payment.